Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public is doing a HUGE giveaway and it ends this weekend!

We want to see you at The Bitcoin Conference in Vegas May 27-29. We are giving away TWO Industry Passes and an invitation to Arch Public’s Invitation Only Dinner in Vegas.

Here’s how you make yourself eligible for our giveaway:

Download our FREE Bitcoin Algorithm right now.

Follow @tryarchpublic on X.

Over the next week we will choose a winner and announce The Bitcoin Conference package in full! See you in Vegas!

And keep stacking sats with The Bitcoin Algorithm!

In This Issue:

Black Monday 2.0?

Bitcoin Thoughts And Analysis

Altcoin Charts

Stock Crash Deepens as Traders Cling to Hope for Fed Rescue

Circle May Delay It’s IPO

Tether Is Prepared To Issue A New Stablecoin

Ethereum Transaction Fees Drop To 2020 Lows

Bitcoin's Big Moment: Senator Gillibrand’s Plan To Lead The Crypto Industry Forward

Black Monday 2.0?

The S&P 500 just closed out one of its worst two-day stretches in market history last week — and yet, Bitcoin barely blinked.

Moments like this are rare. In more than a century of trading, there have only been a handful of times when markets unraveled this violently, this quickly:

Oct 28–29, 1929 (Great Depression)

Dow fell 23% — the crash that triggered the Great Depression and ushered in modern market regulation.Oct 19–20, 1987 (Black Monday)

Dow dropped 28.5% — includes the largest single-day percentage loss in history (−22.6%).Apr 3–4, 2000 (Dot-Com Meltdown Begins)

Nasdaq fell 12.5% — tech stocks tanked as the internet bubble burst, kicking off a brutal bear market.Oct 8–9, 2008 (Great Financial Crisis)

S&P 500 fell 16.65% — panic selling as fears of a global banking collapse peaked.Mar 16–17, 2020 (COVID Panic)

S&P 500 fell 12% — fears of lockdowns and economic freefall triggered record volatility.Apr 3–4, 2025 (Trump’s Tariffs)

S&P 500 fell 10.5% — markets plunged on fears of a full-blown trade war and global recession.

It took five years for another major crisis to emerge. After COVID shocked markets in 2020, we got used to the idea that the worst was behind us. But here we are - April 2025 - and the panic is back. The cause this time? Tariffs and rising geopolitical tensions.

Still, let’s keep it real: the COVID crash was scarier (for now). In March 2020, the U.S. stock market was halted four separate times due to extreme volatility. On March 9, a 7% drop triggered a Level 1 circuit breaker for the first time since 1997. Then it happened again. And again. And again. March 12, March 16, March 18 - three weeks, four halts. Investors didn’t get time to "pause and think" - they froze in terror. ANd they believed that the world was literally ending.

Crypto Twitter held its breath during those halts, staring at red portfolios and hoping the world wouldn’t end between refreshes.

Bitcoin, already limping out of a long bear market, got punched in the face. It dropped from $10,191 on Feb 19 to $4,106 by March 13. That crash was second only to 2018 in terms of mainstream trauma - and that was the moment many began to seriously wonder: could Bitcoin fall into the triple digits?

Fast forward to today, and we’re watching something entirely different unfold.

This time, Bitcoin is the asset under the microscope - not just another tech proxy. During COVID, Bitcoin didn’t act like a store of value. It didn’t look like digital gold. It looked like every other high-beta risk asset: it dumped, then ripped when the Fed intervened. That’s what people remember.

But last week? Bitcoin didn’t flinch. While the S&P just logged one of its worst two-day plunges in decades, Bitcoin barely moved. That led many to ask - is Bitcoin finally showing the uncorrelated, antifragile behavior its fans have been preaching for years?

The answer? no.

Probably because I jinxed it, Bitcoin started showing weakness on Sunday – go figure – and now expectations are high that Monday (today) could echo the chaos of Black Monday. Futures certainly indicate that this will be the case.

Either Bitcoin reacts like it did during peak COVID panic and tanks further alongside traditional markets, or it holds the line and proves it can truly act as a store of value – a flight to safety when it matters most.

