The Wolf Den #1261 - Why Speculation Is Leaving Altcoins Behind

Prediction markets are the present... and future.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education, and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Figure Markets!

Figure is building the future of capital markets through blockchain with $20B unlocked in equity.

Use Democratized Prime for your chance to win big with $25k USDC and Earn ~9% APY. The more you participate, the better your odds!

Figure is the only account you need in the DeFi ecosystem. For every dollar you commit, you get another chance to win $25K USDC.

Start now and enter to win while earning money on your crypto with Democratized Prime*.

CTA: Win $25k USDC

In This Issue:

Why Speculation Is Leaving Altcoins Behind

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

MSTR And BMNR Are Diverging

NYSE’s Quiet Pivot Toward 24/7, On-Chain Equity Markets

Bitcoin ETFs See Biggest Inflows Since October

Bitcoin Inflows SURGE Despite Market Sell Off! Shake Out Or New Lows Incoming?

Why Speculation Is Leaving Altcoins Behind

Americans love to gamble. Not as a metaphor. Literally.

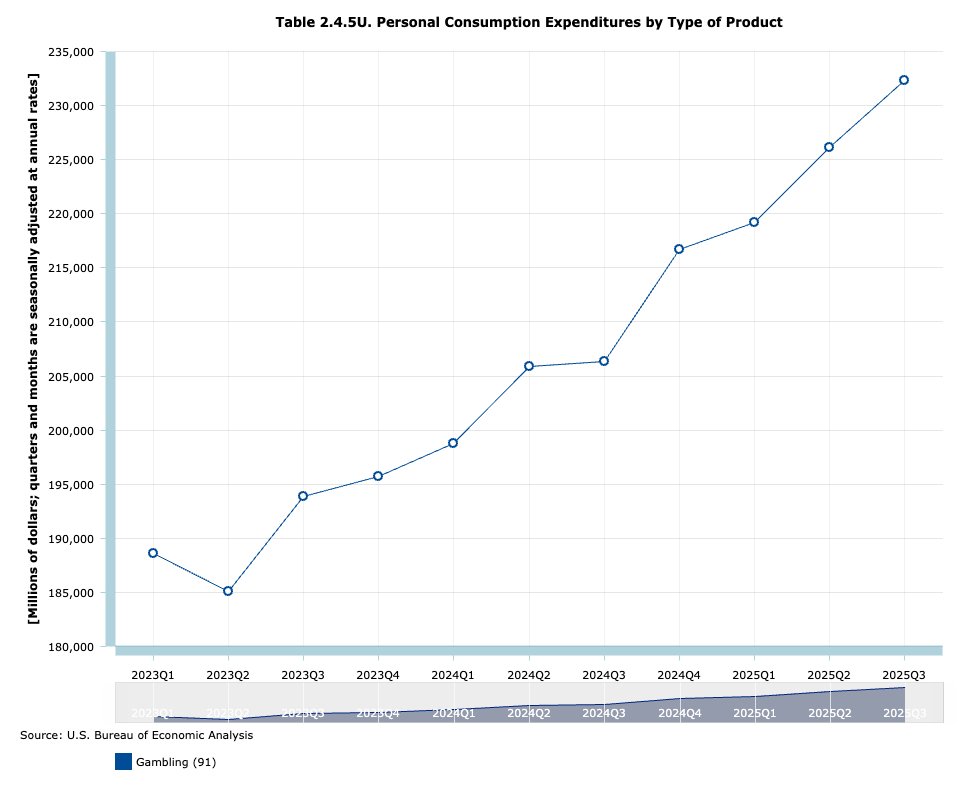

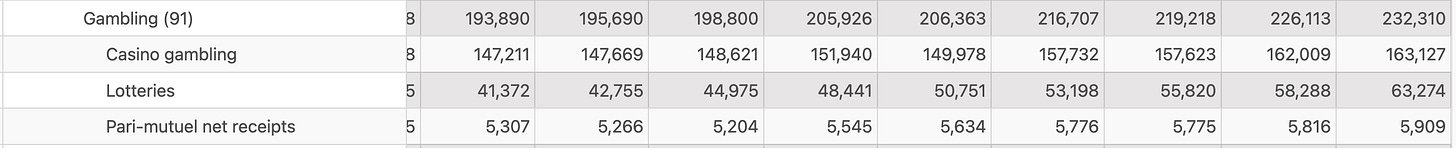

According to the Bureau of Economic Analysis, gambling now accounts for more than $200 billion a year in personal consumption expenditures – and the number is still rising. What most people miss is what that figure actually represents. It isn’t total wagers. It isn’t flashy betting volume. It’s already filtered.

That number reflects net losses. What the house keeps. What consumers actually give up.

In other words, it’s the real economic cost of risk-taking.

