Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Is Crypto Still Anti-Establishment?

Bitcoin Thoughts And Analysis

Stocks Up, Oil Down

Circle Flips USDC Marketcap

Everyone Is Creating Bitcoin Treasury Companies

The Fed Is Beginning To Change Its Tune On Rate Cuts

Trezor Owners Need To Watch For Phishing Emails

Can Bitcoin Hold $100K Amid Global Chaos? | Macro Monday

Is Crypto Still Anti-Establishment?

Who remembers their first crypto buy – not just the transaction, but the moment it clicked?

We were all there once, staring at a screen full of unfamiliar words: seed phrases, hashes, decentralized this, immutable that. It felt like trying to decode a secret message from the future. But beneath the jargon, the signal came through loud and clear:

This wasn’t just money. It was a middle finger to the system.

No banks. No gatekeepers. No 1-800 numbers and 45-minute hold times just to move your own funds. It felt rebellious. A little risky. And that was half the appeal.

Fast forward to today, and… well, things look a little different.

I’ve got nothing but love for VanEck – and you’ll see where I’m going with this.

BlackRock has a spot Bitcoin ETF. JPMorgan just launched a deposit token on Coinbase’s Base network. Fidelity offers Bitcoin and Ethereum in retirement plans and has been mining since 2014. Franklin Templeton tokenized a U.S. Treasury fund. Goldman Sachs has a digital asset platform and trades crypto derivatives. Citadel Securities, along with Fidelity and Charles Schwab, launched EDX Markets – a crypto exchange built for institutions. Nasdaq built a custody solution. Schwab offers crypto exposure through index products. Visa is settling USDC on Ethereum and Solana.

Read that again.

Five years ago, this was unthinkable. So here’s the question that’s been spinning in my head: is crypto still anti-establishment – or have we gone full suit and tie?

As usual in this space, the answer is messy.

Bitcoin was born from the ashes of the 2008 financial crisis. The very first block included a headline about bank bailouts. Now, Coinbase is quoting that same line to market a credit card issued by American Express. Crypto wasn’t created to “upgrade” the system – it was meant to burn the whole thing down. Opt out, not opt in.

But somewhere along the way, that shifted.

First came the VCs – flooding altcoins with capital. Then the rise of centralized exchanges like Coinbase and Binance. Then celebrity endorsements, Super Bowl commercials, and now ETFs, political lobbying, and bank partnerships.

You can argue it’s the natural evolution of any breakthrough tech – the internet, smartphones, streaming. Maybe crypto had to get cozy with the establishment to survive. Or maybe – and this stings – we started enjoying the taste of legitimacy. The headlines. The money. The warm glow of being welcomed inside the building instead of throwing rocks from outside.

Still, I don’t think the anti-establishment fire is gone – it just moved.

It’s in the builders pushing code under pseudonyms. The people running full nodes out of principle. The users of privacy tools and decentralized protocols. It’s in the developers grinding on GitHub with no token in sight. In the refusal to KYC a wallet. In the weird forums and group chats that still feel underground.

It’s also in the quiet middle – regular people rethinking the system without burning it all down. The investor who buys Bitcoin on Coinbase but stores it on a Ledger. The dad who sets up a multisig wallet to protect his family’s savings. The professional cashing out a 401(k) to bet on Bitcoin. The millennial who dumps a Wells Fargo credit card for Robinhood – not because it’s perfect, but because it’s different. They aren’t radicals. They’re cautious optimists making small, intentional decisions that pressure the system from within.

That pressure matters. Every one of those choices sends a message. It forces legacy players to adapt – not out of goodwill, but necessity.

So where does that leave us?

Crypto today is split. On one side: the polished, institutional layer – compliant, regulated, predictable. On the other: the wild frontier – open-source, chaotic, sometimes brilliant, sometimes a total mess. And both are thriving.

We now have an administration openly supporting crypto innovation and participating in it. That brings its own problems, sure – but I’d rather have a government with a hand in the cookie jar than one trying to burn the kitchen down. At least for now, we still have space to self-regulate, reward good actors, expose bad ones, and let the experiment run.

