Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Finding Purpose in Unthinkable Loss

Bitcoin Thoughts And Analysis

Stocks And Dollar Down On Powell Threats

Bitcoin Cycles Comparison

Charles Schwab Has Plans To Offer Crypto Products

Prediction Markets Have Recession Odds Over 50%

Bitcoin’s Price Every Easter

DeFi Sentiment Is Struggling

This Is Bitcoin’s Turning Point: Custody, Stablecoins & The New Crypto Rules l Mike Belshe

Finding Purpose in Unthinkable Loss

It was a quiet weekend in the crypto markets, so I thought it was a fitting time to share a story as we head into the week – one that’s emotional, heartbreaking, but ultimately inspiring. It involves 9/11 and Howard Lutnick, now the U.S. Secretary of Commerce. While it may stir a range of emotions, I encourage you to stay until the end.

The following is a transcript from an ABC interview on November 8, 2011, between Howard Lutnick and Connie Chung. For brevity, I’ve excluded some minor details – but made sure to capture the essence of the interview and its key points.

As you read the text below, take a brief pause from the morning rush – and try to place yourself in that room. The weight of this conversation is immense.

Connie Chung: “Of the thousand Cantor employees at the Trade Center, only 300 are accounted for at this time, and none was at the building at that time. This immense human loss has truly devastated the chairman and CEO, Howard Lutnick, whose own brother is missing and presumed dead.

You have suffered such great professional and personal loss. What is the fate of your brother?”

Howard Lutnick: “Well, my brother, my brother was on the 103rd floor. He worked - he worked for me, and um, he worked at Cantor. And um, he - he called my sister just after the just after the plane hit, and he told her that um, he said that the smoke was pouring in. He was - he was stuck in a corner office, there was no way out, and the smoke was coming in. And he's - he's not good, and - and things are not good. And he's not going to make it. And he just wanted to say that he loved her, and he wanted to say goodbye, and uh, tell everyone that - that he loved them.

And then the phone went - the phone went dead.

So - so while I'm the head of the company, I'm trying to help my 700 employees who are missing their loved one's - I'm just - just another one of them. Just another one of them.”

Connie Chung: “Normally, you would have been in your office - on which floor? The 105th floor. And yet you didn’t go in early that morning because of a critical decision you made.”

Howard Lutnick: “My - uh, my little boy - I have a 5-year-old, and it was his first day of kindergarten at, uh, at Horace Mann. So, I took him for his first day of big boy school, and uh, because of that, I was late getting down to the office, and therefore I wasn’t in the building. I was on my way to the building instead.”

Connie Chung: “And when you got to the building?”

Howard Lutnick: “Well, I - I - I saw the building on fire, so I - I didn’t go in. Um, but I stood - I stood at the door off of Church Street, um, where there were flags, and I stood at that door. And people were coming out, and I was yelling at them, you know, to run and get out. And uh, there were police sort of around me, um, yelling at people, telling them to get out, and - and I would ask them what floor they were coming from. ‘What floor are you coming from?’ Someone would say 55, and I'd scream, ‘We have 55!’ Because I kept wanting to get up the building and get people out. Our employees were on 101 to 105 - the top floors of Number One World Trade Center, which they now call the North Tower.”

Connie Chung: “So how high was the highest number that you got to?”

Howard Lutnick: “I got to the 91st floor, and I knew if I got one employee - if one person came down from that floor, I knew that there had to be others. There would be others behind them. There would be others going out other doors. That would be good. But I got up to 91, and then I heard the sound. It sounded like another plane was going to hit the building, and it was, but it didn’t sound like it was far away. It sounded like it was right where the ceiling is above us. It was so unbelievably loud, and someone screamed out, ‘Another one’s coming!’ So I just turned around and ran.”

Connie Chung: “What was it?”

Howard Lutnick: “It was - it was Number Two World Trade Center collapsing, so I'm - I'm - I'm standing underneath a building like an idiot, um, and I start running…

I don't know of a single one of my employees who got down - zero. Zero. And it's really sad, but I think we're all pulling together with the view that we want to make things happen for them. We - we need to take care of them. We need to figure out how to take care of them and give them more, and take care of them. And I think it's going to be a different kind of drive than I've ever had before.

It's not about my - it's not about my family. I get to kiss my kids. I get to kiss my kids tonight, but other people don’t get to kiss their kids, and I just have to help them. And I think - I think what's amazing - there are 300 people who lost all their friends. They lost the person to their left, they lost the person to their right, and they call me up and they say, ‘I want to go to work.’ I say, ‘Why do you want to go to work? Let’s just go to funerals.’ They go, ‘No, no, I want to go to work. I can’t stay home. I can’t stay home. I have to make - I have to work. I have to do something.’

