Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

The Week You Couldn’t Afford to Miss

Bitcoin Thoughts And Analysis

Stock Futures Drop Ahead Of Inflation Data

Who’s Leading The Corporate Bitcoin Movement?

Nakamoto Holdings Announces A Merger To Acquire More Bitcoin

XRP Surges Into Top 3 Crypto Spots

There Is A Strategic ETH Reserve Tracker

Does Bitcoin’s Next Mega Rally Start NOW? Shocking US-China Twist Sparks Bull Frenzy!

The Week You Couldn’t Afford to Miss

Let’s be honest: most of you reading this are feeling pretty damn good right now.

I did some quick rounding – numbers are moving fast – but the bottom line is clear: unless you were short, you walked away a winner.

Bitcoin: +9%

Ethereum: +36%

XRP: +20%

Solana: +20%

Doge: +34%

Tesla: +17%

Microsoft: +3.5%

Nvidia: +11.4%

S&P 500: +4%

NASDAQ: +6%

QQQ: +6%

Aside from gold losing 4%, if you held almost anything, you pulled in some epic returns. It was one of those rare stretches that reminds investors of an old truth:

There are months when nothing happens – and then there are days when months happen.

Miss just a handful of these explosive days each year, and your annual performance can get wrecked. Portfolios don’t get punished for being early – they get punished for being absent.

That brings me to a few thoughts I want to share – especially for those navigating their first crypto bull market (or even their third or fourth). These aren’t hot takes or predictions. Think of them as a gut check. A moment to steady the ship and make sure you’re still pointed in the right direction.

Which will sting more – the regret of selling too early, or the frustration of missing out?

There’s no universal answer to this. If you’re looking at your portfolio and thinking, this is life-changing – maybe it’s $5,000, maybe it’s $5 million – then locking in those gains might come with peace, not regret. But if you’re sitting there thinking, this isn’t it yet, then it may be worth holding on. The real question is: would you rather live with the regret of selling too soon, or the regret of watching it all slip away?

Once you know your answer, you’re no longer reacting. You’re operating with intention.

Am I actually making smart moves – or is luck doing the heavy lifting?

Bull markets are deceptive. Everything works. Everything goes up. But that feeling of brilliance can be misleading. So ask yourself:

Did I have a thesis?

Did I size my positions with discipline?

Were my decisions consistent – or were they emotional?

If your wins are backed by a process you can repeat in any market, then you're on solid ground. If not, luck may be your current strategy – and luck always runs out.

The goal isn’t to eliminate luck. It’s to stop relying on it.

How did I react the last time things got hard?

This is one of the most revealing questions an investor can ask. When the market turned against me – what did I do?

Did I panic sell?

Did I double down recklessly?

Did I freeze in fear?

Or did I zoom out, check my thesis, and act with clarity?

The way you handle stress says more about your readiness than your current gains. If you say you’d rather risk the regret of selling too late – but you panic every time things dip – there’s a disconnect between what you hope you’ll do and how you actually behave.

Conviction without emotional control is just wishful thinking.

What assumptions am I making right now – just because prices are going up?

Bull markets distort perception. Especially in crypto, where the echo chamber is deafening. Everyone’s a genius, every coin is the next big thing, and every opinion is reinforced by price action. In that kind of feedback loop, it’s hard to separate truth from crowd psychology.

Ask yourself:

Are my beliefs still grounded in independent thinking – or am I just repeating what’s being echoed around me?

This is where real contrarians shine. It’s easy to challenge consensus when you’re being ignored or doubted. It’s much harder when everyone agrees with you. When your ideas are being validated by rising prices, can you still hold yourself accountable?

That’s the real test of conviction.

What have I been wrong about before – and am I about to make the same mistake again?

If none of the above hit your blind spot, this question will.

Every investor carries baggage – from bad timing, weak hands, chasing hype, ignoring red flags. The goal isn’t to avoid mistakes. It’s to avoid repeating them.

Have you taken the time to understand why you were wrong last time? Was it the analysis? The emotion? The ego?

And more importantly: have you actually changed anything?

Awareness without action is just nostalgia. If you can name the mistake and prove you’ve built guardrails around it – then you’re not just surviving the market. You’re evolving with it.

Bull markets in crypto are rare. Bitcoin’s last true run was in 2021 – and even that felt incomplete. For alts, it’s been far longer and far more painful.

If this really is the start of something bigger, ask yourself:

Are you prepared to take full advantage – or are you still dragging hesitation and habits from the last cycle?

The window for preparation is closing. Soon, it’ll just be chaos – price swings, media hype, greed, FOMO, scams, noise. I’ll be here every day helping you stay grounded. But no one can press your sell button. No one can hold your conviction. That’s on you.

