Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

⚡️ Taking Back Financial Independence & Freedom ⚡️

Yesterday I recorded a podcast with CJK, the founder of Peoples Reserve. This episode will be published this weekend and you’re not going to want to miss it.

We talked about the transformation of Bitcoin from ‘magic internet money’ to ‘digital gold’ through the mainstream monetization of the asset class. We also talked about what comes next; Bitcoin’s evolution from digital gold to pristine collateral through the financialization of the asset class.

Peoples Reserve is at the tip of the spear of financial innovation with their Bitcoin Powered Finance products and services. Their mission is to empower responsible savers of Bitcoin to unlock the purchasing power of their savings without having to give up ownership. They’re seeking to redefine the ‘risk-free’ borrower and rate of return by establishing a true free market yield curve without stated or anchored interest rates.

There is no better mission to align with than taking back financial independence and freedom! Follow along as they lead the charge by signing up for their newsletter at PeoplesReserve.com.

In This Issue:

Do Not Fall For These Scams

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Markets Waiting For Trump Decision On Iran

Protect Your Password Right Now

Trump Wants GENIUS Passed

Ethereum’s Leaders Are Finally Bull Posting

What Happens To Bitcoin If The U.S. Strikes Iran?

Don’t Fall For These Scams

I was putting together today’s newsletter and warming up with the news segments below when I hit the “Protect Your Password Right Now” section – and it just didn’t feel like enough. Two days ago, we saw the largest password and credential leak in history. Sixteen billion passwords were exposed – including login details from Facebook, Apple, Google, Microsoft, and dozens of other platforms we all rely on.

It’s easy to brush off headlines like this – but I’m not. I’m taking it seriously. I’m not just hoping I won’t be a victim – I’m actively doing something about it. You’ll find more on the breach in the news section below, but today I want to dig deeper. Because if that many credentials are floating around out there, you better believe crypto users are being targeted.

We’re way past the Nigerian prince at the airport or the mystery inheritance from your long-lost uncle. Today’s scams are smarter, sneakier, and aimed straight at your crypto wallet. OGs and newcomers alike are getting hit – especially by phishing attacks. And unless we stay ahead of these tactics, they’ll keep draining our hard-earned capital.

So today, I’m going beyond the usual “just use a cold wallet” advice. I want to break down a newer scam I’ve seen gaining traction – one that’s surprisingly effective and definitely worth knowing about. More importantly, I’ll share some practical tips you can actually act on. Let’s make sure we’re not the next target.

Here’s the remainder of the post:

“A few minutes before the call, he asked to switch to Zoom Business “for compliance reasons” — said one of his LPs would be joining - Kent (who I also knew). Given we were doing a lot of treasury deals and there was genuine LP interest, it didn’t seem out of the ordinary. I joined the Zoom. No audio.

But I could see both of them. They messaged in the chat: “Can you hear us?” They told me to update Zoom to fix the audio issue. That’s when it happened when I update.

Six wallets drained (my fault for not keeping things more buttoned up). My laptop compromised completely. Years of savings - gone in minutes.

I found out later that Alex’s account had been hacked. And the worst part? While my wallet was being emptied, the hacker kept chatting on Telegram like nothing was wrong.

He even joked: “Let’s catch up at SG.” It was surreal and completely Violating. But in the darkest moment, whitehat hackers stepped up - complete strangers offering help when I was at my lowest.

Turns out I was compromised by DPRK affiliated threat known as dangrouspassword.”

This is an incredibly sad situation, and my heart goes out to the individual affected – I truly hope they’re able to recover their life savings. As difficult as it is, the best thing we can do now is unpack what happened and learn from it – so others don’t fall victim to the same tactics.

First, the hacker exploited a compromised account of someone the victim knew – which naturally lowered his guard. He didn’t verify the meeting through another channel. And while it might feel excessive to confirm every single meeting with a phone call or email, it’s smart to double-check when reconnecting with someone you haven’t spoken to in a long time – especially if something feels even slightly off.

Second, the big red flag – aside from using hot wallets – was the request to switch platforms for “compliance reasons.” That’s highly unusual and should trigger immediate suspicion. Even if it might be legitimate, any request to change platforms last minute – particularly under pressure – warrants a pause. Installing or updating software mid-call is extremely risky, as malware can easily be disguised as a normal update.

