Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

⚡️ Taking Back Financial Independence & Freedom ⚡

Earlier this week, I had the chance to sit down with CJK, Founder of Peoples Reserve, for a conversation that inspired me. If you haven't already seen it, the full interview is now available. You can watch it HERE.

We explored Bitcoin’s evolution - not just as a store of value, but as pristine collateral for a new financial system. Their Bitcoin-backed mortgage with dynamic interest rates shows how Peoples Reserve is helping Bitcoiners tap into value without selling their most important asset.

This is about more than tech, it’s about reimagining the way to build wealth. It's about giving everyday savers access to the same financial tools the elite have used for decades. Bitcoin is engineered money. Peoples Reserve is engineering the system around it.

Stay ahead of the curve - sign up for their newsletter at PeoplesReserve.com.

In This Issue:

New York Is A Symbol For Bitcoin

Bitcoin Thoughts And Analysis

Dollar Drops, Trump Pressures Powell; Futures Rise

Trump Is Searching For A Fed Chair Replacement

SpaceX and OpenAI Will Soon Be Tokenized

U.S. Director of Federal Housing Turns Pro-Crypto

Robinhood Now Has A Crypto Matching Program

Adam Back: Bitcoin Will Absorb The Entire Financial System

New York Is A Symbol For Bitcoin

There’s one place on Earth that stands above all others when it comes to finance: New York City. As the beating heart of global capital, it’s home to the world’s largest stock exchanges, powerhouse investment banks, and a dense network of financial firms that influence markets around the globe. The Wolf of Wall Street was filmed there. So was Billions. The Federal Reserve’s gold vault sits beneath lower Manhattan. Deals that move markets are struck over steak at Keens or martinis at Cipriani. The original Bitcoin ATM? It’s in the Lower East Side. And the OG Bitcoin Center? Still there on Broadway.

The mayor of New York City holds a role that’s truly one-of-a-kind. While the mayor can’t directly write financial laws – that job belongs to state and federal legislators – they wield tremendous influence over the city’s financial ecosystem. Through local policy on taxes, zoning, business licensing, and infrastructure, the mayor helps shape the playing field where Wall Street firms, fintech disruptors, and global banks either thrive or fade.

Take Mayor Eric Adams. He’s been on a mission to make New York City the center of cryptocurrency – and he’s using the mayoral platform to push hard in that direction. From taking his first paycheck in Bitcoin to forming a Digital Asset Advisory Council, Adams has made it clear that innovation belongs in NYC. He’s openly criticized the state’s burdensome BitLicense, calling it a threat to crypto growth and urging Albany to repeal it. He can’t change state law, but his stance sends a powerful message – and it’s rare to see a mayor challenge state policy so directly, especially in defense of financial progress.

All of this leads to what was a huge honor: on Tuesday, I sat down with Mayor Eric Adams in Brooklyn at Permissionless IV for a one-on-one panel titled “Making NYC the Crypto Capital of the World.”

Here are some of the highlights:

“The role of the mayor, particularly in a city as large as New York, is that you must be substantive and symbolic. The substance is, of course, bringing down crime, educating children, building housing, all that good stuff, but the symbolism is just as important. We are witnessing an evolution in how we are paying for goods and services, and New York needs to lead the way. This is the financial capital of the globe, and we must be a part of that evolution.

While I was on the campaign trail, I had the opportunity to meet Brock Pierce, who talked about Bitcoin and how this new form of exchange for goods and services is something we need to embrace. I started to do my reading, and I was blown away by how important and innovative this industry is and how we moved it out of New York. We criminalized, we targeted; so many investors were under investigation, we just really turned against an entire industry. I said no to that. So, when I became mayor, I took my first three paychecks in Bitcoin and still have them until today, and people laughed at me, but I say, “Who’s laughing now?”

This is the only industry that, if you do an analysis of the history of this country, is the only industry with an intentional action to make sure this industry does not grow. In New York specifically, we have to turn that around. So, I thought the actions of the former governor were wrong, and I think they were misguided. It pushed this industry into the shadows. Many people left the city, and a lot of people went to other countries because they did not want to go through that level of harassment. We harassed the hell out of this industry. He pushed it out of New York State, and I am in Brooklyn today to say I am welcoming it back in New York City. We need to be the Bitcoin capital of the entire globe…

There’s a number of things we can do:

Number one, we are going to create a Digital Asset Council and bring in those leaders from across the globe, and be a part of this council so we can navigate how we can start building from the ground up. I believe the community folks who are in this room don’t realize their power. These laws that are made at the state level—we need a strong advocacy group to go to Albany, walk the halls of Albany, speak with the local electors, the state senators, the assembly persons, and the governor’s office to explain this industry because many people don’t understand this industry.

