Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Algorithmic excellence from Arch Public on display late yesterday. Extraordinary precision: archpublic.com

two buys at $78.9K and $80.1K

one sell at $86.9K

2.25X long, net +11%.

We often get asked, “but does it beat buy and hold?”

The answer is yes. A resounding yes.

$100K deployed Jan. 1, 2021 - Jan. 1, 2025:

Buy and Hold = $185,346

Arch Arb + Intelligence = $313,937

In This Issue:

The 99% Fallacy

Bitcoin Thoughts And Analysis

Legacy Markets

Why is Everyone Talking About Hyperliquid?

The SEC Is Committed To Doing Better

Ethereum’s Pectra Upgrade Is Almost Here

Q1 Was The Worst Quarter Fro Crypto Hacks Ever

$200 Trillion Bitcoin & The Stablecoin Tsunami | What's Next For Crypto?

The 99% Fallacy

Nothing gets me more riled up than hearing the tired old line: “99% of crypto projects will fail.” You hear it in other forms too – “99% of traders will fail,” “99% of tokens will fail,” and so on.

Every time I hear it, I can’t help but picture the person saying it – married to their bags, entrenched in their biases, and completely blind to the possibility that the statement might actually apply to them.

What fascinates me is how easily we gloss over the quiet implication behind this claim. The irony is brutal: the same people who confidently repeat this statistic are often included in the 99% they’re warning about.

I’ve written about this before and called it the “99% Fallacy.” It’s a self-fulfilling prophecy for those who repeat it without ever stopping to ask: “What makes me the 1%?”

Don’t worry, I’m going somewhere new with this idea – just give me a moment.

Here’s CoinMarketCap today:

Here are the top 8 assets from three years ago:

And here’s the top 8 from 2017:

Ignore Argus showing up ahead of Bitcoin here – it was a glitch in the price feed. The real takeaway is this: nothing in this space is immune to change, and nothing is an exception to the 99% fallacy.

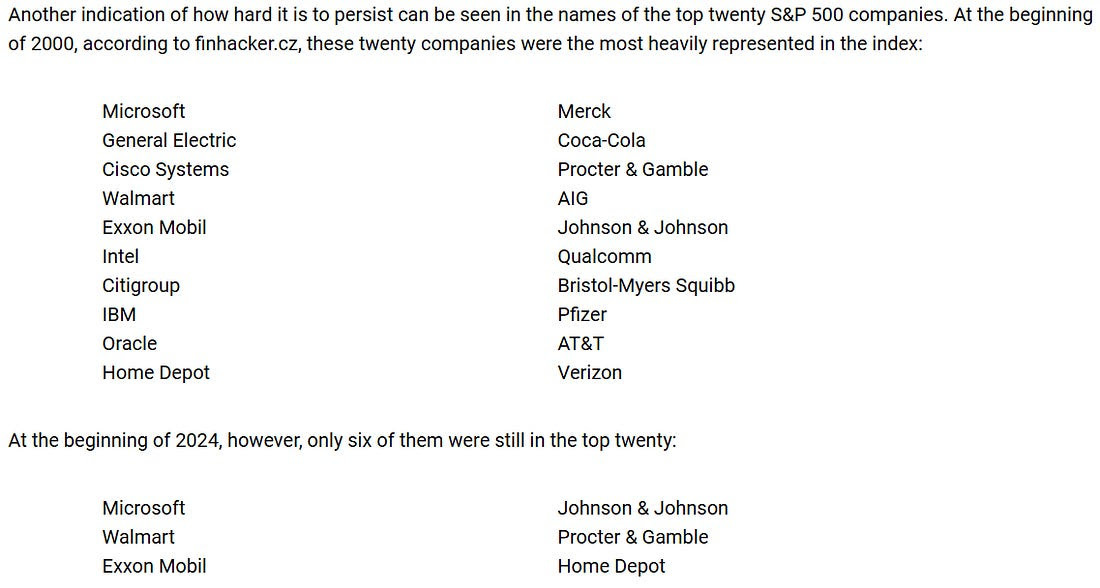

I shared this image about 30 newsletters ago, but it’s worth revisiting – this time, through the lens of legacy markets. The lesson holds across every asset class: dominance is temporary, and belief in permanence is usually what gets people wrecked.

Where I want to steer this conversation now is toward the flood of crypto ETF filings we’re seeing pour in. I’m genuinely not sure what some of these issuers are thinking. We’re talking about ETFs including XRP, LTC, SUI, HBAR, SOL, DOGE, ADA, CRO, DOT – and now even PENGU and NFTs?

