Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public had a blast at The Bitcoin Conference in Vegas this year. The video above proves it! Hosting Jack Mallers, Adam Back, Bo Hines, Vlad Tenev and other with Scott brought hundreds to our ‘conference within a conference’.

More importantly, we did a little math. Had you been using our Bitcoin Algorithm Arbitrage Strategy from Bitcoin Nashville (last year) to Bitcoin Vegas, these would’ve been your results:

+3.27 additional Bitcoin

+52K in cash yield

98 total trades

average Bitcoin price: $56.7K

Talk to us, you won’t regret it!

In This Issue:

Become Your Own Bitcoin Acquisition Vehicle

Bitcoin Thoughts And Analysis

Altcoin Charts

Futures Steady Ahead of Key Talks; UK Stocks Reach Record High

SEC Wraps Up DeFi Roundtable Discussion

Crypto Twitter Was Fooled Once Again

Bitwise And Proshares File For Circle Based ETF Products

Nasdaq Crypto Index Expands, SEC Review Pending

Everyone Wants Bitcoin - So Why Isn’t It Moving? | Macro Monday

Become Your Own Bitcoin Acquisition Vehicle

Yesterday, Strategy announced another Bitcoin buy: 1,045 BTC for $110.2 million. That brings the company’s total holdings to 582,000 BTC. I’ve been tracking Saylor’s march toward 1 million – he’s now 58.2% of the way there. This marks nine straight Mondays of buying. Credit to MSTR, STRK, and STRF. We still haven’t seen all three weapons fire at full force during a major Bitcoin move.

I still believe a day is coming when Saylor announces a purchase that tops his largest to date – more than 55,500 BTC in a single shot. Maybe that sounds crazy. But bull markets are where crazy thrives.

Today, though, the spotlight isn’t on Strategy – it’s on one of its disciples. A company just announced plans to issue 555 million shares – yes, million – to increase its Bitcoin holdings to 210,000 BTC. That’s roughly 1% of all Bitcoin in existence. And when you factor in the estimated 20% that’s lost or unrecoverable, that number jumps to around 1.25% of the accessible supply.

Here’s the kicker: this company used to operate budget hotels. It was a penny stock. Then, in April of last year, it pivoted into a Bitcoin acquisition vehicle. As of now, it’s reached just 4.2% of its goal – with plans to acquire the other 95.8% by 2027.

Whatever Saylor is handing out, it must be powerful stuff. Turning a bottom-of-the-barrel hotel stock into a potential Bitcoin whale? That’s some next-level shit.

If you haven’t already guessed, the company is Metaplanet.