Third, we need to build out the pipeline. We are introducing this to our school systems where our young people are going to start embracing what blockchain represents and how this technology is important for data protection, protection of our records. We are going to explain Bitcoin, cryptocurrency, and the whole universe, and then we are going to put together practical practices. Just as I get my paycheck in Bitcoin, we also want to show how you can pay your local utility bills, how you can pay summons if you have those, and other ways you can pay for city services.

And lastly, there’s a real investment for those. This is an international city. Here in Brooklyn, 40% of people speak a language other than English at home. Other parts, they are sending money back to their family members, and by sending that money back, the amount of money they are paying to all of these top companies - they are losing billions of dollars. Once people see the financial benefits and how it impacts them in their pockets, they’re going to push legislation forward in a real way.

My response: “This is the global financial capital of the world. You would have to imagine that the biggest crypto companies one day will be on Wall Street next to Goldman Sachs, J.P. Morgan, and BlackRock - who have obviously adopted our asset class.”

Eric Adams: “Many left. They fled because it was unfair. I never thought I would quote Arnold Schwarzenegger, but, ‘They’ll be back.’”

My response: “In Vegas, you made waves talking about a BitBond. Maybe we can dive into what the BitBond would look like, why it’s important, and how it could work in New York City.”

Eric Adams: “We have a great deal of financial instruments that allow those who are invested in everything from tax-free bonds to other bonds. We want to examine how we can have a BitBond here to allow those who want to use Bitcoin to do the same level of investments. Our team is examining our OMB, my budget director, to see the formation of that. The current comptroller is against it, but we think there are ways we can do it to circumvent him. It’s going to take a lot of creativity to bring other people forward in this direction.

Again, the lack of education and understanding of what this universe looks like is making it fearful for people to move forward. What we have done is identified those cases where there was some form of fraud or abuse, as though we don’t have fraud and abuse in stocks, in currency, in credit. We highlight any misstep and use it as a way to say why this industry should not grow. What we want to do here in the city is examine the potential of a BitBond and also continue to expand the industry here in the city at the same time.”

Naturally, I tried to pin down a timeline – like any good journalist would – but didn’t get much of an answer. The reality is, implementing a BitBond in a city like New York is going to be a heavy lift. Mayor Adams openly admitted the city’s Comptroller is against it, meaning they’ll need to find creative ways around internal resistance. What he did stress is that a BitBond won’t happen unless the city mobilizes and recognizes the power it holds.

But just think about what that would signal. A BitBond in New York City would be a seismic statement. Every fund manager, crypto VC, and financial talking head on Wall Street would be dissecting it. Companies looking for a home base in the U.S. would suddenly have a new reason to consider NYC. And firms already here? They might actually stay put. The “old money” label that’s clung to Wall Street for decades would finally start to crack. A BitBond wouldn’t just be another product – it’d be proof that New York isn’t clinging to the past, but confidently betting on the future.

Just having Eric Adams in office is already a massive step in the right direction.

That was the core of the mayor’s message. In the final minutes of our interview, he doubled down on four things: education, embracing blockchain, keeping crypto at the center of political discourse, and scrapping outdated roadblocks like the BitLicense. His vision isn’t just about adopting new tech – it’s about making sure New York remains relevant in a rapidly evolving world.

And that’s why this matters. His role is pivotal – and unfortunately, it may soon be slipping into the hands of someone who hasn’t said a single word about this industry.

I understand there’s more to New York than just solving crypto issues and that Mayor Adams had has his issues, but given how impactful this city is on the global stage, forward thinking finance must be a top priority - and making sure crypto has a place in that ecosystem is imperative.

I encourage everyone voting in this race to consider the message it sends if crypto progress in New York is derailed simply because the next mayor doesn’t care about the industry. Eric Adams may or may not align with your political views – and that’s fine. But if you care about the future of crypto, that should carry real weight when you head to the polls.

From my conversations with the mayor – both on and off stage – I can confidently say he’s done his homework. Quite a bit, actually, for a Baby Boomer. And having him in office is a sign that the city is doing its homework, too. For those outside New York, I encourage you to find out where your own mayor stands on crypto. Don’t overlook your influence in local government. Living in the U.S. is a privilege – you can literally walk into your representative’s office or pick up the phone and ask where they stand. That kind of access is rare globally. Don’t waste it.

