The Wolf Den #1162 - Trump’s Crypto Agenda – And the BlackRock Reveal No One Saw Coming

All the highlights below...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Algorithmic excellence from Arch Public on display late yesterday. Extraordinary precision: archpublic.com

two buys at $78.9K and $80.1K

one sell at $86.9K

2.25X long, net +11%.

We often get asked, “but does it beat buy and hold?”

The answer is yes. A resounding yes.

$100K deployed Jan. 1, 2021 - Jan. 1, 2025:

Buy and Hold = $185,346

Arch Arb + Intelligence = $313,937

In This Issue:

Trump’s Crypto Agenda – And the BlackRock Reveal No One Saw Coming

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Tether’s Size Is Unmatched

ETF Fillings Are Out Of Control

PumpFun Launches PumpSwap

Coinbase Releases An Ethereum Validator Report

Bitcoin EXPLODING To $200,000 By The End Of 2025?! Crypto Bull Cycle Just Getting Started!

Trump’s Crypto Agenda – And the BlackRock Reveal No One Saw Coming

Yesterday in New York City, the Digital Asset Summit wrapped up its third and final day, and I’ve got all the key takeaways for you. Stick around – I’ve uncovered more than just Trump’s remarks, and I’m pretty sure I caught something no other outlet has reported yet. It’s a big one. Let’s dive in, starting with Trump’s call-in.

Trump addressed DAS from the White House, and I’ve got the full transcript of his nearly three-minute speech below. While most of it echoes what we’ve already heard, it’s still worth a read – it lays out his crypto agenda and priorities with surprising clarity. He touches on the big themes: ending regulatory crackdowns, establishing a Bitcoin strategic reserve, supporting stablecoin legislation, and positioning the U.S. as a global crypto leader.

I’ve highlighted the key moments:

“A very big hello to everyone at the Blockworks Digital Asset Summit. It’s an honor to speak with you about how the United States is going to dominate crypto and the next generation of financial technologies. It’s not going to be easy, but we are way ahead.

Just two weeks ago, we hosted the first-ever White House Digital Asset Summit, bringing together many of the world’s top leaders in crypto for a conversation led by our White House AI and Crypto Czar, David Sacks, who’s a fantastic and very brilliant guy.

That same week, I signed an order creating the brand-new Bitcoin Strategic Reserve and the U.S. Digital Asset Crypto Stockpile, which will allow the federal government to maximize the value of its holdings instead of foolishly selling them for a fraction of their long-term value - which is exactly what Biden did. He got a fraction of their value.

We are ending the last administration’s regulatory war on crypto and Bitcoin, and that includes stopping the lawless Operation Choke Point 2.0. Operation Choke Point went beyond regulation - and I mean far beyond. It was a form of lawfare through government weaponization. Frankly, it was a disgrace.

As of January 20, 2025, all of that is over. I’ve also called on Congress to pass landmark legislation creating simple, common-sense rules for stablecoins and market structure.

With the right legal framework, institutions large and small will be liberated to invest, innovate, and take part in one of the most exciting technological revolutions in modern history. It’s so big - I think it's as big as you can get.

Pioneers like you will be able to improve our banking and payment system and promote greater privacy, safety, security, and wealth for American consumers and businesses alike. You will unleash an explosion of economic growth, and with dollar-backed stablecoins, you will help expand the dominance of the U.S. dollar for many, many years to come. It'll be at the top, and that's where we want to keep it. We only want to keep it at the top - always.

I can already see that the energy and passion of the crypto community are the kind of spirit that built our country, and it’s exciting to watch as you invent the future of finance. It’s going to be right here in the U.S.A. - the good ole USA.

Together, we will make America the undisputed Bitcoin superpower and crypto capital of the world.

Thank you, good luck, and God bless America.”

Trump sure loves to wish us good luck… kind of odd, right?

Anyway, the TLDR is that nothing in this speech was new. Every time Trump speaks, the rumor mill starts buzzing – mostly about him eliminating capital gains taxes on crypto. What people don’t realize is that this is almost certainly something that would require Congressional approval, and Trump isn’t about to lay all his cards on the table in the first few months of his presidency. He’s playing the long game – aiming to win over four years, not just the first two months.

Even if Trump has considered eliminating capital gains, there’s no reason for him to pull that lever now. He knows that the reserve and stockpile are already a big deal and can keep investors happy for a long time.

