Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Algorithmic excellence from Arch Public on display late yesterday. Extraordinary precision: archpublic.com

two buys at $78.9K and $80.1K

one sell at $86.9K

2.25X long, net +11%.

We often get asked, “but does it beat buy and hold?”

The answer is yes. A resounding yes.

$100K deployed Jan. 1, 2021 - Jan. 1, 2025:

Buy and Hold = $185,346

Arch Arb + Intelligence = $313,937

In This Issue:

Times Have Changed

Bitcoin Thoughts And Analysis

Legacy Markets

DeFi Is In Decline

Both Binance And Gemini Were Breached

Galaxy Digital Settles With New York Attorney General

Marathon Is Planning To Buy A Lot Of Bitcoin

Can Cardano Supercharge Bitcoin? Charles Hoskinson Reveals All

Times Have Changed

It’s been a rough quarter for crypto investors.

On January 1, 2025, Bitcoin opened the year at $94,929. By January 21, it had climbed to $107,180, fueling hopes that Q1 would deliver a strong rally before the typical summer slowdown.

But the market gods had other plans.

After topping out in mid-January, Bitcoin began a slow bleed – slipping below $100K, then $90K, then $80K – eventually hitting a low of $76,624 three weeks ago. Since its high, Bitcoin is down 28.5%.

If Bitcoin’s Q1 story was disappointing, Ethereum’s was downright tragic. It started the year at $3,366 and briefly climbed in tandem with BTC before rolling over hard. In truth, ETH had already been trending downward since hitting $4,106 back on December 16, 2024. Since that peak, it’s down 55.8%.

Solana didn’t escape the carnage either, though its massive run from late 2023 through late 2024 gave it more of a cushion. As for the rest of the altcoin market – it’s the same song, different verse. Most are down 50%, 60%, even 70% from their highs. Whether or not your portfolio outperformed mostly came down to sheer luck – maybe you held XRP, BNB, or TRX at the right time.

Either way, Q1 is finally behind us.

This quarter couldn’t be over fast enough.

The goal today wasn’t actually to depress you - there is a positive spin on all this.

A few days ago, Bo Hines, the Executive Director of the Presidential Council of Advisers for Digital Assets, who is working closely with the other high ranking appointed crypto leader in D.C., announced this…

This is about as good as it gets for DeFi in the U.S. and crypto as a whole. The April 7, 2022 Financial Institution Letter was devastating for the prospect of crypto finding any meaningful traction in banks. Let’s discuss how debilitating the FDIC’s previous guidance was.

Banks looking to offer crypto trading or custodial services have, until now, faced an impossible hurdle: they had to prove to the FDIC that they could fully manage the risks associated with digital assets. Under the previous administration, this was more or less a dead end. The complexity and rapidly evolving nature of crypto made it nearly impossible for banks to meet the vague and often unrealistic expectations set by regulators.

The list of effectively banned activities was extensive.

Ever wonder why banks haven’t accepted crypto assets as collateral for loans? This rule is a major reason. It also helps explain why, even after the SEC began approving crypto ETFs and index funds, banks still couldn't meaningfully engage with the space. The same restrictions applied to custody, trading partnerships with exchanges, or simply buying Bitcoin for their own balance sheets.

This so-called “approval rule” created a regulatory brick wall that no traditional institution could scale without legal risk. It’s eerily reminiscent of the old SEC line: “Just come in and register.”

Here’s a screenshot from the 2022 rule that spelled it all out.

It gets even better.

This is hypothetical, but imagine you’re Bank of America and you want to partner with Tether – giving clients the ability to deposit USDT into checking accounts or even use it to pay off debt. Seems straightforward enough, right? The bank’s exposure to crypto risk would be minimal, especially with Tether maintaining a 1:1 peg to the dollar.

But how was Bank of America supposed to prove there wasn’t systemic risk in partnering with Tether until the FDIC, SEC, and the administration shifted their stance? Under prior FDIC guidance, that was nearly impossible.

Here’s another example: what if Wells Fargo simply wanted to give clients direct access to buying Bitcoin, Ethereum, Solana, and a few other major digital assets? It sounds like a basic brokerage service. But how could they do that while remaining compliant with consumer protection laws, when every U.S. regulator had a different definition of what those assets even were?

Just a year ago, everything except Bitcoin was presumed to be – or outright called – a security. At the same time, crypto firms flatly denied those claims, leaving banks stuck in regulatory limbo.

On paper, it sounds good to have regulatory bodies working to minimize systemic risk and protect consumers. In practice, it made crypto-bank partnerships nearly impossible.

