Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Bitcoin is back above $100K again. Over the past 60 days, The Bitcoin Algorithm bought Bitcoin at $74K, $77K, and $79K. Did you??

Using institutional trading technology allows you to remove emotions and execute trading strategies with incredible precision. Talk to us, you won’t regret it.

Join thousands of users that have chosen to take advantage of crypto volatility with Arch Public.

Use this link to hyperlink ‘Talk to us!’

In This Issue:

The World Changes In One Week

Bitcoin Thoughts And Analysis

Stocks And Bonds Fall As Investors Pull Back From U.S. Assets

CZ Shares Crucial Security Tips

FTX Repayments Are Coming Soon

Tether Issuance On Tron Surpasses Issuance On Ethereum

U.S. Credit Has Been Downgraded

Wall Street’s Big Crypto Bet – The Truth About Tokenized Securities | Michael Sonnenshein

The World Changes In One Week

On June 5th, 2021, before a crowd of 12,000 at the Bitcoin Conference in Miami, President Nayib Bukele made history. In a pre-recorded video played at the Mana Wynwood Convention Center, he announced that El Salvador would become the first country in the world to adopt Bitcoin as legal tender.

But that wasn’t all – taxes could be paid in Bitcoin, capital gains taxes would be waived, and businesses would be required to accept it as payment, ushering in a bold new era of crypto-powered nationhood.

I was there – somewhere in the crowd with all of you – when the announcement dropped. It still resonates deeply with me. Bukele’s video aired during Jack Mallers’ keynote – already the most anticipated talk of the conference.

At first, the crowd was dead silent. Just for a few seconds. And then, as the reality of what had just been said sank in, the place erupted. It was electric.

To this day, I still get chills watching that moment replayed on YouTube.

About a week later, Bitcoin’s price embarked on an epic run – from around $40,000 to the mid-$60,000s – before making a final push to nearly $69,000, marking a cycle top. The announcement dominated every conversation. It was the most important moment in Bitcoin’s history – rivaled only by Trump’s speech at Bitcoin 2024.

There hasn’t been a moment in conference history that’s topped it.

The announcement led headlines throughout the bull market. Within days, news of Bitcoin adoption began rippling across Latin America. Take a look below at what some regional politicians said shortly after El Salvador’s announcement:

Gabriel Silva – Congressman, National Assembly of Panama:

“This is important. And Panama cannot be left behind. If we want to be a true technology and entrepreneurship hub, we have to support cryptocurrencies. We will be preparing a proposal to present at the Assembly. If you are interested in building it, you can contact me.”

Carlitos Rejala – Congressman and National Deputy of Paraguay:

“As I was saying a long time ago, our country needs to advance hand in hand with the new generation. The moment has come, our moment. This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon Rocket #BTC & #PayPal.”

Fábio Ostermann – State Deputy, Rio Grande Do Sul (Brazil):

– Added laser eyes to Twitter profile picture

Francisco Sánchez – National Deputy for Neuquén (Argentina):

– Added laser eyes to Twitter profile picture

The running idea at the time? That the world’s most advanced economies were about to sit back and watch so-called ‘third world countries’ adopt the most innovative technology of the 21st century before them. Latin American nations looked ready to embrace Bitcoin faster than China could roll out a CBDC – or fossilized U.S. politicians could Google the word “cryptocurrencies.”

Wild times.

Of course, the bear market wasn’t far behind – and like so many things Bitcoiners predict, meaningful progress took much longer than anyone expected.

Fast forward to today, and it finally feels like adoption is gaining real momentum. Not exactly how we imagined it… but it’s happening – in that “gradually, then suddenly” kind of way.

Here’s a snapshot of my timeline, just from the past few days:

This is the mayor of Panama City.

The game is changing - because $1 billion in Bitcoin no longer feels as monumental.

Is Ukraine next?

Florida may not have passed its Bitcoin bill, but buying shares of MSTR is pretty epic.

This news seems to drop every other day.

China is gradually easing its stance on Bitcoin, and this could be far bigger than we anticipate.

Everything is bigger in Texas.

Long story short, these are just a few of the screenshots I’ve come across recently – and the list keeps growing by the day. All of it is building toward one thing: in just eight days, Bitcoin 2025 kicks off in Las Vegas, Nevada.

The biggest stage in the world for Bitcoin announcements.

The conference’s motto says it all: “Embrace the Game Theory.”

It’s hosted by Nakamoto, David Bailey’s Bitcoin-native holding company, and the speaker lineup already reads like a political and financial power list: U.S. Vice President JD Vance, Eric Trump, Donald Trump Jr., Michael Saylor, Ross Ulbricht, David Sacks, and Bo Hines are all confirmed.

With names like that — and surprise guests still under wraps — it’s hard to imagine there won’t be major announcements once the spotlight hits the stage.

If there’s ever going to be a moment to rival El Salvador’s Bitcoin adoption announcement from 2021, this might be it.

The world changes in one week.

Embrace the game theory.

