The Wolf Den #692 - Can Amazon Conquer Crypto?

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trade on Bitget!

Bitget is the best crypto exchange for both spot and leverage, world’s largest crypto copy trading platform, the official partner of Juventus Football Club and a top 5 exchange by volume as listed on CoinMarketCap!

Sign up using my link to Bitget and you will get:

Up to an $8000 sign-up bonus 🔥

15% discount on ALL futures trading fees 🔥

In This Issue:

Can Amazon Conquer Crypto?

Bitcoin Thoughts And Analysis

Legacy Markets

Is This The End of Hex?

Grayscale’s Arguments Were A Success

Binance.US Can Officially Acquire Voyager

He Is On A Mission To Provide 1 Billion People With Internet Using Blockchain | Micky Watkins

Can Amazon Conquer Crypto?

It was the 5th of July, 1994, in Bellevue, Washington. Jeff Bezos, a larger-than-life entrepreneur, opened the digital doors of Amazon, an online book retailer he created in his small garage. Within just 1.5 years of starting, Amazon racked up an impressive $15.7 million in revenue. By 1997, the company had gone public and had become one of the biggest names in e-commerce.

At the time, there was a general consensus that selling books was a good idea, but selling anything else on the internet was foolish. However, Bezos had bigger plans for Amazon, as he intended the platform to be “exotic” and “different,” which its name implied, aiming to do the things others deemed impossible. Amazon changed the way the world shopped, and now it’s attempting to do the same with NFTs.

Earlier this year, Amazon made a major announcement about its plan to enter the NFT arena and launch Amazon Digital Marketplace. Critics piled in fast, making some valid points. The primary point of attack was that Coinbase, Reddit, and GameStop had already failed in their NFT endeavors, so Amazon likely would too.

Nevertheless, Amazon was by far the most tried and tested when it came to proving doubters wrong. Even Warren Buffet doubted Amazon long ago, stating “I’ve admired Jeff, and I’ve admired him for a long, long time. But I did not think he was going to succeed on the scale that he has.” None of the previous attempts to capture the NFT market had the track record nor armor that Amazon had. If anyone could succeed, it was Amazon.

One advantage of Amazon's attempt was that it had already seen other platforms fail and could learn from their mistakes. For example, Coinbase's social attempt was a failure, Reddit’s avatars weren't that interesting, and Gamestop’s Web3 approach wasn't technologically there yet. There is no doubt that Amazon has taken diligent notes about what works and what doesn't, and it has learned from the mistakes of others.

Behold Amazon’s pitch: On the 24th of April, Amazon is launching a cutting-edge digital marketplace that will reside under the banner “Amazon Digital Marketplace.” Initially, this tab will only be available in the United States, gradually branching out to the rest of the world. On launch day, the platform will feature 15 different NFT collections that are intricately linked to physical goods, which distinguishes Amazon’s offering from its competitors. The NFTs are being advertised as easy to purchase, without the technical difficulties posed by MetaMask or cryptocurrency, requiring only a debit or credit card. Amazon’s unique selling point lies in its promise to deliver the NFT to your account while simultaneously delivering the physical item right to your doorstep. That’s how Amazon intends to stand out in the market.

Despite the simplicity of Amazon's strategy, there are still concerns about the platform's potential for failure. It's worth noting that the much-anticipated Coinbase NFT launch garnered millions of early signups but did not go as planned. During the first five hours of live trading, Coinbase only managed to reach $60,000 in sales compared to OpenSea, which raked in $124M in the same time frame. Coinbase's inability to thrive in the market was evidenced by its failure to match OpenSea, which makes more revenue in one hour than Coinbase does in a month. The odds are indeed stacked against non-crypto platforms.

However, the key distinction is that Amazon is not aiming to replicate OpenSea or Coinbase’s approach, and that is precisely why it has a chance to succeed. Amazon has a unique vision to create its own NFT ecosystem instead of trying to compete with existing players in the NFT arena. By focusing on its own NFT platform and building its own unique features, Amazon might just have a chance to carve out a niche in this burgeoning market.

Here are some bullet points to consider:

Amazon has over 310 million active users worldwide and is one of the biggest names in e-commerce, with a reach that spans across over 50 countries.

