Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public is the ONLY firm that gives you access to Institutional level tech that turns crypto volatility into extraordinary profits.

Thousands of clients are benefitting from our FREE products. Nearly a thousand clients have joined our Concierge Program and have customized size, execution, yield to match their goals and needs. Arch Public’s Algos have become a movement.

We want to talk to you and give you access to tools that will dynamically shift how you interact with markets.

Schedule a demo and speak to Andrew and Arch. You won’t be disappointed.

In This Issue:

Securities 2.0

Bitcoin Thoughts And Analysis

Dollar Dumps, Stocks Follow

The GENIUS Bill Is Inching Forward

Don’t Fall For Crazy Predictions

The Strategic ETH Reserve Is Just Getting Started

Texas May Be The 3rd State To Pass Bitcoin Legislation

The Bitcoin Floodgates Just Opened, Here’s Why Demand Could Go Parabolic

Securities 2.0

Securities 2.0.

It has a nice ring to it.

Honestly, it’s more intuitive than “Web3” or “DeFi.”

Explaining Web3 usually requires a history lesson – and let’s be honest, Web1 and Web2 weren’t even labeled until people started hyping Web3. As for DeFi? That’s an even tougher sell. It’s jargon stacked on jargon.

But “Securities 2.0” tells you exactly what’s happening: today’s financial assets are getting an upgrade. And if someone asks how, there’s a simple answer – you’ll be able to trade them anywhere, anytime, with near-instant settlement and fractional fees. Think Wall Street without the walls.

(There are plenty more reasons to embrace tokenization – which I explore below – but that’s the simplest one-sentence pitch.)

Securities 2.0 feels like a breath of fresh air. It’s simple, direct, and rooted in concepts that even traditional investors can wrap their heads around.

I’m using the term because I saw it in a recent Robinhood press release, tied to a policy proposal they submitted to the SEC on tokenization.

The highlights from that release are below:

“Global interest in RWA tokenization has surged since 2023. Security Token Market projects the global RWA market to reach $30 trillion by 2030. Robinhood CEO Vlad Tenev stated during the filing: ‘RWA tokenization represents a new paradigm for institutional asset allocation. Robinhood is committed to leading this trend under a compliant framework.’”

“RWA tokenization represents a new paradigm for institutional asset allocation. Robinhood is committed to leading this trend under a compliant framework,” Emily Carter, Head of Blockchain Research at Goldman Sachs.

“Robinhood’s comprehensive RRE product architecture ushers the U.S. into the era of Securities 2.0—setting a new benchmark for integrating traditional finance with blockchain.”

“RRE adopts a Solana + Base architecture, utilizing off-chain matching and on-chain settlement…”

I wasn’t able to get my hands on the recent 42-page SEC policy proposal Robinhood submitted, but between their press release and an April letter to the SEC, they’ve laid out a well-articulated case for tokenization – which, frankly, should start being referred to more often as Securities 2.0. It’s clearer, more intuitive, and far better at signaling the real shift underway in how markets could – and should – operate.

Think about it this way: the next time you’re talking finance – or even crypto – with a middle-aged or older investor, try using the term digital assets instead of crypto, and Securities 2.0 instead of tokenization. If the conversation turns more technical, by all means explain that digital assets are secured with cryptography and Securities 2.0 are essentially tokenized securities. But starting with a simple, familiar framing can make all the difference – it’s a night-and-day shift in how the message is received.

Let’s peel back the layers of Robinhood’s April letter to the SEC. It was addressed directly to Chairman Atkins, Commissioner Peirce, and members of the SEC’s Crypto Task Force.

Robinhood sells the idea of tokenization by outlining five “Innumerable Benefits” in its policy proposal.

A. Tokenization Can Enhance Transaction Settlement

This ties back to what I said earlier. Robinhood argues that tokenization enables near-instant transaction settlement – improving market efficiency and reducing costs and risks for both intermediaries and consumers. They also quote Commissioner Peirce, who noted another risk-reducing characteristic of blockchain tech: “the use of a blockchain-based database may be more secure in some respects than using a centralized database with a single point of failure.”

B. Tokenization Allows for Better Price Discovery and More Capital Formation

The benefit of 24/7/365 trading is greater price competition – especially for traditionally illiquid real-world assets (RWAs). Unlike conventional markets, which rely on manual processes and limited trading hours, tokenized RWAs can trade at any time on decentralized platforms. This continuous access leads to more efficient pricing and attracts new capital.

