Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

BOOOOM!!!

Bitcoin Thoughts And Analysis

Wall Street’s Schizophrenia

Pro Tip: Reset Your Portfolio Tracker

Trump’s Appointees Are Still Bullish On Crypto

Paul Atkins Is About To Be Confirmed

Cathie Wood Is Still The GOAT

BOOOOM!!!

We Are So Back.

Yesterday was an absolute whirlwind.

This is how the day started:

Was this inside information? Yes. Is that what we are going to discuss? No.

Markets liked this post and reacted with a small bounce, but in the afternoon, we got the real news and… BOOOOOOOOM… we are back (for now).

As expected, markets loved the news that Trump is initiating a 90-day pause. It’s also all the confirmation we needed that the market is completely in Trump’s hands right now. If a deal with China gets done, expect a similar rally. If China decides to play hardball, this pause could easily be rolled back. We’re not out of the woods yet - but we’re starting to see the tree line.

As a side note, I want to mention this, but it’s definitely not the main focus of today.

This is a nice change of pace:

Bitcoin – and altcoins especially – still have a long way to go. But with the right conditions, that progress could come much faster than most people expect. Personally, I’d much rather be exposed and unsure whether we’re out of the woods than sitting on the sidelines waiting for a dip that may never come.

Even though yesterday marked the end of one chapter, Trump’s tariffs will remain the central topic across financial circles – how could they not be? So today, I’m using this space to share expert perspectives that cut through the noise. No politics. No clickbait. No hidden agenda. Just real insight from some of the best minds in the game.

Let’s kick it off with VanEck – a respected investment firm known for its ETF lineup and increasing focus on digital assets. For the piece below, VanEck tapped a range of portfolio managers across markets to weigh in on the proposed tariffs. I’ve skipped the commentary that doesn’t apply to us and highlighted what matters most.

VanEck - “Our Portfolio Managers Weigh Impact of Trump’s Tariffs”

I have to include Matthew Sigel’s (Head of Digital Asset Research) entire piece.

There’s more…

“That interest is no longer theoretical. China and Russia have reportedly begun settling some energy transactions in Bitcoin and other digital assets. Bolivia has announced plans to import electricity using crypto. And French energy utility EDF is exploring whether it can mine Bitcoin with surplus electricity currently exported to Germany. These are early signs that Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems.”

“Investors should watch the evolving path of Fed policy: dovish shifts in rate expectations and rising liquidity are historically positive for Bitcoin. The U.S. Dollar Index (DXY) remains a key signal—any sustained dollar weakness may bolster the Bitcoin-as-hedge narrative, particularly in an environment of geopolitical fragmentation. Importantly, while 10-year Treasury yields surged on Monday, Bitcoin’s reaction was notably subdued. Unlike in 2022, rising yields did not trigger a wave of forced liquidations or volatility in crypto markets, suggesting that BTC may be decoupling from old macro sensitivities. Bitcoin ETP flows and on-chain activity also matter: despite recent volatility, U.S.-listed spot Bitcoin ETPs are still net positive by ~$600 million year-to-date, with renewed inflows in late March. Finally, watch for retaliatory moves from China or the EU—especially those aimed at bypassing dollar-based systems—which could accelerate adoption of crypto as an alternative settlement layer.”

Sorry, that was a lot, but we can boil down Sigel’s message into a few key points:

Bitcoin is performing exceptionally well at a weak time, outpacing the NASDAQ across every major timeframe, proving its resilience and strength in the face of global uncertainty.

We're seeing Bitcoin gain real traction, with countries like China, Russia, and Bolivia using it for energy transactions, showing how it's becoming a go-to tool for bypassing the U.S.-centric financial system.

Bitcoin investors need to monitor Fed policy, dollar strength, and geopolitical developments, as dovish shifts and moves away from dollar-based infrastructure may further boost Bitcoin's appeal.

Next, I am going to stay in this same report, but only pull key quotes that pertain to us:

Portfolio Manager, Gold and Precious Metals

“Gold and gold stocks should ultimately benefit from the heightened level of risk across the global economy and global financial system. The unpredictability of economic policies and heightened market volatility should boost gold's appeal as the preferred safe-haven asset during times of global uncertainty. This should support a shift in investor sentiment towards gold and related equities.”

