The Wolf Den #658 - The Cathie Wood Comeback

2023 Might Be The Year That The Queen Of Retail Reclaims Her Crown

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

THIS NEWSLETTER IS SPONSORED BY MEXC!

Sign up using my link to MEXC and receive:

* Up to a $9,100 sign up bonus 🔥

* Available for US users 🔥

* 10% cashback on ALL trading fees 🔥

* 0 fees on ALL spot/futures maker orders 🔥

In This Issue:

The Cathie Wood Comeback

Bitcoin Thoughts And Analysis

Legacy Markets

Coinbase To Face Another Lawsuit

Vauld Buys Time

FTX Was Hacked For $415M

The Artist’s Way Into Crypto & NFTs | Robyn Ward, Contemporary Irish Artist

The Cathie Wood Comeback

Cathie Wood is no stranger to disruption. The year is 2014, and at 58 years of age, Cathie Wood is forced to leave her comfortable CIO position at Alliance Bernstein for her lacking performance and beliefs deemed, “too risky.”

“I had 3 children, two dogs, and a nanny, and I had complete silence because I knew they were going to be away for two weeks. I wasn't even thinking about work and I got the message loud and clear. You have to take all the technologies that have disrupted other industries and start to disrupt your own and focus on the new creation.”

In that same year, ARK Invest was born. The company was named after the biblical Ark of the Covenant. Cathie Wood began a divinely inspired trail-blazing investment career that was destined to shock the world. But like all good stories, her success was going to come at a cost. Despite designing new advancements in ETF structures and changing up the game at ARK, Wood’s first two years were not what she was hoping for. Even her friends doubted her

“Many of my friends thought I was going to fail, and they told me that because they wanted to protect me.”

“After two and a half years of no traction effectively, I began to ask if that was a bad move.”

But as we know, the opening ARK was not a mistake. Coming to Wood’s rescue was legendary investor and devout Christian Bill Hwang, who saw Cathie as someone he could financially save and relate to. Hwang funded Wood’s ETFs and ARK was off the ground running.

With the confidence boost, Cathie Wood was ready to go all in on the themes and ideas she had been developing her entire career. Cathie was ready to actively invest, beat indexes, discover technological trends, and buy other companies other large funds wouldn't dare touch. By 2018 Cathie Wood was still relatively a nobody, but her time was just around the corner. Her ideas were still ridiculed, but her performance was soon to be spectacular.

Big bets on Tesla, Robinhood, Gamestop, and Bitcoin began to pay off, earning Cathie Wood the title, “The Queen of Retail Investing.” ARK’s flagship ETF grew tenfold in 2020 and had the third-highest inflows behind only Vanguard and BlackRock; each of which had hundreds of ETFs combined. ARK was perfectly positioned for the unprecedented combination of risk, loose monetary policy, and bizarre market behavior.

But Cathie Wood’s success never comes without a test.

As the market began to correct in early 2021, the ARK Innovation ETF was hit by a metaphorical flood. From ARK’s high of $155.3, the ETF fell all the way to $29.43, losing 81% of its value. For gamblers, these are regular numbers, but for index investors, this type of volatility was unheard of. Cathie Wood was once again written and investors fled the fund.

But Cathie Wood was, and always will be, more than a lucky stock picker.

“We are a volatile strategy. Volatility on the upside is not a bad thing. It took a lot to get people's attention because they thought we were too risky or too crazy and I see that now coming full circle. It’s much less risky than what the benchmarks are. The benchmarks are filling up with value traps. The innovation platform that involves 14 different technologies is going to disrupt and disintermediate the traditional world order. The big risk is in the benchmarks, not what we are doing.”

For some investors, Cathie Wood's strategy may be controversial, but to her loyal followers, her outlook is seen as the truth. The question now becomes, are Cathie Wood and ARK positioned for an epic comeback? On January 12th, Wood sent a letter to her investors that may bring some overdue hope.

Titled, “What The Market Overlooked in 2022,” the letter details Wood's perspective on the current state of the market and the disruptive technologies her firm is currently researching and investing in. In the letter, Wood states that in 2022, transparency was more important than ever as shares of innovation-focused companies suffered disproportionately. She also notes that in her 45 years on Wall Street and over 30 years in portfolio management, she has never seen markets this dislocated.

The letter goes on to explore a handful of disruptive technologies such as digital wallets and blockchain technology, which Wood is a strong proponent of. She notes that digital wallets overtook cash as the top transaction method for offline commerce in 2020 and accounted for around 50% of global online commerce volume in 2021. Additionally, Wood highlights the potential of public blockchains like Bitcoin and Ethereum as a solution to the fraud and mismanagement associated with centralized, opaque institutions.

While the letter does not specifically mention Wood's love for Coinbase stock, which her firm has been aggressively bidding, or her famous prediction that Bitcoin will reach $1 million by 2030, these are well-known aspects of her investment strategy. Regardless of whether or not these predictions come to fruition, Cathie Wood has certainly made a name for herself in the investment world.

Overall, Cathie Wood's opinion on the market and disruptive technologies is worth considering, and 2023 may be the year for her comeback.

The link to the letter is provided for those who are interested in reading it in full.

* WE HAVE MADE THE MOVE TO SUBSTACK! Hopefully this newsletter finds you without any complications or issues. Please let us know if you are having any problems.

Bitcoin Thoughts And Analysis

I have seen quite a few people describe an ascending triangle, which would be a bullish pattern. I see a clear ascending, or rising, wedge, which statistically should break to the downside. That said, in a true bull market, no asset breaks more ascending wedges to the upside than Bitcoin.