C. The Programmability of Tokenized Assets Would Aid Compliance

Once the SEC fully grasps this point, it could become the strongest selling feature from a regulatory perspective. Smart contracts allow tokenized RWAs to embed compliance directly into the asset – including transfer limits, holding periods, KYC/AML checks, and jurisdictional restrictions. They can also automate corporate actions like dividend distributions, coupon payments, and shareholder voting. This reduces manual work and human error, while lowering administrative costs.

D. Tokenization Promotes Liquidity and Inclusion in the Financial Marketplace

Tokenization breaks down large assets into smaller, fractionalized units – making them more accessible to a broader set of investors. This improves liquidity for illiquid assets and expands market participation. Combined with digital wallets and decentralized trading platforms, tokenization lowers barriers to entry and promotes more democratic access to investing.

E. Tokenization Enhances Transparency

Recording transactions on a blockchain creates an immutable, publicly verifiable ledger. That means real-time tracking of ownership and transaction history – improving fraud detection, boosting auditability, and enhancing overall market integrity. This is another point the SEC should have no problem embracing.

Securities 2.0 might be one of crypto’s simplest and most compelling narratives. It could actually be easier to explain – and gain adoption – than even Bitcoin or stablecoins. The simpler an idea is to understand, the faster it spreads and the larger it grows. That’s why I’m confident tokenization will emerge as the next major crypto use case – right behind stablecoins, which succeeded precisely because of their clarity.

The $30 trillion estimate keeps circulating as the projected size of the tokenization market by 2030 – and honestly, I buy it. Tokenization has the potential to claim a massive share of the total addressable market for global securities. It won’t happen overnight – this will take decades, along with new leadership and regulatory standards – but it’s within reach.

If you’re thinking about how to capture this trend as an investor, start with the infrastructure. Focus on the protocols enabling RWAs to move on-chain – Ethereum, Solana, and Ondo are the key digital assets to watch. On the equity side, Coinbase and Robinhood stand out as early infrastructure leaders.

Bitcoin is digital gold.

Stablecoins are digital dollars.

Securities 2.0 are digital stocks and bonds – traditional assets, upgraded for the blockchain era.

