Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Bitcoin Algorithm Arbitrage Strategy as $BTC passes $100K:

all BUYS <$85K in the last 60 days.

2.25X Long Bias.

18% cash yield in the last 60 days.

+42% total return in the last 60 days.

And. It’s. Free. Arch + Gemini

In This Issue:

Don’t ‘Buy Now, Pay Later’

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Stocks Rise On Easing Trade Tensions

Arizona’s Governor Capitulates

Coinbase Acquires Deribit

The Trump Drama Never Ends

Bitcoin & Ethereum Skyrocket! MASSIVE Crypto Rally Ahead?!

Don’t ‘Buy Now, Pay Later’

I personally did not have ‘financing a Chipotle burrito’ on my 2025 bingo card.

If you’re scratching your head, here’s what I’m talking about: Klarna – the popular buy-now-pay-later platform that lets you finance just about anything – has partnered with DoorDash. Yes, that DoorDash. Meaning your $10.90 Chipotle chicken burrito can now be paid off in four easy, interest-free installments over the next few weeks.

BOOM. The future is officially here.

Part of me wants to be honest and say: this is genius – why didn’t I think of it?

But another part of me feels deeply ashamed to be an American.

Let’s unpack what the hell is going on.

First things first – this isn’t a hit piece on DoorDash or Klarna. I like DoorDash. I use it. (No, I wasn’t paid to say that.)

This is a commentary on the rise of buy now, pay later (BNPL) apps – the financial tools quietly transforming everyday purchases into future debt. What once were routine expenses are now being split into installments, turning lunch into a liability.

If you’re one of my more seasoned readers (hi, boomers), you probably remember layaway. It was a fixture of old-school retail – advertised on black-and-white TVs and tucked into the back pages of Sears catalogs. The rules were simple: pay in full first, then take the item home. It was a system built on delayed gratification – a concept that today feels like ancient history.

Fast forward to now, and that idea has been flipped on its head. BNPL apps have modernized the layaway model with slick UIs, instant credit checks, and near-invisible integration into digital and physical checkout flows. What used to be a slow, intentional process – saving, budgeting, paying up front – has been replaced with instant access to debt, repackaged as “flexibility.”

Quick side note: I have a strong suspicion COVID accelerated all of this. Combine mass financial uncertainty, a spike in online shopping, a wave of stimulus checks, TikTok-fueled consumption, and unstable employment – and you get a perfect storm. One that didn’t just introduce BNPL to the masses, but helped normalize it as a go-to financial strategy. It wasn’t just a pivot. It was a cultural shift.

Now, all it takes is a tap at checkout, and you can walk away with that new pair of shoes or takeout burrito – payments and consequences delayed for another day. It’s the ultimate convenience. But it comes at a price: the erosion of patience, replaced with frictionless, invisible debt.

The most popular players in this space – Klarna, Afterpay, Affirm, and Zip – are everywhere. They're not just options. They're default features, embedded into the checkout flow of almost every major retailer.

Each app offers its own spin:

Want short- or long-term financing? Use Affirm.

Prefer a one-time Visa that splits your purchase into four payments over six weeks? Zip’s your friend.

Why choose one when you can use them all?

To be fair, BNPL isn’t inherently bad. Most offer 0% interest, and when used responsibly, they can be smart cash-flow tools. If you’re disciplined, keeping your money longer can be a good thing. But many people aren’t disciplined. And when payments are missed, those “interest-free” plans can quickly morph into 20–30% APR nightmares.

And here’s the kicker: these apps are easier to access than a credit card. No deep credit checks. No hard scrutiny. Just an email, a few taps, and boom – instant, frictionless credit.

That low barrier to entry makes BNPL tempting – especially for consumers who don’t qualify for traditional credit or are looking to avoid high credit card APRs. And while the service is theoretically for everyone, it disproportionately appeals to – and profits from – the financially vulnerable. Yes, these companies have other revenue streams, but their biggest margins come from the repeat users who rely on financing everything: groceries, gas, movie tickets, takeout.