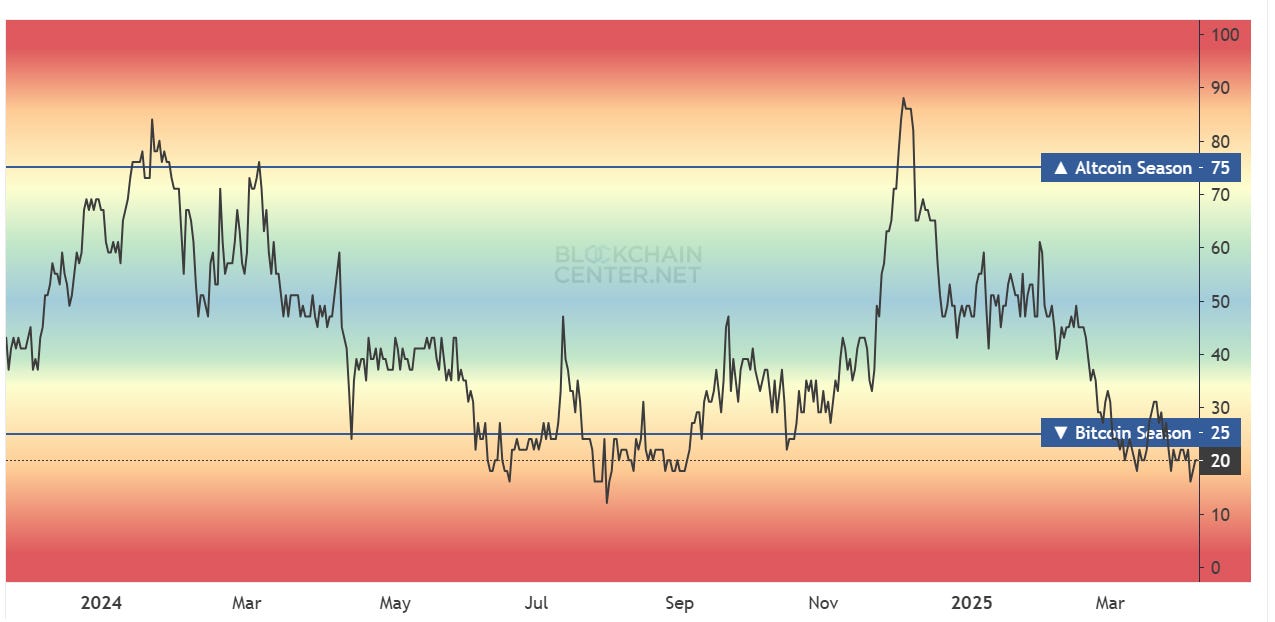

Now’s probably the right time to bring altcoins into the conversation. Let’s not sugarcoat it: they’ve been wrecked this cycle.

I agree that QE will serve altcoins well, but the real question is whether you can hold until then and whether altcoins can avoid losing so much that they’re past the point of no recovery by the time that happens.

It may not feel like it due to the lackluster performance, but we are definitely in ‘Bitcoin Season.’

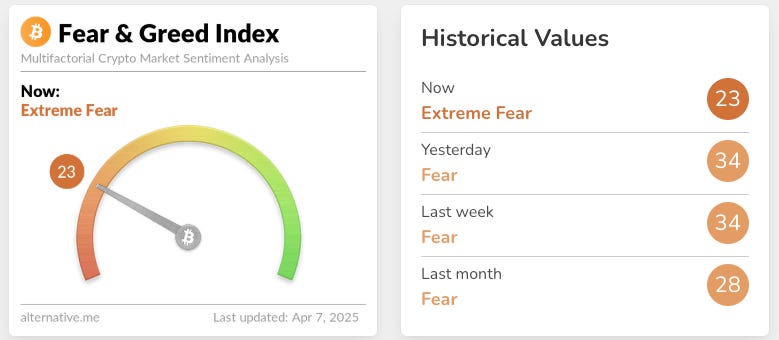

The Fear & Greed Index is in ‘Extreme Fear.’

If there’s a capitulation coming, it’s probably this week.

And since I’m jumping around now, here’s my TLDR on tariffs.

