Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

America’s Strategic Bitcoin Advantage

Bitcoin Thoughts And Analysis

Altcoin Charts

Market Turmoil Deepens Amid US Fiscal Concerns

Texas Is About To Sign A Bitcoin Bill

Vivek’s Strive Looks To Purchase 75,000 BTC

Trump’s Meme Coin Dinner Is Tomorow

The SEC Charges Unicoin

Bitcoin Headed To $200K-$315K, June Will Be Explosive | Mike Alfred

America’s Strategic Bitcoin Advantage

For years, it felt like the U.S. was dragging its feet while the rest of the world charged forward with crypto. But something shifted over the past year. Momentum started to build – and for those paying close attention, there was one clear moment when it all began.

On May 8, 2024, at Mar-a-Lago, Donald Trump hosted a private dinner for holders of his Mugshot NFT collection. And in true Trump fashion, while addressing the room, he delivered a series of off-script remarks that electrified the crowd. At the time, I don’t think he fully understood the movement he was stepping into – or how much it could boost his election odds – but he struck gold. Everything changed from that moment on.

Here’s what he said:

“Biden doesn’t know, Gensler is very much against it, the Democrats are very much against it.”

He turned crypto into a partisan issue.

“If you like crypto in any form, and it comes in a lot of different forms, if you are in favor of crypto, you better vote for Trump.”

He branded himself as the crypto candidate.

“Crypto is moving out of the US due to hostility against it... We will stop this because I don’t want it – if we are going to embrace it, we should allow them to be here.”

He vowed to bring crypto innovation back to the U.S.

“Can we donate to the Trump campaign using crypto? I believe the answer is yes. If you can’t, I’ll make sure you can.”

And, naturally, he asked for donations in crypto. (Did anyone not see that coming?)

The press ran with it for weeks. And Trump kept doubling down – speech after speech, event after event – until it became clear: the Republican front-runner had embraced crypto as a key part of his platform. Since then, a lot has happened. But the momentum hasn’t slowed. In fact, the U.S. is now beginning to carve out a clear lead in the space.

Which brings me to a recent study I want to spotlight – published by River, a Bitcoin-only financial institution. The report is titled “The American Bitcoin Advantage” and kicks off with a striking line:

“How Americans came to own 40% of all Bitcoin.”

Let’s dig into what they found.

Something that stood out to me in the study were two numbers I don’t expect to stay this high for long: the U.S. market share of corporate Bitcoin holdings at 94.8%, and spot Bitcoin ETFs at 79.2%. While the U.S. is undeniably the financial capital of the world, those figures are sky-high. If a country like China were to fully open its doors to crypto, those percentages could drop off a cliff.

That wouldn’t necessarily be a bad thing – in fact, it could ignite a global Bitcoin accumulation race – but it’s definitely something to keep in mind.

The U.S. accounts for just 4% of the world’s population – but holds 40% of global Bitcoin. That alone tells me one thing: if you were born in the U.S., regardless of your financial situation, you’re fortunate in at least one regard – Bitcoin exposure is significantly higher here. People know about it, talk about it, use it. That kind of access and awareness simply isn’t a given in most other parts of the world.

If you're reading this newsletter from outside the U.S., consider yourself lucky for finding your way here and choosing to dig deeper into this asset class. You're ahead of the curve – and that’s no small feat.

