Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

The Bitcoin Conference Is Underway!

The Time Has Come For ETH Treasuries

Solana’s Co-Founders' Face Personal Data Leak

Trump Media Locks In $2.5B Bitcoin Acquisition Deal

Cetus Protocol Is Compensating All Losses

The Bitcoin Rush Starts Now | Macro Monday

The Bitcoin Conference Is Underway!

I’m boots on the ground in Vegas, at The Venetian, fully committed to delivering this newsletter - and capturing some great content along the way.

Yesterday was one for the books:

I won’t spoil the interviews, but trust me - you won’t want to miss them when they drop. There’s nothing quite like capturing in-person conversations, during a bull market, right in the heart of the Bitcoin epicenter.

Long story short, a lot of content is on the way, and there is going to be A TON of news this week.

Some ideas I have been tossing around in my head that I wouldn’t be surprised to see happen this week are:

A new nation-state announcing a Bitcoin purchase.

A surprise company - one no one saw coming - adding Bitcoin to its balance sheet.

Existing Bitcoin-aligned companies significantly ramping up their BTC strategies.

A major regulatory announcement or legal breakthrough favoring Bitcoin.

A high-profile figure publicly endorsing or integrating Bitcoin into their business.

A major traditional finance institution launching a Bitcoin-related product.

An unexpected merger, acquisition, or partnership in the Bitcoin space.

We’re at a point where market-moving announcements don’t pack the same punch - but that won’t stop companies from using this week’s spotlight to their advantage. For instance, I interviewed Jack Mallers yesterday, and while he didn’t reveal any inside info, he did hint on X that announcements are coming soon for both Strike and Twenty One on Thursday.

The thing about conferences, though, is they have a history of pulling the rug out from under Bitcoin. It’s almost a pattern at this point: anticipation builds, bullish narratives dominate the headlines, major figures make announcements - and just as the hype hits its peak, the market cools off or corrects sharply. Maybe it’s just the PTSD inside of me talking, but there’s something about all these firms sending their top decision-makers to the conference, liquidity drying up, none of us having service, and then - like clockwork - when we finally reconnect, Bitcoin’s down as a big F-you to everyone… just because it can.

Granted, we’re in a bull market now, and there are more bullish developments unfolding than at any point in Bitcoin’s history - so maybe we rip higher from here. But I’m staying cautious over the next few days and weeks. I’m not selling or shorting - just sharing my thoughts. Dips are still for buying.

Let’s get back on track.

Steak ‘n Shake sent their COO to the Bitcoin conference, where he praised Bitcoin and explained how it benefits both the company and its customers. What stood out most about this presentation was how genuine and unexpected it felt. Steak ‘n Shake isn’t your typical Bitcoin advocate - it’s not the kind of brand you’d expect to take a bold stance on an emerging financial technology. And yet, here they are, fully leaning in.

I loved how the presentation opened by highlighting all the innovative milestones Steak 'n Shake has achieved: inventing the steakburger, perfecting homemade milkshakes, becoming the first restaurant chain to launch beef tallow fries, and accepting Bitcoin as payment at all locations where it’s legally permitted.

“The day we launched Bitcoin payments at Steak ‘n Shake, Steak ‘n Shake accounted for 2/10ths of 1% of the global Bitcoin transactions in the world. That means in that day, 1 in every 500 Bitcoin transactions globally happened at Steak ‘n Shake. And while Bitcoin may be the future, Steak ‘n Shake has brought Bitcoin into the present. There’s no question we have seen an upsurge in our business… We weren’t seeking a marketing gimmick; rather, we were seeking to provide our customer with another viable option with which to pay for our products.”

Props to Steak ‘n Shake - they didn’t pay me a cent for this review. I’m sharing it entirely on my own accord, and I genuinely encourage all of you to visit a location, I know I will be doing so myself.

On a less positive note, I want to address some of the Saylor FUD that has been circulating recently, regarding the Strategy clones and more so the fact that Strategy won’t publish its public keys.

In case you haven’t noticed, there’s plenty of criticism surrounding this issue. I’m not here to take sides today, but I have publicly shared the same concerns as Nic for weeks, and those have only increased since being here. I have been pitched 20 of these in the first day, so it’s definitely something worth exploring and thinking more deeply about. On another note, Saylor was recently asked whether Strategy has any plans to publish on-chain proof-of-reserves. He gave a pretty long-winded response, 8 minutes to be exact, so before forming an opinion, I encourage you to listen to his full response (you can access the clip by clicking on the video below) - not just the clips that leave out important context.

Some of Saylor’s quotes:

“It actually dilutes the security of the issuer, the custodians, the exchanges and the investors. It’s not a good idea, it’s a bad idea.”

“No institutional-grade or enterprise security analyst would think it’s a good idea to publish all of the wallet addresses, such that you could be traced back and forth.”

“Go to AI, put it in deep think mode and then ask it ‘what are the security problems of publishing your wallet addresses?’ and ‘how might it undermine the security of your company over time. It would write 50 pages of security problems.”