Table 2.4.5U. Personal Consumption Expenditures by Type of Product

[Millions of dollars; quarters and months are seasonally adjusted at annual rates]

According to Statista: “The gambling industry is also a major cog in the U.S. economy, with the national commercial gross gaming revenue (GGR) reaching 71.92 billion U.S. dollars in 2024.”

I asked several different AIs what percentage of U.S. GDP is gambling-related. Every answer landed in roughly the same range: between 1% and 2%.

That puts gambling on par with – or ahead of – categories we instinctively think of as major leisure spending: movie theaters, spectator sports, live entertainment, and large segments of media consumption. And unlike one-off fads, it’s become a durable, growing line item in U.S. consumption data. This isn’t niche behavior. It’s mainstream.

What stands out isn’t just the size. It’s the consistency. Gambling spending rises quietly quarter after quarter, barely reacting to economic cycles. That suggests something deeper than novelty or hype. Risk itself has become a form of entertainment – or perhaps it always has been. Either way, participation matters more than outcomes. People aren’t just consuming products or experiences. They’re consuming uncertainty.

Once you see that, a lot of other trends snap into focus. Options trading. Leverage. Zero-day bets. Sports betting apps. Markets start to look like games, and games start to look like markets. This isn’t a detour from the financial system. It’s an evolution in how people interact with it.

For those of us in crypto, that has clear implications.

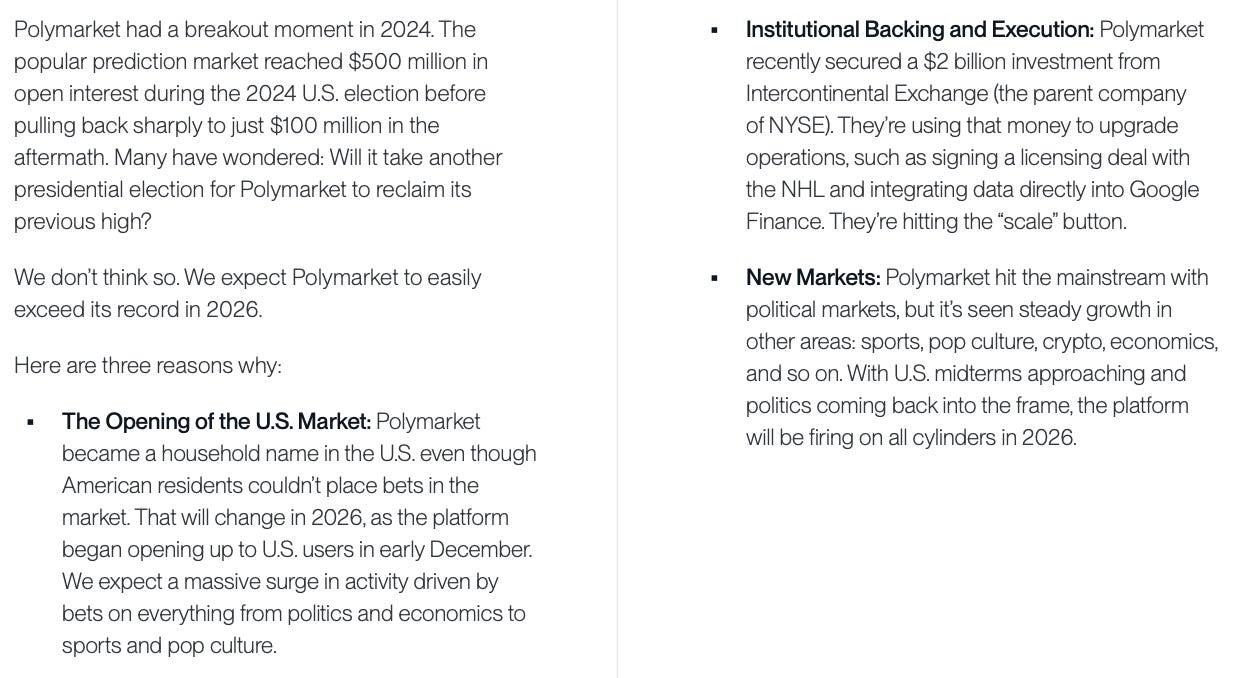

The most immediate is the rise of prediction markets. The second-order effect is altcoins. If you followed my various 2026 outlooks, you probably noticed how often prediction markets showed up as a reference point. That’s not a coincidence.

“The rise of prediction markets such as Polymarket and Kalshi shows that consumer-grade applications have arrived, not as experiments, but as products with clearer market fit. And in the United States, spot ETFs, most notably for Bitcoin, have begun to achieve the kind of mainstream traction that changes perceptions quietly, through familiarity, rather than through hype.”

Grayscale: “Continued growth in the popularity of prediction markets may also drive new demand for stablecoins.”

By now, almost everyone expects prediction markets to grow meaningfully in 2026.