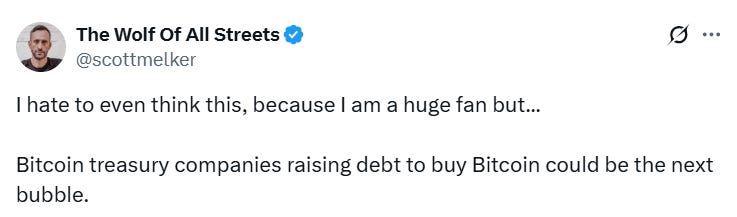

Before you jump to the next segment, one last thing you should see:

Coinbase is set to become the first crypto company to join the S&P 500 next week – a major milestone for the industry. Congratulations to Coinbase and all COIN holders. This moment has been a long time coming, and it marks the start of a new chapter for crypto’s role in mainstream finance.

Bitcoin Thoughts And Analysis

Bitcoin is taking a breather just below the $106,099 resistance level, after a strong rally from sub-$90K levels in April. Yesterday’s candle showed some indecision, which makes sense given the proximity to the key psychological milestone of $100,000 and the well-defined horizontal resistance between $106K and $109,358. This area previously marked the top of the February range and is likely to be heavily contested.

Price is comfortably above both the 50-day and 200-day moving averages, which are rising and signaling trend strength. Volume has decreased slightly during this consolidation phase, a normal occurrence after a powerful breakout, but we’ll want to see volume pick back up if Bitcoin makes a run at the highs.

If bulls can clear $106K cleanly with conviction, $109,358 is the final local resistance before we enter open skies and potential new highs. On the downside, $99,517 now serves as the first line of support, and a deeper pullback could retest the $92,817 level — the site of the previous breakout.

The structure remains bullish, but some cooling or consolidation here would be healthy, especially after such an aggressive move.

Stock Futures Drop Ahead Of Inflation Data

US stock futures slipped Tuesday, with S&P 500 and Nasdaq 100 contracts down 0.3% and 0.2% respectively, as markets took a breather following Monday’s rally fueled by US-China tariff de-escalation. Investors shifted focus to upcoming inflation data, which may reflect early signs of tariff-related price pressures.

UnitedHealth dropped 10% after suspending its 2025 guidance, while Boeing gained 1% after China lifted a delivery ban. Pinterest fell on reports Google may unveil a competing visual search product. Bayer surged up to 12% on strong pharmaceutical earnings.

Safe-haven demand returned as Treasury yields fell and gold rose. The dollar weakened after Monday’s sharp rebound, with analysts noting lingering trade and inflation concerns. Despite the rally, UBS downgraded US equities to neutral, and Goldman Sachs sees limited near-term upside.

Stocks

S&P 500 futures fell 0.3% as of 7:28 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 rose 0.2%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.1109

The British pound rose 0.3% to $1.3209

The Japanese yen rose 0.3% to 148.04 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $103,599.32

Ether rose 0.6% to $2,499.85

Bonds

The yield on 10-year Treasuries declined two basis points to 4.45%

Germany’s 10-year yield advanced two basis points to 2.67%

Britain’s 10-year yield advanced one basis point to 4.66%

Commodities

West Texas Intermediate crude rose 0.7% to $62.40 a barrel

Spot gold rose 0.6% to $3,255.80 an ounce

Who’s Leading The Corporate Bitcoin Movement?

Over the past few weeks, momentum has clearly been building among companies adopting Bitcoin-focused treasury strategies and positioning themselves as long-term holders of the asset. To help make sense of the activity, here’s a quick rundown of the top players and their relative scale:

Strategy – 568,840 BTC

Twenty-One Capital – 31,500 BTC

Metaplanet – 5,555 BTC

Strive – No BTC yet; operating as a $2B firm

Nakamoto Holdings – No BTC yet; raised $510M via PIPE and $200M in convertible notes

GameStop – No BTC yet; raised $1.8B to purchase BTC

None of these companies individually – or even collectively – come close to Strategy’s scale. But their collective influence could ultimately be more powerful. Five distinct firms publicly committing to Bitcoin sends a stronger signal than a single whale buyer, regardless of how many coins each acquires. It reframes the narrative: this isn’t just one bold bet – it’s becoming an institutional movement.

That said, I’m cautiously optimistic.

There’s a growing appetite to use leverage and raise capital aggressively to buy Bitcoin – and that comes with real risk. Leverage isn’t a problem in and of itself, but in a volatile asset class like BTC, it’s a tool that requires discipline and experience. Without both, things can spiral quickly.

Nakamoto Holdings Announces A Merger To Acquire More Bitcoin

Nakamoto Holdings, the newly launched Bitcoin-focused holding company founded by David Bailey, is merging with KindlyMD, a publicly traded healthcare firm, to kick off its Bitcoin treasury strategy. The move marks the first step in Nakamoto’s broader vision to build a global ecosystem of Bitcoin-native businesses spanning media, advisory, and financial services.

The combined company will pursue one clear objective: accumulate Bitcoin and grow Bitcoin holdings per share – a concept they’re calling “Bitcoin Yield.” That yield will be generated through a mix of equity, debt, and other financial instruments.