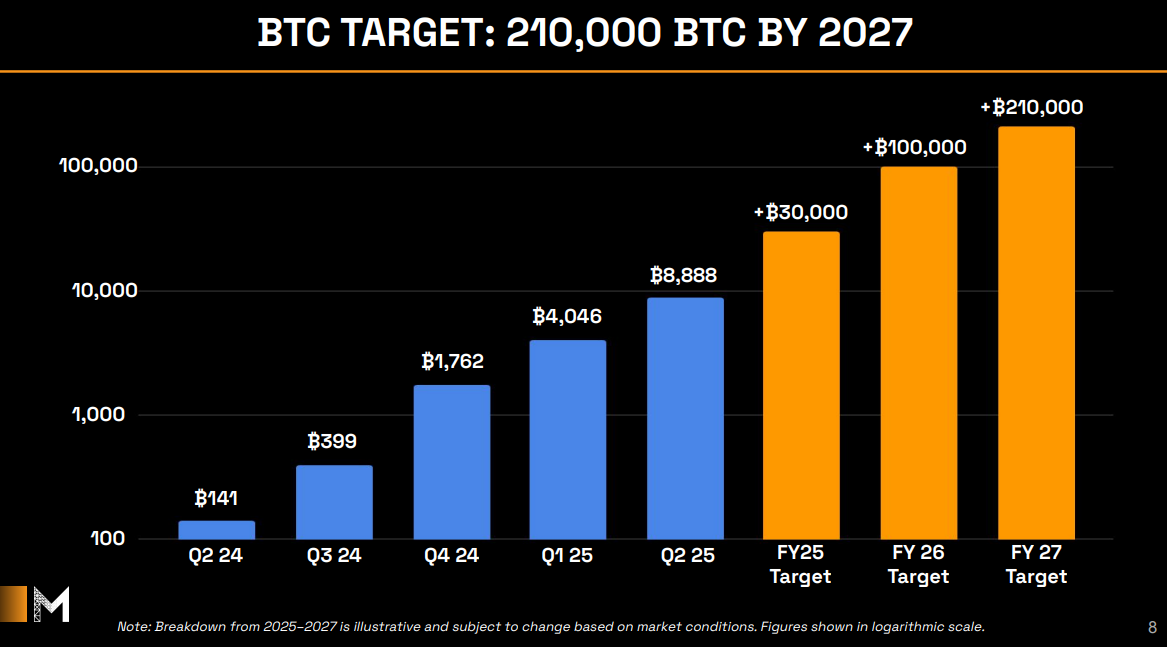

Metaplanet currently ranks #10 among corporations holding Bitcoin, with 8,888 BTC on its balance sheet. Its stock – MTLPF – surged 26% last Friday after it unveiled its new acquisition roadmap.

Let’s take a better look at the ‘555 Million Plan.’

Here are the goals:

The trajectory:

The speed at which Metaplanet wants to pull this off is unthinkably impressive:

This is an explanation of why Metaplanet trades at a premium to NAV:

Here’s a statement from Metaplanet on the plan:

I’ve got to give major props to Metaplanet. Even if they fall short of their 1% target and end up with, say, 100,000 or 150,000 BTC, that’s still a massive win. If you reach for the stars and land on the moon, you’ve done something right.

I have two main takeaways from all this – one optimistic, the other more cautious.

Let’s start with the good.

Not everyone can do what Metaplanet is attempting – and honestly, I’m not convinced they themselves will be able to pull it off. And that’s actually a good thing. Here’s why: if Bitcoin’s price takes off, going from 8,888 BTC to 210,000 becomes nearly impossible.

If the U.S. government ever gets serious and scoops up a sizable stash – maybe even gunning for the 1 million BTC target Senator Lummis has floated – or if a major tech company finally takes the orange pill, it’s game over for the smaller firms hoping to quietly accumulate their way into significance.

Sure, Metaplanet and the others who’ve already started are in an incredible position. As long as they don’t sell, they’re likely set for life. But the window to make big moves is closing fast – and those who hesitate from here may never catch up.

Strategy is one of one. I can see a few clones following their lead and finding success to some extent over time. But not all of them will make it to 1% – or anywhere close.

Now for the bad.

Does anyone remember what happened with GBTC in the last bear market? I swear investors have the memory of a goldfish.

Grayscale’s Bitcoin Trust launched in 2013 and traded at a premium for years – at one point more than 130% above the value of the Bitcoin it held. That premium eventually collapsed into a deep discount, with GBTC trading nearly 50% below its net asset value.

Confidence vanished. Liquidity dried up. What was once a bullish trade turned into a painful lesson in structural risk. For a while, there were real fears Grayscale would be forced to unwind the trust or liquidate holdings.

Investors were stuck – unwilling to sell at a loss, hoping lawsuits and regulatory pressure would force the SEC to approve the ETF conversion. The ride was brutal, especially for those who bought the top and watched their paper losses pile up while Bitcoin itself remained unchanged.

So how does this relate to Metaplanet?

Right now, investors are pricing the stock not just on the Bitcoin it holds, but on the assumption that it will successfully execute its wild acquisition strategy. If sentiment shifts – or if Bitcoin runs away from them and their plan starts to look unrealistic – the premium could vanish overnight.

What happens to the people buying shares at the peak of the hype, just before the next bear market? They could be looking at losses far steeper than simply holding spot Bitcoin. The stock could trade below the value of the BTC it represents.

