Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

The Most Ignored Rule in Crypto

Bitcoin Thoughts And Analysis

Stocks Slide, Oil Gains As Iran Tensions Escalate

Trump Media Files For Bitcoin And Ethereum ETFs

Is Tron Going Public?

JPMorgan May Be Launching A Stablecoin

Strategy Is One Purchase Away From 600,000 BTC

Bitcoin Buying Frenzy - Is The Dollar Doomed? | Macro Monday

The Most Ignored Rule in Crypto

In crypto, everyone talks about ‘doing your own research’ – but almost nobody actually does it. I say this not in a joking way, but as seriously as possible: ‘DYOR’ has become more of a meme than a mindset. It gets thrown around like a disclaimer, not a discipline. The reality is, most people blindly follow influencers, chase hype, and dump money into projects they barely understand. When the red flags begin to wave, investors ignore them – and then when it’s blatantly obvious it’s too late, they’re shocked it didn’t work out.

Time and time again.

If the root cause of not doing your own research is pure laziness, well – there’s not much I can do. But if it’s partly because you’re unsure how to do the research, then that’s something I can help with.

Let’s start with the basics of how I do my own research. If I’m thinking about investing in something crypto-related, the very first thing I check isn’t the use case, the founders, or the community hype. It’s the market cap. Before anything else, I want to understand how much this asset is already worth – because that alone can reveal a lot.

Mentally, I have a few categories I group cryptocurrencies into:

The Top 10: These are generally considered the ‘safest’ bets in crypto (as safe as crypto gets). These are the most widely adopted assets – like Bitcoin, Ethereum, and major Layer 1s. They tend to have high liquidity, strong institutional interest, and broad awareness. Be warned though, big doesn’t mean invincible (Terra was once in the top 10).

Just Outside the Top 10 (Ranks 11–25): These projects are still well-established, often with working products, real user bases, and multi-year track records. They’re typically backed by strong teams and active communities. While slightly riskier than the top 10, they can offer more upside. Still, they’re not immune to regulatory pressure, competition, or narrative shifts.

Mid-Caps (Ranks 26–50): This range includes a mix of maturing protocols and up-and-coming players. Some may have strong fundamentals, while others are still riding hype or investor momentum. They usually have lower liquidity and more volatility. Plenty of opportunity – but also much more risk if the project stalls or fails to deliver.

Lower Mid-Caps (Ranks 51–100+): These are speculative assets with some degree of traction – whether it’s a strong community, early partnerships, or a unique narrative. They’re often highly sensitive to market sentiment and token unlocks. They’ve done something right to get here, but have a lot left to accomplish. Being in the top 100 gives visibility, but there’s very little guarantee they’ll be around next cycle.

I concentrate my portfolio as high up on this list as possible. The majority of my investments are in Bitcoin, of course, followed by Ethereum and then Solana. I’m not trying to be fancy – and when I do venture into more speculative bets, it’s with a small portion of my total portfolio. That way, if it goes to zero (which is entirely possible and honestly likely), it doesn’t move the needle for me financially or emotionally.

Next, I want to understand the tokenomics of what I’m buying – an extremely underrated and often misunderstood part of evaluating any crypto project. To illustrate, let’s compare Solana with a lesser-known token. The easiest way to explore tokenomics is through platforms like CoinMarketCap, CoinGecko, or even a quick Google search. On CoinMarketCap, for example, you can simply click on a token and scroll down to the “Tokenomics” section for a clear overview.

“The total supply of SOL is not fixed, with new tokens being created through inflation to reward validators. The inflation rate started at 8% annually and decreases by 15% each year until reaching a long-term fixed rate of 1.5%.”

While Solana isn’t perfect, it serves as a good example of healthy supply distribution. The majority of tokens are unlocked, the largest portion is held by the community, and the team’s stake doesn’t dominate the total supply.

Let’s look at ICP, Internet Computer Token (I choose this randomly).

