Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Who Holds The Bitcoin?

Ripple vs The SEC Is Finally Over

This Is Why You Don’t Pray On Failure

Rates Remain Unchanged

Donald Trump Is Speaking At DAS Today

Who Holds The Bitcoin

Conceptualizing large numbers can be tricky. Right now, Bitcoin is worth $85,000 and counting. 85,000 seconds is just shy of a full day - 23 hours and 26 minutes. $85,000 makes for a strong down payment on a half a million-dollar home. In terms of distance, it’s roughly 40 miles in steps, or about 1.5 times the length of a marathon. If you think in terms of people, 85,000 is about the capacity of a large stadium, packed with cheering fans. Breaking it down this way makes the number feel more relatable.

Now, try to visualize what it means for Strategy to hold 499,226 BTC, for ETFs and funds to control 1.29 million BTC, or for nearly 4 million coins to be lost forever. When I close my eyes and try to picture these figures, all I see is a blur of grey - it’s almost impossible to truly grasp. That’s why today, I want to share with all of you a pretty neat and free-to-use resource BitcoinTreasuries.net. The site itself is a tool that allows you to see who owns what Bitcoin, where it is, and how these various entities stack up against each other and the total supply.

BitcoinTreasuries.net: Your Ultimate Bitcoin Treasury Data Hub

“BitcoinTreasuries.net is the premier source for comprehensive data on Bitcoin holdings by public companies, private entities, and governments. As one of the most cited websites in financial publications, we provide trusted, up-to-date information that financial leaders and investors rely on. Whether you’re an analyst, investor, or crypto enthusiast, our platform offers essential insights into the world of Bitcoin treasuries. Our data has been featured in articles by Investopedia, River, Investing News, Seeking Alpha, CriptoNoticias, Blocktrainer, CCN, CoinDesk, Yahoo Finance, BizNews, The Street, RBC, Bitcoin Magazine, and The New York Times.”

No time to waste, let’s find out where the Bitcoin is, referencing the platform.

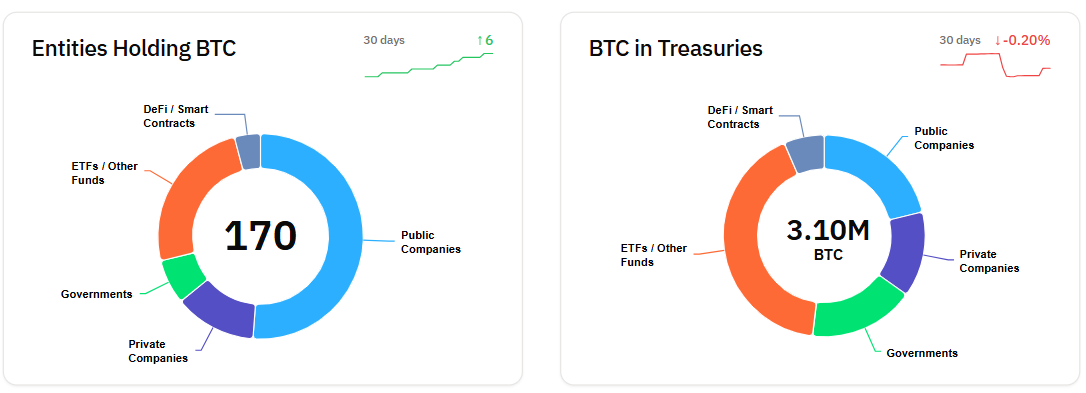

One important detail to note about the left pie-chart is that it’s not counting the amount of Bitcoin owned, but the entities themselves. There are 87 public companies holding Bitcoin, compared to just 12 governments. Even with widespread government adoption, public companies should always outnumber governments by a large margin in terms of the number of entities.

More interesting is the chart on the right. Here, we can get a glimpse into what each entity, as a whole owns.

ETFs and Other Funds - ₿1,291,562

Public Companies - ₿658,009

Governments - ₿526,418

Private Companies - ₿424,130

DeFi / Smart Contracts - ₿201,250

Amid all the debate about whether we’re early or late to crypto, the fact that governments still own less Bitcoin than public companies tells me everything I need to know. I’m not surprised this is the case right now - we should expect public companies to move faster on Bitcoin than entire governments. But that won’t last forever.

Let’s further break down these categories, starting with “ETFs and Other Funds.”