We’ve made it this far because of grassroots activism – and it’s going to take 10x more to see Bitcoin purchased at the federal level and eventually hit $1 million. New York matters because it proves this asset class belongs in our country, regardless of party lines. The city can either stand as a beacon of financial innovation – or a cautionary tale of missed opportunity.

If a blue state like New York can stand behind crypto, we win. The future of this industry depends on all of us staying engaged, informed, and relentless in pushing for progress. Let’s keep the momentum alive.

Bitcoin Thoughts And Analysis

Bitcoin continues to keep traders on their toes. After briefly sweeping the lows below $100,000 earlier this week – an aggressive shakeout that likely liquidated overleveraged longs – it staged a sharp recovery. We’re now seeing price comfortably above the 50-day moving average, with back-to-back daily candles holding above the key $105,787 level. That’s the type of reclaim bulls love to see.

What makes this move especially compelling is the volume profile. The bounce wasn’t some weak drift higher – it came on rising volume, suggesting real buyers stepped in to defend the lows. We’ve also seen consistent participation ever since – signaling that this might not just be a relief rally, but a potential shift in momentum.

Now the focus turns to resistance. The level to beat is $112,000 – a zone that’s capped every major push this month. Break above that, and we’re no longer talking about recovering ground – we’re talking about new highs and possibly kicking off a much larger move. But before we get ahead of ourselves, this current consolidation near $107K is healthy. If price can hang here for a bit, absorb selling pressure, and build a base – that’s often how the best breakouts form.

Of course, bulls don’t want to see $105,787 lost again. That would make this whole move look like a failed breakout – and failed breakouts can get ugly fast. But for now, the technicals lean bullish. Bitcoin faked out the market, sucked in liquidity, and flipped key levels. Until proven otherwise, the bounce is valid – and the bulls have the momentum.

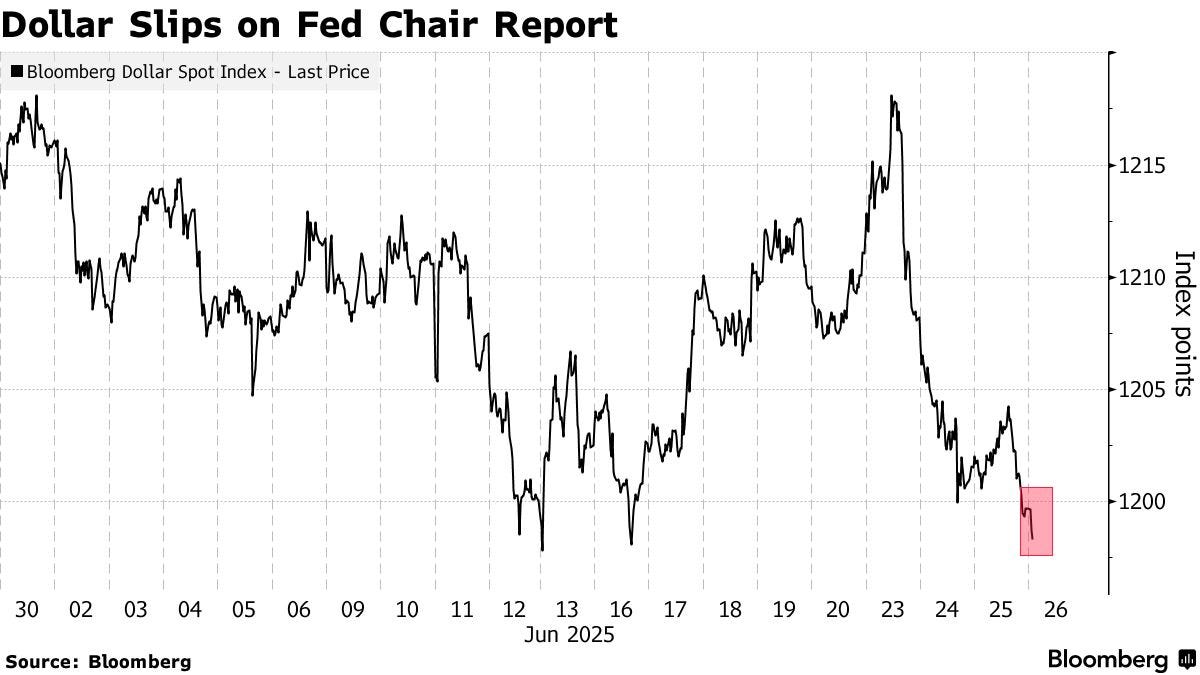

Dollar Drops, Trump Pressures Powell; Futures Rise

The dollar slid to its lowest level since April 2022 after reports emerged that Donald Trump may name a new Fed Chair as early as September. Traders interpreted the move as a signal of faster interest rate cuts, accelerating bets on a more dovish Fed. Markets are now pricing in 63 basis points of easing by year-end, up from 51 just last week. Treasury yields fell, and the S&P 500 futures rose 0.4%, with tech stocks leading the way on strong earnings from Micron and continued momentum from Nvidia.

