The Wolf Den #1186 - Deal Frenzy: Crypto’s Biggest Players Are Making Moves

Buying Bitcoin And Solana Is The New "Strategy."

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Deal Frenzy: Crypto’s Biggest Players Are Making Moves

Bitcoin Thoughts And Analysis

Altcoin Charts

Tariff Tensions Freeze Stocks As Dollar Dips

Bitcoin Passed Silver And Alphabet Again… Briefly

TRUMP Token Has New Utility

The SEC Met With El Salvador To Discuss Crypto

Russia Is Launching A Crypto Exchange

Deal Frenzy: Crypto’s Biggest Players Are Making Moves

Is it all finally happening?

Gold looks like it is topping…

Trump confirmed he isn’t interested in firing Jerome Powell – at least for now.

“I have no intention of firing him. None whatsoever. Never did. The press runs away with things. I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates. It’s a perfect time to lower interest rates. If he doesn’t, is it the end? Nooo. It’s not, but it would be good timing. It could have taken place earlier. I have no intention of firing him.”

The China trade war is still a mess – but reading between the lines, it seems to be gradually sorting itself out.

And the end result for Bitcoin? Good news, stacked on top of more good news. Here’s the scoop:

A new superpower has just emerged in the crypto space – an alliance between four titans: Tether, Cantor, Bitfinex, and SoftBank. The mission is clear and unmistakable: accumulate Bitcoin. A lot of f***ing Bitcoin – excuse my French.

Before we get into the details, let’s meet the players:

Tether – The stablecoin issuer behind USDT, with a $145B market cap and over 100,000 BTC in its investment and treasury strategy.

Cantor Fitzgerald – I just did a deep dive on Cantor earlier this week. Howard Lutnick, the current U.S. Secretary of Commerce, was the firm’s longtime CEO. Cantor is an iconic global financial institution that’s steadily increasing its digital asset exposure.

Bitfinex – One of the OGs. The 11th largest centralized crypto spot exchange and 12th largest derivatives exchange. Bitfinex has been around since 2012 and remains a trusted pillar in the space.

SoftBank – The global tech investment juggernaut behind the Vision Fund, known for backing the world’s biggest startups. It’s now making bold moves in crypto.

Here’s the summary from the original Financial Times article:

Brandon Lutnick, son of Howard and chair of the brokerage, is joining forces with SoftBank, Tether, and Bitfinex to launch a Bitcoin acquisition vehicle called Twenty One. But this isn’t just any BTC play – this is a multibillion-dollar initiative kicking off with 42,000 BTC, putting it right behind Strategy (MicroStrategy) and Marathon Digital (MARA) on the Bitcoin balance sheet leaderboard.

And it gets better – Twenty One Capital is going public via a SPAC merger with Cantor Equity Partners, and the CEO of this new venture? None other than Jack Mallers.

According to the FT: “The deal values the vehicle at $3.6bn including debt, based on a bitcoin price of $85,000,” Twenty One Capital said Wednesday.

Here’s what each partner is contributing:

– Tether: at least $1.5B in BTC

– SoftBank: $900M in BTC (so yes – they already owned BTC and kept it quiet or have been buying)

– Bitfinex: $600M in BTC

– Cantor SPAC: raising a $385M convertible bond and a separate $200M private placement to acquire even more BTC

The company plans to trade under the ticker $XXI.

One more thing: we now know that SoftBank was one of the two mystery corporations my friend Andrew Parish has been teasing for weeks. Mystery solved – and it’s massive.

I can’t stress this part enough.

For those interested in learning more about SoftBank, Jeff Park from Bitwise penned a brief memo on the bank that I encourage all of you to read

In other news that fits today’s theme of deals, deals, and more deals – SOL Strategies has entered into an agreement with ATW Partners, whose mission is equally clear: acquire and stake SOL.

