Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Volatility simplified. Focusing on ‘signal’ offers exceptional alpha opportunities with Bitcoin.

Buys at $78K, $79K, $76K.

Small Sells at $82K, $83K.

2.25X Long Bias.

More Bitcoin, More Cash.

Only your spot Bitcoin position used.

24/7 Liquidity.

added .27 $BTC

added +11%

added +4% Yield

**Yes, this is an infinite money glitch. Use it for FREE! Now.

In This Issue:

The $30 Trillion Opportunity Hiding in Plain Sight

Bitcoin Thoughts And Analysis

Altcoin Charts

Dollar Down, Stocks Up, Uncertainty Still Dominates

Make Sure To Pay Your Crypto Taxes!

Rumors Fly: CZ Provided Evidence Against Justin Sun

Mantra’s OM Token Rugs

The SEC Has Dropped The Helium Lawsuit

Tether: The U.S. Dollar’s Secret Weapon (And Why They’re Buying Billions in Bitcoin) | Paolo Ardoino

The $30 Trillion Opportunity Hiding in Plain Sight

Something remarkable is happening right under our noses — and hardly anyone seems to notice. Back on March 27, just two and a half weeks ago, I flagged this in the news segment of the newsletter.

It’s easy to see why BUIDL has caught my attention — it checks all the boxes of a product or trend that could go absolutely parabolic in short order. It’s tokenization. It’s BlackRock. It’s live on top-tier blockchains. It’s still in its infancy. And most importantly, it solves a real-world problem.

Quick refresher if you’re not already familiar:

BUIDL is a collaboration between BlackRock and Securitize, a leader in real-world asset tokenization. It’s designed to bring traditional finance on-chain through tokenized funds launched in partnership with leading asset managers. The fund is only available to qualified institutional investors and comes with a $5 million minimum investment — underscoring its institutional focus. At its core, BUIDL is the premier tokenized U.S. Treasury fund.

Now, back to the bigger point — BUIDL is on an absolute tear. As of April 12, 2025, it’s sitting at $2.44 billion in AUM. Let’s track how it’s grown.

04/14/2025 - BUIDL $293.4m (one year ago)

10/14/2024 - BUIDL $550.5m (six months ago)

01/14/2025 - BUIDL $634.4m (three months ago)

03/14/2025 - BUIDL $1.24b (one month ago)

03/31/2025 - BUIDL $1.92b (two weeks ago)

04/14/2025 - BUIDL $2.44b (today)