The various tokenomic breakdowns I’ve seen for ICP don’t align perfectly, but they all point to the same concerns: large allocations to the pre-sale and foundation, and less than half of the total supply currently unlocked. If you’re holding ICP, no offense intended – you’re absolutely free to disagree. But from a risk assessment standpoint, these are significant red flags. If you’re considering an investment, make sure you get the most accurate and up-to-date information on supply distribution. The best place to start is usually the project’s official whitepaper or website.

Next, I want to dig into everything I can about the team and roadmap. Have the founders walked away from past projects or left a trail of failed startups? That’s a red flag. Do they have a checkered past or a history of shady behavior? That’s a dealbreaker. And if the roadmap is filled with vague promises or outlandish goals with no clear path to execution? I’m out.

If I’m making a serious investment, I’m watching old interviews, checking LinkedIn profiles, reading past blog posts, and looking at how long the team has been involved in crypto. I want to know if they’ve stuck through bear markets, how they communicate with the community, and whether they’ve actually shipped anything before. You don’t need to be a world-class detective – but you need to put your best detective hat on and do the necessary hours of research to save you from months of regret.

At this point, I have a solid grasp of what the project is trying to achieve. The next step is the hardest – and it’s something that takes years of experience to truly develop. It’s not about uncovering some hidden secret about the project, but understanding where it fits into the bigger picture. There’s no exact science here. It means analyzing its competitors, evaluating the strength and engagement of its community, and assessing its long-term viability in the context of where the industry is headed. You’re asking: Does this project really need to exist – and can it survive the next cycle?

This means not only surviving the next bear market, but withstanding the unforeseen challenges this space inevitably brings. Maybe regulators turn their crosshairs in this direction. Maybe a new wave of contagion comes not from overleveraged exchanges, but from companies holding massive treasuries in speculative tokens. These are the ticking time bombs no one talks about – until it’s too late – and they affect everything.

The further down the risk curve your investment is, the more vulnerable it becomes – regardless of whether it’s directly tied to major contagions or not. When panic hits or liquidity dries up, capital rushes to safety. There simply isn’t enough money flowing in to support every niche project. Even solid ideas get punished when the market tightens. That’s the reality of crypto – correlation spikes when things fall apart.

For an altcoin to survive multiple market cycles, it needs more than just dedication – it needs a damn good use case and a world-class team. The project has to have that ‘it’ factor – that spark that sets it apart from the noise. Whether it’s undeniable utility, cult-like community support, or relentless execution, something has to make it stand out when everything else fades.

No specific method or amount of research guarantees you’ll uncover that elusive ‘it’ factor – and sometimes, you may even mistakenly assign it to the wrong project. But the more you dig, the better your odds of finding something real. In a space flooded with noise and hype, the real edge comes from doing the work most people skip. You can laugh it off – or you can just do the work.

The upside to doing your own research is that, if done well, it often leads you back to the strongest assets – like Bitcoin. But the downside is that poor research can send you deeper into riskier plays under the illusion of confidence. It’s a double-edged sword: research is essential, but only when paired with critical thinking and a healthy dose of skepticism.

The next time someone tells you to DYOR, stop and consider what they actually mean. Are they just slapping a disclaimer on a questionable opinion to dodge accountability? Or are they genuinely encouraging you to learn about something with real potential? The difference matters – and so does the quality of your research.

The bull market will reward the investors who took this advice seriously – it always does. So, on that note, close your tabs, block out the noise, and start truly understanding what you own or plan to own. No one can spoon-feed your knowledge and conviction. That part is on you.

