Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

BitBonds, BlackRock, and Bitcoin

Bitcoin Thoughts And Analysis

Altcoin Charts

Markets Are Tariffied

Visa Is Building On Ethereum

The Trump Family Is Mining

Saylor Can’t Stop, Won’t Stop

Bitcoin & Stocks Crash, Gold Hits Record: How April 2 Tariffs Could Shake Crypto! | Macro Monday

BitBonds, BlackRock, and Bitcoin

It’s one of those days where a lot of good news is flying under the radar.

If Bitcoin were in an uptrend, we’d probably be seeing a healthy green candle right about now. But alas, macro still rules the day – and crypto remains chained to Trump’s tariffs, the Fed’s next move, incoming economic data, and the ever-looming recession narrative.

Still, no time to sulk. Just because bullish headlines aren’t moving price today doesn’t mean they won’t matter tomorrow.

Let’s start with one of the biggest: Larry Fink dropped his 2025 Annual Chairman’s Letter to Investors – and yes, a significant chunk was devoted to his favorite blockchain buzzwords: Bitcoin and tokenization.

The crypto portion wasn’t overwhelming in length, but it packed enough substance to warrant a full breakdown. Everything you need to know is below.

The letter starts tame – but trust me, it gets better.

Here’s where it starts to get interesting.

This has to be the quote of the week: “If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

The CEO of the world’s largest asset manager is floating a pretty wild (and telling) idea: that the U.S. dollar’s dominance as the global reserve currency might actually be at risk – not from China, not from gold – but from Bitcoin.

That’s not Reddit speculation. That’s Larry Fink. Let that sink in.

Federal debt is the centerpiece of Fink’s thesis – and it’s worth revisiting, even if just briefly. The TLDR? As U.S. debt continues its relentless climb, something has to give.

And for Larry Fink, that “something” might just be the dollar stepping aside… to make room for Bitcoin.

I’m as much of a Bitcoiner as anyone in this space, but let me be clear: I don’t want Bitcoin’s success to hinge on the collapse of the U.S. dollar. I’m not rooting for the downfall of the American economy. A scenario like that wouldn’t just shake the U.S. – it would ripple across the entire world.

I own Bitcoin because that kind of breakdown could happen – not because I want it to. Ideally, Bitcoin thrives as a stable, forward-looking alternative that people choose because of its merit, not because fiat failed spectacularly. That belief ties back to something fundamental for me: I don’t wish destruction on anything just to see my investments win.

Now, this next part didn’t grab headlines like the Bitcoin quote did – but that just means it’s your alpha for the day.

Larry Fink is all-in on tokenization – and his analogy couldn’t be more on point. Comparing SWIFT to the postal service and tokenization to email perfectly captures just how outdated the current system is.

So where will BlackRock build this future? The answer’s already in front of us – Ethereum and Solana, with Ethereum almost certainly taking the lead.

We’ve only seen BlackRock scratch the surface of what it’s really planning here. My prediction? By the end of 2025, we’ll see tokenized stocks – go ahead and write it down.

No, they won’t be mainstream overnight, and they won’t be as easy to buy as crypto just yet. But they’ll exist. They’ll be built, piloted, and quietly rolled out on both legacy finance platforms and crypto-native ones. The infrastructure is already taking shape – now it’s just a matter of time.

The case for tokenization isn’t about profit - it’s about modernizing the financial landscape in a fair and efficient way.

That wraps up everything Larry Fink said in his annual letter that’s relevant to us. If you’ve got the time, I’d highly recommend reading the entire letter. The digital asset section wasn’t some isolated crypto sidebar – it was woven into a much bigger narrative about where markets are today and where they’re heading.

It’s clear: BlackRock doesn’t see digital assets as a sideshow. They see them as part of the main event.

