The Wolf Den #1164 - Inside The Minds of Institutional Investors

A brief glimpse into what is coming...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Inside The Minds of Institutional Investors

Bitcoin Thoughts And Analysis

Legacy Markets

Ethereum Has An Abysmal Q1

Strategy Crosses 500,000 BTC

Coinbase May Acquire Deribit

Trump’s Team Is Launching A Stablecoin and ETFs

Is Bitcoin Set To Explode? Crypto Volatility Is Going Up | Macro Monday

Inside The Minds of Institutional Investors

The market is finally heating up, but I don’t want to jinx it, so I’ll leave it at that for now.

Today’s story is that Coinbase recently teamed up with EY-Parthenon to explore institutional attitudes toward crypto. Together, they produced an in-depth report titled “Increasing Allocations in a Maturing Market,” which serves as their “2025 Institutional Investor Digital Assets Survey.”

I know that this might come as a shocker, but the best insight in this space doesn’t come from your favorite X influencer or YouTuber. It comes from the actual data - and I have all the highlights below. Here’s the mission of the survey: “To better understand how institutional investors think about digital assets (including sentiment, allocations, future expectations, tokenization, and payments), Coinbase, in collaboration with EY-Parthenon practice, conducted a survey of 352 institutional investors.”

Let’s start with the background and methodology used:

Surveyed only decision-makers (e.g., COO, CEO, Head of Transformation)

Survey dates January 13, 2025–January 24, 2025

Findings are based on a survey of N=352 institutional investors

Survey was focused on US (62% of respondents) and Europe (28% in UK/EU)

Respondents are currently invested, previously invested, or planning to invest in digital assets or digital asset-related products in the next 12 months.

Here’s a breakdown of who was surveyed:

Over half of the participants were institutions with AUM between $1 billion and $50 billion, while over a quarter managed between $51 billion and $1 trillion. These are not smaller players; these are the institutions that will actually move price.

I love this paragraph in the introduction:

“There are substantive reasons to believe in this bull cycle. The market is more mature and resilient, the introduction of ETPs for Bitcoin and Ethereum and other products has expanded market participation, and there is a positive outlook on the evolving regulatory environment across the US, EU and the globe.”

What’s unique about the timing of this report is that it was conducted post-election / inauguration, but prior to both of the Presidents’ executive orders.

Let’s explore the key findings with their accompanying charts.

“Eighty-five percent of respondents increased allocations to digital assets and digital assets-related products in 2024, and a similar portion plan to continue doing so.”

Until the “Holdings remained unchanged” category grows, we have to assume we're in a bull market. Obviously, this data will lag since it's published research from institutions, who tend to be slower players. But for now, it’s full steam ahead.

“In 2025, 59% of respondents plan to allocate over 5% of their assets under management to cryptocurrencies, with US respondents and hedge funds indicating higher allocations than other segments.”

It’s interesting to see that firms’ plans to allocate to crypto from last year to this year are nearly identical. While we obviously want to see growth, as long as institutions are sitting in the higher percentage tiers, this corroborates that we are still very much in a macro bull market.

“Concerns on regulatory clarity and volatility remain key issues for investors globally. In light of this, emerging regulatory clarity is recognized as the #1 catalyst for industry growth.”

This is my opinion, but if this poll had been done after the two crypto executive orders released, all of these numbers would be at least 5% to 10% higher, particularly for “Near-term regulatory clarity (next 12 months).”