Bitcoin Thoughts And Analysis

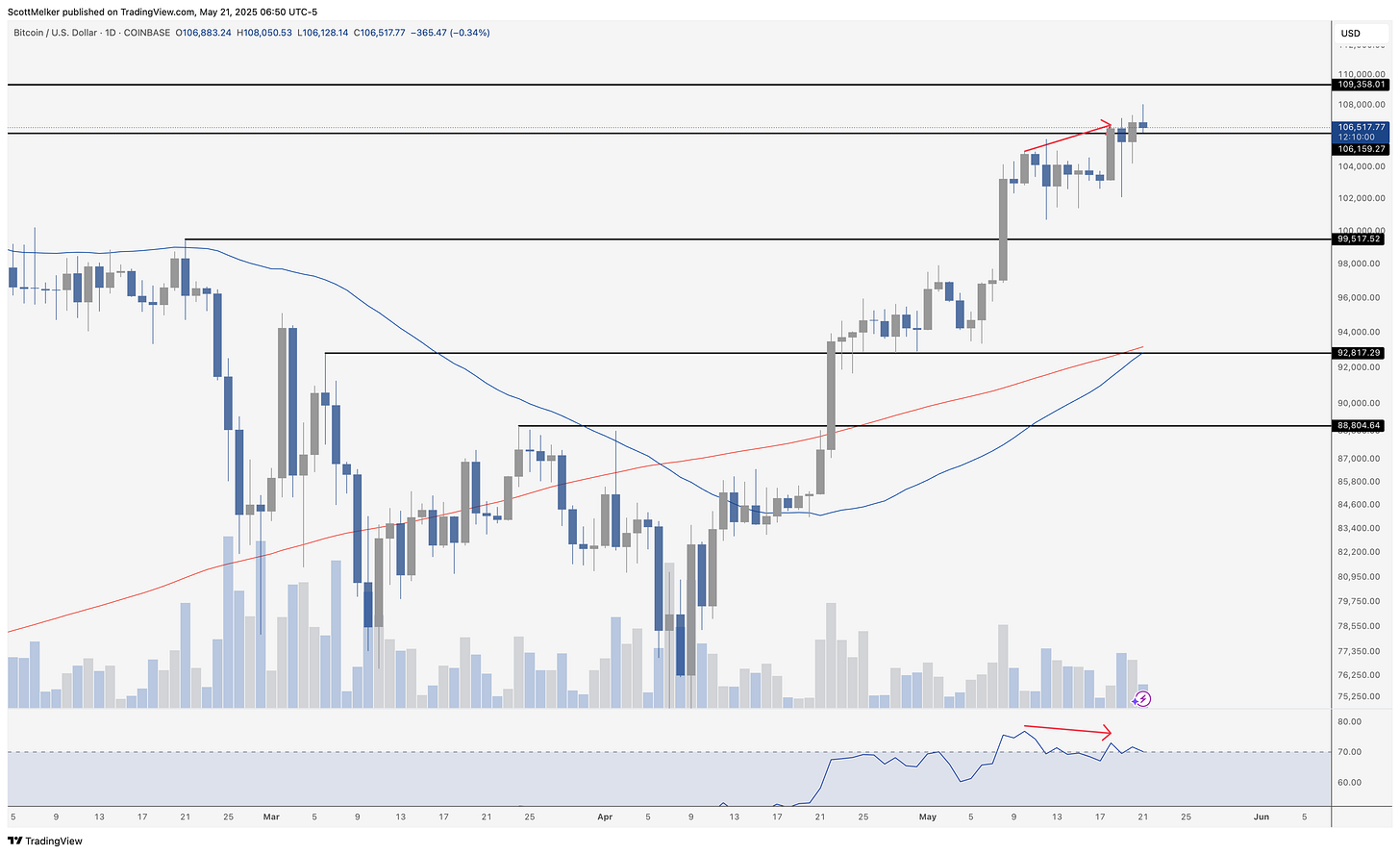

Bitcoin remains perched near the recent highs but continues to show signs of exhaustion. We now have a confirmed bearish divergence on the daily RSI - price made a new high while momentum failed to follow through. That kind of signal, especially coming out of overbought territory, typically warrants caution.

So far, Bitcoin has held above the key $106,159 level, but the divergence plus fading volume suggest that bulls are losing steam. It’s worth noting that each daily candle since the high has had a long upper wick, implying sellers are stepping in on every push higher.

Technically, as long as Bitcoin remains above $99,517 - the prior breakout level - the structure is still bullish. But the divergence, coupled with a possible fake out above resistance and weekend euphoria, leaves room for a pullback. If we do see a correction, $99,517 and $92,817 are the levels to watch.

Bottom line: price is still trending up, but momentum is slowing. Time to tighten stops and manage risk carefully - especially as sentiment appears to be running ahead of the market.

Dollar Dumps, Stocks Follow

US stocks and the dollar fell as investor caution mounted amid political wrangling over Trump-era tax cuts and rising geopolitical tensions. S&P 500 futures dropped 0.7%, extending the market's retreat, while European shares also declined. Treasuries weakened, with 30-year yields climbing further above 5%, and the greenback slid against all major currencies. Meanwhile, oil prices rose nearly 1% following reports that Israel may be preparing to strike Iranian nuclear facilities, fueling uncertainty in global energy markets.

Markets are grappling with a mix of risks — from stalled US-China trade diplomacy to ongoing fiscal negotiations on Capitol Hill. Despite recent optimism, strategists like RBC’s Frederique Carrier warn that deep-rooted trade tensions remain unresolved. Trading volumes were light, and even bond auctions in the UK and EU were delayed due to technical issues.

Morgan Stanley offered a brighter long-term view, projecting the S&P 500 to hit 6,500 by Q2 2026, supported by expected interest-rate cuts and weakening US economic dominance. Analysts also foresee a continued decline in the dollar, which has lost appeal as the world's go-to reserve currency.

Corporate headlines added to the mixed sentiment. Target slashed its sales forecast after a weak quarter. Nvidia’s CEO criticized US export restrictions on AI chips, urging the government to ease rules to stay competitive. Boeing neared a key production milestone for its 737 jets, Baidu beat revenue expectations, and Medtronic announced plans to spin off its diabetes division. Meanwhile, UnitedHealth shares plunged following a report that it secretly paid nursing homes to limit hospital transfers, raising ethical and regulatory concerns.

