Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my brand new newsletter, THE DAILY CLOSE!

I built THE DAILY CLOSE to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

$25 a month, or $250 a year

In This Issue:

The Bonds Are Back In Town

Analysis of Silvergate and Grayscale Developments And The Effect on Bitcoin - IntoTheBlock

Bitcoin Thoughts And Analysis

Legacy Markets

Vitalik Dumped On You… Again

Coinbase Announces “Wallet as a Service”

The Market Is Expecting 50bps

The Lummis-Gillibrand Bill Is Back On The Docket

The Bonds Are Back In Town

Bonds have historically held the esteemed reputation of being the assured gateway to a prosperous retirement and a legacy of wealth for future generations. In bygone eras, hardworking individuals could diligently invest $100,000, reap the benefits of reinvested dividends, and foresee a substantial fortune of more than $500,000 after three decades. The pursuit of the American Dream seemed clear-cut, but today, circumstances have shifted, and the investment landscape presents new challenges.

The resurgence of bond rates to their previous levels presents investors with a fresh set of decisions to ponder. As evidenced by the chart below, which was obtained from the U.S. Treasury, bond yields were once remarkably high, enticing investors from all walks of life. Imagine earning an annual return of 9% on your nest egg - that level of profitability is unheard of in today's market.

Before delving into the current ascent of bond rates, let's take a step back and examine the types of investors who traditionally gravitate towards bonds. In contemporary times, typical bond investors fall into one of the following categories:

Individual Investors: This group encompasses individuals seeking a dependable source of income and seeking to diversify their investment portfolio. They often invest in bonds either directly or via mutual funds.

Institutional Investors: This group consists of pension funds, insurance companies, and other large financial institutions that invest on behalf of their clients. They often possess significant amounts of capital to invest and may acquire bonds directly from issuers.

Government Entities: Governments frequently procure bonds to finance their operations or manage their cash reserves. For example, central banks may purchase government bonds to regulate the money supply.

Corporations: Corporations may also invest in bonds to earn a stable return on their excess cash.

A few years ago, bonds were perceived as virtually worthless. This was largely accurate. Now? Not so much. Investors (including myself) are returning in droves. Due to the inflationary environment, escalating interest rates, and uncertainty surrounding equities, bonds have become a dependable alternative to more volatile investment options. In actuality, the volatility within the bond market has become quite absurd.

In 2021, earning any meaningful amount of interest required an investment of at least a few million dollars. Yields were so meager that typical bond shoppers didn't even bother, while analysts deemed the market to be broken. Over the past decade, merely coming close to earning what previous generations did would necessitate the entire family becoming breadwinning machines, leaving only crumbs to spare. As an example, take a look at the rates from early 2021 - there was barely anything to gain.

The investment landscape of recent times has felt akin to sprinting on a treadmill that gradually accelerates and elongates, culminating in a scenario where hitting the panic button becomes increasingly arduous. Ultimately, this results in the family tumbling off the back, leaving them without adequate retirement funds. However, now that the treadmill has slowed down, investors have ample reason to hop back on.

If we consider the contrast to present-day, it's astounding to see the magnitude of change that has occurred.

