Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

One Zettahash

Bitcoin Thoughts And Analysis

Stocks Flat, Yields Steady

ETH Staking Delayed

In-Kind Redemptions Also Delayed

Kraken Is Now Offering Stocks and ETFs

The World’s First SOL ETF Is About To Launch

Trump’s Tariffs Just Supercharged Bitcoin - Here’s What’s Coming | Macro Monday

One Zettahash

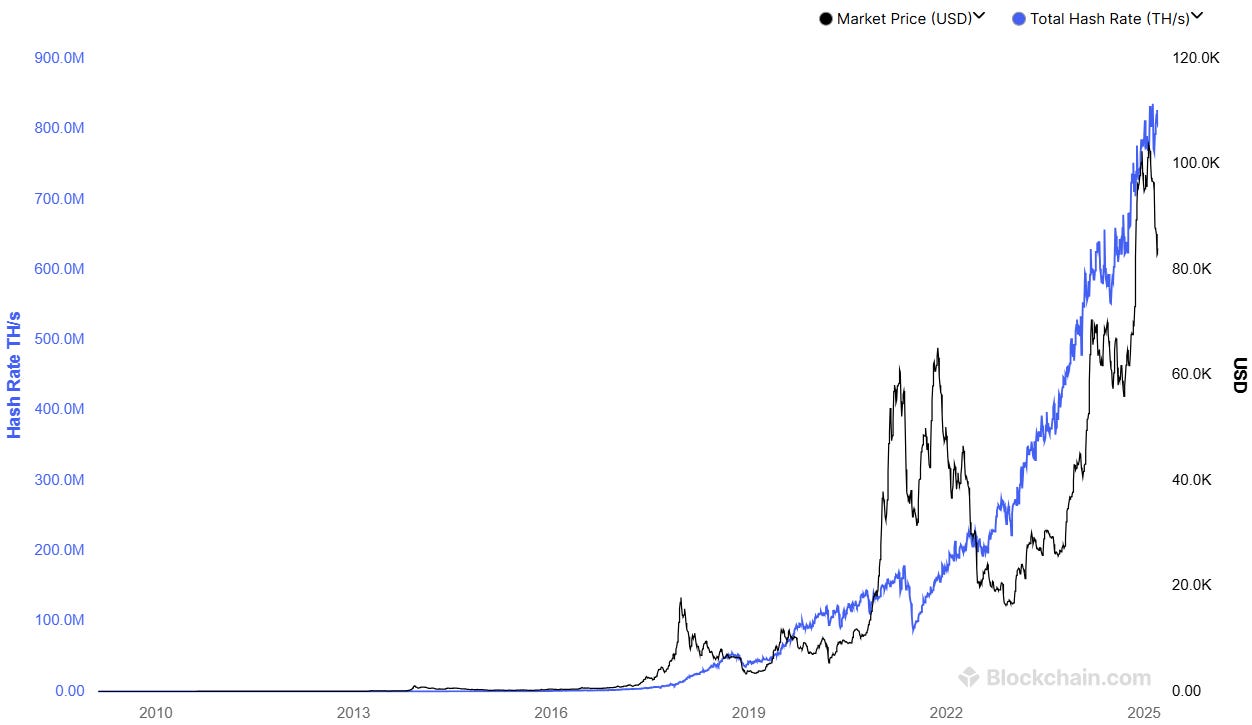

The historical Bitcoin hashrate chart is a thing of beauty - a relentless, upward march that reflects the network’s growing strength and security

Here’s that chart overlayed with the price of Bitcoin.

Think about this: 94.5% of all the Bitcoin that will ever exist has already been mined - yet miners are pouring in with more power than ever before. That alone should tell you something important: the Bitcoin network is doing something right.

To be a miner is to be a high-risk, high-reward entrepreneur - equal parts engineer, energy expert, and strategist. These aren’t just people solving math problems. They’re building the digital scaffolding of the world’s most resilient monetary network, using cutting-edge technology and innovating on energy use in real time. It’s fitting - almost poetic - that these are the people securing Bitcoin.

But the bigger story here is what’s happening to Bitcoin’s hashrate. It’s soaring toward one zettahash - that’s one sextillion hashes per second - a milestone that would’ve sounded absurd not long ago. Depending on the source, we may have already crossed it:

CoinWarz - 871.81 EH/s

Blockchain.com - 902.02 EH/s

BitInfoCharts - 978.82 EH/s

YCharts - 1.039B TH/s

Before I go any further on this, I want to provide a basic overview of mining and what this all means in the context of hashrate.

When discussing Bitcoin mining, we often use simplified terms like ‘computing power’ or ‘solving complex calculations,’ depending on the context. To a non-Bitcoiner - or really anyone not deep into tech - hashrate is typically a foreign concept. It helps to think of it not just as raw processing speed, but as the number of guesses a machine can make every second to solve a cryptographic puzzle.