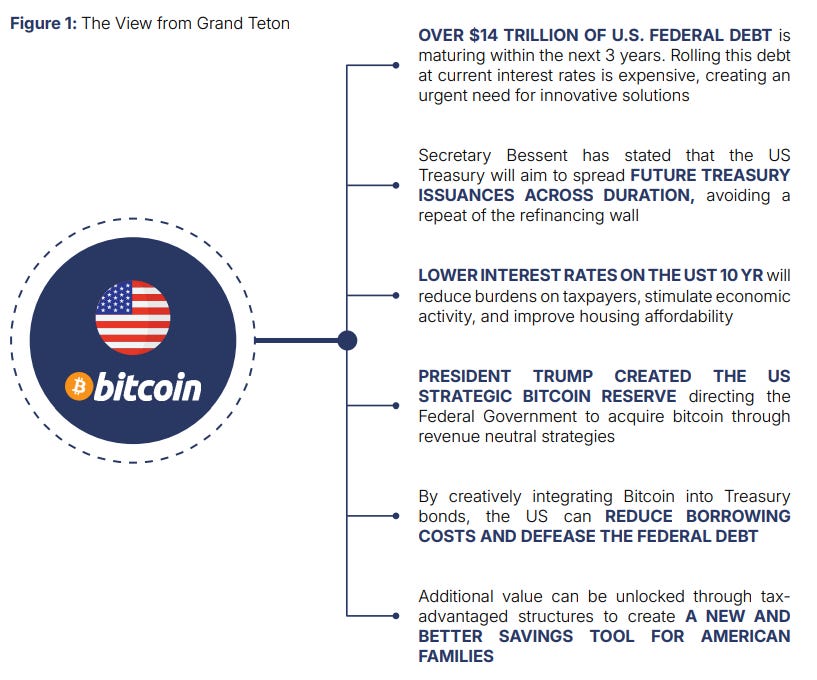

For the second half of this intro, I want to switch gears over to a policy brief that was put out by the Bitcoin Policy Institute. Just to catch everyone up, “The Bitcoin Policy Institute (BPI) is a non-partisan, non-profit think tank. It is dedicated to educating policymakers and the public on Bitcoin and disruptive digital technologies, providing research-based insights to inform sound policy in the United States.” In short, the BPI has been instrumental in advancing the Bitcoin reserve at the federal level, and this latest policy brief is directly connected to and supporting that effort.

The policy brief is a 60-minute read, so I’ll have to limit what I share.

From the executive summary:

The argument is that BitBonds satisfy the “budget-neutral strategy” laid out in Trump’s executive order, in order to bear no cost on American taxpayers.

“The proposed structure allocates 90% of bond proceeds to conventional government funding operations and 10% to bitcoin acquisition.”

“Detailed financial analysis indicates that implementation of the ₿ Bonds program at the proposed scale of $2 trillion (approximately 20% of 2025 refinancing needs) could generate annual interest savings of $70 billion compared to conventional Treasury issuance. Over a ten-year period, this represents nominal savings of $700 billion and a present value of $554.4 billion. After accounting for the initial bitcoin purchase of $200 billion, the program delivers net taxpayer savings of $354.4 billion even if bitcoin prices remain static.”

That paragraph’s a lot to digest, but here’s the bottom line: the U.S. could save $70 billion annually compared to traditional borrowing – invest $200 billion into Bitcoin – and still come out ahead, even if Bitcoin’s price doesn’t budge an inch.

It’s a rare win-win scenario on paper. The structure is conservative enough to avoid overexposure to BTC, yet bold enough to put real skin in the game. It’s not a moonshot bet – it’s a calculated hedge with upside.

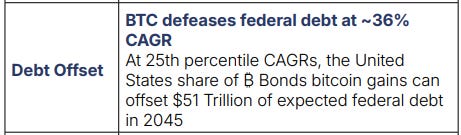

More graphics:

Look at these Bitcoin values. The higher percentages may be a stretch, but they shouldn’t be dismissed entirely. Aim for the stars and reach the moon.

A $51 trillion offset of expected federal debt from BitBonds by 2045.

More highlights:

“The tax-advantaged status would make ₿ Bonds particularly attractive for retirement accounts, education savings, and general household wealth building.”

“We foresee a broad base of investor interest in the offering, with 80% of ₿ Bonds purchased by institutional and foreign investors13, while the remaining 20% ($400 billion) can be purchased by U.S. households.”

“By establishing standards and best practices for sovereign bitcoin integration, the United States can influence global development of bitcoin markets in ways that align with American values and interests.”

“The accessibility of ₿ Bonds through existing Treasury channels would democratize access to an asset class that has historically benefited early adopters and sophisticated investors.”

“The Strategic Bitcoin Reserve provides a hedge against inflation, currency debasement, and potential bulwark against the erosion of the dollar’s reserve currency status.”

If the U.S. government moves forward with BitBonds and embraces the rationale laid out by the BPI, it would effectively align the two most powerful entities in the free world – BlackRock and the federal government – on the same page. Larry Fink and the BPI are saying out loud what policymakers are quietly discussing behind closed doors. Anyone holding Bitcoin stands to benefit enormously.

Now imagine this: what if BitBonds are tokenized? Suddenly, the U.S. Bitcoin acquisition strategy becomes more efficient, transparent, liquid, and globally accessible. Investors of all sizes could buy in – helping the U.S. reduce its debt, strengthen the economy, and reinforce the dollar through Bitcoin. It’s a no-brainer – a win-win-win-win.

Sure, it’s a forward-looking idea that would require Congressional approval for Bitcoin purchases and widespread confidence in tokenization. But it’s also a realistic endgame. And for all the Ethereum skeptics out there – the smart contract platform doesn’t look so bad when it’s being used to accelerate the Bitcoin mission.