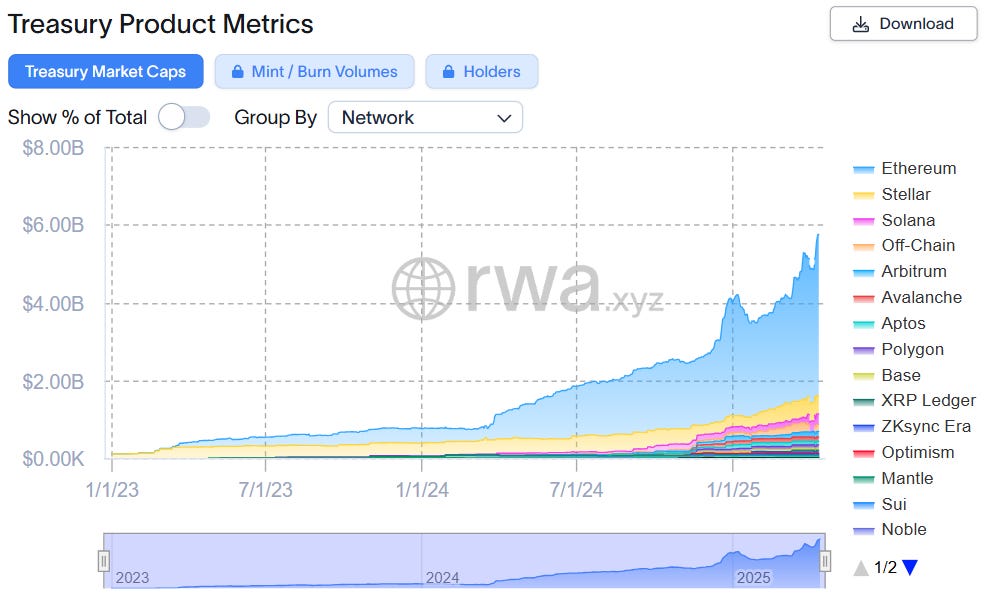

For most of 2024, BUIDL – along with its tokenized treasury peers – saw steady, predictable growth. But something changed in mid-December. All of the products began drifting upward, and by March, BUIDL completely separated from the pack, surging while its main competitors began to trend down.

Why is BUIDL outpacing everyone else? It’s hard to say definitively, but BlackRock’s scale, distribution power, and brand recognition likely play a major role. My hunch? Tokenized treasuries are on the edge of a breakout moment, and BlackRock is flexing its muscle while the broader market is still dragging its feet.

That’s not to say there’s anything wrong with the competing products – in fact, their minimal declines are relatively impressive given the market backdrop. But make no mistake, BUIDL is pulling away for a reason.

Also, one of the bigger headlines from a few weeks back was BUIDL expanding to Solana – but so far, it hasn’t moved the needle. Ethereum’s dominance in tokenized treasuries is only accelerating. At this point, there isn’t even a close second. If this trend continues just a little longer, it’s going to become impossible to ignore – the chart is going full parabolic.

Let’s shift gears, because treasury products aren’t the only thing heating up.

Tokenized commodities – currently sitting at a modest $1.39 billion market cap – are starting to show signs of life. Gold is still the only major commodity seeing traction, but after nearly a year of stagnation, it’s suddenly catching a bid.

Also catching my attention now is tokenized stocks.

Tokenized stocks are still so early that the chart barely has a pulse. At the moment, Algorand holds the edge as the go-to network for these assets – but let’s be honest, the second Ethereum and a major issuer get involved, it’s game over. Ethereum will take the lead… and never look back.

Coinbase, Robinhood – if you’re out there, tokenize your stocks already. List them on-chain, attract a wave of new buyers, boost your fee revenue, watch your stock price rip, and sit back as the media scrambles to make sense of it.

Now, speaking of Ethereum – easily the most hated major asset in crypto over the past year – it still dominates nearly every major tokenization category. Whether we’re talking stablecoins, tokenized treasuries, commodities, or institutional funds, Ethereum remains the top dog. And if you’re looking for a single metric to forecast which chain will lead the tokenization race, Ethereum’s stablecoin dominance is the clearest signal we’ve got.