Don’t get me wrong – I’d love to see these ETFs succeed. And maybe, from a business standpoint, it makes sense for issuers even if inflows are light. But I just don’t see this ending well a few years down the road. If PENGU is getting an ETF, then all bets are off. At this point, why not file for TRUMP, BONK, GHIBLI, or POT (yes, Harry Pothead)?

Just throw all caution to the wind, I guess.

But seriously – what kind of message does this send to legacy investors? Imagine logging into your brokerage account, clicking the “Crypto ETF” tab, sorting by assets, and being greeted by a lineup of tickers that look more like internet memes than legitimate investments. It undermines the credibility the crypto industry has spent over a decade building. Instead of fostering trust, it makes crypto look like a speculative invasion of traditional finance – which risks alienating conservative investors who might otherwise be open to exploring the space.

Much of this reminds me of the Grayscale days – the crypto trust products that were, for a while, the only bridge between digital assets and traditional finance. Back then, Grayscale served a real need: giving institutions and retail investors regulated access to Bitcoin and other cryptos without the hassle of wallets and keys.

But over time, Grayscale’s product list became bloated with assets that now feel out of touch – or just plain extinct. Remember these?

BAT.

BCH.

MANA.

ETC.

FIL.

XLM.

ZEC.

Let’s take BAT (Basic Attention Token), for example:

And this is Zcash (ZEC):

This isn’t a knock on Grayscale – I like the company, and they’ve done a lot to legitimize crypto in traditional finance circles. But history has proven that the 99% rule – fallacy or not – doesn’t hand out exemptions. It doesn’t care who filed the ETF or how big the issuer is. It’s coming for most of these products, whether they’re single-asset or diversified.

Even if issuers manage to turn a profit, it’s not a good look when the underlying asset trends toward zero and the investors who held get wrecked. Those people aren’t coming back – they’ll leave the space with a bad taste in their mouth and a deep distrust of crypto.

Ironically, as much as I give crypto investors a hard time for not fully internalizing this truth, we actually grasp it far better than the early and late majority – the wave of newcomers just now dipping their toes into the space, slowly scaling from 1% to 3% to 5% allocations.

The one thing that keeps us from making the same mistake? Bitcoin.

This past cycle made one thing unmistakably clear: Bitcoin is the only guaranteed winner. Betting against it is always a losing trade. Whether you held spot BTC, a Bitcoin ETF, a trust, or gained exposure through MSTR – you came out ahead.

Meanwhile, newcomers will be drawn to shiny new products, only to get wiped out over time. Because 99% of what they buy – outside of Bitcoin – simply won’t stand the test of time.

If you made it through this past cycle, hopefully you’ve learned the lesson: Bitcoin is your insurance policy against the inevitable fallout of hype-driven speculation. When millions of new investors flood in, and the noise reaches a fever pitch, your edge will come from discipline – from knowing that 99% of what’s new and promising will quickly lose its shine when the tide turns.

There’s no stopping the ETF flood. Yes, they’ll pump our bags in the short term. But no – most won’t age well.

Buy Bitcoin and hold it. If you must venture further, do just a little – if you truly believe you’re part of the 1%. It’s really that simple.

Bitcoin Thoughts And Analysis

Bitcoin is currently retesting the $85,000 level, which previously acted as resistance and is now being tested as support. A successful hold here would be a bullish development.

The 200 MA (red) has now been flipped into support after price broke above it earlier this week. That level is now converging with $85K, adding extra confluence. However, price has stalled just below the 50 MA (blue), which continues to act as resistance—currently sitting near $88K.

The move off the bottom remains intact for now, with a clear series of higher lows and higher highs. But today’s rejection wick off the highs is something to keep an eye on. A strong close below $85K would muddy the structure.

In short: holding the 200 MA and $85K is key. Above, the 50 MA and $91K are the next hurdles. This is the make-or-break zone for momentum.

