Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Two days ago Arch Public’s Concierge Program clients had an incredible day. Trading both the MES and MNQ profits were +10.2% for the DAY! In the past 70 days Concierge Program clients are up +46.3%. See yesterday’s trades below.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

The Truth About Net Worth

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

A Brief Discussion On Ethereum

Crypto And AI

Brian Armstrong Calls For The SEC To Drop All Frivolous Cases

We Have A New ETF Approval To Root For

The Bull Market Is Back! What Coins Should You Trade To Maximize Your Stack? | Trading Alpha

The Truth About Net Worth

The crypto market is heating up.

With Bitcoin nearly touching new all-time highs, I find myself checking prices twice as often as I have in recent weeks combined.

After all, I'm only human—I'm sure I'm not alone in this habit.

As I noticed myself slipping into this pattern, I realized I needed to share something important with all of you, and I can't overstate its significance.

From this moment on, remember, without exception, that your net worth does not define your self-worth in any way, shape, or form.

In fact, your self-worth is infinitely greater than your net worth.

To put it simply:

Self-Worth ≠ Net Worth and…

Self-Worth >> Net Worth

I'm sharing this now because if Bitcoin's price surpasses previous highs—which we all hope for, of course—price discussions will become even more dominant. This often leads to a mindset trap where investors or traders begin to subconsciously, then consciously, equate their self-worth with market performance. From experience, this approach leads nowhere productive for future performance or mental health.

What’s fascinating is how easily we fall into these traps, especially in the crypto space, where conversations are public and the scoreboard is always visible. It creates a cycle of comparing one quality asset to another, only to see a historic Bitcoin chart overshadow that performance. Meanwhile, a meme coin that launched last week has skyrocketed 1,000x, making everyone else seem rich—except you.

That's how quickly our sense of self-worth can spiral.

Part of the problem is that crypto investors can develop a superiority complex, which clouds our judgment of ourselves and others, leading to a misguided sense of self-worth tied to market performance. The answer is simple: while crypto is undeniably transformative, it’s essential to recognize that those who don’t believe in it may simply need more exposure or time to unwind old beliefs. Instead of judging, let’s acknowledge that each person’s journey is unique, shaped by different experiences and perspectives.

Next, we must stop glorifying the price performance of assets against one another. Crypto isn’t a sports competition where individuals and teams are celebrated for their ability to compete; it’s a collaborative movement focused on revolutionizing and improving an outdated and often harmful financial system. The scoreboard shouldn’t be measured solely by price; it should reflect the innovation in the space: new technologies being built, lives positively impacted, capital being freed, progress toward decentralization, creation of new financial opportunities, and improvements in security and transparency.

Third, crypto investors must release the notion that they should have picked the fastest horse. Somewhere, someone may have constructed a near-perfect portfolio by choosing Solana over Bitcoin and Ethereum, MicroStrategy over Coinbase, Bonk and Wif over countless other memecoins, and allocating the rest to MSTX (the leveraged MSTR ETF) at launch. But that person is a rare exception—a unicorn. If you own any amount of crypto, you deserve credit for taking a risk that much of the world has disregarded, even if your selection hasn’t been the top performer.

My fourth and final point: an investor’s success shouldn’t be defined solely by gains, but by a commitment to learning and staying within their circle of competence in this uncharted territory. If we measured success purely by performance, we’d all feel ashamed that NVIDIA has outperformed Bitcoin—a ridiculous comparison. If Bitcoin fits your area of expertise, then it’s a solid choice. If Ethereum aligns with your understanding, then ETH is the right move. The same goes for Solana and everything else. Maximizing gains isn’t a skill, so let’s stop holding ourselves to impossible standards.

Bitcoin is nearly turning its old all-time high into support. Whether this is your first all-time high or your fourth, let’s act like we’ve been here before, support each other’s successes, and not let comparison steal our joy.

We’re not just part of history—we’re making it, day in and day out.

Self-Worth ≠ Net Worth and…

Self-Worth >> Net Worth.

Bitcoin Thoughts And Analysis

Consolidation under resistance usually leads to expansion. Sitting just under the previous all time high and gathering strength is actually what we want to see.

