Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Arch Public

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Pennsylvania Passes Bitcoin Rights Bill

Bernstein Analyst Predicts 200,000 Bitcoin Price

Michael Saylor Clears The Air

Kraken Aims To Compete With Base

Arch Public

You’ve probably heard me talk about Arch Public by now—I mention it at the top of the newsletter twice a week and occasionally dive into a longer segment after the intro.

Those that have been reading the newsletter for a while know that I never give up this top space—I keep it reserved for my own thoughts. But the performance Arch Public has delivered compared to any other asset or mixed basket is nothing short of eye-popping.

So today, I’m passing the mic over to my good friend Andrew Parish from Arch Public, so he can break it down for you and share more about what they’re up to.

Oh, and remember the $10,000 portfolio I started when I first partnered with Arch Public on April 24th? It’s up 47%, now sitting at $14,076. That’s the reason I’m obsessed with this product.

Now I will let my good friend Andrew Parish do the talking…

Scott Melker has said it over and over again: people love Arch Public. They love the multiplicity of strategy choices and diversity of outcomes, daily liquidity, service, and the hands-free experience of allowing algorithms to produce “better than hedge fund” returns.

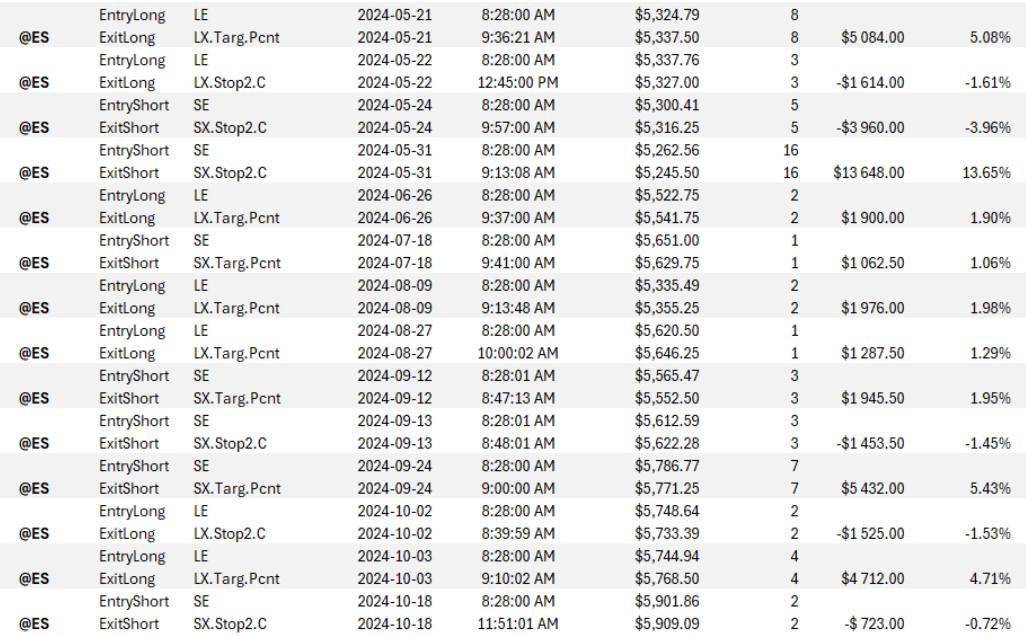

Let’s be clear about performance. See the last few months of trades and overall returns for two of Arch Public’s strategies: SP500 and the NASDAQ:

Arch Public’s Concierge Program offers a personalized trading experience tailored to investors’ individual needs, from capital size to risk tolerance. The program provides access to a wide array of sophisticated algorithmic trading strategies focused on futures indexes, including Nasdaq, S&P 500, Russell, and Dow. One of its most notable features is the ability to customize a portfolio of algorithms that exploit both market upswings and downturns, offering a more flexible approach than traditional stock investing. This flexibility, combined with a +37% increase in client performance over the last two months, highlights its potential for significant growth.

Members of the Concierge Program benefit from white-glove service, including a dedicated account manager who works closely with them to optimize their portfolios and achieve their financial goals. The program caters to a broad range of investors, with account sizes starting from $25,000 and scaling up to over $10 million. Whether seeking long-term returns or income generation, clients can take advantage of both market volatility and stability, thanks to the unbiased nature of Arch Public’s algorithms, which are continuously updated by a team of researchers and developers.

After you finish reading this, come back and listen to one of Arch’s clients describe their experience with the team and products:

Additionally, the Concierge Program is designed to help investors optimize tax advantages, offering benefits like the 60/40 tax treatment on futures trading, which allows part of the profits to be taxed as long-term capital gains. This makes the program not only a high-performance investment option but also a smart choice for investors looking to optimize their tax strategies while maintaining liquidity and market agility.

Our focus at Arch Public has remained threefold: daily liquidity, risk management, and service.

(Back To Scott)

If any of this interests you, I highly recommend checking out Arch Public, joining the waitlist, and setting up a free demo call to learn more about the product. I can personally vouch that Andrew takes great care of everyone, so you'll be in good hands if you sign up.

I hope all of you have a great weekend, Wolf out.