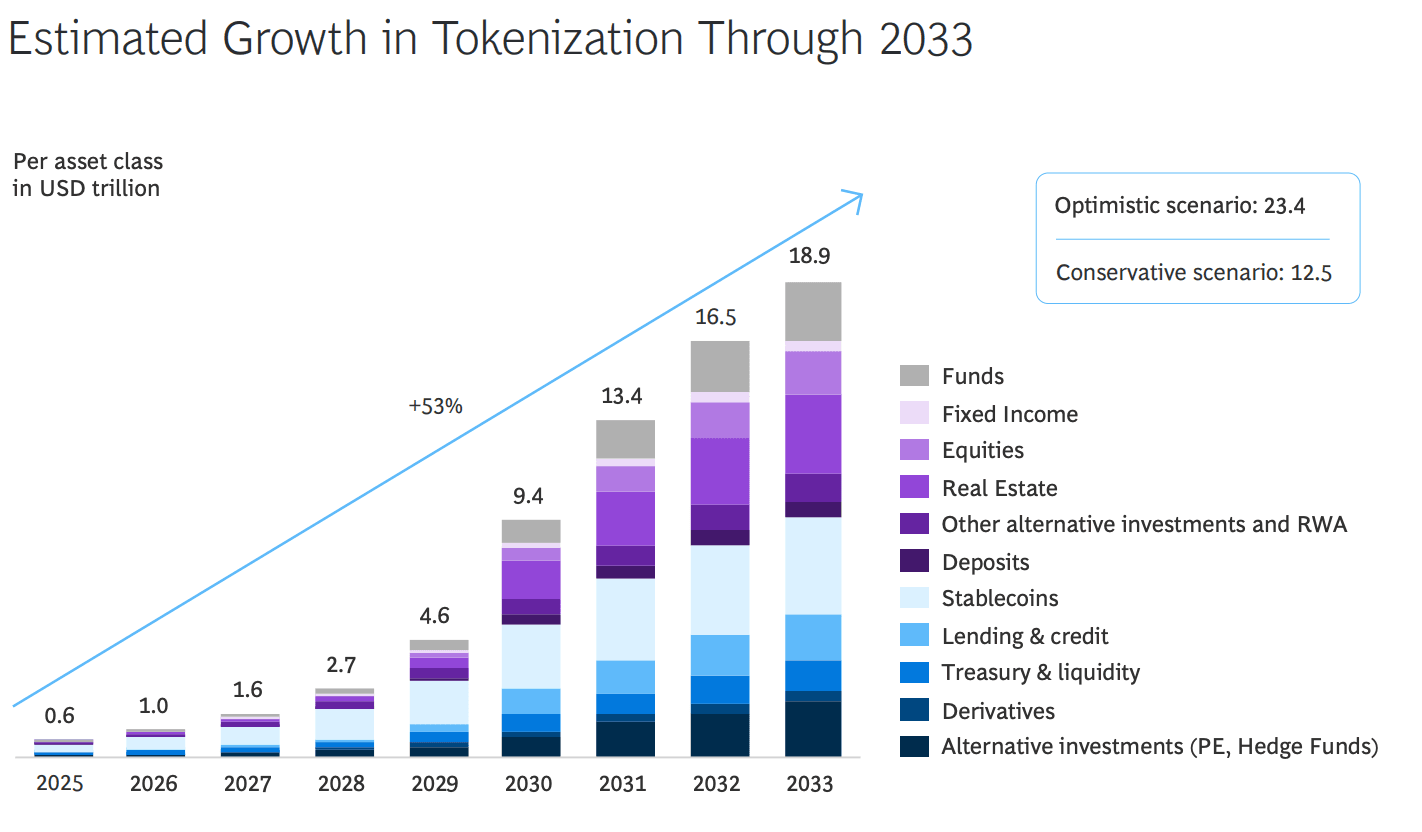

If you’re still here, you’re in luck, I saved the best news for last - I have some predictions around tokenization that are truly mind-blowing. The first image and paragraph come from a Ripple report titled “Approaching the Tokenization Tipping Point.”

The size of the tokenization market cap in 2025 is barely a blip - it’s like a financial speck of dust. It reminds me of the iconic “Pale Blue Dot” photo of Earth from 1990 - small, distant, and just the beginning of something much bigger.

“Overall tokenized assets are expected to increase to over $18 trillion, reflecting a CAGR of 53%. From real estate to lending and credit, tokenization is redesigning the infrastructure layer that global financial institutions depend on. The promise: a financial system that’s programmable, interoperable, always on, and broadly accessible.”

A few more predictions… all seeming to land around the $30 trillion mark.

Here’s the total RWA chart, sitting at just $20.88B in size.

Some trackers peg the total slightly above or below, but rounding to an even $20 billion is close enough. If the experts are right – and tokenized real-world assets (RWAs) hit a $30 trillion market cap by 2030 or shortly after – we’re looking at a 1,500x increase. That’s a 149,900% gain from where we are today.

In what universe does Ethereum not benefit from that?

If Ethereum’s core developers and the broader ecosystem can make even modest progress on rethinking how value accrues to the chain and its native token – and if tokenization grows even halfway to those projections – then Ethereum is positioned for one of the most powerful value inflection points in its history.

When tokenization finally goes mainstream, it won’t just be noticeable – it’ll fundamentally reshape how value moves across the globe. The impact will be deep, wide-reaching, and impossible to ignore.

