Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Never lose another trade. Yes, you read that right. Never. Lose.

Our dev team has created an update to our Bitcoin Algorithm Arbitrage Strategy that never allows you to execute a losing trade.

Unprecedented. Execution. Excellence. Oh, and a reminder that you can use our Algo(s) for free up to $10K.

Never lose another trade. We dare you to prove us wrong! Schedule a demo or just download the Algo for free.

In This Issue:

Is Strategy Preparing To Sell Bitcoin?

Bitcoin Is Still Holding Support

Stocks Down, Yields Up. Welcome To The Nightmare.

What Are The Odds Of A Cut In May?

World Liberty Financial Is Preparing For An Airdrop

Ripple Acquires Hidden Road For $1.25B

The U.S. DOJ Disbands Crypto Enforcement Unit

Is It Finally Time To Buy Bitcoin – Or Will It Nuke 20%?

Is MSTR Preparing To Sell Bitcoin?

Since markets are spiraling and crypto’s become a migraine, I figured we could all use a break from the noise coming out of the White House. Let’s tune out the Trump tariff tantrum for a day and focus on something else.

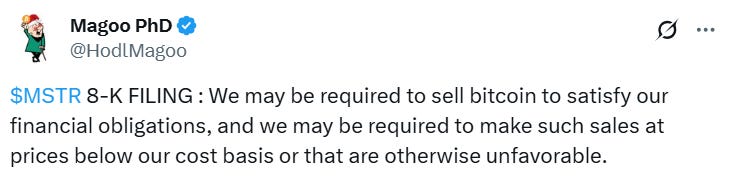

Yesterday, I saw a rumor on X that Strategy is now ‘preparing to sell Bitcoin.’

These posts were all in reference to the form and paragraph below:

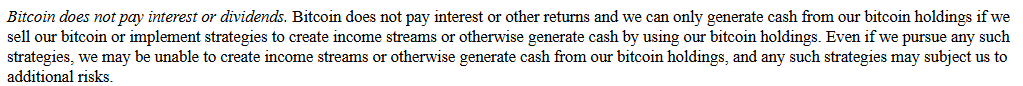

It reads, “As bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable. Any such sale of bitcoin may have a material adverse effect on our operating results and financial condition, and could impair our ability to secure additional equity or debt financing in the future. Our inability to secure additional equity or debt financing in a timely manner, on favorable terms or at all, or to sell our bitcoin in amounts and at prices sufficient to satisfy our financial obligations, including our debt service and cash dividend obligations, could cause us to default under such obligations. Any default on our current or future indebtedness or preferred stock may have a material adverse effect on our financial condition.”

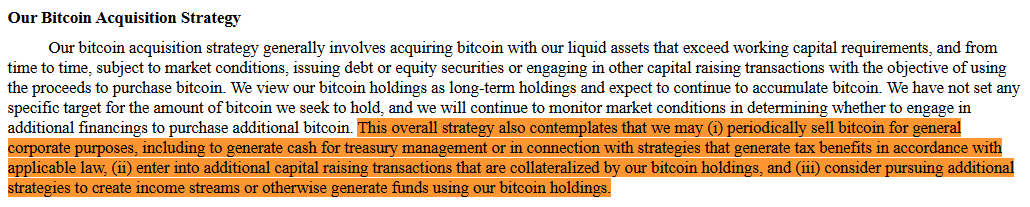

That’s not the only time they mentioned it in the same filing:

I find it interesting that the bolded sentence above was singled out, especially when there are other statements in the text about the company potentially defaulting. I'm fairly certain that a default by Strategy, which would likely involve liquidating all the Bitcoin, is worse than simply having to “sell Bitcoin to satisfy financial obligations.”

Reading the posts, and seeing that Strategy did in fact include the statement in an SEC filing, the question becomes, is this a common statement and is Strategy actually preparing to sell?