I don’t see a world where gold benefits as a safe-haven asset during times of uncertainty and Bitcoin doesn’t. I simply don’t see it.

Portfolio Manager, Commodity Index Strategy

“These tariffs are much higher and worse than expected. The outlook for global growth has collapsed. Gold has held up better than most commodity sectors but has pulled back about 4% from the new all-time highs reached on April 2. I believe that Trump’s global tariff war is very bullish gold. Indicators to Watch: The dollar. I think that this trade war is very bearish the dollar in the longer term. If I am correct, commodities should be supported and could resume a bullish trend.”

The commodity index portfolio manager is reiterating a bullish stance on gold and adding long-term bearish outlook on the dollar, both of which are very positive signs for Bitcoin.

Now, let’s shift gears to my other favorite crypto investment firm, Bitwise, which is fully focused on crypto.

Bitwise - “The Fallout From Trump’s Tariff Push”

“So when it comes to the tariff push, the thing I’m most certain of is this: The Trump administration wants a significantly weaker dollar, even if it means sacrificing the dollar’s role as the world’s sole reserve currency. This has big implications for bitcoin.”

“The underlying message is clear: The dollar needs to go lower.”

“My sense is that we will move from a single reserve currency (the dollar) to a more fractured reserve system, with hard money like bitcoin and gold playing a bigger role than it does today. In this context, the case for bitcoin is simple: When international dynamics are fraught and global currencies are in flux, where else can investors go for a scarce, global, digital store of value that sits outside the control of any government or entity?

As the old saying goes, “chaos is a ladder.”

In December, Bitwise predicted that bitcoin would end the year at $200,000. I still think that’s in play.”

Matt Hougan’s premise is twofold:

The Trump administration pushing for a weaker dollar will drive both short-term and long-term gains for Bitcoin, as dollar weakness historically correlates with Bitcoin price increases.

Chaos is a ladder, and Bitcoin is built to climb, it is decentralized, a scarce store of value, and challenging the dollar’s dominance as the world’s reserve currency.

*I discussed some of this with Matt on Tuesday.

Jeff Park from Bitwise, who has been killing it lately, still has some concerns though…

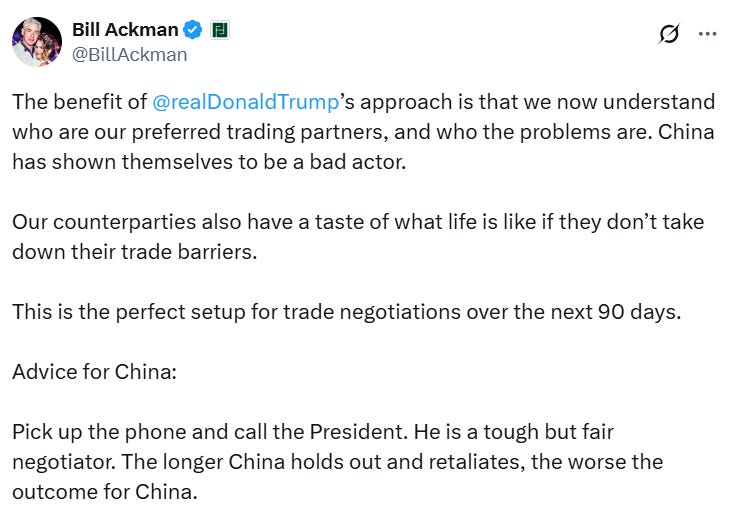

To balance out Jeff Park’s concerns, I’ve got a few highlights from Bill Ackman. Even if you think he’s playing political favorites in his analysis, there’s no denying this guy’s investment chops.

This post was sent hours before Trump pulled hard on the wheel and initiated the pause. See what he had to say below, right before that decision was made:

“If the president doesn’t pause the effect of the tariffs soon, many small businesses will go bankrupt. Medium-sized businesses will be next. A 90-day pause will enable @realDonaldTrump to accomplish his objectives without destroying small businesses in the short term. May cooler heads prevail.”

The argument Ackman made was that small businesses, particularly those in the coffee and tea industry, would be hit hard by Trump’s tariffs.