This was never a fight between good and evil. It’s not even a fight, really. Crypto didn’t sell out – it scaled. And scaling brings friction.

The challenge now is to grow without losing the soul of what made this space matter. That won’t be easy.

But if anyone can do it, it’s us – the ones who didn’t just get in to make money, but to make change.

Join Me For Drinks With NYC Mayor Eric Adams - TONIGHT!

REMINDER: I’m hosting an intimate gathering today in support of NYC Mayor Eric Adams – a longtime crypto advocate and early Bitcoiner.

Eric made headlines in 2022 by taking his first three paychecks in Bitcoin, has consistently pushed back against the burdensome BitLicense, and even proposed BitBonds to modernize the city’s financial infrastructure. He’s been on our side from the start.

If you’re in New York for Permissionless (where I’ll be doing a fireside chat with the Mayor in just a few hours), come join us. You’ll have a chance to meet both of us, connect with like-minded leaders, and help shape the future of crypto in NYC. Space is limited – this is a small venue with real face time.

👉 Register here: https://lu.ma/g1x0hj07

👉 DONATE here: ericadams2025.link/melker

Can’t make it in person? Please consider making a small contribution to support a crypto-friendly future for New York City. Every bit helps.

Bitcoin Thoughts And Analysis

Bitcoin’s daily chart shows a textbook liquidity sweep followed by a strong recovery. After dipping below the critical $100,000 psychological level late last week, price tagged a low around $99,000 before reversing sharply. This move likely shook out overleveraged longs and trapped breakout shorts – setting the stage for a high-volume bounce. Importantly, BTC reclaimed both the $100,716 horizontal support and the 50-day moving average – signaling renewed short-term bullish momentum.

Currently, Bitcoin is trading just below the key resistance level at $105,787 – a price zone that has repeatedly acted as a ceiling throughout June. A decisive breakout and close above this level would likely open the door to a move toward the $112,000 range highs. Until then, $105,787 remains the level to beat. If price rejects from here, the $100K zone becomes crucial once again – with $92,817 as the next major support below.

Volume has been supportive on the bounce, suggesting real demand stepped in on the sweep of the lows. For bulls to maintain control, they’ll want to see continued strength above the 50-day moving average and a clear break of resistance. For now, the structure looks constructive – but the next couple of daily closes will determine whether this was just a relief rally or the start of a broader continuation higher. We are basically trading between two key levels in a small range.