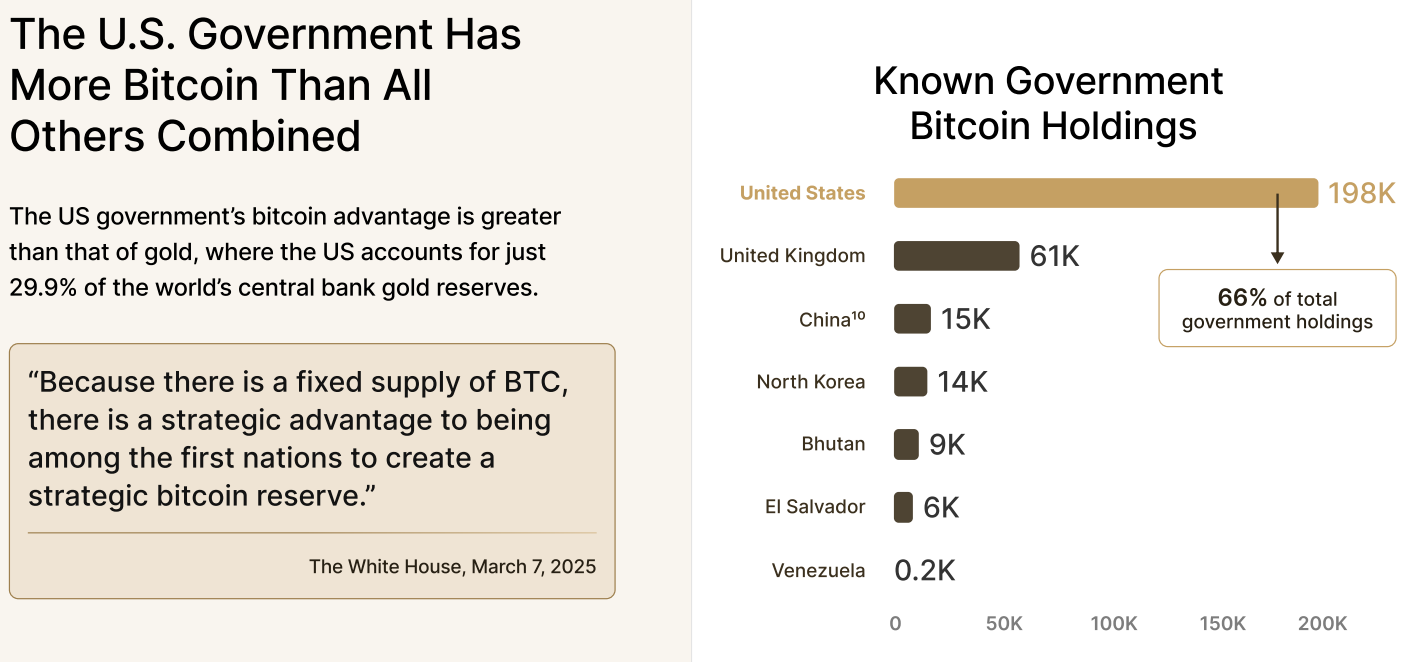

The race among nation-states hasn’t even started yet - and just look at where things already stand:

No wonder the U.S. isn’t in a rush - they’re already holding a commanding lead.

