Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Algorithmic excellence from Arch Public on display late yesterday. Extraordinary precision: archpublic.com

two buys at $78.9K and $80.1K

one sell at $86.9K

2.25X long, net +11%.

We often get asked, “but does it beat buy and hold?”

The answer is yes. A resounding yes.

$100K deployed Jan. 1, 2021 - Jan. 1, 2025:

Buy and Hold = $185,346

Arch Arb + Intelligence = $313,937

In This Issue:

Keeping Up With The Trumps

Bitcoin Thoughts And Analysis

Liberation Day - Legacy Markets

Tether Bought 8,888 BTC In Q1

Grayscale Seeks To Convert GDLC Fund Into An ETF

Let The IPOs Roll - Circle Is Going Public

GameStop Is Ready To Play Ball

Is Bitcoin About To DESTROY The Dollar's Reserve Currency Status?

‘Keeping Up With The Trumps’

Keeping Up With The Trumps honestly needs to be a real show – immediately.

And if it ever airs, I’m bookmarking this newsletter as proof that I called it first. Each week, we’d tune in to a new episode exploring the Trump family’s ever-expanding crypto universe. What kind of DeFi experiment is Barron secretly building in the White House basement? What did Eric Trump post on X… and then quietly edit five minutes later? Did Donald Trump just sign an executive order declaring $TRUMP the official currency of the United States? The possibilities are endless – and let’s not forget, this show would have a four-season guarantee with the size of this family and the length of the term.

But in all seriousness, let’s shift gears. Today’s focus is on tracking everything the Trump family has done in crypto outside the confines of politics and the White House – from business ventures to personal investments, and how those moves have shaped the broader industry.

It’s worth paying attention. Whether we like it or not, the main character in this drama – Donald Trump – may eventually use his position to amplify or protect these plays. Ethics and legality aside (because, let’s be real, this is reality TV), let’s rewind the tape and start where it all began: Trump Digital Trading Cards.

For collectors who are into Trump memorabilia, I’ll admit – this was actually a pretty clever idea. For everyone else, especially those not into political collectibles, it felt more like a novelty item straight out of a late-night sketch. But here’s the twist: the original Trump NFTs, launched in 2022, have turned out to be a surprisingly solid investment.

They’re still seeing active sales, and the community hasn’t given up on the idea that these tokens might eventually unlock some kind of financial utility or access. Hope, it seems, is part of the value proposition.

Here’s a recent activity log from OpenSea:

Since the original drop, Trump hasn’t just dipped his toe back in – he’s cannonballed in, going back for seconds, thirds, fourths, and now fifths. The latest batch of Trump NFTs didn’t launch on Polygon like the originals, but on Bitcoin using Ordinals. Yes, Bitcoin Ordinals. I haven’t followed every drop closely, but I recently stumbled on this gem: “The new NFT collection is available for collectors who acquired the 100 NFT cards from the ‘Mugshot Edition.’”

That sentence alone is insane – but for die-hard collectors, I’m sure it was pure euphoria.

Anyway, let’s keep the show moving.

Our next episode takes us to the launch of World Liberty Financial, fast-forwarding to September 2024. You can imagine there was a lot of hesitation around launching more crypto ventures – until it became increasingly clear Trump would win the election. Once that reality settled in, the floodgates opened.

Of all the Trump crypto ventures, WLFI is easily the most ambitious. It has the broadest scope, the deepest family involvement – including Trump himself – and it comes the closest to becoming a full-blown Trump-branded financial ecosystem in crypto. Originally pitched as a decentralized finance platform, it has since evolved at a dizzying pace.

A few weeks back, I did a full deep dive on this, titled World Liberty Financial: DeFi-ing the Odds. In it, I covered everything: the rocky launch, the influencer backlash, shifting public perception (a recurring theme), the aggressive token-buying spree, the overwhelming ETH allocation, the infamous ‘token swap deals,’ and how the team eventually completed their fundraising goal. I also tackled the question everyone’s asking – whether this team is sitting on insider info. (Spoiler: I don’t think they are.)

Honestly, WLFI could be its own season of our reality TV show.

