Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

"You Deserve The Mediocre Result"

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

World Liberty Financial Teams Up With TRUMP Coin

The ETH ETF Is On A Hot Streak

Will Tether Go Public?

How The USA Is Becoming The Bitcoin Superpower Of The World | Bo Hines

"You Deserve The Mediocre Result"

Nobody could deliver a quote quite like Charlie Munger:

“I think it's in the nature of long-term shareholding with the normal vicissitudes in worldly outcomes and in markets that the long-term holder has his quoted value of his stock go down by say 50 percent. In fact, you can argue that if you’re not willing to react with equanimity to a market price decline of 50 percent 2 or 3 times a century, you’re not fit to be a common shareholder and you deserve the mediocre result you are going to get - compared to the people who do have the temperament who can be more philosophical about these market fluctuations.”

What Charlie Munger is basically saying here is that if you don’t have the balls to watch your portfolio get cut in half without losing your mind, then congrats - you’ve earned yourself a lifetime of mediocre returns.

This quote appeared in a recent investor research report by Michael Mauboussin, Head of Research at Counterpoint Global, a Morgan Stanley fund. I’ll be breaking down the report today. Here’s Michael’s summary of the quote, “Munger not only argues that you have to be calm about these declines, he goes further to suggest that if you cannot deal with them ‘you deserve the mediocre result you are going to get.’ In other words, big drawdowns are a price to pay for superior long-term investment returns.”

Here’s the basic premise of what the research is trying to understand:

It’s a pretty straightforward report, and I’ll get to the meat of it in a moment.

“All great stocks rebounded from the bottom, but not all rebounds from the bottom are great stocks.”

I loved that line from Michael Mauboussin’s recent investor research report. It’s a clear reminder that price alone doesn’t make a bargain. Some stocks are cheap for a reason – and the real skill lies in knowing the difference between a temporary setback and a terminal decline.

For the rest of this introduction, I’m going to focus on the key takeaways and only briefly touch on the data. There’s too much to cover here in full, so I highly recommend reading the full report if you want the complete picture. That said, here’s one point worth highlighting - and worth considering in the context of the broader crypto space:

“The data also reveal that the further a stock falls from its peak, the lower its probability of ever again attaining its past apex. Only about one in six stocks that decline 95-100 percent ever get back to their prior peak, while four in five in the 0–50 percent drawdown group do so.”

I don’t know what the math would look like for crypto, but I’d imagine it’s even harsher. With no cash flows, no earnings, and fewer fundamentals to anchor price, a 90% drop is almost always a death sentence - not a buying opportunity.

Here are two key charts I’ll reference throughout the rest of the introduction.

Exhibit 4 is absolutely fascinating. It analyzes market drawdowns from 1985 to 2024, showing how the severity of a decline impacts both the odds and duration of recovery. The chart presents data on drawdown length, percentage recovered from the bottom, the likelihood of returning to prior highs, and the average time to full recovery.

The message is clear: the deeper the fall, the longer – and less likely – the comeback. If a stock drops 95%, the chance it ever returns to its prior peak is just 16%. Now consider that in the context of crypto – where cash flows, earnings, and fundamentals are often nonexistent – and the odds likely get much worse.

“Analysis of the peak recovery from maximum drawdown, expressed as a percent of par, shows that a majority of companies that have drawdowns of 80 percent or more never get back to par. But note that the percentage recoveries off of the lows can be spectacular.”

Side note: Bitcoin is our spectacular asset.

Another key insight from the report:

“It is essential to remember the math of compounding. For instance, a $100 stock with a CAGR of -50% for five years will drop to $3.13. If that same stock then enjoys a +50% CAGR for the next five years, it only rises to $23.73. That’s an impressive rebound off the bottom – but still a far cry from the original $100.”

Now let’s look at two case studies that build on this research. First up: NVIDIA.

“We now share two brief case studies. One shows how suffering can precede a period of extraordinary shareholder returns, and the other how suffering can persist. NVIDIA Corporation did an IPO in January 1999 and has been one of the best stocks in the market since that time. In the 20 years ended in 2024, the compound annual return for NVIDIA’s stock was 39 percent, making it the leader among all stocks in the S&P 500. The ride from the IPO to the present has not been all smooth. From January 4, 2002 to October 8, 2002, NVIDIA’s stock dropped 90 percent (Exhibit 15). This maximum drawdown was larger than the median of 85 percent for all U.S. stocks and happened in 0.8 years versus a median of 2.5 years for the complete sample.”

From the data above, we learned that it takes the average company about 2.5 years to recover its previous peak stock price (Exhibit 1). NVIDIA’s shares not only fell harder than most – a brutal 90% drop – but also took longer to bounce back. And yet, it became a rare outlier. Its epic run continues today.