Now here’s the part no one else covered – but they definitely should have. Below is a transcript from Robbert Mitchnick, BlackRock’s Head of Digital Assets, discussing the Ethereum ETF and staking. To me, this sounds like definitive proof that staking is coming to the ETH ETF – and it’s now just a matter of time.

“There’s a little bit of a misconception out there that the ETH ETFs have been ‘meh.’ The truth is, take ETHA, for example - the iShares Ethereum Trust - it had $4 billion of inflows in its first six months. The number of ETFs historically that have had more than that is a very short list.

When you compare it to IBIT and the Bitcoin ETF complex generally, it does not look that amazing. But when you compare it to the actual ETF universe, it’s actually been incredibly successful. I know people have that perception out there, but I can say that from a BlackRock perspective, we think it’s been tremendously successful.

There’s obviously a next phase in the potential evolution of this because an ETF has turned out to be a compelling vehicle for lots of different investor types - there’s no question. It’s less perfect without staking. Staking yield is a meaningful part of how you can generate investment returns, and all the ETFs at launch did not have staking.

If that is able to get resolved - and it’s not a particularly easy problem - it’s not as simple as a new administration greenlighting something and then boom, we’re all good, off to the races. There are a lot of fairly complex challenges that have to be figured out. But if that can get figured out, then I think it’s going to be a step-change upwards in terms of the activity around those products.

I’ll say very practically, from an asset management perspective, one of the things in the roadmap that will help - particularly as we were talking about - is staking and how you make that work in ETFs.”

BlackRock's view of the ETH ETF as “tremendously successful” should make some critics rethink their stance on its performance. BlackRock’s bullish outlook also reinforces their commitment to staking – which they’ve all but confirmed – alongside BUIDL and tokenization, signaling the clear direction this is heading.

BlackRock is moving fast – very fast – but they’re not rushing, nor will they ever. Enabling staking will supercharge the ETH ETF and unlock even greater opportunities within the Ethereum ecosystem for BlackRock to explore down the line. The market will catch up to this sooner or later.

This is the last big moment I wanted to share from the summit:

Tom Emmer needs no introduction – he’s a Capitol Hill Bitcoin OG, tirelessly pushing to get Congress on board with the orange wave. When asked at the summit about the U.S. purchasing 1 million Bitcoin, he responded: “Yes, there is legislation… and before this Congress is done, that legislation will be enacted.”

Congress can do more than Trump when it comes to acquiring Bitcoin. While Trump can explore budget-neutral methods to accumulate Bitcoin, Congress has the power to vote and approve the purchase outright – at whatever amount they choose. Imagine if Congress passes legislation to acquire 1 million Bitcoin, and Trump follows through with budget-neutral strategies to acquire it – then other countries start following suit. BOOM. Game theory has begun.

I can feel the sentiment in the space starting to shift. We’re not out of the woods yet and could easily face another downturn, but we’re getting there, day by day. Props to Blockworks for securing the President of the United States as a speaker – writing this makes me want to attend more conferences. At least now, we don’t have to worry as much about a bear market hitting during the Bitcoin Conference in May.

I’m bullish, and you should be too. Go enjoy the weekend. Wolf out!

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with highlighting Aptos block times vs some of the other fastest networks in the space. This is pretty unbelievable.

Next, I want to highlight this integration of Stargate, a liquidity transport protocol, with Aptos.

Via this integration, Aptos DeFi users can:

Supply USDC into money markets such as @AriesMarkets, @EchelonMarket, @Meso_Finance, and @EchoProtocol_

Provide USDC LP on DEXs like @ThalaLabs, @CellanaFinance, @PontemNetwork, and @Hyperfluidxyz

