Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

The Eye of The Storm

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Stocks Continue To Dump, While Bonds And Bitcoin Rally

The S&P500 Is Now In Correction Territory

The Genius and Stable Acst Are Making progress

Sen. Ted Cruz Introduces FLARE Act

TRUMP Coin Does Not Like Liberation Day

Bitcoin CRUMBLES Against Gold?! | Stablecoin Bill Just Took a HUGE Step Forward!

The Eye of The Storm

I said it in early March, and I’ll say it again now - ‘It has to get worse before it gets better.’

Politics aside, there’s a growing belief that Trump is strategically engineering fear in the markets. Why? Because sustaining a rally over the next four years would be nearly impossible after inheriting two blockbuster years – +24.23% in 2023 and +23.31% in 2024. For context, the S&P 500 has only logged back-to-back 20%+ gains five times in history. So is Trump ripping the Band-Aid off now to inflict short-term pain in service of long-term gain? Or is this just accidental chaos? That’s for you – and history – to decide.

Again, keeping politics out of it, would crypto actually be in a better spot right now if Kamala had won? Even with how brutal the price action has been since Trump took office, the answer has to be no. Kamala Harris wouldn’t have signed a single crypto executive order, let alone two. There would be no Paul Atkins, Scott Bessent, Howard Lutnick, David Sacks, or Bo Hines anywhere near the White House.

On the “President Kamala” timeline, a Bitcoin Strategic Reserve or Digital Asset Stockpile wouldn’t even be a whisper, let alone national policy. Sure, asset prices might be higher today, April 4, 2025, under her leadership – but we’d still be stuck in the same conversations:

A) What drives this market higher?

B) How do we escape Operation Chokepoint?

C) Who’s the SEC targeting next?

The truth is, in both timelines – Trump or Kamala – crypto remains deeply tethered to broader macro forces. Even with historically bullish news, it hasn’t decoupled. So imagine what it would look like with bearish news and a lukewarm market backdrop. Under Kamala, if crypto were to break from the broader market, it would almost certainly be to the downside.

In hindsight, crypto was damned if we elected Trump, and damned if we didn’t. The only difference? With Trump, the pain might come fast and hard – but there’s a decent shot it clears the path for a powerful rebound. With Kamala, the downturn would likely have been slower, more drawn out, and less obviously worth enduring.

Personally, I’d rather rip the Band-Aid off.

If I wanted to talk about tariffs, now would be the time – but I’ll spare you. I’ve shared my thoughts on X, and I’d rather stick to crypto – something that A) won’t split the audience, and B) I actually understand. The bottom line: Bitcoin is heading to $1 million, with or without tariffs, and with or without Trump. The only real question is whether he’ll help accelerate that path or slow it down.

And if you're looking for someone who explains this better than anyone else?

There’s no better place to start than an Arthur Hayes blog.

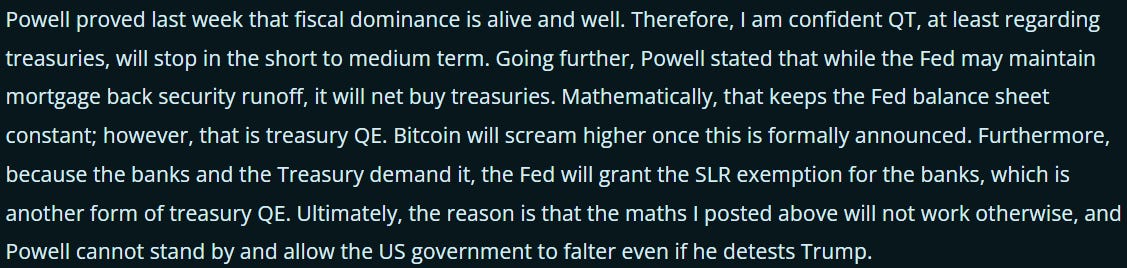

For those curious, this one is titled “The BBC,” which stands for Big Bessent C... (use your imagination).

Hayes on Trump:

“The TLDR is that he is willing to tolerate significant economic pain and a precipitous fall in popularity to do what he believes is right for America. As traders, we must take ‘right’ and ‘wrong’ out of the equation and tether ourselves to probabilities and maths. Ultimately, our portfolio doesn’t care about whether America is strong or weak relative to other nation-states but whether there is more or less fiat currency sloshing around the world in the near future.”

I’m skipping ahead here, glossing over the math and nuance, because I know this is the part all of you want to hear:

“We know an additional $240 billion of relative dollar liquidity will be created starting April 1. In the near future, I believe it will happen at the latest in the third quarter of this year, that $240 billion will rise to $420 billion annualized. Once QE starts, it doesn’t stop for a long time; it increases as the economy needs more printed money to stand still.”