This brings us full circle to a core takeaway from the report:

“Big drawdowns are a price to pay for superior long-term investment returns.”

Now let’s look at another household name you’re likely familiar with – and see how it stacks up against NVIDIA: Foot Locker.

“Reflecting the slide in Woolworth’s retail business, the stock had a maximum drawdown of 91 percent from July 13, 1990 to February 18, 1999 (Exhibit 16). Unlike NVIDIA’s quick drop, it was a protracted decline that lasted 8.6 years from peak to trough. Foot Locker’s ascension was even longer. It took 13.6 years – to September 21, 2012 – to return to par.”

Brutal.

NVIDIA and Foot Locker experienced similar drawdowns – but their recoveries couldn’t have been more different. NVIDIA returned to its peak in under five years. Foot Locker took more than 22. The takeaway? The speed and success of recovery after a major decline can vary wildly, even when the drawdowns look the same on paper. Not all drops are equal – and understanding the why behind the numbers is everything for an investor.

Here’s the conclusion of the report:

“Long-term investors need to be aware of the pattern of drawdowns and be prepared to face them when they inevitably occur. The best investors and stocks suffer through large drawdowns, which can be considered a cost of doing business over the long haul.

The median drawdown for the 6,500 stocks in our sample from 1985–2024 was 85 percent and took 2.5 years from peak to trough. More than one-half of all stocks never recover to their prior highs.

Relative to smaller drawdowns, larger drawdowns, on average, take longer to occur, recover to the previous peak less often, and yet can provide attractive returns off the lows. Recoveries from drawdowns of all sizes have significant skewness, which means some stocks do extremely well relative to the pack. As a result, average returns from rebounds are higher than median returns.

An investor who had the perfect foresight to create a portfolio of the stocks with the highest returns in the next five years would still see substantial drawdowns along the way. Indeed, one five-year stretch of the foresight portfolio had a 76 percent drawdown. This underscores how hard it is for professionals to manage through drawdowns.

Trying to pick a bottom is a fool’s errand. But we offer some qualitative considerations for whether it makes sense to play a rebound. These include an assessment of whether cyclical (NVIDIA example) or secular (Foot Locker example) factors induced the drawdown, whether the basic unit of analysis is viable, how lumpy investments are, the financial strength and staying power of the company, whether there is access to capital, if need be, and whether management is dealing with the challenges head-on.”

The best way I can conclude this research with my own two cents is by saying that drawdowns are a natural part of the game. If you never experience them, you’re doing something wrong – you’re either too afraid to lose or taking profits too early. Either way, you’re just not making real money. No asset is immune to drawdowns, and even the best can fall far and hard. Learning this is half the battle; the other half is making your best judgment about whether the asset you own has a real chance of recovering. There’s no secret formula for this, but asking the right questions can take you a long way.

Thankfully, I’m optimistic about the next six months and beyond for crypto. I see the space trending higher – whether that means altcoins rebounding from deep drawdowns or Bitcoin pushing to new highs. If anything, I’d expect quality altcoins to start outperforming Bitcoin moving forward.

That said, don’t lose sight of the bigger picture. As this article pointed out, “only one in six stocks that decline 95–100% ever return to their prior peak.” Apply that logic to crypto – an even more volatile and unproven asset class – and the odds are worse.

In other words: not everything comes back. Choose wisely, and don’t mistake survival for inevitability.

Before wrapping up this newsletter, I want to highlight a memorable moment from my interview with Bo Hines in Vegas during the Bitcoin conference. For those unfamiliar, Bo Hines is the Executive Director of the White House’s Presidential Council of Advisers for Digital Assets. He is incredibly articulate and is currently playing a key role in ensuring the U.S. has a real chance to acquire Bitcoin.

I had the opportunity to ask him about updates on the Strategic Bitcoin Reserve (SBR). While he confirmed many of his previous statements, what stood out to me was that he wasn’t willing to reveal the exact method the U.S. would use to buy Bitcoin. This is actually a positive sign. To me, it shows that the U.S. is taking this seriously enough to keep its strategy confidential – likely to protect it from other countries – and will disclose it only when the time is right. This approach would help safeguard Bitcoin’s price and keep the U.S. in a strong position moving forward.

The full interview is linked below in the WOAS podcast segment.

My question: “We have an executive order, but you've alluded to the fact that we need these things codified in law to make sure that if there ever is regime change, that they last. Sure. What's the path to that happening? Obviously, Lummis has presented the bill. Nashville – everybody was there when President Trump went off stage, and Senator Lummis was obviously one of our favorites, talked to her so many times. You know, what are the odds of that getting passed? It seems like there's a hierarchy here – stablecoins, market structure. As you said, I'm hearing people talk less about the actual legislation on the strategic Bitcoin reserve for now.”

