Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

You may have noticed that last week I announced that I’ve taken an equity stake in Arch Public. I’ve been working with Tillman and Andrew for more than a year and believe in how they’ve brought institutional tech to retail and offer it to you for free.

There is so much coming from Arch Public and my community will always hear it first!! For now, just know that I believe in the product, leadership, and service that Arch Public offers to thousands of you.

Another reminder that their products are free to use and get your proverbial feet wet. I’d encourage you to go use the product, or sign up and talk directly to Andrew, Arch Public’s Co-Founder and COO.

In This Issue:

The Bull Market Is Cancelled

Bitcoin Thoughts And Analysis

Markets Show Resilience As Oil Shock Fears Ease

Come And Meet The Mayor Of NYC

Texas Bitcoin Bill Makes It Across The Line

Cathie Wood’s ARK Offloads CRCL Position

An Update On Crypto Stocks

Major Win For Bitcoin And Crypto: Senator Hagerty On His Historic Stablecoin Bill

The Bull Market Is Cancelled

Yup, you read that title right.

The bull market is over. Pack it up. The U.S. is heading to war, the price of oil is about to triple, inflation will roar back, and the Fed - well, they’re not cutting rates anytime soon.

It was fun while it lasted.

Okay, clearly I’m exaggerating. Let’s be real: by Tuesday morning, a Trump post on Truth Social announcing a surprise deal with Iran could send legacy markets up 3%, crypto up 10%, and make yesterday’s headlines feel like ancient history.

Fundamentally, there’s nothing broken with Bitcoin, or the S&P 500 right now. What we’re seeing is panic - sellers overpowering buyers - and in that kind of environment, riskier assets are naturally going to take the biggest hits. I’m in no rush at this point, but dip buyers will start shopping for assets on sale.

Don’t make it hard.

Here’s what everyone’s talking about right now: the Strait of Hormuz. I’m pretty sure 99% of investors hadn’t heard of it until it popped up on their X feed a couple of days ago. I don’t have much to add on this topic - I’m not a Middle Eastern historian or a geopolitical expert - but these headlines don’t feel all that different from others we’ve seen play out in recent years. Yes, this is an exaggerated take, tailor made for X…

Take a look at this.

I’m not putting much trust in a poll with just $1.5 million in volume. That alone is the main reason I’m sharing the image - not endorsing it as truth. Polymarket can be useful and ahead of the curve at times, but a million-dollar market is likely being driven by a handful of whales - or even just one. I would honestly trust a CNN or Fox anchor before a million-dollar poll.

Just take a look at how volatile recession odds have been this year - they nearly hit 70%, dropped all the way down to 20%, and now they’re spiking again. Even with $7.5 million in volume, there still isn’t enough liquidity to make this market reliable. For comparison, the election markets were trading between $3 billion and $4 billion, which is why they offered a much clearer and more accurate signal.

What we are seeing right now, just speaking in terms of headlines, is the same story dressed in different clothes as:

Russia invading Ukraine - Feb 2022

Israel attacking Iran - Apr 2024

India attacking Pakistan - Feb 2019 (airstrikes and skirmishes, no full-scale war)

Hamas attacking Israel (Gaza conflict) - Oct 2023

Iran launching missile and drone attacks on Israel - Apr 2024

Ongoing China–Taiwan tensions - escalating since 2022

USA conducting strikes on Iran-backed groups (limited actions, ongoing)

Side note: I’m not trying to minimize any of these events or reduce the loss of life to ‘it’s all the same.’ My intention is simply to make a broader point - that while each conflict has its own complexities, they all reflect a recurring cycle of geopolitical tensions that disrupt markets temporarily (emphasis on temporarily) but rarely seem to make a long-term impact.

The S&P really is just a beautiful chart, and while Bitcoin’s isn’t as sexy, it’s still a hell of a chart.

It’s going to take a lot more than some Middle East tension to knock these two off course.

One thing I’ll be watching closely is a spike in inflation and how it might influence the Fed’s decision on cutting rates at upcoming meetings.

If oil spikes, inflation will naturally follow - and even a slight uptick could easily wipe out any chance of a July rate cut and weaken the odds for September. It’s something I’ll be watching more closely, but regardless, I’m not selling any assets.