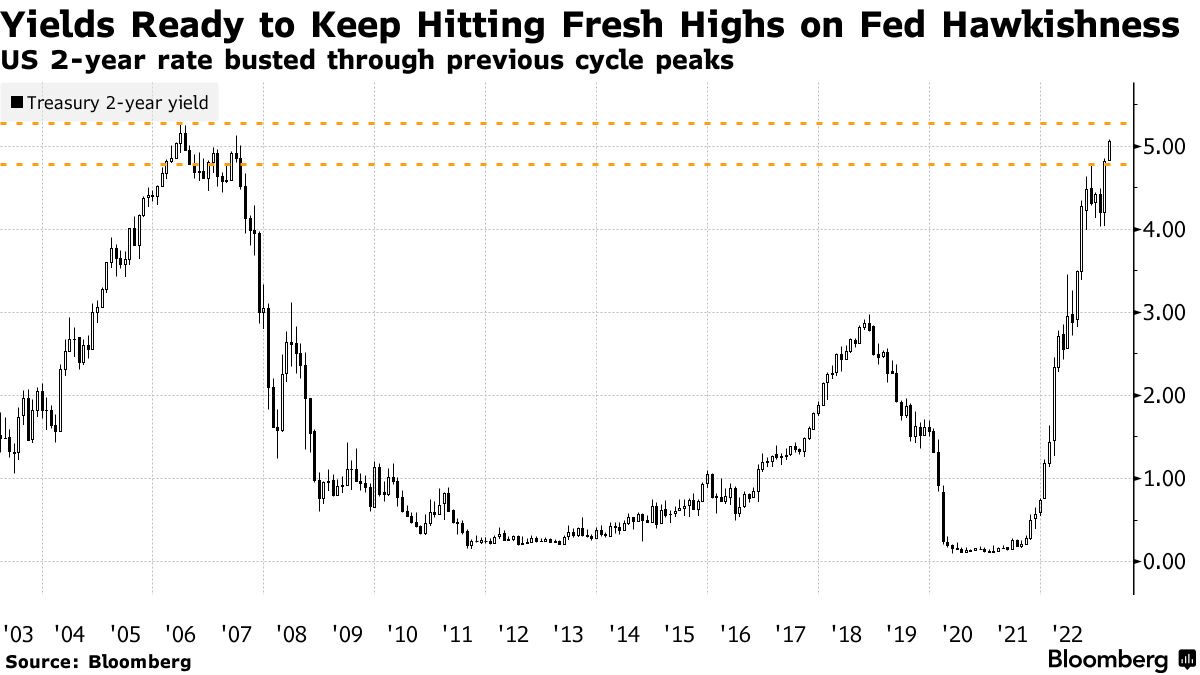

If you've been keeping up with current events, you've likely heard a lot of buzz about the 2-year note reaching 5%. The last time this occurred was in 2007, and while some analysts have drawn parallels to the Great Recession, it's crucial to note that our current macro environment is markedly distinct - there's no guarantee that history will repeat itself.

The intention of this introduction is to provide a historical outlook on bonds, acknowledge their unpredictable nature, and underscore the potential opportunities they offer (though, it's essential to seek advice solely from a licensed financial advisor). Personally, I speculate that bond rates will plummet significantly in the next few years, and in the absence of a reliable yield, crypto will ascend. Consequently, Ethereum staking, in particular, is poised to benefit tremendously.

Analysis of Silvergate and Grayscale Developments And The Effect on Bitcoin - IntoTheBlock

In this report, we bring to you the latest in on-chain cryptocurrency analysis. We look at the blockchain directly and analyze balances, transactions, and the overall activity of market participants. This gives us a unique insight into the future of the market.

This section is written in conjunction with IntoTheBlock (ITB). ITB is an intelligence company that leverages machine learning and advanced statistics to extract intelligent signals tailored to crypto-assets. IntoTheBlock tackles one of the hardest problems in crypto: to provide investors with a view of a crypto asset that goes beyond price and volume data.

The Wolf Den research team uses IntoTheBlock to dig deeper and get the most important insights about the crypto market.

Analysis of Silvergate and Grayscale Developments And The Effect on Bitcoin

This week, the crypto currencies industry saw important developments. Silvergate Bank, a major player in the crypto industry, has stated that it will shut down operations and liquidate voluntarily in accordance with relevant regulations. At the same time, the CEO of Grayscale, Michael Sonnenshein, is optimistic about the future of his firs after an initial hearing about their Bitcoin ETF application. This piece seeks to analyze the market reaction to the recent announcements and its effect on Bitcoin.

Source: IntoTheBlock Capital Markets Insights

Despite Bitcoin seeing a 28% increase over the last three months, Silvergate's stock SI has taken a major hit, falling by 75% during the same time period.

The liquidation of Silvergate Bank raises significant concerns about the regulation of the sector in the short term and the potential challenges faced by crypto companies in accessing traditional banking services.

Silvergate bank’s implosion was mainly generated by its investment into long term US Treasury bonds.

Regrettably, Silvergate purchased these treasury bills during a time of historically minimal interest rates.

The issue lies in the fact that as the Federal Reserve raises interest rates, individuals lose interest in holding onto t-bills that offer a lower interest rate, as they can easily obtain a new t-bill from the government at a higher rate.

Essentially this drives down the value of the t-bill if you have to sell it on the bond market before the maturity date.

Source: IntoTheBlock Capital Markets Insights

While GBTC has been trading at a discount to the underlying bitcoin since early 2021, it has seen a substantial increase of 60% in value over the last 3 months, outperforming Bitcoin's 28% increase.

GBTC’s main benefit of converting into an ETF stands on Regulation M relief for ETFs.

This allows market makers to create and redeem shares in an ETF to manage supply and demand imbalances, without violating rules against market manipulation.

Essentially market makers would be able to redeem the underlying asset eliminating any premium/discounts on the ETF.

Source: IntoTheBlock’s Bitcoin Analytics

Bitcoin has recently decorrelated from traditional market indices such as the Nasdaq 100 and the S&P 500, outperforming both of them in the last 3 month by over 20%

As of now, approximately 42% of Bitcoin addresses are experiencing gains or are in the money around the current price

The percentage of addresses in the Global in and out of the Money in the last rally to $25K Bitcoin was of 70% in the money

This indicates that a significant portion of Bitcoin holders currently hold positions close to the price range at which Bitcoin has been trading.

Bitcoin Thoughts And Analysis

$25,212.

I have been screaming this number from the rooftop for weeks. While it was very easy to be overly bullish as priced reached this key level, the strong rejection and failure to push beyond was a good signal that we would see some retracement.

People get bullish at resistance.

As you can see, that level, the 200 MA and the 50 MA with an active death cross were too much for Bitcoin price.

No need to panic, just normal market movement for now in the face of a heap of bad news and after a major upside move from 15 to 25K.