Here’s hoping this year starts turning around for assets – especially crypto. Maybe, just maybe, the comeback begins this week.

Let’s get after it.

Bitcoin Thoughts And Analysis

Bitcoin is holding steady near the top of its recent bounce, pressing right into the underside of the 200-day moving average (red) and the 50-day moving average (blue), both of which are currently acting as resistance. This is a critical test zone – price has stalled here multiple times, and bulls will need to push decisively above these levels to flip the broader trend.

So far, this rally has been impressive off the bottom near $73,835, a key level that also served as the May 2024 all-time high. That horizontal line continues to act as a magnet for price, offering strong support on each revisit.

Volume remains relatively muted on this climb, which could suggest waning enthusiasm or simply consolidation before a stronger move. A decisive close above both moving averages would add weight to the bullish case, while rejection here could result in another retest of support levels below.

For now, Bitcoin is stuck in the middle of its range, making this a “wait and see” moment. Momentum is with the bulls, but they still have some major levels to conquer before the trend flips back in their favor.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Because I’m apparently a glutton for punishment, I’m once again daring to post an Ethereum chart. On the weekly, price wicked below the 2018 highs (which is wild when you think about it) and bounced. Last week printed a classic doji — small bullish body, long lower wick — a textbook sign of indecision at support.

If this week closes green, it could confirm a technical reversal. Oh, and this weekly candle had huge volume.

Has ETH finally found its bottom?

Dollar Down, Stocks Up, Uncertainty Still Dominates

Stocks climbed Monday as President Donald Trump signaled a temporary exemption from tariffs on popular consumer electronics — a move that boosted tech shares and offered a modest reprieve to battered markets. S&P 500 futures gained 1.6%, and European equities rose more than 2%, led by a rally in technology names. Apple jumped around 5% in premarket trading, while Goldman Sachs advanced after reporting strong first-quarter earnings.

The pause in levies on electronics, which had been included in a sweeping 145% tariff package on China and a global 10% flat duty, offered a sign that the administration might be open to negotiation. Trump said a specific tariff for electronics would be introduced later. The White House emphasized that this was part of a broader strategy to treat electronics as a standalone category — not a full reversal.

Markets welcomed the softer tone. US Treasury yields dipped, the dollar extended its slide for a fifth day, and gold eased slightly after last week’s record run. Oil prices firmed modestly. Meanwhile, safe-haven demand lifted the yen, which reached its strongest level since September, and the euro continued to benefit from greenback weakness, building on its fastest rally in 15 years.

Still, Wall Street strategists remain cautious. Citigroup downgraded US equities to neutral, citing diminishing "US exceptionalism" and growing global competition, particularly from China’s emerging AI capabilities and Europe’s fiscal expansion. Morgan Stanley’s Mike Wilson slashed his S&P 500 earnings forecast and warned that, despite reduced short-term recession risks, uncertainty around policy and growth remains elevated.

Analysts agreed that last week’s market rout — and the administration’s response — suggest Trump’s policies are not immune to market pressure. “The good news from last week is that Trump has a pain threshold,” said Aneeka Gupta of Wisdom Tree. “Markets can impose constraints on his policies.”

Still, with a 90-day pause on reciprocal tariffs and no clear trade roadmap, investors remain wary. As PineBridge’s Michael Kelly noted, doubts about the rule of law and policy consistency in the US could temper global investor confidence going forward.

In commodities, Goldman Sachs warned that global oil markets could face significant surpluses this year and next as trade frictions dampen demand. The path forward remains murky — even as markets catch their breath, the volatility may be far from over.

