Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

STOP! And read this… the free version of our Algorithms now trades four separate assets: Bitcoin, Solana, Ethereum, and XRP.

A reminder that when you use the free version of our products you get access to ALL of our algos, not just one or two!

Also, Arch Public and Gemini are taking over the Whale Experience at Bitcoin Vegas. And we are doing a massive giveaway while we are there. You won’t want to miss it!!

In This Issue:

Making Sense of Q1

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Legacy Markets Are Closed, Asia Ticks Higher

Strategic Reserves Are Coming

Donald Trump Wants Jerome Powell Fired

Ethena And Securitize Partner For RWA Tokenization

Can You REALLY Hack Bitcoin… And Win 1 BTC ($84,000)?

Making Sense of Q1

Bitwise just dropped a massive Q1 2025 report - “The Best Worst Quarter in Crypto’s History” - a 72-page deep dive led by none other than my good friend, Matt Hougan. The content coming out of Bitwise can only be described as top-tier. No fluff, no filler – just smart, sharp, insight-packed analysis.

Without wasting any more time, I’m going to run through the biggest highlights from the report. Strap in – this train is moving fast.

The title of the report is clever; it opens as follows: “Frustrating. That’s the best word to describe the past quarter. On the one hand, it was historically positive. We saw the first pro-crypto president take office and immediately sign an executive order making the growth of digital assets a national priority. The U.S. created a Strategic Bitcoin Reserve, the SEC dropped nearly all of its lawsuits against the crypto industry, and Operation Choke Point 2.0—which nearly cut off crypto from the traditional banking sector— was shut down. Crypto dreamed of these developments for years, and they finally all happened.

And yet, despite all the good news, crypto prices fell. Sharply. The Bitwise 10 Large Cap Crypto Index dropped 18%, crypto equities tumbled 27%, and Ethereum—the second-largest crypto asset—fell an astonishing 45%.”

So much happened this quarter, the headlines were all over the place – from the largest crypto hack in history to the launch of a Strategic Bitcoin Reserve to full-blown meme coin mayhem. It felt like every day brought something new, chaotic, or game-changing.

Here’s what stood out:

Simply put, it was a rough quarter for diversified crypto portfolios – and Bitwise felt the pain just like everyone else. Don’t get it twisted: those numbers in parentheses? They’re negative returns, not gains!

If we actually are in “The Mainstream Cycle,” then we can do a whole lot better than this:

This chart really puts the current cycle’s performance into perspective. Yes, Bitcoin is expected to deliver diminishing returns with each new cycle – assuming cycles even still matter – but so far, it’s barely gotten off the ground.

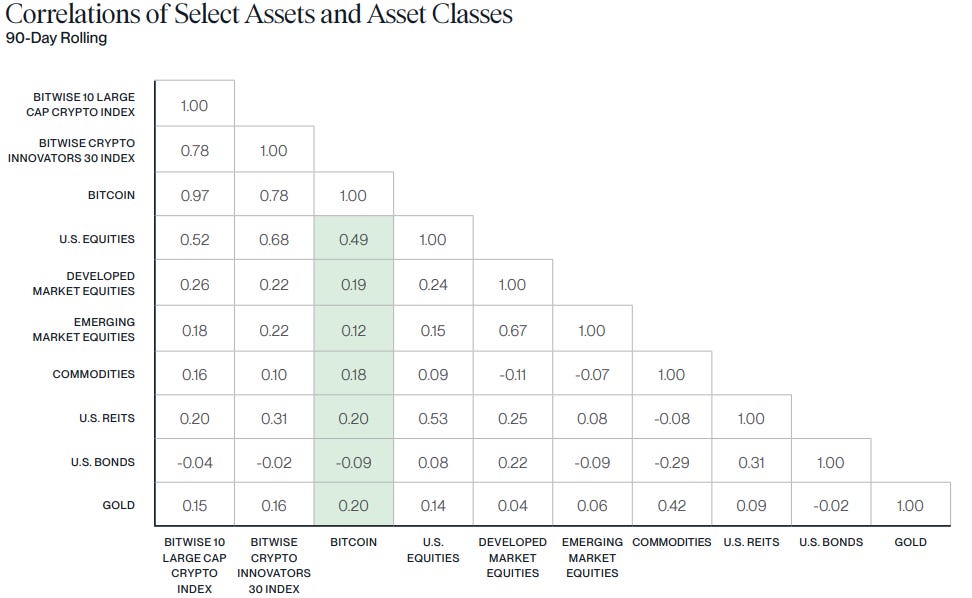

As much as critics love to highlight Bitcoin’s recent drawdown and its alignment with major indexes, it still stands out as an uncorrelated asset. Sure, this snapshot only covers the past quarter - but considering how turbulent that period was, you’d expect Bitcoin to have fallen harder alongside everything else. And yet, it didn’t.