It is likely only a matter of time before Bitcoin breaks up again.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

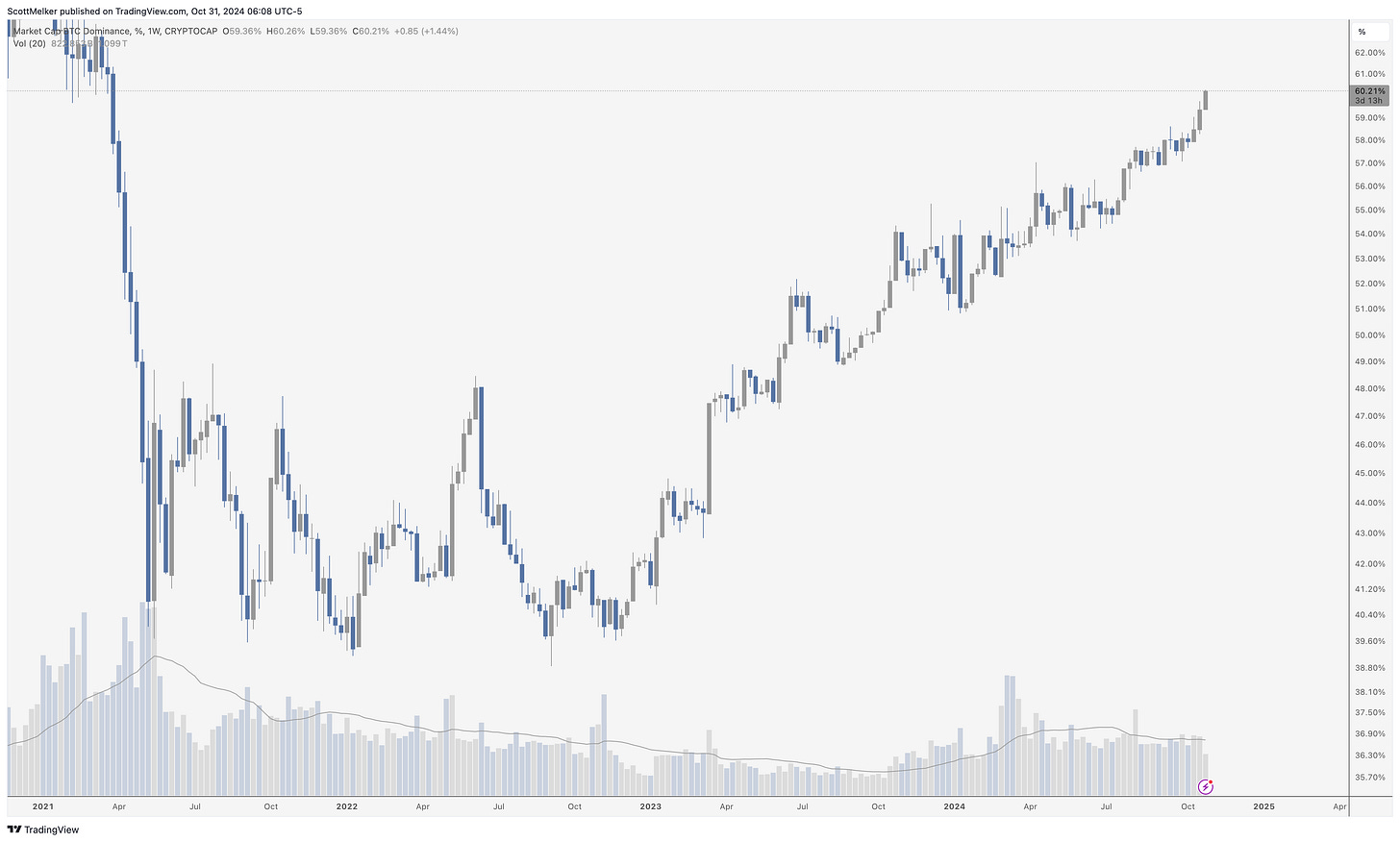

I am sorry to continue to beat a dead horse, but the altcoin cycle has not begun yet. Dominance just reached 60%, meaning that Bitcoin continues to put the smack down on your favorite smaller tokens.

Long term, this could be a time to scale in, but if you are trading, there’s no confirmation yet that altcoins are set to outperform.

Legacy Markets

Stock markets saw declines amid disappointing earnings reports from Microsoft and Meta, leading Nasdaq 100 futures to drop over 1% as the two stocks alone accounted for half of the losses. Investors are questioning the profitability of tech giants as they continue heavy spending on AI and cloud services. Meanwhile, the dollar index is on track for its largest monthly gain since 2022, spurred by robust US economic data that led investors to reduce expectations for near-term Fed interest rate cuts.

In Europe, stocks also fell, with the Stoxx Europe 600 seeing its largest monthly decline in a year. European bond markets dropped as inflation data suggested a gradual interest rate reduction path. UK bonds weakened amid speculation of tighter fiscal policy to support government borrowing plans. Asian markets were also mixed, with Japanese, Australian, and South Korean shares falling, while Hong Kong shares rose following positive Chinese manufacturing data.