Bitcoin Thoughts And Analysis

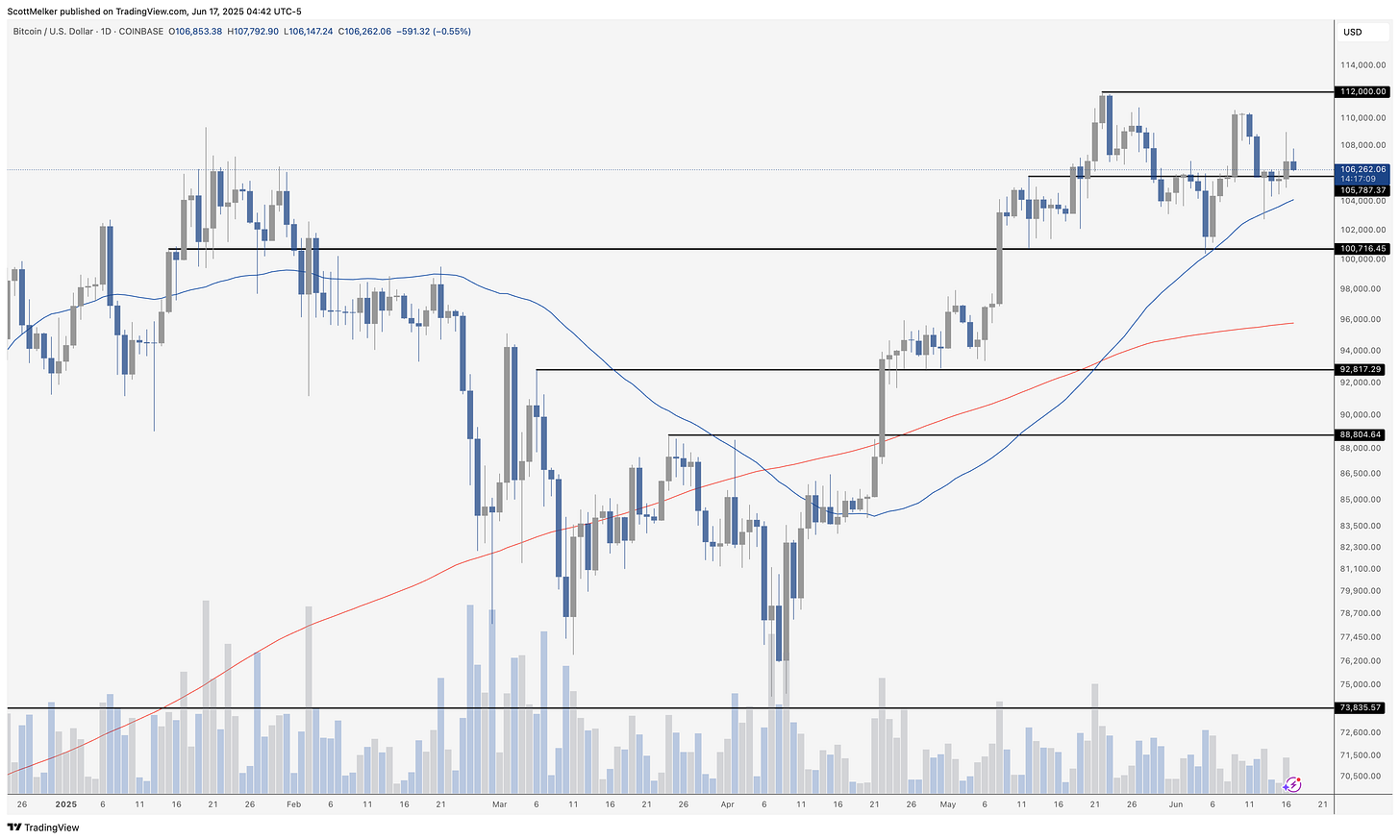

Not much to see here – Bitcoin continues to range quietly between support at ~$100,700 and resistance at $112,000. Price is hovering just above the 50-day moving average, which has flattened out, signaling a pause in momentum rather than a directional shift.

The recent higher low around $100,700 remains the key structural level to watch. As long as that zone holds, the bullish bias technically remains intact, but the lack of follow-through toward the highs suggests weakening momentum. Volume continues to decline, which is typical during sideways consolidation and often precedes expansion – but there's no sign of that happening yet.

A breakout above $112K would likely trigger momentum buyers, while a breakdown below $100K could put $92,800 and even $88,800 back on the table. Until then, it's just rangebound chop – and patience is the only real trade.

Nothing broken, nothing confirmed – just a waiting game for now.

Stocks Slide, Oil Gains As Iran Tensions Escalate

U.S. stock futures slipped and oil prices edged higher following President Trump’s surprise comments urging the evacuation of Tehran. The remarks, shared during the G7 summit in Alberta, injected fresh uncertainty into global markets just as investors were beginning to hope that Israel–Iran tensions might not spiral further. Trump later clarified that his early departure from the summit was unrelated to a ceasefire, but market participants remained on edge.

