Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

'They' Are Now Explaining It To 'Us'

Bitcoin Thoughts And Analysis

Legacy Markets

MicroStrategy is Raising $42 Billion (With A ‘B’)

There Are Now Two Fillings For A Solana ETF

The Bad Quarters Are Behind Us

This Is What The SEC Has Cost Us

Bitcoin Demand Skyrockets – Is Now The Perfect Time To Invest?

'They' Are Now Explaining It To 'Us'

Do you remember the hype that was once generated in the crypto space whenever a House or Senate hearing was called on digital assets and a knowledgeable advocate took the floor, dunked on some ignorant politicians, and advanced the crypto conversation?

Even further back in time, when a random guy held the “Buy Bitcoin” sign on live TV behind Janet Yellen during a Federal Reserve broadcast, it was enough to send shockwaves through the community. Back in those days, even the smallest nod to Bitcoin—grassroots or unexpected—felt like a major victory.

Fast-forward to today, and we’ve come a VERY long way. A Presidential candidate is wishing Bitcoiners a happy Birthday. LOL.

That said, simply having their attention doesn’t mean they truly understand. Now, we’re up against a new set of challenges: enduring their attempts to explain our own space back to us, sorting through misinformation, and pushing back against the parts that are just plain wrong.

For example, the U.S. Treasury recently released a lengthy PDF to the public—a presentation to the Treasury Borrowing Advisory Committee (TBAC)—with a 17-page section, buried toward the back, focused entirely on the intersection of digital assets and the treasury market. The issue? Some of it just doesn’t add up and is plain crap.

There’s a lot of content in here, so while I can’t fact-check every detail, I’ll highlight some of the major misconceptions these so-called ‘early adopters’—in this case, the Treasury Department—are still getting wrong about crypto. Considering Janet Yellen is the Treasury Secretary, it’s not all that surprising—though not entirely awful either. I’ll also spotlight some of the positives.

False and False.

“Small base?” “The number of users in the Cryptocurrencies market is expected to reach 861.00m users by 2025.” In the beginning of 2024, I remember it being widely circulated there were well over 500 million crypto users.

“Limited to holding digital assets for investment purposes?” This is a fundamental misunderstanding of what this space has to offer. Janet Yellen needs to go back and do some studying.