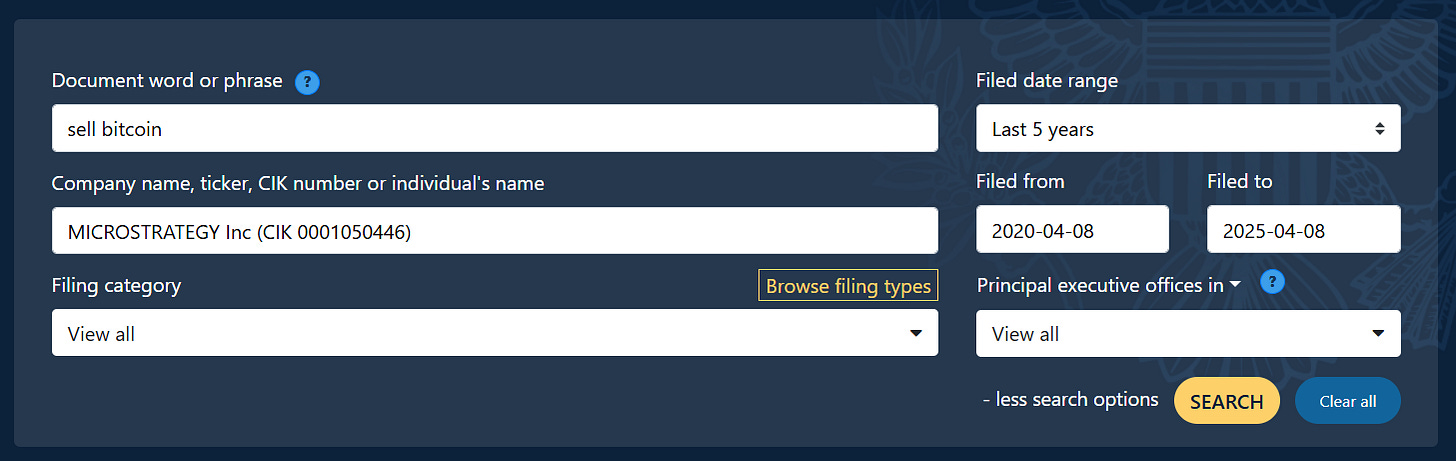

To answer the first part of the question, I went over to EDGAR, the SEC’s database, and started reviewing relevant filings for context.

First of all, no two 8-K filings are the same. The purpose of an 8-K filing is to report significant events or corporate changes that shareholders and the SEC should be aware of. These filings can vary greatly depending on the nature of the event being reported, such as mergers, acquisitions, changes in leadership, or financial restatements. Some are very brief; the most recent Strategy 8-K is quite a bit longer. Some don’t even mention Bitcoin.

Here’s an 8-K filing from January 6, 2025, discussing selling Bitcoin:

Here’s a prospectus from June 14, 2021, discussing selling Bitcoin:

I did a keyword search for ‘sell Bitcoin,’ and these are all the filings that satisfy that two-word combination.

There were 148 results in total, included in a wide variety of forms.

This doesn’t even account for what might have populated if I had searched ‘sell our Bitcoin.’ These statements are nothing more than legal jargon, written by Strategy’s lawyers to cover their bases.

You get the idea.

It’s pretty crazy how an individual can pick something - literally anything - entirely random, shout it in the town square, and watch as the unsubstantiated rumor spreads like wildfire. Granted, this one didn’t go too far and was contained rather quickly, but it’s a perfect case study for how these fake headlines spread. It’s almost identical to the CNBC headline from just a couple of days ago about the 90-day tariff delay.

This leads us to the next question - is Strategy preparing to sell?

That’s a negative, Ghost Rider.

Let’s see what Strategy’s debt looks like:

“A significant decrease in the market value of our bitcoin holdings could adversely affect our ability to satisfy our financial obligations

As of December 31, 2024, our outstanding indebtedness was $7.274 billion, and our annual contractual interest expense was $35.1 million. Additionally, as of February 14, 2025, we had outstanding series A perpetual strike preferred stock with a liquidation preference of $730.0 million in the aggregate, with respect to which we are required to pay annual dividends of $58.4 million, which we can pay in cash or shares of our class A common stock.”

“The Company has issued the following convertible notes (collectively, the Convertible Notes”) in private offerings:

$650.0 million aggregate principal amount of 0.750% Convertible Senior Notes due 2025 (the “2025 Convertible Notes”), all of which were previously redeemed or converted into our class A common stock by July 15, 2024;

$1.050 billion aggregate principal amount of 0% Convertible Senior Notes due 2027 (the “2027 Convertible Notes”);

$1.010 billion aggregate principal amount of 0.625% Convertible Senior Notes due 2028 (the “2028 Convertible Notes”);

$3.000 billion aggregate principal amount of 0% Convertible Senior Notes due 2029 (the “2029 Convertible Notes”);

$800.0 million aggregate principal amount of 0.625% Convertible Senior Notes due 2030 (the “2030 Convertible Notes”);

$603.8 million aggregate principal amount of 0.875% Convertible Senior Notes due 2031 (the “2031 Convertible Notes”); and

$800.0 million aggregate principal amount of 2.25% Convertible Senior Notes due 2032 (the “2032 Convertible Notes”).”