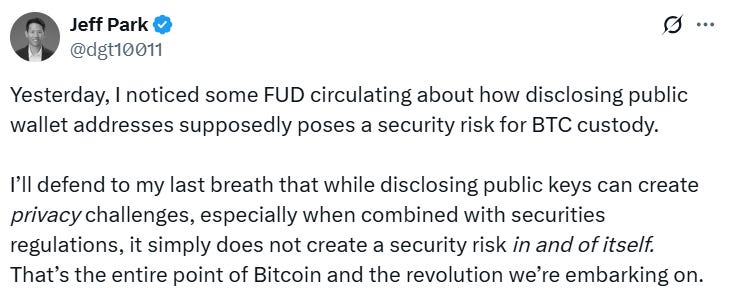

Jeff Park from Bitwise is among many of the people out there not satisfied with Saylor’s response:

In other news announced at the conference, Jack Dorsey’s company, Square is piloting real-time Bitcoin payments, starting with a merch truck inside The Venetian. Shoppers can use Bitcoin via the Lightning Network to instantly buy Bitcoin themed items with Square handling exchange rates and confirmations behind the scenes. The bigger plan however is to enable Bitcoin payments anywhere there is a Square point-of-sale terminals to accept payment. According to the announcement, “the Bitcoin payments feature is expected to start rolling out in the second half of 2025 and reach all eligible sellers in 2026.” Merchants who accept Bitcoin will have the option to either instantly convert it to fiat or hold onto it - an option that’s both practical and, frankly, genius.

If you see me at the conference, don’t hesitate to say hi! We’re all Bitcoiners here - part of the same community, and no one’s above anyone else. Whether it’s your first conference or your tenth, we’re all here for the same reason: to connect, share ideas, and push this movement forward. That just about sums up all the highlights from day one. I’ll do my best to stay on top of all the news coming out of the conference and break it down here.

The Time Has Come For ETH Treasuries

SharpLink Gaming, an online betting platform, has launched an Ethereum-based corporate treasury strategy and announced a $425 million private investment in public equity (PIPE) deal. The company is selling over 69 million shares at $6.15 each ($6.72 for certain executives). The raise was led by Ethereum infrastructure firm Consensys and included major crypto investors you probably have heard of including ParaFi, Electric Capital, Pantera, and Galaxy Digital. CEO Rob Phythian and CFO Robert DeLucia also participated.

As part of the deal, Ethereum co-founder and Consensys CEO Joseph Lubin has been nominated as chairman of SharpLink’s board of directors. Lubin stated that Consensys looks forward to partnering with SharpLink to develop its Ethereum treasury strategy and support its core business as a strategic advisor.

As for my personal thoughts on this, I can’t help but wonder: could SharpLink become the equivalent of Strategy for Ethereum? I don’t want to jump the gun, but a $425 million purchase would essentially put SharpLink in contention for the second-largest ETH holder, according to the Strategic Ethereum Reserve. Ethereum would benefit immensely if a company stepped up and made it their mission to acquire ETH with the same conviction that Saylor brings to Strategy on behalf of Bitcoin.

The transaction is expected to close around May 29, 2025, and SharpLink plans to use the funds primarily to acquire ETH as its main treasury reserve asset, alongside general corporate purposes.

Solana’s Co-Founders' Personal Data Was Leaked

In a strange turn of events, the official Instagram account of the renowned hip-hop group Migos was briefly hijacked on Monday and used to leak sensitive personal information belonging to Solana co-founder Raj Gokal. While in control of the 13 million follower account, the hackers posted images of alleged IDs, passport scans, and other private documents tied to Gokal and another individual named “Arvind.” These posts included threatening captions and references to a failed extortion attempt, including one message demanding an unpaid ransom of 40 BTC.

In addition to leaking information, the attackers also promoted a scam and other malicious content intended to harm the co-founders and viewers of the content. Unfortunately for Coinbase, many initially assumed the exchange was behind the leak, but that doesn’t appear to be the case. This hack is unrelated. While no crypto assets were directly affected, the incident did cause serious personal harm. I’m sharing this as a reminder: anyone can become a victim of a hack. Even the most security-conscious individuals can slip up or be outmaneuvered. Stay vigilant, especially as the bull market gains momentum and asset prices climb. The higher the stakes, the greater the security risks.

Trump Media Locks In $2.5B Bitcoin Acquisition Deal

Just in time for the annual Bitcoin conference, Trump Media is now officially raising capital to buy Bitcoin. Interestingly, this move was leaked a couple of days ago, though the company initially denied the rumor - until now. As a Bitcoiner, I’m always glad to see more Bitcoin being bought, but there’s a deeper issue here that isn’t getting enough attention.

This move raises serious questions about conflicts of interest. If the United States is moving toward holding Bitcoin - whether through an executive order or broader legislative efforts like Senator Cynthia Lummis' Bitcoin Act - Trump Media’s involvement complicates things. If the executive order alone guides U.S. Bitcoin acquisition, that’s one thing. But if the goal is to pass the Bitcoin Act, which many Bitcoiners support, this development could actually make that process more difficult. Democrats will likely view this as a prime opportunity to stall or push back on new Bitcoin legislation in Congress.

I guess next week we are going to find out if my suspicion is true.

I hope I am wrong.

Cetus Protocol Is Compensating All Losses

Here’s the full statement:

“We have great news. Using our cash and token treasuries, we are now in a position to fully cover the stolen assets currently off-chain if the locked funds are recovered through the upcoming community vote. This includes a critical loan from the Sui Foundation, making a 100% recovery for all affected users possible. Because full recovery is dependent upon the results of the community vote, we humbly ask for the Sui community’s full support to recover the funds via the upcoming vote. We recognize that this is an extraordinary ask forced by our actions, however we think it is the right decision especially for those affected. Regardless of the outcome of the vote, recovery will begin immediately after. A detailed plan will follow. We deeply regret the impact caused by the recent incident and sincerely apologize to our users and the broader ecosystem for the exposure. Your trust is our top priority, and we are fully committed to making things right. We ask that everyone comes together to pass the vote, make everyone whole, and rebuild a stronger, more resilient Sui DeFi ecosystem.”

The Bitcoin Rush Starts Now | Macro Monday

A surprising new class of Bitcoin buyers is stepping in – and it might just kick off the next major Bitcoin rush. Who are they, and why now? Join Dave Weisberger, Mike McGlone, and James Lavish as we break it all down in this week’s Macro Monday – from crypto to global markets!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.