To understand the broader picture, take a look at this recent data point from Equifax:

“As of February 2025, the monthly Equifax Consumer Credit Trends Report showed that total U.S. consumer debt was $17.68 trillion, up 1.8% from February 2024. Mortgage debt, including home equity loans, accounted for $13.05 trillion, a 73.8% share of total debt, while non-mortgage consumer debt totaled $4.64 trillion, with 36.1% of non-mortgage consumer debt attributable to auto loans and leases and 28.6% attributable to student loans.”

That 0% interest looks great – until it doesn’t. The moment you miss a payment, fees kick in. APR spikes. And what started as convenience becomes a financial trap.

BNPL platforms have gamified debt. They’ve made it fast, seamless, and deceptively low-stakes. But that’s exactly what makes them so dangerous.

The developers and analysts behind these apps know how many users will fall behind on payments – and they bake it into the business model. While they lose money on responsible users, they more than make up for it on late fees, rollovers, and interest spikes. They also profit in other ways: charging merchants to offer BNPL at checkout, selling consumer data, and offloading loans to financial institutions. These companies know precisely how to nudge you at checkout – and how to keep you coming back for the next hit.

The takeaway? Most people are better off skipping BNPL altogether. Financing was never meant for burritos. It was designed for large, planned purchases – things like appliances, cars, and well-earned vacations. Using it for everyday items isn’t financial planning. It’s financial clownery. If you need four easy payments for guac, the problem probably isn’t inflation – it’s impulse.

And while I know most of you reading this are financially literate – you’re here, after all – I’d still encourage you to pause and reflect on your own liabilities. Whether it’s student debt, credit cards, margin, or exposure to volatile digital assets, understanding how your liabilities are structured is crucial to building long-term financial stability.

Yesterday, I broke down Strive’s philosophy on using Bitcoin as a hurdle rate. Now take that mindset and apply it to your daily spending. Ask yourself: does this purchase beat Bitcoin? Or your favorite digital asset from last week? I get it – that sounds a little intense. But even using that lens with some restraint can be a powerful tool to align your short-term spending with your long-term financial goals.

I debated whether to say it, but… Bitcoin is over one hun… just kidding, I’m not jinxing it. Have a great weekend.

Hope you enjoyed this intro – it’s been a wild week for news and prices. I’ve got some strong stories lined up below, so keep reading.

Before I wrap up, though, here are two quick things I want to highlight:

While this doesn’t make up for the lost funds, justice has been served. Crypto is hard - I lost money in Celsius too - but seeing accountability is at least some consolation. Hopefully, this sets a precedent for future cases and reminds founders that deception has real consequences.

Second, the Senate failed yesterday to pass the GENIUS Act. Kind of a bummer.

What should have been a bipartisan effort became partisan and messy, with two Republicans - Josh Hawley and Rand Paul - flipping sides to vote with the Democrats, and several Democrats who were believed to be pro-crypto ultimately voting against the bill… including Gillibrand, who was on of the authors of the bill.

Whether there are genuine sticking points that align with Democratic Party values or this is just another case of Trump Derangement Syndrome, I expect this act to return and eventually make it through. Crypto has always found a way to win. The Genius Act won’t be the exception.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s start with the growth of USDC on Aptos. This isn’t a knock on Solana, with its $83 billion market cap - it’s a nod of respect to Aptos, which, despite being just 3.6% the size of SOL at $3 billion, continues to punch well above its weight

All of the remaining posts will be quick, rapid-fire updates featuring some of the top new projects on Aptos. Tapp - a modular decentralized exchange (DEX) built on Aptos - is up next. Unlike traditional DEXs, modular exchanges separate core functions like execution, settlement, and liquidity management, allowing for greater flexibility, scalability, and customization. “The platform aims to unify deep liquidity with comprehensive trading functionality, setting a new standard for decentralized exchanges.”

Next on the list is Kofi Finance, a liquid staking protocol that maximizes users' yields through cutting-edge strategies such as MEV revenue sharing and leveraged liquid staking vaults.

Last, but certainly not least, Mario Nawfal’s Roundtable gave a shoutout to the Aptos chain for its lightning speed. The image is hard to read, but Aptos clocked in at 30.68 tx/s, 0.13s blocktime, and 0.9s finality - taking first place among other high-quality competing chains.