The broader implications are clear: a more Trump-aligned Fed could usher in easier monetary policy, weaken the dollar further, and stoke inflation. The dollar has already dropped 8% this year amid tariff uncertainty and questions over its global dominance.

Micron shares jumped on AI chip demand, lifting the entire tech sector. Meanwhile, the Fed unveiled plans to ease capital rules for big banks, and traders are eyeing today’s durable goods and inflation data closely for further clues on economic direction.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:27 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.6% to $1.1729

The British pound rose 0.6% to $1.3751

The Japanese yen rose 0.8% to 144.01 per dollar

Cryptocurrencies

Bitcoin fell 0.5% to $107,348.31

Ether rose 0.9% to $2,460.39

Bonds

The yield on 10-year Treasuries declined two basis points to 4.27%

Germany’s 10-year yield was little changed at 2.56%

Britain’s 10-year yield declined one basis point to 4.47%

Commodities

West Texas Intermediate crude rose 0.3% to $65.12 a barrel

Spot gold rose 0.2% to $3,339.21 an ounce

Trump Is Searching For A Fed Chair Replacement

Jerome Powell’s current term as Federal Reserve Chair is set to end on May 15, 2026. He was sworn in for his second four-year term on May 23, 2022. Unlike some agency heads, Powell’s position is structurally insulated – he can’t be fired by the President simply for refusing to cut rates. There’s often confusion on this point, especially after Trump was able to effectively push out SEC Chairman Gary Gensler. But that situation was different – Gensler stepped down early, which is fairly common when a new administration from a different political party takes office.

The heat Trump has thrown at Powell so far hasn’t come close to what Gensler faced – and even if it did, Powell’s role offers far more protection. That hasn’t stopped Trump from saying he wants to “fire him,” adding that “he goes out pretty soon, fortunately, because I think he's terrible.” Despite the public criticism, Powell seems determined to finish out his term.

Time will tell how it plays out. But if you’re hoping for the money printer to turn back on, then you may be rooting for Trump to get his way. Of course, that comes with its own set of long-term risks – which is exactly why we have Bitcoin in the first place.

SpaceX and OpenAI Will Soon Be Tokenized

Slowly but surely, the once-inaccessible world of private markets is moving on-chain. Republic is now taking meaningful steps in that direction by offering blockchain-based assets that track shares of high-profile private companies like SpaceX, OpenAI, and Anthropic. While these tokens won’t confer actual shareholder rights, they will provide retail investors with price exposure to firms that have long been off-limits.

Leveraging provisions from the 2012 JOBS Act, Republic plans to raise up to $5 million annually through the issuance of these securities. Trading will take place on crypto exchange INX – which Republic is in the process of acquiring – and minimum investments could be as low as $50. It’s a significant move toward democratizing access to private equity and unlocking a new frontier for crypto-powered capital markets.

