The Wolf Den #1192 - Bitcoin Doesn’t Care

If The Government Shuts Down

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Bitcoin Doesn’t Care

Bitcoin Thoughts And Analysis

Legacy Markets

Strategy’s Purchases Have Slowed

ChinaAMC Tests the Waters of Tokenization on Ethereum

Eric Trump Said, “Buy The Dips”

The Smartest Man Alive Is A Bitcoiner

This New York Financial Regulator Just Seppted Down

Bitcoin PUMPS Towards $124K ATHs! Breakout Beginning Or Bull Trap Incoming?

Bitcoin Doesn’t Care

Bitcoin doesn’t give a damn if the government shuts down.

Sure, the price could fall if risk-on assets take a hit - that’s always on the table - but fundamentally, a shutdown changes nothing for Bitcoin.

I figured this was the right time to dig into the topic, since speculation is already surfacing and misconceptions naturally follow.

I won’t name the source of this article. I enjoy their reporting, but I can imagine someone unfamiliar with how Bitcoin works reading the title - “What Happens to Bitcoin If the US Government Shuts Down?” - and thinking it spells trouble. As if a shutdown could somehow pause the blockchain, or switch Bitcoin off like a government service.

Of course, that’s not how it works. The Bitcoin network doesn’t depend on government funding, agencies, or political budgets. Blocks keep getting mined, transactions keep getting settled, and the protocol keeps running - shutdown or no shutdown. The only impact is indirect, through markets: if equities sell off and risk assets fall, Bitcoin’s price might get caught in the crosswinds. But the network itself? Untouched, unstoppable, and indifferent.

