Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

🔥 Privacy and security are essential for everyone, but especially for crypto investors. I use NordVPN to protect my privacy and help keep my crypto safe!

Get exclusive NordVPN deal here - starting at just $4 per month, a 40% discount 🔥

It's risk-free with Nord's 30-day money-back guarantee 🔥

Every purchase of a 2 year plan receives an additional bonus + 4 months subscription time! 🔥

👉 https://nordvpn.com/WolfOfAllStreets 🔥

In This Issue:

June 5th, 2026

Bitcoin Thoughts And Analysis

Legacy Markets

Testnet ETH Now Has A Value?!

Inflation Running Hot

Jump Counter Exploits Hacker

Insiders Share The Truth Behind The Collapse Of The Crypto Lender Voyager | Shingo and Adam Lavine

June 5th, 2026

On April 20, 2021, the Senate confirmed Gary Gensler as the chair of the SEC by a vote of 54-45, for a term ending on June 5, 2026. Everything was going well for the crypto market. Bitcoin was trading over $50,000 and the assumption was that Gary was 'our guy.'

We couldn't have been more wrong. Not even halfway through his term, Gary managed to go from being the (crypto) 'people's champ' to public enemy number one.

It would be hard to put in a worse performance than Goldman Gary. While I'm not a psychologist, a famous quote by Abraham Maslow may offer some insight into this overreaching regulatory catastrophe.

“If the only tool you have is a hammer, you tend to see every problem as a nail.”

This quote describes a concept known as the 'law of the instrument,' which is a cognitive bias involving an over-reliance on a familiar or favorite tool. While originally related to education, its logic can be broadened to help explain why some officers view everything as a crime or some artists see everything as art. In Gary Gensler's case, as a regulator, if all he knows are a set of tests from the '30s and '40s, everything starts to look like a security, and that's the issue at hand.

In a recent interview with New York Magazine, Gary Gensler lost even more support from the crypto community for essentially professing that everything is a security except Bitcoin. The following paragraph, from the author of the article who interviewed Gary, is worth noting for its similarity to the hammer and nail concept above.

“The new Congress is looking again at crypto-specific legislation, but Gensler believes that the SEC has all of the legal tools that it needs. Over the course of our discussion, he articulated a straightforward view of the agency’s reach — that pretty much every sort of crypto transaction already falls under the SEC’s jurisdiction except spot transactions in bitcoin itself and the actual purchase or sale of goods or services with cryptocurrencies.”

Now, let’s see what Gary Gensler had to say that prompted this opinion.

“Everything other than Bitcoin, you can find a website, you can find a group of entrepreneurs, they might set up their legal entities in a tax haven offshore, they might have a foundation, they might lawyer it up to try to arbitrage and make it hard jurisdictionally or so forth. They might drop their tokens overseas at first and contend or pretend that it’s going to take six months before they come back to the U.S. But at the core, these tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

So there you have it. If Gary had his way, everything except for Bitcoin would be deemed a security and taken behind the barn and shot. The good news is that while Gary can talk the talk, he must overcome the law to walk the walk, and that won't be easy. Just because Gary is the commissioner does not make his statements true. A judge has to make the final decision. As we know from other ongoing cases, that takes time.

That is why I titled this newsletter "June 5th, 2026."

In my view, June 5th represents the finish line. Defeating Gary doesn't guarantee clear skies ahead, but it does mean we have one less significant obstacle in our path. To those who doubt crypto, I ask this question: will Gary last longer than crypto (by regulating it to death), or will crypto last longer than Gary (by winning the fight)? It's tough to be worse than Gary, so if we can fight tooth and nail until that date and survive, we win.

That catches us up on the SEC front, but let's take a quick look at a very recent quote from one of our other “favorite regulators,” Janet Yellen.

“We haven't suggested outright banning of crypto activities, but it is critical to put in place a strong regulatory framework. We're working with other governments.”

I have to give credit where credit is due, and I applaud Janet Yellen for not wishing to ban crypto. She has always believed in preserving crypto, despite making some outrageous remarks about it. Perhaps Gary could learn a thing or two from her.

Let’s just hope he doesn’t end up with her job, which we all know is his end goal…

Bitcoin Thoughts And Analysis

No surprises here, right? While it was easy to get extremely excited by Bitcoin’s renewed uptrend, we all know by now that $25,212 was the key level of resistance. Two candles in a row had wicks right up to this line with rejections, forming tweezer tops. That is a bearish reversal signal, pending this week’s candle as confirmation. We want to see a good week to cancel this signal.

The 50 and 200 MAs both remain as resistance in this area as well, with the death cross two weeks ago happening and the 50 MA still pointing down aggressively.

There’s no real reason to dig into lower time frames. This is the story.