As for what happens today – your guess is as good as anyone’s. Just because the crowd is bracing for a “Black Monday 2.0” doesn’t mean it’s wrong – sometimes consensus gets it right. Crypto’s weekend dip felt like a warning shot, and let’s be honest – this entire storm is circling Trump like Pigpen’s dust cloud in a Peanuts comic strip. Right now, the White House holds most of the cards. If they stay quiet, markets will chart their own messy course – but one comment, one tweet, one offhand remark from Trump could flip everything on its head.

And let’s not forget the Fed – they could swoop in and try to appease Trump’s demands, which could instantly reverse the pain. But I’m not betting on that. The vibes are off, sentiment’s in the gutter, and the higher probability still points to more downside – even if everyone’s already expecting it. Even a Fed cut is likely to do very little in the face of this storm, without significant QE and fiscal stimulus.

That said, I’m doing very little. I bought some Bitcoin. Otherwise, no sudden moves, no panic trades, no chasing bounces. If you were going to panic, that window has likely slammed shut. At this point, it’s about bracing for the eye of the storm – and not flinching while it passes.

I know it’s brutal, even if you’re not selling. Watching your net worth drip lower day after day wears on you – but this is the process. The painful, slow, soul-testing part of the process that every long-term investor has to endure.

Because if Bitcoin becomes what we truly believe it can be, there will come a day – not today, maybe not tomorrow – when it breaks free from this chaos and charges upward on its own terms.

And when that day comes, we’ll be ready.

Bitcoin Thoughts And Analysis

Bitcoin is sitting at a critical inflection point on the daily chart. After breaking down from the symmetrical triangle with strong momentum, it continued lower, with volume confirming the move.

It’s now landed squarely in the $73K–$75K region – a zone that just so happens to be the May 2024 all-time high. I’ve casually mentioned for over a year that a retest of that level wouldn’t be out of the question – and here we are.

Both the 50 MA and 200 MA were already acting as resistance going into this drop, so there were plenty of warning signs before the breakdown. With price now resting above major horizontal support, bulls need to hold the line here to keep the broader uptrend intact. A bounce would be constructive and could eventually form a higher low on the larger timeframe. But if this level fails, the door opens for a much deeper correction.

Bottom line: this is a massive test. The next move will likely shape the tone for the rest of the quarter.

Altcoin Charts

They’re dead for now.

ETH/USD

Doc fixed the flux capacitor, got the DeLorean up to 88 and sent Ethereum back to 2018. It literally just broke slightly below the January, 2018 bull market high.

Great Scott!

Stock Crash Deepens as Traders Cling to Hope for Fed Rescue

Global stock markets plunged Monday, deepening last week’s historic selloff as investors fled to safety amid mounting fears over President Donald Trump’s aggressive tariffs and their potential to trigger a recession. European shares tumbled over 5%, pushing the Stoxx 600 index toward bear-market territory, while futures indicated another sharp decline for Wall Street. Asian equities experienced their steepest drop since the 2008 financial crisis, with Japan’s stock market triggering circuit breakers after a nearly 8% intraday fall.

The escalating turmoil has intensified pressure on the Federal Reserve to intervene. Traders are increasingly pinning hopes on substantial Fed interest-rate cuts to stabilize markets, betting on five more 25-basis-point reductions this year, and pricing in about a 40% chance of an emergency rate cut by next week – well ahead of the scheduled May 7 policy meeting. Two-year US Treasury yields, highly sensitive to monetary policy shifts, plunged 22 basis points to 3.43%, extending recent steep declines.

Despite the market's growing anxiety, Trump and his economic advisers remained defiant, dismissing recession fears and insisting the tariffs would eventually boost US economic strength. Yet prominent investors – including Bill Ackman and Stanley Druckenmiller – criticized the administration's policy moves, warning they risk causing long-term damage to economic growth and fueling inflation. Wall Street analysts echoed those concerns, with JPMorgan’s Bruce Kasman predicting a recession later this year if tariffs remain in place, and Goldman Sachs economists raising their own recession probabilities.