Full disclosure: I had no idea SOL Strategies even existed until this news broke – and I’m not sure it was widely known either. Before diving into the press release, I did a bit of digging into what SOL Strategies actually is. Here are the key takeaways from their “About Us” page:

“SOL Strategies is the only publicly-traded company offering exposure to Solana staking. First publicly listed on the Canadian Securities Exchange (CSE) in 2018 under the ticker $HODL, Cypherpunk Holdings was a trailblazer in blockchain innovation and digital asset investment, originally focusing on privacy-focused cryptocurrencies and technology. Now SOL Strategies, we are dedicated to investing in the Solana ecosystem, managing staking validators, and driving value through strategic engagement in decentralized finance.”

Now for the news.

SOL Strategies has secured a $500 million convertible note facility from ATW Partners – an investor – in a first-of-its-kind structure for the digital asset space. The funding is entirely allocated to purchasing SOL tokens, which the company will stake using its own validators on the Solana network. Staking allows SOL Strategies to earn yield, and a portion of that yield – up to 85% – will be used to pay interest to ATW, not in cash, but directly in SOL tokens. The first $20 million tranche of this facility is expected to close around May 1, with the remaining $480 million available through future drawdowns, subject to certain conditions.

If you’re following along so far, this approach bears quite a bit of similarity to what Strategy has done with Bitcoin. Like Strategy, SOL Strategies is using large amounts of capital to acquire and hold a single crypto asset – in this case, SOL. However, there are some key differences. While Strategy simply buys and holds Bitcoin as a treasury reserve asset, SOL Strategies is not only acquiring SOL but actively participating in the network by staking it and running validators.

“This is the largest financing facility of its kind in the Solana ecosystem – and the first ever directly tied to staking yield. By securing up to half a billion dollars in strategic capital, we are doubling down on our conviction in Solana and our commitment to being the leading institutional staking platform. Every dollar deployed is immediately yield-generating, and accretive to both our balance sheet and our validator business. This structure is not only innovative – it is highly scalable.”

– Leah Wald, CEO of SOL Strategies

Imagine if one of the defining narratives of 2025 is the rise of firms like 21 Capital and SOL Strategies – companies modeled after Strategy, with a singular focus on financially engineering their way into accumulating an ever-growing share of digital assets. This could play out in one of two ways: either a disastrous unraveling under the weight of excessive leverage, or striking the perfect balance and fast-tracking the adoption and accumulation of scarce digital assets. It’s a fine line, and I imagine it can be crossed in either direction if lessons from previous cycles aren’t applied.

As an outside spectator, I fully support the efforts of these companies. I’m excited to see what Strategy, 21 Capital, and SOL Strategies – and likely others – grow into. Maybe they become neo-futuristic banks for global Bitcoin demand, on-chain asset managers, or digital-native bridges between traditional finance and crypto.

The sky is the limit – and a lot of Bitcoin and Solana will be purchased. If anything, yesterday’s news is further proof that Strategy’s model is working, and Saylor is a genius.

Imitation truly is the highest form of flattery.

Bitcoin Thoughts And Analysis

Bitcoin continues to impress on the daily chart.

After breaking through both the long-term descending trendline and the key resistance at $88,804, price has now clearly confirmed a higher high – officially shifting the market structure back to bullish. It’s also holding well above both the 50-day and 200-day moving averages, showing strong momentum behind the move.

The breakout came on a surge of volume, validating the move and signaling genuine interest from buyers. While we could see a short-term pause or retest of the $88,804 level, the current strength suggests bulls are back in control – at least for now.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