Of course, that raises a broader question: does crypto even need banks? That’s a conversation for another day – but the short answer is yes, if we want to see trillions of dollars in capital enter this space over the next few years, as most of us are hoping for.

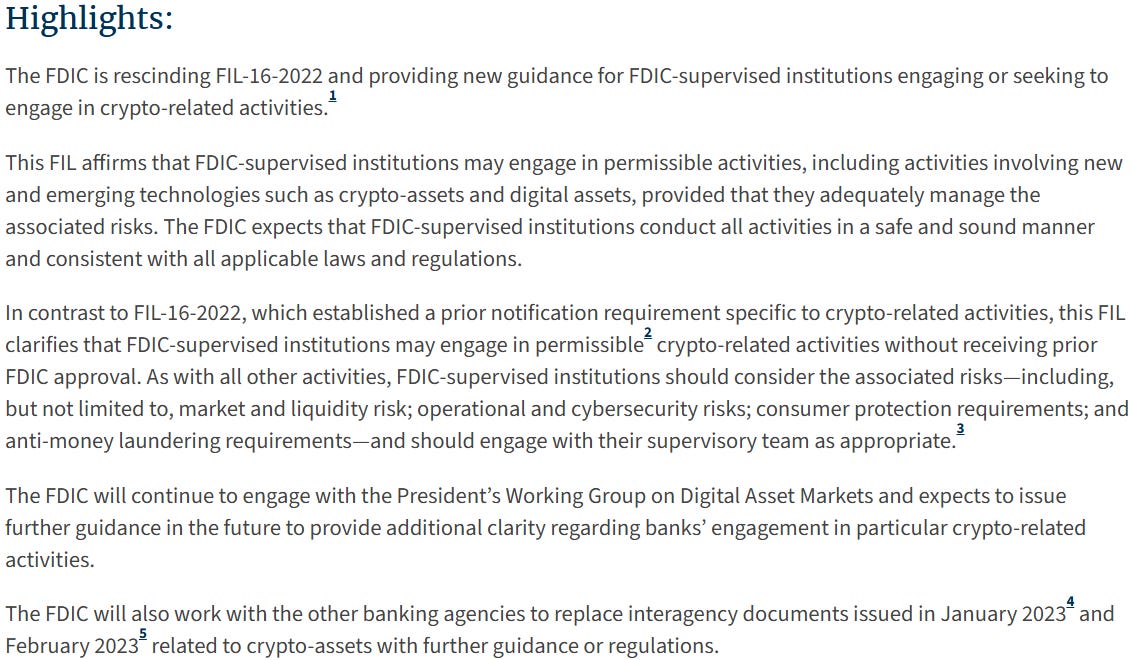

The good news today? The shackles have been broken.

“The FDIC is rescinding FIL-16-2022 and providing new guidance to clarify that FDIC-supervised institutions may engage in permissible crypto-related activities without receiving prior FDIC approval.”

What activities no longer require permission, you ask?

They include:

Custody services for customers

Holding stablecoin reserves

Runing and using nodes

Stablecoins for payment

Not only has the language and tone changed, but the FDIC also affirmed, “The FDIC will continue to engage with the President’s Working Group on Digital Asset Markets and expects to issue further guidance in the future to provide additional clarity regarding banks’ engagement in particular crypto-related activities.”

How much the FDIC ultimately allows remains to be seen – but with the support of the Presidential Working Group and a friendlier administration, the odds are finally tilting in our favor. In the months and years ahead, we can expect major banks to steadily roll out crypto products, likely starting with high-net-worth clients before expanding to the broader market.

I know this won’t sit well with some, especially those who live by the ethos: “Long Bitcoin, short the banks.” But if this movement is truly about making a global impact and transforming the financial system, then bypassing or dismantling banks altogether isn’t going to move the needle as fast as many hope. Controversial take, but refusing to work with banks at this stage may create more friction than progress.

That doesn’t mean we need to trust them. It doesn’t mean they’re right. But the “us vs. them” mentality no longer serves us when we’re still a fraction of their size. For over a decade, we’ve been fighting for a seat at the table – and now we finally have one. This is when influence and alignment matter most.

As investors, if we can zoom out, ignore the price action (yes, I know it’s hard), and tally up the institutional wins from this past quarter – it’s clear we’re heading in the right direction.

Seeing that notice at the top of a rule that handcuffed our industry for years is a massive signal – even if price didn’t react. Given the current market climate, we shouldn’t have expected a surge. But what did rise? Banks quietly scheduling meetings between their C-suites and digital asset teams to start brainstorming new initiatives.