Bo Hines: “Well, I think we bought ourselves a little bit of time there just through the executive order. I mean, we've shown what our views are on Bitcoin itself and recognizing it as being unique for what it is, and I think that was a very clear landmark that we've laid down. And so, with that, I think that just providing the clear regulatory framework more generally for everything happening in the digital assets ecosystem gives us the momentum that we need in order to enshrine the strategic Bitcoin reserve into law.

I think our Democratic counterparts certainly recognize that we have to harness this asset class for the American people, and there are certainly going to be countries overseas that are racing to accumulate as much as they can…

I will say very clearly we want as much Bitcoin as we can possibly get. We have to do this in budget-neutral ways that don't cost a taxpayer a dime, but there are countless ways in which we can do it. And, you know, if you read the fine print of the executive order, it kicks these innovative ideas over to Commerce and Treasury to come up with, but we'll flesh these out amongst our working group actors. We will move expeditiously on those that can be quickly implemented.

But it's not one size fits all. It's not like we have to do this in one singular format. You know, there can be hundreds of different ways we do this, if not thousands. And so, we talked about this in different verticals, whether it be through mining activity, whether it be through Bit Bonds. I mean, there's tons of creative things in Bitcoin – it's endless.

And so people ask me to give clear examples, and the reason I don't want to tell you what we're going to do first yet is because I really don't want to poison the well. We want to do something that's going to be the most effective for the United States. And so, when we're ready to announce that – which I'm sure we will be in short order – I think that this community will be extremely pleased.”

Bitcoin Thoughts And Analysis

Bitcoin continues to defy expectations. What looked like a clean head and shoulders breakdown just days ago has now flipped into a textbook fakeout. Price broke the neckline with conviction – only to reverse hard and bounce perfectly off the 50-day moving average, a key level that’s now acting as support.

Since that breakdown, we've seen four strong green candles in a row, reclaiming not just the broken neckline but also invalidating the bearish pattern entirely. That kind of move catches a lot of traders offside – and squeezes them back in higher.

Momentum is back on the bulls’ side for now. Volume is still relatively modest, but the price action is clear: dip bought, structure reclaimed, and bulls back in control – at least for now.

Altcoin Charts

Here’s my altcoin thought for the day… if I had to choose, I would still rather be in Bitcoin than basically any altcoin in the short term.

Stocks Steady as Investors Watch US-China Talks

Stocks held steady on Monday as investors turned their attention to US–China trade talks in London, watching for signs of a potential thaw in tensions between the two largest global economies. The S&P 500 remained near record levels after breaking above 6,000 for the first time since February, while Chinese equities listed in Hong Kong entered a bull market. European markets showed little movement, and emerging-market stocks were on track for their highest close in over three years. Despite ongoing concerns about tariffs introduced by President Trump two months ago, the broader market has shrugged off the initial volatility, with traders still searching for catalysts to sustain the rally.

Tesla shares fell 2.8% in premarket trading after a downgrade by Baird, which cited increasing uncertainty stemming from a public clash between Elon Musk and Trump. The US dollar slipped 0.3%, marking a fresh two-year low, while Treasury yields eased, with the 10-year rate dipping to 4.48%. A $22 billion auction of 30-year Treasury bonds scheduled for Thursday is drawing significant attention amid a broader investor pullback from long-term government debt. Market participants are also closely watching Wednesday’s inflation report for May, which is expected to show a slight uptick in consumer prices due to businesses passing on higher import costs.

BlackRock’s Vasiliki Pachatouridi noted that while the firm remains underweight on long-duration bonds, some investors still see value in Treasuries when yields rise above 5%. She added that dips in the 30-year bond earlier in May did attract buyers, signaling selective confidence in longer-term US debt. Meanwhile, BlackRock described European fixed income as a “good place to be” in the current environment.

In corporate news, Sunnova Energy filed for bankruptcy in Texas as the rooftop solar firm struggled with debt and weak sales prospects. Meta Platforms is reportedly preparing a major investment in a leading AI data startup, while Qualcomm announced a $2.4 billion cash deal to acquire UK-based semiconductor firm Alphawave, aiming to bolster its AI capabilities. WPP CEO Mark Read is set to retire at year’s end, as the global ad giant navigates slowing sales. L’Oréal expanded its skincare presence by acquiring a majority stake in UK-based Medik8, and NatWest is finalizing its third significant risk-transfer deal this year tied to its corporate loan book.