That’s all for this week on Aptos - make sure to show them some love! They’re a big reason this newsletter remains free.

Bitcoin Thoughts And Analysis

Bitcoin has blasted through the psychological $100,000 level and is now consolidating just above it with impressive strength. Price is currently trading around $103,200, holding firmly above previous resistance at $99,517 – a zone that had capped price action for months.

This breakout is technically clean: the move came on increased volume, with price trending well above both the 50-day and 200-day moving averages. RSI remains elevated but not extreme, reflecting strong momentum without immediate signs of exhaustion. That said, it's entering overbought territory – something worth watching, though not inherently bearish in a trending market.

The next key resistance levels are $106,099 and $109,358 – both historical rejection zones. Bulls will likely be eyeing those levels for profit-taking or potential cooling. On the downside, a retest of the $99,500–$100,000 area as support would be textbook bullish continuation if buyers step in.

Overall, this is a breakout worth respecting. The $100K psychological milestone has now been claimed – and that could change the market’s sentiment dramatically moving forward.

Altcoin Charts

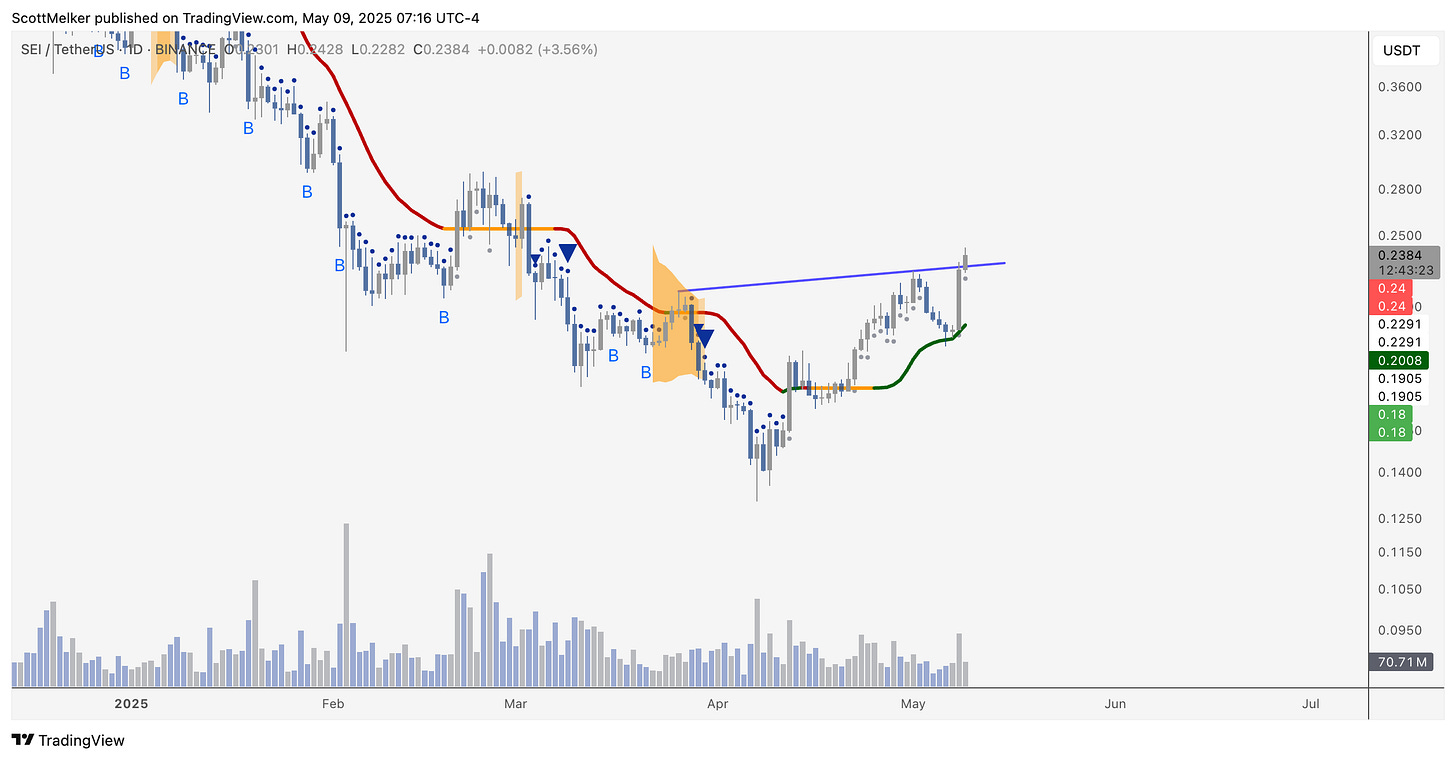

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

At the moment, we are seeing inverse head and shoulders break outs across the board on many altcoins. Just look for bottom signals and throw the dart. This could be the best risk/reward moment for altcoins we have seen in years.

Here are three examples, just from quickly flipping through charts - ROSE, NEAR and SEI.

We’re seeing one of those rare moments in crypto – Bitcoin is rising, and Bitcoin dominance is falling hard at the same time. That’s like spotting a unicorn renting a beachside apartment on Mars.

This move is largely being led by ETH, which I’ve been screaming was overdue for a breakout. To be fair, I’ve been early on that call... for a while now. But it’s finally happening.

ETH massively outpacing Bitcoin on a move like this is the clearest signal yet that an “alt season,” or something close to it, might be on the table. When ETH leads, the rest often follow. The rising tide lifts all boats – even the dead ones.

The dream scenario for altcoin holders? Bitcoin keeps climbing slowly or goes sideways, giving ETH and the broader altcoin market room to run. Confidence is returning, and for now, the rotation is real.

Stocks Rise On Easing Trade Tensions

US stock futures rose for a third straight day as easing global trade tensions fueled optimism. Nasdaq 100 and S&P 500 contracts edged higher, supported by strong earnings from companies like Microchip Technology, Pinterest, Cloudflare, and Lyft. European markets also rallied, with Germany’s DAX hitting a record high.