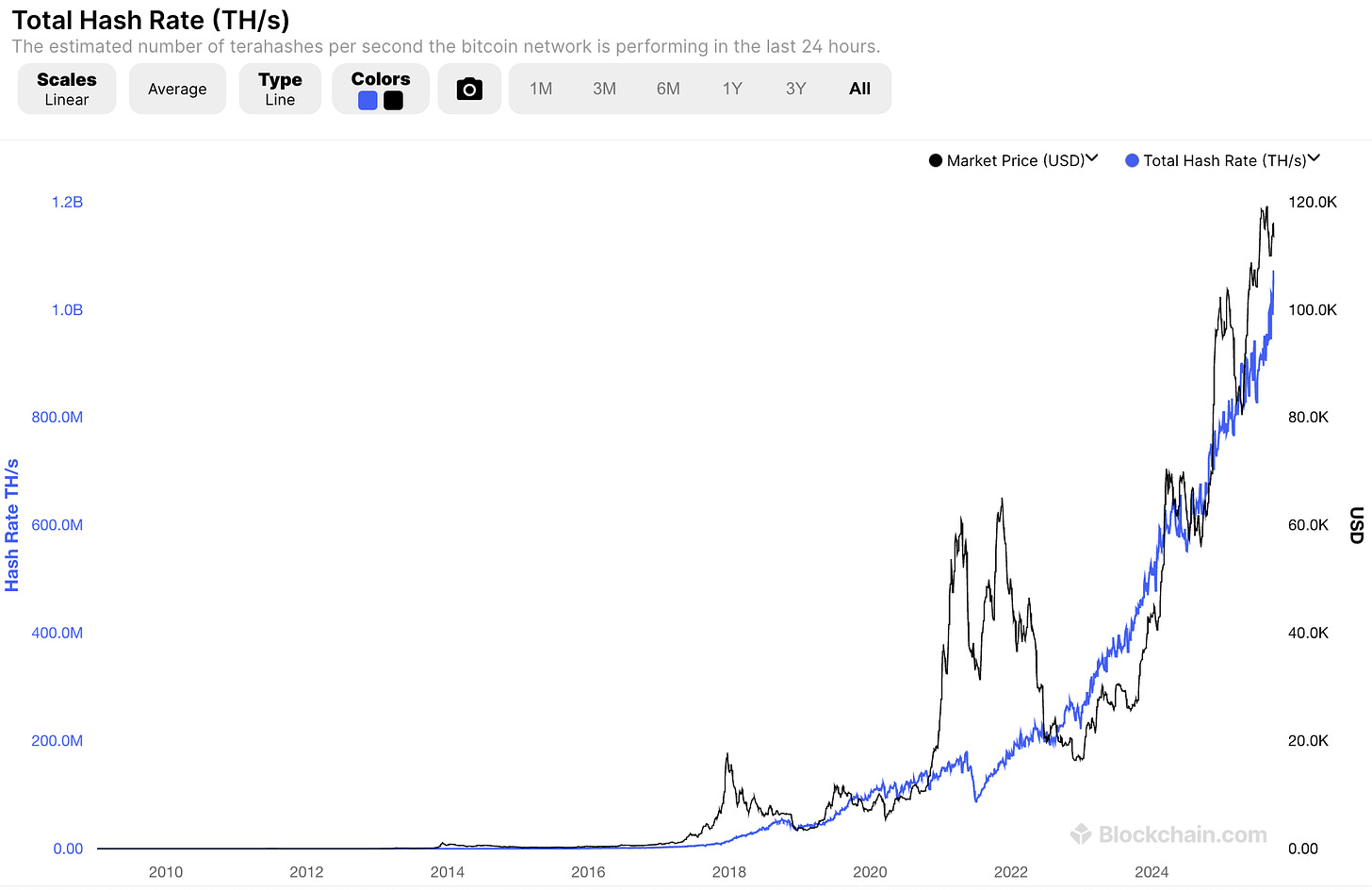

This can be evidenced by an exponentially growing hashrate and a practically perfect uptime.

As you can see in the chart, Bitcoin’s uptime record is nearly flawless - with the lone exception of a brief software bug in 2013 that caused a temporary chain split. That hiccup lasted only a few hours, was quickly resolved, and no funds were lost. Since then, the network has run without interruption, reinforcing Bitcoin’s reputation for unmatched reliability.

Try and find me another decentralized payments or financial network with this kind of record - no banks, no payment processors, no credit card companies, can come close.

The article’s main point is that the only real impact on Bitcoin comes from traders waiting for jobs data that influences Fed interest rate decisions. A price impact. If a shutdown delays or even disrupts that data, markets will react - but in the grand scheme of things, holders shouldn’t really care at all for the sake of their Bitcoin.

Now that we’ve cleared that up, I want to shift to how disruptive a government shutdown can really be - not to fearmonger, but to connect the dots on one of the key reasons Bitcoin matters. A budget standoff in Washington can freeze entire agencies, delay vital data, and throw millions of lives into limbo, exposing another way just how fragile centralized systems are.

The last time the U.S. government shut down was from December 2018 through January 2019. It dragged on for 35 days - the longest shutdown in history - and furloughed roughly 800,000 federal workers, forcing many to go without paychecks and pushing countless families into financial stress. Entire agencies ground to a halt, critical services were delayed, and the economy lost an estimated $11 billion, with about $3 billion of that gone for good.

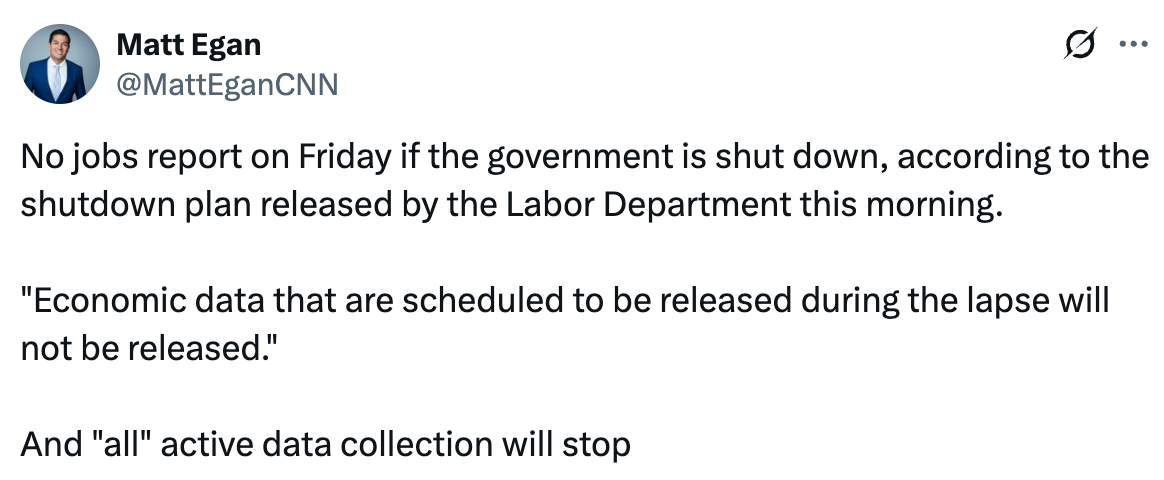

The impacts of any shutdown ripple across a wide range of industries and sectors - from air travel and housing to small business lending, agriculture, and government contracting. Even financial markets feel the strain, as money stops flowing through programs and payments, and delayed economic data leaves investors and the Fed flying blind.

Since this is a crypto newsletter, I’m going to hone in on that last part - how a shutdown can disrupt our financial system. When Washington screeches to a halt, so does the flow of money through countless centralized channels. Critical services like Social Security and veterans’ benefits face processing delays, small business loans through the SBA stop, and FHA and VA home loans stall, leaving buyers and sellers in limbo.

