Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trade all spot pairs on Bitget for ZERO fees! You read that right, zero fees…

Bitget is the best crypto exchange for both spot and leverage, world’s largest crypto copy trading platform, the official partner of Juventus Football Club and a top 5 exchange by volume as listed on CoinMarketCap!

Sign up using my link to Bitget and you will get:

• Up to an $8000 sign up bonus

• 15% discount on ALL futures trading fees

• 0 fees on ALL spot market pairs

In This Issue:

We Are At War

Bitcoin Thoughts And Analysis

Legacy Markets

Bitcoin Addresses Are On The Rise

Federal Reserve Bank of NY Speaks Highly of Bitcoin

Paxos and Circle Are Next

We Are At War

The First World War was an absolute nightmare for the German and French soldiers who were fighting on the Western Front. The trenches along the front lines were filled with the bodies of young and old soldiers who had died in combat. The soldiers faced dangers such as disease, starvation, frostbite, and constant shellfire on a daily basis. But on one particular Christmas day, something extraordinary took place.

The "Christmas Truce" is considered to be one of the greatest displays of humanity during one of the darkest times in history. According to one lieutenant who witnessed the event, "it was one of the most extraordinary sights that anyone has ever seen." Along a 20-mile stretch of the war-torn front line, German soldiers climbed out of their trenches, without their weapons, to shake hands, share tea, smoke cigars, and even play soccer with the French soldiers.

This moment of peace during the war serves as a parallel to the current state of the crypto war-front. Just like the soldiers in the First World War, those in the crypto world are facing a war of attrition. However, the start of 2023 brought about a temporary peace, much like the "Christmas Truce." After a difficult fourth quarter of 2022, the crypto market saw a warm welcome in the form of rising prices, with Goldman Sachs even rating crypto as their number one asset. This positive trend continued until recent events brought the reality of the ongoing war back into focus.

Brian Armstrong, the CEO of Coinbase, took to Twitter to raise concerns about the possibility of the SEC trying to get rid of crypto staking for retail customers in the United States.

“We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.”

This tweet thread was quickly followed by the news that Kraken had decided to shut down their crypto-staking operations in order to settle with the SEC.

These events, along with other recent developments such as Binance halting USD withdrawals and deposits, Signature bank distancing themselves from crypto, the SEC investigating Kraken for selling unregistered securities, and the Federal Reserve denying Custodia's application for a master account, all point to mounting pressure against legitimate crypto activity in the US. This attack is misguided, but it is also precise.

Nic Carter released a newsletter titled "Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs," which highlights the seriousness of the situation. He notes that if regulators continue their pressure campaign, they risk losing control of the crypto industry and increasing risk by pushing activity to less sophisticated jurisdictions. When I said that 2023 was the “Year of The Regulator” just over a week ago, I meant it. January offered some nice relief for prices, but there is an entire war that still has yet to be fought, and regulators are trying to wear us down to win the war before it even begins in earnest.

Here are the highlights from Nic Carter’s expose:

“If they can choke off fiat access, they can marginalize the industry — on and off shore — without regulating it directly.”

“Time and again, using the expression “safety and soundness,” they’ve made it clear that for a bank, touching public blockchains in any way is considered unacceptably risky.”

“If bank regulators continue their pressure campaign, they risk not only losing control of the crypto industry but ironically increasing risk, by pushing activity to less sophisticated jurisdictions, less able to manage genuine risks that may emerge.”

We cannot let the dopamine rush of Bitcoin’s bounce off the bottom distract us from the larger issue.

The start of 2023 brought about a temporary peace, much like the "Christmas Truce," but it is now time to continue the fight. This is a battle that cannot be won through political means alone, but instead requires the crypto community to work together to overcome the challenges ahead. It is important to remain focused on the task at hand and not be distracted by the temporary spikes in prices.

The "Christmas Truce" has ended and it is time to continue the war.

Bitcoin Thoughts And Analysis

We’ve been waiting for a dip, and now it has arrived. It’s hard to predict how far price will drop, but I have been discussing this area, around $21,473 for a while. We have already come close, and it could obviously be front run if we are preparing to bounce from here.

$25,212 remains the key level. Nothing is truly bullish until that is broken and we have a macro higher high.

The death cross of the 50 MA and 200 MA will confirm on Sunday.

This looks ripe for a bounce. RSI is already oversold with potential bullish divergence. We need to wait until the next candle close and see if we get a clear “elbow up” on RSI. Price is also testing the 200 MA on the 4-hour for the first time since January 6th. $21,646 is also key support on the 4-hour, which is almost exactly where price bounced, for now.

Legacy Markets

Stocks, Futures Fall With Bonds on Hawkish Bets: Markets Wrap

tocks and US Treasuries saw a selloff due to mounting wagers for more hawkish monetary policy. US stock futures dropped, with Tesla and tech names in the red, while Lyft tumbled after a disappointing outlook. European equities and bonds also saw a drop. Treasuries extended losses as yields on two-year Treasury rose above 10-year's by the most since the 1980s, indicating flagging confidence in the economy. The market is paying close attention to official comments and data for hints on the rates trajectory. Japanese reports of a surprise nomination for a new Bank of Japan head sparked a jump in the yen, while German two-year yields rose to the highest since 2008 as ECB tightening bets increased. The UK narrowly avoided a recession last year, according to data. Stocks are headed for their first weekly decline in three due to Fed speeches reinforcing the need for longer-term rate hikes. The US inflation update next week is a potential inflection point for the Treasury yield curve. Oil prices rose after Russia announced a plan to cut March production by 500,000 barrels a day.