Stocks

S&P 500 futures rose 1.6% as of 7:30 a.m. New York time

Nasdaq 100 futures rose 1.8%

Futures on the Dow Jones Industrial Average rose 1.1%

The Stoxx Europe 600 rose 2.2%

The MSCI World Index rose 0.6%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.1391

The British pound rose 0.8% to $1.3196

The Japanese yen rose 0.3% to 143.17 per dollar

Cryptocurrencies

Bitcoin rose 1.6% to $84,839.59

Ether rose 5.4% to $1,675.71

Bonds

The yield on 10-year Treasuries declined four basis points to 4.45%

Germany’s 10-year yield declined four basis points to 2.53%

Britain’s 10-year yield declined seven basis points to 4.68%

Commodities

West Texas Intermediate crude rose 1.4% to $62.37 a barrel

Spot gold fell 0.4% to $3,223.30 an ounce

Make Sure To Pay Your Crypto Taxes!

Waylon Wilcox, a 45-year-old from Pennsylvania, has pleaded guilty to underreporting more than $13 million in income from the sale of 97 CryptoPunk NFTs, dodging around $3.3 million in taxes. I’m including this not just because it marks the first major U.S. tax evasion case involving NFTs, but also because – well, it’s tax season right now.

NFT gains are treated just like crypto, stocks, or any other capital assets. Do your taxes. And if you’re unsure, talk to a licensed professional. Can’t file on time? Look into an extension – just make sure you’re getting real guidance.

Rumors Fly: CZ Provided Evidence Against Justin Sun

An interesting story broke via the Wall Street Journal, claiming that Binance founder CZ provided evidence against TRON founder Justin Sun as part of his plea deal with U.S. prosecutors. CZ was quick to downplay the report on X, hinting it might be part of a smear campaign and even suggesting—without evidence—that WSJ employees were paid to damage his reputation. “People who become gov witnesses don’t go to prison,” he wrote, referencing his own four-month sentence.

I want to believe CZ, but his claim that government witnesses don’t go to prison doesn’t exactly hold up under scrutiny. Take Caroline Ellison, for example—the former CEO of Alameda Research cooperated fully with prosecutors and testified against Sam Bankman-Fried. Her cooperation helped slash a potential 110-year sentence down to just two, yet she still served time. Cooperation may reduce the penalty, but it doesn’t guarantee a walk free.

Mantra’s OM Token Rugs

This looks really bad for OM holders. The token lost 90% of its value yesterday, and while it’s too early to say definitively what happened, the sudden collapse has raised serious concerns. At this stage, it’s unclear whether the drop was due to a hack, internal exploit, or a deliberate rug pull — but speculation is rampant. Before the plunge, OM had a $6 billion market cap, ranking between Bitcoin Cash and Litecoin as the 20th largest crypto asset. If this does turn out to be malicious, it would mark one of the biggest incidents in recent memory.

I’m not sure what to make of this post from Mantra. A $6 billion coin doesn’t drop 90% from liquidations, something really strange is going on.

The SEC Has Dropped The Helium Lawsuit

The SEC is wasting no time. On the very same day Paul Atkins was officially confirmed as the new chairman, the commission issued a full reversal on its case against Helium — a case that was only filed in January, alleging securities violations. For those unfamiliar, Helium is a blockchain network designed to let “anyone build and own massive wireless networks,” using a proof-of-coverage model powered by global hotspots.

Altcoins are quietly stacking up wins. Their time is coming.

“With this dismissal, we can now definitively say that all compatible Helium Hotspots and the distribution of HNT, IOT, and MOBILE tokens through the Helium Network are not securities. With the dismissal of the SEC’s unregistered securities claims with prejudice, the outcome establishes that selling hardware and distributing tokens for network growth does not automatically make them securities in the eyes of the SEC. It also means that the SEC cannot bring these charges against Helium again.”

Tether: The U.S. Dollar’s Secret Weapon (And Why They’re Buying Billions in Bitcoin) | Paolo Ardoino

We dive into an exclusive chat with Paolo Ardoino, CEO of Tether, on The Wolf Of All Streets podcast, exploring his groundbreaking journey to lobby U.S. lawmakers about stablecoins. We uncover how stablecoins could reshape global finance, why Paolo's U.S. visit was crucial for crypto regulation, and Tether’s massive role in supporting the dollar worldwide. This conversation could change how we see crypto’s future—don’t miss it!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.