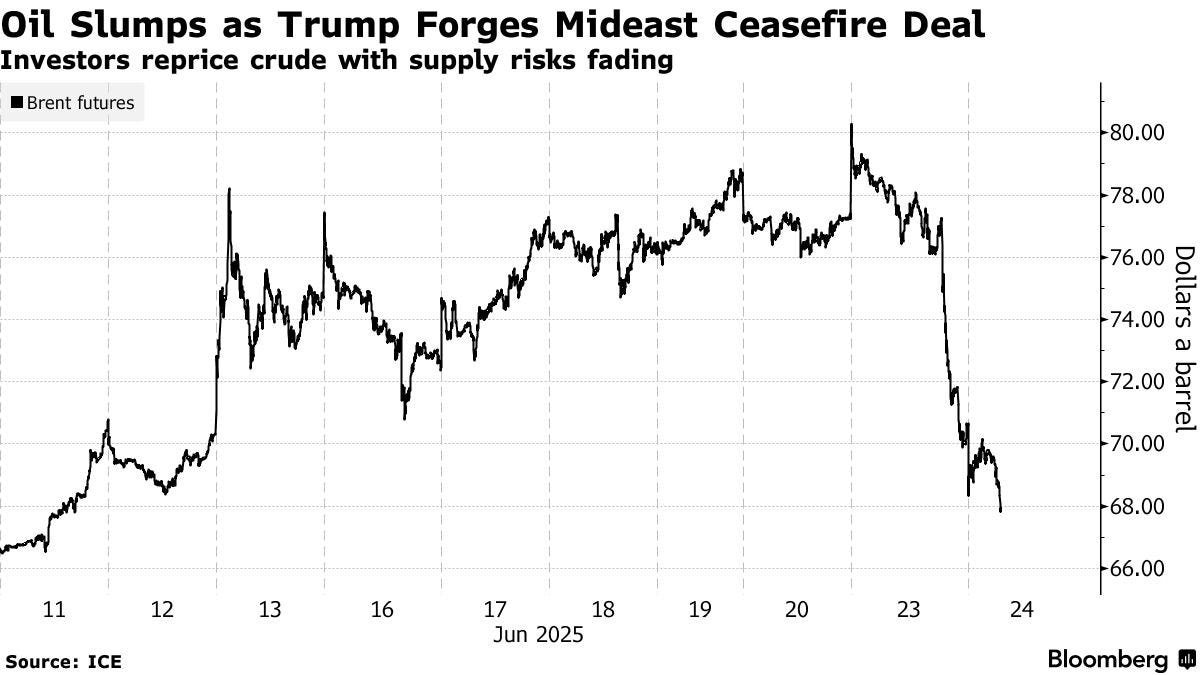

Stocks Up, Oil Down

Stocks climbed and oil prices dropped on cautious optimism following U.S. President Donald Trump’s announcement of a ceasefire between Israel and Iran. Brent crude initially plunged as much as 5.6% – falling below levels seen before Israel’s recent attacks on Iranian nuclear sites – before paring some losses to trade above $69 a barrel. The market reaction turned mixed after Israel reported a new missile launch, which Iran denied, but the broader tone remained one of relief.

Equity markets responded positively to the potential de-escalation. S&P 500 futures gained 0.8%, pointing to a second day of upward momentum, while European and Asian stocks also rose. The dollar, which had been a key safe haven during the conflict, slid 0.4% against a basket of currencies – its largest drop since the hostilities began. The move reflects receding demand to hedge against geopolitical risk, especially in energy markets.

Investors welcomed the possibility of reduced inflationary pressure as oil prices retreated. Analysts noted that a sustained truce could help support consumption and growth, even if there’s no guarantee that the ceasefire will hold. Meanwhile, U.S. Treasury yields were little changed, with market attention turning to upcoming testimony from Federal Reserve Chair Jerome Powell, which could offer fresh signals on interest rates and broader economic policy.

In corporate news, Tesla rose 2.6% in premarket trading after rolling out its long-promised driverless taxi service. Alphabet is under new scrutiny from the UK antitrust regulator over its advertising and search dominance. Nvidia CEO Jensen Huang began selling stock under a plan allowing him to offload up to $865 million by year’s end. Spanish drugmaker Grifols was found to have paid higher prices for plasma from a related entity compared to third parties, while Spain’s government is reportedly imposing further conditions on BBVA’s planned acquisition of Banco Sabadell.

The geopolitical tensions of the past two weeks may be easing, but markets are quickly shifting back to economic fundamentals – including tariffs, inflation, and growth – as the next catalysts for volatility.

Stocks

S&P 500 futures rose 0.7% as of 6:31 a.m. New York time

Nasdaq 100 futures rose 0.9%

Futures on the Dow Jones Industrial Average rose 0.7%

The Stoxx Europe 600 rose 1.2%

The MSCI World Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.4%

The euro rose 0.2% to $1.1597

The British pound rose 0.6% to $1.3609

The Japanese yen rose 0.8% to 145.03 per dollar

Cryptocurrencies

Bitcoin rose 1.4% to $105,210.89

Ether rose 2.9% to $2,415.84

Bonds

The yield on 10-year Treasuries was little changed at 4.34%

Germany’s 10-year yield advanced five basis points to 2.55%

Britain’s 10-year yield advanced one basis point to 4.51%

Commodities

West Texas Intermediate crude fell 2.9% to $66.52 a barrel

Spot gold fell 1.3% to $3,325.68 an ounce

Circle Flips USDC Marketcap

HO-LEE-COW. Circle continued its rally yesterday, climbing to $298.99 with an intraday market cap of $72.03B - surpassing USDC’s $61.3B market cap. If not for Coinbase’s explosive move last week, Circle would now be worth more than Coinbase itself. Let that sink in: Circle, the issuer of USDC, is on the verge of eclipsing the market cap of Coinbase - the most trusted exchange in the U.S., operating in over 100 countries and USDC’s primary distribution partner. It’s mindblowing. So far, every short has been brutally punished - but eventually, the momentum will cool. Still, it’s a reminder that crypto hasn’t lost its magic touch: in this market, the right assets can still soar well beyond anyone’s expectations.