Imagine a federal worker who relies on direct deposit through their bank. During a shutdown, their paycheck is frozen - it simply doesn’t arrive. The bank still expects the mortgage payment on the first, the car loan payment mid-month, and the credit card bill at month’s end. With no paycheck coming in, the worker dips into savings or racks up debt, but after a few weeks, the cushion runs out. Late fees pile up, the credit score takes a hit, and the bank account that once felt automatic suddenly feels empty.

Or imagine you’re a first-time homebuyer. You’ve spent months saving for a down payment, finally found the right house, and secured pre-approval for an FHA loan. The seller has accepted your offer, closing is scheduled, and your bank is ready to wire the funds. Then the government shuts down. FHA staff are furloughed, loan approvals come to a halt, and your file sits untouched. Your bank can’t move forward without the federal sign-off, and as the days drag on, the seller grows impatient, and your deal teeters on collapse.

Perhaps more relatable, imagine you’re waiting on the approval of a crypto ETF. Your firm has spent months meeting with the SEC, and behind closed doors, you’ve been told the fund is nearly across the finish line. You’ve lined up hundreds of millions in investor demand, signaled your advisors to prepare, and institutions are ready to allocate - all that’s left is the signature. Then the government shuts down. This scenario could easily happen as soon as this week.

Last one - and again, something many of you can relate to. Maybe you’re building a DeFi project and working to register a new product, secure a no-action letter, or even just get clarity on whether your token is classified as a security. The last thing you want to deal with is regulatory red tape, but it’s unavoidable. You’ve filed the paperwork, hired compliance counsel, and are waiting on feedback to move forward. Then the government shuts down. You get the point.

A government shutdown does affect things like museums, state parks, and passport offices - services people don’t always feel day to day. But the more serious disruptions happen behind the scenes and can spill directly into our industry - one that, if given the choice, would rather avoid dealing with governments altogether.

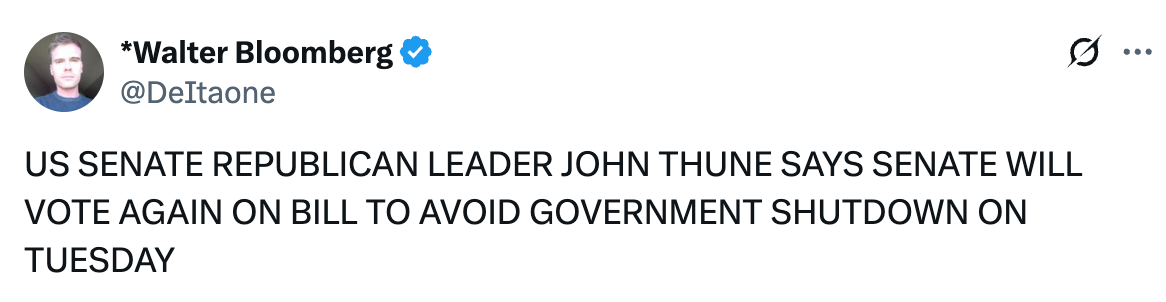

As of right now, a key vote is being held today, while congressional leaders from both parties meet with President Trump in a last-minute effort to avoid a government shutdown. As of late afternoon Monday, neither side appears ready to compromise, and without a funding deal by Tuesday night, many federal offices will close and nonessential workers will be furloughed, adding strain to employees and the broader economy.

This situation is changing by the hour and could be resolved by the time you read this later today.