Third, I generally avoid using Telegram for business conversations with people I really know and trust in crypto. It’s just too vulnerable. If I meet someone in person and want to stay in touch, I ask for their phone number. That way, if anything ever feels strange, I can call them directly – and I’ll know their voice. Only share your number with people you trust completely – otherwise, it defeats the purpose.

The most unsettling part of this story is that it could’ve easily happened to me – or to anyone. The scam wasn’t obvious. And when your guard is down, it’s shockingly easy to miss the red flags. That’s exactly why we need to develop instinctive habits – immediate red flag recognition – so we’re protected when our defenses are weakest.

Next, I want to walk you through a series of images – from obvious scams to some of the more sophisticated traps I’ve seen making the rounds. Let’s break them down. This first one should be obvious:

The sender’s address is “289170334@qq.com,” which is a random QQ email, not an official Tether domain. Legitimate communications from Tether would come from an official domain, which I doubt they are emailing anyone anyways randomly.

The email claims a “reward has been found” in your wallet with no context or reason why. This kind of vague, unexpected ‘free money’ narrative is a classic hook for scams. There has also never been a Tether airdrop, one Google search would have solved this.

“Please use today during the day” and “otherwise your reward will be transferred” are urgency tactics designed to pressure the recipient into acting fast without thinking clearly.

A Google Docs link in this context is highly suspicious. Scammers often use this method to disguise phishing links or deliver malware.

Lastly, the email contains no personalization, and there's an unverified attachment at the bottom - both classic signs of a mass phishing attempt.

This scam actually does a lot of things right – and that’s exactly what makes it so dangerous. It plays on curiosity, trust, and the appeal of easy money by name-dropping a legitimate company like Coinbase, which gives it just enough credibility to pass a quick sniff test. For someone new to crypto or just looking for a side hustle, getting paid $350 a week to visit a Bitcoin ATM sounds pretty harmless. The language is casual and clean enough to feel believable, and that red, all-caps call-to-action at the bottom? It’s designed to push you to act fast – before you’ve had time to think.

It’s not sophisticated, but it’s just convincing enough to trip up someone who isn’t on high alert.

Now let’s break down what’s wrong with it. There’s no official branding, no @coinbase email address – nothing about it actually confirms it came from the company. The writing is awkward in spots (what does “visit at least one Bitcoin ATM” even mean?), and the request to email them again from your personal address is a classic social engineering trick. It’s meant to move the conversation off any monitored or secure platform and into a more vulnerable channel. And the job itself? It doesn’t make sense. There’s no legitimate role that pays you weekly just to show up at a crypto ATM. The vagueness is intentional – it’s designed to lure you in before you think too hard about it.

The scammer might not be targeting your funds directly – at least not at first. They could be after your personal data, financial information, access to your devices via malware, or even trying to recruit you into the scam to help it spread.

Okay – last one coming up, and this one’s the most difficult to spot. Let’s see if you catch it.

This scam looks pretty convincing. It’s smartly crafted to imitate an official Coinbase email, complete with authentic-looking logos and branding that boost its credibility. The subject line and message describe a believable issue – an incorrect account balance due to a “formatting error.” It feels urgent enough to grab your attention, but not so alarming that it raises immediate red flags. The language is polished and professional, and that “Log in” button is subtle but effective – gently nudging you right where the scammer wants you. The real kicker? It frames itself as a “correction” email, building on the illusion that there’s already been some communication. That little touch adds a surprising amount of trust.

To the untrained eye, this one is dangerously believable.

Recognizing it as a scam takes a bit of prior knowledge. For starters, Coinbase doesn’t call, text, or email customers out of the blue. They do send out automated promotional emails or responses to specific support inquiries – but not vague alerts about account balances or formatting errors. More importantly, legitimate companies don’t ask you to log in through unsolicited emails. If there were truly an issue, they’d prompt you to visit their official site or app, not serve up a button in an email that could easily redirect you somewhere malicious.

If you get an email like this that looks legit, don’t click the link. Instead, open a browser and log in the way you normally would. Once you’re inside your account, check your balance, confirm your personal info, and look for any alerts. If everything checks out, head back to that email, block the sender, and delete the message.

That’s it for this week. Stay sharp out there – and enjoy your weekend.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with the news that Tapp Exchange is now live on the Aptos mainnet!