If this dip feels unusually painful, it’s a sign you’re overexposed to riskier assets - and it might be time to rebalance toward something less volatile. The S&P is still just a hair below its all-time high, and Bitcoin being 12% off its peak is barely a volatile move by Bitcoin standards.

Alts are of course taking a harder hit - and while it sucks, it makes sense. Their shine in the market has been largely usurped by crypto stocks, COIN, CRCL, HOOD, MSTR, and NAKA. Bitcoin dominance keeps climbing, fresh capital is limited, and the Fed isn’t in any hurry to cut rates. That said, they’re not all doomed - so long as you’re not overexposed and you’re holding quality projects.

One point I haven’t made before - but want to throw into this random rant - is that Bitcoin should make up at least 50% of your long-term crypto portfolio. That’s the bare minimum I’d recommend (not financial advice) for anyone trying to strike a balanced allocation between Bitcoin and alts. Honestly, even 50% doesn’t feel conservative enough. If you’re below that threshold, I would strongly suggest reconsidering - especially given that Bitcoin dominance has been on a clear uptrend for the past 2.5 years.

I try to stay around 70-75%.

Also, the only community that seems even remotely reasonable when it comes to making long-term price predictions is the Bitcoin crowd. I’ve said for a long time that Bitcoin is headed to $1 million - and I still believe that. But I don’t feel nearly as confident making similar calls for altcoins, especially those that haven’t even reclaimed their all-time highs from years ago.

Bitcoin is in a category of its own - proven, resilient, and increasingly institutionalized - while altcoins still have to earn their place in the long-term picture.

Lastly, summer months tends to suck for crypto markets:

We’re in a bull market, so there’s reason to believe this summer will hold up better than it would in a bear market - but it’s still going to take more to push assets higher than it will for them to drift lower.

Also, the last time altcoins had a strong June was in 2021. Every June since has clearly belonged to Bitcoin.

Now that my brain is done spewing, here are my takeaways:

Geopolitical headlines feel urgent in the moment, but rarely shift long-term market cycles - especially for assets like Bitcoin and the S&P.

Emotional narratives dominate the short term, but disciplined positioning wins over time.

The rotation we’re seeing isn’t just out of alts - it’s a redefinition of what “safe” means in crypto, with Bitcoin leading the way.

Without real product-market fit, most altcoins remain little more than venture bets wrapped in a fake security.

A delayed Fed pivot may hurt in the short term, but it gives Bitcoin more breathing room before any real alt season can emerge.

Selling here makes little sense - neither the data nor the sentiment supports it.

Historically, summer has not been kind to altcoins.

I hope this helps - writing out my thoughts gives me a reason to sit on my hands and stay patient. My game plan is pretty straightforward: if my bids get filled, great. If not, I’m more than happy with what I’m already holding.

Bitcoin Thoughts And Analysis

Bitcoin just performed a textbook liquidity sweep, dipping below the psychological $100,000 level and the early June swing low near $100,377. This move triggered stop-losses and drew in short positions before quickly rebounding back above support – a classic example of "grab and go" price action designed to collect liquidity.

This kind of move often traps impatient bears and can act as a springboard for a short-term reversal if bulls manage to hold the reclaimed level. While today’s candle hasn’t closed yet, the wick below $100K shows aggressive buying interest. If we see confirmation over the next couple of days – particularly with a close back above the key $101,450–$101,800 range – it strengthens the case for a bounce.

Markets Show Resilience As Oil Shock Fears Ease

US stock futures rose Monday as oil prices steadied and fears of a major energy shock receded. The cautious optimism followed speculation that Iran’s response to the recent US bombing of its nuclear sites will not significantly disrupt oil flows from the Middle East. S&P 500 futures edged up 0.2%, Brent crude remained flat after paring a sharp intraday gain, and the dollar strengthened.

Despite Iran’s foreign minister signaling that all options remain on the table, crude shipments through the crucial Strait of Hormuz have so far been unaffected. Analysts believe a complete closure of the waterway remains unlikely, though market sentiment will likely stay range-bound as tensions evolve. Some fund managers have already trimmed equity exposure, helping to reduce the risk of a steep selloff.