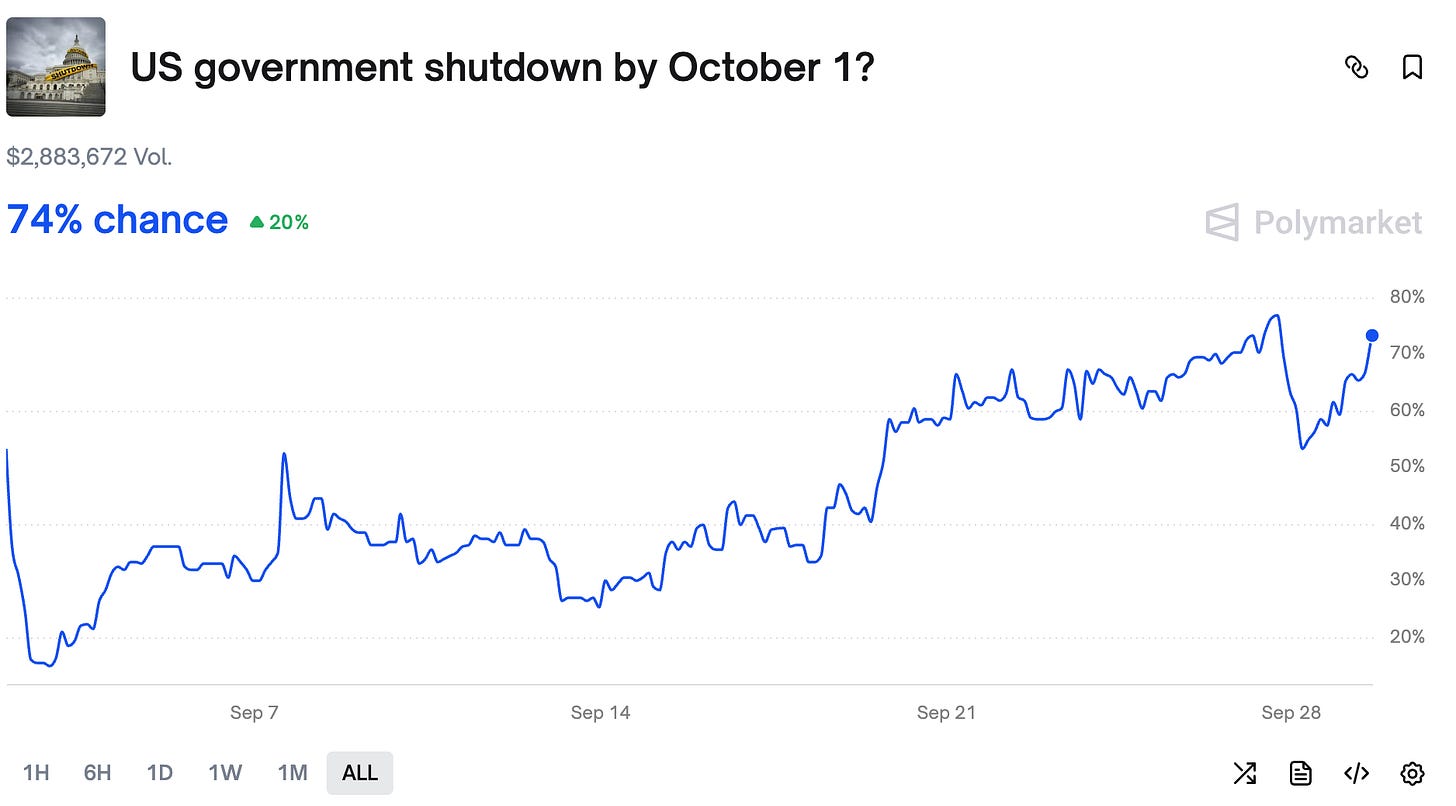

Polymarket is predicting there will be a shutdown.

My reason for writing this segment was to highlight the contrast: Bitcoin operates outside that machinery. It doesn’t shut down, doesn’t wait on political gridlock, and doesn’t need anyone’s approval to move value across the globe. That’s not just a feature - it’s the foundation of why Bitcoin is such a powerful financial tool.

Sure, if the government shuts down this week, Bitcoin’s short-term momentum could take a hit - but it makes no difference to the bull market or its long-term trajectory. It simply doesn’t matter. Buy Bitcoin and opt out of the dysfunction.

You’ll be glad you did.