In other assets, oil prices edged higher, gold retreated after reaching a record high, and the yen strengthened as the Bank of Japan maintained its interest rate amid economic uncertainties.

Key events this week:

Eurozone CPI, unemployment, Thursday

US personal income, spending and PCE inflation data, initial jobless claims, Thursday

Amazon, Apple earnings, Thursday

China Caixin manufacturing PMI, Friday

US employment, ISM manufacturing, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.8% as of 6:37 a.m. New York time

Nasdaq 100 futures fell 1.1%

Futures on the Dow Jones Industrial Average fell 0.5%

The Stoxx Europe 600 fell 0.9%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.1% to $1.0868

The British pound rose 0.2% to $1.2991

The Japanese yen rose 0.6% to 152.46 per dollar

Cryptocurrencies

Bitcoin fell 0.7% to $72,315.01

Ether fell 1.8% to $2,630.07

Bonds

The yield on 10-year Treasuries declined two basis points to 4.28%

Germany’s 10-year yield advanced two basis points to 2.41%

Britain’s 10-year yield advanced six basis points to 4.41%

Commodities

West Texas Intermediate crude rose 0.6% to $68.99 a barrel

Spot gold fell 0.3% to $2,779.12 an ounce

A Brief Discussion On Ethereum

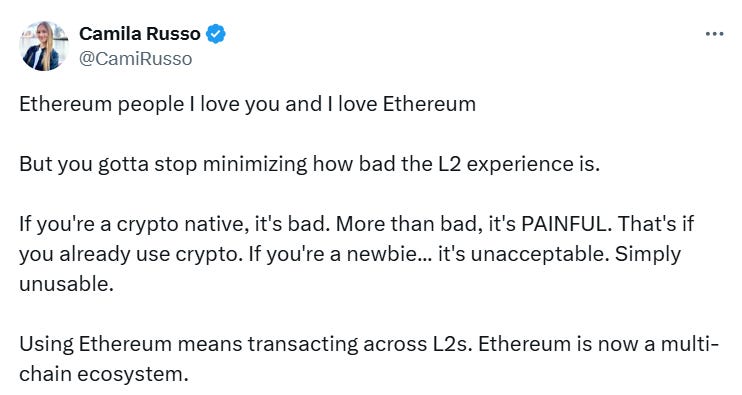

Camila Russo, founder of “The Defiant,” a credible and popular DeFi newsletter, recently called out some of Ethereum’s shortcomings, prompting an interesting response from Vitalik. It’s no secret that Ethereum’s been lagging behind both Bitcoin and Solana this cycle, which makes this the perfect time to dig into what’s going on. I’ll keep it brief for now, but there’s plenty to explore. Let’s see what Camila had to say to start.

“Maybe the mint you really like is one chain, while the dapp you wanna airdrop farm is on another. Maybe you're a business like The Defiant, and get stables in three different chains bc that's where your clients have their cash. So no, the argument of, "just use one chain and it's seamless," is not a solution. The vision of many chains working seamlessly within one umbrella ecosystem is not a solution either. The experience needs to be seamless across all L2s and mainnet. Or it just doesn't work.

And yes, I know there are technical solutions that are being worked on. but they're not here. and those that ARE here, aren't being implemented. What's the point of having account abstraction if almost no wallet and protocol is using it? Improving Ethereum UX will require cross-ecosystem coordination. That's already hard. But it's going to be impossible if everyone deludes themselves by saying, "It's not that bad." Listen, it's bad.”

Here’s Vitalik’s response:

Vitalik’s response, of course, proceeds to move into the technical weeds, but the main question is simple: should Ethereum builders take accountability for today’s shortcomings, or ignore the pressure to justify what’s currently lacking?

That’s up for you to decide.

In other Ethereum news, I want to share a quick post from @RyanSAdams, who dives into one angle of the short-term price performance criticism around Ethereum.

The post explains that Ethereum’s economic model alternates between “burn” and “expand” cycles, responding to changes in blockspace demand and supply. During burn cycles, when demand exceeds blockspace capacity, ETH becomes deflationary as more tokens are burned than issued. The most recent burn cycle lasted from spring 2023 until a blockspace increase in March 2024. In expand cycles, such as the current one initiated by EIP-4844, blockspace availability rises, making transactions cheaper and causing ETH to turn inflationary again.