It’s a shame these kinds of developments aren’t happening during a raging bull market. But if the news is this good while sentiment is this bad, just imagine what it’ll look like when companies, institutions, and governments are driven by full-blown FOMO. Good news doesn’t disappear – it compounds. Momentum just takes time to show up in the charts.

I like Bitcoin here. I’ll like it at $70K if it gets there, and I’ll like it over $100K, because the final destination is way higher. Those who understand Bitcoin know: this is a forever asset. Maybe we’re all a little crazy – but I’d rather be crazy than watch my dollars bleed out to inflation or miss out on one of the greatest asymmetric opportunities of our time.

The good news is here. You just have to be patient enough to let it matter.

Bitcoin Thoughts And Analysis

Bitcoin is sideways. That’s all I’ve got for you today.

Markets Are Tariffied

US stock futures swung between gains and losses, signaling another volatile session ahead of President Trump’s tariff announcement on April 2. S&P 500 futures were down 0.2% after giving up earlier gains, though Tesla rose about 3% premarket, and Newsmax surged another 11%, extending its huge debut rally. European stocks gained, with the Stoxx 600 Index climbing 1.2%, led by pharmaceutical shares following a JPMorgan assessment that tariffs would have a manageable impact on the sector.

Investors remained wary amid uncertainty over the scope and severity of Trump's reciprocal tariffs, set to be detailed at 3 pm Wednesday. While Trump has labeled this a "Liberation Day" signaling more aggressive trade protectionism, markets fear prolonged and contentious negotiations, prompting caution. The uncertainty has caused strategists at Goldman Sachs to lower their forecasts for both European and US stocks.

Treasury yields slipped three basis points, and gold continued to rise as traders sought safe havens. Bond yields across Europe also fell, aided by data showing inflation easing closer to the ECB's target, supporting expectations for a rate cut later this month. Elsewhere, base metals and iron ore advanced following strong manufacturing data from China, indicating improving economic momentum.

Stocks

S&P 500 futures were little changed as of 6:18 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 rose 1%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0799

The British pound was little changed at $1.2917

The Japanese yen rose 0.3% to 149.51 per dollar

Cryptocurrencies

Bitcoin rose 2.5% to $84,465.67

Ether rose 3.5% to $1,883.01

Bonds

The yield on 10-year Treasuries declined four basis points to 4.17%

Germany’s 10-year yield declined seven basis points to 2.67%

Britain’s 10-year yield declined seven basis points to 4.61%

Commodities

West Texas Intermediate crude rose 0.8% to $71.95 a barrel

Spot gold rose 0.4% to $3,135.42 an ounce

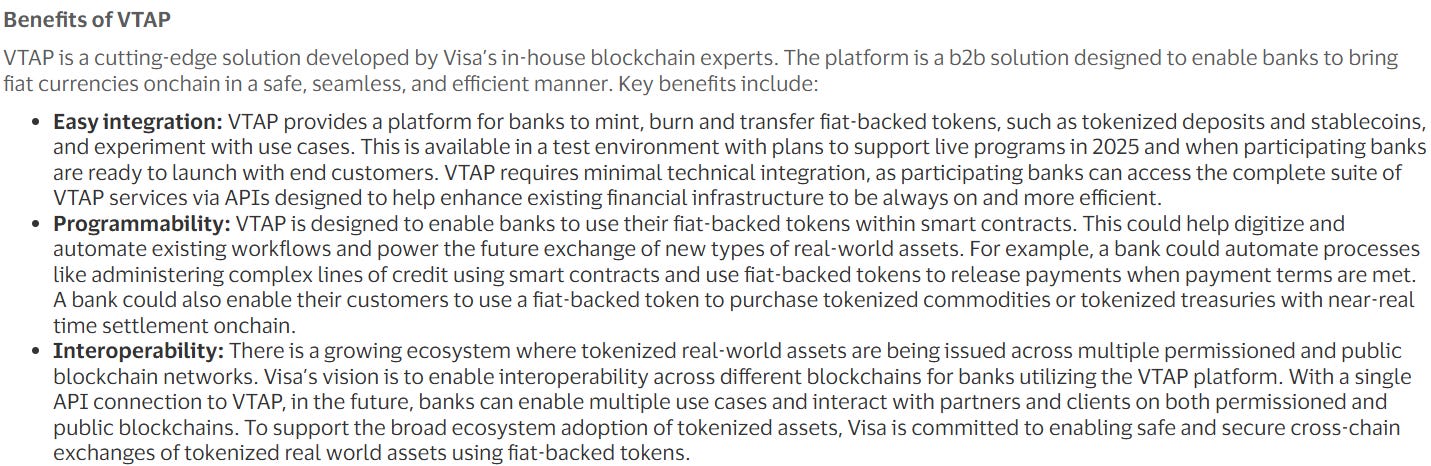

Visa Is Tokenizing On Ethereum

Visa just rolled out something big – and with a name like this, it sounds straight out of a sci-fi film: Visa’s Tokenized Asset Platform, or VTAP. Pretty slick.

