The Wolf Den #1227 - Wall Street Still Doesn’t Understand Crypto Stocks

Which means it is still early...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Important Announcement!

Wall Street Still Doesn’t Understand Crypto Stocks

Aptos Weekly Review

Markets Rally On Trade Progress And Rate-Cut Hopes

Ledger Nano S Is Becoming Obsolete!

Bit Digital Is Moving From BTC Mining To ETH Staking

An Important Clarification On The FHFA Crypto News

Bitcoin Set To Explode As AI, ETFs, And Trump Shake The Markets

Important Announcement!

Yes, this is 100% legit! I have not been hacked. It’s me, Scott Melker, sharing the news.

I finally built a community. It is FREE.

I created a Telegram channel with my team to share crypto news, charts, updates - and most importantly, my real-time thoughts. It’s a place where you’ll get direct access to what I’m seeing and thinking, along with plenty of commentary from my team. You can discuss the news of the day and charts with us.

I’ve been slow to promote it on X or anywhere else because I want people to trickle in. This is my first time doing something like this, and I’m more than okay with it growing slowly and organically as we figure things out together.

To keep it clean and free of bots, I’ve gated access through an exchange. You’ll need to sign up for Blofin to join - but it’s 100% free and super simple, I promise. You don’t need to do anything else - fund an account, make any trades. Blofin is available to everyone, everywhere, which made it the perfect choice.

Come check it out - it’s pretty cool.

You can gain access HERE or see my X post HERE.

Wall Street Still Doesn’t Understand Crypto Stocks

Wall Street still has mixed feelings about crypto–related stocks.

Three years ago, I remember digging through analyst ratings – everything was slapped with an ‘F,’ ‘one star,’ ‘underperform,’ or ‘strong sell.’ There weren’t many names to choose from back then – really just COIN, HOOD, and MSTR – but it didn’t matter. Wall Street’s message was loud and clear: “Avoid these stocks at all costs – they’re trash.”

Here’s where those stocks were trading on June 27, 2022:

COIN: $60.45

HOOD: $9.72

MSTR: $20.61

If you followed Wall Street’s advice, you missed out on massive gains:

COIN is up +522%

HOOD is up +764.3%

MSTR is up a ridiculous +1,781%

For context, the S&P 500 returned just +56.15% in the same period. So much for “strong sell.”

Also – sidenote – Coinbase just hit a new all–time high. It took four years and 74 days, but it finally happened. Congrats to the Coinbase holders. You earned this.

Coinbase is up first.

Schwab, Morningstar, and Argus still do not like Coinbase.

Market Edge, LSEG, and MSCI do.

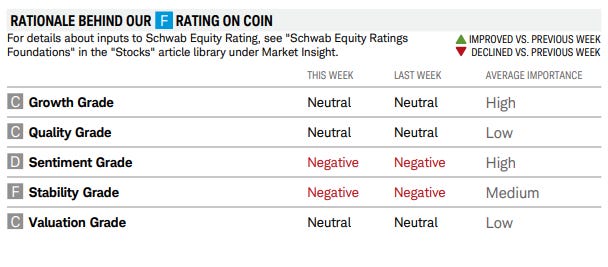

I did some digging into Schwab’s rating, and here’s where the ‘F’ comes from:

Schwab also gives Coinbase a 4 out of 10 on its ESG score.

The chart below is from Yahoo Finance.

I would say Wall Street has mixed feelings about Coinbase.

Next up, Strategy.

Schwab scores it an ‘F,’ CFRA rates it a ‘Strong Sell,’ Market Edge gives it a ‘Long,’ LSEG rates it a ‘Buy,’ and Vickers assigns a ‘BBB.’

Let’s see why CFRA scored MSTR a ‘strong sell.’

Basically, CFRA doesn’t like anything about MSTR except its price, which scored positive, and its valuation, which is neutral. Everything else is negative - deep in the red.

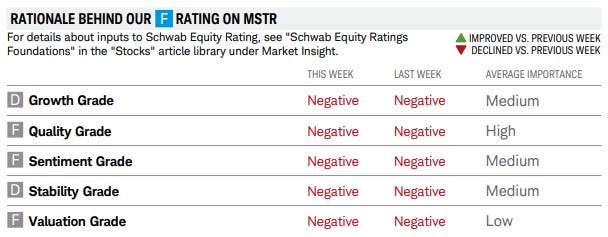

Schwab just gives MSTR a bad rating across the board. If I brought home this report card as a kid, I would've gotten my ass beaten.

It’s not as bad over on Yahoo, the analysts over there are more positive.