What far fewer people are paying attention to is why the timing suddenly matters. Starting this year, a relatively quiet tax change is set to materially alter the economics of gambling in the U.S. A new provision limits how much gambling losses can be used to offset winnings, cutting the deduction from 100% to 90%. On paper, that sounds trivial. In practice, it isn’t.

Gamblers can now be taxed on income they never actually kept. You can end the year flat – or even down – and still owe taxes on gains that vanished along the way.

That kind of distortion doesn’t just penalize gamblers. It changes behavior. As traditional sportsbooks and casinos quietly become less tax-efficient, activity is likely to migrate toward structures that look less like bets and more like financial instruments. Prediction markets fit neatly into that gap. They settle through contracts rather than betting slips, which makes both the economics and the potential tax treatment very different. What reads like a minor rule tweak could end up nudging meaningful volume away from legacy gambling and toward market-based, increasingly crypto-native alternatives.

If there’s one call I actually feel comfortable making in the 2026 outlooks, it’s this: prediction markets will grow in a material way.

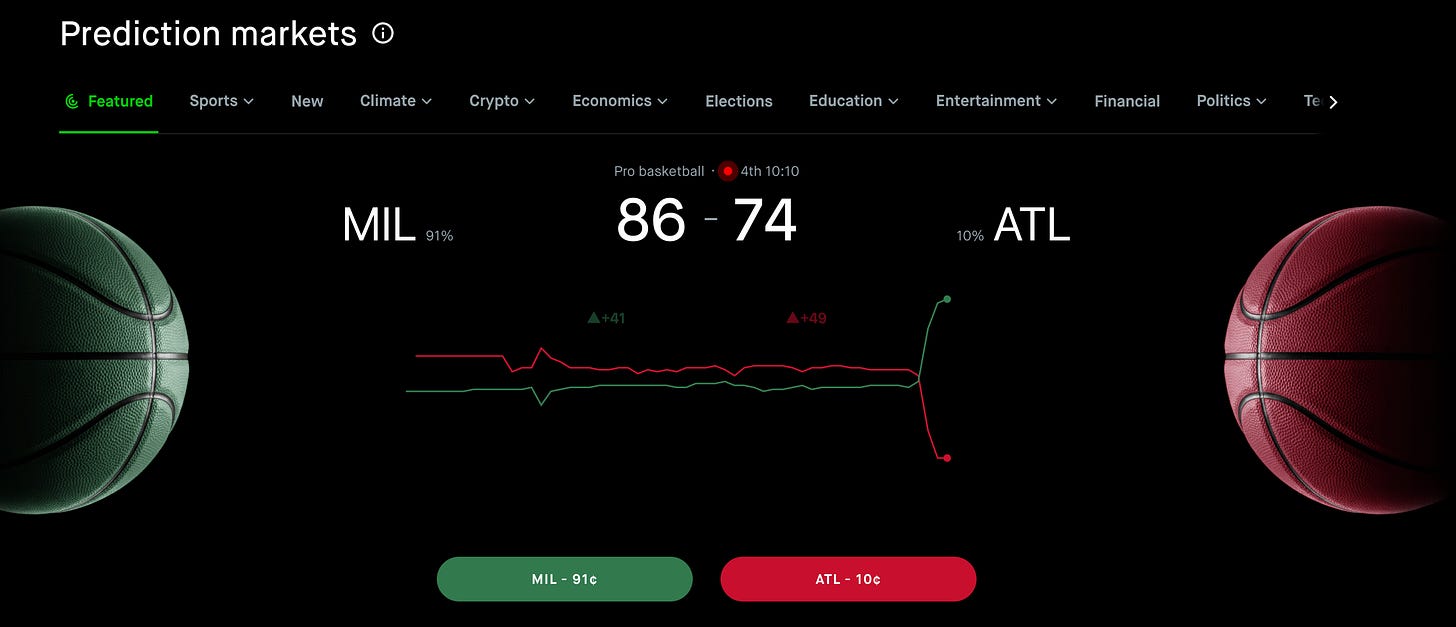

We’re already watching it happen. Robinhood is taking the category seriously, launching its own prediction market. Coinbase clearly is too, acquiring The Clearing Company just last month as part of its expansion into the space. When platforms of that size start building infrastructure instead of experimenting, it’s usually a signal that something real is forming underneath.

That pressure is going to be felt by incumbents like Polymarket and Kalshi. But pressure isn’t a bad thing. Competition forces better products, tighter execution, and faster iteration. Prediction markets will benefit from that dynamic, not suffer from it.

Where this starts to get uncomfortable is for altcoins.

Not because the technology stopped improving. Not because participants suddenly became disciplined investors. But because altcoins were always competing more for attention than for capital. Their core function, especially last cycle, was to package speculation into something people could rally around – memes, themes, roadmaps, communities. Once speculation itself became cleaner, faster, and more directly tied to real-world outcomes, that packaging started to look unnecessary.