Bitcoin Thoughts And Analysis

Yesterday’s daily and weekly candle closes were the highest in Bitcoin’s history – a strong bullish technical signal in theory. But almost immediately after the close, price reversed sharply, casting doubt on the breakout above $106,000.

More importantly, we’re seeing a potential bearish divergence developing. Price made a higher high, while RSI printed a lower high and is now dropping out of overbought territory. This divergence is confirmed across all lower time frames and is even forming on the weekly, though that still needs confirmation.

Adding to the concern – the move up occurred on low Sunday volume, which always raises an eyebrow. The broader market also feels euphoric, but this is happening in an environment where macro uncertainty still looms large.

This could be a fakeout above resistance, and caution is warranted here. A confirmed breakdown back into the prior range would shift the short-term bias to bearish.

Stay sharp – signals are starting to flash yellow.

Stocks And Bonds Fall As Investors Pull Back From U.S. Assets

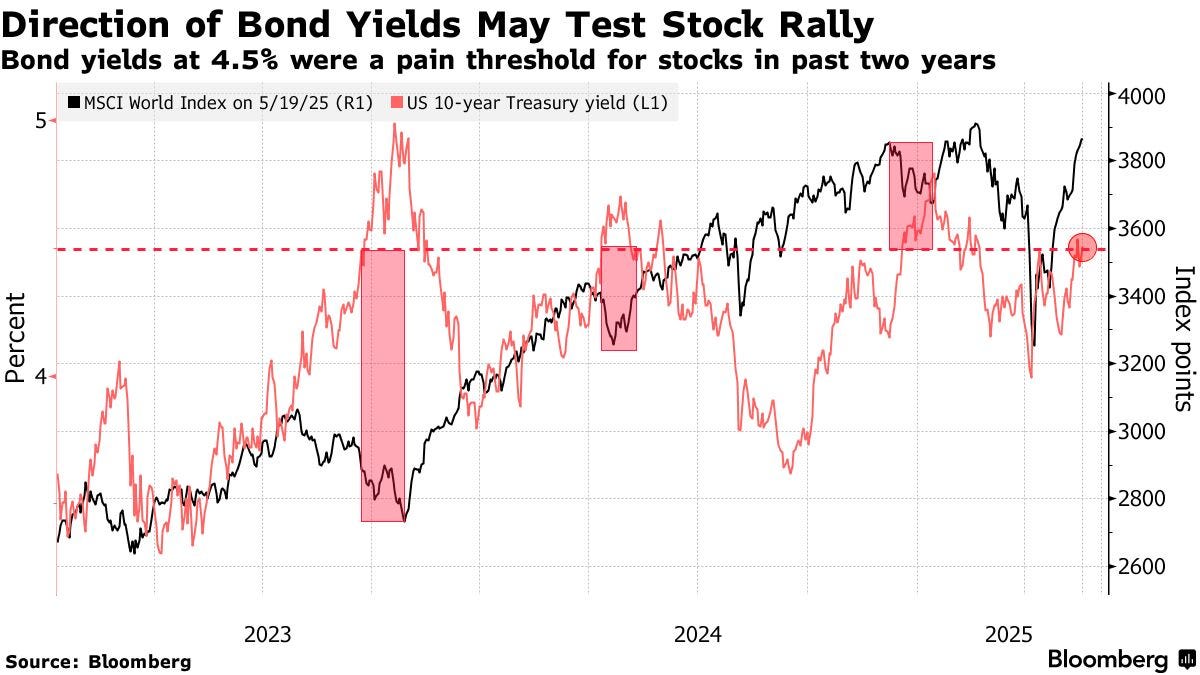

US markets pulled back sharply as Moody’s Ratings downgraded the US government’s credit rating, sparking a retreat from American assets. Stocks, bonds, and the dollar all fell, with S&P 500 futures dropping 1.1% and 30-year Treasury yields climbing above 5% – their highest level since November 2023. The downgrade intensified concerns over fiscal stability amid a ballooning budget deficit and mounting political uncertainty, including proposed tax cuts and spending reforms from the Trump administration.

The downgrade aligns Moody’s with earlier decisions by Fitch and S&P, placing the world’s largest economy below a top-tier credit rating. While Moody’s acknowledged the US’s economic and financial strengths, it concluded that these no longer fully offset the deterioration in fiscal metrics. In response, haven assets like gold rose 1.2%, while the euro and other major currencies gained ground against the dollar.

Market analysts were split in their reactions. Some, like Morgan Stanley’s Michael Wilson, urged investors to view the dip as a buying opportunity. He pointed to a strong earnings season, improving profit outlooks, and optimism surrounding a new trade agreement with China. Others, however, warned that rising Treasury yields could pose a longer-term risk to equity valuations – especially if the dollar loses its global appeal.

Adding to the uncertainty, a House committee advanced Trump’s tax and spending plan after Republican hardliners pushed through controversial Medicaid cuts. Meanwhile, tech stocks weakened across the board, with all members of the “Magnificent Seven” retreating in premarket trading. Alibaba’s shares dropped 1.8% following reports that the Trump administration raised red flags over its AI potentially being used on iPhones.