Markets cheered Thursday’s US-UK trade deal and signs of potential tariff relief in upcoming US-China negotiations. Investors are hopeful that a weekend meeting between the two nations will lead to de-escalation.

Bitcoin climbed to a three-month high and oil extended gains, while Treasuries held steady and the dollar dipped slightly. The European Central Bank signaled further rate cuts, contrasting with a more cautious Federal Reserve. Despite the rebound in US equities, Bank of America sees stronger opportunities abroad, with recent fund flows favoring international stocks over US assets.

Stocks

S&P 500 futures rose 0.3% as of 6:53 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.1249

The British pound rose 0.2% to $1.3271

The Japanese yen rose 0.4% to 145.29 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $103,333.89

Ether rose 7.5% to $2,350.07

Bonds

The yield on 10-year Treasuries was little changed at 4.38%

Germany’s 10-year yield advanced four basis points to 2.58%

Britain’s 10-year yield advanced four basis points to 4.59%

Commodities

West Texas Intermediate crude rose 2.1% to $61.14 a barrel

Spot gold rose 0.6% to $3,324.64 an ounce

Arizona’s Governor Capitulates

After Arizona Governor Katie Hobbs vetoed Senate Bill 1025 – the state’s original crypto reserve bill – backlash was swift and widespread. But that public pressure may have worked. In the wake of the veto, a competing (and less overtly “orange-pilled”) bill made its way to her desk and was ultimately signed into law – making Arizona the second state to pass crypto legislation.

House Bill 2749 allows the state to take custody of unclaimed crypto assets after three years of inactivity. These assets won’t be funded by taxpayers or state money. Instead, the law creates a Bitcoin and Digital Asset Reserve Fund where the state can stake those abandoned assets to earn rewards, or accept airdrops, with proceeds going directly into the fund.

“This law ensures Arizona doesn’t leave value sitting on the table and puts us in a position to lead the country in how we secure, manage, and ultimately benefit from abandoned digital currency,” said bill sponsor Jeff Weninger.

Sure, it’s not the same as allocating part of the state budget to buy Bitcoin outright – but it’s a significant first step.

Even more notable is what this may signal: Governor Hobbs’ approval of HB 2749 could pave the way for Senate Bill 1373, currently awaiting her signature. SB 1373 would allow Arizona Treasurer Kimberly Yee to allocate up to 10% of the state’s Budget Stabilization Fund into Bitcoin.