(I wrote an entire piece on this.)

Prediction markets offer what altcoins never quite did: immediate resolution, constant relevance, crypto-native mechanics, and feedback loops measured in hours rather than months. You don’t need to believe in a long-term vision or convince others to join you. You just need an opinion about what happens next. In that environment, waiting for a low-cap token to catch a bid feels slower and more abstract than it used to.

The speculative impulse hasn’t disappeared. It’s been redirected.

As prediction markets grow, altcoins don’t vanish – but they face much stiffer competition for attention, liquidity, and mindshare. These markets cut both ways. They onboard new users into crypto-native mechanics, but they also siphon speculative energy into venues with clearer rules and faster outcomes. That shift doesn’t kill altcoins. It forces them to justify themselves in a tougher environment.

That said, I don’t think altcoins are dead.

They still possess characteristics that map naturally to gambling behavior, which is part of why they’ve been so durable. They’re volatile. They trade 24/7. They’re driven by narratives that are easy to understand and easy to trade. Small market caps allow for dramatic moves. Liquidity can appear and disappear quickly. You don’t need deep conviction or a long time horizon – just timing and momentum.

They also gamify participation in ways traditional markets can’t. Communities, memes, social signaling, and shared narratives all reinforce engagement. Buying an altcoin isn’t just a price bet. It’s a way to belong to a story while it’s unfolding. That combination of volatility, narrative, and social feedback is powerful. The problem isn’t that those qualities disappeared. It’s that they’re no longer unique.

At the same time, Wall Street wouldn’t be spending time, money, and political capital on tokenization, ETFs, and on-chain settlement if there weren’t real use cases emerging beneath the noise. But tokens that exist primarily as vehicles for speculation now face a harder reality. They benefit from America’s growing appetite for gambling – just not enough to offset the pressure coming from prediction markets. That equation also depends on Bitcoin finding sustained momentum first.

The broader takeaway is this: the rise of gambling, prediction markets, and speculation-driven finance isn’t a side story. It’s becoming a defining feature of how people engage with markets. Crypto sits at the center of that shift – benefiting from it in some areas and competing with it in others.

Prediction markets are likely to keep growing because they align almost perfectly with how people already behave in a world where gambling is normalized and constant. Altcoins now face a higher bar. Not to exist, but to matter.

The winners going forward won’t just absorb speculative demand. They’ll give it structure, purpose, and a reason to stick around.

Bitcoin Thoughts And Analysis

DAILY CHARTS

Bitcoin has moved back below the former resistance zone around 94–95K, invalidating the recent ascending triangle breakout. With price no longer holding above that level, the measured move target associated with the pattern is off the table.

Importantly, this represents a failed pattern rather than a failed trend. Bitcoin remains within the broader rising channel from the November lows, and downside price action has been orderly rather than impulsive. For now, this suggests the market needs additional time to consolidate before attempting another push higher. A loss of rising channel support would be required to shift the broader structural bias.

Notably, Bitcoin is back at the 50 MA and is still making higher lows since the bottom.

Altcoin Charts

Altcoins remain largely range-bound as capital continues to concentrate in Bitcoin. This is typical behavior during periods when Bitcoin is resolving higher from major structures, as liquidity tends to favor the highest-conviction asset. While most altcoins are consolidating rather than trending, this type of compression often precedes rotation once Bitcoin pauses. For now, selectivity and patience remain key.

There’s not much to do with altcoins at the moment.