Supply into @Merkle_Trade Perp DEX USDC vault

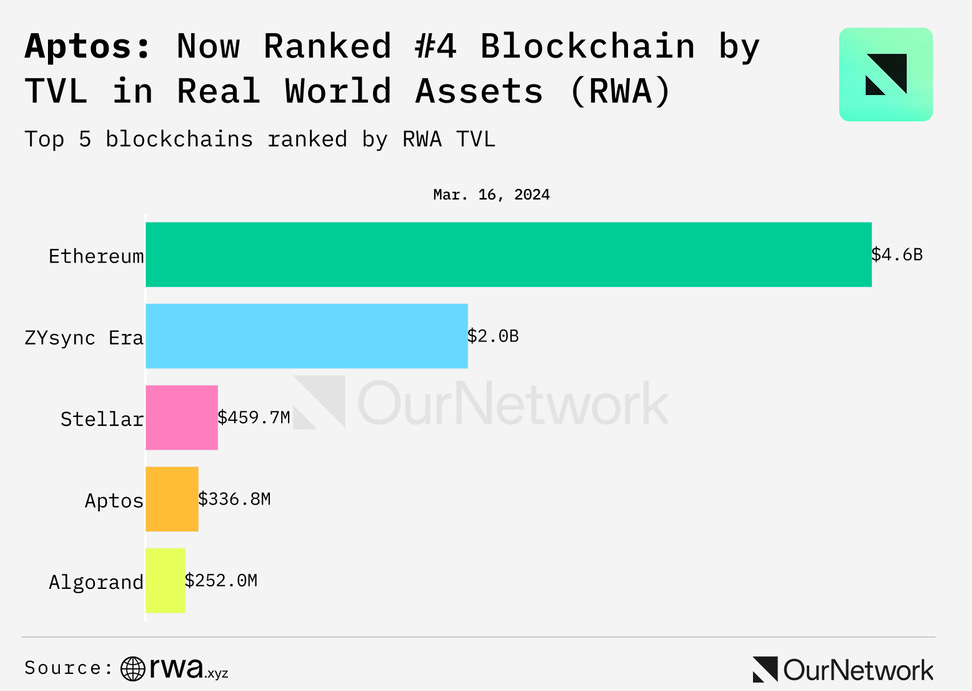

Last but not least, OurNetwork has released its fourth issue focused on Aptos, stating “a network which has come a long way since we first covered it in April 2024.” Get this, “Aptos’ total value locked (TVL) is up nearly 150% to $1.26B from $512M since OurNetwork’s first Aptos-focused issue, according to DeFiLlama. In APT terms, Aptos’ native token, the jump is even more stark — it’s hit 240.6M APT from 58.8M APT in late April. That’s an over a 300% increase, showing how strong the growth has been when accounting for crypto’s volatility.” I have three of the best charts below from that report.

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

Bitcoin continues to face resistance at the 200 MA, which it briefly reclaimed earlier this week before failing to hold. The rejection confirms that the 200 MA remains a key barrier, with price currently trading below it.

We're still stuck between $85,000 resistance and the broader support zone around $77,000. Volume remains unimpressive on this bounce, signaling that buyers are not stepping in aggressively. This makes the recent push toward $85,000 look more like a relief rally than a genuine breakout attempt.

RSI remains neutral, hovering near the midline after confirming bullish divergence coming out of oversold territory earlier this month. Momentum seems to be fading, and Bitcoin will need to clear the 200 MA with conviction to build bullish momentum toward $91,000. A breakdown from here would likely target the $77,000 area again.

For now, Bitcoin remains range-bound, with traders waiting for a decisive move to confirm the next direction.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Solana is forming a textbook ascending triangle on the 4-hour chart, which is generally considered a bullish pattern. Ascending triangles are characterized by higher lows (signaling increasing buying pressure) and a flat resistance line at the top – in this case, around $136.

The structure indicates that buyers are stepping in at progressively higher levels, tightening the price action into a wedge. If Solana breaks out above the flat top with volume, the measured move target would be calculated by taking the height of the triangle and adding it to the breakout point – which could easily send Solana toward $160 or higher.

However, the 50 MA (blue line) is acting as resistance right now, which means bulls need to reclaim that level first to build momentum. A breakdown below the rising trendline would invalidate the bullish setup and could lead to a retest of the $120 zone. For now, the structure remains intact, but a decisive move is coming soon.

Price can break support and still remain a technical ascending triangle - as long as we continue to see higher lows.

Traders generally wait for a break of the flat resistance on top, so keep this one marked.

Legacy Markets

US stock futures fell as disappointing corporate earnings and growing concerns over tariffs weighed on market sentiment. S&P 500 futures dropped about 0.3%, with FedEx tumbling 8% after cutting its earnings forecast due to inflation and weak demand, while Nike slid 7% after signaling lower profitability tied to US tariffs on products from China and Mexico. The weak earnings add to fears about the global economic outlook, especially ahead of President Donald Trump’s April 2 deadline for broad reciprocal tariffs. While the Federal Reserve has indicated room for rate cuts, concerns are rising that tariff-driven inflation could limit central banks’ ability to support growth.

