Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Last week I announced that I’ve taken an equity stake in Arch Public. I’ve been working with Tillman and Andrew for more than a year and believe in how they’ve brought institutional tech to retail and offered it to you for free.

There is so much coming from Arch Public and my community will always hear it first!! For now, just know that I believe in the product, leadership, and service that Arch Public offers to thousands of you.

Another reminder that their products are free to use. I’d encourage you to go use the product, or sign up and talk directly to Andrew, Arch Public’s Co-Founder and COO.

In This Issue:

‘Millionaire’ Math

Bitcoin Thoughts And Analysis

Markets Steady, Awaiting Powell

VanEck Has Concerns About Bitcoin Treasury Companies

Powell Speaks About Rate Cuts And Crypto

This U.S. Lawmaker Wants To Ban Officials Profiting From Crypto

Are CRCL Gains Rotating Into COIN?

$120K Next? Bitcoin Surges As Israel-Iran War Ends!

‘Millionaire’ Math

Take a close look at this graphic. It’s from a Federal Reserve Board report titled “Changes in U.S. Family Finances from 2019 to 2022.” Although the data was published in late 2023 and might seem a bit dated, it remains highly relevant to the financial realities we face today.

Here’s the line that really stands out:

“Specifically, real median net worth surged 37 percent to $192,900, and real mean net worth increased 23 percent to $1,063,700.”

Now, before you start sweating at that million-dollar figure, remember: this is the mean net worth, which is skewed by the ultra-wealthy. The median gives a much clearer picture of the typical American family - and it’s still a sizable jump. But the fact that $1 million is increasingly being viewed as “normal” wealth? That’s the part that feels wild.

There’s more. According to the same Fed report:

“Between the 2019 and 2022 surveys, real median family income rose a modest 3 percent, while real mean family income grew 15 percent. Increases were largest at the top, consistent with rising income inequality.”

So, while income barely moved, net worth exploded - a 3% bump in income vs. a 37% surge in net worth. That tells us a few important things:

Asset ownership matters more than ever. If you don’t own a home, stocks, or a business, it’s getting harder to keep up. Wealth is growing outside the paycheck.

Wealth inequality is growing. The rich are pulling ahead not through work, but through ownership.

Policy is lagging. Wage growth alone won’t solve this - we need broader access to asset ownership.

Some quick math: around 23.7 million U.S. households are considered millionaires - roughly 1 in 6. But that doesn’t mean every sixth house on your street is sitting on a pile of cash. These households are clustered in wealthy areas, and much of that wealth isn’t visible. Still, the number is far higher than most people assume.

When I was growing up, being a millionaire was a huge deal. You either hit the jackpot, struck oil like the Beverly Hillbillies, or worked your entire life, saving and investing with discipline. It meant decades of sacrifice. Today? You can become a millionaire from a crypto run, a startup equity grant, or a lucky NFT mint. It’s a different world.

But here’s the uncomfortable truth: $1 million may no longer be enough to retire comfortably in the U.S. If you retire at 64, that money needs to last 25+ years - covering housing, healthcare, and basic living expenses. For a single person, maybe. For a family? Not without major compromises or supplemental income.

Inflation doesn’t affect the wealthy like it does the rest of us. In fact, it often benefits them. During the COVID inflation wave, home prices and asset values soared. The wealthy, who already owned those assets, came out ahead - while everyone else struggled to keep up with rising costs and stagnant wages. For them, inflation wasn’t a threat - it was an opportunity.

So where do digital assets come in?

I believe within the next decade, we’ll see “digital assets” added as a formal wealth category in Fed reports. What percentage of new millionaires will come from crypto? 10% or more seems likely. Think about it: most working families don’t have access to real estate, equities, or private businesses. But Bitcoin? That’s globally available - a truly democratized asset.

Bitcoin has disrupted the traditional wealth-building path. It’s allowed average people to build real wealth in ways that were previously impossible. I fully believe Bitcoin could reach $1 million within the next decade. If that happens, anyone who owns a full Bitcoin today becomes a millionaire - not in stocks or net worth spreadsheets, but in the world’s hardest asset.

And with only 21 million Bitcoins ever, that future millionaire list is capped - and realistically, much lower than 21 million due to lost coins and fractional ownership.