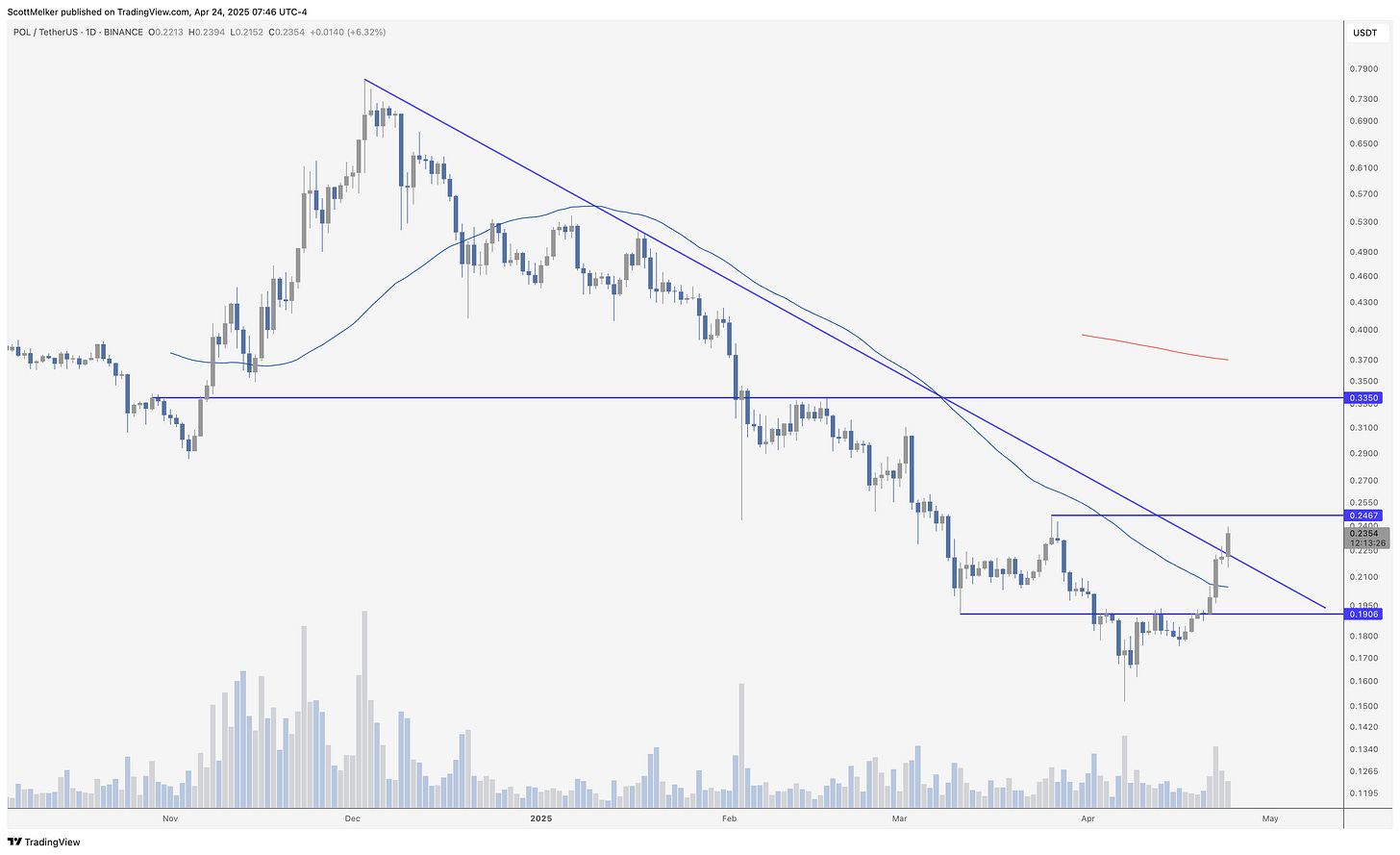

POL / USDT

I shared this chart on X two days ago…

Here is the chart now.

It just dropped a strong technical signal.

After months of being locked in a brutal downtrend, price has officially broken above descending resistance for the first time since November. This is the first real structural shift to the upside we’ve seen in a while, and it comes with solid volume confirmation.

Not only that – the breakout pushed through the 50 MA, suggesting a possible trend reversal.

Cautious optimism is warranted – $POL still has a long road to reclaim previous highs, and past rallies have been short-lived. But from a pure technical perspective, this is the cleanest setup bulls have seen in months.