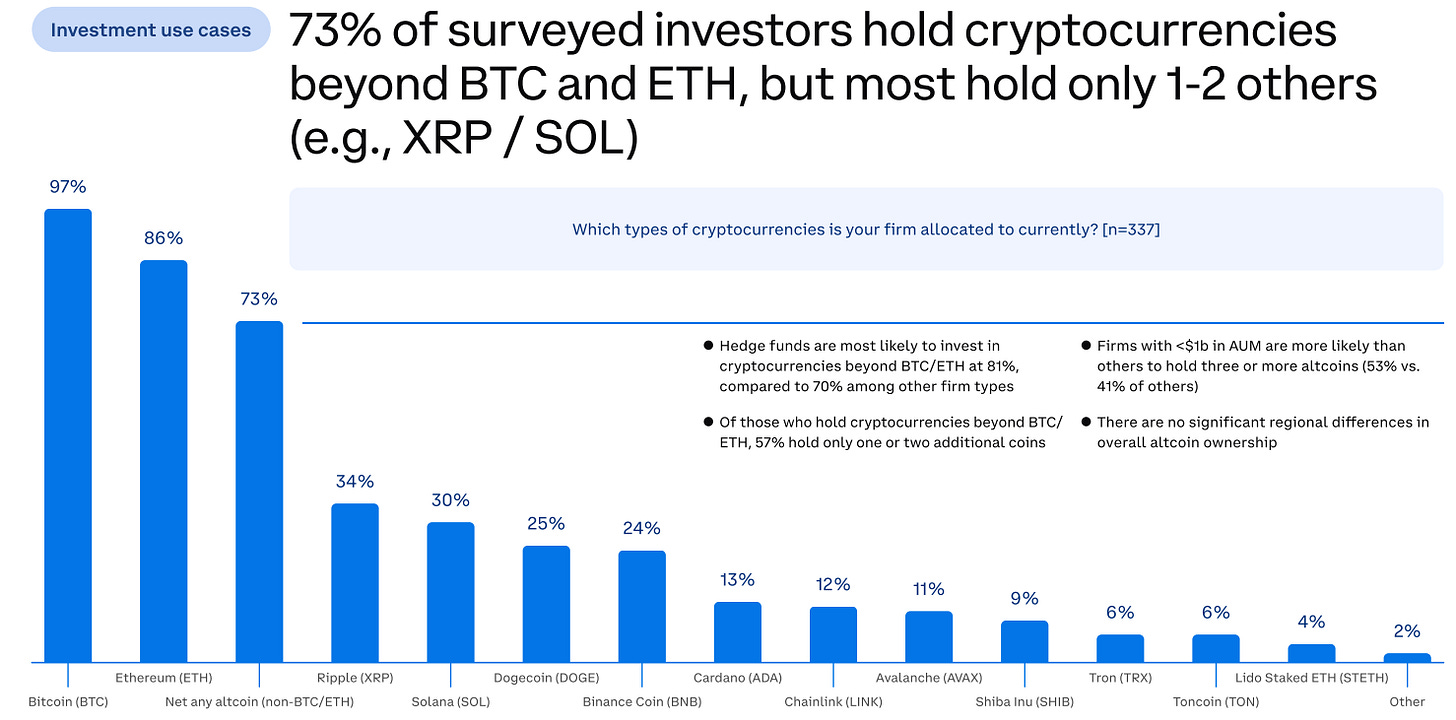

“Seventy-three percent of institutional investors currently hold one or more altcoins beyond BTC and ETH, led by hedge funds at 80%.”

From left to right, the X-axis includes: Bitcoin, Ethereum, Net any altcoin (non-BTC/ETH), Ripple, Solana, Dogecoin, Binance Coin, Cardano, Chainlink, Avalanche, Shiba Inu, Tron, Toncoin, Lido Staked ETH, and Other.

“Sixty percent of investors prefer to gain exposure to crypto through registered vehicles (e.g., ETPs1), with high levels of interest in further innovation including diversified index funds, altcoin ETPs, and US-based perpetual futures.”

Institutions are clearly showing a preference for registered products over holding assets on an exchange or in a wallet. More interestingly, respondents indicated they would likely invest in both “New spot ETPs with diversified, multi-token index strategies (e.g., staking, leverage)” and “New spot ETPs for single assets (e.g., Solana, XRP, or other).”

“The percentage of respondents that engage with DeFi is set to triple in the next two years, from 24% to 75%.”

The order of use cases, from most interest to least, is as follows: Derivatives, Staking, Lending, Access to altcoins, Cross-border settlement, Yield farming, Automated multi-application strategies, Borrowing, and None.

“Almost half of respondents leverage stablecoins, with key use cases focused on yield generation, transactional convenience in the markets, and foreign exchange.”

Hedge funds (70%) are nearly twice as likely as other firms (37%) to use stablecoins, simply because stablecoins are a necessary tool for traders.