Tens of thousands of pages have been filed with the SEC detailing Strategy's business structure. While I don’t claim to have a complete or comprehensive grasp of the company’s assets, debts, and liabilities, I do know this: Strategy has accumulated 528,185 BTC - worth approximately $40.6 billion, and the Bitcoin price is $77,000. Even if the company were forced to liquidate a portion of its holdings to meet debt obligations, I believe its business model would remain intact. Based on a quick review of the debts mentioned above, I’m fairly confident Strategy can meet its required payments.

Also, two things: first, if there’s a bit of spillage and Strategy ends up selling some Bitcoin, it doesn’t mean everything falls apart. Second, as soon as Bitcoin rebounds, this concern disappears into thin air. It would sting if it happened with the market down, but I still don’t think we are remotely close.

Try to block out the noise coming from the White House - this level of chaos won’t last forever. I know things feel rough right now, but stay the course. Focus on staying afloat, and keep accumulating if that’s part of your plan.

Bitcoin Is Still Holding Support

Bitcoin is trying its little heart out to stand strong in the face of global mayhem. It has once again bounced just above the March 2024 high, around $74,000. It’s hard to be excited about any asset at the moment, but this is still a key support level that is currently holding. I am still a dip buyer for the long term, loving these prices.

Stocks Down, Yields Up. Welcome To The Nightmare.

Global stocks and bonds plunged Wednesday as investors recoiled from President Trump's decision to raise tariffs on China to 104%, the highest U.S. tariff rate in a century, significantly escalating the ongoing trade conflict. The selloff drove Europe’s benchmark index down as much as 3.6% and sent yields on 30-year U.S. Treasuries surging above 5% for the first time since late 2023. The dollar declined for a second straight day, reflecting growing concerns about the credibility of U.S. assets as safe havens.

Amid widespread panic selling, U.K. borrowing costs spiked to their highest since 1998, while yields on Japan’s 40-year bonds reached record levels. Initial brief stabilization came when China signaled openness to dialogue but simultaneously reiterated it was fully prepared to respond firmly, leaving markets jittery and uncertain.

The rapid escalation of the trade war has intensified worries of a U.S. recession. Economists at JPMorgan and Goldman Sachs have already increased their recession risk assessments, underscoring the complexity facing the Federal Reserve if tariff-induced inflation takes hold. Ray Dalio, founder of Bridgewater Associates, warned of potential systemic risk, describing current market conditions as a "once-in-a-lifetime" disruption across monetary, geopolitical, and economic frameworks.

Traditional havens shifted as traders turned away from Treasuries and sought shelter in the Japanese yen and Swiss franc, with the euro also rising above $1.10. Meanwhile, commodities remained under intense pressure, with oil hitting fresh four-year lows amid growth concerns.

