Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public had released our Bitcoin Yield Algorithm. Spot $BTC only. A product that is a first of its kind.

+20.3% APY

+25.77% CAGR

NO leverage. NO lending. You keep custody control of your Bitcoin at all times. Our 4 Year Case Study showcases Bitcoin volatility being the perfect vehicle to produce cash yield without giving up custody.

We often get asked “but do your strategies outperform buy and hold?” The answer is a resounding Yes!

Buy and Hold: 11.18% CAGR and 0% APY.

Oh, and a reminder that our Bitcoin Algorithm is still FREE!

In This Issue:

Buffett Out, Bitcoin In

Markets Slip As Trade War Impact Becomes Clear

Arizona Governor Vetoes The Bitcoin Bill

The SEC Moves To Embrace Tokenization

Ripple Tries To Buy Circle

Bitcoin Is About To Explode To $140,000 - Here’s Why! | Macro Monday

Buffett Out, Bitcoin In

Taking a break from the screen and news cycle to network and capture content at TOKEN2049 was a refreshing change of pace – but I’m glad to be back and fully focused on all of you. I did my best to keep up with the headlines this past week because a lot has happened. I kept a running list of everything I missed (at least the items worth sharing) and included it either here in the intro or down in the news section.

This newsletter should bring us completely up to speed.

Warren Buffett’s Surprise Retirement

To kick things off, we have to start with the legend himself: Warren Buffett.

At Berkshire Hathaway’s annual shareholder meeting in Omaha on Saturday, Buffett – still sharp at 94 – announced he’ll retire at the end of the year after leading the company for six decades. Vice Chairman Greg Abel is set to take over as CEO. The announcement came as a surprise to most, as Buffett had only shared his decision with his children. True to form, he delivered the moment with characteristic ease and humor. When the crowd of roughly 40,000 gave him a standing ovation, he joked, “The enthusiasm shown by that response could be interpreted in two ways.”

Buffett reassured shareholders that he isn’t going anywhere entirely. He emphasized that he has no plans to sell his shares and intends to remain involved in some capacity. “I could be helpful, I believe, in certain respects, if we ran into periods of great opportunity or anything,” he said – hinting that his wisdom will still be within reach.

On the news, Berkshire shares fell as much as 6.8% at the start of Monday trading, but have since recovered a percentage point. I imagine the stock will continue on as normal as the torch is passed.

One especially noteworthy detail: Berkshire Hathaway is now sitting on its largest cash position ever – $347.7 billion. That number will likely keep climbing as the value of cash continues to erode, but more importantly, it signals how Buffett sees the market. It doesn’t sound like he’s forecasting a crash – but he clearly believes attractive opportunities are coming. As for Greg Abel, he’s been silent on crypto, which isn’t surprising.

Goldman Sachs Steps Deeper Into Digital Assets

Next up is news out of Goldman Sachs, which ties in with other major institutional players like Morgan Stanley and Charles Schwab – both of which I’ve been covering over the past couple of weeks.

Goldman plans to enable 24/7 trading of tokenized Treasuries and money market fund shares, reflecting rising client demand for on-chain financial products. Mathew McDermott, the bank’s head of digital assets, shared the news at TOKEN2049 and said the firm aims to integrate traditional assets like collateral into blockchain infrastructure.

At present, Goldman already operates a crypto derivatives desk and is preparing three tokenization projects for 2025 – including its first U.S. fund tokenization and a euro-denominated digital bond.

This story follows recent announcements from Charles Schwab and Morgan Stanley. Schwab revealed plans to launch spot Bitcoin trading for clients by April 2026, while Morgan Stanley is preparing to roll out crypto trading on its E*Trade platform in the same timeframe.

TradFi is clearly gearing up to meet growing client demand – and with that comes the potential for a significant influx of capital into the industry. For crypto-native companies, this should be a wake-up call: they have about a year to keep innovating before the financial giants fully arrive.