“Fifty-seven percent of surveyed respondents are interested in investing in tokenized assets, particularly alternative funds, to drive portfolio diversification.”

Last, but certainly not least, is tokenization. I have a second graph to accompany this topic.

The list on which tokenized asset classes or security types firms are most interested in investing goes: Alternative funds (e.g., private equity, private credit, real estate), Commodities (e.g., gold, oil), Equities, Public funds (e.g., mutual funds, ETPs, UCITs*), Real estate, Bonds, Government bonds (e.g., US Treasuries), Money market funds, and then Cash. Also, only 11% of firms are currently invested in tokenized assets, while 61% of respondents say they will invest in them this year or next.

I think it’s safe to say that institutions are here, and their presence is growing. This data won’t tell us whether a recession is coming or if Bitcoin will need to retest $76,000 in a few months. But from a broader perspective, it’s crystal clear that significant capital from larger players is flowing into this space and seeking greater exposure.

Institutions tend to move slowly, and this data is essentially a signal of their upcoming moves. If you're an investor hoping for growth in stablecoins, expansive tokenization, increased ETF inflows, more DeFi participation, reduced hesitation around regulations, and rising AUMs, it's all set to happen over the next couple of years, regardless of price fluctuations. The foundation is being laid.

I’ll conclude today the same way I did yesterday - ignore the price, it is deceiving. Prices will inevitably rise to accommodate larger players; it’s that simple. Bitcoin will return to $110,000 and move a lot higher, so just be patient.

Bitcoin Thoughts And Analysis

Bitcoin is starting to look pretty solid here. We’ve got a clear series of higher lows and higher highs off the bottom — exactly what you want to see for a bullish trend reversal. The 200 MA, which had been acting as resistance, has now flipped to support. That’s a big win for the bulls.

Price has also broken convincingly above the $85,000 level, which adds to the bullish case. This kind of structure — higher highs and higher lows — usually signals a shift in momentum. It’s still possible that this could be a bear flag, but the retrace has been deep enough that it’s looking more like a legitimate trend change.

The next major test is around $91,000. A push through that level would really solidify the bullish case, but for now, the market structure is looking encouraging.

The 50 MA is still overhead, which could act as resistance in the short term — so that’s something to keep an eye on. Meanwhile, the RSI has now broken above the 50 level, confirming improved bullish momentum. If price holds here and RSI continues to climb, things could heat up quickly.

Legacy Markets

Wall Street’s rally appeared set to fade on Tuesday as President Trump’s latest tariff threats and reduced expectations for Federal Reserve rate cuts weighed on sentiment. Nasdaq 100 futures fell 0.2%, while S&P 500 futures slipped 0.1%, pointing to a pullback after one of the best sessions for US stocks this year. Tesla was on track to snap its longest winning streak of 2025 following data showing fresh sales declines in Europe.

Trump threatened a 25% tariff on any country purchasing crude from Venezuela, sending Brent crude up 0.5%. While markets initially rallied on signs that Trump’s upcoming trade sanctions might be narrower than feared, his comments about tariffs on automobile imports and “reciprocal” tariffs starting next week have added to confusion. Investors remain uncertain about the potential impact on inflation and growth.

The Atlanta Fed’s Raphael Bostic said he expects just one 25-basis-point rate cut this year due to “bumpy” inflation, challenging market bets on two cuts. Treasury yields edged higher, and the dollar steadied after four days of gains. Gold prices rose slightly, holding near record highs.

In Europe, the Stoxx 600 rose 0.6%, snapping a three-day losing streak. Hong Kong-listed Chinese tech stocks fell 3.8%, pressured by weak earnings and Xiaomi’s jumbo share sale. Turkish stocks rose about 4% after authorities implemented emergency measures to stabilize markets following the arrest of a key opposition figure. Economic officials are set to address foreign investors later on Tuesday.