S&P 500 futures dropped 0.5%, while Brent crude rose 1.3%, swinging between gains and losses. Despite the volatility in equities and oil, safe-haven assets like gold, the U.S. dollar, and Treasuries remained relatively steady. The market’s focus has now zeroed in on energy, as investors weigh the possibility of supply disruptions through the Strait of Hormuz — a key shipping channel responsible for nearly 20% of global oil flow.

Traders are still processing mixed signals. Earlier in the day, Trump claimed that Iran was open to talks about de-escalating the conflict with Israel, even as military exchanges continued. While he declined to comment on potential U.S. military involvement, the ambiguity has left global markets navigating through a dense fog of geopolitical risk. Analysts warn that prices could surge if Iran acts to block key oil routes — a scenario that would inject fresh inflationary pressure into an already delicate macroeconomic landscape.

On the international front, Trump struck a trade deal with UK Prime Minister Keir Starmer, aimed at easing U.S. tariffs on British exports and expanding quotas for U.S. agricultural products. Talks with Japanese PM Shigeru Ishiba, however, failed to yield an agreement.

Meanwhile, the Bank of Japan left rates unchanged and will taper bond purchases more gradually in 2026, signaling caution amid market volatility. Long-end JGB yields rose slightly, and the yen stabilized post-announcement. Markets are now awaiting the Federal Reserve’s rate decision Wednesday, with Fed Chair Powell expected to maintain a cautious tone amid lingering inflation concerns tied to Trump’s tariff policies.

Key Events This Week:

🏦 Central Bank Decisions

Federal Reserve (June 17–18): The Federal Open Market Committee (FOMC) is expected to keep interest rates unchanged. Investors will closely watch for any signals regarding future monetary policy, especially in light of recent geopolitical tensions and fluctuating oil prices.

Bank of Japan (June 18): The Bank of Japan is anticipated to maintain its current interest rate policy. Any commentary on inflation risks or adjustments to bond purchase programs will be of interest to global markets.

Bank of England (June 20): The Bank of England is expected to hold rates steady amid economic uncertainty and rising unemployment figures.

🛍️ U.S. Economic Indicators

Retail Sales (June 17): The U.S. Census Bureau will release retail sales data for May, providing insight into consumer spending patterns.

Housing Starts (June 18): Data on new residential construction projects will be released, offering a glimpse into the housing market's health.

Industrial Production (June 18): This report will shed light on the output of U.S. factories, mines, and utilities, indicating the strength of the industrial sector.

🌍 Global Economic Events

G7 Summit (Ongoing): Leaders from the Group of Seven nations are meeting in Alberta, Canada, to discuss pressing global issues, including trade policies and geopolitical tensions.

Philippine Central Bank Decision (June 19): The Bangko Sentral ng Pilipinas is expected to cut its key interest rate by 25 basis points to support economic growth amid slowing inflation.

Stocks

The Stoxx Europe 600 fell 0.7% as of 9:10 a.m. London time

S&P 500 futures fell 0.5%

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.7%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1553

The Japanese yen was little changed at 144.65 per dollar

The offshore yuan was little changed at 7.1834 per dollar

The British pound fell 0.1% to $1.3562

Cryptocurrencies

Bitcoin fell 1.9% to $106,733.78

Ether fell 3.2% to $2,585.31

Bonds

The yield on 10-year Treasuries was little changed at 4.44%

Germany’s 10-year yield advanced two basis points to 2.55%

Britain’s 10-year yield advanced three basis points to 4.56%

Commodities

Brent crude rose 1.3% to $74.15 a barrel

Spot gold was little changed

Trump Media Files For Bitcoin And Ethereum ETFs

The significance of Trump Media & Technology Group filing to launch the Truth Social Bitcoin and Ethereum ETF lies in one key detail: it’s a joint ETF – signaling continued support and validation of Ethereum from the Trump camp, not just Bitcoin.