Coinbase is back on top in terms of trading volume, overtaking Uniswap. I’ve got love for both platforms, but in the natural order of things, Coinbase should be well ahead of Uniswap here. I expect its lead to keep widening - at least until meme season hits again, especially if it centers around ETH-based coins (if it happens at all).

Of all the charts shared in the entire report, this one may have grabbed the most media attention:

I don’t see a world where stablecoins ever hand the lead back to Visa in terms of volume. Stablecoins will force Visa to adopt blockchain technology or risk being left behind entirely.

Institutional investors will appreciate this next chart more than anyone. As Bitcoin’s volatility continues to decline - as it naturally should over time - it creates a more stable environment for larger players to hold meaningful positions. Many asset managers operate within strict risk thresholds, and lower volatility makes Bitcoin far more appealing within those frameworks.

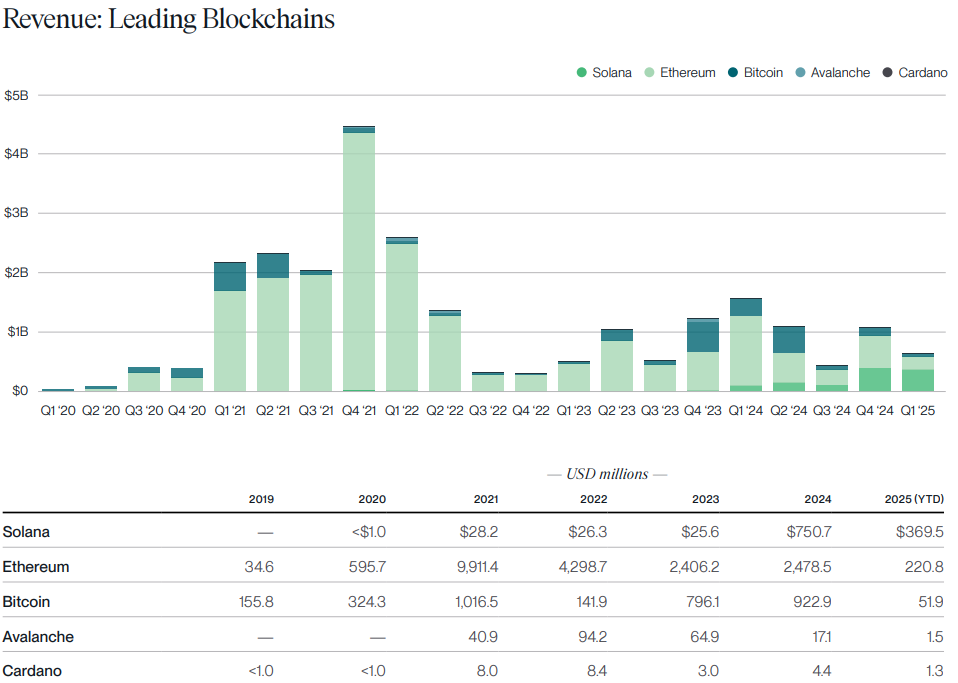

This is where Ethereum is taking the biggest hit. Its revenue has been siphoned off by competitors and Layer 2s, leaving the main chain with minimal value accrual - and that’s showing up in the price. If Ethereum can solve this, it’s full steam ahead. If not, the second half of the bull market could be a rough ride.

This list is unreal. Every one of these companies can now move forward with confidence – no looming investigations, no threat of jail time or crippling penalties. Give it a few months, and we’ll likely see a wave of innovation and fresh products pouring out from this group.

I saved this image purposefully for last. Will 2025 really be the year that finally breaks Bitcoin’s pattern of three good years followed by one bad? I don’t think so.

If Q1 was the “best worst quarter in crypto history,” then maybe we’re actually setting up for the best recovery quarter - and eventually, the best bull run quarter - in Bitcoin history.

Honestly, if you stripped away everything Bitcoin has going for it right now and the U.S. government only started buying Bitcoin, that alone would send the price skyrocketing. We wouldn’t even need state adoption, sovereign wealth funds, public companies, ETF flows, or hedge funds. Just that single move - the U.S. putting money where its mouth is - would change everything. It really is that simple.

The good news? All of this will eventually happen - just at different intervals, each with its own curveballs. But under the right conditions, a few of these variables could align at once - and when they do, investors are going to wish they went all in.

Good times are ahead.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll share an Aptos review, covering the network’s latest announcements and milestones. To kick things off this week, I’m starting with a post from CZ spotlighting YZI Labs, which in turn highlighted an Aptos article titled “How to Build a High-Performance Blockchain.”

Here’s the article from Aptos Labs that CZ referred to as “worth a read.”

In the article, Aptos introduces a familiar analogy to better explain the following concept: “The key to improving blockchain throughput (transactions per second) and latency (time until finality) lies in optimizing how different stages.”