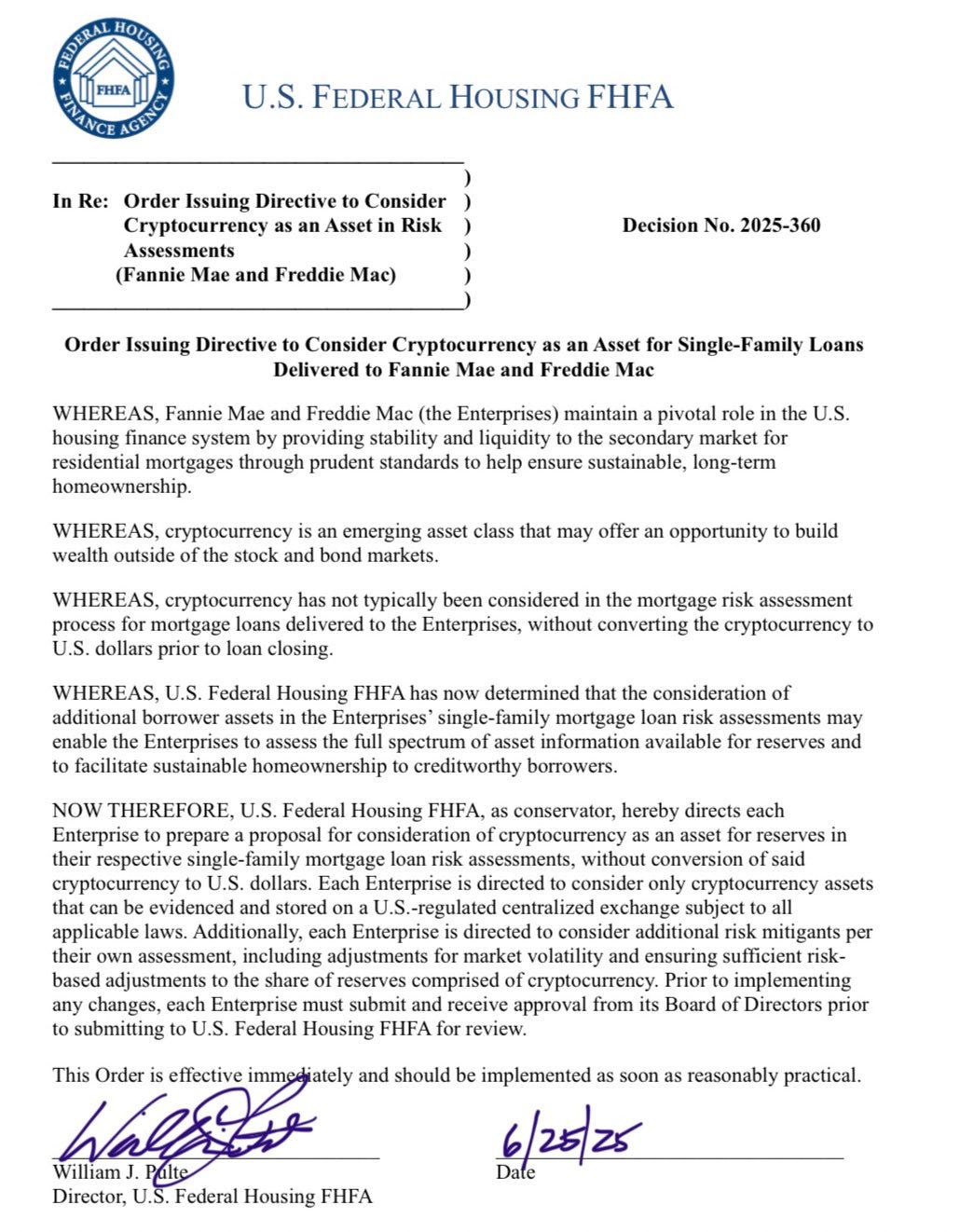

U.S. Director Of Federal Housing Turns Pro-Crypto

Rather than me summarizing the order, take a look for yourself.

For those unfamiliar, Fannie Mae and Freddie Mac collectively hold more than $7.8 trillion in assets. So when these institutions begin taking steps toward recognizing Bitcoin, it marks a major milestone in the asset’s institutionalization. We’ve already seen signs of this shift – JPMorgan recently started accepting IBIT as collateral for loans and factoring crypto holdings into net worth assessments.

Moves like these might not trigger an immediate price spike – but they’re laying the foundation for long-term demand and utility. This is how mainstream adoption happens: quietly, through infrastructure, policy, and access. The price action will catch up later.

Robinhood Now Has A Crypto Matching Program

Robinhood stock jumped a cool 7.5% after CEO Vlad Tenev announced a new crypto deposit match program and several upcoming product upgrades. Starting now, Robinhood will match 1% of customers’ crypto deposits, increasing to 2% if the community deposits $500 million or more, with the promotion running through July 7. It’s a pretty genius move because now the community has a shared goal that Robinhood will directly benefit from. From what I am seeing, this is only available in Europe, I don’t have a Robinhood account to be 100% sure.

The company is also rolling out new features like an AI-powered insights tool called Cortex’s Digest, enhanced charting and indicators on its mobile app, and easier trading processes, including options. Plus, users will soon see simulated potential returns on stocks. These updates highlight Robinhood’s push to make its platform more powerful and user-friendly. In many ways, Robinhood has been one step ahead of the competition - pioneering new features and often forcing others to follow suit. In other areas, however, it lags behind; for example, its staking options remain limited compared to platforms that offer broader DeFi integrations and yield opportunities.

Adam Back: Bitcoin Will Absorb The Entire Financial System

I sat down with Adam Back at Bitcoin 2025 in Las Vegas to talk about Bitcoin's past, present, and explosive future. We covered everything from self-custody fears to ETF adoption, institutional power plays, and how Bitcoin could absorb the global monetary premium. This was one of the deepest, most honest conversations I’ve had – only on The Wolf Of All Streets.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Please share your research into the progress of the threat of quantum computing to BTC.

James Forshall