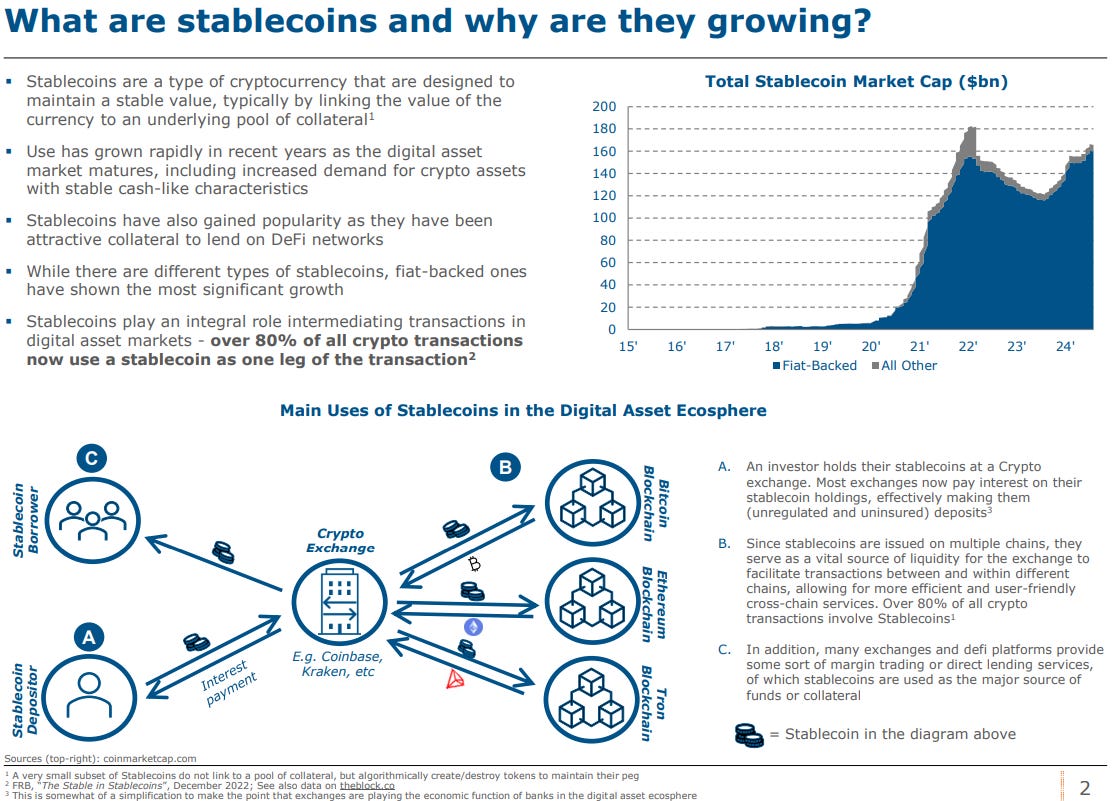

This next slide deserves a pass. To be honest, it's pretty difficult to misunderstand what stablecoins are and why they could be growing.

This actually was my favorite slide in the presentation.

The intern that put this one together deserves a raise.

Here’s where a major flaw in the presentation arises. The Treasury department lays out the “promise” of the tokenization and begins on the right track, (marked with checkmarks) until this statement, “These ledgers will also need to be developed under the auspices of central banks and the foundation of the trust they provide.”

Having a centralized authority oversee the development of tokenized ledgers violates the very principles that make cryptocurrencies and stablecoins attractive in the first place: autonomy, transparency, and user control. Not to mention, what’s that crap about, “Central Bank Digital Currencies (CBDC) will likely need to replace stablecoins as the primary form of digital currency underpinning tokenized transactions.” This might satisfy some old heads on Wall Street, but I doubt that BlackRock or Franklin Templeton—two major players in the tokenization space—are on board with that plan.

First, they argue that central banks should oversee the development of these ledgers, and then they claim this will lead to greater “transparency and accountability.” The Treasury Department seems intent on co-opting the technology that others have built, using our buzzwords to win over the public, and then carrying on with business as usual.

This entire slide is a joke—just look at the bottom right corner. Bitcoin, Ethereum, and all other crypto assets still face a long road ahead in challenging and displacing the establishment's expectations. If these assets don't prevail, we’ll be left with financial networks that are little more than an upgrade of the existing ones: centralized, permissioned, opaque, and maybe just a touch faster.

While we had to push our way into the conversation, the Treasury Department has missed the mark here. That said, I still believe this outcome is a significant step up from where we were 3 to 5 years ago. To their credit, they did get this part right.

Perhaps a pro-crypto president can do the trick, but I wouldn’t hold my breath. Trump never said anything about establishing one body of government to govern crypto, but he did say he would, “create a Bitcoin and crypto Presidential Advisory Council.” Here’s the conclusion from the presentation.

Overall, I would rate the Treasury’s understanding, focus, and perspective a 5/10. They earn points for acknowledging the benefits of this technology and demonstrating some grasp of how it works. However, significant deductions are warranted due to their insistence on relying on centralized technology and oversight methods, which ultimately detract from the original purpose of decentralization, transparency, and user empowerment. This approach undermines the core values that make blockchain and crypto assets so revolutionary, potentially leading to a future that mirrors the existing financial landscape rather than transforming it for the better.

Anyways, the market seems jittery about the upcoming election. From what I'm hearing and seeing, there's credible evidence to suggest this is a very tight race. Could it swing dramatically in either direction? Absolutely. But my intuition tells me it's going to be close, and every vote truly matters. If you're a U.S. citizen, make sure to get out and vote. The essence of crypto is about empowering individuals, and participating in the electoral process is just as empowering. Your vote is your voice—make it count!

