Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Never lose another trade. Yes, you read that right. Never. Lose.

Our dev team has created an update to our Bitcoin Algorithm Arbitrage Strategy that never allows you to execute a losing trade.

Unprecedented. Execution. Excellence. Oh, and a reminder that you can use our Algo(s) for free up to $10K.

Never lose another trade. We dare you to prove us wrong! Schedule a demo or just download the Algo for free.

In This Issue:

The Bitcoin Door

Bitcoin Thoughts And Analysis

Futures Slide As Nvidia And ASML Spark Fresh Tech Jitters

Bitcoin’s Correlation To The Nasdaq And Gold

Tariffs May Be Used To Buy Bitcoin

Standard Chartered Predicts A Stablecoin Marketcap Surge

Trump Is Launching A Crypto Game

Bitcoin Only Gets Stronger | Here Is What’s Next

The Bitcoin Door

“The first person through the door always gets shot.”

I love this quote – it can be used for just about anything. It naturally works well in the obvious places: business, politics, and warfare – but also fits just as well with social situations, family dynamics, investing, and even everyday life.

When Saylor first started buying Bitcoin in 2020 – back when hardly anyone had even heard of MicroStrategy – the company became an easy target for the mainstream media, taking fire from all directions. The barrage still hasn’t ended.

Bloomberg

Forbes

Cointelegraph

Reuters

‘Junk bonds’ was the most common insult hurled at MicroStrategy by financial media outlets and credit rating agencies. The term referred to the company’s high-yield, non-investment-grade debt offerings used to buy more Bitcoin – which critics viewed as reckless and speculative. Bear in mind, Saylor himself never used that terminology. The ‘junk bond’ label was the media’s framing, not his.

Five years later, GameStop has become the latest target for critics who’ve grown tired of taking shots at Strategy.

Barrons

Marquette University

This one was particularly unique in that it came in the form of a paper: “Through a multi-faceted approach, incorporating corporate finance, behavioral finance, and market efficiency theories, the analysis argues that GME’s strategy is largely irrational.”

Benzinga

What stood out about the recent GameStop coverage is that many articles struck a more cautious tone this time around. Instead of outright condemnation, critics mostly questioned the decision or amplified voices like Peter Schiff’s, who didn’t hold back: “Now that all the fools have already rushed in, smarter investors are selling as they realize that wasting cash buying Bitcoin is not a viable long-term business model.”

Bear in mind, GameStop hasn’t even bought Bitcoin yet. We don’t know how far it will go with its acquisition plans. While it isn’t the first company to walk through the Bitcoin door – Tesla, Block, Tether, Marathon, and others have stepped through already – this one stands out because it mirrors Strategy’s approach exactly. GameStop is the first recognizable public company to follow that playbook so precisely.

No two companies are going to walk through the Bitcoin door identically, nor will they experience the same outcomes – but one thing is certain: crossing that threshold, despite the noise, signals a belief in a brighter future that’s still unfolding in real time.

The next company that one-ups GameStop – bigger, more tech-forward, more strategically aligned with Bitcoin – will attract even louder criticism. Eventually, the media backlash will lose its sting. But as long as it keeps coming, it’s proof we’re still early.

Just imagine the headlines when Amazon starts buying Bitcoin at $150,000 – when NVIDIA issues bonds to acquire it at $200,000 – when Apple quietly starts holding Bitcoin in reserves at $250,000.

Chaos.

Before I wrap up, I want to share a short story from Anthony Scaramucci’s new book, The Little Book of Bitcoin. If you haven’t grabbed a copy yet, I highly recommend it. I’m about to spoil a small part, but don’t worry – it won’t take away from the experience. If anything, it captures what it feels like to walk through that metaphorical Bitcoin door.

It was time to get the message out: "To the Moon: SkyBridge Launches Its Bitcoin Fund."

The reaction to the initial press reaction was, to put it mildly, not particularly kind. Snarky, at times derisive. Pretty much every publication noted the 200%-plus run Bitcoin had had in 2020. A few couldn’t help point to my 11-day stint as White House Communications director.

Whatever!

Had I bought Apple or even shares of Tesla, no one would’ve said anything. Heck, had I launched a special-purpose acquisition company (SPAC) no one would’ve said “boo.” But financial media, much like the entities they cover, can be slow to spot changes and are often wary of new and untested technologies. They didn’t understand Bitcoin.