That’s where the real momentum begins – and once those initiatives materialize, that’s what will drive prices in a meaningful way.

Yes, I’m bullish – especially on Bitcoin. But I’m also optimistic about DeFi, even if the path forward is steeper. DeFi’s infrastructure is strong, its use cases are real, and with the right conditions, it will catch its second wind.

I’ll leave you with this post – one sentence that captures everything perfectly.

Bitcoin Thoughts And Analysis

Holding off on charts for today, as everything is vague and muddled. Very difficult to make any sort of definitive analysis without it being a complete shot in the dark. Bitcoin looks weak, but there are signals in both directions. The truth is - it is at the will of macro at the moment, and there is too much uncertainty. Just be calm and wait for more clarity.

Legacy Markets

Global markets tumbled on the final day of a turbulent quarter, as mounting concerns over U.S. tariffs sent equities lower and safe-haven assets soaring. S&P 500 futures pointed to a 1% drop, putting the index on pace for its worst quarterly performance since 2022 with a 5.1% loss. The Nasdaq 100 fell even further, down 1.4% premarket, led by sharp declines in Nvidia, Palantir, and Tesla. Asian markets were hit particularly hard, with Japan’s Nikkei plunging 4% and Taiwan’s index falling into correction territory. Europe’s Stoxx 600 shed 1.2%.

Rising fears of a global economic slowdown have wiped out roughly $5 trillion from U.S. equities since late February. Goldman Sachs strategist David Kostin cut his year-end S&P 500 target to 5,700, down from 6,200, citing growing recession risks tied to trade tensions. Jefferies' Mohit Kumar warned that April 2 – the day Trump’s reciprocal tariffs are set to begin – may not bring clarity, but rather the start of prolonged, disruptive negotiations.

Bloomberg Economics projects a potential 4% hit to U.S. GDP and a 2.5% inflation surge over the next few years if tariffs are broadly implemented. The fallout is fueling expectations of rate cuts, with 10-year Treasury yields dropping to 4.18%, and bund yields also falling. Treasuries are on track to outperform equities for the first time since March 2020, as investors increasingly price in recession risk.

Gold soared to a record high on haven demand, while the dollar firmed. Trump also stoked geopolitical tensions, threatening to curb all oil exports from Russia. With markets on edge and confidence shaken, investors are bracing for continued volatility as the second quarter begins.

Stocks

S&P 500 futures fell 0.6% as of 6:12 a.m. New York time

Nasdaq 100 futures fell 0.9%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 fell 1.7%