Don't wait until November 5th if you can help it; the lines are often unbearable. If early voting is open in your county, I encourage you to get ahead of the crowds. For official details on the election, visit https://www.nass.org/can-I-vote.

Bitcoin Thoughts And Analysis

Bitcoin came within a few hundred dollars of a new all time high - then flushed leverage and dropped back below $70K. Not unexpected.

Today’s candle looks potentially very bullish, with a long wick down below support. We need to see it close up here.

Things still look great.

Legacy Markets

The latest U.S. jobs report, showing only 12,000 new payrolls for October, has revived expectations for Federal Reserve rate cuts, spurring a bond rally and a slight stock uptick. The modest hiring figures were distorted by hurricanes and a significant Boeing strike, with unemployment steady at 4.1%. Markets are now pricing in a 25-basis-point Fed cut in November and possibly another in December, supported by downward revisions to previous job gains and persistent but manageable wage inflation.

Analysts like Seema Shah and Jeff Roach see the storm impact as temporary but still supportive of easing. They predict cumulative cuts through 2024, aiming for a 3.0%-3.5% Fed funds rate by mid-2025. However, concerns remain, such as persistently high wages that could complicate the Fed's inflation targets. Corporate earnings revealed mixed performances: Exxon and Chevron exceeded forecasts thanks to rising oil production, while Amazon impressed with efficient cost management, contrasting with Apple's growth concerns in China. Meanwhile, Intel’s positive revenue outlook signaled potential recovery in its market share.

In conclusion, the October jobs report, though affected by one-off factors, reinforces the market’s conviction that the Fed will ease rates. Investors are now looking for further Fed actions amid this mixed economic backdrop.

Stocks

The S&P 500 rose 0.5% as of 9:31 a.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average rose 0.5%

The Stoxx Europe 600 rose 1%

The MSCI World Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0871

The British pound rose 0.4% to $1.2954

The Japanese yen was little changed at 152.18 per dollar

Cryptocurrencies

Bitcoin rose 0.4% to $70,200.32

Ether rose 0.7% to $2,535.76

Bonds

The yield on 10-year Treasuries declined two basis points to 4.26%

Germany’s 10-year yield declined two basis points to 2.37%

Britain’s 10-year yield declined six basis points to 4.39%

Commodities

West Texas Intermediate crude rose 2.5% to $70.96 a barrel

Spot gold rose 0.4% to $2,755.02 an ounce

MicroStrategy is Raising $42 Billion (With A ‘B’)

MicroStrategy’s third-quarter earnings report was historic, to say the least. The company revealed plans to invest $42 billion in Bitcoin over the next three years, the largest telegraphed Bitcoin purchase plans—ever—that is simultaneously the world’s largest equity dilution. Since August 2020, the original cost basis of its Bitcoin holdings has totaled $9.9 billion. This means that, over the next three years, MicroStrategy intends to spend nearly four times as much on Bitcoin as it did in the previous four years. Included in the three-year vision is the 21/21 plan, which is outlined below. I don't think there is anyone on the planet as tapped into Bitcoin as Michael Saylor.

“Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital. Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our ‘21/21 Plan.’ As a Bitcoin Treasury Company, we plan to use the additional capital to buy more bitcoin as a treasury reserve asset in a manner that will allow us to achieve higher BTC Yield.”

“BTC Yield KPI: Year-to-date 2024, the Company’s BTC Yield is 17.8%. The Company is revising its long-term target to achieve an annual BTC Yield of 6% to 10% between 2025 and 2027. BTC Yield is a key performance indicator (“KPI”) that the Company uses to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders. See “Important Information about BTC Yield KPI” in this press release for the definition of BTC Yield and how it is calculated.”