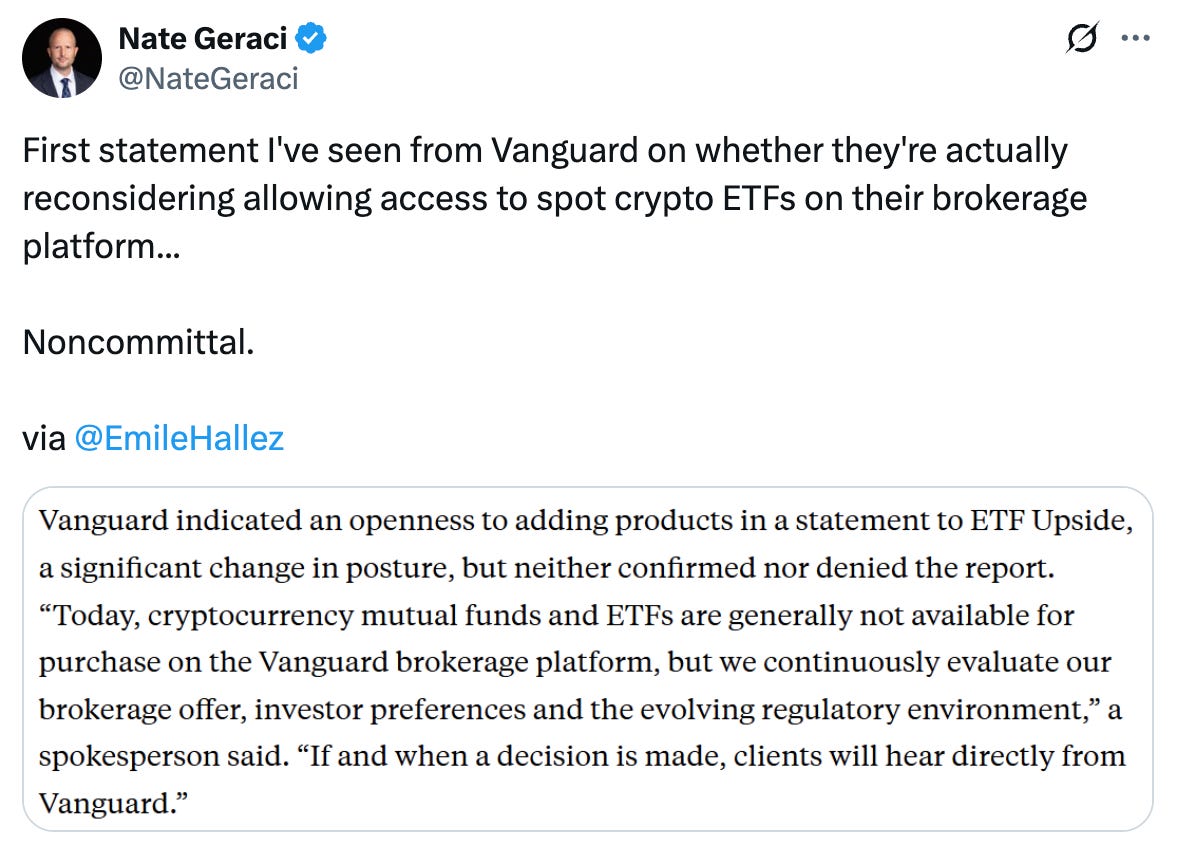

On another note, at the end of yesterday’s newsletter, I pointed out that Vanguard hadn’t made any official statements - and then, just a few hours after it went out, this news dropped in the afternoon.

It’s still vague, but it’s a world apart from: “You will never see a fund from Vanguard on Bitcoin.” An official announcement from Vanguard won’t take long.

Last thing, if you’re not already in my Telegram group, come hang out - it’s free to join.

Bitcoin Thoughts And Analysis

DAILY CHART

Bitcoin is struggling at the 50 MA and remains trapped in a range.