One ongoing frustration, though, is transparency. Early on, we had a clear view of WLFI’s portfolio. Now? Not so much. If you check Arkham or other wallet trackers, it might look like they sold their ETH – but that’s not accurate. The bulk of the holdings appear to have been moved to Coinbase Prime, most likely for safekeeping. The vault is still full; it’s just behind closed doors now.

I did manage to find this; it was posted on March 5th.

One week ago (we’re going to have to skip ahead on the Trump timeline), WLFI announced plans to launch its own stablecoin, USD1, on both Ethereum and Binance Smart Chain – with expansion to other blockchains already in the works. From that announcement, we learned that “the token would form part of the company's strategy to enter the tokenized government bonds market.” Each USD1 will be redeemable 1:1 for U.S. dollars and fully backed by short-term U.S. government treasuries, dollar deposits, and other cash equivalents.

Episode three – we’re switching gears now – has to be about TRUMP, the meme coin. This takes us back to January 17 of this year. Of all the episodes we’ll cover, TRUMP is by far the most dramatic, not just because it’s a meme coin with the former president’s name slapped on it, but because, up to this point, it’s been the biggest letdown in the entire lineup – and, arguably, the meme coin that broke the market’s back.

High expectations. Even higher volatility. And then… thud.

That’s the TRUMP chart: a $10.4 price tag, translating to a $10.4 billion fully diluted valuation – down from a staggering $70 billion at launch. The Solana-based meme coin exploded out of the gate, dominating headlines for 48 straight hours. And then, like clockwork – just like every meme coin before it – it nosedived off a cliff.

The tokenomics were simple enough: 20% to the public, 80% to the team. But let’s be real – are we seriously supposed to believe that all of that 20% public allocation didn’t end up in the hands of a few well-connected insiders? The launch happened at 9 p.m. on a Friday, during the Crypto Ball, on Solana, and required a Moonshot wallet to participate. That’s not retail-friendly – that’s a digital velvet rope.

Yeah right, my ass.

Then came MELANIA – a dumpster fire inside a larger dumpster fire – launched one day before Trump’s inauguration. The same group of insiders, shocked that TRUMP had flirted with a $100 billion (albeit temporary) valuation, decided to sprint it back with a half-baked sequel. They slapped Melania’s name on it, tossed it into the meme inferno, and… well, you can guess how that went.

I doubt Trump is paying much attention to any of this. It’s likely all being run by the goons he empowered – guys who probably needed nothing more than a head nod or a half-hearted “sure” to go full send. I don’t own TRUMP or MELANIA, and I don’t plan to, especially with token unlocks coming up in a couple of weeks. That’ll be the tell – does the team dump or hold?

That said, there’s still time to breathe life back into TRUMP. If the team dumps a small portion, burns the majority, and uses the proceeds for something that actually benefits people – disaster relief, public goods, charity, or hell, even buying Bitcoin for the public – then the coin might just have a shot at a surprise redemption arc. MELANIA? Yeah... that one’s probably toast.

Now let’s fast forward to a more buttoned-up episode: Trump Media & Technology Group Corp signing a non-binding agreement with Crypto.com to launch a series of ETFs and ETPs under the Truth.Fi brand. There were rumors swirling for a while, and now it's official – the plan is to roll out the products later this year, pending a definitive agreement and regulatory approval. They'll be available in the U.S., Europe, Asia – everywhere.

“The ETFs, made available through Crypto.com’s broker-dealer Foris Capital US LLC, are expected to comprise digital assets as well as securities with a Made in America focus spanning diverse industries such as energy. Crypto.com will support backend technology, custody, and crypto liquidity, including a unique ETF basket of cryptocurrencies like Bitcoin, Cronos, and others.”

Not the most thrilling storyline, but the takeaway is clear: there’s no reason to believe Trump won’t send crypto flying. His family’s wealth is now heavily tied to the industry. Ethics aside, patient crypto investors could benefit in a big way.

And then, for the most recent episode – just aired yesterday – we’ve got the Trump family entering industrial-scale Bitcoin mining. Not as dramatic, but it definitely deepens the plot. Eric Trump has partnered with Hut 8 to launch American Bitcoin, a mining venture with its own strategic BTC reserve.

For context, Hut 8 isn’t some random name – it’s one of the top players in Bitcoin mining and energy infrastructure, already sitting on 10,237 BTC. With this move, Hut 8 contributed nearly all its ASIC miners in exchange for a majority stake in American Data Centers, now rebranded as American Bitcoin.