It seems to be the case that Yahoo only highlights analysts with positive reviews for this stock, even though I know there's plenty of negative sentiment out there, which isn’t hard to find.

Last but not least, HOOD.

Schwab scores it an ‘D,’ CFRA rates it a ‘Hold,’ Market Edge gives it a ‘Long,’ LSEG rates it a ‘Buy,’ and the MSCI ESG rating is a ‘BBB.’

Aside from sentiment, Schwab doesn’t like anything about this stock.

I would say this is a pretty decent score from CFRA, which doesn’t seem to be a huge fan of crypto.

Let’s see what analysts are saying over at Yahoo.

For the most part, the optics around HOOD seem positive, and most Wall Street analysts appear to be sticking with their outlook. It’ll be interesting to see if that changes as Robinhood deepens its crypto exposure.

The broader takeaway is this: Wall Street still has mixed feelings about crypto stocks. You’ve got companies like COIN, HOOD, and MSTR that have been around a while. Then you’ve got newer players – CRCL, GME’s pivot, and all the fresh treasury plays for Bitcoin, Ethereum, and now even Solana – just starting to find their footing. Wall Street probably needs a minute to digest just how much it doesn’t like what these companies are doing.

Here’s the good news – if you looked at analyst ratings three years ago, they were brutal. No nuance, no forgiveness, just blanket pessimism. And anyone who trusted that guidance missed out on massive gains. Odds are, history repeats. Quality crypto–related stocks will likely perform well over the next few years – because crypto will. It’s basic math. And many of these companies are simple vehicles – broad bets on the asset class or Bitcoin itself.

Right now, crypto stocks are the shiny new object – and honestly, that’s half the appeal. It’s been a rough stretch for altcoins, but that’s probably temporary. Eventually, the hot ball of money will rotate back when the time’s right. Until then, crypto stocks are – and will continue to be – the trade. At some point though, the crowd will realize you can’t keep bidding up the companies selling shovels if no one’s actually digging in the dirt.

Moral of the story: don’t rely on Wall Street to do your homework. A room full of geriatric men probably isn’t the best group to evaluate what twenty– and thirty–something innovators are building to dismantle the very banks those guys spent their lives defending. No hate – just saying.

Buy mostly Bitcoin, some alts, and hold a little exposure to crypto companies you actually believe in. It’s a balanced approach – and one that’s likely to pay off long term.

You’re welcome.

NFA.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with the news that Bitwise has amended its Aptos ETF, meaning approval is one step closer!

And there’s more…

As of now, all crypto ETFs are ‘cash-create,’ meaning they use cash - not crypto - for share creation and redemption. This approach is less tax-efficient than in-kind transfers but simplifies custody and compliance. Aptos and all other ETFs would benefit tremendously from ‘in-kind.’

Up next, we have this, I’ll break it down:

Aave just got approval to launch on Aptos, marking its first time expanding beyond Ethereum-based (EVM) blockchains. Aptos is a different kind of network, so this move shows Aave is trying to reach new users and grow outside its usual ecosystem. There’s no exact launch date yet, but it’s coming soon.

Next, I have this pretty cool chart I came across on X:

Sui has been one of the most talked about alts this cycle, but what people don’t realize is that Aptos is quite a bit faster. Speed matters when a network is doing millions of transactions on an average day.

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Markets Rally On Trade Progress And Rate-Cut Hopes

Stocks climbed globally as the U.S. moved closer to finalizing trade deals with China and other major partners. Commerce Secretary Howard Lutnick confirmed progress ahead of a July 9 deadline for reciprocal tariffs, while the Treasury reached an agreement with G-7 allies to drop the proposed “revenge tax” in exchange for relief from foreign digital service taxes—easing investor concerns about global tax uncertainty.

The S&P 500 futures rose 0.2% and the Nasdaq 100 hit a new record. European shares also advanced, led by a rally in sportswear stocks after Nike signaled improving sales. Meanwhile, inflation data from France and Spain remained tame, keeping the European Central Bank on track to hit its 2% target.

Markets are increasingly betting on Federal Reserve rate cuts. Recent U.S. data has cooled inflation fears, and the swaps market is now fully pricing in two cuts this year, with growing odds of a third. Fed officials, however, are waiting for more evidence that tariff-induced price hikes won’t lead to sustained inflation.