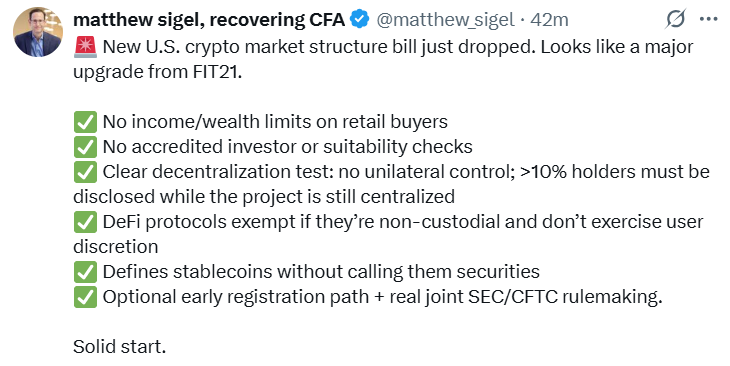

New Crypto Market Structure Bill

Next: a newly released crypto market structure bill dropped yesterday and is being positioned as the successor to FIT21.

For context, here’s a brief explainer of the FIT21 bill:

The Financial Innovation and Technology for the 21st Century Act (FIT21) provides the robust, time-tested consumer protections and regulatory clarity needed to let digital asset innovation flourish in the United States.

As for the new bill, the House Financial Services Committee and the House Agriculture Committee have just released a 212-page draft, which will be discussed today by both digital asset subcommittees. As discussions get underway and the details take shape, I’ll circle back with updates. It’s still early in its lifecycle, so I won’t dive too deep just yet – but it’s a promising step toward positive regulation.

Strategy Keeps Buying – But It’s Getting Competitive

Strategy also deserves a quick mention for continuing its Monday Bitcoin purchases – now for the fourth consecutive week.

An interesting dynamic is beginning to unfold: Michael Saylor stands to benefit from Twenty One Capital’s Bitcoin buying – which pushes the price higher – but at the same time, they’re also scooping up supply that Strategy might have otherwise acquired. Strategy may still be the dominant player within a year or two, but it’s now facing real competition from firms built specifically to accumulate Bitcoin.

And of course, we’re still waiting on confirmation of GameStop’s rumored upcoming purchase.

Strategic Bitcoin Reserve Hits a Key Milestone

Last on the agenda: yesterday marked a key milestone – the 60-day mark since the March 6 executive order titled “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.” This date, set by Trump’s directive, is expected to trigger the next phase of action or guidance tied to the order.

I asked ChatGPT if it’s normal for agencies to miss these kinds of deadlines, and here’s what it said:

“Yes, it’s actually quite common for federal agencies like the Treasury to miss or delay internal deadlines tied to executive orders – especially if the order was issued relatively recently or under a new administration. These deadlines are often more like guidelines; while they’re intended to spur timely action, the actual delivery of reports, frameworks, or updates can be delayed by bureaucratic processes, interagency coordination, or shifting political priorities.”

So I’m confident we’ll see something in the days ahead – or you may have already come across updates by the time you’re reading this newsletter.

Trump’s executive order is the biggest narrative the industry has this cycle. As a businessman first, Trump understands there’s no need to rush with crypto. Panic-driven decisions rarely lead to sustainable success. Hopefully, he’s taking a more measured approach – one that positions the industry for long-term growth. I imagine there are a lot of conversations happening behind closed doors that we’re not yet privy to.

That wraps up all the news – and it’s great to be back. To everyone I met at TOKEN2049 who stopped to say hi, it was an absolute pleasure.

I’m more motivated than ever for the rest of this bull cycle – and for number go up.

It’s going to happen. Just be patient.

Markets Slip As Trade War Impact Becomes Clear

US stock futures fell on Tuesday as renewed fears about trade war fallout weighed on global markets. S&P 500 and Nasdaq 100 contracts declined 0.7% and 0.9%, respectively. Palantir dropped 8% after disappointing earnings, while Ford slumped 2.6% after pulling guidance and warning tariffs could cost it $2.5 billion in 2025. Tesla and Meta led declines among major tech names.

In Europe, the Stoxx 600 snapped a 10-day winning streak, pressured by corporate warnings and political uncertainty in Germany after chancellor-designate Friedrich Merz failed to secure parliamentary backing. Philips and Vestas also flagged tariff risks.

Investors are retreating from risk as optimism from recent US tariff concessions fades. Analysts expect long-term damage to earnings, even if trade talks improve. Meanwhile, expectations for aggressive Fed rate cuts are easing. The central bank is now forecast to begin cuts in July, down from earlier predictions of four cuts this year.