Key events:

US University of Michigan consumer sentiment, Friday

Fed’s Christopher Waller and Patrick Harker speak, Friday

Here are some of the main market moves:

Stocks

S&P 500 futures fell 0.7% as of 6:39 a.m. New York time

Nasdaq 100 futures fell 1.2%

Futures on the Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 fell 1.4%

The MSCI World index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.4% to $1.0697

The British pound fell 0.1% to $1.2106

The Japanese yen rose 0.5% to 130.87 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $21,777.1

Ether fell 0.1% to $1,538.97

Bonds

The yield on 10-year Treasuries advanced five basis points to 3.71%

Germany’s 10-year yield advanced seven basis points to 2.38%

Britain’s 10-year yield advanced 10 basis points to 3.39%

Commodities

West Texas Intermediate crude rose 2.4% to $79.91 a barrel

Gold futures fell 0.3% to $1,873.30 an ounce

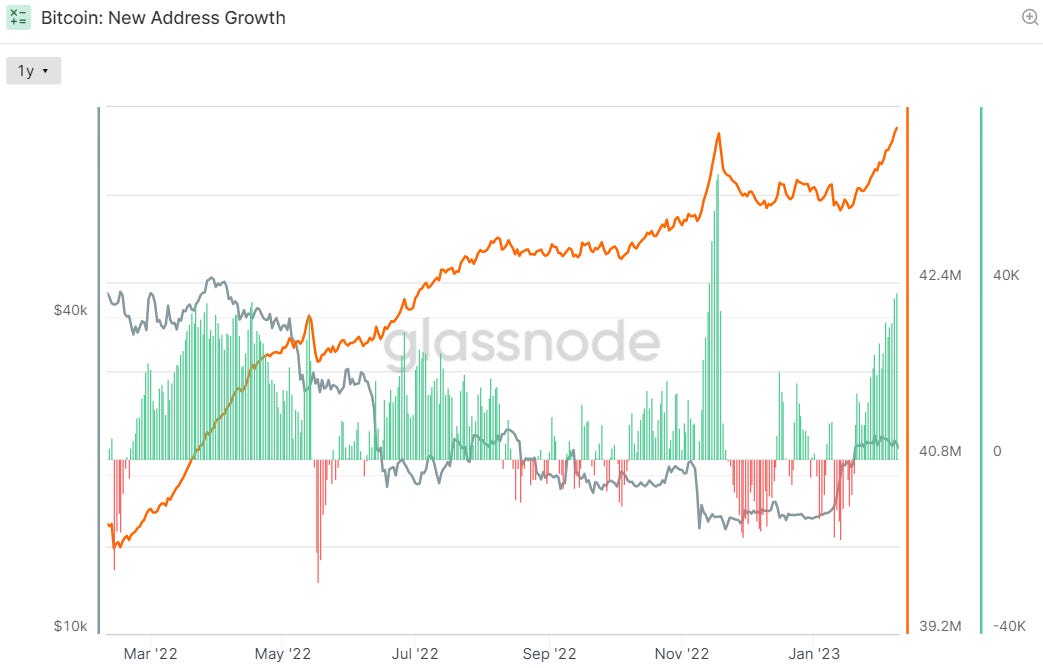

Bitcoin Addresses Are On The Rise

Bitcoin Addresses With Non-zero Balance Hit New Record High – Will New Investors Pump the BTC Price?

Despite the challenging circumstances, the pool of prospective investors eager to invest in Bitcoin continues to expand. Just this week, on Wednesday, a new record was established for Bitcoin addresses that hold a non-zero balance, a number that had not been surpassed since November of the previous year. Currently, there are 43.8 million non-zero addresses, with "Shrimp" wallets, which are comprised of less than 1 BTC, reaching an all-time high of 42.827 million total wallets. On the other hand, the growth of larger wallets has remained stagnant, indicating that Bitcoin ownership is shifting from bigger players to smaller ones. All of this data (and more) can be found on Glassnode

Federal Reserve Bank of NY Speaks Highly of Bitcoin

The New York Federal Reserve has surprisingly released a report in support of Bitcoin. In the 31-page report titled "The Bitcoin - Macro Disconnect," the digital asset is recognized for its disconnection from global markets.

“In our empirical analysis, we find that Bitcoin is unresponsive to both monetary and macroeconomic news. In particular, the result that Bitcoin does not react to monetary news is puzzling as it casts some doubts on the role of discount rates in pricing Bitcoin.”

I didn’t see that one coming.

Paxos and Circle Are Next

The pressure continues, but reliable reports indicate that Paxos and Circle are next in line, following Kraken. Given how quickly Kraken surrendered to the SEC's demands, it remains to be seen whether Paxos and Circle will follow suit. There is a lot of speculation surrounding the situation, but it appears that the government's efforts to impede the progress of cryptocurrency are intensifying. It is unlikely that anything the government does will entirely halt the growth of crypto, but it may cause some difficulties along the way. Brace yourself for more challenges.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.