Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Algorithmic excellence from Arch Public was on display late yesterday. Extraordinary precision: archpublic.com

two buys at $78.9K and $80.1K

one sell at $86.9K

2.25X long, net +11%.

We often get asked, “but does it beat buy and hold?” The answer is yes. A resounding yes.

$100K deployed Jan. 1, 2021 - Jan. 1, 2025:

Buy and Hold = $185,346

Arch Arb + Intelligence = $313,937

In This Issue:

The U.S. Wants Bitcoin

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Fidelity Taps Ethereum For Tokenization Needs

The IMF Is Not Buying Bitcoin

Strategy Should Reach 500,000 BTC This Week

The White Paper Is NOT In The White House

How Binance Became A Crypto Empire – Richard Teng On The Rise To 250M+ Users

The U.S. Wants Bitcoin

Trump’s executive order, titled “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile,” proposed acquiring Bitcoin through government-held BTC, provided the strategies remain budget-neutral.

The executive order reads:

“The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers. However, the United States Government shall not acquire additional Stockpile Assets other than in connection with criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any agency without further executive or legislative action.”

It amazes me that Bitcoin is trading at just $85,000.

When the executive order news broke, I shared a detailed list in the newsletter outlining several ways the U.S. government could acquire Bitcoin in a budget-neutral way. Let’s revisit that list.

It’s long, but take a moment to consider each option – there are several creative and realistic paths that could lead to a substantial Bitcoin stockpile:

Trump should accept BTC in the SBR for the “Gold Card.”

Fund BTC buys with profits from seized crypto sales.

Trade U.S. Treasuries for BTC with major institutions.

Sell off government waste via DOGE to fund BTC purchases.

Launch Bitcoin-backed government bonds.

Reward miners for selling BTC to the government.

Settle tax debts with BTC payments.

Partner with private firms for strategic BTC acquisitions.

Use a 2% Bitcoin rewards card for federal spending to stack BTC at no taxpayer cost.

Allocate surplus from the Treasury’s ESF to buy BTC.

Revalue gold to market price and sell a portion to fund BTC purchases.

Offer tax breaks for BTC donations to the reserve.

Use tariff revenue, like ASIC import fees, to acquire BTC.

Mine BTC using wasted energy or subsidize such mining operations.

Implement a crypto trading tax to fund the BTC reserve.

Some of these ideas might sound far-fetched – like selling off wasteful assets via DOGE or launching Bitcoin-backed government bonds – but maybe it’s not as crazy as it seems.

Bo Hines, the Executive Director of the Presidential Council of Advisers for Digital Assets, is working closely with David Sacks (the crypto and AI czar) and key figures at the Treasury Department and Department of Commerce on Bitcoin policy. If these conversations are happening at that level, this is no longer just speculation – it’s a strategic shift in motion.

Here’s what Bo Hines said in a recent interview with CoinDesk:

Interviewer: “What do you think the target amount should be for the United States?”

Bo Hines: “Well, you know, I get asked this question a lot, and I think the answer, as I mentioned at the summit yesterday, is as much as we can possibly get - so long as it's in budget-neutral ways that don't cost the taxpayer a dime… We'll be able to come up with ways to accumulate more, really, over the course of the next few years.

And beyond that, I mean, look, we view Bitcoin as digital gold. That's why we set up the Strategic Bitcoin Reserve the way we did. We feel like it's in the best interest of Americans to hold on to this asset long term and accumulate as much as we can get. Um, you know, that's why we've akin this to digital gold and talked about building the digital Fort Knox for the United States.

Interviewer: “What is the emergency purpose of storing and acquiring Bitcoin for the United States taxpayer?”

Bo Hines: “Well, look, I mean, just like gold, it's finite, right? There's only so much of it. And we know that there’s going to be a race among other actors, potential adversarial actors, to accumulate as much as they can possibly get as well. You know, as the resource becomes more scarce, the price could tend to go up. And that’s what we've seen over the course of the last few years.

And, you know, while we're not financial advisors, and we ask anyone who’s thinking about investing in a volatile space, whether it be crypto or somewhere else, to consult an expert before they do, we view it in the long-term interest of the United States to hold on to assets that have intrinsic stored value. And so, that's why we've separated Bitcoin from other digital assets.