The MSCI World Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0807

The British pound fell 0.2% to $1.2919

The Japanese yen rose 0.4% to 149.24 per dollar

Cryptocurrencies

Bitcoin fell 1.4% to $81,345.7

Ether fell 1.9% to $1,780.56

Bonds

The yield on 10-year Treasuries declined six basis points to 4.19%

Germany’s 10-year yield declined five basis points to 2.68%

Britain’s 10-year yield declined four basis points to 4.65%

Commodities

West Texas Intermediate crude rose 0.6% to $69.43 a barrel

Spot gold rose 0.9% to $3,114.42 an ounce

DeFi Is In Decline

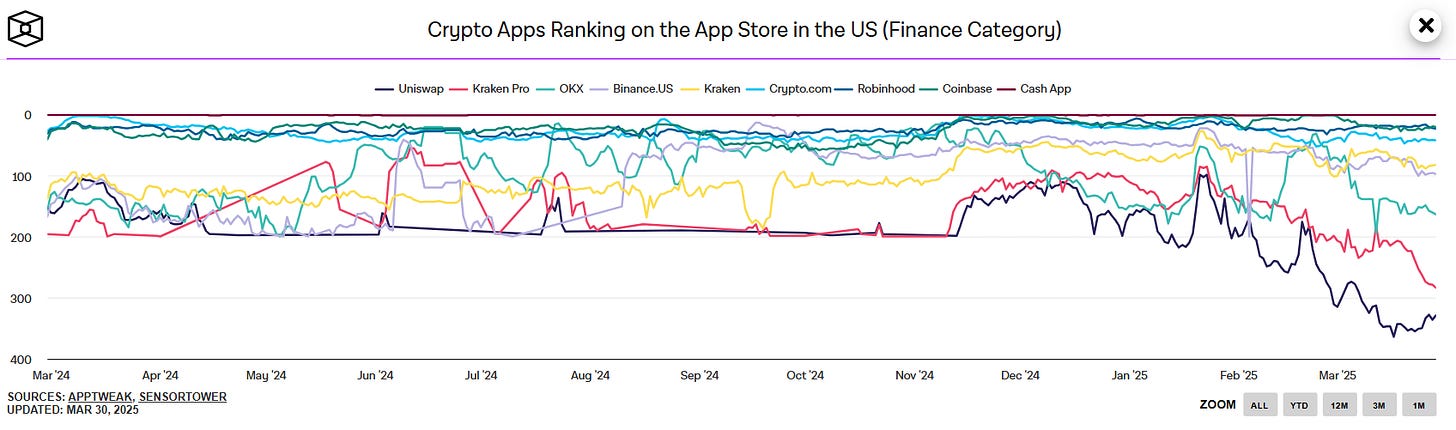

Uniswap’s position in the U.S. finance app rankings has taken a steep dive, dropping from #99 to #364 over the past two months. For most of 2024, it held steady in the 190s before surging into the 110s following Donald Trump’s pro-crypto election victory. At the peak of inauguration buzz in January, it briefly reached #99.

But that momentum has completely unraveled. Uniswap is now ranking even lower than it did throughout 2023, suggesting the spike was more election hype than sustained user growth.

Uniswap’s fundamentals are mirroring its fall in the rankings. The number of traders on Uniswap’s Ethereum network has dropped 45% in 2025, falling from 69,680 to just 37,000 – the lowest since July 2023. Monthly trading volume tells the same story, declining 10% from December to January, and then another 22% the following month.

Uniswap’s sharp drop in app store rankings appears to have coincided with a broader trend. Kraken Pro, OKX, Binance U.S., Kraken, and Crypto.com all saw ranking declines as well. Interestingly, Robinhood and Coinbase remained stable – likely a reflection of their deeper integration with traditional finance and more retail-friendly platforms.

Both Binance And Gemini Were Breached

A major security breach has compromised the personal data of over 100,000 cryptocurrency traders on Binance and Gemini, sparking alarm across the industry. The leaked information includes names, emails, phone numbers, and locations – all of which are now reportedly up for sale on the dark web.

The breach came to light when a dark web actor known as AKM69 claimed to possess a database of Gemini account holders, primarily from the U.S., with smaller groups from the U.K. and Singapore. While the seller vaguely alluded to the data being used for fraud or marketing schemes, the exact source of the breach remains unknown.

The exposure raises serious concerns about targeted scams, phishing attacks, and identity fraud – especially given the scale and sensitivity of the data involved.

Just days earlier, on March 26, another dark web seller going by the name kiki88888 listed login credentials for over 132,000 Binance accounts. While there’s no evidence of a direct breach, experts believe the data was likely harvested through large-scale phishing campaigns.

Security analysts are urging users to avoid clicking on suspicious links and to enable two-factor authentication immediately. As of now, both Binance and Gemini have yet to issue official statements regarding either incident – a silence that’s only adding to user concerns.

Galaxy Digital Settles With New York Attorney General

In its Q4 earnings report, Galaxy Digital – the crypto investment firm led by Mike Novogratz – revealed it will pay a $200 million settlement to the New York Attorney General’s office over its role in the 2022 Terra-Luna collapse. The agreement resolves issues related to the firm’s investment activity, trading behavior, and public commentary surrounding LUNA, which famously erased around $60 billion in value during its May 2022 implosion.

Despite the hefty penalty, Galaxy still reported a $174 million profit for Q4 and $365 million in earnings for the full year of 2024, having already factored in the legal provision for the settlement.Marathon Is Planning To Buy A Lot Of Bitcoin

Marathon Digital, the largest Bitcoin miner by market cap at $4.3 billion and the second-largest public holder of Bitcoin after Strategy, has announced a new $2 billion at-the-market (ATM) stock offering. As expected, the primary goal is to acquire more Bitcoin.

This move follows their previous $1.5 billion offering, which played a major role in building their current treasury of 46,376 BTC. With this latest raise, Marathon is doubling down on its Bitcoin accumulation strategy – reinforcing its position as one of the most aggressive BTC acquirers in the public markets.

Can Cardano Supercharge Bitcoin? Charles Hoskinson Reveals All

We're diving deep with Charles Hoskinson, founder of Cardano, on The Wolf Of All Streets podcast. Charles shares insider stories from his experience lobbying in Washington and reveals what's truly behind Cardano's success and misconceptions. Join us to explore the future of Bitcoin, decentralization, and how crypto is reshaping global finance.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.