Here are the three factories proposed:

The Simple Factory – Like an old-school blockchain, it builds one car (or block) at a time. Each worker (validator) waits their turn to perform a task. This leads to a lot of idle time and limited output.

The Ford Factory – Inspired by Henry Ford’s assembly line, each worker specializes in one step, and multiple cars move down the line simultaneously. This increases productivity (throughput), but each car still takes time to complete.

The Magic Factory – Now imagine every part of the car being built at the same time by different workers. Everything happens concurrently, slashing build time and boosting efficiency across the board.

From the article, “To truly push blockchain performance to the limit, we need to build a ‘magic factory’—one where these stages can operate in parallel.” And that’s where Zaptos comes into the equation, to do just that. “Aptos’ pipelined approach significantly boosted throughput, but Zaptos takes it a step further, driving latency down to sub-second levels while sustaining high TPS.”

Before wrapping up, I wanted to share this thread from Aptos highlighting their partnership with ODNO working on RWA. If you get the chance, it’s definitely worth a read - check it out HERE.

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

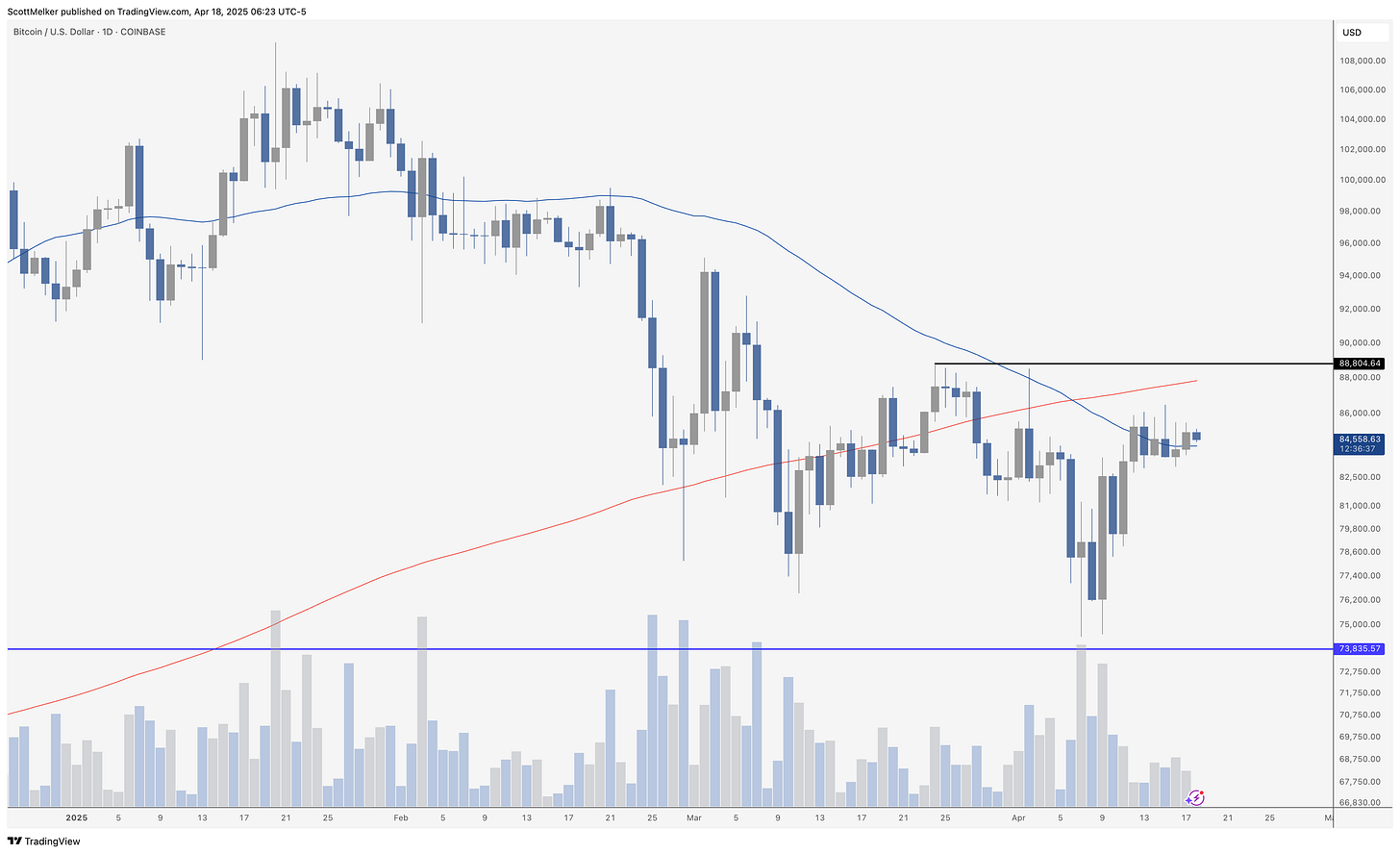

Bitcoin Thoughts And Analysis

Bitcoin finally closed a strong daily candle well above the 50-day moving average – a notable technical development, especially since that moving average is beginning to curve upward again. It’s the first convincing close above the 50 MA in months, signaling a potential shift in short-term trend.