Around 70% of American adults are Amazon Prime members, which translates to roughly 148.6 million people.

There are over 12 million products sold on Amazon.

Amazon is nearing a $1 trillion market capitalization

Amazon is available in over 50 countries

Do you believe that Amazon’s NFT platform will ultimately succeed? Despite the current lull in interest for NFTs, as revealed by Google Trends, transactional volume across various platforms is also reportedly down by at least 90%. Ordinals also pose a new concern to the sector. For instance, it was reported last year that OpenSea, considered one of the best NFT platforms, experienced a 99% decline in trading volume from its peak. This is undoubtedly a steep climb for NFTs, and even steeper for legacy corporations.

Notwithstanding these challenges, Amazon’s CEO remains resolute, stating that he expects NFTs to continue growing significantly, with the possibility of Amazon integrating crypto payments. If NFTs indeed turn out to be a success on Amazon’s platform, it will only be a matter of time before the company opens up to crypto, which is the Holy Grail of adoption. It's important not to allow regulators to cast doubt on your beliefs. Cryptocurrency is here to stay.

Bitcoin Thoughts And Analysis

We once again saw Bitcoin become temporarily correlated to the stock market on a day when Powell commented on the economy and inflation. After trading sideways for days, we saw a small drop in Bitcoin price - not particularly meaningful, but still worth discussing after such insane chop.

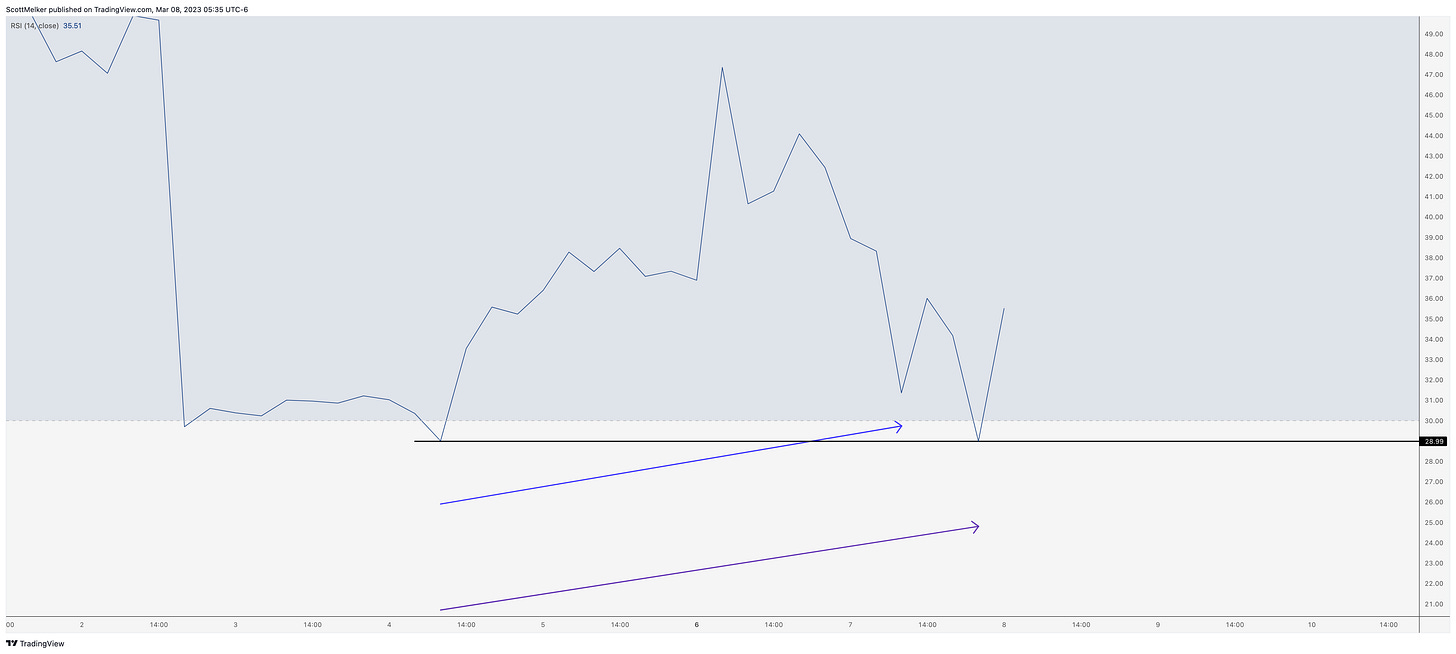

As I mentioned days ago when RSI hit oversold, I wanted to wait to see bullish divergence. We got that last night, shown in blue. However, no signal is perfect and we know that price can still drop further, making a larger divergence.