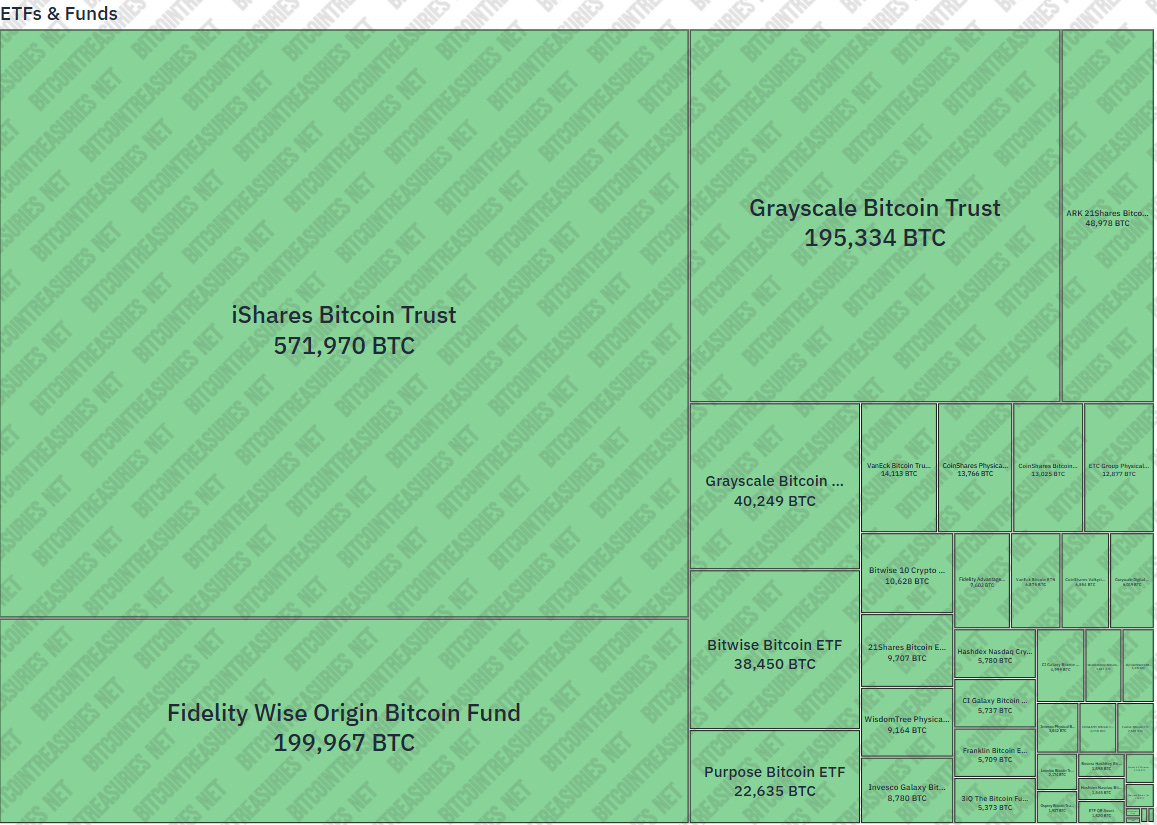

There are a total of 42 ETFs and funds on this list, and from the image above, I could only make out six names - iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, Grayscale’s Bitcoin Trust, Grayscale’s Mini Trust, Bitwise Bitcoin ETF, and Purpose Bitcoin ETF. The rest were too small to read. For those wondering, my eyesight is fine, and the image quality isn’t bad - what’s really happening is a clear reflection of how dominant the top entities are compared to everything else.

iShares Bitcoin ETF alone makes up 44.28% of the entire list. Next is Fidelity’s Bitcoin ETF at 15.48%, almost the same size as Grayscale’s Bitcoin ETF at 15.12%. Combined, these three entities account for 74.88% of the list. In other words, just three of the 42 ETFs and funds make up nearly 75% of the total.

This is why I keep saying over and over - it’s cool that altcoins are starting to get ETF filings, but until Fidelity and especially BlackRock step up to the plate, it doesn’t really matter. Grayscale only holds so much Bitcoin because it was once the only vehicle available. It shouldn’t really be in the same conversation as Fidelity and BlackRock in terms of inflows.

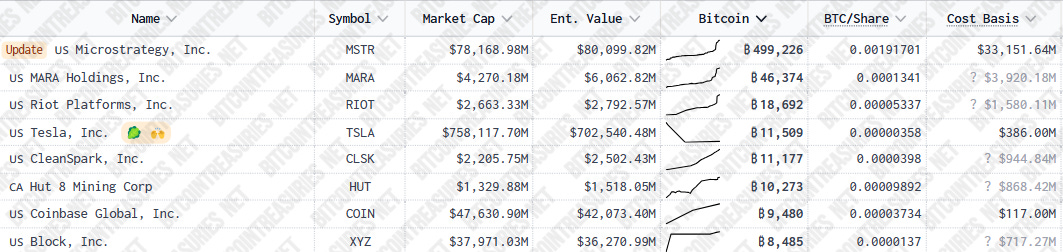

Moving on to public companies, the pattern of consolidation near the top is even more extreme. Any guesses who’s leading? Strategy’s 499,226 BTC makes up 75.86% of the total 658,009 BTC among ALL public companies. The image below shows Strategy’s position in size compared to 81 other public companies that hold Bitcoin.