Stocks

S&P 500 futures fell 0.7% as of 6:53 a.m. New York time

Nasdaq 100 futures fell 0.7%

Futures on the Dow Jones Industrial Average fell 1%

The Stoxx Europe 600 fell 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.4%

The euro rose 0.5% to $1.1342

The British pound rose 0.2% to $1.3414

The Japanese yen rose 0.6% to 143.70 per dollar

Cryptocurrencies

Bitcoin fell 0.5% to $106,386.01

Ether rose 0.6% to $2,530.56

Bonds

The yield on 10-year Treasuries advanced five basis points to 4.53%

Germany’s 10-year yield advanced five basis points to 2.66%

Britain’s 10-year yield advanced seven basis points to 4.77%

Commodities

West Texas Intermediate crude rose 0.9% to $62.57 a barrel

Spot gold rose 0.6% to $3,310.94 an ounce

The GENIUS Bill Is Inching Forward

The Senate took a significant step toward regulating our industry on Monday by advancing the GENIUS Act - a crucial bill focused on stablecoins and the clarity they need to exist in the U.S. The vote passed 66–32, with 16 Democrats joining most Republicans in support, despite all Senate Democrats blocking the bill just two weeks earlier.

The shift came after bipartisan negotiations led to a key amendment that addressed Democratic concerns. The changes include stronger consumer protections, restrictions on tech companies issuing stablecoins, and expanded ethics rules that would temporarily apply to figures like Elon Musk and David Sacks. With these revisions in place, Democratic negotiators agreed to back the bill’s advancement.

Do note: This was a procedural vote to advance the bill toward a final vote. Specifically, the Senate voted to invoke cloture, meaning they agreed to move forward with debate and potentially vote on final passage later. This kind of vote needs 60+ senators to succeed, which it got (66–32). The actual final vote to pass the GENIUS Act is still to come.

Don’t Fall For Crazy Predictions

Of course, I hope Fred Krueger is right. I also hoped Balaji Srinivasan would be right with his $1 million BTC bet – and PlanC with his $288,000 price prediction for 2021. But hope alone isn’t enough. Wildly bullish predictions on short timeframes almost never hit the mark. Please don’t make trades based on these forecasts, and don’t get swept up if Bitcoin kicks off a price-discovery rally in the coming weeks that reignites talk of $600,000 in 90 days.

Don’t get me wrong – I’d love to be the fool who has to come back here when Bitcoin hits $600,000 and admit I was wrong. My bags are packed, and I’d be ready to celebrate. But until then, I’m staying grounded and focused on the fundamentals – not the hype. Most of these predictions are rooted in sound logic – they’re just way off on the timing.

The Strategic ETH Reserve Is Just Getting Started

I see potential in the idea of a SER (strategic ETH reserve), but the concept still has a long way to go.

The top ETH holder is the Ethereum Foundation (no surprise there), which occasionally sells ETH to fund operations. Next is PulseChain SAC - a controversial name in the space (don’t shoot the messenger). Then there's Coinbase, a holder you’d actually want to see holding ETH. The idea of tracking companies that hold ETH still feels very early - but every trend has to start somewhere, and it’s great to see the community beginning to follow along. That said, I’m not sure why World Liberty Financial isn’t on the list.

Texas May Be The Third State To Pass Bitcoin Legislation

Here’s Dennis Porter’s update from yesterday: “I’m being told the 3rd reading will likely take place tomorrow which means tomorrow would be the final vote for SB21 (SBR) before it goes to the Governor’s desk. But it’s unlikely to be shot down on third reading. It’s possible but very uncommon. Every state is different!” The good news is that Texas is already a very pro-Bitcoin state, so the governor is unlikely to be a barrier to this bill becoming law. Even better, the bill has already passed through the Senate, and the upcoming third hearing is expected to be more procedural than substantive. The biggest hurdle is behind us!

The Bitcoin Floodgates Just Opened, Here’s Why Demand Could Go Parabolic

Discover Bitcoin Yield with Arch Public!

Bitcoin demand is surging as JPMorgan opens access for its 80 million clients to buy BTC, signaling a major shift in traditional finance. Meanwhile, the Senate advances the GENIUS Act, potentially ushering in a new era of stablecoin regulation. On top of that, Bitcoin ETF inflows are skyrocketing again, with the basis trade nearing 9 percent. Join Paget Stanco from Gemini, Andrew Parish, and Tillman Holloway from Arch Public as we break it all down live!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

A very good article