This space is going to create a lot of millionaires. But it will reward discipline and understanding. Those who buy the right assets and hold them for the long term will thrive. The rest - those who ignore the opportunity or bag-hold speculative altcoins - will simply fund the next wave of crypto wealth.

So yes, the definition of “millionaire” is evolving. And fast. The mix of rising net worth, stagnant wages, and a new digital asset class is reshaping what wealth looks like - and who gets to participate.

Don’t panic if you’re not there yet. There’s still time. Bitcoin still has a 10x in it - and you can’t confidently say that about any other asset on the planet.

Bitcoin Thoughts And Analysis

Bitcoin continues its rally, now pushing toward $107K after a sharp three-day surge. The key development here was a sweep of the range lows just below $100,000, where price wicked down, flushed weak hands, and immediately reversed with authority. That fakeout move set the stage for a strong bounce, triggering what now looks like a classic deviation below support.

From there, Bitcoin ripped higher, reclaiming the critical $105,787 horizontal level and flipping it into support. That level had acted as resistance for much of June, capping upside progress - but now that price is holding above it, the breakout has legs. Importantly, the move also reclaimed the 50-day moving average, further solidifying the bullish case.

Volume is ticking higher as well, adding confirmation to the price action. As long as Bitcoin holds above $105,787, the next upside target sits clearly at $112,000 - the swing high from earlier this month. A breakout above that level could open the door to fresh highs and renewed momentum.

Markets Steady, Awaiting Powell

US stock futures remained steady early Wednesday as investors awaited the second day of testimony from Federal Reserve Chair Jerome Powell. The Nasdaq 100 closed at a record high on Tuesday, while S&P 500 futures and European stocks hovered flat. Treasuries also held firm, with little movement following a five basis point drop in the 10-year yield after Powell’s remarks boosted expectations for rate cuts later this year. Traders are now pricing in a 15% chance of a rate cut in July and expect at least two cuts by year-end.

Oil prices bounced back, with Brent crude rising 1.5% to around $68 per barrel after a steep two-day decline. The dollar edged up 0.1%. The market’s focus is shifting from Middle East conflict to domestic economic concerns – including tariffs, trade risks, and fiscal pressures – as corporate earnings and growth forecasts come under scrutiny. A fragile ceasefire between Israel and Iran appeared to be holding, easing geopolitical tensions for now.

According to Lilian Chovin of Coutts, “slightly weaker growth momentum” is currently being seen as positive by markets, as it revives hopes for rate cuts.

Stocks

The Stoxx Europe 600 was little changed as of 10:01 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 0.8%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1610

The Japanese yen fell 0.4% to 145.48 per dollar

The offshore yuan was little changed at 7.1709 per dollar

The British pound was little changed at $1.3619

Cryptocurrencies

Bitcoin rose 0.5% to $106,663.86

Ether fell 0.4% to $2,439.54

Bonds

The yield on 10-year Treasuries was little changed at 4.29%

Germany’s 10-year yield declined one basis point to 2.53%

Britain’s 10-year yield declined two basis points to 4.45%

Commodities

Brent crude rose 1.5% to $68.18 a barrel

Spot gold was little changed

VanEck Has Concerns About Bitcoin Treasury Companies

Cointelegraph recently published an article outlining VanEck’s warning that Bitcoin treasury companies – firms holding large amounts of BTC on their balance sheets – face significant capital erosion risks if they’re unprepared for volatility or a bear market. I’ve expressed similar concerns in past newsletters, but let’s look at VanEck’s take.

As newer, lower-fee Bitcoin ETFs entered the market, demand for GBTC plummeted. VanEck notes – as I have – that the lack of a redemption mechanism and a six-month lockup left companies like 3AC and BlockFi holding assets trading well below NAV. That disconnect between paper valuations and real liquidity helped accelerate their collapse.

The article draws a parallel to the 2008 financial crisis: firms like Lehman and Bear Stearns relied on debt and high-risk assets. Similarly, today’s BTC-heavy treasury firms – especially those financing BTC purchases through stock issuance or borrowing – are vulnerable to sharp drawdowns. Without strong risk management, a falling BTC price can set off a vicious cycle: dilution, liquidity gaps, and even bankruptcy, regardless of long-term conviction.

To reduce risk, VanEck suggests practical steps: halting share issuance when prices disconnect from value, initiating buybacks, reassessing BTC strategy if shares trade consistently below NAV, and tying executive incentives to shareholder value – not just Bitcoin accumulation.