In Europe, private-sector growth stalled, with the latest PMI data coming in at just 50.2 — barely in expansion territory. Meanwhile, 10-year Treasury yields nudged higher to 4.39% on concerns that prolonged geopolitical instability could reignite inflation.

Elsewhere, Tesla launched its long-promised driverless taxi service, BA and Singapore Airlines canceled flights to the Gulf, and Prosus NV posted its first-ever profit. M&A activity stayed hot, with Advent agreeing to acquire Spectris Plc for $5.1 billion, and UK REIT Assura Plc finding itself at the center of a takeover tug-of-war.

Key Events This Week:

Fed Chair Jerome Powell Testifies

Powell will address Congress – providing insight into the Fed’s stance on inflation, growth, and interest rates. Expect markets to react to any hint at timing for rate cuts.Core PCE Inflation Report (May)

The Fed’s preferred inflation gauge drops this week. A hotter-than-expected number could dampen hopes for near-term easing.Earnings from Nike, FedEx, and Micron

These reports will offer a pulse check on consumer demand, supply chain dynamics, and tech sector sentiment.Central Bank Activity

Multiple major central banks – including the Bank of Japan, Bank of England, and Swiss National Bank – will release rate decisions and guidance, helping shape global monetary direction.Geopolitical Tensions and Oil

Markets are still watching the Middle East closely. Any disruption in oil flows – especially through the Strait of Hormuz – could spike energy prices and stoke inflation concerns.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 10:15 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index fell 1.1%

The MSCI Emerging Markets Index fell 0.8%

Currencies

The Bloomberg Dollar Spot Index rose 0.5%

The euro fell 0.5% to $1.1468

The Japanese yen fell 1.2% to 147.79 per dollar

The offshore yuan fell 0.2% to 7.1914 per dollar

The British pound fell 0.4% to $1.3395

Cryptocurrencies

Bitcoin rose 2.2% to $101,729.2

Ether rose 3.2% to $2,258.5

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.39%

Germany’s 10-year yield advanced three basis points to 2.54%

Britain’s 10-year yield advanced two basis points to 4.55%

Commodities

Brent crude was little changed

Spot gold was little changed

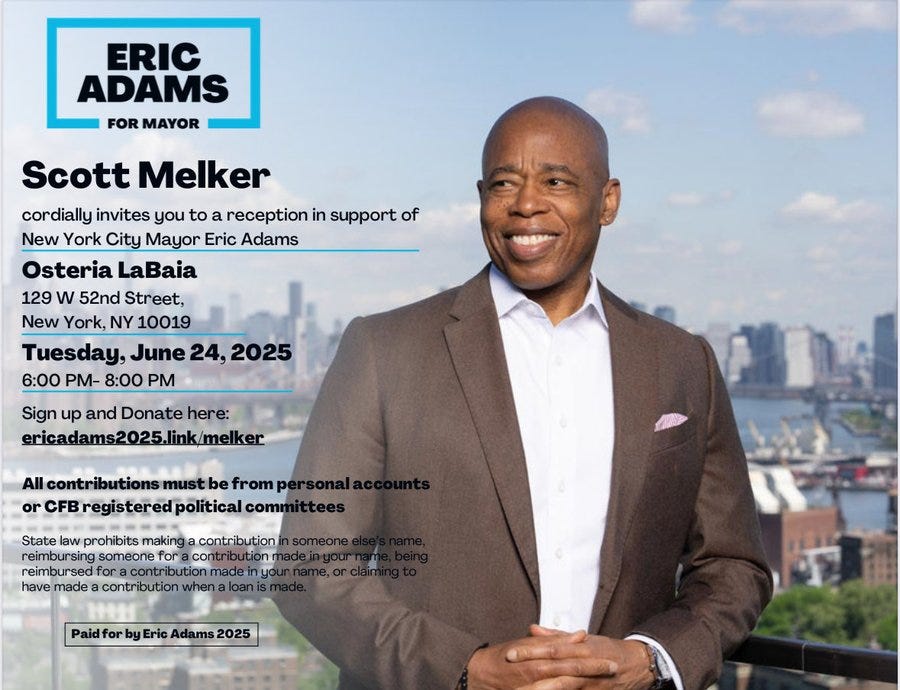

Come And Meet The Mayor Of NYC

I’ll be in NYC with Mayor Eric Adams, meeting and talking with anyone who joins this event to support the mayor and discuss crypto. It’s a great networking opportunity for anyone living in the city - or anyone willing to fly in and connect. I hope to see you there!

