Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Alt Season Soon?

Bitcoin Thoughts And Analysis

Markets Slip Ahead Of Key Inflation Data Release

Staked ETH Is On The Rise

NFTs Are Starting To Turn Around

Trump Backed Bitcoin Miner Is Accumulating Bitcoin

Every Child Will Be Given $1,000 At Birth?

Bitcoin & Altcoins Skyrocet Ahead Of Senate Vote - What's Next For Crypto?

Alt Season Soon?

Alright folks, deep breaths. I’m officially declaring this newsletter a jinx-free zone. Anything you read below about Ethereum is strictly informational. Any sudden price moves – up, down, or interdimensional – are purely coincidental. Your favorite (and humble) ETH holder is just here to type.

It’s been nearly a year since the ETH ETF launched. Given the brutal environment for altcoins, rising Bitcoin dominance since mid-2021, and the fact that Total 2 remains well below its late-2021 market cap peak, ETH has actually held up impressively.

Quick detour: the peak on this chart is $1.71 trillion. Altcoins still need to climb 41% just to get back to where they were.

Keep in mind, less than a year of operation is nothing in ETF terms. The average U.S. ETF is estimated to be 8 to 10 years old. For some of the OGs – SPY, QQQ, IVV, and VOO – they launched in 1993, 1999, 2000, and 2010, respectively.

Here are some key stats on the ETH ETF:

Cumulative Total Net Inflow: $3.38B

Total Value Traded: $398.72M

Total Net Assets: $9.8B

Positive Inflow Streak: 21 days and counting

Funny enough, despite these impressive numbers, I’m still pretty convinced that the average Wall Street OG – say, 50 years and older – knows next to nothing about ETH. They sure as hell don’t have a crypto wallet, wouldn’t understand the point of a stablecoin (bank wires exist, right?), and likely see blockchain as just another tech fad rather than a fundamental shift in finance.

To them, ETH is like an alien – much like how computers felt to me growing up.

For my older readers, you’ll understand. For newer readers, let me take you back in time. If you were born in the ’70s, personal computers didn’t show up in person until the early ’80s – and even then, they were rare, fascinating beasts. My first impressions of “computers” came from movies and TV: massive, humming mainframes hidden in sterile, air-conditioned rooms, operated by serious people in lab coats feeding them punch cards.

As a kid, the idea of owning or even touching one felt like science fiction. The blinking lights, the sounds, the sheer size – it all made computing feel like some mystical force. Before they became mainstream, if you didn’t own a computer, you were just out of luck. There wasn’t one in your pocket. You had to visit your rich friend’s house or wait to use one at school. For adults, entry-level models were expensive and barely useful unless you had a very specific purpose.

Those early machines – the Commodore PET, Apple II, and others – looked more like typewriters with tiny green screens. Games were primitive, storage was a mess of glitchy cassette tapes, and “going online” meant dialing into a bulletin board system with a noisy modem. Using a computer required real technical skill.

Sound familiar?

Ethereum today mirrors that era. Clunky interfaces, obscure jargon, failed transactions over minor errors, and apps that still feel like prototypes – this is Ethereum in its current form. It’s a playground for the curious, the builders, and the believers. And just like those early computers, it’s laying the foundation for a future most people still can’t quite visualize.

To be fair, Ethereum has matured a lot. We’re no longer in the Wild West phase. There’s Coinbase for one-click staking. ENS lets us use human-readable names instead of long wallet addresses. You can swap tokens on a Ledger. There are now actual recovery options. It used to feel like every action could blow up in your face. Today, it’s still technical – but far less terrifying.

Even the Ethereum Foundation feels more in sync with the community. Their communication has improved dramatically – more frequent, more clear, and more aligned with what actual users want. Their recent posts feel like they’re talking to us, not at us.

It’s reminiscent of the internet’s transition from arcane hobbyist protocol to the intuitive, mainstream system it is now. No investor wants to feel left in the dark. Making Ethereum more approachable is key to its continued growth and, ultimately, its widespread adoption.