And so they - they actually wanted to try to figure out how to be in business. It’s unbelievable. It doesn’t make any sense. But the reason they want to be in business - and there’s only one reason to be in business - is because we have to make our company able to take care of my 700 families. Seven hundred families. Seven hundred families. Just, I can't say it I can't say it without crying.”

Connie Chung: “It’s been said that the loss of your company will have worldwide impact.”

Howard Lutnick: “I don’t care when we open - if we open, it doesn’t matter to me. And they - collectively, 250 of them - collectively voted that they were going to open the markets. And this morning at 7 a.m., those people opened for business. Not to make money, not to - but they did it because they thought, if the Fed, the Treasury wanted it to be open, and it was important enough for them to show strength for America and for these markets, then they were going to do their damnedest to get it open. And they did.

And I - I voted against it. I said, ‘Why? I don’t want you to work. I want you to go home and kiss your kids and hug your families.’ But they - it’s them. They wanted - they wanted to do it. Maybe for themselves, maybe for their friends who they lost.

But so, right this second, our electronic systems are running around the world, and it’s - I don’t know, maybe it’s a miracle. Maybe it’s because these people are just - they’re unbelievable. They’re the best.”

Connie Chung: “Maybe they’re the best because they had an incredible boss.”

Howard Lutnick: “I think it goes the other way around. I think you can always be a good boss if you have the right people, and I'm glad they chose to be with me - but I'm the saddest person in the world that they chose to be with me, because they would have chosen to be with me. So many people, so many names, so many people I loved.”

End of interview.

Cantor Fitzgerald, the financial services firm led by Howard Lutnick, resumed operations just two days after the 9/11 attacks. The company made the decision to keep going, honoring its commitment to the employees and families of those who were lost. That morning, 658 Cantor Fitzgerald employees lost their lives – every single employee who was in the North Tower.

I didn’t want to disrupt the flow for readers, but for context: Howard held back tears throughout the entire interview, breaking down several times with long pauses, especially when speaking about his brother, his friends, the families, and the decision to continue working.

I don’t want to speak for anyone affected by this tragedy, but I do want to briefly reflect on some meaningful takeaways from the interview and commend Howard for his strength and humanity in the face of such profound loss. His openness, resilience, and commitment to those around him has left a lasting impression.

To this day, Howard continues to give back – supporting the families of those who were lost and dedicating himself to causes that honor their memory. It’s a testament to the power of leadership rooted in compassion.

Howard shared this post on September 11 of last year.

I hope that all of you reading this story can find—even in a small way—a renewed sense of purpose in whatever pursuit you’re after. Our time is limited, and every day truly counts.

Whether this story touches you personally or it’s something you’ve only read about in books, whether you lean red or blue, or whether you politically admire Howard or not, I share it in hopes that it serves as a reminder to find your why, to lead with integrity, and to keep moving forward—not just for ourselves or the markets, but for the people and principles that matter most.

Try not to dwell too long on this story. Take a moment to reflect, digest it, then shift your focus to the news below and make the most of your day. Cantor employees returned to work with renewed passion—you can certainly make the most of today.

Let’s make this a great week.

Bitcoin Thoughts And Analysis

Bitcoin just printed a textbook breakout on the daily chart – pushing cleanly through descending resistance from the all-time high. The move came on increasing volume, which adds credibility to the breakout and shows buyers are finally stepping in with conviction. We need to see it hold and close the day like this for confirmation.

Price is now well above the 50-day moving average, which is curling upward, offering short-term support. This is the healthiest the chart has looked in weeks.

That said, we’re not out of the woods yet. The 200-day moving average is still looming just above, along with the key horizontal level at $88,804. A close above that level would break market structure and confirm a higher high – a bullish shift worth watching.

For now, momentum is clearly with the bulls, but the next 24–48 hours will be critical to see if they can seal the deal.

Stocks And Dollar Down On Powell Threats

US stock futures and the dollar dropped sharply as traders digested growing fears that President Donald Trump may try to remove Federal Reserve Chair Jerome Powell. S&P 500 futures fell 1% while the Bloomberg Dollar Spot Index hit a 15-month low. Gold surged above $3,380 an ounce as investors sought safe havens.