“And I think we can say that, you know, we'd like to have the largest stockpile, or reserve, I should say, than the rest of our adversaries across the globe.”

Here’s the key part.

Interviewer: “So, the executive order suggests acquiring Bitcoin in a budget-neutral way. Senator Cynthia Lummis has reintroduced the Bitcoin Act, suggesting that Fed earnings and gold certificates could be used to acquire Bitcoin. Any ideas on what methods are on the table here?”

Bo Hines: “Well, I mean, I think Senator Lummis is really moving the ball forward on Capitol Hill, not only with the SBR but with many other initiatives as well.”

“You know, I think she has a very interesting idea about a budget-neutral way in which we could acquire more. I think she talks about the gold certificates that date back to the 1970s, and how we could realize their actual value today and use that to purchase more Bitcoin. That’s just one creative way, and we’re going to have these conversations with the interagency working group that was set up. We’ll sort through and flesh out the best ideas and decide how we’re going to implement this. But we’re going to do that in short order. We want to move quickly, you know, as David has said.”

To clarify, Bo Hines isn’t explicitly saying that the U.S. will sell gold to buy Bitcoin. Rather, he’s referring to the idea of using gold certificates – paper representations of gold dating back to the 1970s – and realizing their current value to potentially acquire Bitcoin. It’s a subtle but creative way for the U.S. to remain budget neutral.

You don’t have to take my word for it that the U.S. will acquire as much Bitcoin as it can through a range of creative strategies – take it from the Executive Director of the Presidential Council of Advisers for Digital Assets, who is working directly with Donald Trump, Scott Bessent, Howard Lutnick, and David Sacks. Both Bitcoin believers and doubters are failing to grasp the significance of these statements.

Long story short, the price is misleading you – ignore it. We’re not talking about smaller countries like Germany, South Korea, Canada, Italy, or France (though they’re making their own strides). We’re talking about the United States – the world’s largest economy by gross domestic product – signaling they want “as much Bitcoin as they can get.” You’re not bullish enough. Case closed.