“Digital Assets: As of September 30, 2024, the carrying value of the Company’s digital assets (comprised of approximately 252,220 bitcoins) was $6.851 billion. As of September 30, 2024, the original cost basis and market value of the Company’s bitcoin were $9.904 billion and $16.007 billion, respectively, which reflects an average cost per bitcoin of approximately $39,266 and a market price per bitcoin of $63,463, respectively.”

“In particular, BTC Yield is not equivalent to “yield” in the traditional financial context. BTC Yield is a key performance indicator (“KPI”) that represents the % change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding.”

There Are Now Two Fillings For A Solana ETF

Canary Funds, the firm behind the recent XRP and Litecoin ETF filings, just threw in a SOL ETF application, making it the second in line after VanEck’s submission earlier this summer. Given the lukewarm demand for an ETH ETF, it’s hard to see much appetite for a Litecoin, Ripple, or even Solana ETF. After all, this is Wall Street we’re talking about, not crypto bros betting on memecoins.

The Bad Quarters Are Behind Us

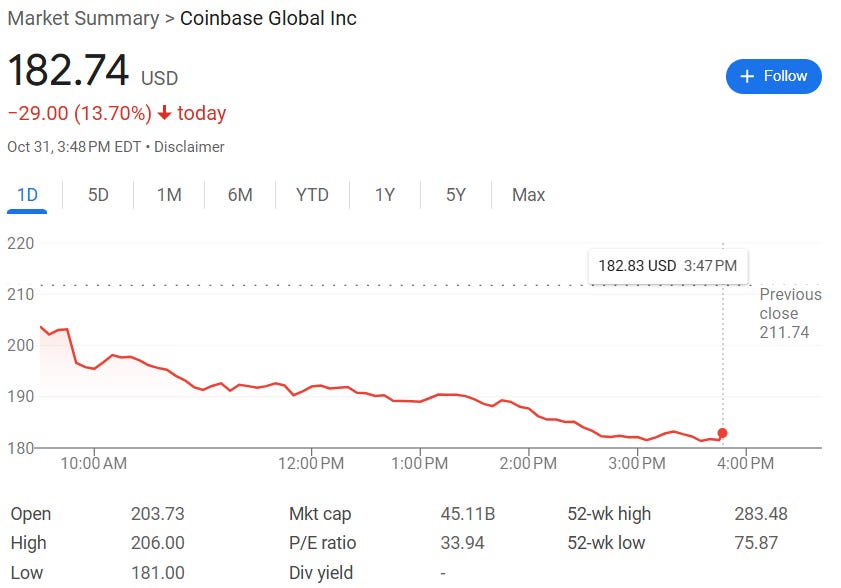

It shouldn’t come as a surprise that major crypto companies had a rough Q3 considering there wasn't interest in the market for the entire quarter. For Coinbase, “In the third quarter, the crypto exchange reported earnings per share of $0.28, below the expected $0.41, and revenue of $1.21 billion, falling short of the anticipated $1.26 billion.” Robinhood on the other hand had some positive performance in its crypto offering, options trading and, platform revenue but missed after, “posting a net income of $150 million, or $0.17 per diluted share, compared to an $85 million loss a year prior,” resulting in a 13% drop in the stock. Volume in the crypto market is already surging, and if this trend continues, crypto stocks are poised to perform exceptionally well as we move further into Q4. As Wall Street begins to recognize this, expectations will rise, driving stock prices much higher.

This Is What The SEC Has Cost Us

This is interesting. The Blockchain Association reported that under Gary Gensler's leadership, the U.S. SEC has cost crypto companies at least $426 million in litigation. The association highlighted that the SEC filed 104 cases against the industry between 2021 and 2023, with data from member companies indicating significant spending on defense. The Blockchain Association called for an end to this “law-fare” and advocated for new leadership at the SEC to ensure a fair approach to crypto regulation.

Bitcoin Demand Skyrockets – Is Now The Perfect Time To Invest?

Join me as I sit down with Gary Cardone, an entrepreneur and investor, to dive into the latest crypto trends. As Bitcoin faces massive demand from institutional investors, we explore what this could mean ahead of the upcoming U.S. election.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.