Legacy Markets

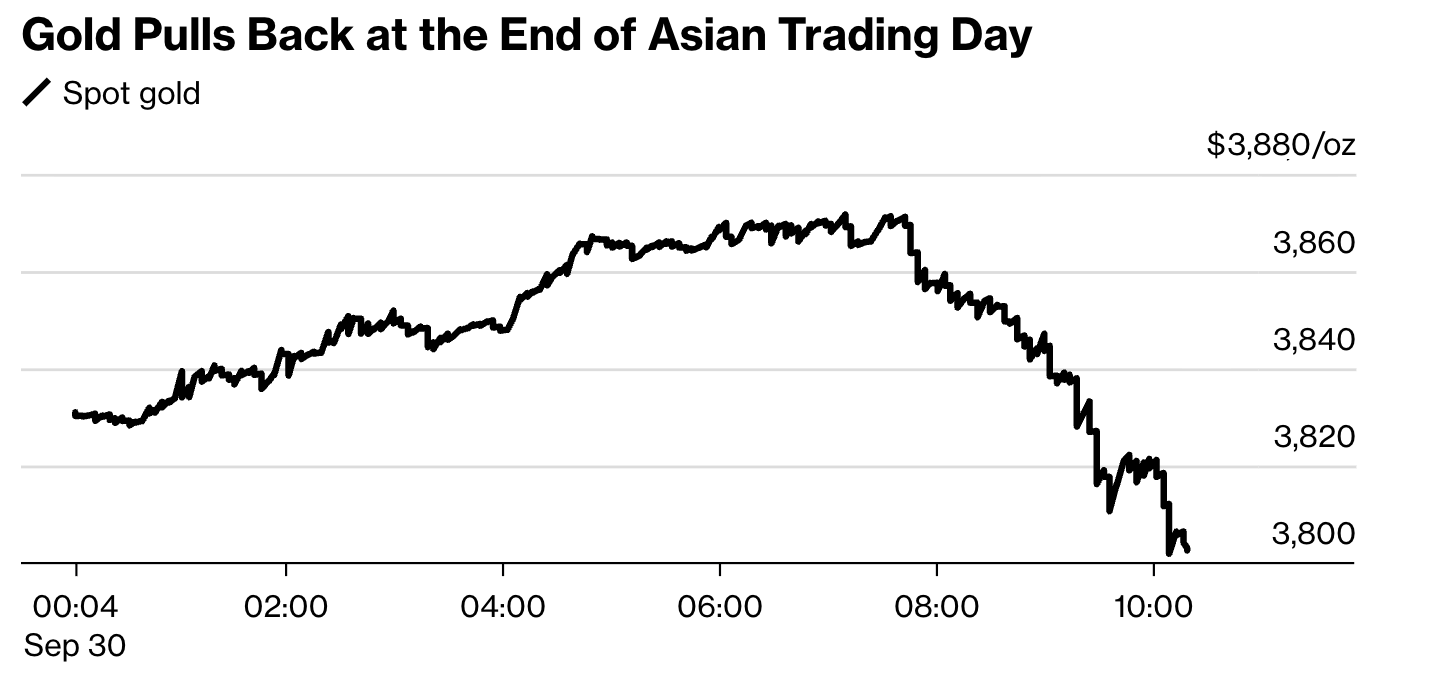

Stocks and the dollar slipped as fears of a U.S. government shutdown rippled through global markets, while gold pulled back after a record-setting run. After surging more than 10% in September on Fed rate-cut bets and safe-haven demand, gold eased to around $3,800 an ounce, with traders pointing to Chinese investors reducing exposure ahead of Golden Week.

U.S. and European equities softened, BHP shares fell on news that China’s state buyer halted iron ore purchases, and Treasuries extended a three-quarter winning streak. The S&P 500 is still on track for its best September in 15 years, powered by AI enthusiasm, strong earnings, and easier policy expectations.

Uncertainty looms over this week’s U.S. labor data as the budget standoff threatens to delay Friday’s payrolls report. Fed officials continue to flag a cooling labor market alongside stubborn inflation, complicating the policy path. UBS urged investors to look beyond shutdown fears, favoring quality fixed income.

In corporate news, Exxon plans to cut 2,000 jobs, UBS blasted Switzerland’s proposed banking reforms, Jefferies posted record Q3 revenue, and Boeing has begun work on a new aircraft to eventually replace the 737 Max.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:29 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 fell 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.1745

The British pound was little changed at $1.3440

The Japanese yen rose 0.4% to 147.94 per dollar

Cryptocurrencies

Bitcoin fell 1.3% to $112,889.08

Ether fell 1.9% to $4,146.92

Bonds

The yield on 10-year Treasuries declined one basis point to 4.13%

Germany’s 10-year yield was little changed at 2.71%

Britain’s 10-year yield was little changed at 4.70%

Commodities

West Texas Intermediate crude fell 1.1% to $62.74 a barrel

Spot gold fell 0.8% to $3,804 an ounce

Strategy’s Purchases Have Slowed

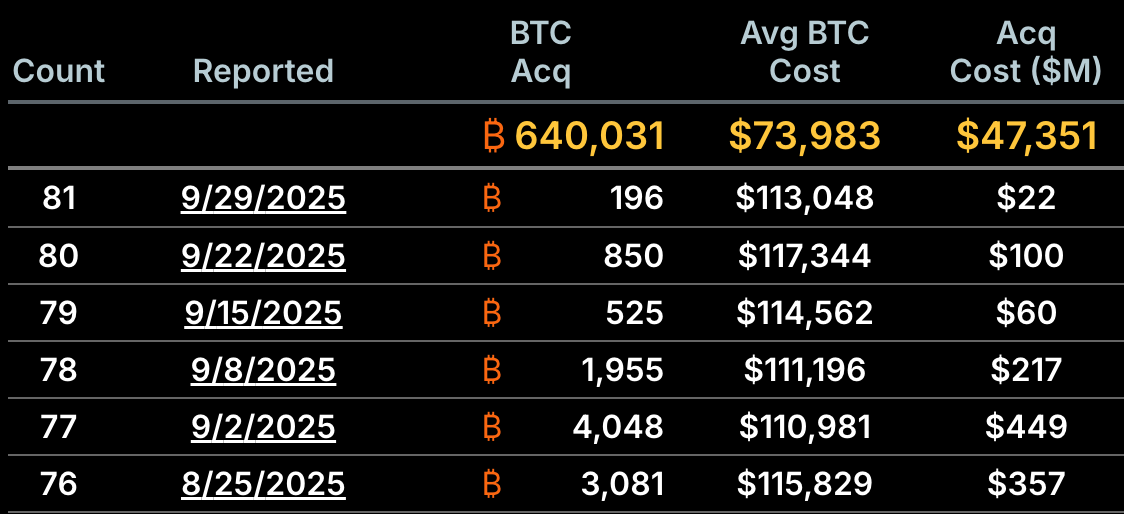

As the image above shows, Saylor’s purchases have slowed significantly in recent weeks - falling from the low thousands of Bitcoin to just the low hundreds. I can’t say with absolute certainty, but it seems highly likely this slowdown is tied directly to the recent price decline.