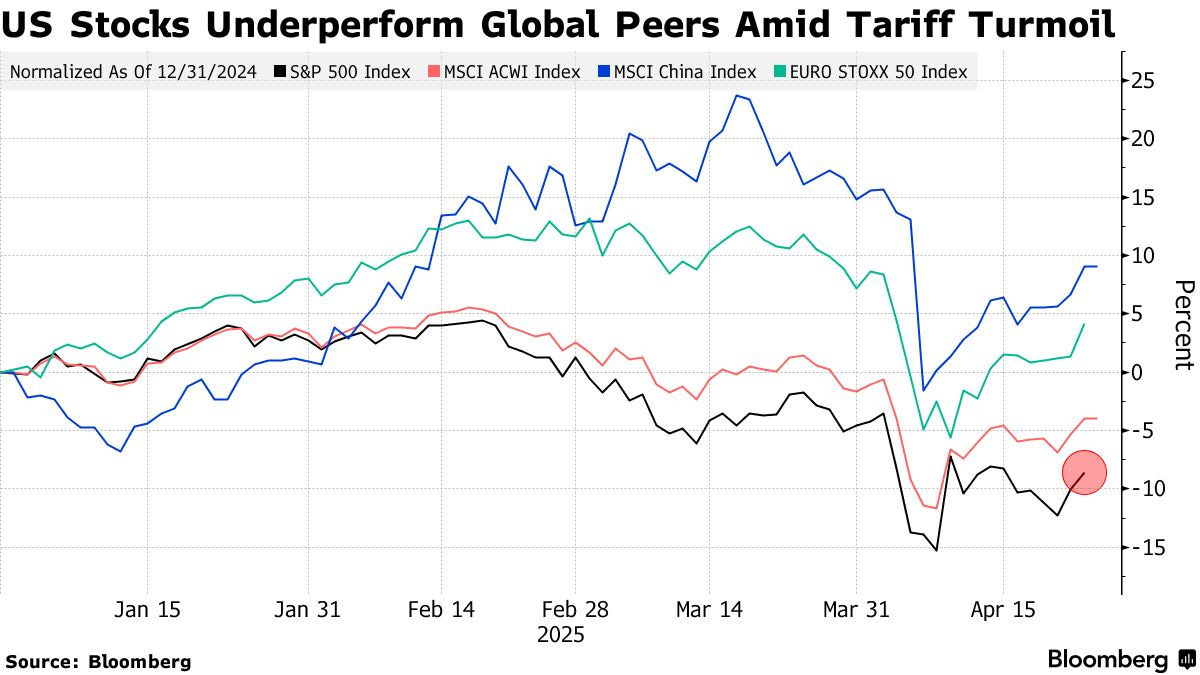

Tariff Tensions Freeze Stocks As Dollar Dips

Stocks paused Thursday as hopes for swift progress in the US-China trade standoff faded. S&P 500 futures fluctuated after two days of gains, while the dollar weakened and Treasuries climbed, as investors sought havens amid renewed uncertainty around President Trump’s tariff agenda.

China maintained a firm stance, demanding the US revoke all unilateral tariffs before trade talks resume. Trump, meanwhile, suggested a new tariff rate on Chinese imports could come within weeks — though Treasury Secretary Scott Bessent warned that a full deal might take years. The conflicting signals left markets struggling for direction.

Safe-haven demand returned, lifting gold, the yen, and the Swiss franc. European equities pared earlier losses, while IBM shares slumped 8% premarket after disappointing earnings. Unilever rose on stronger-than-expected sales, but BNP Paribas slipped as profits fell.

Strategists at Deutsche Bank downgraded their S&P 500 year-end target by 12%, citing a disproportionate tariff burden on US companies. The team cut its 2025 EPS forecast from $282 to $240 — and warned consensus expectations are still too high.

Market sentiment remains whipsawed by inconsistent messaging from Washington, keeping traders on edge. “The narrative is all over the place,” said UBP’s Peter Kinsella. “It’s impossible to trade.”