Markets were rattled after Trump’s top economic advisor, Kevin Hassett, confirmed the president is exploring whether he can fire Powell. Trump has repeatedly lashed out at the Fed for not cutting interest rates, posting last week that Powell’s “termination cannot come fast enough.”

The yen, euro, and Swiss franc all gained, weighing on Japan’s Nikkei 225, which fell 1.3%. Brent crude slid below $67. European markets were mostly closed for the Easter holiday.

Fed officials and international leaders warned against undermining the central bank’s independence. Chicago Fed President Austan Goolsbee emphasized the broad consensus on the importance of keeping monetary policy free from political interference. French Finance Minister Eric Lombard said firing Powell would destabilize the economy and damage trust in the dollar.

Investors appear to be rotating out of US assets, with Deutsche Bank reporting that some Chinese clients are shifting from Treasuries to European bonds. The US yield curve steepened, reflecting expectations of future rate cuts and concerns over long-term US credibility.

In equities, Tesla dropped 2.7% in premarket trading ahead of earnings. Analyst Dan Ives called this a “code red” moment for the company, urging Elon Musk to refocus amid growing distractions.

Stocks

S&P 500 futures fell 1.2% as of 9:35 a.m. London time

Nasdaq 100 futures fell 1.3%

Futures on the Dow Jones Industrial Average fell 1.1%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.9%

The euro rose 1.4% to $1.1549

The Japanese yen rose 1.1% to 140.67 per dollar

The offshore yuan rose 0.2% to 7.2892 per dollar

The British pound rose 0.8% to $1.3403

Cryptocurrencies

Bitcoin rose 2.9% to $87,609.62

Ether rose 3.6% to $1,645.91

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.36%

Germany’s 10-year yield was little changed at 2.47%

Britain’s 10-year yield was little changed at 4.57%

Commodities

Brent crude fell 1.8% to $66.60 a barrel

Spot gold rose 1.8% to $3,387.80 an ounce

Bitcoin Cycles Comparison

The graphics might be a bit hard to see in detail, but the key takeaway from this segment is this: when measuring past cycles from their halving events, the current Bitcoin cycle appears to be underperforming - lagging behind where we’d typically expect it to be at this stage.

But when measured from the cycle’s bottom – as shown in the second image above – this cycle is tracking closely with the previous three. Plus, if the theory holds that each cycle lasts slightly longer than the last, then everything appears to be on track.

Charles Schwab Has Plans To Offer Crypto Products

Charles Schwab CEO Rick Wurster is aiming for an April 2026 launch of spot Bitcoin trading for Schwab clients, spurred by a 400% surge in crypto-related web traffic. Wurster, who stepped into the CEO role in 2025, has shown interest in offering direct crypto access but has waited for regulatory clarity. With Trump’s re-election, he anticipates a more favorable environment for digital assets. While Wurster doesn’t personally own crypto, he’s admitted to regretting missing out on the gains – a reflection of Schwab’s growing alignment with traditional finance’s pivot toward crypto.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto. Our goal is to do that in the next 12 months, and we are on a great path to be able to do that.”

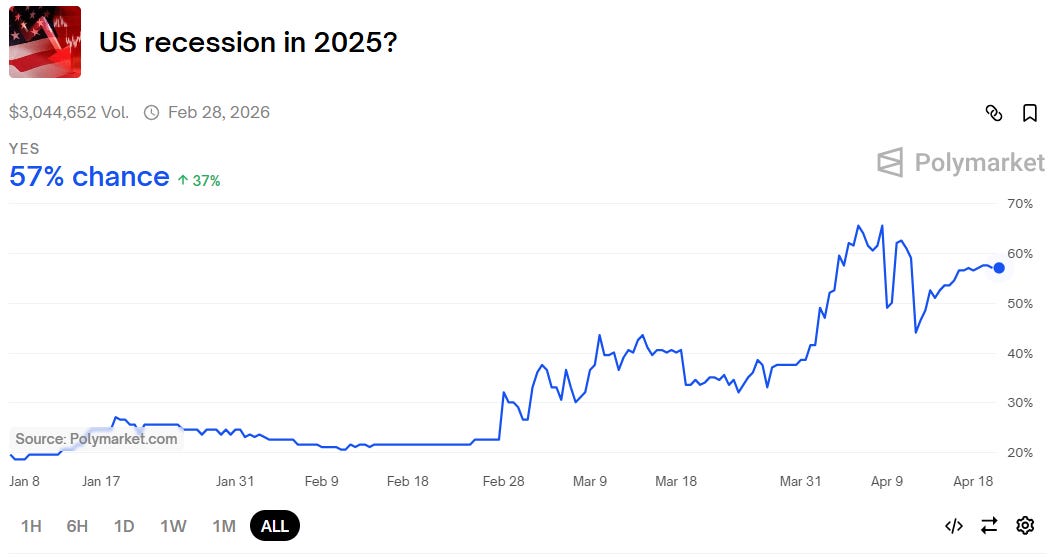

Prediction Markets Have Recession Odds Over 50%

The rules for qualifying as to what constitutes a recession are as follows:

“1. The National Bureau of Economic Research (NBER) publicly announces that a recession has occurred in the United States, at any point in 2025, with the announcement made by December 31, 2025, 11:59 PM ET.

2. The seasonally adjusted annualized percent change in quarterly U.S. real GDP from the previous quarter is less than 0.0 for two consecutive quarters between Q4 2024 and Q4 2025 (inclusive), as reported by the Bureau of Economic Analysis (BEA).

3. Otherwise, this market will resolve to ‘No.’”

Eyeballing the chart above for TA, it looks like the odds of a recession are in a bull market. Hopefully, this is one of those times when the crowd is wrong - and the markets turn around.

Kalshi currently estimates a 25% chance that the recession began in Q1, and a 30% chance it will begin in Q2. As time passes without an official announcement, these probabilities are likely to adjust - potentially shifting to new dates and reflecting a changing market.

Bitcoin’s Price Every Easter

Bitcoin’s price on Easter Sunday has charted a remarkable long-term trajectory – from just $0.73 in 2011 to over $84,000 in 2025 – highlighting the asset’s exponential growth over the past 15 years. I think it’s time we start seeing the following Easter Sundays all in the six-figure territory.

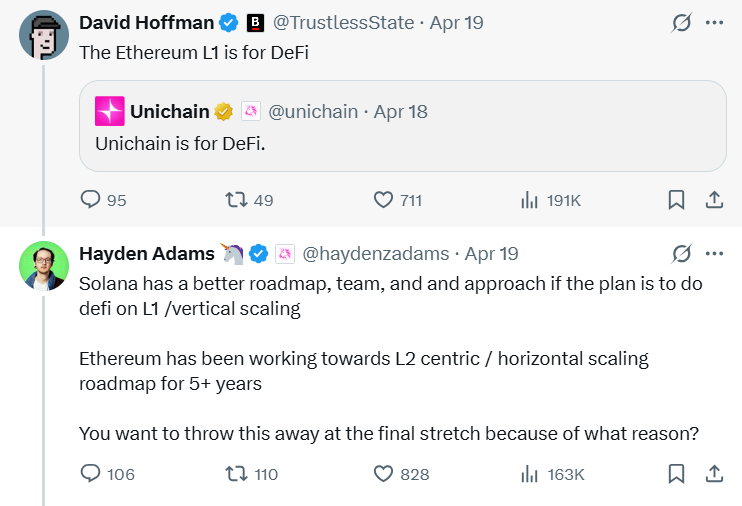

DeFi Sentiment Is Struggling

I’ve said this at least a hundred times – if the prices of Ethereum and Solana were higher, we wouldn’t be having these existential debates about L1 vs. L2 scaling, ETH vs. Solana, or the tension between Ethereum’s spirit and the prioritization of winning. Hayden Adams, the CEO of Uniswap, ruffled some Ethereum feathers over the weekend when he made the case that Solana, in its current form, is a better solution for DeFi than Ethereum in its current form. If the debate interests you, the thread is filled with solid counterpoints and counter-counterpoints, but here’s the catch: even if Solana is the better alternative today, the TAM (total addressable market) DeFi is trying to capture is so massive that Ethereum still has time to make improvements and steer the ship back on track.

This Is Bitcoin’s Turning Point: Custody, Stablecoins & The New Crypto Rules l Mike Belshe

In this episode, BitGo CEO Mike Belshe joins Scott to dissect the evolving landscape of crypto regulation, infrastructure, and institutional adoption. From the controversial SAB 121 and regulatory overreach to the deeper implications of market structure and custody, Belshe doesn’t hold back. The conversation dives into the role of stablecoins and tokenized real-world assets (RWA), and how they’re reshaping the financial system. With a new U.S. administration on the horizon, we explore what changes may be coming compared to past regimes - and what that means for crypto’s future. A must-listen for anyone navigating the intersection of policy, tech, and capital.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.