Bitcoin Thoughts And Analysis

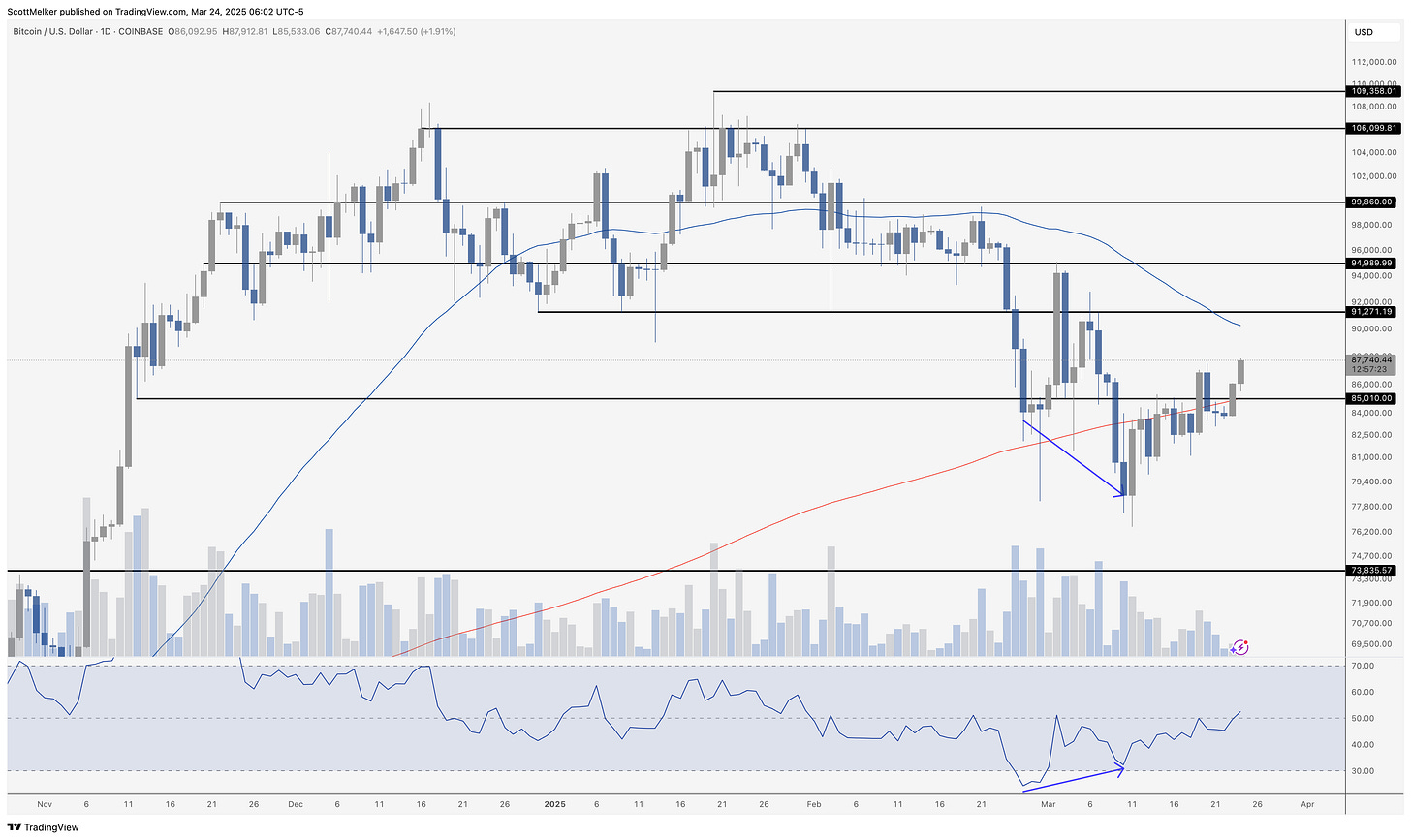

Bitcoin is finally waking up. After weeks of choppy action and failed attempts to break out, price has pushed decisively above the $85,000 resistance zone. The bullish divergence on RSI that confirmed earlier this month is doing its job — momentum is building, and buyers are stepping in.

We're now flirting with the 200 MA, which previously acted as stiff resistance. A clean break and close above it would open the door to the $91,000 zone — and possibly even higher. RSI is trending upward, showing growing strength, but we’ll need to see follow-through to confirm that this isn’t just another fakeout.

Volume remains underwhelming, which is the one red flag here. If this rally is the real deal, we should start seeing more aggressive buying. For now, Bitcoin looks constructive — but as always, this market has a habit of humbling even the most confident traders. Let’s see if the bulls have the strength to keep pushing.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

A number of altcoins are showing similar patterns, which I shared in the newsletter last week - ascending triangle breakouts.

Here is SOL, with a target of $165:

Here is ETH, with a target of $2,197.

It is nice to see larger caps keep up with Bitcoin on this move up. Let’s see if this is a harbinger of things to come.

Legacy Markets

US stock futures rallied, with Nasdaq 100 futures up 1.2% and S&P 500 futures gaining about 1%, as traders bought up beaten-down tech shares and grew optimistic that US tariffs may be more targeted than previously feared. Tesla rose about 4% in premarket trading, while Nvidia and Palantir also gained following reports that Jack Ma’s Ant Group has developed AI techniques that could reduce costs by 20%.

The dollar weakened, and Treasury yields ticked higher. European stocks were little changed, though SAP SE overtook Novo Nordisk to become Europe’s most valuable public company. Investors took comfort from reports that the Trump administration’s upcoming tariffs, set to be announced on April 2, will likely target specific sectors rather than be applied broadly — raising hopes that some industries and countries may be spared.

Morgan Stanley strategists noted that a 3.8% drop in the dollar since January and signs of stabilizing earnings from the Magnificent Seven could help attract capital back to US markets. Meanwhile, protests erupted across Turkey after the arrest of Istanbul Mayor Ekrem Imamoglu, President Erdogan’s main political rival, pushing the lira down 0.6% to near record lows. Investors are also awaiting US PMI data, which is expected to show that the economy remains in expansion mode.