On July 29, 2025, Saylor made one of his largest purchases - 21,021 BTC - with Bitcoin trading around $118,000 after hitting fresh all-time highs the week before. Historical data shows that the higher Bitcoin climbs, the more aggressively Strategy tends to buy. While he has occasionally taken advantage of dips, his biggest moves seem to come when momentum is strongest.

If Bitcoin soon gains momentum again, we can expect him to be eager to pull the trigger and return to his usual purchase sizes.

ChinaAMC Tests the Waters of Tokenization on Ethereum

China Asset Management Company (ChinaAMC), with over $400B in assets under management, has launched a tokenized money market fund on Ethereum. The fund - called CUMIU - invests in short-term deposits and high-quality money market instruments, charges just a 0.05% fee, and has already deployed $502M, making it the 11th-largest tokenized product.

The rollout remains limited to just two holders, allowing ChinaAMC to test blockchain infrastructure and compliance amid cautious Chinese regulatory oversight. While regulators recently urged brokerages in Hong Kong to slow RWA initiatives, ChinaAMC’s move highlights the broader momentum in tokenization, with $30B of RWAs now on-chain and adoption continuing to grow worldwide.

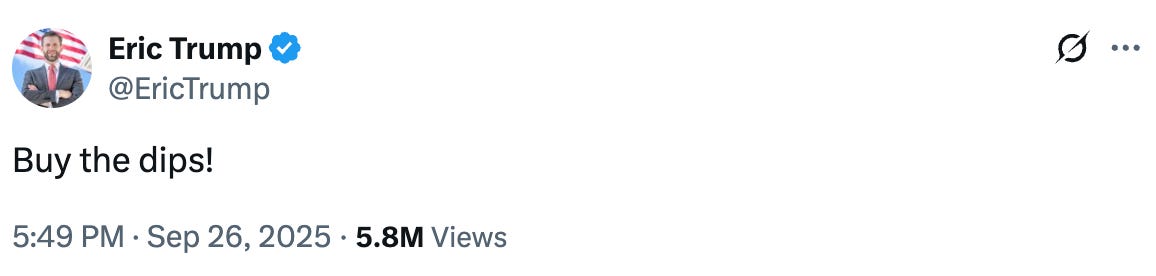

Eric Trump Said, “Buy The Dips.”

Jim Cramer said it too, so I’m not sure if that means these two suggestions cancel each other out, or if they are now supercharged.

I give no credibility to Jim Cramer because of his crypto track record, but at least with Eric, the last two times he said to buy were back in February and August - both at levels lower than today, though also before some market pullbacks. Given Eric isn’t a trader, I have to agree with his sentiment: dips are for buying, even if the timing isn’t perfect.

Bitcoin’s time is coming.