That brings us current on ‘Keeping Up With the Trumps.’ We’ve now covered NFTs, DeFi, memecoins, ETFs, and mining – and that’s just what’s happening outside the White House. Trump’s political show has its own characters, its own drama, and its own production team.

So far, the only real “flop” – and I use that term lightly – is the TRUMP meme coin. But even that’s not a lost cause. WLFI’s portfolio might be down, but the project raised its full allocation, keeps moving, and is gaining traction with new partners. These ventures are always doubted early on… until they aren’t.

And here’s the thing: Trump hates losing, especially with his name attached. He also happens to be President of the United States, which – let’s be honest – is a pretty helpful advantage. Put those two together, and you’ve got a show that’s worth watching closely.

It’s not just entertainment. It’s alpha.

Bitcoin Thoughts And Analysis

The daily Bitcoin chart is taking shape inside a symmetrical triangle, formed by a clear series of lower highs and higher lows since the local top in early March. These converging diagonal support and resistance lines are setting up for a breakout – or breakdown – in the coming days or weeks. Price is currently squeezing toward the apex, hovering just below the key 50-day moving average.

This kind of coiling price action often precedes a large move. The 200-day moving average is currently acting as resistance, while the 50 MA looms above as resistance as well. A break of the downtrend line would likely flip market sentiment more bullish, especially if confirmed with strong volume. Conversely, a drop below the rising trendline would invalidate the current series of higher lows and could usher in a deeper retracement.

Keep an eye on volume – the move out of this structure could be fast and violent.

Liberation Day - Legacy Markets

US stock futures slid as markets awaited President Trump’s tariff announcement, set for the close of trading, with investors still uncertain about the extent and details of his reciprocal trade levies. S&P 500 futures fell 0.5%, with technology shares leading the decline, as Tesla and Palantir both dropped more than 2% premarket, and Newsmax retreated sharply after its recent IPO surge. Europe's Stoxx 600 also declined 0.8%, pressured by healthcare stocks amid concerns over layoffs at the US Department of Health and their potential impact on vaccines and gene therapies.

Treasury yields remained near one-month lows, with the 10-year yield down two basis points, while gold hovered near recent record highs as investors sought safer assets. Speculation intensified following reports that Trump’s administration is considering a more moderate, middle-ground tariff option, potentially involving tiered or customized reciprocal tariffs. Traders remain wary that negotiations will be lengthy and could exacerbate economic uncertainty.

Meanwhile, China reportedly restricted local firms from investing in the US, while Europe reiterated readiness to retaliate if tariffs are imposed, further heightening concerns about a global trade conflict. Central bankers warned of the inflationary and economic growth risks posed by trade disruptions. Markets are now pricing three Fed rate cuts this year amid growing worries about recessionary impacts.

Stocks

S&P 500 futures fell 0.5% as of 6:33 a.m. New York time

Nasdaq 100 futures fell 0.6%

Futures on the Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 fell 0.8%

The MSCI World Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was unchanged at $1.0793

The British pound was little changed at $1.2935

The Japanese yen rose 0.2% to 149.38 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $85,028.28

Ether fell 1.9% to $1,876.73

Bonds

The yield on 10-year Treasuries declined two basis points to 4.15%

Germany’s 10-year yield declined two basis points to 2.67%

Britain’s 10-year yield was little changed at 4.63%

Commodities

West Texas Intermediate crude fell 0.4% to $70.94 a barrel

Spot gold rose 0.4% to $3,126.07 an ounce

Tether Bought 8,888 BTC In Q1

Tether purchased 8,888 BTC in Q1 2025 for $735 million, bringing its total holdings to 92,646 BTC, worth about $7.8 billion. The transaction, recorded on April 1, aligns with Tether’s strategy of quarterly Bitcoin accumulation and transfers to its reserve wallet. Since announcing in May 2023 that it would allocate 15% of net profits to BTC, Tether has steadily increased its holdings, now making it the sixth-largest single-wallet holder. At current prices, the company has $3.86 billion in unrealized gains.