Stocks

S&P 500 futures were little changed as of 7 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.6% to $1.1380

The British pound rose 0.3% to $1.3300

The Japanese yen rose 0.7% to 142.48 per dollar

Cryptocurrencies

Bitcoin fell 1.2% to $92,541.17

Ether fell 2.6% to $1,750.2

Bonds

The yield on 10-year Treasuries declined three basis points to 4.35%

Germany’s 10-year yield declined two basis points to 2.48%

Britain’s 10-year yield declined two basis points to 4.54%

Commodities

West Texas Intermediate crude rose 1.1% to $62.96 a barrel

Spot gold rose 1.3% to $3,330.33 an ounce

Bitcoin Passed Silver And Alphabet Again… Briefly

Bitcoin briefly surpassed both Alphabet and silver when it crossed above $94,000 – and as of now, it's just inches away from overtaking silver in market capitalization once again. By the time you read this, it may have already crossed that threshold.

What I’m really interested in, though, isn’t just Bitcoin passing silver – it’s doing so in a way that creates a permanent separation. Technically, Bitcoin has surpassed silver in the past, but never with the kind of sustained momentum needed to cement a lasting lead. This time could be different.

Once silver is in the rearview mirror for good, it’ll be thrilling to start checking off the remaining giants: Amazon, NVIDIA, Microsoft, Apple – and finally, gold.

Bitcoin is an apex predator.

TRUMP Token Has New Utility

It’s a fascinating world we live in. The TRUMP token surged yesterday after news broke that the top 220 holders can register to attend a Gala Dinner at Trump’s private, members-only club in Washington D.C. There’s even a leaderboard to track who’s currently at the top.

It gets even better: “FOR THE TOP 25 COIN HOLDERS, YOU are Invited to an Exclusive Reception before Dinner with YOUR FAVORITE PRESIDENT! PLUS, We have separately by us arranged for a Special VIP White House Tour for you – so make sure you stay in town.”

This news is meaningful because it offers a degree of redemption for TRUMP Coin and gives holders a renewed sense of optimism. While it doesn’t change the likelihood that insiders still exist within the ecosystem, the prospect of smaller, more frequent giveaways could help ensure broader participation. TRUMP Coin is now functioning as an access token – which is a step in a positive direction for what was an aimless meme before. It signals utility and that Trump is actively engaging with his crypto-focused community.

The SEC Met With El Salvador To Discuss Crypto

Never in a million years would I have expected to see a headline about the SEC’s crypto task force meeting with El Salvador’s National Commission on Digital Assets (CNAD) to discuss crypto regulation and a potential cross-border sandbox – yet that’s exactly what happened. According to meeting notes, El Salvador’s commission agreed to collaborate with the SEC on a sandbox pilot program, capped at $10,000 per scenario. The proposal would allow U.S.-licensed brokers to obtain a digital asset license in El Salvador and issue “non-securities” tokens in partnership with a local company – an effort aimed at aligning regulatory approaches and fostering deeper cooperation as El Salvador continues to expand its digital asset ecosystem.

Russia Is Launching A Crypto Exchange

Russia’s Central Bank and Finance Ministry are set to launch a regulated cryptocurrency exchange specifically for “highly qualified investors,” according to a report from Interfax. The exchange will operate within an experimental legal regime – and eligibility will be limited to individuals with over 100 million rubles (around $1.2 million) in securities and deposits, or an annual income exceeding 50 million rubles ($600,000). This initiative reflects Russia’s ongoing efforts to integrate crypto into its financial system despite international sanctions.

“This will legalize crypto assets and bring crypto operations out of the shadows. Naturally, this will not happen domestically, but as part of the operations permitted under the experimental legal regime,” said Russian Finance Minister Anton Siluanov. Russia’s Central Bank echoed this sentiment last month: “The introduction of the experimental legal regime is aimed at improving transparency of the cryptocurrency market, setting standards for providing services in this market, and expanding investment opportunities for sophisticated investors with higher risk appetites.”

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.