Now price is coming into support, which has been tested a few times, making it a bit weaker. $21,473 is the level to watch now, another number that I have been throwing out in the cryptoverse for quite a while.

We can get a better look at these key levels on the daily chart. Multiple rejections at the top, clear support at the bottom.

There was also major bearish divergence with overbought RSI.

My slight concern here is that oversold RSI is inevitable - it always makes the roundtrip. That means another drop of roughly 10, which I hope will happen with more sideways action and less of major drop. All lower time frames are already oversold.

While I expected a bit more bounce yesterday, I was feeling skeptical that the bottom was in, even with the bullish divergence. That’s why I stated that my conviction was low. That remains the case, although I refuse to be overly bearish at support. Let’s see if this area holds.

Legacy Markets

Global stocks fell on Thursday as investors priced in the likelihood of higher interest rates and a potential US recession. Futures on the S&P 500 and Nasdaq both slipped, with chipmakers Nvidia Corp and Advanced Micro Devices Inc down in pre-market trading. Europe's Stoxx 600 benchmark also dropped, with Credit Suisse Group AG a notable loser after delaying the publication of its annual report. The comments from Federal Reserve chief Jerome Powell added to investors' concerns. The next highlight for markets is Friday's jobs report, which could trigger more bets for a bigger hike at the March 21-22 Fed meeting.

Key events this week:

US Challenger job cuts, initial jobless claims, household change in net worth, Thursday

Bank of Japan policy rate decision, Friday

US nonfarm payrolls, unemployment rate, monthly budget statement, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 4:39 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 fell 0.6%

The MSCI World index was little changed

S&P 500 futures fell 0.3%

Nasdaq 100 futures fell 0.5%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.7%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.2% to $1.0569

The British pound rose 0.3% to $1.1884

The Japanese yen rose 0.9% to 136.16 per dollar

The offshore yuan was little changed at 6.9663 per dollar

Cryptocurrencies

Bitcoin fell 1.7% to $21,636.76

Ether fell 1.4% to $1,531.4

Bonds

The yield on 10-year Treasuries was little changed at 3.99%

Germany’s 10-year yield advanced four basis points to 2.68%

Britain’s 10-year yield advanced three basis points to 3.80%

Commodities

West Texas Intermediate crude fell 0.4% to $76.36 a barrel

Gold futures rose 0.1% to $1,821 an ounce

Vitalik Dumped On You… Again

Regrettably, the crypto community seems to have developed a peculiar fascination with bestowing Vitalik with coins he never solicited and subsequently watching him dump them on the open market. This precise scenario has already unfolded in the past and has been repeated yet again, this time involving a Shiba-inspired knockoff known as SHIKOKU (SHIK).

On March 7th, Vitalik liquidated 500 trillion SHIK for approximately 380 ETH ($595,448) and a few other low-value coins, totaling 59.3 ETH ($92,971). Since these coins were essentially worthless and had poor liquidity, their prices plummeted considerably after Vitalik's sell orders, leading to a decline in the market.

Maybe stop sending him free coins?

Coinbase Announces “Wallet as a Service”

My objective is to maintain impartiality in my selection of news stories, but there's no denying that Coinbase has dominated the news cycle lately, so it's been a frequent feature in this newsletter. To be transparent, I do own $COIN, but I strive to remain objective in my reporting. The latest development from Coinbase is the introduction of their new product, 'Wallet as a Service,' which aims to cater to businesses and gaming applications alike, streamlining the navigation process in the cryptocurrency wallet realm.

Here’s what Coinbase said, “we view this as being the central enabling technology and revenue source for our developer strategy. It could help companies bring the next hundred million customers into Web3 through a seamless wallet-onboarding experience. In a world where wallets are simple, companies can finally build Web3 experiences accessible to everyone regardless of technical knowledge.”

The Market Is Expecting 50bps

The CME Group boasts a fascinating tool known as the 'CME FedWatch Tool,' which leverages "30-Day Fed Funds futures pricing data" to forecast rate hikes. The figures are in a constant state of flux, but currently, the market anticipates a 50bps hike in March with a 77% probability. Three weeks ago, the market had only attributed a mere 9% chance to a 50bps hike, but recent overheated economic data and a hawkish Powell tone have resulted in a significant shift in sentiment. The meeting is slated to take place on March 22nd.

The Lummis-Gillibrand Bill Is Back On The Docket

The Lummis-Gillibrand bill, which aims to establish a regulatory framework for the cryptocurrency industry and determine whether such projects fall under the jurisdiction of the SEC or CFTC, will release a new draft in mid-April after it was deferred in 2022. The bill was initially proposed by Senators Kirsten Gillibrand and Cynthia Lummis, and the next draft aims to offer clarity to many crypto projects. The proposed legislation remains bipartisan work between the two Senators, but it is uncertain whether the new Congress will move forward with it. If passed, it will provide much-needed regulatory clarity for crypto projects and help determine which assets fall under the jurisdiction of the SEC and CFTC.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Great analysis Scott, thanks for bring all this information together! 👏