Let me be clear – I’m not saying this will happen. This isn’t financial advice. I’m not telling anyone to buy or sell Metaplanet, or any other stock. I actually like what Metaplanet is doing and I want them to succeed. Same goes for all the Bitcoin acquisition companies.

But in this space, you’ve got to acknowledge risk. This is Bitcoin – volatility isn’t a bug, it’s a feature. And trust me, from experience, it feels a lot better to hold spot Bitcoin during a downturn than to hold stock in a company that’s trading at a discount to the Bitcoin it owns.

There’s nothing better than buying spot Bitcoin with money you can afford – no leverage – and stacking consistently. Become your own Bitcoin acquisition vehicle. Find ways to make money, stay disciplined, and build your position over time.

Because in the long run, steady personal accumulation beats 99% of the companies trying to do it for you.

Best of luck. Bitcoin is still heading to $1 million – don’t get shaken out on the way.

Bitcoin Thoughts And Analysis

Nice move. Yesterday had a massive daily candle, moving from ~105K to ~110K. The volume was less than impressive, which should always give us a bit of pause, but still a nice upside pop through a key level of resistance.

The all time high is in site - we need to see it break on volume convincingly.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Ethereum is in an interesting spot. It is sandwiched between the weekly 50 and 200 MAs, both key areas to watch on any chart. It has been trading between these lines for the better part of 6 weeks, astounding compression and consolidation. A close above the 50 would signal major upside is likely, while a close back below would mean this run is likely over. As you can see, we have wicks on almost every candle testing each.

My bias is up.

Futures Steady Ahead of Key Talks; UK Stocks Reach Record High

U.S. stock futures remained largely unchanged ahead of the second day of negotiations between the Trump administration and China, as investors stayed on the sidelines awaiting signs of progress in the ongoing trade dispute. After an early gain, S&P 500 futures reversed course, reflecting market caution. Meanwhile, European equities posted modest losses, though the UK’s FTSE 100 stood out, reaching an all-time high close for the first time since March.

Monday's trade talks between the U.S. and China yielded no breakthrough, but optimism lingered as American officials suggested that an easing of tensions over tech shipments and rare earth elements might be within reach. With a key U.S. inflation report due on Wednesday, markets are awaiting new catalysts after rebounding near record highs from their April lows. HSBC strategist Alastair Pinder noted that equities still appear to have upward momentum, with potential for U.S. markets to catch up.

The FTSE 100’s strength was attributed to an improved economic outlook and the UK's recent trade agreement with the U.S., following Trump’s April 2 tariff declarations. However, investor sentiment in London remains mixed, as the city faces a trend of companies delisting or shelving IPOs in favor of U.S. markets.

In Asia, Chinese stocks were volatile amid fluctuating headlines from the trade discussions. The Hang Seng China Enterprises Index fell nearly 1% before recovering most of its losses. President Trump attempted to bolster confidence by stating the U.S. was “doing well with China” and receiving only “good reports.”

On the bond front, U.S. Treasuries extended gains, with the 10-year yield falling to 4.45%, while the dollar rose 0.2% against a basket of major currencies. Traders are closely watching a $58 billion auction of three-year Treasuries on Tuesday for signs of waning foreign demand. ING’s Chris Turner pointed out that a weak showing could reignite concerns over dollar strength.

In Corporate News:

– Mark Zuckerberg is reportedly dissatisfied with Meta’s progress in AI and is forming a specialized team to pursue artificial general intelligence.

– Novo Nordisk shares surged to a two-month high after reports that activist hedge fund Parvus Asset Management has taken a stake in the company.

– Taiwan Semiconductor posted a nearly 40% year-over-year jump in May revenue as clients increased chip orders amid trade uncertainty.

– Thames Water’s senior creditors submitted a £5 billion rescue plan to regulators in an effort to stabilize the troubled utility.

– Europe’s only alternative to Starlink is under financial pressure and urgently seeking funding to compete with Elon Musk’s satellite internet venture.