Many in the press took their cues from Warren Buffett and Charlie Munger, two of the greatest investors of all time, but also two people who never missed an opportunity to slam Bitcoin as a “zero” or liken it to a “venereal disease” or worse. “If Warren thinks it’s a scam, well, it must darn right be a scam,” the thinking went, all while Bitcoin continued its march higher.

They would latch on to Jamie Dimon’s “pet rock” comments.

And the colorful characters who populated the crypto landscape at the time, young arrogant guys with “Lambos” and Instagram feeds posting their Coinbase account returns, certainly rubbed some journalists the wrong way: “How could this be a serious investment? Look at who’s buying! What could these kids HODLing and talking about their diamond hands and posting about their YOLO trades possibly know about serious finance?”

It was easier to call it a scam than to do the hard work. But again, these are the same folks calling Amazon a bubble in 1999. If I’ve learned anything in my decades in finance, it’s this: don’t let the press manage your money.

So, three days before Christmas in December 2020, I was about to go on CNBC and announce to the world we were starting our fund. I went on Scott Wapner’s Halftime Show, which is CNBC’s highest-rated broadcast and the one most popular with both institutional and retail investors alike…

“Why now?” Scott asked in his dogged way. “You don’t feel it’s a little late? You don’t feel that some investor may say, ‘Well, now that SkyBridge has jumped into Bitcoin, that’s got to be some type of top?’”

By the time we launched the fund, Bitcoin’s price had already tripled that year, so his point was well taken. And it seemed every day, a new prominent investor was jumping into the deep end of the crypto pool, making our decision seem more a reaction to the hype as opposed to perhaps one that was helping drive it…

People were fascinated by our move, even if they weren't necessarily in agreement with it. Client reaction was mixed and seemed to depend on one's role on Wall Street. Some called it mathematical blather. Some longtime clients liked it. The big banks, whom we relied on to distribute our product, were none too pleased. Why would they? We were now proponents of a new technology that could disrupt their business (they all came around).

Morgan Stanley, which was our longtime distributor, wanted to impose limits on position sizes. Our fund was structured so that no single strategy could exceed 40%, and we didn't want a special exemption for Bitcoin.

But our timing could not have been better.

That line – “our timing could not have been better” – is the entire point.

The timing worked because they walked through the door. Sure, doing it earlier might’ve yielded a higher return. Doing it later might’ve gotten a better reception. But the most important thing was that they did it.

Crossing the Bitcoin threshold is never easy. Anyone who’s ever bought BTC and told their friends or family knows what comes next – skepticism, ridicule, confusion. And still, more than sixteen years after Bitcoin was born, there has never been a better time to take that step.

If you’re the first among your friends, your family, your office – maybe even your company – to believe in Bitcoin, you might take some heat. But you’ll also be the one others look to when the time comes to follow.

And trust me – that moment will come.

Bitcoin Thoughts And Analysis

Bitcoin continues to struggle with the 50-day moving average, currently acting as dynamic resistance. Price is hovering just below it, unable to break through cleanly, and the 200 MA remains overhead, adding additional pressure from above.

Market structure remains bearish for now – we’re still printing lower highs and lower lows. That structure won’t flip until Bitcoin can break decisively above $88,804, the last significant swing high from late March. A close above that level would mark a higher high and potentially signal a trend reversal.

Until then, it’s just a relief rally within a broader downtrend. The bulls need to reclaim key levels with conviction – otherwise, this could be a pause before another leg lower.

Futures Slide As Nvidia And ASML Spark Fresh Tech Jitters

Global stocks retreated sharply on Wednesday as renewed trade tensions and weak tech sector earnings rattled investor confidence. Nasdaq 100 futures fell 1.5% after the Trump administration imposed new restrictions on Nvidia Corp.’s chip exports to China, reigniting fears of a prolonged trade war. Nvidia shares sank roughly 6% in premarket trading, while ASML Holding NV dropped more than 7% following a disappointing order outlook that pointed to persistent softness in the chip industry. European equities followed suit, with the Stoxx 600 Index slipping 0.8%.

In a sign of mounting risk aversion, gold surged to a new record above $3,300 an ounce, and the Swiss franc rallied. The dollar weakened, while UK bonds rallied after British inflation cooled more than expected, raising hopes for interest-rate cuts from the Bank of England. Oil prices reversed early declines after reports emerged that China may be open to negotiations with the US - though Beijing reportedly expects a series of goodwill gestures before re-engaging in talks.