That is what happened, giving us the exaggerated bullish divergence in purpose. Exaggerated divergence is when you have equal lows on the indicator and lower low on price. I consider this a weaker signal, especially since we do not yet have bullish divergence yet on higher time frames. You can see the equal lows below.

I am leaning towards a trip back to 25K here on this divergence, but my conviction is relatively low.

On this low time frame, you can see that $22,086 is a key level. On the left side of the chart, this line was the resistance that flipped to support before the huge move up to $25,000. We want to see that flipped back to support here before considering the divergences.

Legacy Markets

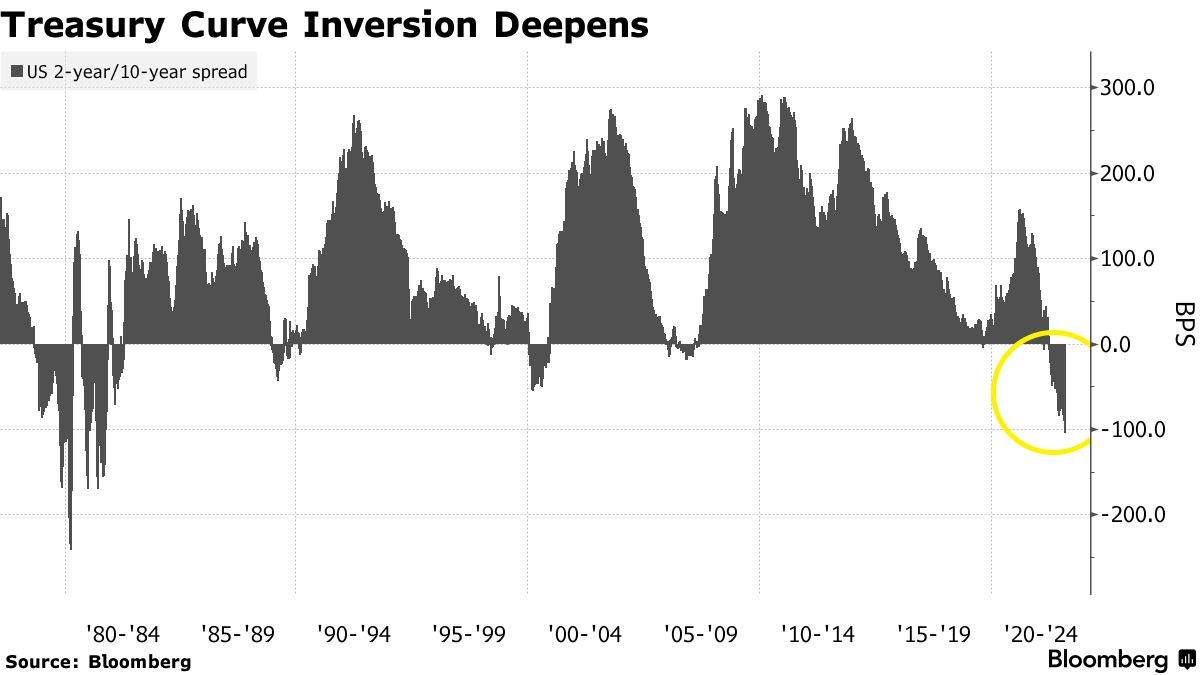

US stock futures have settled on Wednesday, after a decline sparked by hawkish comments from the Federal Reserve Chair, Jerome Powell. His comments caused a rise in Treasury bond yields, boosted interest rate wagers, and triggered concerns that the world's largest economy would not be able to avoid a recession. The rise in global bond yields has now paused, with contracts on the S&P 500 and Nasdaq rising about 0.2%, while Europe’s Stoxx 600 equity benchmark slipped about 0.2%. Despite the pause, the markets are still awaiting more testimony from Powell later today. Money markets are now pricing US interest rates to rise above 5.6% later this year after Powell signaled readiness to speed up policy tightening, should inflation keep running hot.