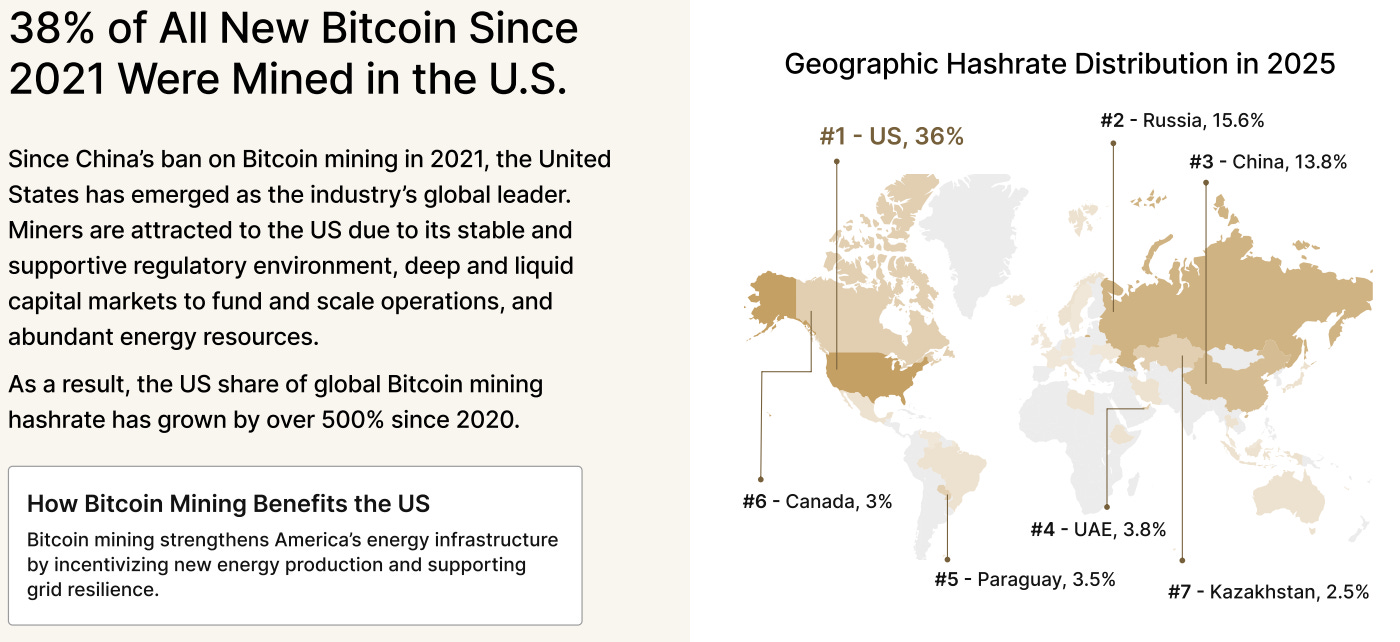

Mining is another area where I expect the gap to narrow - unless Trump makes bold, strategic moves to strengthen the Bitcoin mining industry in the U.S. If China were to reverse its stance, it could quickly regain a significant share of the hashrate.

Next up is the GENIUS Act. If it passes, it would become the first comprehensive federal framework for digital assets – particularly stablecoins – laying the foundation for a more structured and secure crypto ecosystem in the U.S. Knock on wood it does, because the benefits wouldn’t just flow to Circle and Tether. It would also be a major win for Ethereum, Solana, and Tron – the main chains where these assets are issued and actively traded.

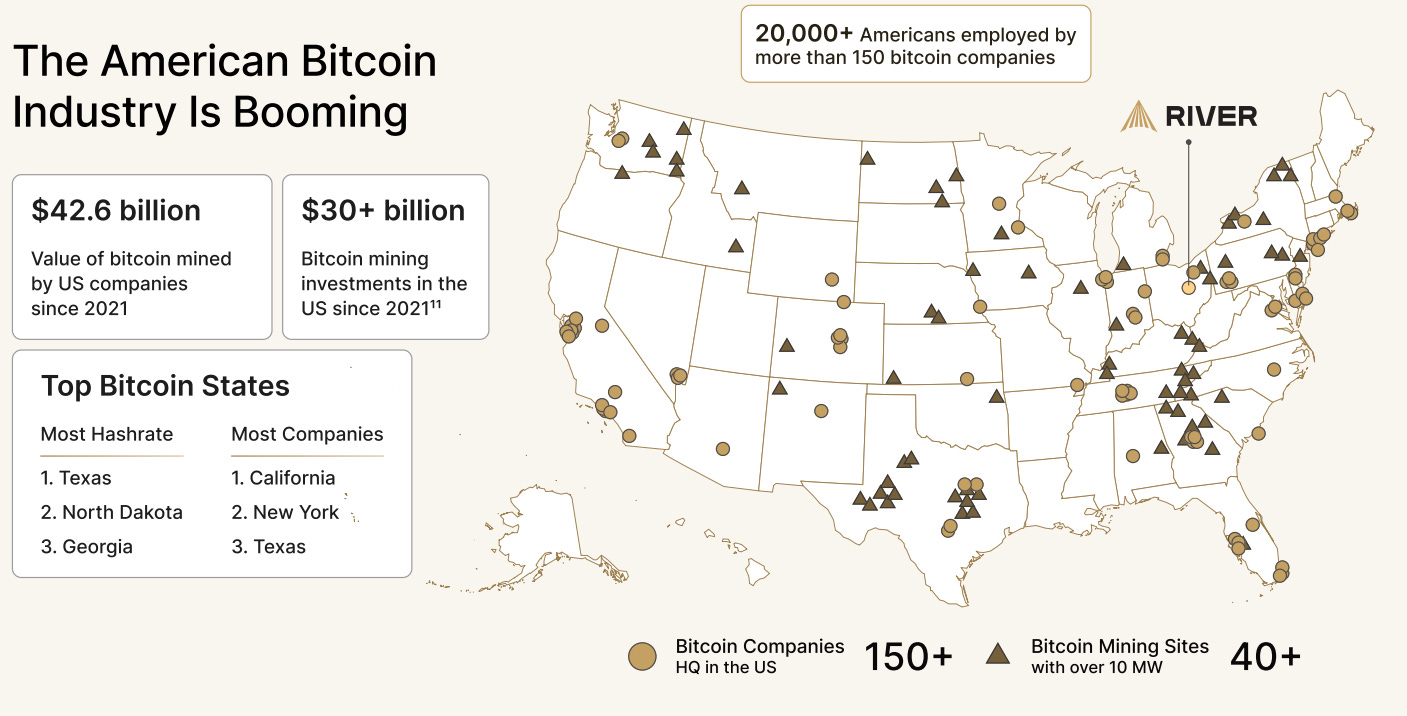

Last but not least, take a look at this:

Texas ranks in the top three for both “Most Hashrate” and “Most Companies,” which makes for the perfect segue into the first news segment below. Spoiler alert: it’s starting to look like another U.S. state is gearing up to pass pro-Bitcoin legislation – and this one isn’t small. In fact, everything’s bigger there.