When looking at the map, the only other names I can make out are MARA and Tesla before my eyes start to hurt again. Marathon Digital Holdings holds less than 10% of what Strategy holds, and Tesla holds about a quarter of what Marathon holds. Saylor is one of the key reasons Bitcoin is sitting in the 80's right now. If he had never bought Bitcoin, influenced millions of people, and advocated for it with governments, and other public companies, we might be somewhere around $30,000 or $40,000 - maybe $50,000 if I'm being generous.

By the way, I'm only commenting on the size comparison image. If you want to see the details, BitcoinTreasuries.net also presents the data in table form:

Moving on to governments, here is the breakdown:

United States - ₿198,109

China - ₿190,000

United Kingdom - ₿61,245

Ukraine - ₿46,351

North Korea - ₿13,562

Bhutan - ₿10,635

El Salvador - ₿6,120

Venezuela - ₿240

Finland - ₿90

Georgia - ₿66

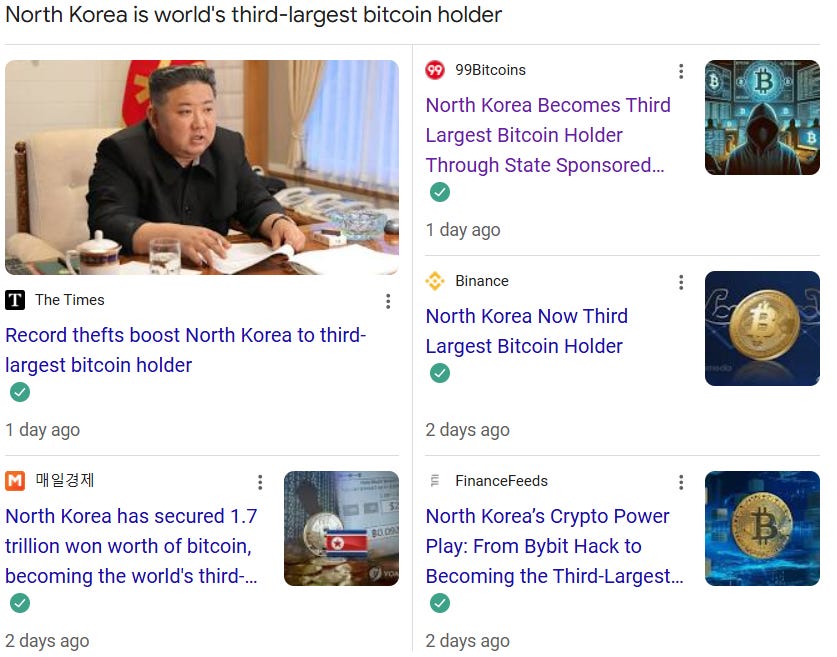

What’s odd about this list, which I noticed while putting it together, is that North Korea is not the third-largest government Bitcoin holder, despite what major publications are claiming. While all the articles agree that North Korea holds 13,562 BTC, they’re incorrectly ranking it as #3. I’m not sure if I’m missing something or if this is just a case of widespread misinformation, but it’s odd. That said, it doesn’t really matter in the grand scheme of things.

What really matters about this list is that El Salvador and Bhutan are the only governments that have truly taken Bitcoin seriously, yet they’re near the bottom. The size and purchasing power of the United States, should it choose to buy Bitcoin, would be enormous. The same goes for other major world powers like China, Russia, or the UK. This list is still in its early stages, and governments currently hold significantly less Bitcoin than public companies. Governments will dramatically alter who owns what Bitcoin in the coming years, and we’re only just getting started.

Private companies and DeFi/Smart contracts deserve a mention, but they aren’t as interesting to me. Feel free to head over to the platform for a better look at these two, as I don’t have any particularly compelling takeaways.

What I DO want to discuss is this:

What you're looking at is essentially a map of the entire supply. On the left-hand side are the entities we discussed, while the right side represents a sea of grey, symbolizing all of us who partially make up the total supply - unless your Bitcoin is held by an ETF or another entity, rather than in true custody.