Legacy Markets

Key events this week:

Eurozone economic confidence, consumer confidence, Monday

US durable goods, Monday

US wholesale inventories, Conf. Board consumer confidence, Tuesday

China manufacturing PMI, non-manufacturing PMI, Caixin manufacturing PMI, Wednesday

Eurozone S&P Global Eurozone Manufacturing PMI, Wednesday

US construction spending, ISM Manufacturing, light vehicle sales, Wednesday

Eurozone CPI, unemployment, Thursday

US initial jobless claims, Thursday

Eurozone S&P Global Eurozone Services PMI, PPI, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 1.1% as of 10:46 a.m. London time

S&P 500 futures rose 0.5%

Nasdaq 100 futures rose 0.6%

Futures on the Dow Jones Industrial Average rose 0.4%

The MSCI Asia Pacific Index fell 0.5%

The MSCI Emerging Markets Index fell 0.7%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.1% to $1.0563

The Japanese yen rose 0.1% to 136.34 per dollar

The offshore yuan rose 0.1% to 6.9712 per dollar

The British pound rose 0.3% to $1.1979

Cryptocurrencies

Bitcoin fell 0.8% to $23,370.37

Ether fell 0.4% to $1,635.2

Bonds

The yield on 10-year Treasuries advanced two basis points to 3.96%

Germany’s 10-year yield advanced three basis points to 2.56%

Britain’s 10-year yield advanced 13 basis points to 3.79%

Commodities

Brent crude fell 0.2% to $83.01 a barrel

Spot gold was little changed

Testnet ETH Now Has A Value?!

The saying "if there is a will, there is a way" is particularly true in the world of crypto. Recently, a group of greedy traders managed to give real-world value to testnet ETH, which was not meant to have any value. Testnet ETH has always been distributed to developers to allow them to test and explore the project without worrying about gas, taxes, or losses using GoETH (prop money).

As Ethereum has gained popularity, more developers have started running testnets, creating an opportunity for traders. GoETH has a limited supply, but some traders began hoarding the token, creating a liquid market and attributing real value to the tokens. The unfortunate result is that developers don't have enough GoETH, while bots profit at the expense of others needing to run tests. Although it's impossible to shut down the markets, Ethereum developers are already developing a new testnet called Holesky that should solve the issue. More information about Holesky is expected after the merge.

Inflation Running Hot

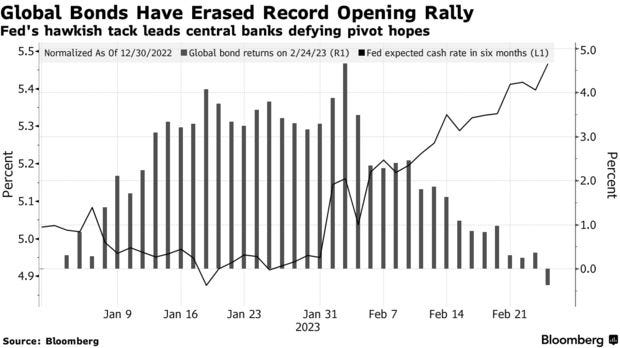

As widely expected, inflation is proving to be more stubborn than even the so-called "experts" had predicted. The latest Personal Consumption Expenditures (PCE) data, released on Friday, confirms that the Fed has more work to do to combat rising prices. In January, PCE increased by 0.6% on a monthly basis, and 4.7% over the year, a figure that caught Wall Street off-guard as the market was expecting a 0.5% increase for the month and a 4.4% rise over the year. Notably, these figures worsened from December to January, contributing to the recent market downturn. However, investors received mixed signals, as other metrics performed well, with consumer spending, inflation-adjusted personal income, and personal savings rate all outperforming expectations.

It seems as though the market has been bracing for a recession, yet continually finding just enough momentum to stave it off.

Jump Counter Exploits Hacker

In February of last year, the cryptocurrency space was rocked by the news of Wormhole losing $325 million in wrapped Ether (wETH) via the protocol's token bridge. Following the hack, the stolen funds were moved around various decentralized applications (dapps) on Ethereum, leading many to assume that the funds were gone forever. However, Jump and Oasis had other ideas.

Over the weekend, it was announced that the stolen funds had been recovered by Jump and Oasis using a "counter exploit." In essence, Jump and Oasis reclaimed the stolen funds. This action has upset the crypto community because it required a court order and an abuse of power by the involved parties.

While it's true that this "sets a bad precedent," we must remember how decentralized finance (DeFi) came to be. If Ethereum hadn't rolled back the chain during the DAO hack, the crypto landscape would look drastically different today. It's crucial that serious lessons are learned, and that we move beyond this incident. Pushback from the community is necessary to ensure that such occurrences are prevented in the future.

Insiders Share The Truth Behind The Collapse Of The Crypto Lender Voyager | Shingo and Adam Lavine

Adam and Shingo Lavine are a father & son team who built Ethos, a project that was merged with Voyager. Shingo later became the CIO and a board member of Voyager. In this episode, Shingo and Adam share the history of their relationship with Voyager and provide their version of what they think led to one of the biggest collapses in the history of crypto. In the second part of the episode, we talk about the new project Shingo and Adam are building.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.