Legacy Markets

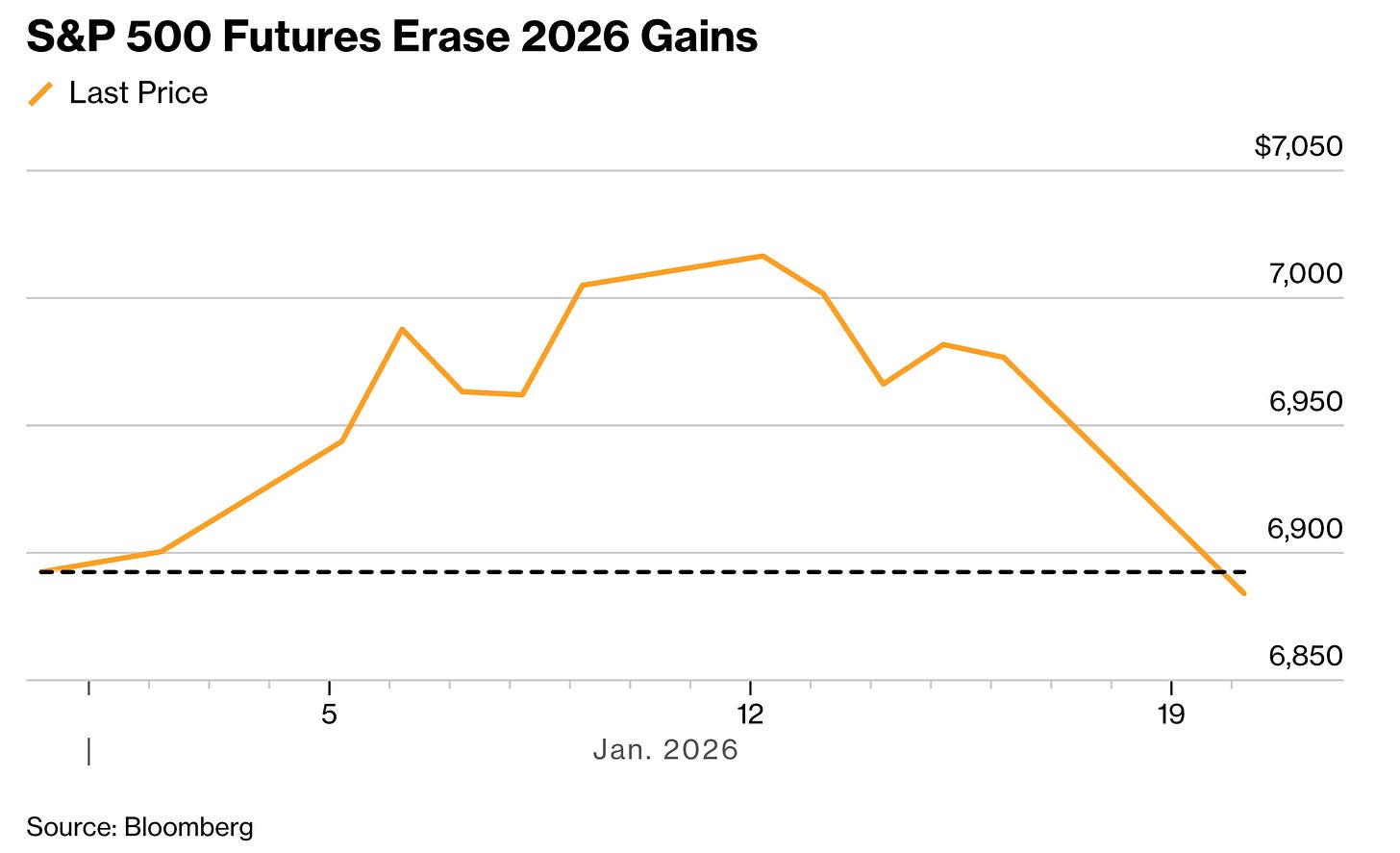

Global markets sold off sharply as geopolitical tensions and bond-market stress hit risk appetite at the same time.

US equities slid hard, with S&P 500 futures down nearly 2% and on track to erase all gains for 2026, while Nasdaq futures fell more than 2%. European stocks also dropped as the standoff between the US and Europe over Greenland showed no signs of easing, reviving fears of a broader trade conflict. Trump’s tariff threats against France added to the unease.

Bond markets amplified the move. Heavy selling in Japanese government debt, triggered by election-related fiscal concerns, sent Japan’s long-term yields to record highs and spilled into global markets. US 30-year yields jumped to nearly 5%, pressuring equities worldwide.

Investors rotated into havens, pushing gold above $4,700 an ounce for the first time and sending silver to another record. The dollar weakened. Attention now turns to a potential Supreme Court ruling on Trump’s trade policies and his upcoming remarks in Davos, both of which could determine whether markets find relief or face further volatility.

Key economic events this week:

Monday

• US Existing Home Sales

• US Manufacturing PMI (Final)

Tuesday

• US JOLTS Job Openings

• Fed Speakers (policy/labor focus)

Wednesday

• US ADP Employment Change

• US Services PMI (Final)

• FOMC Meeting Minutes

Thursday

• US Initial Jobless Claims

• US Durable Goods Orders

• US Pending Home Sales

Friday

• US Nonfarm Payrolls (January)

• US Unemployment Rate

• US Average Hourly Earnings

• US Consumer Sentiment (Preliminary)

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 1.4% as of 10:08 a.m. London time