Side note, please considering donating to the campaign. The event has limited space.

Texas Bitcoin Bill Makes It Across The Line

Texas has officially become the third U.S. state to create a strategic Bitcoin reserve, after Governor Greg Abbott signed SB 21 into law, following Arizona and New Hampshire. What’s particularly special about the news is that Texas is the first to establish a publicly funded, stand-alone Bitcoin reserve managed outside the state treasury by Comptroller Glenn Hegar. The legislation, championed by Senator Charles Schwertner, allows the state to invest in Bitcoin as a high-performing asset, much like land or gold. Abbott also signed HB 4488, which protects the reserve from routine state fund reallocations and ensures its legal status even if no Bitcoin is purchased by next year. Texas is clearly thinking two steps ahead.

Texas Blockchain Council founder said the following, “My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas. It's still early and the comptroller is going to utilize proven investing standards to determine how much to buy, when to purchase, and that's really outside of the hands of anybody except the professionals at the comptroller's office.” State Senator Charles Schwertner, said this February, “We can buy land, we can buy gold; I think the state of Texas should have the option of evaluating the best performing asset over the last 10 years.”

Here are a few highlights from the bill:

This segment grants the comptroller full authority over the management of the reserve.

This segment continues the discussion around market cap requirements- criteria that only Bitcoin currently meets and is likely to remain the sole qualifier for the foreseeable future.

Cathie Wood’s ARK Offloads CRCL Position

ARK Invest sold a large portion of its Circle holdings last week, offloading 609,175 shares worth around $121.5 million on Friday, June 20, after the stock surged 20% to $240.30 - more than triple its IPO price from June 5. Combined with earlier sales on Monday and Tuesday, ARK shed in total about 1.25 million shares in total, roughly 29% of its initial 4.49 million-share position. Despite the selloff, ARK still holds around 2.5 million shares, valued at over $500 million, making it Circle’s eighth-largest shareholder with about 8% of the public float.

There’s a pretty neat site called, “Cathie’s ARK” that can be used to track exactly what her ETFs hold and follow the trades in real time.

An Update On Crypto Stocks

We used to only have to keep track altcoins, Bitcoin, and a handful of select crypto stocks - but now there’s a full third category emerging and it’s crypto-related stocks.

On June 21, 2025, Circle’s stock jumped 25% to near its all-time high, driven by growing adoption of stablecoins and its recent addition to Sam Altman’s World Chain. The rally was also fueled by speculation that Amazon and Walmart might launch their own stablecoins pending passage of the GENIUS Act - though this prospect drew criticism from Senator Warren and consumer groups concerned about regulatory gaps. Since its $31 IPO, Circle’s shares have soared over 347%, encouraging companies like Shopify and RippleX to integrate USDC across their platforms.

Meanwhile, GameStop’s stock dropped 22% following a $2.25 billion bond offering, raising concerns about CEO Ryan Cohen’s unclear plans despite the company’s sizable Bitcoin holdings. SharpLink Gaming plunged 72% after an SEC filing sparked sell-off fears; the company attributed the decline to misinterpretation and confirmed a $463 million Ethereum treasury. Currently, Strategy (MSTR) is still trading below its 52-week high - 31.9% off the $542.99 peak - as Saylor continues to accumulate Bitcoin. Meanwhile, Coinbase (COIN) is showing renewed strength, now just 13.4% shy of its 52-week high.

Major Win For Bitcoin And Crypto: Senator Hagerty On His Historic Stablecoin Bill

I sat down with Senator Bill Hagerty for The Wolf Of All Streets just one day after the Senate passed his groundbreaking crypto bill – the GENIUS Act. We talked about how this stablecoin legislation could reshape the future of money in America and kill off any chance of a central bank digital currency. If you want to understand where crypto regulation is really headed, this is the episode you can’t miss.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.