There’s still a ways to go – “blobs” aren’t exactly intuitive, and we may be a decade away from your average Wall Street OG fully understanding what they are. But most ETH investors today at least have some sense of what scaling the Ethereum mainnet means – and how improved UX can drive real, lasting adoption. Ethereum is definitely on the right track.

We won’t recognize it when it happens – because breakthroughs rarely shout. They sneak up on us. But Ethereum’s iPhone moment is coming – probably within the next five years.

Picture this: someone walks onstage and unveils a product or platform so smooth, so intuitive, that using Ethereum suddenly feels as natural as unlocking your phone. No jargon. No confusing addresses. No clunky bridges or pop-up signature requests. Just seamless access to a decentralized world. That’s when Ethereum stops being a tech curiosity and becomes part of everyday life – changing how we manage money, ownership, and trust forever.

That iPhone moment will only be the beginning. And no – you’re not late.

My guess? It’ll center around tokenization and real-world assets. But just like nobody predicted we’d carry pocket-sized supercomputers that stream videos and trade stocks, no one can say for sure where Ethereum is ultimately headed.

What I do know is that I’m extremely excited for what’s ahead. ETH has plenty of juice left in the tank. Just back in December, it touched $4,000 – still about $800 shy of its all-time high.

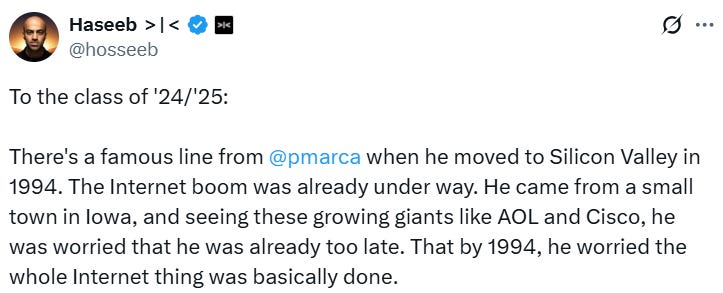

And after writing this intro, I stumbled on a quote from my friend Haseeb that felt serendipitous – and like the perfect note to end on.

“I felt the same when I first got into crypto VC in 2018. Polychain, Pantera, a16z, DCG, and others were already legendary. Was there really space for another crypto VC? Seemed like maybe it was already too late, and the industry had consolidated.

Don't worry. Barely anything has happened yet.

BTC is still 1/10 of gold. Less than 1% of the world is on-chain. There hasn't been a single law passed in the US about crypto. And there's not a single major central bank in the world owning any of this stuff.

You're not late. Crypto is still tiny compared to what it's going to be in 20 years. So welcome to the crypto—a lot is going to change from here. Come make your mark.”

And to all my Solana investors out there – don’t worry, I haven’t forgotten about you. In fact, you arguably got the biggest news of all yesterday. Welcome to the big leagues. If I had to pick one asset next in line for an ETF, Solana would’ve been my top choice – and while nothing is finalized yet, the news is clearly moving in the right direction.

SOL has the good fortune of avoiding the day-one outflows that ETH had to endure – but now it has to prove it deserves a seat at the table. Still, launching a SOL ETF on the eve of an altcoin season could be rocket fuel. It’s the kind of timing that might supercharge the breakout everyone’s been anticipating.

That said, it’s worth remembering that it took Ethereum nearly a year to see consistent inflows and meaningful size in its ETF. The upside for Solana? Ethereum has already whet the appetite of crypto investors eager to diversify – so the runway may be shorter this time around.

I’m optimistic.

I’m optimistic for Bitcoin – it can’t fail.

I’m optimistic for Ethereum – which could still mount an epic comeback.

And I’m optimistic for the entire industry – which refuses to die and only grows stronger with time.