S&P 500 futures fell 1.8%

Nasdaq 100 futures fell 2.2%

Futures on the Dow Jones Industrial Average fell 1.7%

The MSCI Asia Pacific Index fell 0.6%

The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.7% to $1.1729

The Japanese yen rose 0.2% to 157.77 per dollar

The offshore yuan was little changed at 6.9529 per dollar

The British pound rose 0.4% to $1.3475

Cryptocurrencies

Bitcoin fell 2.1% to $90,995.29

Ether fell 3.6% to $3,094.99

Bonds

The yield on 10-year Treasuries advanced seven basis points to 4.29%

Germany’s 10-year yield advanced four basis points to 2.88%

Britain’s 10-year yield advanced five basis points to 4.47%

Commodities

Brent crude rose 0.2% to $64.07 a barrel

Spot gold rose 1.3% to $4,732.78 an ounce

MSTR And BMNR Are Diverging

Not to be Captain Obvious, but the distinction between MSTR and BMNR is becoming increasingly clear. I used to be able to compare the two based on market cap relative to the size of their holdings and draw some loose conclusions about growth and correlation. That’s now getting harder to do. As their strategies diverge - beyond just BMNR staking while MSTR doesn’t - the comparison itself starts to break down, and it’s becoming nearly impossible to treat them as variations of the same trade.

There’s also now a growing philosophical split. With Saylor, the messaging is simple and consistent: “never sell your Bitcoin” and “there is no second best.” Meanwhile, Tom Lee is openly discussing things like Mr. Beast. That doesn’t make either approach wrong, but it does change the framework. The case for Strategy remains clean and easy to underwrite, while BitMine now comes with additional layers of complexity that didn’t exist before.

Michael Saylor: “We’re buying it to hold it 100 years. That $66K to $16K crash...That shook out the tourists. That shook out the non-believers. When Bitcoin was 16K, we were all ready to ride it to zero. And that’s what you’ll find with the Bitcoin maximalists.”

Tom Lee: “MrBeast and Beast Industries, in our view, is the leading content creator of our generation, with a reach and engagement unmatched with GenZ, GenAlpha and Millennials. Beast Industries is the largest and most innovative creator based platform in the world and our corporate and personal values are strongly aligned.”

CEO of Beast Industries: “We are excited to welcome Tom Lee and Bitmine as new investors in Beast Industries joining our current top-tier venture investors. Their support is a strong validation of our vision, strategy, and growth trajectory and it provides additional capital to achieve our goal to become the most impactful entertainment brand in the world. We look forward to exploring ways to further collaborate and incorporate DeFi into our upcoming financial services platform.”

I think there will be plenty of disagreement with this, but investing in Beast Industries is, at the very least, a reflection of BitMine’s view on ETH. If Saylor’s decision to exclusively buy Bitcoin - and repeat that there is no second best - is a direct expression of his conviction, then logically, BitMine’s decision to branch meaningfully outside of crypto has to reflect something as well. It may not be a rejection, but it’s still a signal.

That said, BitMine can absolutely remain very bullish on ETH at the same time. These things aren’t mutually exclusive. Tom Lee also comes from a Wall Street background, where diversification isn’t seen as dilution - it’s seen as a virtue. So this move doesn’t necessarily undermine the ETH thesis, but it does add nuance, and that nuance is exactly what makes BitMine harder to underwrite than a pure, single-asset strategy.

NYSE’s Quiet Pivot Toward 24/7, On-Chain Equity Markets

The New York Stock Exchange, through its parent Intercontinental Exchange, is building a regulated platform to trade and settle tokenized stocks on-chain, pending approval. The system would pair NYSE’s current matching engine with blockchain-based settlement to enable 24/7 trading, faster settlement, stablecoin funding, and multi-chain custody, all while keeping access routed through broker-dealers.

Crucially, the tokenized shares would be fully equivalent to regular equities, carrying the same dividends and voting rights. The platform would support both tokenized versions of existing shares and stocks issued natively on-chain. This fits into ICE’s broader push toward always-on markets, including tokenized collateral and digital money, with partners like BNY and Citi helping explore tokenized deposits to move liquidity outside normal banking hours.

If approved, the setup could shorten settlement cycles, reduce counterparty risk, and free up capital tied up in clearing - potentially reshaping how equity markets handle trading hours, liquidity, and risk over time. Leadership at NYSE and ICE has framed this as a long-term, structural shift toward running trading, settlement, and custody directly on-chain, without sacrificing regulation or investor protections.

As of now, the NYSE hasn’t disclosed which blockchains, if any, the platform will ultimately rely on. If the exchange opts for a private or permissioned ledger instead of a public network like Ethereum, Ondo, or Solana, the implications are very different. In that case, this wouldn’t really be tokenization in the crypto-native sense - it would be traditional market infrastructure rebuilt with distributed ledger technology. That approach would do little for public altcoin ecosystems, stripping them of the composability, openness, and settlement neutrality that make tokenization meaningfully distinct in the first place.

If that were to be the case, it would look less like crypto integrating into capital markets and more like the same plumbing, rebuilt with newer tools.