In commodities, copper surged on supply concerns tied to upcoming tariffs, while oil slid after a ceasefire between Israel and Iran. Gold fell for the second straight week.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 5:38 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 1%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1708

The British pound was little changed at $1.3738

The Japanese yen was little changed at 144.39 per dollar

Cryptocurrencies

Bitcoin fell 0.7% to $107,087.58

Ether rose 0.4% to $2,456.25

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.27%

Germany’s 10-year yield was little changed at 2.57%

Britain’s 10-year yield advanced one basis point to 4.48%

Commodities

West Texas Intermediate crude rose 0.8% to $65.74 a barrel

Spot gold fell 1.2% to $3,288.88 an ounce

Ledger Nano S Is Becoming Obsolete!

This is an important PSA for anyone still using a Ledger Nano S with crypto stored on it. Read the image above carefully. Ledger is decommissioning the Nano S and pushing users to upgrade. It’s frustrating - and hopefully they learn from the community’s disappointment. This forces people to: A) spend more money, B) move crypto (which carries risk), and C) maybe even ditch their hardware wallet entirely.

For now, there’s no word on other devices, but if this is their new standard, the Nano X could be next - it launched just three years after the Nano S. I’ve got an article HERE if you want a detailed breakdown on how to transition from a Ledger Nano S to a new device. Also, if you have a Nano S and haven’t plugged it in for a while, I recommend doing so. These devices are known to develop screen issues over time, which can make visibility difficult. If the screen gives out completely, you’ll need to recover your wallet using your 24-word recovery phrase and set it up on a new device - so it’s better to check now, while everything still works.

Bit Digital Is Moving From BTC Mining To ETH Staking

It’s not every day you see an established company - a Nasdaq-listed firm with a market cap of $488 million - leave the Bitcoin ecosystem for Ethereum. Bit Digital, once a pure-play Bitcoin mining company, has slowly been accumulating ETH and just made the decision to go all in. The company is building an Ethereum-focused treasury and plans to sell off its Bitcoin mining equipment to fund the shift toward staking and ETH-native infrastructure.

Bit Digital cited Ethereum’s transition to proof-of-stake as a key driver, offering yields of 4–6.5% annually through staking. For firms looking to generate passive income from crypto, that yield is a strong incentive - especially compared to the increasingly competitive and capital-intensive world of Bitcoin mining. My guess on the news is that Bit Digital didn’t have a real edge in mining and with margins shrinking and treasury-focused ETH strategies just starting to gain traction, they likely saw a chance to get ahead of the curve and pivot toward ETH - while BTC is currently the default, crowded play.

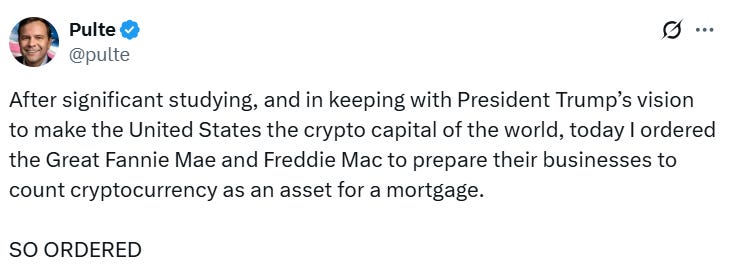

An Important Clarification On The FHFA Crypto News

There’s been a lot of chatter about one line in the Fannie Mae and Freddie Mac update: “Each Enterprise is directed to consider only cryptocurrency assets that can be evidenced and stored on a U.S.-regulated exchange subject to all applicable laws.”

Translation: your Ledger, MetaMask wallet, or crypto on offshore exchanges won’t count toward your mortgage application. Is that ideal? No. Is it a massive step forward? Absolutely.

We’re talking about two of the most traditional, risk-averse institutions in finance recognizing crypto as a legitimate asset class. That alone is a big deal. You don’t go from zero to DeFi overnight – there’s going to be a middle ground. And this is it.

Bottom line: this is still very bullish.

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public is the ONLY firm that gives you access to Institutional level tech that turns crypto volatility into extraordinary profits.

Thousands of clients are benefitting from our FREE products. Nearly a thousand clients have joined our Concierge Program and have customized size, execution, yield to match their goals and needs. Arch Public’s Algos have become a movement.

We want to talk to you and give you access to tools that will dynamically shift how you interact with markets.

Schedule a demo and speak to Andrew and Arch. You won’t be disappointed.

Bitcoin Set To Explode As AI, ETFs, And Trump Shake The Markets

I’m going live with Edan Yago to break down a wild week in crypto – from Tether’s CEO predicting one trillion AI agents transacting in Bitcoin to Trump hinting at replacing Jerome Powell. We’ll dive into Bitcoin ETF flows hitting nearly $4 billion, new crypto rules for mortgages, and Hong Kong opening the doors for crypto trading. Don’t miss this high-energy conversation on where Bitcoin and the global economy are heading next.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.