However, the move came on low volume – which tempers the enthusiasm. Without a surge in buying interest, this breakout could lack staying power. The 200-day moving average remains overhead as resistance, and the horizontal level at $88,804 is still the key barrier to flip market structure and print a higher high.

Encouraging – but not convincing – yet. Bulls need to follow through with strength.

Legacy Markets Are Closed, Asia Ticks Higher

Asian stocks inched higher in subdued trading on Friday – with most major markets closed for the Good Friday holiday. Japan’s Nikkei 225 rose 1%, and Chinese shares pared earlier losses after news of potential US tariffs on Chinese vessels. The broader regional tone remained cautious as investors awaited further clarity on global tariff negotiations.

Following positive momentum from US–Japan talks, President Trump expressed confidence in a deal with the EU and showed reluctance to escalate tensions with China further. However, the US administration's move to target Chinese ships stoked fresh concerns about trade war escalation – shipping stocks in Japan and South Korea gained in response.

In currency markets, the yen held steady after Thursday’s drop – with no indication that exchange rate issues were raised in Japan–US discussions. Meanwhile, China’s sovereign wealth fund appeared to intervene in local equity markets amid rising volatility. Contemporary Amperex shares fell after US lawmakers pressured banks to exit its IPO plans.

Elsewhere, Japan’s inflation surged – led by a 92.1% spike in rice prices – supporting the Bank of Japan’s gradual tightening approach. Trump continued to lash out at Fed Chair Jerome Powell – reiterating threats of removal amid ongoing criticism of the central bank’s reluctance to cut rates. US equities ended the week lower as markets remained on edge.

Stocks

Japan’s Topix rose 1.1%

The Shanghai Composite was little changed

Currencies

The euro was little changed at $1.1375

The Japanese yen was little changed at 142.34 per dollar

Cryptocurrencies

Bitcoin fell 0.6% to $84,654.17

Ether fell 0.1% to $1,582.4

Strategic Reserves Are Coming

Both Binance and the ghost of Binance, CZ, are reportedly working with multiple governments on crypto related issues - Binance on establishing strategic reserves, and CZ on crypto regulation and blockchain. Here’s the remainder of Walter Bloomberg’s post:

It’s nice to see the United States finally stepping into a leadership role in crypto — especially after falling so far behind during the past four years under the previous administration and regulatory regime. It’s wild how fast things can flip. At this pace, by year’s end we’ll likely see several major countries either implementing or formally kicking off their own strategic reserves.

Donald Trump Wants Jerome Powell Fired

Just last week, it came out that Trump asked the Supreme Court for the authority to fire top officials at federal agencies. While we don’t have an official list of names, it doesn’t take much imagination—especially after his latest Truth Social post—to assume Jerome Powell is at the top of it.

What really adds to the absurdity is Elizabeth Warren’s commentary on CNBC yesterday: “Trump should not be calling for Powell to lower rates and say he wants him fired. This is hurting the nature of democracy and will ruin the stock market.”

That’s rich, coming from the same Elizabeth Warren who “urged the Fed to cut rates” just a few months ago.

I didn’t realize the circus was back in town.

Ethena And Securitize Partner For RWA Tokenization

Ethena, the synthetic dollar protocol, and Securitize, a leader in RWA and tokenization, are teaming up to launch a new Ethereum-compatible blockchain called the Converge chain, focused on real-world assets. Built with Arbitrum’s tech stack and using Celestia for data availability, the chain is targeting a mainnet launch by the end of Q2. It’ll feature fast block times, allow users to pay gas with Ethena’s USDe and USDtb, and include a security layer via the Converge Validator Network.

“The idea is that we go on a testnet very soon, in the next few weeks, because we've already been working on this for a while. Then, the mainnet: the goal is to do it before the end of Q2.” – Carlos Domingo, co-founder and CEO of Securitize

“Converge’s ambitious vision of onboarding tens of billions of institutional capital on-chain requires providing users with high performance and elevated security guarantees.” – Guy Young, founder of development firm Ethena Labs

Ethereum remains the go-to chain for tokenization, but most of the action is now on Layer 2s. If Ethereum can continue to harness this network effect and eventually translate it into mainnet value accrual, the price will follow.

Can You REALLY Hack Bitcoin… And Win 1 BTC ($84,000)?

Edan Yago, core contributor to Bitcoin OS, joins me today to discuss if it is even possible to hack the Bitcoin blockchain!

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.