This deal gives public market investors regulated exposure to Bitcoin, backed by a seasoned Bitcoin leadership team and supported by a partnership with a major Bitcoin media platform. It’s a novel entry point for investors looking to add BTC exposure via traditional equities.

The merger drew funding from more than 200 investors across six continents, including top firms like VanEck, Arrington Capital, ParaFi, and Off the Chain. It also brought in prominent names such as Balaji Srinivasan, Adam Back, Jihan Wu, and Ricardo Salinas.

“Traditional finance and Bitcoin-native markets are converging. The securitization of Bitcoin will redraw the world’s economic map. We believe a future is coming where every balance sheet – public or private – holds Bitcoin.

Nakamoto seeks to be the first publicly traded conglomerate designed to accelerate that. Nakamoto’s vision is to bring Bitcoin to the center of global capital markets, packaging it into equity, debt, preferred shares, and new hybrid structures that every investor can understand and own.

Our mission is simple: list these instruments on every major exchange in the world.”

– David Bailey, Founder and CEO of Nakamoto

With this merger, Nakamoto Holdings isn’t just launching a Bitcoin treasury – it’s aiming to reshape how Bitcoin fits into the public markets. And this is likely just the beginning.

XRP Surges Into Top 3 Crypto Spots

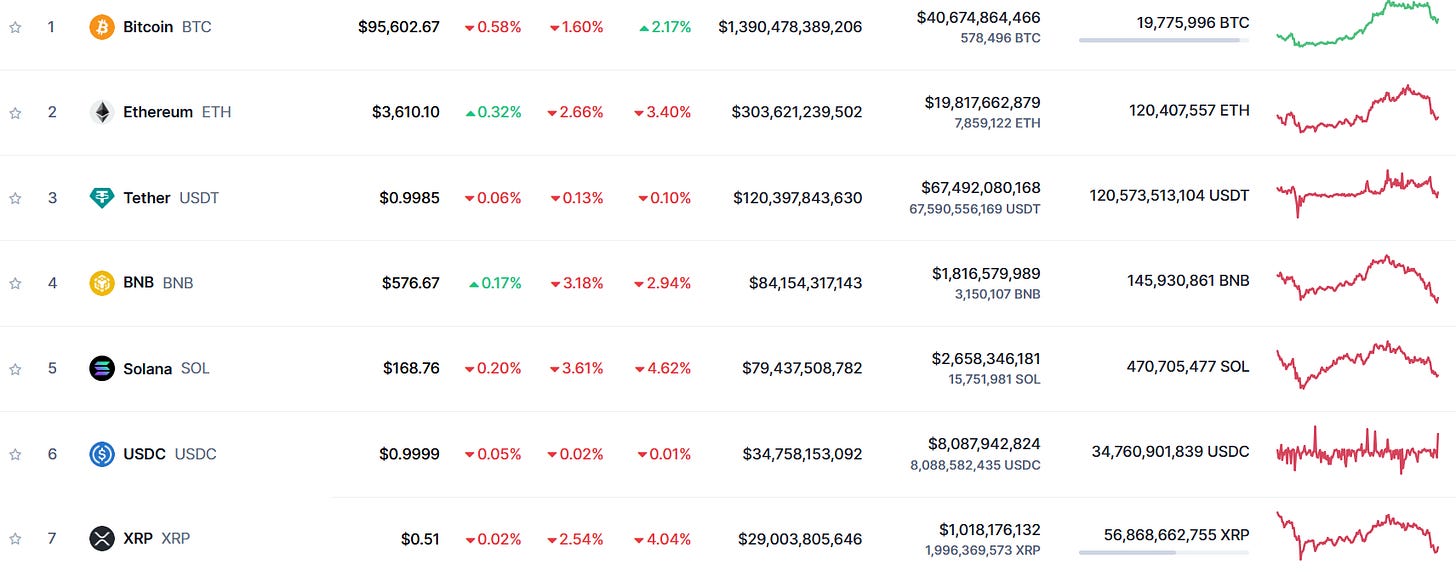

It’s pretty remarkable to think that just last November, XRP had a market cap of $29 billion and was trading around $0.50. Today, it’s nearing $2.60 and has officially overtaken Tether to claim the #3 spot by market cap.

The screenshot below from November 1, 2024, shows XRP’s steady climb past USDC, SOL, BNB, and finally USDT.

I’m genuinely happy for XRP holders – they’ve been through a lot. And I’ll admit it: I didn’t see this coming. I know someone will take a shot at me for saying that, but let’s be honest – no one outside the XRP community really did. For years, they’ve been calling for this breakout – too early and too often – but this time, they were finally right.

There Is A Strategic ETH Reserve Tracker

This tracker is a solid resource – it compiles all the essential info on which entities hold ETH and how much they own. No need to sift through scattered forums, GitHub threads, or dense quarterly filings. It’s all right here, clean and consolidated in one place.

Does Bitcoin’s Next Mega Rally Start NOW? Shocking US-China Twist Sparks Bull Frenzy!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.