And of course, Trump flat our admitted this…

We can debate the Trump pivot ad nauseam. Some are calling it a masterclass in negotiation, while others – myself included – see it more as a capitulation to the market gods and to the billionaires that needed an end to the pain. But that’s not what matters today.

As you sift through the endless takes online, chase down rabbit holes, and settle on the narratives that speak to you, just remember this – by the time it’s obvious the market has turned, the biggest gains will likely be in the rearview. There are only a handful of days each year that move the needle like yesterday did, and missing them can seriously drag down your annual performance.

Sure, we still need progress on the macro front – 10-year yields coming down, inflation cooling, and rate cuts finally materializing – but the momentum is building.

If you believe in Bitcoin, this is still a great time to be stacking. Forget the 8% jump yesterday – we’re still over $20,000 off the all-time high, which leaves plenty of room for meaningful upside.

Bitcoin remains my top asset, and I’m still holding alts with conviction.

One day at a time.

Bitcoin Thoughts And Analysis

Bitcoin may not have fundamentally shifted its structure, but yesterday’s price action deserves a closer look.

First off, we now have what appears to be a tweezer bottom – two candles with nearly identical lows, signaling potential short-term exhaustion of selling pressure. These patterns can mark bottoms, especially when paired with a strong follow-up move… and that’s exactly what we got.

Yesterday's candle was a big green candle, bouncing from just above $73,800 support – a level we’ve been eyeing as the former May 2024 all-time high. That support continues to hold like a champ.

The bounce was strong, but it's important to zoom out. Price is still beneath both the 50 and 200 MA, which remain stacked bearishly following the recent death cross. So while bulls had a great showing, the structure hasn’t changed much yet. This could still be just a dead cat bounce unless we see a decisive break of the downtrend line or reclaim of key moving averages.

In short: promising bounce, strong support reaction, potential tweezer bottom… but no trend reversal confirmed – yet.

Wall Street’s Schizophrenia

US stock futures tumbled, reversing much of Wednesday’s dramatic gains, as investor sentiment shifted from relief over President Trump's temporary tariff pause back to deepening anxiety about long-term economic damage from the trade war. S&P 500 futures declined 1.8%, signaling that Wall Street's historic 10% rally could be short-lived. In premarket trading, tech giants Tesla and Nvidia shed about 3%, pulling back from sharp gains seen yesterday.

Investors retreated into safe havens, with gold, the yen, and Swiss franc climbing, and US Treasuries advancing ahead of a crucial auction of 30-year bonds that will serve as a test of market appetite amid heightened volatility. The dollar weakened for a third consecutive day, while oil prices dropped below $64 a barrel on concerns of weakening global demand.

Strategists expressed skepticism that the relief rally could be sustained. Colin Graham from Robeco said the tariff pause offered limited reassurance, warning that “the damage has been done,” and advised caution against chasing the recent bounce. Citi also recommended against "buying the dip," while Jefferies urged investors to reduce exposure to US markets. Pacific Investment Management Co.'s economist Tiffany Wilding now puts the odds of a US recession at 50%.

Attention has shifted to upcoming US inflation data, which could provide further clues on how aggressively the Federal Reserve might respond amid trade-induced economic uncertainty. Meanwhile, businesses are already scaling back investment as US-China tensions persist, raising fears of a prolonged global slowdown.

In China, policymakers convened to discuss further stimulus options, while the yuan briefly weakened to levels not seen since 2007, reflecting increasing economic strain. Elsewhere, European and Asian stocks staged sharp rebounds, catching up to Wednesday's gains in the US. Europe's Stoxx 600 surged nearly 5%, marking its largest single-day rise since 2020, even as investors remained cautious about long-term trade-war impacts.

Stocks

S&P 500 futures fell 2.3% as of 6:03 a.m. New York time

Nasdaq 100 futures fell 2.4%

Futures on the Dow Jones Industrial Average fell 1.8%

The Stoxx Europe 600 rose 4.9%

The MSCI World Index rose 1.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.7%

The euro rose 1.1% to $1.1068

The British pound rose 0.6% to $1.2893

The Japanese yen rose 1.3% to 145.91 per dollar

Cryptocurrencies

Bitcoin fell 1.4% to $81,998.23

Ether fell 4.1% to $1,604.12

Bonds

The yield on 10-year Treasuries declined five basis points to 4.28%

Germany’s 10-year yield advanced five basis points to 2.64%

Britain’s 10-year yield declined 12 basis points to 4.66%

Commodities

West Texas Intermediate crude fell 3% to $60.86 a barrel

Spot gold rose 1.2% to $3,118.20 an ounce

Pro Tip: Reset Your Portfolio Tracker

If you find yourself constantly checking your portfolio and the market’s volatility is messing with your mental state, try this: write down all your positions, delete your portfolio tracking app, clear the cache, then reinstall it. Re-enter your assets from scratch. It’ll feel like you’re starting fresh today.