That wraps up my thoughts on America’s Bitcoin advantage. It makes sense why the U.S. isn’t in a rush to buy – it already holds a commanding lead, and no major country is seriously threatening to overtake it. The only real incentive to move faster would be locking in lower prices. But let’s be honest – whether the U.S. pursues a budget-neutral strategy or allocates funds directly to Bitcoin, it probably doesn’t matter if BTC is $100,000 or $250,000. Either way, the government has the firepower.

The real challenge is convincing the right people. In the meantime, the slow pace works in our favor – it gives the rest of us more time to accumulate before the next major wave drives prices even higher.

Bitcoin Thoughts And Analysis

Bitcoin just flipped the script.

After multiple days of confirmed bearish divergence on the daily RSI – one of my favorite signals – price has now decisively pushed higher, likely invalidating the setup. This is a strong reminder that no signal is right all the time, and market context always matters more than indicators in isolation.

We now have a new all-time high on both a closing and intraday basis, coupled with a clear surge in volume on the breakout – a textbook bullish confirmation. Price has left the $109,358 zone behind and is holding firmly above it as of now.

The structure couldn’t be cleaner. Higher lows, consistent buying pressure, and now continuation to the upside even in the face of temporary overbought conditions. This was a classic example of “bearish divergence failure” – which often leads to explosive upside as shorts get trapped.

Momentum is back on Bitcoin’s side. The next resistance is undefined territory, but psychologically, the $115K and $120K levels could attract attention.

Bottom line: Bitcoin is doing what strong assets do in bull trends – invalidating bearish signals and grinding higher.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Bitcoin Dominance rose for over a week, causing altcoins to once again underperform Bitcoin as it rose to new highs. This is normal in a real cycle - Bitcoin goes up, then sideways, altcoins go up, then the interest goes quickly back to Bitcoin. It is difficult to play the moves, but exciting to see the trend return after many years.

Today, once again, we have Bitcoin settling above a new all time high and altcoins outperform since. It feels like we are finally about to get a true bull market, but always proceed with caution.

Market Turmoil Deepens Amid US Fiscal Concerns

Global stocks declined on Wednesday as growing anxiety over the US fiscal outlook sparked a wave of risk-off sentiment. European markets saw the Stoxx 600 drop 0.7% – while Asian equities fell 0.6%. US Treasuries stabilized – but not before the 30-year yield surged to its highest level since 2023.

At the core of the sell-off: renewed fears about the ballooning US deficit, intensified by a recent Moody’s downgrade and political wrangling over President Trump’s signature tax proposal. The House may vote on the controversial legislation as early as Thursday – with markets bracing for its potential to add trillions to future deficits.

Strategists point to rising bond yields as the market’s clearest signal. “Rates are now the clearest lens through which sentiment is being expressed,” noted Ahmad Assiri of Pepperstone Group – suggesting risk assets must “rejustify” their valuations in this environment.

JPMorgan CEO Jamie Dimon added to the caution – warning from Shanghai that the US may not be in a “sweet spot” and could face stagflation, driven by a mix of geopolitical threats, budget deficits, and inflation.

Despite the chaos, S&P 500 futures were slightly higher (+0.2%) – signaling investor hesitation rather than panic, for now.

Stocks

The Stoxx Europe 600 fell 0.7% as of 9:22 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average fell 0.1%

The MSCI Asia Pacific Index fell 0.6%

The MSCI Emerging Markets Index fell 0.8%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro was little changed at $1.1325