A day awaits when ETH reclaims its all-time high – and from $2,800, that’s still a 74.6% climb.

I hope you’re there to celebrate with me.

Bitcoin Thoughts And Analysis

Nothing major to report today…

Markets Slip Ahead Of Key Inflation Data Release

U.S. stock futures and Treasury bonds dipped Tuesday as investors braced for Wednesday’s CPI report and Thursday’s PPI release – the Fed’s last major inflation readouts before next week’s policy meeting. S&P 500 futures slipped 0.2%, threatening to end a three-day rally near all-time highs, while 10-year Treasury yields edged up to 4.49% ahead of a $39B auction.

Tesla gained 1.7% premarket after Elon Musk walked back a public outburst targeting Donald Trump, while broader market sentiment remained cautious amid continued U.S.–China trade tensions and deficit concerns. Economists expect core inflation to accelerate to 2.9% annually – a potential headwind for rate cuts, which markets now expect only once this year.

Meanwhile, a Moody’s downgrade has Hong Kong pension funds preparing contingency plans, and a long list of corporate headlines – from BP breakup speculation to Nvidia’s new AI projects – added noise to a data-driven day.

Stocks

S&P 500 futures fell 0.2% as of 7:30 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 fell 0.2%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1429

The British pound fell 0.1% to $1.3486

The Japanese yen fell 0.2% to 145.21 per dollar

Cryptocurrencies

Bitcoin fell 0.6% to $109,294.12

Ether fell 0.1% to $2,770.34

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.49%

Germany’s 10-year yield advanced one basis point to 2.54%

Britain’s 10-year yield advanced five basis points to 4.59%

Commodities

West Texas Intermediate crude rose 1.5% to $65.93 a barrel

Spot gold rose 0.2% to $3,330.73 an ounce

Staked ETH Is On The Rise

Staked ETH has hit a record high of nearly 34.8 million – now accounting for over 28% of the total Ethereum supply. Validator participation is on the rise again after a brief slowdown, with more than 1 million validators currently active.

Lido remains the dominant player in the staking market, with about a 26% share. Binance and Coinbase follow, together holding over 15%. Meanwhile, ether.fi – a liquid restaking platform – is gaining ground fast, with staked ETH up 16% in the past month.

Ethereum staking has steadily expanded since the Beacon Chain launch – and that growth accelerated with key upgrades like the Merge, Shapella, and Dencun. As restaking strategies mature and service providers evolve, the Ethereum staking ecosystem continues to strengthen.

NFTs Are Starting To Turn Around

CoinTelegraph just published an opinion piece that challenges the prevailing narratives around NFTs – and it’s worth paying attention to.

The article argues that NFTs are no longer just speculative art assets or fleeting internet fads. Instead, they’re quietly maturing into foundational infrastructure for emerging tech – especially in gaming, AI, and decentralized apps. While trading volume has declined, the number of NFT sales has remained relatively steady – a signal that utility is beginning to replace speculation.

Real-world asset NFTs, domain names, and metaverse infrastructure are gaining momentum. Platforms like The Sandbox and Mythical Games are proving that in-game NFTs can offer real functionality. This new phase isn’t about hype – it’s about integration. NFTs are becoming building blocks for the next generation of digital environments.

The original promise of NFTs – digital ownership, programmable rights, and verifiable identity – is resurfacing as agentic AI and decentralized systems mature. NFTs now function as access credentials for autonomous AI agents, enabling them to operate, transact, and interact independently onchain. From drone identities to machine-auditing tools and social avatars, NFTs are powering real infrastructure behind the scenes.

These “invisible NFTs” might not make headlines – but they’re quietly becoming the connective tissue of the decentralized web. And if this utility-based shift is real, prices will eventually follow. That doesn’t mean every NFT will be valuable – especially if the use case is something like credentialing an AI agent. In those cases, the cost should reflect practical value, not speculative mania.

But one thing is clear: NFTs aren’t dead. They’re just growing up – and they’ll continue to benefit the chains they live on.