Grayscale Seeks To Convert GDLC Fund Into An ETF

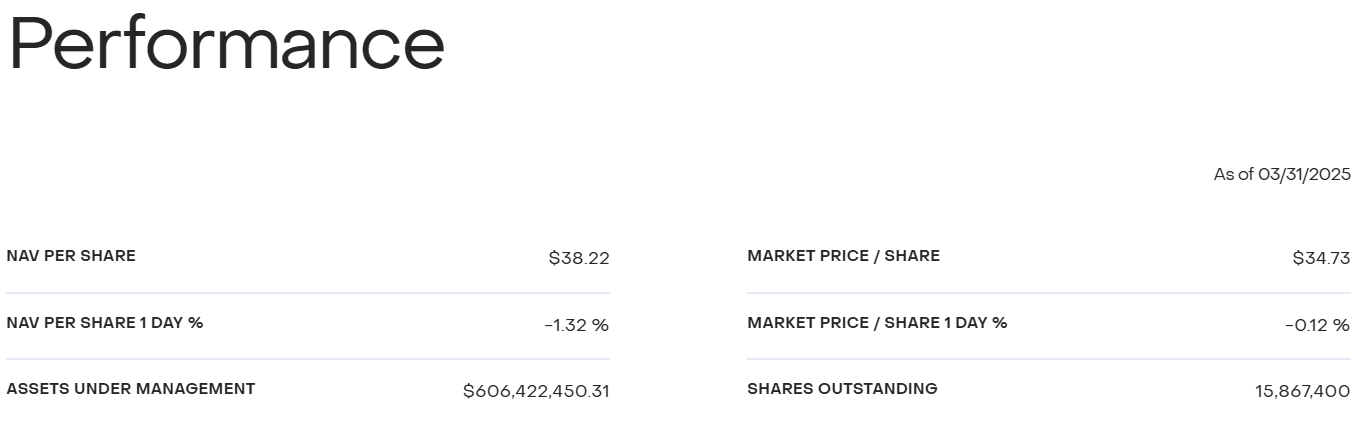

Grayscale has applied to convert its Digital Large Cap Fund (GDLC) into a spot ETF. The fund currently holds five major crypto assets, primarily Bitcoin (79.4%), along with Ethereum (10.69%), XRP (5.85%), Solana (2.92%), and Cardano (1.14%). Since the fund has launched in 2018, it’s up 479% and has $606 million in AUM. One interesting thing to note about the fund is that the NAV per share is greater than the market price, which means the fund or asset is trading at a discount to its intrinsic value. This often occurs due to market sentiment, liquidity concerns, or investor pessimism, even if the underlying assets are performing well.

Let The IPOs Roll - Circle Is Going Public

For nearly a year now, Circle has been hinting at filling for an IPO and the decision is now official. Just two days ago, Circle reportedly hired JPMorgan and Citi as underwriters for its planned IPO. For Circle, this is a long-time coming following the companies failed attempt to go public via a SPAC merger in 2021, that later resulted in cancelling the plans due to a bear market. Many of the details at this point remain unknown, but according to people familiar with the matter, Circle is seeking a $4 billion to $5 billion valuation.

“For Circle, becoming a publicly traded corporation on the New York Stock Exchange is a continuation of our desire to operate with the greatest transparency and accountability possible. We are building what we believe to be critical infrastructure for the financial system, and we seek to work with leading companies and governments around the world in shaping and building this new internet financial system,” founder and CEO Jeremy Allaire claimed in the filing.

Ultimately, this move will be huge for Circle and USDC for a number of reasons: it’s a massive opportunity for revenue growth, building connections, and putting the company head-to-head with an elite few that have gone public. This will also help USDC solidify its position in the United States and continue its competition with Tether, maybe even overtaking it one day.

GameStop Is Ready To Play Ball

Things are moving fast for GameStop, who has taken a page straight out of Strategy’s playbook. The company now has $1.48B following its plan to raise capital through convertible senior notes with the intent to acquire Bitcoin. My guess is that this works out very well for GameStop in the long run, maybe immediately, simply due to the fact that GameStop commands a cult-like investor and fan base which Bitcoin will resonate with. Ryan Cohen, GameStop’s CEO, is a certified baller, and I really hope he is able to turn around the company with Bitcoin. The orange pill has been consumed.

Is Bitcoin About To DESTROY The Dollar's Reserve Currency Status?

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.