The bottom line: holding Bitcoin isn’t enough. These firms need real financial discipline and strategic flexibility – or markets will make those decisions for them.

Powell Speaks About Rate Cuts And Crypto

During his testimony in Congress yesterday, Jerome Powell reaffirmed the Federal Reserve’s cautious, data-dependent approach to interest rate policy, stating that the Fed is “well positioned to wait” before making any changes. While acknowledging the lingering uncertainty over whether inflationary pressures will prove temporary or persistent, he made it clear that rate cuts will only come “when the time is right.”

Powell also flagged potential price increases stemming from new tariffs as an area of concern – a reminder that inflation risks aren’t entirely in the rearview mirror. Perhaps most notably, he offered a signal of growing regulatory acceptance of digital assets, stating that banks are allowed to engage in crypto-related activities.

“The banks get to decide who their customers are; that’s not our decision,” Powell said. “Banks are free to provide banking services to the crypto industry, to crypto companies, and banks are also free to conduct crypto activities.”

The Fed is walking a tightrope – balancing inflation, economic growth, and financial innovation – while keeping a close eye on the data that will ultimately guide its next move.to activities as long as they do so in a way that is protective of safety and soundness.”

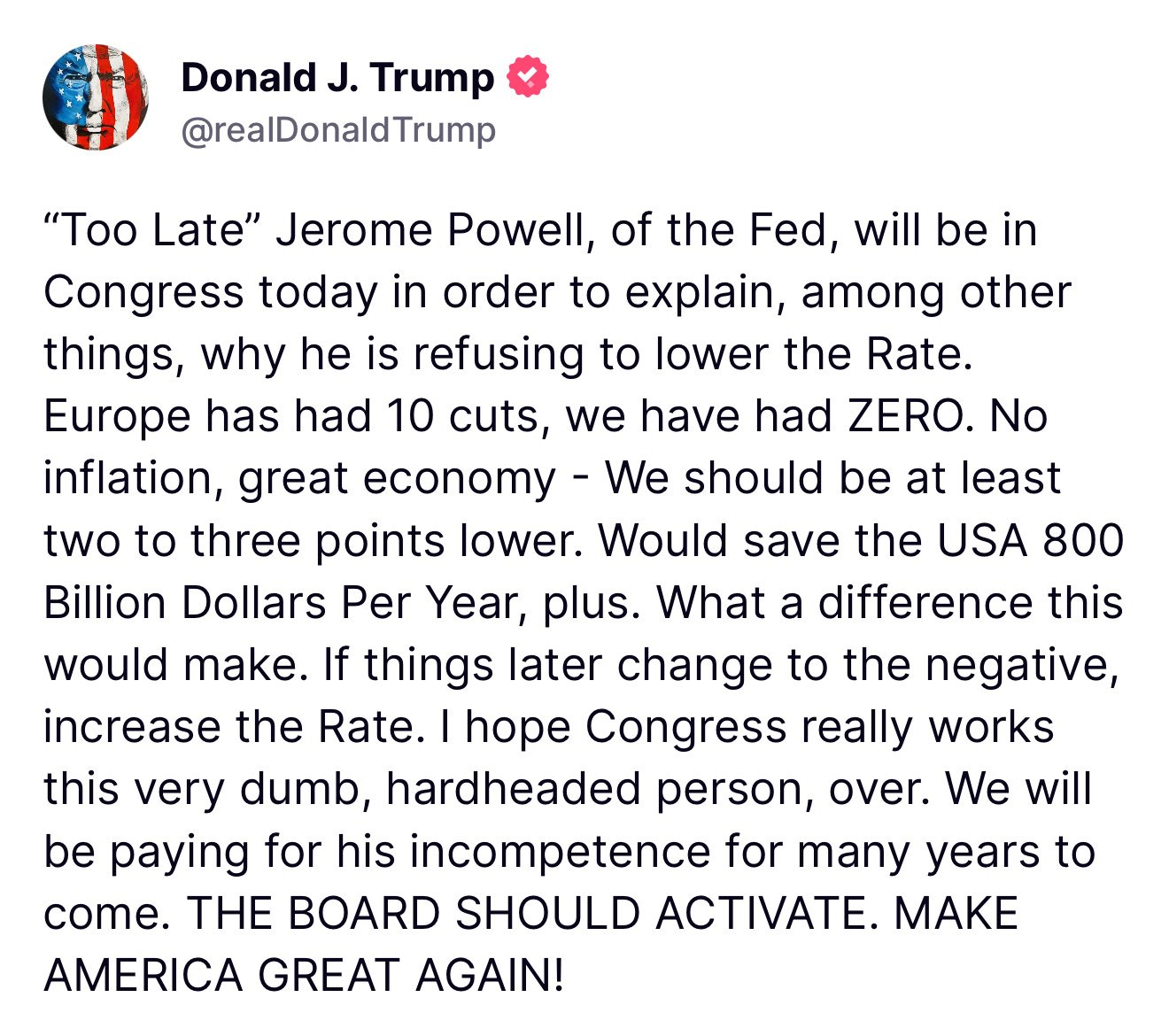

Trump is obviously not happy about this.

This U.S. Lawmaker Wants To Ban Officials Profiting From Crypto

Called the Curbing Officials’ Income and Nondisclosure (COIN) Act - which has nothing to do with Coinbase - this bill aims to prevent public officials, including the president, from profiting off digital assets. Setting aside party lines, the bill makes sense because other major officials, such as members of Congress and executive branch appointees, already face restrictions on conflicts of interest and asset holdings to ensure their decisions remain impartial (not that those rules are often followed anyways).

If Commerce Secretary Howard Lutnick just divested all of his assets, along with U.S. Treasury Secretary Scott Bessent doing the same, it only makes sense that Trump should as well. The problem, though, is that it’s doubtful Trump would ever sign this bill into law, and many crypto investors enjoy seeing the president and his immediate family directly involved in the space. As Senator Schiff noted in a press release, “This legislation follows recent White House financial disclosure reporting revealing that President Trump raked in $57.3 million from his crypto venture with World Liberty Financial in 2024.”