The S&P 500 remains up slightly for the week after four consecutive weeks of losses. However, volatility is expected later on Friday due to triple witching — the expiry of options contracts worth $4.5 trillion. Europe’s Stoxx 600 index fell 0.5%. Despite market headwinds, stock funds saw their largest weekly inflows this year, as some investors remain optimistic that the trade war won’t derail the economy or equity markets, according to Bank of America.

The Turkish lira headed for its worst weekly drop in nearly two years, with Istanbul stocks down about 7% after protests erupted following the detention of a key opposition leader. Treasury yields fell, while gold held near record highs as major banks raised their price targets. Gold funds have recorded the largest four-week inflow ever, according to BofA data.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 8:21 a.m. New York time

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 0.6%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0850

The British pound fell 0.2% to $1.2947

The Japanese yen was little changed at 148.81 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $84,257.76

Ether fell 0.4% to $1,970.97

Bonds

The yield on 10-year Treasuries declined three basis points to 4.20%

Germany’s 10-year yield declined three basis points to 2.75%

Britain’s 10-year yield was little changed at 4.65%

Commodities

West Texas Intermediate crude fell 0.3% to $67.87 a barrel

Spot gold fell 0.3% to $3,034.46 an ounce

Tether’s Size Is Unmatched

Tether, the $143 billion stablecoin giant, was the seventh-largest buyer of U.S. Treasurys in 2024, surpassing countries like Canada, Taiwan, and Mexico. The company acquired over $33.1 billion in Treasurys, trailing behind the Cayman Islands, which topped the list with over $100 billion in purchases, according to Tether CEO Paolo Ardoino.

This may sound crazy, but I genuinely believe there’s a real possibility that Tether could become the largest U.S. Treasury purchaser in the world. As Tether continues to expand across all markets, I don’t see why the stablecoin couldn’t one day reach a trillion-dollar market cap. As Tether climbs, it’s going to draw in a lot more eyes from U.S. and global officials.

ETF Fillings Are Out Of Control

Canary Capital has submitted an ETF filing for the PENGU token and Pudgy Penguin NFTs. It never crossed my mind that an ETF would form around NFTs, but it’s especially odd considering how poorly the PENGU token has performed. At least the Pudgy Penguin NFTs themselves have turned out to be a winner – currently the sixth-largest collection of all time in terms of volume.

I don’t see these exotic crypto ETFs playing out well for investors or issuers in the long run – and that’s not even a jab at Pudgy Penguins, which has actually been a success. The PENGU chart is below.

PumpFun Launches PumpSwap

In a bid to attract new users and capital, Pump.fun has announced PumpSwap – a native decentralized exchange built on Solana – following a nearly 60% drop in monthly revenue. Unlike the previous system, PumpSwap will launch tokens after completing their bonding curve, eliminating the 6 SOL migration fee.

The new AMM-based DEX functions similarly to Raydium V4 and Uniswap V2, allowing users to create and contribute to liquidity pools at no cost while charging a 0.25% trading fee (0.20% to liquidity providers, 0.05% to the protocol). Building in a bear market is always a smart move, but PumpSwap won’t solve the meme crisis until fresh capital starts rotating into altcoins – primarily Ethereum and Solana.

Coinbase Releases An Ethereum Validator Performance Report

Coinbase has released its first Ethereum validator performance report, offering transparency into its staking performance and validator operations. The report covers data from February 2025 and applies specifically to Coinbase’s own validators, excluding customers who delegate to partner staking providers.

Number of Coinbase validators: 120k

Staked to Coinbase validators: 3.84M ETH → 11.42% of total staked ETH (as of 3/4/25)

Staked through partners: 581.5k ETH (as of 3/4/25)

0 slashing or double signing events (since inception)

Uptime: 99.75%

Bitcoin EXPLODING To $200,000 By The End Of 2025?! Crypto Bull Cycle Just Getting Started!

Today’s LIVE is packed! Dave Weisberger, co-founder of CoinRoutes, and Edan Yago, Core Contributor of Bitcoin OS, break down Trump's surprise crypto address at DAS, the dramatic drop of the Ripple case, and the Fed’s latest decision to pause rate hikes amid shifting inflation forecasts. Plus, Bitcoin ETFs are seeing major inflows—four days straight! With analysts calling for a $200,000 Bitcoin price by 2025, is the crypto bull market just warming up?

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.