“TappExchange is the first modular DEX on Aptos. Its core feature, Tapp Hooks, lets developers customize swap behavior, integrate native yield strategies, or automate logic at the protocol layer. This makes it possible to design tailored financial flows while tapping into deep liquidity.”

I did some research on Tapp and it’s awesome. Here’s my summary from the ecosystem highlight Aptos detailed: TAPP is the first DEX on Aptos to offer Uniswap V4-style features, enabling fully customizable liquidity pools and efficient swaps through flash accounting. It combines active liquidity management, AI-powered routing, and DEX aggregation to deliver optimized pricing and returns. More than just a DEX, TAPP acts as a modular liquidity layer for Aptos, growing stronger with each new integration thanks to ve(3,3) mechanics and compounding network effects.

Up next, this news just dropped:

I did some digging and it’s true! The Wyoming Stable Token Commission (STC) is a government body created in March 2023 under the Wyoming Stable Token Act. Its job is to oversee the issuance of the Wyoming Stable Token (WYST) - a state-backed digital currency that is fully redeemable 1:1 for U.S. dollars. The WYST is held in trust by the state of Wyoming, meaning every token is backed by actual dollars, and tokens are only issued when someone deposits USD with the state.

In short: WYST is a state-issued stablecoin designed to be a secure, dollar-backed digital asset, with the state of Wyoming managing the reserves and guaranteeing redemption. Here’s what I found on the platform: “The current Candidate Blockchains are: Aptos, Arbitrum, Avalanche, Base, Ethereum, Polygon, Optimism, Sei, Stellar, Solana, and Sui.”

Last but not least, I want to call to everyone’s attention this event coming up in October.

Early bird tickets are priced at $49 - an extremely affordable rate for a conference, especially considering how high ticket prices can typically go. Aptos is becoming a hub for cutting-edge finance - from tokenized credit and stablecoin payments to advanced DeFi and trading tools. Over two days, attendees can explore the ecosystem through live demos, in-depth discussions, and networking opportunities. It’s a chance to see the future of finance on Aptos in action.

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

Bitcoin continues to treat the 50-day moving average like a sacred line in the sand. Once again, price dipped to test the level and found immediate support – bouncing right off the blue line with a solid daily candle and gaining over 1% in the process. That makes multiple successful defenses of the 50 MA in recent weeks – clearly, traders are watching it closely.

The key takeaway here isn’t just the bounce, but the fact that BTC remains in a tightening range between ~$112,000 resistance and ~$100,700 support. We’re seeing a clear battle between bulls and bears – with bulls still managing to defend higher lows while momentum tries to rebuild. As long as the 50 MA continues to hold, the structure remains bullish – but if it breaks, it could signal a retest of the $100K psychological level or even a deeper pullback toward the mid-$90Ks.

For now, the trend is still your friend. But keep one eye on the moving average – because the moment it fails, this range could resolve sharply. Until then, it’s a patient trader’s market.

Markets Waiting For Trump Decision On Iran

European stocks bounced back on Friday while oil prices retreated, following a White House statement easing concerns over imminent U.S. military involvement in the Israel–Iran conflict. The Stoxx Europe 600 ended a three-day losing streak, even though it remained on pace for a second straight week of losses. U.S. equity futures slipped slightly after a Juneteenth holiday closure, and Brent crude dropped 2%, trimming its earlier gains. The dollar weakened, and Treasury yields held steady as markets cautiously responded to shifting geopolitical signals.

Investor nerves were on edge earlier this week after Bloomberg reported that U.S. officials were preparing for a potential strike on Iran. However, President Trump signaled that a final decision would come within two weeks and that a negotiated solution remained possible. Israel continued targeting Iranian nuclear facilities and issued a stern warning against Tehran’s leadership, awaiting the U.S. response. Analysts noted the potential for significant market gaps at Sunday’s open, particularly if tensions escalate over the weekend.

Oil markets, which have already priced in about an $8 geopolitical premium since Israel and Iran began exchanging strikes, could see Brent crude surge as high as $130–$150 per barrel if the U.S. intervenes and Iran retaliates forcefully. Such a scenario could derail central banks’ plans to ease monetary policy, particularly in light of recent Fed warnings about persistent inflation and lowered growth forecasts. Meanwhile, in Japan, inflation hit a two-year high, setting the stage for potential changes in monetary policy and further scrutiny ahead of summer elections.