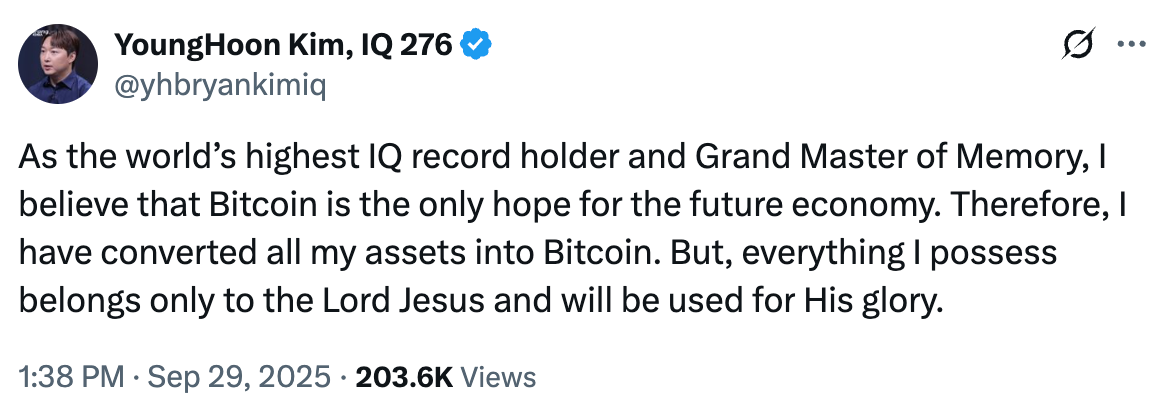

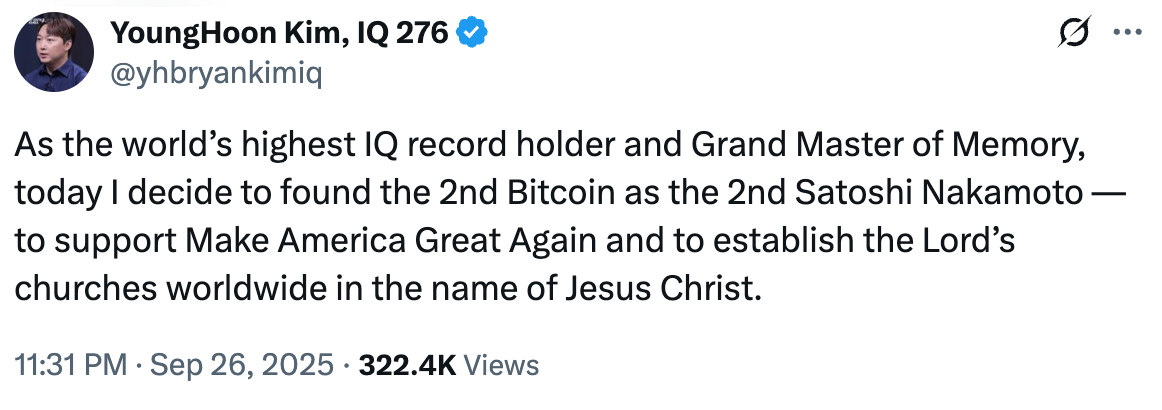

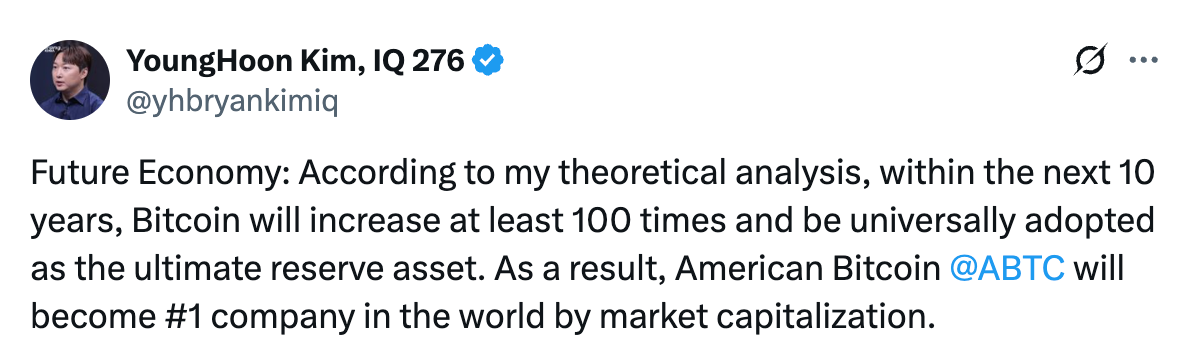

The Smartest Man Alive Is A Bitcoiner

There’s a lot packed into these posts, and honestly, half of it goes over my head. But the world’s highest IQ record holder is a Bitcoiner - and that has to count for something.

I’m not exactly sure what he means by a “second Bitcoin,” but I do like that he sees Bitcoin at least 100x higher - though that may be pretty disastrous for the world.

This New York Financial Regulator Just Seppted Down

Adrienne Harris is stepping down after four years as superintendent of the New York Department of Financial Services, the powerful regulator of Wall Street banks, insurers, and crypto firms. She will be succeeded on Oct. 18 by Kaitlin Asrow, who has led NYDFS’s crypto licensing and supervision efforts and built one of the largest digital asset regulatory teams globally.

Under Harris, the NYDFS shaped U.S. stablecoin policy and reviewed nearly every federal crypto proposal, giving New York major influence over national rules. She also emphasized proactive engagement with regulators, warning the industry to “never surprise your regulator.” Before leaving, she pushed for stronger U.S.–UK coordination on digital assets, highlighting cross-border frameworks like passporting.

Harris leaves behind a mixed reputation in crypto: some respect her for providing structure and credibility, while others argue New York’s regime remains one of the most burdensome and stifling for innovation. I’ll share more on Kaitlin Asrow soon if I find details that are relevant to all of you.

Bitcoin PUMPS Towards $124K ATHs! Breakout Beginning Or Bull Trap Incoming?

Bitcoin has bounced back hard above $112K, sparking fresh debate over whether the bull run is alive and well - or if this is just another trap before more downside. Analysts are split as traders weigh heavy liquidations, macro uncertainty, and the upcoming Fed decision. In this video, we break down Bitcoin’s latest price action, why some believe the bull market isn’t over, and the key levels to watch as BTC tests its momentum.

🎙 Guests

Dave Weisberger – CEO of CoinRoutes

James Lavish – CIO & Macro Strategist

Mike McGlone – Senior Commodity Strategist at Bloomberg

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.