We’re not there yet – but we’re getting closer.

Coinbase Will Acquire Deribit

Holy cow. Coinbase is spending $2.9 billion to acquire Deribit, the world’s leading crypto options exchange. This deal is the largest M&A in crypto history. Before this, all the previous major deals were in the low to mid $1 billion range. This essentially doubles all the acquisitions we previously thought were massive.

From the Coinbase blog: “Today, we’re announcing a milestone transaction: Coinbase has entered into an agreement to acquire Deribit, the world's leading crypto options exchange with approximately $30 billion of current open interest [1]. This strategic acquisition significantly advances Coinbase’s derivatives business, establishing us as the premier global platform for crypto derivatives.”

“We’re excited to join forces with Coinbase to power a new era in global crypto derivatives. As the leading crypto options platform, we’ve built a strong, profitable business, and this acquisition will accelerate the foundation we laid while providing traders with even more opportunities across spot, futures, perpetuals, and options – all under one trusted brand. Together with Coinbase, we’re set to shape the future of the global crypto derivatives market.” - Deribit CEO Luuk Strijers.

Below are the four reasons Coinbase says it is “excited about the deal.”

“Creating the Most Comprehensive Institutional Derivatives Platform: Deribit is the global leader in crypto options. Deribit's robust options platform complements Coinbase’s rapidly growing US futures and international perpetual futures businesses, completing our derivatives offering.

Market Leadership & Immediate Scale: This acquisition makes Coinbase the global leader in crypto derivatives by open interest and options volume. [2] Deribit facilitated over $1 trillion in trading volume last year across key markets ex-US, with strong demand from institutional and advanced traders.

Durable, Diversified Revenues and Enhanced Profitability: Deribit will immediately enhance profitability and add diversity and durability to our trading revenues upon close.

Accelerating Our Global Derivatives Strategy: With Deribit’s strong presence and professional client base, Coinbase is making its most substantial move yet to accelerate our international growth strategy.”

The Trump Drama Never Ends

Remember that post from early March – the one that sent the entire crypto space spiraling? Turns out, the story behind it is even more chaotic than we thought.

According to new reporting from multiple outlets, including Politico, Trump was misled by a lobbyist with ties to Ripple Labs into promoting XRP as part of a proposed U.S. national cryptocurrency reserve. The March 2 post, which mentioned XRP, Solana, and Cardano, was reportedly drafted by a staffer for lobbyist Brian Ballard – whose firm represents Ripple.

At the time, Trump shared the post without realizing the connection. When he later found out about Ripple’s ties to Ballard, he was reportedly furious – telling associates that Ballard is “not welcome in anything anymore.”

The move sparked backlash, confusion, and plenty of speculation across crypto Twitter. Now we know why: it was never part of the plan. Just a bad play by a well-connected lobbyist – and a serious reminder that even in the highest levels of power, the signal-to-noise ratio can get messy.

What this means for the future of a digital asset stockpile – particularly one that includes anything other than Bitcoin – is anyone’s guess. But it probably doesn’t help the cause.

My best read for now: Bitcoin will continue to be accumulated through budget-neutral strategies, just as the administration has consistently affirmed. Altcoins, on the other hand, will likely remain sidelined – at least for the near term. That said, the door isn’t completely closed. Their moment may still come, just on a different timeline.

In other Trump news, the president made this remark yesterday during his UK trade announcement:

“You better go out and buy stock now. This country will be like a rocket ship that goes straight up. This is going to be numbers that nobody's ever seen before.”

No U.S. president in history has spoken about the stock market – or issued investment-style endorsements – as openly or aggressively as Donald Trump. It’s unprecedented. As an investor, I obviously hope he’s right. But as a citizen, it’s hard not to feel a bit uneasy.

What do you think?

Bitcoin & Ethereum Skyrocket! MASSIVE Crypto Rally Ahead?!

Edan Yago, core contributor to Bitcoin OS, and Scott Dykstra, co-founder of Space and Time, join me today to break down the latest crypto news and explore whether a new crypto rally is just around the corner!

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.