The market remains highly sensitive to developments in the tech and trade space. Nvidia disclosed in a regulatory filing that it had been notified by the US government that its H20 chip would now require a license for export to China indefinitely. The company expects a $5.5 billion writedown this quarter due to inventory and contractual obligations tied to the chip. The move, which revokes prior exemptions, highlights the unpredictability of US trade policy under President Trump and suggests a deepening undercurrent of strategic hostility between the US and China.

“This move is unnerving for two reasons,” said Vishnu Varathan of Mizuho Bank. “First, it conveys the mercurial nature of Trump’s tariffs. Second, it suggests the US-China undercurrents are rather abusive - even as there appears to be some calm on the surface.”

Markets are also bracing for a speech by Federal Reserve Chair Jerome Powell and the release of US retail sales data for March, both of which could shape expectations for future monetary policy amid the uncertainty.

While China’s potential openness to renewed dialogue offers some hope, analysts remain cautious. “We’re staying defensive,” said Francois Antomarchi of Degroof Petercam Asset Management, “especially around tech stocks with high exposure to China. It’s unclear whether we’ve seen the geopolitical bottom yet.”

As the week continues, investors will be closely watching US earnings season, central bank commentary, and geopolitical developments to gauge whether markets can stabilize - or if further downside lies ahead.

Stocks

S&P 500 futures fell 0.8% as of 7:15 a.m. New York time

Nasdaq 100 futures fell 1.5%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.8%

The MSCI World Index fell 0.1%

S&P 500 futures fell 0.8%

Nasdaq 100 futures fell 1.5%

The MSCI Asia Pacific Index fell 0.8%

The MSCI Emerging Markets Index fell 0.9%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.7% to $1.1363

The British pound rose 0.3% to $1.3265

The Japanese yen rose 0.3% to 142.75 per dollar

The offshore yuan rose 0.3% to 7.3085 per dollar

Cryptocurrencies

Bitcoin was little changed at $84,005.67

Ether fell 0.7% to $1,583.87

Bonds

The yield on 10-year Treasuries was little changed at 4.33%

Germany’s 10-year yield declined three basis points to 2.50%

Britain’s 10-year yield declined three basis points to 4.62%

Commodities

West Texas Intermediate crude rose 0.9% to $61.88 a barrel

Spot gold rose 2.1% to $3,298.17 an ounce

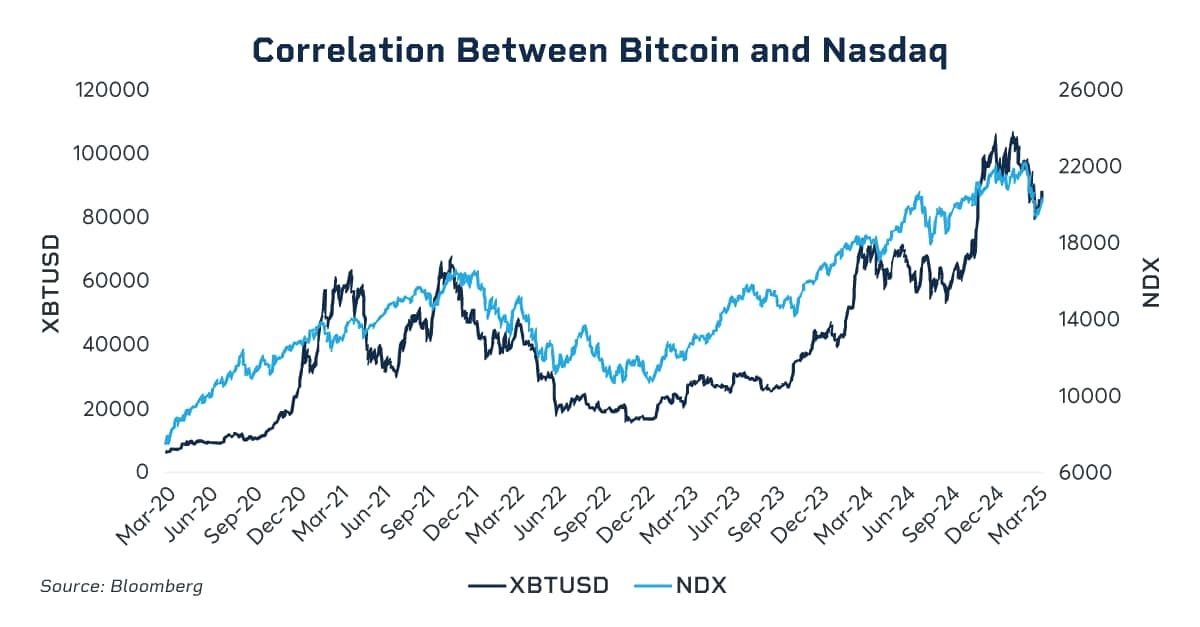

Bitcoin’s Correlation To The Nasdaq And Gold

I came across these two charts and figured they were worth sharing.