Stocks

The Stoxx Europe 600 rose 0.5% as of 9:41 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 1%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.1518

The Japanese yen was little changed at 145.34 per dollar

The offshore yuan was little changed at 7.1842 per dollar

The British pound rose 0.1% to $1.3485

Cryptocurrencies

Bitcoin rose 2% to $106,397.09

Ether rose 2% to $2,557.84

Bonds

The yield on 10-year Treasuries was little changed at 4.40%

Germany’s 10-year yield was little changed at 2.52%

Britain’s 10-year yield was little changed at 4.53%

Commodities

Brent crude fell 1.9% to $77.33 a barrel

Spot gold fell 0.6% to $3,350.48 an ounce

Protect Your Password Right Now

Stop what you're doing.

Go to wherever your crypto is stored, change your password, and don’t save it anywhere online. Then, enable two-factor authentication (2FA). Seriously – do that now. I’ll wait.

Back? Good. Because this is the largest data leak in internet history.

According to Cybernews and Forbes, a staggering 16 billion credentials have been exposed – and this isn’t recycled data from old breaches. Most of it is newly compromised. We’re talking logins from Apple, Google, Facebook, GitHub, Telegram, and even government services. If you’ve touched the internet in the past decade, you’re probably in this leak.

Cybersecurity researchers are calling it a “weapon of mass hacking.” And they’re not exaggerating. With this much data floating around, phishing attempts, account takeovers, and unauthorized access are inevitable – unless you take action.

Protecting yourself isn’t just a good idea anymore – it’s a necessity. Change your passwords. Use a password manager or switch to passkeys. Stay alert. Be skeptical. And assume that any strange email or login request is a scam until proven otherwise.

This isn’t fear-mongering – it’s the new normal. Treat it that way.