One particularly compelling insight from Arthur’s blog was his case study comparing the performance of stocks and gold after the TARP bailout was announced on October 3, 2008. Both assets benefit from fiat liquidity, but their dependencies differ – stocks rely on government solvency, making them vulnerable during deflationary shocks, while gold, as an anti-establishment asset, reacts more quickly to liquidity injections.

Following TARP’s announcement, both stocks and gold initially fell in response to Lehman Brothers’ collapse. But when TARP failed to stop the bleeding, the Fed introduced QE1 in December 2008. That’s when gold surged. Stocks continued to decline until March 2009, when the Fed’s full-scale money printing finally caught up. By early 2010, gold was up 30% since Lehman’s failure – stocks had barely moved, up just 1%.

The white line tracks the S&P 500, and the gold line represents gold – both indexed from October 3, 2008. It would’ve been fascinating to see how Bitcoin would’ve responded in real time, but in its absence, gold remains our best proxy.

As Arthur Hayes puts it: “Bitcoin Value = Technology + Fiat Liquidity.”

“Even if US stocks continue falling in reaction to tariffs, a collapse in earnings expectations, and or foreigner demand waning, I am confident that the odds favor Bitcoin continuing to climb higher.”

My (not financial) advice? Don’t get swept up in the tariff hysteria. Just focus on stacking assets while they’re on sale. If you’ve been eyeing Bitcoin or other discounted plays, now’s your window – and you can thank tariffs for the markdown. Not buying yet and waiting on QE to return? You can thank tariffs for speeding that up, too.

Here’s the wild part: you can stay optimistic about all of this without needing a strong opinion on what tariffs mean for the economy, small businesses, or the average American. As investors, we need to zoom out, think bigger, and act accordingly. That’s the clearest path to long-term gains.

Bitcoin will walk out of this brighter and more orange than ever – just wait longer than the president can kick up dust, and you win.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

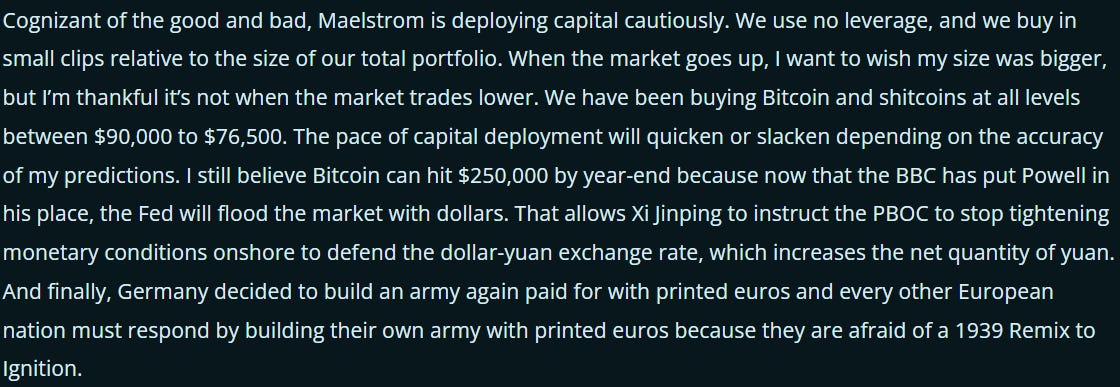

Each week, I’ll provide an Aptos review, covering the network’s latest announcements and achievements. This week, let’s kick things off with Aptos breaking into the top 10 for total market cap issued on the chain.

To track these metrics, visit DeFiLlama, select the ‘Stables’ tab on the left, and then navigate to ‘Chains’ to view the leading networks. To secure a spot in the top 10, Aptos had to surpass both TON and Berachain. As the data shows, USDT dominates the network, making up 69.7% of stablecoin supply, while Aptos is approaching a total market cap of nearly $1 billion. Up next, which is kind of similar in nature, is this:

BUIDL has surged 191.45% over the past 30 days, and Aptos is likely to be a major beneficiary of this growth. Up next, which is in the spirit of March madness, Aptos has begun Move Madness, which is dedicated to powering the next generation of DeFi super apps on Aptos. “That means giving developers the tools to move faster, write safer code, and launch more powerful applications—especially in high-performance verticals like DeFi. Over the past few months, contributors across the ecosystem have been enhancing the Move programming platform to better support the most demanding on-chain financial applications.”