Stocks

S&P 500 futures were little changed as of 6:17 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.1%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.1427

The British pound rose 0.3% to $1.3573

The Japanese yen rose 0.5% to 144.06 per dollar

Cryptocurrencies

Bitcoin rose 1.2% to $107,450.62

Ether fell 0.1% to $2,529.02

Bonds

The yield on 10-year Treasuries declined three basis points to 4.48%

Germany’s 10-year yield declined four basis points to 2.53%

Britain’s 10-year yield declined two basis points to 4.62%

Commodities

West Texas Intermediate crude rose 0.3% to $64.77 a barrel

Spot gold rose 0.2% to $3,318.60 an ounce

World Liberty Financial Teams Up With TRUMP Coin

We know Trump is involved in World Liberty Financial, he is named the “Chief Crypto Advocate” of the project.

We also know Trump is officially involved with the TRUMP meme coin, as he recently invited token holders to a gala dinner and has previously hosted events tied to similarly branded Trump projects – like his NFTs. And yet, somehow, these two projects didn’t seem to be in contact with each other at all. Just last week, WLFI sent a cease-and-desist to Fight Fight Fight LLC, the group behind the $TRUMP meme coin.

This has since been resolved – as outlined in the post above – but it makes one thing clear: Trump’s actual involvement in either project is virtually nonexistent. If he’d played even a minor role, it’s hard to imagine something like this slipping through the cracks. It reinforces the idea that his name is being used more as a branding tool than a sign of meaningful participation.

Frankly, it’s embarrassing this happened – and a clear lapse in professionalism.

The ETH ETF Is On A Hot Streak

Following a legendary 31-day Bitcoin ETF inflow run, spot Ethereum ETFs have now seen 15 straight days of net inflows – adding up to $837.5 million since May 16, or roughly 25% of their total inflows since launching in May 2024. This streak, which began shortly after Ethereum’s Pectra Upgrade, is the longest run of inflows since late 2024 and brings total inflows to $3.33 billion.

BlackRock’s ETHA leads the pack with nearly $600 million in recent inflows, though Grayscale’s ETHE and ETH funds still hold the most assets under management at $4.09 billion. Fidelity trails with $1.09 billion, while other ETFs remain below $250 million. The surge in inflows also aligns with a 38% rise in Ether’s price over the past month.

Given Ethereum’s recent price action, the asset feels poised to move – if Bitcoin plays along. In an ideal scenario, Ethereum would carve out its own momentum, but that independence hasn’t materialized yet. Altcoins still appear to rely on Bitcoin holding steady or trending upward.

That said, sentiment-wise, I’m feeling optimistic about Ethereum in the short to medium term.

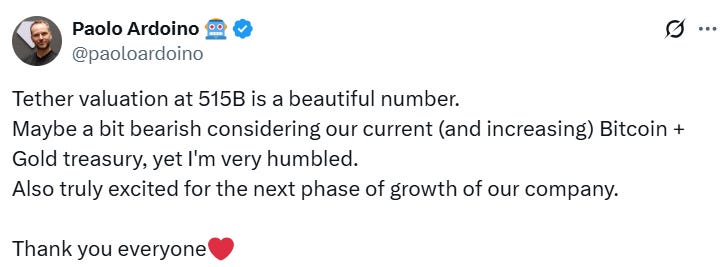

Will Tether Go Public?

In Jon Ma’s post, he shared some compelling math to illustrate that – based on Circle’s valuation and USDT’s reserves – Tether would currently rank as the 19th largest company in the world, surpassing both Oracle and Costco. If Tether were to double in size – which seems highly plausible given the rapid growth of its stablecoin and its expanding ventures into AI and Bitcoin treasury acquisition – it would rival Berkshire Hathaway and break into the top 10 largest companies globally.

Since this was Paolo’s response to Ma’s post, it seems clear that Tether isn’t planning an IPO anytime soon – or, if it is, it's keeping it exceptionally quiet. Unlike Circle, which publicly teased its IPO for an extended period and operated under U.S. regulatory oversight, Tether has remained silent on the topic and is based in the British Virgin Islands – giving it more flexibility and far less pressure to go public. That contrast highlights the very different paths these two stablecoin giants are taking.

How The USA Is Becoming The Bitcoin Superpower Of The World | Bo Hines

Bo Hines, Executive Director of the White House’s Presidential Council of Advisers for Digital Assets, joined me on The Wolf Of All Streets to expose the U.S. government’s dramatic shift from fighting crypto to embracing it. We unpack how the new administration is dismantling outdated rules, advancing stablecoin legislation, and laying the groundwork for a national Bitcoin reserve. If you want an inside look at how Washington is going all-in on crypto, this is the episode to watch.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.