The volatility index (VIX), widely considered a gauge of market fear, spiked to levels unseen since the early days of the Covid-19 pandemic, fueling worries that markets are nearing a point of capitulation. Amid the turmoil, safe-haven assets rallied strongly, with the yen and Swiss franc rising sharply, while gold held near record highs. Commodities broadly weakened, with oil prices sinking after Saudi Arabia dramatically reduced prices, underscoring the market’s concerns about collapsing global demand.

Emerging markets also came under intense selling pressure, posting their worst single-day losses since the global financial crisis. China signaled readiness to roll out new stimulus measures aimed at stabilizing its economy amid tariff-related damage, though details remained uncertain.

Market strategists emphasized the urgent need for clarity on trade policy or a significant policy pivot from either Trump or the Fed, with many cautioning that stocks have yet to fully price in the worst-case scenario. For now, investor confidence remains fragile, and the prevailing sentiment is that until the US administration moderates its aggressive stance or the Fed steps decisively into action, further volatility and market losses remain likely.

Stocks

The Stoxx Europe 600 fell 5.8% as of 10:18 a.m. London time

S&P 500 futures fell 4%

Nasdaq 100 futures fell 4.3%

Futures on the Dow Jones Industrial Average fell 3.8%

The MSCI Asia Pacific Index fell 8.4%

The MSCI Emerging Markets Index fell 7.9%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.0974

The Japanese yen rose 0.7% to 145.88 per dollar

The offshore yuan fell 0.5% to 7.3280 per dollar

The British pound fell 0.2% to $1.2859

Cryptocurrencies

Bitcoin fell 3.8% to $75,820.54

Ether fell 6.1% to $1,478.02

Bonds

The yield on 10-year Treasuries declined six basis points to 3.93%

Germany’s 10-year yield declined 12 basis points to 2.46%

Britain’s 10-year yield declined one basis point to 4.44%

Commodities

Brent crude fell 3.7% to $63.15 a barrel

Spot gold fell 0.4% to $3,024.65 an ounce

Circle May Delay It’s IPO

Just days after filing to go public – a move it’s been eyeing for years – Circle may now hit pause on its IPO plans. According to the Wall Street Journal, the stablecoin issuer is “waiting anxiously” in the wake of escalating macro uncertainty sparked by President Trump’s sweeping tariff announcement on April 2.

Circle filed its S-1 with the SEC on April 1 and intends to list under the ticker “CRCL” – but it now joins companies like Klarna and StubHub in reevaluating whether this is the right moment to enter public markets. So far, details like the number of shares and expected pricing remain under wraps.

Tether Is Prepared To Issue A New Stablecoin

Despite growing concerns over how U.S. stablecoin regulations might affect foreign issuers, i.e. the House’s STABLE Act and the Senate’s GENIUS Act, Tether doesn’t seem worried. CEO Paolo Ardoino told Decrypt that even if its main stablecoin, USDT, gets banned in the U.S., it won’t be a major issue. Instead, Tether is exploring the creation of a separate, U.S.-based stablecoin that would comply with upcoming American regulations. “We believe that our main stablecoin is perfected for emerging markets, but we can craft a payment stablecoin that works for the U.S. We need to have two products with two different value propositions.” The challenge at hand is that the legislation Congress is currently deciding on would place stringent AML requirements of the Bank Secrecy Act, along with vigorous audits of their reserves.

Ethereum Transaction Fees Drop To 2020 Lows

If you squint your eyes all the way to the bottom right of the chart below, you’ll see that Ethereum transaction fees have literally hit rock bottom, reaching their lowest levels in years, with the seven-day moving average showing fees under $500,000 per day - a sharp decline from the $30 million peak in March 2024.

Not everything is doom and gloom, though. The number of daily transactions remains steady at around 1.2 million per day, indicating that while demand hasn't decreased, the network's economics have shifted.

I know it seems like I’m picking on ETH but throw a dart at any random altcoin and the story is nearly the same or worse.

Bitcoin's Big Moment: Senator Gillibrand’s Plan To Lead The Crypto Industry Forward

We're sitting down again with Senator Kirsten Gillibrand on The Wolf Of All Streets to unpack the future of cryptocurrency regulation in the U.S. After years of uncertainty and setbacks, 2025 could finally see clear laws on stablecoins and crypto market structure. Join us to learn why regulation matters to every investor and how it could shape the future of finance.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.