No, it won’t magically change your actual portfolio value – but it will give you a mental reset. With all the previous downward price action erased from view, you’re left with a clean slate. That shift in perspective can be surprisingly powerful.

And if you're doing this near a market bottom? Even better. As prices begin to recover, you’ll see more green than red – not because your portfolio is doing better, but because your mind isn’t constantly comparing to previous highs. Sometimes, that’s all it takes to stay sane.

Trump’s Appointees Are Still Bullish On Crypto

“Digital asset firms were victims of a weaponized justice system under the Biden regulatory regime. President Trump is the true crypto President — under his leadership, we’ll usher in a golden age for digital assets and emerging financial technologies.”

It’s nice to see these two continuing to share positive sentiment on this space. At least we know that Trump’s team and his elected officials are not just fair-weather believers. In fact, it doesn’t seem like anyone on Capitol Hill cares about the price - they are committed to the cause.

“We will take a close look at regulatory impediments to blockchain, stablecoins, and new payment systems, and we will consider reforms to unleash the awesome power of the American capital market. Americans deserve a financial services industry that works for all Americans, including and especially Main Street. Under President Trump’s leadership, the Treasury Department and I will deliver that to you. Thank you.”

ETH Options Approved!

With Ether options now approved, the floodgates are open for a new wave of exotic ETH ETF products – covered call strategy ETFs, downside protection ETFs, even leveraged and inverse plays. Investors will soon have far more tools to dial in precision strategies around Ethereum.

The one big-ticket item still missing? An ETH staking ETF.

BlackRock hasn’t filed for it yet, but it feels inevitable. Robert Mitchnick has already spoken about it at length – and when BlackRock talks, it’s rarely speculative. It’s a signal. At this point, it’s less a question of “if” and more a matter of “when.”

“Tons of people asking me about Ethereum ETF Staking approval timelines. Its possible they could be approved for staking early, but the final deadline is at the end of October. Potential intermediate deadlines before the final approval (or denial) are in late May & late August.” - James Seyffart

In other ETH news, I want to share this:

“On a risk/reward basis in a new cycle trend, I want to own the most hated thing and not the most loved thing of the previous cycle. So, what’s the most hated L1? It’s ETH. I think ETH can be the dark horse that does very, very well and can retake its previous all-time high of $5,000 back in 2021 before Solana goes up 2 or 3x before it takes its previous all-time high of $300. That would be the trade that I would be making if I had fresh capital.” Arthur Hayes just confirmed this on a podcast with Laura Shin.

Paul Atkins Is About To Be Confirmed

By the time you’re reading this, there’s a good chance Paul Atkins has been confirmed by the Senate as the new SEC Chairman. Over the past few months, we’ve gotten a solid read on his pro-crypto stance, and it’ll be interesting to see just how aggressively he moves to course-correct the missteps of the previous administration - or whether he simply empowers Hester Peirce to take the lead. Either way, I’m bullish and excited to see where his leadership takes things.

Cathie Wood Is Still The GOAT

I haven’t seen Cathie Wood’s name pop up in the news in a little bit, but I haven’t forgot about her epic 2020 run that put her on the map. Nobody does it better than Cathie Wood in a risk-on bull market. As for the news, Cathie Wood’s Ark Invest added nearly 200,000 Coinbase shares - worth about $31 million - over the last three trading days as markets dropped amid Trump’s trade war news. The purchases were spread across three Ark ETFs (ARKK, ARKW, and ARKF), bringing Ark’s total Coinbase holdings to over 3 million shares, now valued around $550 million. Despite selling off some shares earlier in 2024, Ark remains one of the largest institutional holders of Coinbase stock. I’d love to see Wood’s bet on this pay off.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.