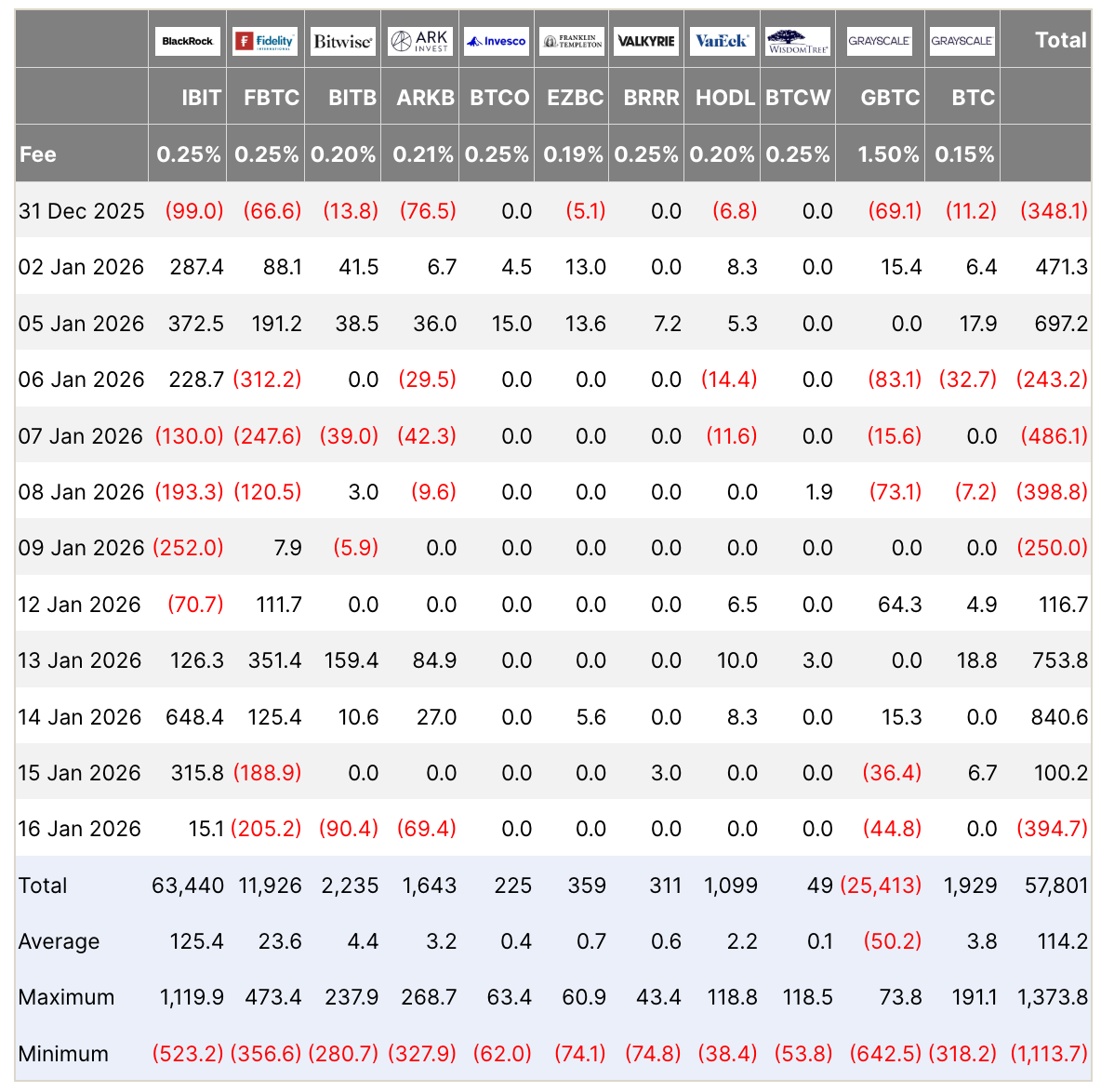

Bitcoin ETFs See Biggest Inflows Since October

U.S. spot bitcoin ETFs just logged their strongest week of inflows in more than three months, pulling in $1.42 billion in net new capital - the best showing since early October. The bulk of that demand came from BlackRock’s IBIT, which alone absorbed $1.03 billion over the week ended January 16.

The surge in ETF buying coincided with Bitcoin briefly pushing above $97,000, up from roughly $90,500 at the start of the week. Since then, price has pulled back to around $92,600, following broader macro risk-off headlines and a sharp unwind in leveraged positions. Over the past 24 hours, the crypto market saw roughly $824 million in liquidations, with about $764 million coming from long positions.