Stocks

The Stoxx Europe 600 rose 0.6% as of 9:58 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.3%

The MSCI Emerging Markets Index fell 0.7%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was unchanged at $1.0801

The Japanese yen rose 0.2% to 150.47 per dollar

The offshore yuan was little changed at 7.2673 per dollar

The British pound was little changed at $1.2931

Cryptocurrencies

Bitcoin fell 0.7% to $87,287.09

Ether fell 0.7% to $2,071.82

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.35%

Germany’s 10-year yield advanced five basis points to 2.82%

Britain’s 10-year yield advanced three basis points to 4.74%

Commodities

Brent crude rose 0.7% to $73.49 a barrel

Spot gold rose 0.4% to $3,023.03 an ounce

Ethereum Has An Abysmal Q1

What has traditionally been Ethereum’s strongest quarter – Q1 – has now become its second-worst, down -37.55%. The only worse Q1 was in 2018, when ETH dropped -46.61%. Bitcoin, meanwhile, is down -5.69% this quarter, and Solana has fallen -25%.

There are still a few days left for a turnaround before the quarter closes, but at this point, the focus shifts to Q2. Sentiment is about as bad as it gets – which could set up a powerful rebound if some of the tailwinds start to align: staking ETFs, tokenization, DeFi growth, and, of course, Base.

Strategy Crosses 500,000 BTC

Here’s a fun fact: MicroStrategy is now closer to holding 1 million Bitcoin than zero. With 506,137 BTC, Saylor’s stash represents roughly 3% of the total 21 million supply – factoring in lost Bitcoin.

What’s remarkable is that Strategy has already influenced many public and private companies to buy Bitcoin – I covered this last week. But so far, they’ve yet to inspire a major player to move with the same level of aggression. Granted, Strategy didn’t start at this pace, but their relentless accumulation sets a precedent that few, if any, have had the conviction to follow.

In other news, I want to flag what may be the same rumor or two separate ones. Andrew and Jeff Park are deeply connected on Wall Street, so it’s worth keeping on our radar. Just remember – a rumor is still a rumor until it's confirmed. Don’t get excited until the news is official.

Coinbase May Acquire Deribit

Coinbase is reportedly in advanced talks to acquire Deribit, a leading derivatives exchange, according to Bloomberg. The two companies have reportedly informed Dubai regulators, and Deribit’s valuation is estimated at $4–$5 billion.

This deal would mark Coinbase’s major entry into the lucrative crypto derivatives market, where Deribit processed nearly $1.2 trillion in trades in 2024. If it goes through, Coinbase will join a growing list of high-profile fintech and crypto acquisitions – including Stripe and Bridge, Kraken and Ninja Trader, Robinhood and Bitstamp, Circle and Hashnote, and, last but not least, MoonPay and Iron.

Trump’s Team Is Launching A Stablecoin and ETFs

President Donald Trump’s decentralized finance project, World Liberty Financial, has launched a stablecoin called USD1 on both Ethereum and Binance’s BNB Chain. This launch follows months of planning, with earlier reports in October revealing that the Trump family and their business partners had been working through legal and safety concerns. Now, with Trump back in the White House and stablecoin legislation gaining momentum, World Liberty has officially entered the competitive and profitable stablecoin market.

Stablecoins like USD1, typically pegged to the U.S. dollar, act as key on- and off-ramps between crypto and traditional finance, offering stable value amid market fluctuations.

In other Trump news (yesterday was busy), Trump Media and Technology Group Corp has signed a non-binding agreement to partner with Crypto.com to launch a series of ETFs and ETPs under the Truth.Fi brand. The plan is to roll out the ETFs later this year, pending a definitive agreement and regulatory approval. The products are expected to be widely available internationally, including in the United States, Europe, and Asia. According to the Global Newswire release:

“The ETFs, made available through Crypto.com’s broker dealer Foris Capital US LLC, are expected to comprise digital assets as well as securities with a Made in America focus spanning diverse industries such as energy. Crypto.com will support the backend technology, provide custody, and supply the cryptocurrencies for the ETFs, which are anticipated to include a unique ETF basket of cryptocurrencies incorporating Bitcoin, Cronos, and other crypto assets.”

There’s no reason to believe Trump won’t pump crypto into the stratosphere. His family’s wealth is now largely riding on this space. Ethics aside, patient crypto investors stand to benefit tremendously.

Is Bitcoin Set To Explode? Crypto Volatility Is Going Up | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.