VTAP is Visa’s newest product aimed at bringing traditional finance deeper into the blockchain world. It enables banks to issue fiat-backed tokens on public blockchains – and it’s being packaged up through the Visa Developer Platform, giving financial institutions a sandbox to experiment with tokenization before going live.

One of the first major players jumping in? BBVA – Banco Bilbao Vizcaya Argentaria. They plan to use VTAP to issue tokens on the public Ethereum network, with live pilots expected to launch in 2025.

Visa building rails for banks to tokenize fiat on Ethereum? That’s not just cool – that’s legacy finance signaling it’s ready to play ball in crypto’s backyard.

One interesting thing to note, from an earlier press release back in October of last year when the exploration was first announced, is this, “Potential use cases include executing automated payments through smart contracts, managing complex credit lines, or making 'tokenized' treasury securities available to banking customers that can be settled in near real-time.”

Vanessa Colella, the Global Head of Innovation and Digital Partnerships at Visa said this: “Visa has been at the forefront of digital payments for nearly sixty years, and with the introduction of VTAP, we are once again setting the pace for the industry. We're excited to leverage our experience with tokenization to help banks integrate blockchain technologies into their operations.”

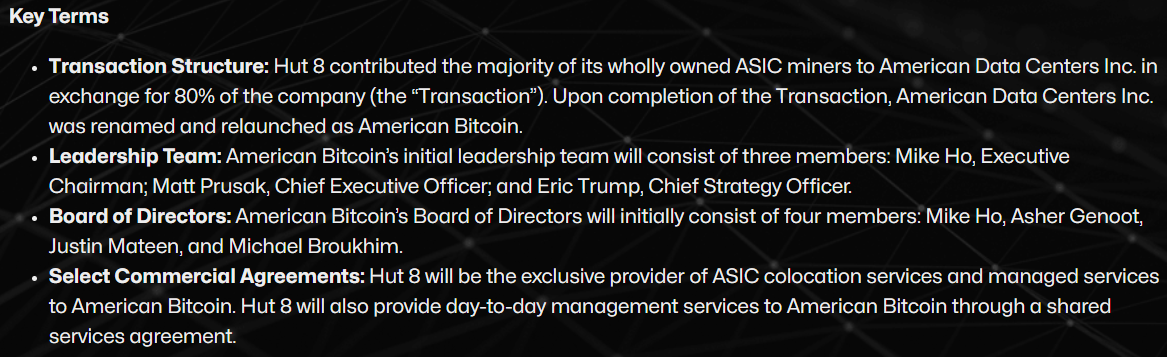

The Trump Family Is Mining

The Trump family’s crypto playbook just got another chapter – and this time, it’s all about mining. Eric Trump is partnering with Hut 8 to launch American Bitcoin, a new industrial-scale mining venture with its own strategic Bitcoin reserve.

If you’re not familiar, Hut 8 is no small player. It’s one of the leading names in Bitcoin mining and energy infrastructure, with 10,237 BTC already sitting in its reserve. With this move, Hut 8 is contributing nearly all of its ASIC miners in exchange for a majority stake in American Data Centers, Inc., which has now been rebranded as American Bitcoin.

This isn’t just another mining operation – it’s a signal. The Trump family is now directly involved in securing the Bitcoin network and stacking sats at scale. Below are some of the key details from the announcement.

Saylor Can’t Stop, Won’t Stop

Twenty-two thousand and change – that’s a lot of Bitcoin.

James from CoinDesk flagged this on X to help put it into perspective: this single purchase ranks right up there with some of the biggest buys we’ve ever seen. For reference, the largest Bitcoin acquisition MicroStrategy ever made was 55,500 BTC in late 2024 – and most of their other big moves were in the 20,000 BTC range.

This isn’t just a splash – it’s a cannonball into the deep end.

When the bull market comes roaring back and all three of Saylor’s weapons – MSTR, STRK, and STRF – are firing at full blast, don’t be surprised if we witness a single purchase that breaks the Strategy record.

Sounds crazy? Maybe. But if Saylor keeps this pace up, 1 million Bitcoin isn’t just a wild dream – it’s a plausible milestone before this cycle ends. The man isn’t just buying dips – he’s trying to buy history.

Bitcoin & Stocks Crash, Gold Hits Record: How April 2 Tariffs Could Shake Crypto! | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.