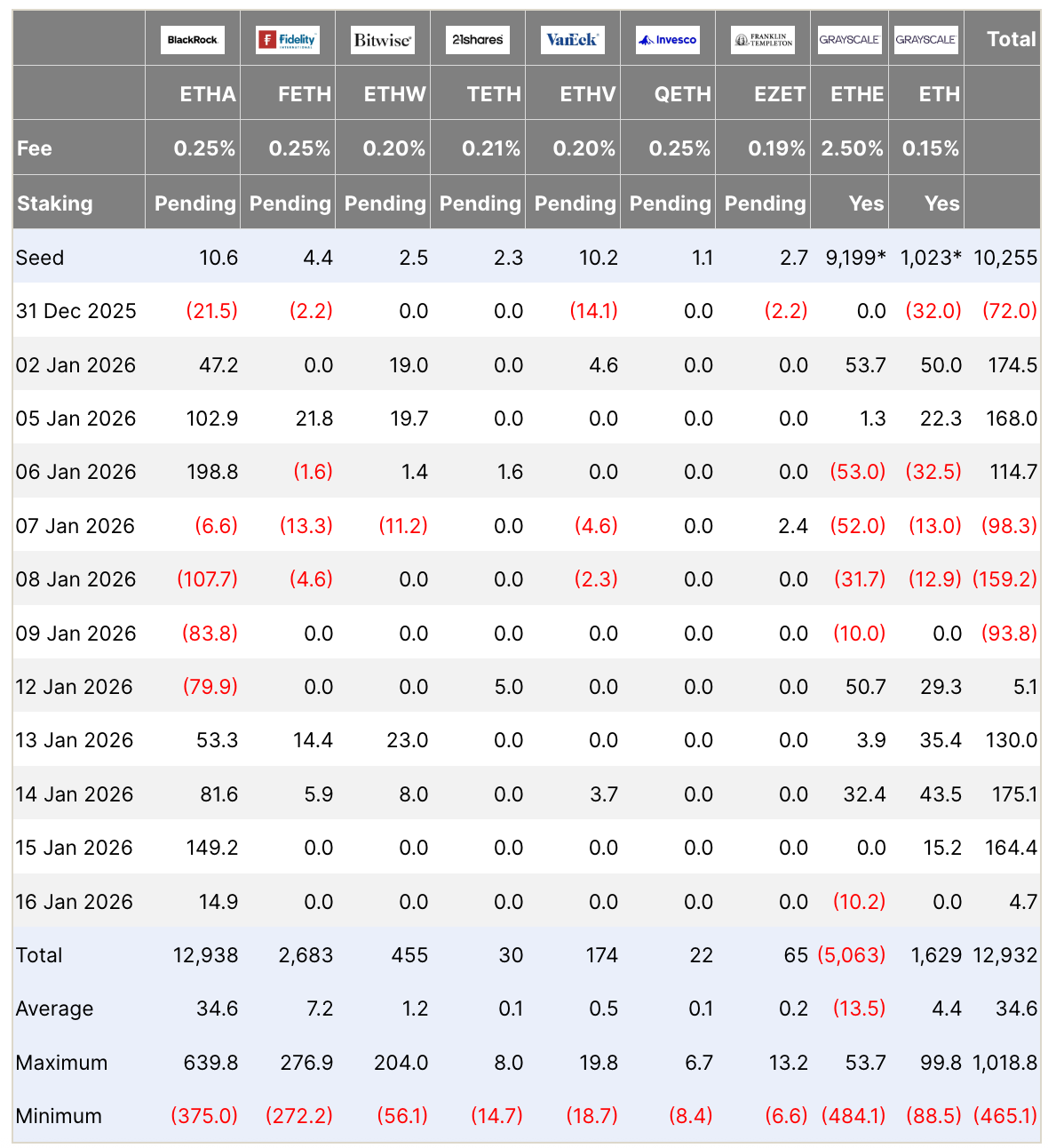

Ethereum saw a similar, though smaller, trend: spot ETH ETFs recorded $479 million in inflows, their strongest weekly total since October, suggesting institutional interest is firming up across major crypto assets, even as prices chop around.

Bitcoin Inflows SURGE Despite Market Sell Off! Shake Out Or New Lows Incoming?

Markets are flashing warning signs as Bitcoin struggles to gain traction and stocks wobble amid growing concern that Trump’s latest policy moves could trigger a liquidity shock. In this episode, we break down the weak BTC price action, rising macro stress, and why traders are suddenly bracing for a potential liquidity dump that could hit both crypto and traditional markets at the same time.

💳Apply for the Gemini Credit Card

🎙 Guests

Dave Weisberger – CEO of CoinRoutes

James Lavish – CIO & Macro Strategist

Mike McGlone – Senior Commodity Strategist at Bloomberg

Lawrence Leopard - Investment Manager & Author

My Platforms And Sponsors

Figure – Enter to win $25k USDC with Democratized Prime while earning ~9% APY! They also have the lowest industry interest rates at 8.91% with 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Promote your brand with The Wolf of All Streets. For sponsorship and partnership opportunities, contact info@thewolfofallstreets.io.

The Wolf Pack - My Telegram group where I share daily market updates, real-time observations, and ongoing discussions with the community. There’s a dedicated channel and group chat, and it’s completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.