Legacy Markets

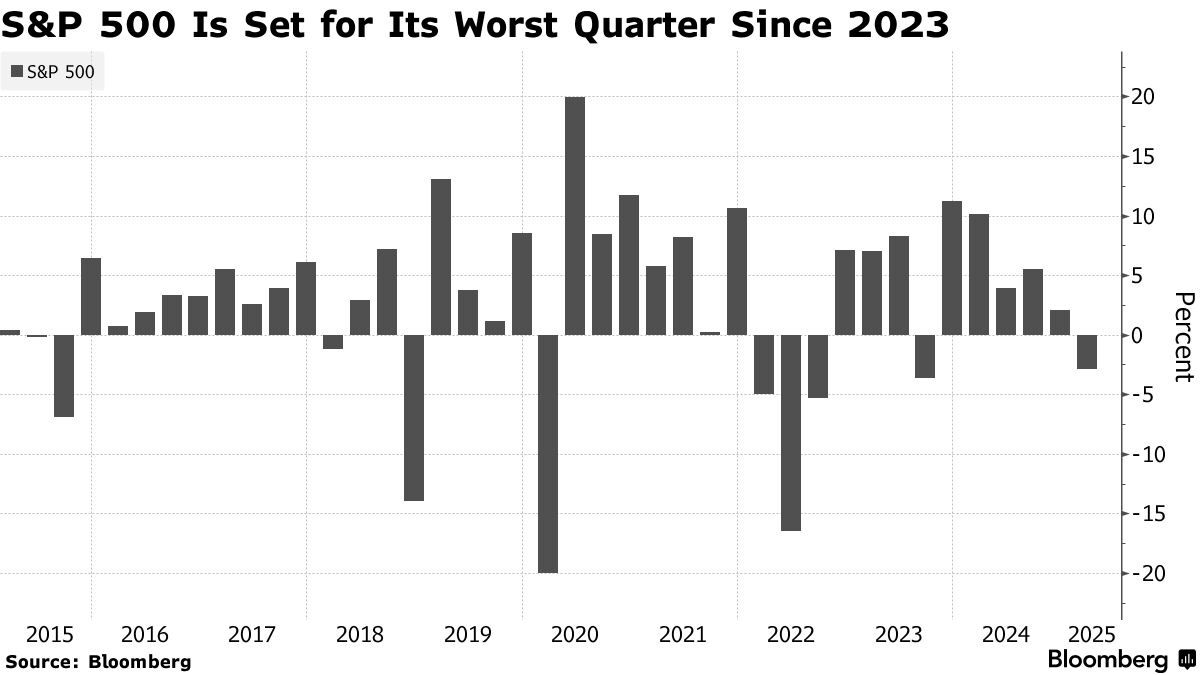

Stocks slid as President Trump pushed forward with a 25% tariff on auto imports and warned of broader retaliation against the EU and Canada, intensifying fears of a deepening trade war. The S&P 500 fell 0.3%, with automakers like Toyota, Mercedes-Benz, and GM hit hard. The Nasdaq 100 lost 0.6% and the Dow dropped 0.4%. Though the U.S. economy grew faster than expected last quarter at 2.4% and inflation was revised slightly lower, investors remained focused on the current risks tied to tariffs and sticky inflation.

Markets were unsettled ahead of Friday’s key PCE inflation data, which is expected to show continued price pressure. Bond markets reflected unease, with short-dated Treasuries outperforming longer ones. The dollar was little changed. Analysts say despite better past data, uncertainty around trade and economic policy continues to dominate sentiment. While some technical indicators suggest stocks may have found a short-term bottom, strategists see choppy trading ahead.

Sentiment has slightly improved, with the AAII survey showing a dip in bearishness, though pessimism remains historically high. BlackRock’s Jean Boivin believes U.S. equities will regain leadership over Europe, where optimism remains narrowly focused on defense and banking sectors. All eyes now turn to April 2, dubbed “Liberation Day,” when Trump is expected to unveil his next round of tariffs.Some of the main moves in markets:

Stocks

The S&P 500 fell 0.3% as of 4 p.m. New York time

The Nasdaq 100 fell 0.6%

The Dow Jones Industrial Average fell 0.4%

The MSCI World Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.4% to $1.0795

The British pound rose 0.5% to $1.2950

The Japanese yen fell 0.3% to 151.04 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $87,052.04

Ether fell 0.3% to $2,004.22

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.36%

Germany’s 10-year yield declined two basis points to 2.77%

Britain’s 10-year yield advanced six basis points to 4.78%

Commodities

West Texas Intermediate crude rose 0.2% to $69.79 a barrel

Spot gold rose 1.3% to $3,057.49 an ounce

Why is Everyone Talking About Hyperliquid?

I took the bait and decided to figure out what the hell is going on with the Hyperliquid liquidation that’s been rattling the timeline. Full disclosure – this is a bit out of my wheelhouse, since I haven’t been following it closely until now. So, if you’ve been deep in the weeds on this and have more sophisticated takes, feel free to skip this section.

But for those of you who are curious and just want the basics – this one’s for you. After reading a handful of articles (and having a conversation with ChatGPT to help untangle the mess), I’ve pieced together what’s going on.

Let’s start with the obvious question: What is Hyperliquid?

Here’s the TLDR for anyone trying to make sense of the Hyperliquid situation:

Hyperliquid is a decentralized exchange that lets users trade perpetual contracts with leverage. Instead of using traditional liquidation mechanics, it relies on a communal risk pool called the Vault, which inherits liquidated positions if a trader can’t cover their losses.

The drama centers around a token called JELLYJELLY, tied to the Jelly-My-Jelly video app – a low-volume asset listed on the platform. A trader placed a $6 million short on JELLYJELLY, betting the price would drop. But instead of waiting for a natural decline, they artificially pumped the price, triggering their own liquidation.