Everyone Is Creating Bitcoin Treasury Companies

Not every Bitcoin acquisition company is going to make it. Some will mistime the market and launch right at the top. Others will get overleveraged, mismanage capital, or simply fail to weather a long bear market—especially if a larger player starts unwinding their position. The more companies that borrow to buy Bitcoin, the crazier the upside during a mania… but the harder the crash when the music stops.

The latest entrant? Anthony Pompliano. His new firm, ProCap, is merging with Columbus Circle Capital to form ProCap Financial, a public vehicle aiming to acquire up to $1 billion in Bitcoin. Backed by $750 million in funding, it’s being pitched as the largest initial raise ever for a Bitcoin treasury strategy. The playbook is familiar: give investors Bitcoin exposure through a traditional, publicly traded wrapper. The merger should close by year-end.

It’s a solid move. But at this point, it feels more like another chapter in the “Strategy clone” trend than a game-changer.

The Fed Is Beginning To Change Its Tune On Rate Cuts

Here’s the quote everyone was talking about, “Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market. In the meantime, I will continue to carefully monitor economic conditions as the Administration’s policies, the economy, and financial markets continue to evolve… I think it is likely that the impact of tariffs on inflation may take longer, be more delayed, and have a smaller effect than initially expected, especially because many firms frontloaded their stocks of inventories. As we think about the path forward, it is time to consider adjusting the policy rate.”

In total, there are seven members on the Board of Governors of the Federal Reserve System. Furthermore, there are additional voters including: the New York Fed President (always votes) and 4 of the 11 other regional Fed bank presidents, who rotate annually. The Fed values consensus over narrow votes, so major policy changes like rate cuts or hikes typically happen only with broad agreement. We are going to need to see more similar opinions before we can expect a cut.

In other news, the Federal Reserve has removed the phrasing, “reputational risk” from its bank supervision criteria, meaning regulators can no longer penalize banks for offering legal but controversial services - including those tied to crypto - just because they might look bad. Instead, examiners will now focus solely on tangible financial risks like liquidity, credit, and operations. The move follows years of industry pushback, especially from banks frustrated that crypto partnerships were blocked based on subjective optics rather than actual risk.

Trezor Owners Need To Watch For Phishing Emails

Trezor Issues ‘Urgent Alert’ After Support-Form Exploit Sends Phishing Emails – What Users Must Know

Yesterday morning, Trezor issued an urgent security alert after attackers exploited its support contact form to send phishing emails to users. Scammers submitted fake support requests using real user emails, triggering automated replies that looked like legitimate Trezor messages. While no systems were breached, the attackers tricked users into revealing sensitive wallet backup info. Trezor stressed it will never ask for wallet backups and reminded users to keep them private and offline. The issue has been contained, and the company is working on further safeguards.

“There was no email breach. Attackers contacted our support on behalf of affected addresses, triggering an auto-reply as a legitimate Trezor support message. Our contact form remains safe and secure. We’re actively researching ways to prevent future abuse. Stay vigilant and never share your wallet backup!”

Can Bitcoin Hold $100K Amid Global Chaos? | Macro Monday

War is escalating, markets are shaking, and Bitcoin is back above $100K - but can it hold? On this week’s Macro Monday, I’m joined by Dave Weisberger, Mike McGlone, and Peter Tchir to break down the U.S. strikes on Iran, rising oil and inflation risks, and what it all means for global markets. We’ll also dive into the crypto market’s massive $1.2B inflows and whether Bitcoin can stay strong amid rising geopolitical chaos.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Crypto’s secret? Expect chaos and profit anyway.