Stocks

S&P 500 futures were little changed as of 5:29 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 fell 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.1% to $1.1406

The British pound fell 0.5% to $1.3481

The Japanese yen fell 0.1% to 144.76 per dollar

Cryptocurrencies

Bitcoin rose 0.5% to $109,333.08

Ether rose 3.5% to $2,682.78

Bonds

The yield on 10-year Treasuries declined two basis points to 4.45%

Germany’s 10-year yield declined two basis points to 2.55%

Britain’s 10-year yield declined seven basis points to 4.56%

Commodities

West Texas Intermediate crude rose 0.5% to $65.59 a barrel

Spot gold was little changed

SEC Wraps Up DeFi Roundtable Discussion

Highlights from SEC Chairman Paul Atkins:

“The American values of economic liberty, private property rights, and innovation are in the DNA of the DeFi, or Decentralized Finance, movement.”

“I am grateful to the Division of Corporation Finance staff for clarifying its view that voluntary participation in a proof-of-work or proof-of-stake network as a ‘miner,’ ‘validator,’ or ‘staking-as-a-service’ provider is not within the scope of the federal securities laws.”

“The prior President’s administration undermined innovation in self-custodial digital wallets and other on-chain technologies by asserting through regulatory actions that the developers of such software may be conducting brokerage activity. Engineers should not be subject to the federal securities laws solely for publishing this type of software code.”

“An innovation exemption could help fulfill President Trump’s vision to make America the “crypto capital of the planet” by encouraging developers, entrepreneurs, and other firms willing to comply with certain conditions to innovate with on-chain technologies in the United States.”

Crypto Twitter Was Fooled Once Again

Yesterday afternoon, Crypto Twitter (yes, I still call it that - I know it’s X) spiraled into a fake news frenzy as major accounts rushed to share the news that Paraguay had adopted Bitcoin as legal tender. I genuinely can’t believe some of these big accounts didn’t pause for a second to question the post or at least raise concerns.

Has this space really not learned by now? Politicians don’t solicit investments, include wallet addresses you can verify on-chain, and tack on random, out-of-place hashtags. As of right now, little is known as to who is behind the hack, but the government has said this, “The president's official X account has presented irregular activity which suggests possible unauthorized entry.” Mathew Sigel from Bitiwse added this, “However, on-chain data shows the wallet address included in the post holds only $4 and has recorded no transactions since the announcement, suggesting the information is likely false.”

Bitwise And Proshares File For Circle Based ETF Products

ProShares and Bitwise have both filed with the SEC to launch ETFs tied to shares of Circle Internet Group, which just made its public debut on the NYSE last week. ProShares is aiming for a leveraged product that targets 2x the daily returns of Circle’s stock, while Bitwise is taking a different route with an income-focused ETF that uses options strategies to generate yield through call premiums. Both filings were submitted on June 6 - just days after Circle went public - and are expected to become effective by August 20, 2025, pending regulatory approval.

Nasdaq Crypto Index Expands, SEC Review Pending

The Nasdaq Crypto Index has expanded its coverage from five to nine digital assets. Originally composed of Bitcoin, Ethereum, Litecoin, Chainlink, and Uniswap, the index now also includes Ripple, Solana, Cardano, and Stellar. However, the Hashdex NCIQ ETF – which tracks this index – is currently limited to investing only in Bitcoin and Ethereum due to SEC restrictions. To address this, Nasdaq filed a proposed rule change with the SEC back in March. A decision on whether the ETF will be allowed to align with the updated index is expected by November 2.

Everyone Wants Bitcoin - So Why Isn’t It Moving? | Macro Monday

Everyone’s buying Bitcoin - Metaplanet is raising $5.4B, Saylor just added $110M, and Circle’s IPO is on fire. So why is Bitcoin still stuck? Noelle Acheson, Dave Weisberger, Mike McGlone, and James Lavish dig into market sentiment, looming macro risks, and whether inflation data or the U.S. debt spiral will finally move the needle.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

You misunderstand Bitcoin