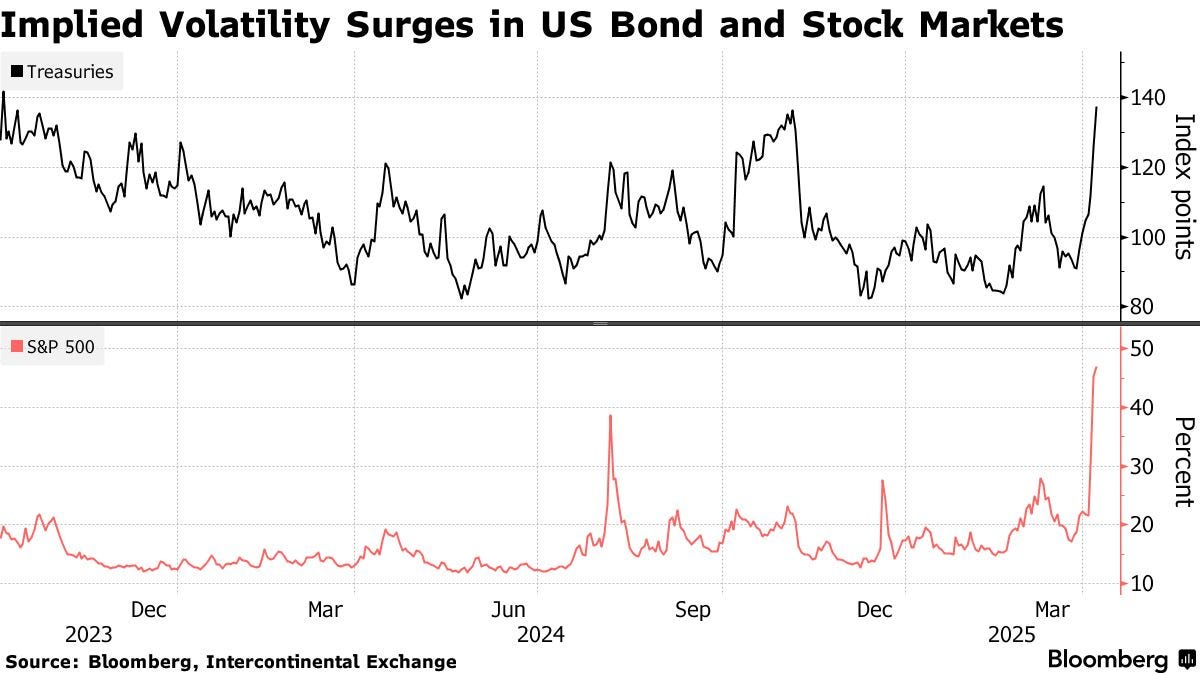

With the S&P 500 down over 12% since Trump first detailed his new global tariff plan a week ago, market volatility has surged, sparking fears of broader financial system stress or even breakdowns. Analysts, including Alexandre Hezez of Group Richelieu, cautioned that continued volatility could trigger "market accidents" and force the Fed into rate cuts despite inflationary pressures, further complicating monetary policy responses.

Stocks

S&P 500 futures were little changed as of 5:29 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 2.7%

The MSCI World Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.6% to $1.1027

The British pound rose 0.5% to $1.2823

The Japanese yen rose 0.6% to 145.35 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $77,223.45

Ether fell 0.4% to $1,474.67

Bonds

The yield on 10-year Treasuries advanced six basis points to 4.35%

Germany’s 10-year yield declined two basis points to 2.61%

Britain’s 10-year yield advanced seven basis points to 4.68%

Commodities

West Texas Intermediate crude fell 3.3% to $57.59 a barrel

Spot gold rose 2.1% to $3,044.85 an ounce

What Are The Odds Of A Cut In May?