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

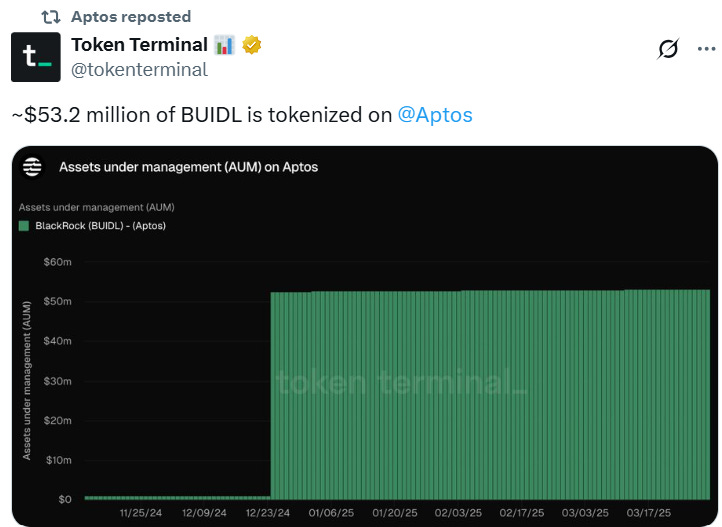

Bitcoin Thoughts And Analysis

Stocks had their worst one day drop in 4 years - and Bitcoin actually printed a green candle, showing incredible relative strength. On a day where tech dropped over 5%, you would have expected a 10%+ drop from Bitcoin, but it did not happen. Is Bitcoin finally decoupling?

As for the technicals…

Bitcoin continues to coil tightly inside a large symmetrical triangle on the daily chart, printing higher lows and lower highs as volatility compresses. After a strong rejection from both the 50-day and 200-day moving averages earlier this week, price found support once again on the ascending trendline – buyers are clearly defending that level.

Volume has remained muted during this consolidation, which is typical for a pattern like this. But remember: triangles are neutral until they break. This setup is approaching its apex, meaning a decisive move is likely coming soon.

Watch for a break above $88,000 to signal a potential bullish breakout – or a drop below the rising trendline to flip the script. Until then, it’s all about patience.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Picture perfect bounce off of the $112 support for Solana. We’re now watching for a potential double bottom — but let’s not get ahead of ourselves. That pattern doesn’t confirm until we break above $147, the swing high between the two lows.

Until then, it’s just a bounce at support… and a strong one. Price is still well below the 50-day moving average and the descending trendline, so bulls have work to do. But they’ve drawn the line at $112. Defined support and resistance make this one worth keeping on the radar.

Stocks Continue To Dump, While Bonds And Bitcoin Rally

Stocks extended their sharp losses, capping off a volatile week marked by intensifying fears that President Donald Trump's aggressive tariff policies will severely damage economic growth. S&P 500 futures fell an additional 0.7%, following a $2.5 trillion selloff in US equities, while MSCI’s global index headed toward its largest weekly decline in seven months. Europe's Stoxx 600 plunged 2%, setting it on course for its worst week in three years.

The turmoil in equities drove investors into the safety of government bonds, pushing yields significantly lower. The benchmark 10-year US Treasury yield dipped below the psychologically significant 4% level, falling roughly 30 basis points this week, as traders priced in a rising risk of recession. German and British 10-year yields also fell sharply, dropping more than 10 basis points as investors sought refuge in safer assets.

This week's dramatic selloff underscores how quickly investor sentiment has shifted away from "US exceptionalism," a trade popular during Trump’s early presidency based on expectations that the US economy would outperform. Trump’s imposition of sweeping tariffs—his most extensive trade measures yet—has heightened worries about elevated inflation, declining economic activity, and increased global trade disruptions. UBS Global Wealth Management cut its forecast for the S&P 500 and warned clients to brace for further market volatility, emphasizing the potential long-term damage of Trump’s reciprocal tariffs.

President Trump’s statements have offered little relief for anxious investors. While he hinted he might reduce tariffs if other nations make substantial concessions, he simultaneously threatened additional levies targeting semiconductors and pharmaceuticals. China, Europe, and other major trade partners have vowed retaliation, amplifying concerns of a prolonged and destructive global trade conflict.

Economists broadly agree that Trump’s tariff policy is likely to drive consumer prices higher while slowing the economy, with some analysts now forecasting a possible US recession. These concerns have strengthened expectations for Federal Reserve intervention, and traders have increased their bets, anticipating more than three Fed interest rate cuts by year-end to offset economic headwinds.

Adding to market uncertainty is Friday’s US jobs report, with payroll gains expected to slow slightly to 140,000 in March from the previous month. Any disappointing data could provide additional fuel for the bond market rally, potentially pushing Treasury yields even lower. Market strategists like Zurich Insurance Co.’s Guy Miller suggest yields on 10-year Treasuries could approach 3% later this year if growth significantly weakens.

Commodity markets have also been severely impacted, as investors factor in weaker global demand. Oil prices plunged again after Thursday’s 6% drop, pressured further by OPEC+ unexpectedly agreeing to boost production at triple the previously planned level in May. Gold, meanwhile, remained elevated near record highs, signaling the deepening risk aversion permeating global markets.