RSI is finally cooling down on lower timeframes, forming consistent bearish divergence. There is also hidden bullish divergence (blue), so this is more a signal of indecision and consolidation than bearishness. Still, I continue to lean towards a small correction before any further movement up. Does not mean it won’t just launch from here! All we can do is play the odds.

Notice the golden cross between the blue and red 50 and 200 MAs on this time frame, which preempted this entire move.

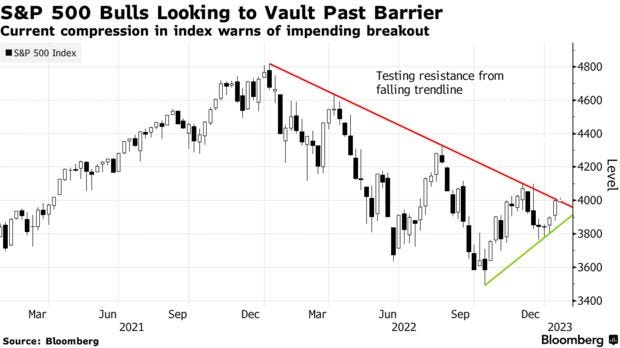

Legacy Markets

U.S. equity-index futures were mixed as investors remain uncertain about the direction of monetary policy and corporate earnings. The Bank of Japan's decision to maintain its monetary settings caused the yen to decrease against the dollar. S&P 500 and Nasdaq 100 contracts were unchanged after a volatile session in New York. Moderna Inc. rose 5.9% after announcing their vaccine for respiratory syncytial virus was successful, but IBM fell after Morgan Stanley lowered their recommendation for the stock. Investors are closely watching indicators of growth and inflation to determine when the Federal Reserve and other central banks will stop increasing interest rates.

Key events this week:

Euro-zone CPI, Wednesday

US retail sales, PPI, industrial production, business inventories, MBA mortgage applications, cross-border investment, Wednesday

Federal Reserve releases Beige Book, Wednesday

Fed speakers include Raphael Bostic, Lorie Logan and Patrick Harker, Wednesday

US housing starts, initial jobless claims, Philadelphia Fed index, Thursday

ECB account of its December policy meeting and President Christine Lagarde on a panel in Davos, Thursday

Fed speakers include Susan Collins and John Williams, Thursday

Japan CPI, Friday

China loan prime rates, Friday

US existing home sales, Friday

IMF’s Kristalina Georgieva and ECB’s Lagarde speak in Davos, Friday

Stocks

The Stoxx Europe 600 rose 0.1% as of 10:19 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.7% to $1.0860

The Japanese yen fell 1% to 129.38 per dollar

The offshore yuan rose 0.2% to 6.7561 per dollar

The British pound rose 0.5% to $1.2347

Cryptocurrencies

Bitcoin fell 0.4% to $21,241.46

Ether fell 0.2% to $1,578.55

Bonds

The yield on 10-year Treasuries declined six basis points to 3.49%

Germany’s 10-year yield was little changed at 2.09%

Britain’s 10-year yield advanced four basis points to 3.37%

Commodities

Brent crude rose 1.3% to $87.07 a barrel

Spot gold rose 0.2% to $1,912.78 an ounce

Coinbase To Face Another Lawsuit

Coinbase has a history of finding itself in the spotlight for both good and bad reasons. Recently, the company is facing a class action lawsuit for their failure to distribute Flare and Spark tokens to XRP holders who were promised an airdrop in 2020 during the XRP snapshot. According to the accusations made by the plaintiff, Coinbase allegedly received the airdrops but refused to distribute them to eligible customers. This lawsuit is further complicated by Flare's association with XRP and the ongoing legal battle involving Ripple. However, Coinbase has not yet addressed the issue with its customers, leading to the lawsuit. Additionally, Coinbase is not the only exchange that has failed to fulfill a promise; Binance.US also promised an airdrop of Ethereum POW, but it has yet to happen. The issue highlights a larger regulatory problem in the crypto industry.

Vauld Buys Time

In the coming months, the dominant news cycle is likely to revolve around the plans bankrupt companies put forth to settle their debts. Crypto lender Vauld, which is now bankrupt, has until February 28th to submit a revival plan to the Singapore court. Initially, Vauld had plans for Nexo to buy the platform, but that deal fell through, further delaying the process. Currently, Vauld has been granted extended creditor protection to finalize negotiations with two other digital-asset fund managers who are offering to take over the assets.

FTX Was Hacked For $415M

$323m was stolen by an “unauthorized third party” on FTX International and another $90m was swiped from FTX.US. We knew the hacks happened during the chaos of the bankruptcy, but we didn’t know how much was lost. Unfortunately, these assets are just as much a part of what is owed to the creditors as the rest of the funds, so now there’s even less to go around. The question still remains as to whether or not FTX will receive a clawback frm Binance, possibly worth up to $2.1b.

The Artist’s Way Into Crypto & NFTs | Robyn Ward, Contemporary Irish Artist

Robyn Ward is a renowned artist who lives between New York, Los Angeles, and Mexico City. I caught up with Robyn in New York, in the House of Muse, where he painted his new masterpiece that he would then fractionalize and sell as NFTs. We talked about why an artist would choose crypto and NFTs, what inspires Robyn and why he prefers to paint instead of moving into the digital world. Check this interview and then go check Robyn’s art.

In this episode with Robyn, we discussed:

The artist's way to crypto

Finding inspiration

Fractionalizing the painting

Opportunities in crypto

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.