The dollar steadied but remains under pressure, with traders adding to bearish bets. Currency volatility persists in Asia, while the Bank of England and European Central Bank are both expected to cut rates this week in response to trade shocks.

Stocks

S&P 500 futures fell 0.7% as of 6:30 a.m. New York time

Nasdaq 100 futures fell 0.9%

Futures on the Dow Jones Industrial Average fell 0.6%

The Stoxx Europe 600 fell 0.6%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.1314

The British pound rose 0.2% to $1.3327

The Japanese yen rose 0.4% to 143.19 per dollar

Cryptocurrencies

Bitcoin was little changed at $94,207.35

Ether fell 0.8% to $1,793.72

Bonds

The yield on 10-year Treasuries was little changed at 4.35%

Germany’s 10-year yield advanced two basis points to 2.53%

Britain’s 10-year yield advanced four basis points to 4.55%

Commodities

West Texas Intermediate crude rose 2.7% to $58.67 a barrel

Spot gold rose 1.4% to $3,379.35 an ounce

Arizona Governor Vetoes The Bitcoin Bill

Last week, I shared hopeful news that Arizona’s Bitcoin bill, SB1025, had officially passed both the House and Senate – putting it just one signature away from becoming law.

Unfortunately, that hope has been dashed. Governor Katie Hobbs officially vetoed the bill, killing its momentum for now. To have another shot, it would need to be reintroduced in either chamber.

“Today, I vetoed Senate Bill 1025. The Arizona State Retirement System is one of the strongest in the nation because it makes sound and informed investments. Arizonans’ retirement funds are not the place for the state to try untested investments like virtual currencies.”

– Governor Katie Hobbs

The irony? Arizona’s state retirement system already holds shares of MicroStrategy – so much for avoiding Bitcoin exposure.

Still, there’s a sliver of hope. Two additional crypto-related bills are still awaiting the governor’s decision. The one with the better odds of being signed, HB2749, is admittedly less orange-pilled. It would allow crypto exchanges to transfer unclaimed digital assets to the state in their native form, rather than liquidating them. The state could then stake these assets and build a reserve that grows passively over time.

It’s not as bold as outright Bitcoin purchases – but it’s still a meaningful step forward.

The Bitcoin community, unsurprisingly, didn’t hold back:

“Politicians don’t understand that Bitcoin doesn’t need Arizona. Arizona needs Bitcoin.”

– Wendy Rogers, SB1025 co-sponsor

“This will age poorly.”

– Jameson Lopp

“Arizona needs a new governor.”

– Rob Schneider

“If she can’t outperform Bitcoin, she must buy it.”

– Anthony Pompliano

Considering the governor’s stance, the odds of any crypto-related bill being signed look increasingly slim – but we’ll keep watching.

The SEC Moves To Embrace Tokenization

The SEC has set aside an entire day for a roundtable featuring top participants from both TradFi and DeFi. The two main topics on the agenda are “Evolution of Finance: Capital Markets 2.0” and “The Future of Tokenization.” Panelists for the tokenization segment include representatives from American University’s Washington College of Law, Chia Network, Robinhood, Canton, Maple Finance, Securitize, and Blockchain Capital.

As soon as the SEC signals its full support for this technology, all bets are off.

In other brief SEC news, the agency has issued another delay - this time on the Litecoin spot ETF. While most analysts had viewed it as the most likely to gain approval, the decision has now been pushed back. This should be the last SEC delay for a while. The next deadline for the LTC spot ETF is in 60 days.

Ripple Tries To Buy Circle

Technically, this story broke last week, but it appears to be ongoing – so it’s still worth a quick mention.

Ripple reportedly made a $5 billion offer to acquire Circle at its expected IPO valuation, which was rejected. Then, rumors began circulating that Ripple came back with a new offer: $20 billion. That figure feels wildly inflated. It wouldn’t make much sense for Ripple to quadruple its original bid – especially considering that while Circle oversees $61 billion in collateral, that amount represents reserves backing USDC, not funds Circle actually owns.

I’m all for M&A activity in the crypto space – but personally, I’d rather see these two companies remain independent and for Circle to finally follow through on its long-standing IPO ambitions.

Bitcoin Is About To Explode To $140,000 - Here’s Why! | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.