Stocks

The Stoxx Europe 600 fell 2% as of 10:16 a.m. London time

S&P 500 futures fell 0.7%

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 1.1%

The MSCI Asia Pacific Index fell 2%

The MSCI Emerging Markets Index fell 0.6%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.7% to $1.0977

The Japanese yen fell 0.3% to 146.46 per dollar

The offshore yuan rose 0.3% to 7.2613 per dollar

The British pound fell 0.9% to $1.2977

Cryptocurrencies

Bitcoin rose 2.6% to $84,428.01

Ether rose 1.7% to $1,828.9

Bonds

The yield on 10-year Treasuries declined seven basis points to 3.96%

Germany’s 10-year yield declined 11 basis points to 2.54%

Britain’s 10-year yield declined 12 basis points to 4.40%

Commodities

Brent crude fell 3.4% to $67.76 a barrel

Spot gold fell 0.8% to $3,090.67 an ounce

The S&P500 Is Now In Correction Territory

Three weeks ago, I wrote a newsletter titled, “Is This A Correction or A Crash?” and clarified where the market was in these distinctions. At that point, the S&P500 was down 9.47% from the highs, the Nasdaq 100 was down 12.92%, and the Russell 2000 was down 17.76%.

Here’s a recap on the difference between a ‘pullback,’ ‘correction,’ and ‘crash.’

So, where are these indexes at now? (From their all-time highs)

The S&P500: -11.8% (correction)

The Nasdaq 100: -16.1% (correction)

The Russell 2000: -22% (crash)

Most major indexes have now entered correction territory and are edging closer to a potential crash. It’s still uncertain whether Trump’s tariffs will be enough to drive the indexes down significantly, as this would require several more tough days, but we’re getting close. A key feature of a crash is its ability to make global headlines, like the Dotcom Bubble, the Global Financial Crisis, and COVID-19.

I guess this is a fitting place to share this…

Markets have no idea how to react to all the drama. Everything coming from the White House is conflicting and confusing - this is peak uncertainty for markets.

The Genius and Stable Acts Are Making progress

Positive stablecoin legislation is on the way! The U.S. House Financial Services Committee approved a Republican-led stablecoin regulation bill, the STABLE Act, with a 32-17 vote, including bi-partisan support from six Democrats. Introduced in February by Representatives French Hill and Bryan Steil, the bill was reportedly influenced by Tether and will now move to the House floor for a full vote.

As for the GENIUS Act, it just secured a 18-6 bipartisan vote in Senate Banking Committee and will now advance to a full debate. As for the Genius Act, it was introduced on February 4, 2025, by Senators Bill Hagerty (R-TN), Tim Scott (R-SC), Kirsten Gillibrand (D-NY), and Cynthia Lummis (R-WY).

For those keeping track of these two bills, the STABLE Act is a House bill focused on regulating stablecoins by enforcing transparency, reserve requirements, and oversight to protect consumers and financial stability. Meanwhile, the GENIUS Act, a bipartisan Senate bill introduced in 2025, aims to establish a clear regulatory framework for payment stablecoins, promoting innovation while ensuring stability and consumer protections.

Sen. Ted Cruz Introduces FLARE Act

Sen. Ted Cruz introduced the “FLARE Act,” a bill aimed at repurposing flared gas for productive uses, including Bitcoin mining and other digital assets. By promoting on-site energy generation, the bill decentralizes electricity sources and enhances grid resilience during high demand or extreme weather. It permanently extends a 100% bonus depreciation for equipment that converts natural gas into electricity while prohibiting entities from China, Iran, North Korea, and Russia from benefiting. Additionally, it seeks to reduce emissions by incentivizing the conversion of stranded natural gas into usable energy.

“I am committed to making Texas the number one place for Bitcoin mining. The FLARE Act incentivizes entrepreneurs and crypto miners to use natural gas that would otherwise be stranded. This bill takes advantage of Texas’s vast energy potential, reinforces our position as the home of the Bitcoin industry, and is good for the environment. I call upon my colleagues to expeditiously take up and advance this legislation.”

TRUMP Coin Does Not Like Liberation Day

The highly anticipated Liberation Day saw the U.S. impose new tariffs on over 180 countries, shaking global markets. While many assets struggled, one took the hardest hit - cue the drum roll… TRUMP. I suppose it makes sense given TRUMP is very far down the risk curve, but the coin is now trading at levels not seen since just a couple of hours after launch. It would be kind of crazy of me to call it ironic TRUMP is down, but it's definitely poetic, that’s for sure.

Bitcoin CRUMBLES Against Gold?! | Stablecoin Bill Just Took a HUGE Step Forward!

Bitcoin’s ‘Digital Gold’ Narrative collapsing?! JPMorgan Issues Warning as Gold skyrockets and Bitcoin Stalls at $84K! I'm diving into the truth behind this narrative with Edan Yago, core contributor at Bitcoin OS.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.