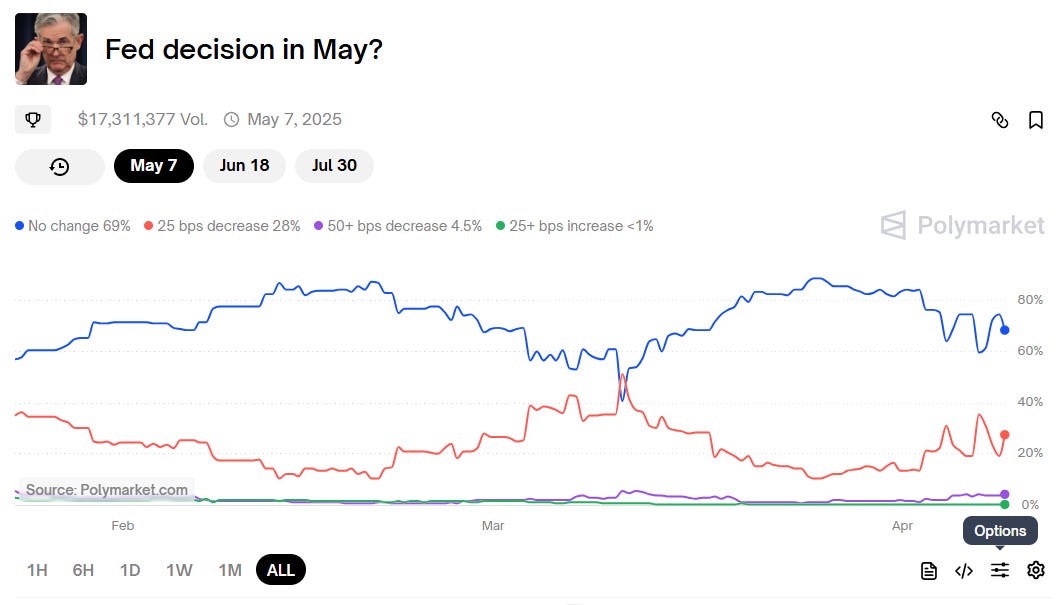

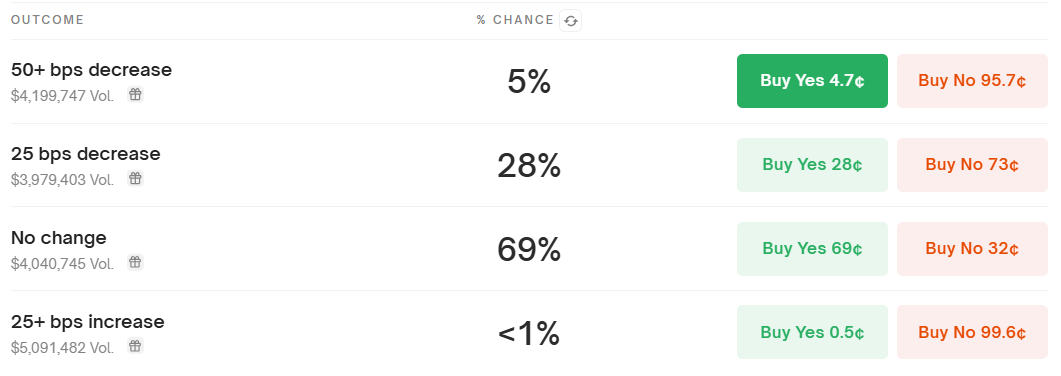

The CME FedWatch Tool is estimating over a 50% chance that the Fed will cut rates by 25 basis points at the May 7 meeting. Meanwhile, Polymarket sees things differently - still viewing no change as the most likely outcome. I'm not sure what to make of the discrepancy, so just be cautious if you're placing bets. Things are changing quickly, and it's hard to keep up. My bet is that the Fed can no longer consider cutting with inflationary concerns from tariffs.

World Liberty Financial Is Preparing For An Airdrop

World Liberty Financial is proposing a test airdrop of its USD1 token to all current WLFI holders. The goal is to validate its onchain airdrop system in a live setting, increase awareness of USD1 ahead of a wider release, and show appreciation to early supporters. The plan is for a small, fixed amount of USD1 to be distributed per eligible wallets on the Ethereum Mainnet. Furthermore, the airdrop is subject to eligibility criteria and timing will be decided by the company, they reserve the right to change or cancel the test at any time. The amount to be airdropped is currently unknown, as are any potential future airdrops.

Ripple Acquires Hidden Road For $1.25B

Ripple is acquiring prime broker Hidden Road for $1.25 billion, marking one of the biggest deals in the digital assets sector. The move makes Ripple the first crypto company to own and operate a global, multi-asset prime brokerage. Hidden Road, which clears $3 trillion annually and serves over 300 top institutional clients, offers services across FX, digital assets, derivatives, and more. With Ripple’s financial backing, Hidden Road is expected to significantly grow and become the largest non-bank prime broker in the world.

“We are at an inflection point for the next phase of digital asset adoption -the US market is effectively open for the first time due to the regulatory overhang of the former SEC coming to an end, and the market is maturing to address the needs of traditional finance. With these tailwinds, we are continuing to pursue opportunities to massively transform the space, leveraging our unique position and strengths of XRP to accelerate our business and enhance our current solutions and technology” - Brad Garlinghouse, CEO of Ripple.

The U.S. DOJ Disbands Crypto Enforcement Unit

The ‘Trump Effect’ continues to impact the crypto space, now with news that the U.S. Department of Justice has shut down its National Cryptocurrency Enforcement Team, (NCET) a unit formed under the Biden administration to tackle crypto-related crimes. This decision, directed by Deputy Attorney General Todd Blanche - a recent Trump appointee - signals a broader reduction in federal oversight of the crypto industry. Todd Blanche described NCET as a “reckless strategy” that “prioritized headlines over effective policy.” Despite how bad of a beating the crypto space has taken, good news continues to pour in that will carry lasting positive effects. As for all ongoing cases, they will now be handled by existing DOJ divisions.

Is It Finally Time To Buy Bitcoin – Or Will It Nuke 20%?

Joining me today are Matt Hougan, CIO at Bitwise, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.