“President Donald Trump’s cryptocurrency dealings have raised significant ethical, legal and constitutional concerns over his use of the office of the presidency to enrich himself and his family. That’s why I am introducing legislation to prevent the financial exploitation of any digital assets by public officials, including the president and the First Family. We need far greater scrutiny of the president’s financial dealings, and to stop him and any other politician from profiting off of such schemes,” said Senator Adam Schiff.

Are CRCL Gains Rotating Into COIN?

The Block published a piece on Coinbase’s recent gains, which gave me a good excuse to share both their highlights and a few of my own thoughts. As I mentioned yesterday, it still doesn’t make sense for Circle to be valued anywhere near Coinbase - maybe someday, but certainly not just weeks after its IPO. The encouraging part is that as CRCL drifts back toward a more reasonable valuation, that capital has to go somewhere - and I wouldn’t be surprised if a meaningful portion rotates into COIN. Coinbase is now hovering near all-time highs after ranging for over a year, and with Robinhood already breaking out, it feels like Coinbase’s moment is near. Especially when you consider how consistently the company has been delivering strong earnings.

The idea that CRCL gains are rotating into COIN seems valid. Let’s see what The Block said in its article:

“Investors and funds that missed the CRCL allocation have likely rotated into COIN as a catch-up play. Circle's S-1 and follow-up commentary show it paid over 60% of its gross USDC-reserve income in 2024 as a distribution fee to its primary partner, Coinbase. Under the standing pact, 50% of all residual interest income on USDC reserves flows to Coinbase, so every uptick in USDC supply or front-end yields levitates Coinbase’s 'Subscription & Services' line.”

“Circle's market cap exceeding that of Coinbase's makes little sense from a fundamentals perspective. Coinbase captures about half of Circle's revenue and has many other business lines in addition. Nevertheless, we don't live in a rational world. We live in an attention economy that thrives on momentum.”

$120K Next? Bitcoin Surges As Israel-Iran War Ends!

Bitcoin is back above $105K as tensions between Israel and Iran ease, giving bulls a reason to regroup. On today’s live show at 9 am EST, I’ll break it all down with Andrew Parish, Tillman Holloway, and John E. Deaton - from the $120K BTC target to what Trump’s ceasefire announcement really means for markets. We’ll also cover oil's dramatic drop, Ethereum ETF inflows crossing $4B, and the latest big-money moves in crypto infrastructure.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.