Because of how Hyperliquid is structured, that short didn’t just vanish. It was passed to the Vault – a design meant to stabilize the system – which now had to carry the burden of that massive short position.

This is where things got ugly. The Vault doesn’t have safeguards to differentiate between natural market behavior and deliberate manipulation. As the manipulated price of JELLYJELLY kept rising, the Vault’s potential losses ballooned to $10.5 million, with fears that if the price reached $0.15374, it could wipe out the entire $230 million Vault.

In response, Hyperliquid delisted JELLYJELLY, removed its price chart, and hid the Vault’s exposure – which only spooked traders further. Meanwhile, Binance and OKX added fuel to the fire by offering high-leverage JELLYJELLY trading, creating even more volatility.

Fortunately, the short position was eventually closed at $0.0095, giving the Vault a $700K profit instead of a meltdown. Hyperliquid later promised to reimburse non-flagged users impacted by the mess.

The takeaway? DeFi platforms need better risk management – especially when using communal liquidity models like Hyperliquid’s Vault. Without circuit breakers, anti-manipulation filters, or real-time transparency, even a single bad actor can push a system to the brink.

This time, it ended with a sigh of relief. But if DeFi keeps scaling without evolving its safeguards, next time we might not be so lucky.

The SEC Is Committed To Doing Better

During a heated Senate Banking Committee hearing on yesterday, President Trump's SEC Chairman nominee, Paul Atkins, vowed to boost morale, depoliticize regulation, and promote fairness for emerging industries like crypto.

I have a handful of his quotes below:

“Since 2017, I’ve led industry efforts to develop best practices for the digital asset industry. I’ve seen how ambiguous and non-existent regulation of digital assets creates uncertainty in the market and inhibits innovation.”

“A top priority of my chairmanship will be to work with my fellow Commissioners in Congress to provide a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.”

“I’m fortunate to have served previously at the SEC... and ultimately as Chief of Staff. From 2002 to 2008 I was honored to serve as an SEC Commissioner. In that time, I advocated for greater transparency and emphasized robust cost-benefit analysis when considering new regulations.”

At one moment, Senator Tim Scott noted, “The SEC suffered a series of damaging losses,” and in response, Atkins said, “I commit to get to work… to cure some of the dysfunction that's there, the demoralization of it, and get back to this mission that's very important.”

Paul Atkins is the right guy for the job. We are lucky.

Ethereum’s Pectra Upgrade Is Almost Here

Ethereum developers are feeling the pressure as the long-anticipated Pectra upgrade faces delays, thanks to a string of unexpected issues across multiple testnets. Initially deployed on Holesky in February, the upgrade failed to finalize. When testing moved to Sepolia, an attacker exploited existing errors, compounding the setbacks.

To restore momentum, developers launched a fresh testnet, Hoodi, on March 17 – and this time, the Pectra upgrade passed with flying colors. With successful testing now behind them, developers are eyeing an April 25 mainnet rollout.

For those unfamiliar, Pectra is a major milestone in Ethereum’s roadmap, aimed at improving scalability, security, and user experience. It includes the highest number of Ethereum Improvement Proposals (EIPs) bundled into a single upgrade to date. Highlights include:

EIP-7702: Wallet and account abstraction improvements

EIP-7251: Raising the validator stake limit to 2,048 ETH

EIP-7691: Doubling the max blob count to improve rollup scalability

If it lands on time, Pectra could mark a meaningful leap forward for Ethereum – both technically and narratively.

Q1 Was The Worst Quarter Fro Crypto Hacks Ever

Q1 2025 was the worst quarter on record for crypto hacks, with a staggering $1.64 billion stolen. The vast majority of that came from just two incidents: the Bybit hack, which alone accounted for $1.46 billion, and the Phemex breach, which added another $69.1 million. Together, they made up 94% of all losses.

February was by far the most damaging month, driven almost entirely by the Bybit exploit, which pushed total monthly losses to $1.53 billion. Centralized finance platforms took the biggest hit, losing $1.5 billion, while decentralized finance losses were comparatively smaller at $106.8 million.

Unfortunately, as the space continues to grow, it's likely only a matter of time before we see an even bigger breach. There’s never been a more critical moment to learn proper self-custody – your security is only as strong as your understanding.

$200 Trillion Bitcoin & The Stablecoin Tsunami | What's Next For Crypto?

Today we're joined by crypto experts Molly Jane Zuckerman (Blockworks), Joshua Frank (The Tie), Edan Yago (Bitcoin OS Core Contributor), and fan-favorite Dave Weisberger to unpack the REAL future of Bitcoin and crypto.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.