In Asia, Chinese industrial output outperformed expectations in April, but soft consumer spending highlighted the lingering challenges in the world’s second-largest economy – despite a recent easing of trade tensions with the US.

Overall, the Moody’s downgrade is another signal that global investors may be reassessing US assets – and the era of unquestioned US financial dominance may be entering a more volatile phase.

Stocks

S&P 500 futures fell 1.1% as of 7:08 a.m. New York time

Nasdaq 100 futures fell 1.4%

Futures on the Dow Jones Industrial Average fell 0.7%

The Stoxx Europe 600 fell 0.6%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.6%

The euro rose 1% to $1.1274

The British pound rose 0.8% to $1.3387

The Japanese yen rose 0.6% to 144.84 per dollar

Cryptocurrencies

Bitcoin fell 1.2% to $102,907.06

Ether rose 0.7% to $2,410.59

Bonds

The yield on 10-year Treasuries advanced seven basis points to 4.54%

Germany’s 10-year yield advanced five basis points to 2.64%

Britain’s 10-year yield advanced six basis points to 4.71%

Commodities

West Texas Intermediate crude fell 1.4% to $61.64 a barrel

Spot gold rose 1.2% to $3,242.91 an ounce

CZ Shares Crucial Security Tips

“Never give your password to a "Helpdesk Agent". The real support agents will never need it.

Don’t click on links you receive in emails. Login to your account only by typing in the URL or through a bookmark. Triple check it’s not a phishing site before entering any password.

Do NOT use the same password on multiple sites. Use a password manager so that you have a uniquie and strong password for each site. Password managers will also not match on a phishing site domain.

Use a hardware 2FA like Yubikey. These will prevent most phishing attacks.”

The most important thing for anyone in crypto to understand is this: Coinbase will never DM, call, or email you out of the blue — and neither will influencers or other exchanges.

If someone reaches out claiming to be an employee, offering support, or asking for money, it’s almost certainly a scam.

When in doubt, tap into the broader X community. While that comes with its own set of risks, there’s a good chance well-intentioned people will help you identify the red flags and steer you away from trouble.

Stay skeptical. Ask questions. And always verify before you trust.

FTX Repayments Are Coming Soon

Considering the size of the crypto market ($3.36 trillion), I think the idea that FTX repayments in the few billions are capable of moving the market is a falsehood, but they may create some second-order effects. The text below is from Blockworks:

Another possibility is that the repayments may spark some retail return. While the amounts involved are unlikely to move the broader market, the narrative around victims being made somewhat whole could renew confidence among smaller investors and prompt a wave of retail re-engagement. Additionally, it will be interesting to see whether Solana experiences heightened volatility leading into the repayments.

Tether Issuance On Tron Surpasses Issuance On Ethereum

Below are the stats on Tether’s issuance across Tron, Ethereum, and Solana. Following a recent $16 billion issuance on Tron, Tether’s total on the network has overtaken Ethereum by $1 billion. My guess is that Tether continues to favor Tron because it offers faster transactions and significantly lower fees than other blockchains like Ethereum. This makes it especially popular for high-volume trading and in emerging markets. That’s not to say issuance on Ethereum will stop - or even slow down - but Tron has always been a solid option for stablecoins. Aside from these two networks, every other competing chain has $2 billion or less. The race is solely between ETH and Tron.

U.S. Credit Has Been Downgraded

Moody’s has downgraded the U.S. government’s credit rating from Aaa to Aa1, primarily due to the growing national debt and lawmakers' inability to curb spending or reduce annual deficits. While the short- to medium-term outlook is negative, Moody’s remains optimistic about the country’s long-term prospects, citing the strength of the U.S. economy and the dollar’s role as the global reserve currency.

“We do not believe that material multi-year reductions in mandatory spending and deficits will result from the current fiscal proposals under consideration. Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat.”

Investor responses to the news have been mixed. Some, like Pointsville CEO Gabor Gurbacs, criticized the move as overly optimistic, pointing to Moody’s poor track record during the 2008 financial crisis. Others, like macro investor Jim Bianco, dismissed the downgrade as insignificant and unlikely to impact how markets view U.S. creditworthiness. Personally, I’m in the ‘whatever’ camp. It’s widely understood America has a growing debt problem that isn’t improving.

I already opted out, so the downgrade doesn’t matter to me so much.

Wall Street’s Big Crypto Bet – The Truth About Tokenized Securities | Michael Sonnenshein

I sat down with Michael Sonnenshein, now COO of Securitize, to explore how institutions like BlackRock and Apollo are going all-in on tokenized assets. We talked about how this could reshape finance as we know it - from daily yield, to DeFi integration, to even tokenizing public equities. This episode of The Wolf Of All Streets dives deep into the future of institutional DeFi and the unstoppable momentum behind tokenization.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.