One thing to consider is that I’m not sure the figure for ‘lost coins’ is entirely accurate. While it’s labeled as an estimate, I’ve seen other estimations that are more than double that amount. The true number is unknown and will likely never be known. Methods to recover lost Bitcoin are improving, but coins are still being lost every day. We also don’t know if Satoshi’s Bitcoin, totaling about 1 million, will ever return to the market. Whether the total is closer to 1.5 million, 3 million, or even over 4 million doesn’t really matter for our purposes today.

What does matter is that the sea of grey (which represents us) should theoretically only ever erode away. All of the entities above will slowly accumulate more Bitcoin over time, leaving less grey and more color on this map. This isn’t necessarily a bad thing, as it will coincide with a rising price, but it will make Bitcoin even scarcer and more concentrated in the hands of a few, unless we choose not to sell. Parting ways with Bitcoin at $100,000, $150,000, or even $200,000 will only accelerate the color spread on this map.

This isn’t me saying never sell, because groceries and rent are valid reasons to sell, but what I am saying is that if you can afford to hold, you’re effectively forcing everyone else to pay a lot more. Granted, all of this is largely just theoretical, as most of us reading won’t impact the bigger picture, but the idea still stands: if you’re willing to wait and not part ways with your Bitcoin, you’re essentially making others pay a higher price. We have the upper hand when it comes to holding the supply and they have the desire to buy.

Strategy, Tether, Wall Street, El Salvador, the U.S. government, and a lot more entities we don’t know yet, all have very deep pockets, and they will try to accumulate Bitcoin as cheaply as possible. However, if the Bitcoin simply isn’t available, they’ll have to raise their bids to meet the asks. That’s the #1 reason I wanted to share all of this with you today. TO answer our original question: We hold the Bitcoin, they don’t. They will have to buy from us, so let’s make them pay.

Keep in mind, this story won’t look as optimistic in 10 years for the billions of people who never bought. The map above will be filled with color, and buying Bitcoin will mean purchasing from a small group of stubborn grey holders (us) who are reluctant to sell, or from massive entities looking to extract every last dollar from you. Personally, I’d rather buy my Bitcoin today and have the option to sell to them later, rather than getting ripped off by paying more for less, years down the road.

The choice is entirely yours.

Ripple vs The SEC Is Finally Over

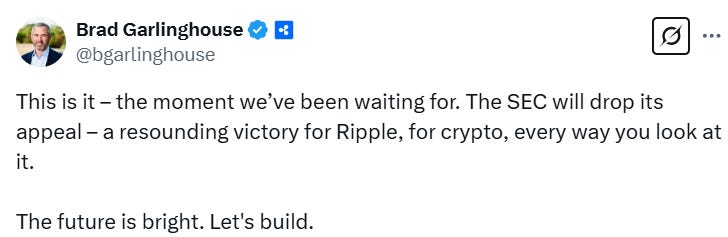

Reports from last week turned out to be true as XRP surged 10% on Wednesday after Ripple CEO Brad Garlinghouse announced that the SEC is set to drop its appeal against the company. Over four years ago, the SEC sued Ripple in 2020 for allegedly raising $1.3 billion through unregistered XRP sales. In 2023, a judge ruled that while Ripple’s institutional sales violated securities laws, its retail sales did not. Ripple was fined $125 million, and then SEC initially appealed. The lawsuit, which caused $15 billion in losses for XRP holders, is now officially over and done. If there was any hesitation for altcoin ETFs because of this outstanding battle, that hurdle has now been cleared.

This Is Why You Don’t Pray On Failure

Tim Walz is clearly out of touch. The only people he’s winning over with this logic are those who want to see Tesla fail. He has effectively isolated everyone else who wants to see American businesses succeed. Tesla is the 11th largest company by market cap in the world, and tens of millions of Americans have exposure through ETFs, mutual funds, or direct investments. Many of these individuals have Tesla in their 401ks or retirement funds, and he wants to see the stock go down? Not to mention, it employs over 100,000 people. This is why I’ll never wish for any asset to fail - because while you may win over a loud minority, you end up hurting everyone else.

Rates Remain Unchanged

As expected, interest rates remain unchanged. However, risk assets responded positively to this statement from the meeting, which essentially signaled a slowdown in quantitative tightening (QT): “The Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.”

Donald Trump Is Speaking At DAS Today

President Trump will make history as the first sitting president to address a crypto industry conference. I know some people are complaining that the outlets got it wrong about it being a crypto conference, but the distinction is that DAS truly is a crypto conference in the sense that it’s not The Bitcoin Conference, which is only about Bitcoin. The announcement follows remarks from Bo Hines, Executive Director of the White House’s Council of Advisers on Digital Assets, who hinted at the administration’s plan to stockpile Bitcoin for a strategic reserve a couple of days ago. Hines emphasized the president’s focus on accumulating assets for Americans rather than seizing them.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.