Trump Backed Bitcoin Miner Is Accumulating Bitcoin

American Bitcoin (ABTC) – a mining firm backed by Donald Trump Jr. and Eric Trump – has accumulated 215 BTC since April, now worth over $23 million, according to a June 6 SEC filing. Unlike many miners, ABTC isn’t selling into the market. Instead, it’s focused on long-term Bitcoin accumulation, treating its reserves as a strategic asset to strengthen both its balance sheet and shareholder value.

As the company put it: “Bitcoin accumulation is not a side effect of ABTC’s business. It is the business.”

ABTC plans to go public via a stock-for-stock merger with Gryphon Digital Mining. The combined entity will retain the American Bitcoin name. Eric Trump will join the board, and Hut 8 – the current majority owner – will continue to manage operations.

I swear, it feels like every week we hear about another Trump family venture into crypto. At this point, it wouldn’t even make sense for Donald Trump not to go full throttle and declare that the U.S. should start buying Bitcoin.

From NFTs and memes to ETFs, DeFi, and now mining – the breadth of their involvement raises serious questions. There’s an undeniable conflict of interest brewing here, one that could complicate any attempt by the federal government to take a financial position in Bitcoin.

Still, we asked for presidential involvement – and now we’ll have to navigate the consequences if challenges arise. Whether you love it or hate it, Trump’s influence over crypto policy is no longer hypothetical. It’s happening in real time.

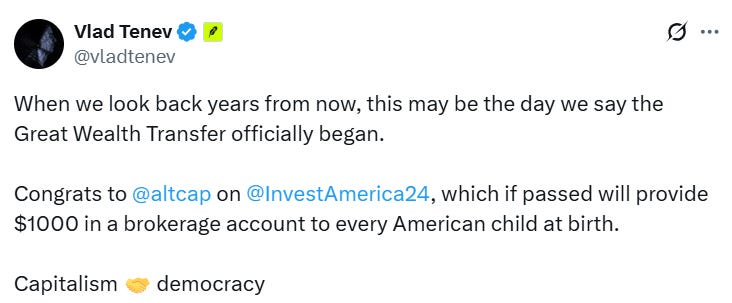

Every Child Will Be Given $1,000 At Birth?

Robinhood CEO Vlad Tenev has publicly backed the “Invest America Act” - a proposed bill that would grant every newborn in the U.S. $1,000 to invest in the S&P 500 via a “Trump account” accessible at age 18. Tenev emphasized that Robinhood could manage these accounts for over 3.5 million newborns annually - all within budget.

The benefits for Robinhood would be massive. Every child would receive a funded account on their platform, effectively onboarding an entire generation of future investors. That kind of early exposure builds familiarity, loyalty, and long-term user retention - shaping the investment habits of millions before they even reach adulthood. It’s a customer acquisition pipeline disguised as policy - and if passed, it would cement Robinhood’s presence at the core of America's financial future.

The proposed program - $1,000 per newborn for roughly 3.5 million births annually - would cost about $3.5 billion each year. In the context of the federal budget and national debt, that’s a relatively modest figure.

Even without additional contributions, a one-time $1,000 investment compounded annually at a 7% return would grow to $3,379 by age 18. If family and friends contributed just $20 per month along the way, that balance would grow to $11,539 - a meaningful financial head start.

Bitcoin & Altcoins Skyrocet Ahead Of Senate Vote - What's Next For Crypto?

Bitcoin is breaking out, altcoins are surging, and Washington is about to vote on the most important stablecoin bill in years. I’m joined live by Andrew Parish and Tillman Holloway from Arch Public, Joshua Frank from The Tie, and Dave Weisberger to break it all down. We’ll cover the $70B BlackRock ETF milestone, the explosive growth of Bitcoin treasury companies, and why institutions are flooding in before regulation hits. Don’t miss this roundtable – everything’s changing fast.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.