Each cycle brings unique benefits: burn cycles enhance ETH’s scarcity, while expand cycles foster growth in Ethereum’s Layer 2 (L2) ecosystems, increasing demand for ETH.

That’s the core idea, but there’s more detail to the post. Feel free to revisit this once your newsletter is done.

Crypto And AI

Coinbase developer Lincoln Murr recently announced the launch of a new tool called "Based Agent," which allows users to create an AI agent connected to their crypto wallet in under three minutes. This AI agent can handle various on-chain tasks, including trading, swaps, and staking. Acting as a customizable template, Based Agent enables users to build AI agents capable of interacting with smart contracts. A fully autonomous mode even allows the agent to execute tasks independently. Developed with support from OpenAI and Replit, users need an API key from Coinbase’s developer program and one from OpenAI to start creating their agents.

This launch follows a recent milestone for Coinbase—facilitating its first transaction between AI agents. However, CEO Brian Armstrong noted that current AI agents still face challenges in handling unsupervised tasks. This marks an exciting step toward the future convergence of crypto and AI.

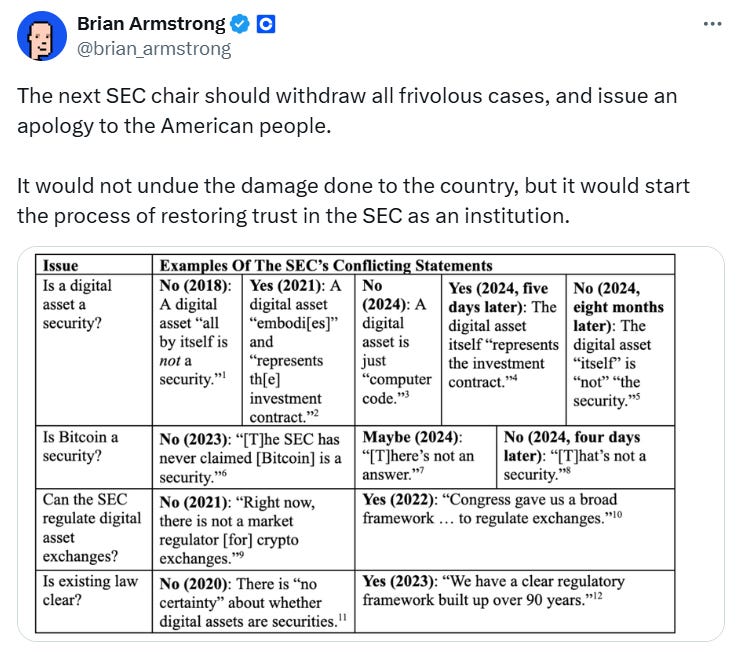

Brian Armstrong Calls For The SEC To Drop All Frivolous Cases

We're less than a week away from gaining more clarity on potential changes in SEC leadership for 2025, and the implications of this shift extend beyond the popular crypto assets currently under investigation. Major companies that provide access and infrastructure, with Coinbase being the largest, could be significantly impacted for the better. If Gary Gensler is replaced as SEC chairman, or steps down, I am anticipating a substantial move on COIN in response to the shifting regulatory landscape. Personally, I would love to see an apology from a new SEC chair.

In other news the SEC has caused, the Ethereum blockchain software company Consensys has unfortunately announced it has been forced to lay off 20% of its staff to keep up with costs of being sued by the SEC. “Multiple cases with the SEC, including ours, represent meaningful jobs and productive investment lost due to the SEC’s abuse of power and Congress’s inability to rectify the problem. Such attacks from the U.S. government will end up costing many companies…many millions of dollars.” All of this and more should come to a swift end if Gensler is removed.

We Have A New ETF Approval To Root For

This ETF submission is particularly interesting because it includes Solana, a token the SEC has previously classified as a security. It’s unclear if Grayscale’s strategy is to file now in anticipation of a regime change or to attempt getting Solana into an approved ETF to bolster the case that it isn’t a security. The SEC’s feedback will be interesting, if we get any.

The Bull Market Is Back! What Coins Should You Trade To Maximize Your Stack? | Trading Alpha

Black Friday sale! 30% off both the Alpha Bundle and the Alpha Screener!

Trading Alpha is a show with John Wick, an anonymous options trader, where we analyze the market and give setups.

Make sure to check out https://tradingalpha.io/?via=scottmelker for elite-level trading tools and indicators. Use code '30OFF' entered during checkout on left hand side for a 30% discount!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thanks for this great article. Let's try to not step into the trap indeed.

Have a nice weekend!