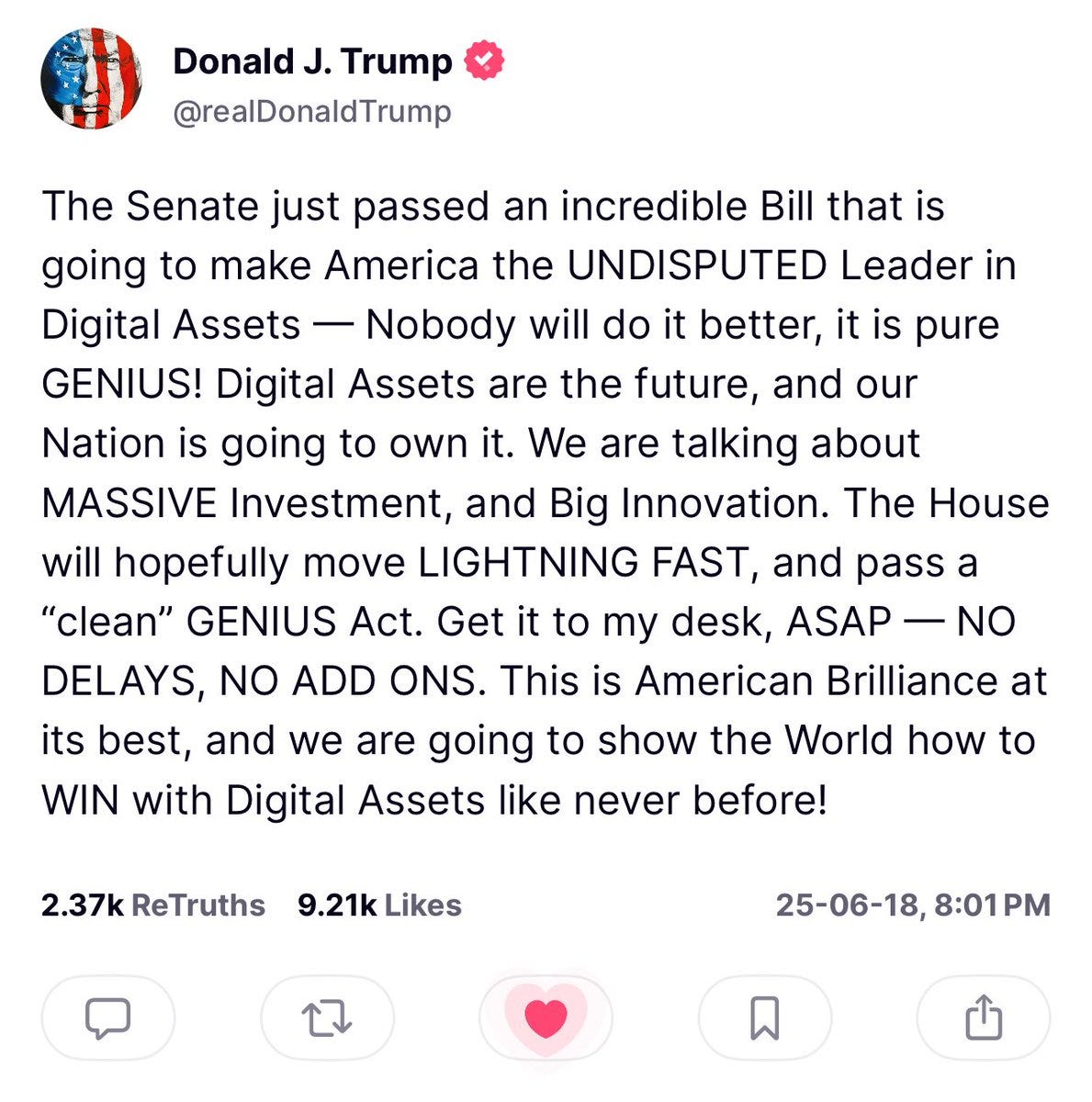

Trump Wants GENIUS Passed

Here’s a polished version of your note for the Wolf Den newsletter – with improved flow, clarity, and dash fixes:

We already knew Trump supported the GENIUS Act – but I didn’t realize just how strongly he felt about it. Hopefully his vocal backing doesn’t turn it into a partisan issue, because this should be a bipartisan win.

Meanwhile, markets are taking notice. Both COIN and CRCL are reacting sharply to the bill’s momentum in Congress. It’s wild to think CRCL was trading around $30 just a few weeks ago, with sentiment already turning bearish at that level. As of yesterday’s close, it’s now sitting at $211.

COIN is just shy of $300 – and might finally be ready to break out of the range it’s been stuck in since March of last year. With USDC so deeply embedded into Coinbase’s infrastructure, both companies going public only strengthens the other. This is one of those rare cases where rising tides really might lift both boats.

Ethereum’s Leaders Are Finally Bull Posting

It’s kind of a rare sight to see ETH’s leaders bullposting, which hasn’t really been the focus for years now. Also, you may remember the segment I did one week ago titled, “Etherealize Releases Bullish ETH Predictions,” where I was critical of the price predictions included in the research. Let me caveat that statement, because that was just a small portion of the report, and overall, the research was very well put together. Both Vitalik and Joseph Lubin (an ETH co-founder and founder of ConsenSys) are approving it. ETH holders are in a good spot.

Here’s some more of Joseph Lubin’s post:

“The thesis that ‘while BTC should be valued as Gold 2.0, ETH should be valued on the scale of the emergent decentralized global economy,’ was an early metaphor in the space, and it remains a very powerful one. Likening ETH to digital oil or energy that powers the future economy is a good proxy for this metaphor.

But this top tier thought piece has one major structural flaw -- a pretty deep structural flaw: it is not bullish enough.

It is not bullish enough on the profound societal paradigm shift Ethereum will drive and embody. But this is understandable, as none of us at this point can fathom how fast, creative and expansive the hybrid human-machine intelligence society will grow. Many of us are convinced that it will grow largely on decentralized rails. So it is not a great leap to suggest that the value resident on and flowing through Ethereum, which will constitute a large portion of Web3 -- the re-decentralized -- will be orders of magnitude larger that today's global GDP. Just look at how the energy, chips and data center spend is growing exponentially and how AI is accelerating everything.”

What Happens To Bitcoin If The U.S. Strikes Iran?

Get a bitcoin-backed loan. Check out: https://www.ledn.io/

Markets are on edge as Bitcoin traders hedge for a drop to $100K and geopolitical tensions escalate. I’m joined live by Mauricio Di Bartolomeo from Ledn to break down what this means for your crypto strategy, how Bitcoin-backed loans work in volatile times, and why ETF inflows are still surging. Plus, we dig into Trump’s stablecoin push and whether it could lock in U.S. dollar dominance through crypto.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.