Filed on June 16, 2025, the ETF is structured as a Nevada business trust and will hold Bitcoin and Ethereum in a roughly 3:1 value ratio, rebalanced quarterly. Yorkville America Digital is listed as the fund sponsor, while Foris DAX Trust Company – an affiliate of Crypto.com – will serve as custodian. Shares are set to trade on NYSE Arca. Although the ticker hasn’t been disclosed yet, the fund will initially offer cash-only share creation and redemption in baskets of 10,000.

Let’s be honest – Donald Trump probably understands and cares very little about Ethereum. But that’s beside the point. His business and financial interests are becoming increasingly entangled with it, thanks to the growing influence of his crypto-savvy circle and the strategic direction of Trump Media & Technology Group. For Ethereum holders, this quiet endorsement is a reason for cautious optimism.

Is Tron Going Public?

Tron – Justin Sun’s blockchain project – is reportedly going public in the U.S. through a reverse merger with Nasdaq-listed SRM Entertainment, according to the Financial Times. The deal is being facilitated by Dominari Securities, and the newly formed entity will be called Tron Inc.

There was also a headline-grabbing rumor that Eric Trump would join the executive team – furthering the Trump family’s ties to crypto – but that part turned out to be false. The confusion stemmed from the fact that Dominari Securities is affiliated with Dominari Holdings and American Data Centers, an AI and infrastructure venture co-founded by Eric and Donald Trump Jr., who both sit on its advisory board.

See the post below:

I still believe Tron Inc. intends to operate as a Saylor-style crypto proxy – holding up to $210 million worth of TRX and leveraging its public market status to amplify its crypto exposure. In that sense, it would mirror the way MicroStrategy uses its balance sheet to bet on Bitcoin, only with TRX at the center of the strategy.

While the Eric Trump executive rumor has been debunked, the market didn’t seem to care. The announcement sent TRX up about 5%, now trading around $0.28.

JPMorgan May Be Launching A Stablecoin

JPMorgan has filed a trademark for “JPMD,” signaling plans to offer services related to “virtual and digital currency, digital tokens and payment tokens, decentralized application tokens, and blockchain-enabled currency.”

This move follows reports that JPMorgan, alongside other major U.S. banks like Bank of America and Citigroup, is exploring a joint stablecoin initiative aimed at competing with crypto-native issuers by offering instant liquidity and market hedging.

It also comes shortly after JPMorgan began accepting spot Bitcoin ETFs - starting with BlackRock’s IBIT - as collateral for loans, and began including digital assets in client credit evaluations.

In short, JPMorgan has turned crypto-friendly over the past couple of months, signaling its recognition of digital assets as a legitimate part of the financial system - and its intent to play a leading role in shaping that future.

Strategy Is One Purchase Away From 600,000 BTC

It’s wild to think that buying around 10,000 BTC now costs about $1 billion – and Strategy already holds nearly 600,000 BTC in its treasury. With the latest purchase of 10,100 BTC, Saylor's total stack is up to 592,100, marking ten consecutive weeks of accumulation.

If he somehow kept up this pace – scooping up 10,000 BTC per week – he’d hit 1 million BTC in just under 41 weeks, putting the milestone somewhere around late March 2026. I’m not necessarily predicting he’ll get there by then, but I wouldn’t be surprised if he did. Between STRK, STRF, and STRD, there’s a real possibility we see some massive buys throughout this bull run. Whether it happens during the rally or after the dust settles, I wouldn’t be shocked if Saylor hits 1 million BTC before the next cycle kicks off – if not even sooner, during the bear market.

Bitcoin Buying Frenzy - Is The Dollar Doomed? | Macro Monday

Join Crypto Is Macro now: https://www.cryptoismacro.com/

Tensions in the Middle East are rising, but markets are shrugging it off – and crypto is booming. Host Noelle Acheson is joined by Mike McGlone, Dave Weisberger, and special guest Peter Tchir to break down what this means for Bitcoin, the Fed, and global stability. Will the Fed go more dovish? Is crypto now seen as a safe haven? We’ve got expert insights and bold predictions on today’s Macro Monday.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.