What we’re actually referring to with hashrate in crypto is the process of repeatedly running a cryptographic hash function - specifically SHA-256, which is fundamental to the Bitcoin protocol. SHA-256, short for Secure Hash Algorithm 256-bit, is widely used not only in Bitcoin, but also across many modern software and firmware systems for ensuring security and data integrity. A hash is simply the output of this function - a fixed-length string that represents data in a secure and verifiable way.

In crypto, we often encounter the term ‘hash’ in conjunction with prefixes that designate a unit of measurement for the processing power of the Bitcoin network. Since each hash is unique, the following are the hashes for 'Scott Melker' and 'hello'. These hashes are immutable, always representing the same input values.

Scott Melker: 75454e9d11d5f49b961cff838cd5029a560d6578364d401f0762cfac51d9e5f1

hello: 2cf24dba5fb0a30e26e83b2ac5b9e29e1b161e5c1fa7425e73043362938b9824

You can use this tool on Github, for free, HERE.

Before I get too carried away, let’s take what we have learned so far and read this chart:

Bitcoin’s current hashrate is at the bottom of this chart (basically). That question mark at the bottom can be replaced with ‘9 years,’ which is quite the jump. Bitcoin’s hashrate first crossed the 1 exahash per second (EH/s) mark in early 2016 - specifically around January to March 2016, depending on the source and calculations used. If you’re curious what that number represents - in the context of a zettahash - it’s one sextillion, or (10²¹) hashes per second - one trillion multiplied by one billion.

This makes sense - Bitcoin’s output started at over a megahash (million hashes) per second. Though this figure may appear substantial, a single computer was, and still is, capable of producing such output. As depicted in the graphic above, Bitcoin's output experienced a tenfold increase every 1-2 years. However, the pace of Bitcoin's rapid growth is not sustainable, which is why it took almost a decade to attain the highly sought-after zettahash, the unit succeeding our current exahash level.

A couple of years ago, nobody would have predicted Bitcoin’s hashrate would grow as fast as it has. This can be seen in the graphic below.

The graphic you just examined was attempting to project when Bitcoin might reach one zettahash per second. The methodology behind it involved taking the growth rate from a notable year as a baseline and extrapolating forward from there. According to this model, if Bitcoin were to follow its 2022 growth rate, it would cross the zettahash threshold shortly after 2030. However, if its trajectory more closely resembled that of 2016, the milestone might not be reached until sometime after 2040.

So, what exactly do we make of this? Does a faster rate of computer processing power mean the Bitcoin network is more secure as the hashrate increases?

This is a tricky question, but I would still say yes, the Bitcoin network becomes more secure as hashrate increases, even if computers are getting faster overall. That’s because security depends on how much total computational power is needed to attack the network. As more miners contribute hashpower, it becomes exponentially more expensive and difficult for any single entity to control 51% of it. While faster computers help everyone, what matters most is that honest miners continue to outpace any potential attacker in total share of the network’s power.

Technically, if everyone’s computers got faster at the same rate - including potential attackers - then the relative security wouldn't change unless honest miners scale up faster than any one attacker could. Security is relative: it’s not about how fast computers are in general, but about how much of the total hashpower is controlled by honest miners versus a possible attacker.

Furthermore, part of answering this question involves understanding just how explosively the total hashrate has grown in recent years. It’s definitely not the case that technological advancements alone over this short time period account for all of Bitcoin’s hashrate growth. The key variables at play include increased institutional investment, higher Bitcoin prices, expansion of mining operations to regions with cheap energy, and innovations in energy efficiency.

Once one or two more of the major trackers push us past this figure, I think we can definitively say we’ve passed the milestone. What this says about Bitcoin, though, is the most important takeaway. It’s not just a network growing in size - it’s a testament to the unwavering strength, resilience, and global trust in the protocol. A couple of years ago, nobody was expecting Bitcoin to reach one zettahash in 2025, but here we are.

Bitcoin’s hashrate represents a growing force of miners, innovators, and believers driving toward an unstoppable future. The rise of the hashrate is the rise of Bitcoin itself - and this is only the beginning. If you know someone who could benefit from understanding this topic, forward them this email. Hashrate is one of the most misunderstood aspects of Bitcoin - and even longtime Bitcoiners didn’t anticipate this level of growth. We all have something to learn.

Bitcoin Thoughts And Analysis

Bitcoin has climbed back above the 50-day moving average (blue line) – a level it hasn’t closed above since January. That alone is notable – it marks a potential shift in momentum after months of trending beneath it. That said, the 200-day moving average (red line) still looms above as overhead resistance and hasn’t been tested on this push yet.

Price action has been constructive off the lows, with higher highs and higher lows forming over the past two weeks. Volume has picked up modestly, though not convincingly, suggesting the rally is cautious rather than euphoric. The $73,835 support level continues to hold firm as the critical line in the sand below.

It’s too early to declare a trend reversal, but closing multiple daily candles above the 50 MA would be a positive signal for bulls. Keep an eye on the 200 MA just above – cracking that level would open the door to more aggressive upside.