The Japanese yen rose 0.4% to 143.06 per dollar

The offshore yuan was little changed at 7.2029 per dollar

The British pound was little changed at $1.3429

Cryptocurrencies

Bitcoin rose 2.6% to $111,071.67

Ether rose 6.7% to $2,677.8

Bonds

The yield on 10-year Treasuries was little changed at 4.59%

Germany’s 10-year yield advanced one basis point to 2.66%

Britain’s 10-year yield advanced two basis points to 4.77%

Commodities

Brent crude fell 1% to $64.28 a barrel

Spot gold rose 0.3% to $3,323.44 an ounce

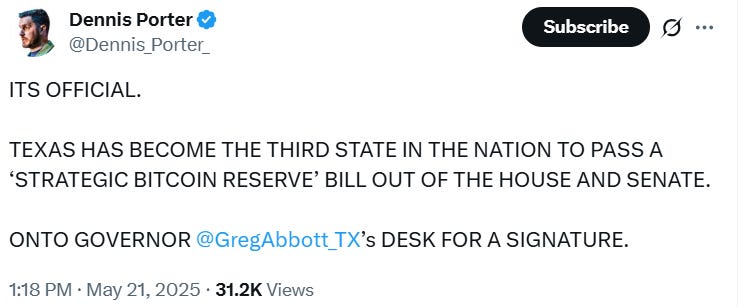

Texas Is About To Sign A Bitcoin Bill

I don’t want to count my chickens before they hatch, but this feels about as close to a done deal as it gets. It’s also worth noting that – like the two bills before it – this one isn’t exclusively a Bitcoin bill. But based on the language, no other digital asset qualifies now or is likely to qualify anytime soon.

“Bitcoin or other cryptocurrency purchased using money in the reserve or received by the reserve must have an average market capitalization of at least $500 billion over the most recent 12-month period.” It also appears that the 12-month window is being extended to 24 months – which pushes alternatives even further out of reach for the foreseeable future.

As Cointelegraph noted, “Texas’s economy is the second-largest in the United States, with a gross domestic product of $2.7 trillion in 2024, according to KVUE. If Texas were its own country, it would have the eighth-largest economy in the world.”

Vivek’s Strive Looks To Purchase 75,000 BTC

Vivek Ramaswamy’s investment firm, Strive, is planning to grow its Bitcoin holdings by purchasing discounted claims from the collapsed Mt. Gox exchange, starting with rights tied to 75,000 Bitcoin. These claims have already been legally validated but haven't yet been distributed.

Here’s Strives statement it filed to the SEC: “On May 20, 2025, Strive Enterprises, Inc., an Ohio corporation (“Strive”), announced that it has entered into a strategic partnership with 117 Castell Advisory Group LLC to source and evaluate distressed Bitcoin claims—such as those from the Mt. Gox estate, which total approximately 75,000 BTC —that have received definitive legal judgments but remain pending distribution. This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

For those who don’t remember, Strive aims to grow its Bitcoin treasury by acquiring undervalued public companies trading below net cash value, effectively buying cash at a discount. It then plans to use that cash to purchase Bitcoin, boosting value for shareholders. The firm sees this as a scalable, multi-billion-dollar strategy.

Trump’s Meme Coin Dinner Is Tomorow

President Trump is set to host an exclusive gala dinner today at his Virginia Golf Club near Washington, D.C., welcoming 220 top holders of the TRUMP token - many of whom are ironically believed to be from outside the U.S. Among them is TRON founder Justin Sun, who topped the leaderboard after spending around $16 million on TRUMP tokens and many other winners are believed to be international exchanges. Of the invitees, the top 25 will be invited to the White House for an exclusive tour. I don’t think this is exactly what the Trump team had in mind, representatives from international exchanges, but that’s what happens when you do a leaderboard challenge. Also, I have no idea if this will turn out to be a classic ‘sell the news,’ event. Just because the dinner wraps up doesn’t mean Trump won’t drop a major surprise announcement for holders while he’s there. Trading these kinds of tokens is always risky - anything can happen.

The SEC Charges Unicoin

The SEC has charged Unicoin, a New York-based crypto company, and three of its top executives with defrauding investors through a misleading token and stock offering. As per the SEC’s press release, “We allege that Unicoin and its executives exploited thousands of investors with fictitious promises that its tokens, when issued, would be backed by real-world assets including an international portfolio of valuable real estate holdings. But as we allege, the real estate assets were worth a mere fraction of what the company claimed, and the majority of the company’s sales of rights certificates were illusory. Unicoin’s most senior executives are alleged to have perpetuated the fraud, and today’s action seeks accountability for their conduct.”

Bitcoin Headed To $200K-$315K, June Will Be Explosive | Mike Alfred

Bitcoin just closed at a record daily high of $106,830, with traders now eyeing wild upside targets - including $300,000 options bets expiring in June. Meanwhile, Vivek Ramaswamy’s Strive is making a bold move to scoop up 75,000 BTC from Mt. Gox claims, aiming to outperform Bitcoin long-term. On the institutional front, Theta Capital secured $175 million for early-stage crypto startups, signaling a revival in VC appetite. As Mike Alfred warns of a supply crunch and Wall Street ramps up spot ETF allocations, the bull case for Bitcoin has never looked stronger.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.