Key events this week:

Euro area GDP, Wednesday

US MBA mortgage applications, ADP employment change, trade balance, JOLTS job openings, Wednesday

Fed Chair Powell’s semiannual Monetary Policy Report to the House Financial Services Committee, Wednesday

Canada rate decision, Wednesday

EIA crude oil inventories, Wednesday

China CPI, PPI, Thursday

US Challenger job cuts, initial jobless claims, household change in net worth, Thursday

Bank of Japan policy rate decision, Friday

US nonfarm payrolls, unemployment rate, monthly budget statement, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 5:58 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 was little changed

The MSCI World index fell 0.3%

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.2%

The MSCI Asia Pacific Index fell 1%

The MSCI Emerging Markets Index fell 1.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0540

The British pound was little changed at $1.1837

The Japanese yen fell 0.2% to 137.40 per dollar

The offshore yuan rose 0.3% to 6.9719 per dollar

Cryptocurrencies

Bitcoin rose 0.3% to $22,111.01

Ether rose 0.6% to $1,559.04

Bonds

The yield on 10-year Treasuries was little changed at 3.97%

Germany’s 10-year yield was little changed at 2.69%

Britain’s 10-year yield was little changed at 3.82%

Commodities

West Texas Intermediate crude fell 0.2% to $77.43 a barrel

Gold futures fell 0.1% to $1,817.60 an ounce

Is This The End of Hex?

As someone who is not deeply invested in Hex news, I have observed a worrying trend emerging in the Hex community, which may indicate that the end is nigh. Specifically, Richard Heart, Hex’s founder, has wiped his Twitter clean of any mention of Hex and has deactivated his Instagram account. In addition, two highly anticipated products from Hex, PulseChain (PLS) and PulseX (PLSX), have been delayed for months, while Hex staking has been rebranded as Hex mining, which may be misleading. These red flags, coupled with the SEC's active investigation of Hex, have caused concern for many who believe it's only a matter of time until Hex falls from grace. I urge you all to be vigilant and stay safe.

Grayscale’s Arguments Were A Success

The image displayed above features commentary from Elliott Z Stein, a seasoned Litigation Analyst at Bloomberg Intelligence. As per Stein and many other analysts examining the scenario, Grayscale’s BTC ETF hearing was promising. Judges have been consistently dealing blows to the SEC over the past week, and it is fun to watch.

The SEC may not want the crypto industry to succeed, but the law seems to think that the regulators efforts are misled.

Grayscale winning this case would be huge.

Binance.US Can Officially Acquire Voyager

Binance.US has received approval to move forward with its acquisition of Voyager Digital's assets in a deal worth over $1 billion. The bankruptcy judge in the Voyager Digital case chose to allow the deal over objections from the U.S. Securities and Exchange Commission and state regulators. The plan had been supported by 97% of Voyager creditors, who could potentially make a 73% recovery. The deal still needs to clear regulatory hurdles before it can be finalized. Voyager's VGX token surged over 8% in the minutes after the ruling.

Voyager creditors can finally breath a sigh of release, as we are one step closer to seeing our funds returned.

Also, it was fun to watch the judge dunk all over the SEC.

He Is On A Mission To Provide 1 Billion People With Internet Using Blockchain | Micky Watkins

Micky Watkins, the telecom industry veteran, is telling his story of how he is changing the lives of ordinary people in Africa, by providing them with mobile network connectivity that runs on a blockchain. He wants to connect 1 billion people by 2030, if you want to know how - listen to this episode of the Wolf Of All Streets episode with Micky Watkins, CEO of World Mobile.

In this episode with Micky, we discussed:

Changing lives

World Mobile

Mobile network operators’ power

Technology behind World Mobile

Business model & progress

Scaling

Providing 1 billion people with mobile connection in Africa

Opportunities in Africa

Competing in the US market

Discovering crypto & blockchain

The balloons

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.