Stocks Flat, Yields Steady

US equity futures hovered near unchanged levels on Tuesday, as markets digested signs that the Trump administration could expand tariff exemptions to mitigate the economic fallout of its protectionist policies. The relative calm followed a two-day rally that saw equities rebound sharply from recent lows.

In Europe, stocks advanced after President Trump hinted at a possible pause on auto tariffs — a move that markets interpreted as a gesture toward negotiation. However, Boeing Co. shares slid 4% in premarket trading after Chinese authorities instructed domestic airlines to halt further deliveries of the company’s aircraft, underscoring continued geopolitical tensions.

The mood across global markets was notably more restrained compared to last week’s turbulence. Investors appeared cautiously optimistic that the White House’s rhetoric may be softening, particularly after a weekend of mixed messaging. “We’re in wait-and-see mode now,” said David Kruk of La Financière de l’Echiquier, noting that traders had been caught off guard by recent policy reversals.

Still, anxiety about the broader economic outlook persists. A Bank of America survey revealed the most negative sentiment toward the global economy in 30 years. Adding to those concerns, the US is pressing ahead with new trade investigations into semiconductor and pharmaceutical imports — steps that could reignite market volatility.

In rates and currencies, 10-year Treasury yields held steady, while the dollar was flat after a five-day losing streak.

Investors are also turning their attention to corporate earnings, with Bank of America set to report results later today — a key test of whether fundamentals can stabilize sentiment amid ongoing policy uncertainty.

Stocks

S&P 500 futures rose 0.3% as of 6:55 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 1%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1344

The British pound rose 0.4% to $1.3246

The Japanese yen rose 0.1% to 142.87 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $85,650.96

Ether fell 0.2% to $1,631.44

Bonds

The yield on 10-year Treasuries was little changed at 4.38%

Germany’s 10-year yield advanced three basis points to 2.55%

Britain’s 10-year yield was little changed at 4.67%

Commodities

West Texas Intermediate crude fell 0.6% to $61.20 a barrel

Spot gold rose 0.4% to $3,222.37 an ounce

ETH Staking Delayed

Following the SEC’s decision to delay a ruling on staking for Grayscale’s Ethereum ETF, the new - and final - deadline for approval or denial is set for June 1st. If that date arrives and BlackRock has not filed for staking on its own ETH ETF, the outcome becomes a coin toss. However, if BlackRock does file, it would likely tip the scales toward approval. This will be an interesting litmus test for the SEC’s stance on crypto: if BlackRock stays on the sidelines, the Commission will be forced to make a call based solely on Grayscale’s application. Either way, one thing is clear - staking is coming in 2025.

In-Kind Redemptions Also Delayed

It still remains the case that all U.S.-listed spot Bitcoin and Ethereum ETFs operate using a cash-only creation and redemption model. This means that when investors buy or redeem ETF shares, the transactions are settled in U.S. dollars rather than directly in Bitcoin or Ethereum. This structure was mandated by the SEC when it approved multiple spot Bitcoin ETFs in January 2024. Not all crypto ETFs will move to in-kind, but adding them into the mix will give larger investors more options and should bring in new money.

Kraken Is Now Offering Stocks and ETFs

Following its acquisition of CFTC-registered NinjaTrader, a global trading platform and futures broker, Kraken now offers U.S. equities trading on its mobile and web platforms. As for this news, through a partnership with broker-dealer Alpaca, customers can now trade over 11,000 U.S. stocks and ETFs without paying commissions. Over half of these will support fractional investing, allowing users to buy portions of a share instead of a full one.

Kraken’s co-CEO said this about the announcement: “Expanding into equities is a natural step for us and paves the way for the tokenization of assets. Crypto isn’t just evolving; it’s becoming the backbone for trading across asset classes, such as equities, commodities and currencies. As demand for 24/7 global access grows, clients want a seamless, all-in-one trading experience.” Tokenized equities is going to take time, but it's coming.

The World’s First SOL ETF Is About To Launch

Canada is preparing to launch the world’s first spot Solana ETFs this week, following approval from the Ontario Securities Commission (OSC). Set to go live tomorrow, April 16, the ETFs will be offered by several issuers - Purpose, Evolve, CI, and 3iQ - and will feature $SOL staking capabilities through TD Bank Group.

Trump’s Tariffs Just Supercharged Bitcoin - Here’s What’s Coming | Macro Monday

Trump’s new tariff plan just sent shockwaves through the markets—and Bitcoin responded fast.

On this week’s Macro Monday, Scott Melker is joined by Mike McGlone and Dave Weisberger, to break down what’s really going on beneath the surface.

We’ll be digging into:

Why tariffs could reshape the macro landscape

How Bitcoin is reacting in real time

What this means for inflation, rate cuts, and market structure

And what traders and investors need to watch this week

The market just shifted—and we’re here to help you make sense of it.

Catch the live conversation with some of the sharpest minds in macro and crypto.

Don’t miss it.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.