Funny enough, Bloomberg made a mistake in the chart below by mixing up the color scheme for Bitcoin and Gold, flipping them. But if you can look past that, you can still appreciate how strongly these two assets diverged in late January.

Gold leading the way isn't a bad sign for Bitcoin - in fact, I expect this to play out well for the digital version later this year.

Tariffs May Be Used To Buy Bitcoin

Bo Hines, Executive Director of the President’s Council of Advisers for Digital Assets, said the following in an interview:

“We obviously made it very clear that we want to acquire as much as we can get. I've said that repeatedly throughout my time on this speaking circuit over the course of the last few months.

At the end of the day, it stipulates we have to acquire Bitcoin in neutral ways that don't cost the taxpayer a dime. With that being said, I think that we have, as the president likes to say, many high-IQ people working on these solutions, and we're going to have countless ideas on how we’re going to accomplish this. And look, we have Secretary Lutnick at Commerce and Secretary Bessent at the Treasury, and many other great actors inside the inner agency working group, and we’ll come together and flesh out some of these ideas and really get to the best solution. We’re very confident we can do so, and we will start doing that in short order.

Well, I think that Senator Lummis has a really interesting idea with the Bitcoin Act of 2025, which has taken the community by storm. Here, what you would do is revalue the gold certificates which we currently have at the Treasury, most of which are valued at around $43 an ounce. So now we are sitting at $3,100 an ounce, being the price of gold. If you took that value, what you could do is use that extra funding to buy more Bitcoin to be used for the reserve. That's just one idea - it's currently circulating through Capitol Hill.

We are looking at many creative ways, whether it be from tariffs, from something else - there are countless ways we can do this… We will look at everything. Everything is on the table. Like we've said, we want as much as we can get, so we are going to make sure no stone is unturned as we start fleshing out this process.”

It’ll be massive news the moment the White House officially announces how it plans to acquire Bitcoin. Every detail — the method, the timing, the size — will dominate headlines and set the tone for a new era of crypto policy.

Standard Chartered Predicts A Stablecoin Marketcap Surge

Standard Chartered analysts are forecasting that the total supply of stablecoins could surge nearly tenfold to $2 trillion by the end of 2028, up from around $230 billion today. A key catalyst for this growth? The potential passage of the GENIUS Act — a U.S. bill that would bring regulatory clarity to the stablecoin sector. The legislation, which recently cleared a Senate committee, is expected to become law by summer.

Analysts argue the GENIUS Act would legitimize the space and pave the way for mass adoption. One ripple effect of a booming stablecoin market: it could generate demand for approximately $1.6 trillion in U.S. Treasury bills, enough to potentially cover all new T-bill issuance during a second Trump term. As it stands, the bill requires stablecoin reserves to have a duration of 93 days or less.

“Our estimate that the stablecoin industry will need to buy $1.6 trillion of T-bills over the next four years ($400 billion a year) suggests that the industry could well account for the largest buying flow of any sector across all U.S. Treasuries. Based on the post-COVID trends of the past four years, the only similar-sized demand was from foreign buyers, but this was spread across T-bills, notes and bonds…The holy grail of international finance is finding an alternative to the USD that offers the same flexibility and liquidity as the USD," the analysts wrote. "On the face of it, stablecoin development could initially increase the attractiveness of USD assets if innovation were concentrated in USD stablecoins.”

Trump Is Launching A Crypto Game

Even with all the creative ways Trump has entered the crypto scene, I never would’ve guessed his next move would be a Monopoly-style game. But according to multiple sources with direct knowledge, Bill Zanker — a longtime Trump associate who helped launch his NFTs and the TRUMP meme coin — is now leading development on a new crypto-based game inspired by Monopoly.

Details are scarce, but insiders say the game will involve in-game currency that hints at crypto integration. It’s reportedly structured like Monopoly, and Zanker is said to be exploring the rights to the 1980s Trump-branded Monopoly spinoff. Given how the TRUMP coin rollout went — and the similarities this project seems to share — expect plenty of skepticism from the crypto crowd.

Bitcoin Only Gets Stronger | Here Is What’s Next

Joining me today are John Deaton, former U.S. Senate candidate and Managing Partner at the Deaton Law Firm, along with my friends from Arch Public, Andrew Parish and Tillman Holloway, who will be providing an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.