Key Events this week:

Eurozone HCOB Manufacturing & Services PMI, Monday

UK S&P Global Manufacturing & Services PMI, Monday

Bank of England Governor Andrew Bailey speaks, Monday

US S&P Global Manufacturing & Services PMI, Monday

Australia budget, Tuesday

Boao Forum for Asia, Tuesday through March 28

Australia CPI, Wednesday

UK CPI, Wednesday

Norway rate decision, Thursday

US revised 4Q GDP, Thursday

Mexico trade, rate decision, Thursday

Tokyo CPI, Friday

US core PCE price index, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.9% as of 6 a.m. New York time

Nasdaq 100 futures rose 1.1%

Futures on the Dow Jones Industrial Average rose 0.8%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.0839

The British pound rose 0.3% to $1.2962

The Japanese yen fell 0.2% to 149.57 per dollar

Cryptocurrencies

Bitcoin rose 2.4% to $87,166.93

Ether rose 5.2% to $2,095.16

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.28%

Germany’s 10-year yield advanced one basis point to 2.78%

Britain’s 10-year yield declined one basis point to 4.70%

Commodities

West Texas Intermediate crude rose 0.3% to $68.51 a barrel

Spot gold was little changed

Fidelity Taps Ethereum For Tokenization Needs

In a bid to compete with BlackRock – and specifically its tokenized BUIDL product – Fidelity Investments, with $5.8 trillion in AUM, has filed paperwork to launch a blockchain-based, tokenized version of its U.S. dollar money market fund. The asset manager aims to register an “OnChain” share class of its Fidelity Treasury Digital Fund (FYHXX), which holds cash and U.S. Treasury securities, using blockchains as a transfer agent.

Subject to regulatory approval, the product is expected to go live on May 30. As for the selected blockchain, Fidelity has chosen Ethereum. See below:

“The OnChain class of the fund currently uses the Ethereum network as the public blockchain. In the future, the fund may use other public blockchain networks, subject to eligibility and other requirements that the fund may impose… Public blockchain networks require the payment of certain transaction fees to validate a transaction on the applicable network. These fees are typically paid in the native digital asset (ether, in the case of Ethereum) for the operation of the blockchain network. Such transaction fees are intended to protect the blockchain networks from frivolous or malicious computational tasks.”

Fidelity is making a serious move here – choosing Ethereum signals confidence in its infrastructure and long-term viability.

The IMF Is Not Buying Bitcoin

The International Monetary Fund has updated its balance of payments standards to account for digital assets in its newly released Balance of Payments Manual, Seventh Edition (BPM7). For the first time, cryptocurrencies like Bitcoin are classified as non-produced nonfinancial assets, while some tokens are treated similarly to equity holdings.

This is a positive development, but there’s no evidence that the IMF will hold Bitcoin anytime soon. I won’t say it will never happen, but misleading posts on X and several questionable claims from multiple accounts have distorted the reality here. The IMF's reserves primarily consist of SDRs, backed by a basket of major currencies, along with gold as a separate asset.

Have we forgotten that the IMF is pressuring El Salvador to scale back its Bitcoin involvement in exchange for funding? That doesn’t sound like an entity that’s about to start buying Bitcoin – if anything, it’s still actively discouraging its adoption. The IMF may be slowly warming to Bitcoin in its research, but they’re not exactly embracing it yet. See the evidence below.

“IMF Reaches Staff-Level Agreement with El Salvador on an Extended Fund Facility Arrangement”

Strategy Should Reach 500,000 BTC This Week

Strategy is just 774 BTC away from crossing the 500,000 BTC threshold – and it may have already happened by the time you read this. The most recent purchase was relatively modest at 130 BTC, but the one before that was a staggering 20,356 BTC.

Saylor now has both STRK and STRF at his disposal for Bitcoin acquisitions, and we have yet to see these tools deployed simultaneously during a meaningful run in BTC and MSTR. When all the pieces align, this could escalate quickly – and dramatically.

The White Paper Is NOT In The White House

Unfortunately, this video is not real. Don’t be discouraged - Trump is pro-Bitcoin enough. Without the White Paper in the White House, we will be just fine. The memes this space can churn out are pretty unparalleled.

How Binance Became A Crypto Empire – Richard Teng On The Rise To 250M+ Users

On this episode of The Wolf Of All Streets, we dive deep with Richard Teng, CEO of Binance, exploring the immense challenges of leading the world's largest crypto exchange, which has grown its empire to an astounding 250 million users despite intense scrutiny. We discuss Binance's global strategy, whether it'll return to the US, and how it balances centralized services with crypto's decentralized ideals. Join us for insights on security, regulation, and the future of crypto.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.