Bitcoin Thoughts And Analysis

Nice. Yesterday confirmed a bullish engulfing candle. bouncing beautifully off of support. We are still sideways, but this gives more confidence that there is no real local correction happening here.

We still need to get above $70,000.

For those who trade MA crosses, it looks like a golden cross between the 50 and 200 MAs is inevitable in the coming days.

Legacy Markets

US stock futures showed gains, potentially trimming the week’s losses, as investors looked past earlier borrowing cost concerns. S&P 500 futures rose 0.3%, and Treasury yields fell for a second day, although the 10-year yield remains up about 10 basis points for the week. Traders are now eyeing upcoming US economic data, including payrolls, for insights on potential Fed rate cuts. With the November 5 presidential election nearing, some analysts predict a market rally if Donald Trump wins, though others caution it may heighten inflation and slow Fed easing.

Meanwhile, pre-election strategies include increasing gold holdings as an inflation hedge, with gold hitting record highs and major inflows. Nvidia shares reached an all-time high, while the Stoxx 600 in Europe declined, led by underwhelming earnings reports from Remy Cointreau, Mercedes-Benz, and others.

Oil rebounded after a two-day drop, as traders focused on Middle East tensions. In Asia, Japan’s yen remained steady as the country’s weekend election may impact its ruling coalition. China held its one-year policy rate unchanged, signaling a cautious approach to economic stimulus.

Key events this week:

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 7:22 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 fell 0.2%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0824

The British pound was little changed at $1.2984

The Japanese yen was little changed at 151.91 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $67,924.66

Ether rose 0.1% to $2,538.63

Bonds

The yield on 10-year Treasuries declined two basis points to 4.20%

Germany’s 10-year yield advanced one basis point to 2.28%

Britain’s 10-year yield declined one basis point to 4.22%

Commodities

West Texas Intermediate crude rose 0.7% to $70.70 a barrel

Spot gold fell 0.5% to $2,722.94 an ounce

Pennsylvania Passes Bitcoin Rights Bill

The big news Dennis Porter has been building up is that Pennsylvania, a major swing state, has passed the *Bitcoin Rights Bill* (House Bill 2481), offering regulatory clarity for digital assets. The bill safeguards residents' rights to self-custody digital assets, permits Bitcoin use as payment, and provides tax guidelines for Bitcoin transactions. While these developments are positive, it's unclear if this will truly “swing the election.”

The bill passed in the Pennsylvania House of Representatives with overwhelming bipartisan support—unanimous among Republicans and three-fourths among Democrats—highlighting a trend of states enacting crypto regulations amid federal uncertainty. However, the bill isn’t yet law; it still requires Senate approval and the governor’s signature.

In case you're unfamiliar, the Satoshi Action Fund (SAF) is a bitcoin advocacy group dedicated to promoting Bitcoin at the state level and supporting lawmakers in establishing clear crypto regulations—a gap the federal government has yet to fill. So far, SAF has helped pass similar legislation in 20 states, with bills enacted into law in Oklahoma, Louisiana, Montana, and Arkansas. Given the bipartisan backing of this bill, it may not sway many voters, but it will certainly draw attention to the issue. With 12% of Pennsylvania’s voters reportedly being crypto holders, that visibility matters.

Bernstein Analyst Predicts 200,000 Bitcoin Price

I didn’t get a chance to report on this news from earlier this week, but it’s 100% worth revisiting. Analysts from global investment firm Bernstein predict that Bitcoin will reach $200,000 by the end of 2025, calling this estimate “conservative.” This prediction came from Bernstein’s latest “Black Book,” titled “From Coin to Compute: The Bitcoin Investing Guide.” The report isn’t public, but this was the key quote everyone seemed to be reporting, “With accelerating institutional adoption, we expect Bitcoin to triple from here to attain a cycle-high price of $200,000 by 2025 end.”

I’m also of the mindset Bitcoin is likely to go over $200,000 this cycle.

Michael Saylor Clears The Air

So, there you have it—as suspected, Michael Saylor does indeed support self-custody: *“While he may still support self-custody—and I believe he does—he also needs to demonstrate that institutions like BlackRock, Fidelity, and Coinbase can be trusted. If Saylor fails in this mission, MicroStrategy risks losing its position as a leader in corporate adoption.”*

I can’t believe there was actually a trend to bash Saylor over one brief comment from a two-hour podcast, taken out of context simply because it didn’t perfectly align with certain voices in the Bitcoin community. Considering all that Saylor has contributed to this space, it’s disappointing he caught heat for this in the first place.

Kraken Aims To Compete With Base

The popular OG crypto exchange Kraken has announced plans to launch its own blockchain, Ink, in early 2025, similar to what Coinbase provides with Base and Binance’s BNB Smart Chain. Ink will enable users to trade, borrow, and lend tokens without intermediaries, marking Kraken's shift toward decentralized services. Although there are no plans for a native token, Kraken will integrate DeFi tools directly into its Kraken Wallet app. A developer testnet will be available in about 16 days, allowing for experimentation with DApps ahead of the full launch. Visit the official site HERE for the latest updates.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.