Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public is doing a HUGE giveaway to end the month of March!

We want to see you at The Bitcoin Conference in Vegas May 27-29. We are giving away TWO Industry Passes and an invitation to Arch Public’s Invitation Only Dinner in Vegas.

Here’s how you make yourself eligible for our giveaway:

1. Download our FREE Bitcoin Algorithm right now.

2. Follow @tryarchpublic on X.

Over the next week we will choose a winner and announce The Bitcoin Conference package in full! See you in Vegas!

And keep stacking sats with The Bitcoin Algorithm!

In This Issue:

The Secret Behind Wealth

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Dip Then Rip

Michael Saylor Struck A Chord

Solana Released A Controversial Advertisement

Tron Is Coming To Solana

Why You MUST Buy Bitcoin Right Now (No Matter the Price) | Mark Yusko Explains

The Secret Behind Wealth

Did you know that the top 25 billionaires on The Forbes 400 list were worth a collective $2.5 trillion in 2024? This small group alone holds nearly half of the $5.4 trillion in total wealth of the entire 400.

You’ll probably recognize most, if not all of the names on the top names on the list:

Elon Musk — $244 billion (Tesla, SpaceX)

Jeff Bezos — $197 billion (Amazon)

Mark Zuckerberg — $181 billion (Meta Platforms)

Larry Ellison — $175 billion (Oracle)

Warren Buffett — $150 billion (Berkshire Hathaway)

Larry Page — $136 billion (Google)

Sergey Brin — $130 billion (Google)

Steve Ballmer — $123 billion (Microsoft)

Bill Gates — $107 billion (Microsoft)

Michael Bloomberg — $105 billion (Bloomberg L.P.)

Year to year, this list doesn’t change much at the top. Warren Buffett has been on the Forbes 400 list since the first edition in 1982. Gates has been a mainstay for decades, Ellison since 1993, and Bloomberg since the early 2000s. This is all pretty intuitive to most people, but what many don’t realize is that just below the top, and all the way to rank 400, this list isn’t as stable as it seems.

The Cato Institute released a 2016 report based on Cornell Research that found, “Between 1992 and 2013, 72 percent of the top 400 retained their spot for no more than a year, and over 97 percent kept it for no more than a decade.” This is what Cato Institue had to say about that stat: “Your odds of ‘making it to the top’ might be better than you think, although it’s tough to stay on top once you get there.”

I would reword that as, ‘Your chances of reaching the top are nearly impossible, and your chances of staying there are nearly impossible squared.’ Before I get to the real takeaway from all of this, we are almost there, I’m going to share a couple more stats Caito shared.

“Over 50 percent of Americans find themselves among the top 10 percent of income-earners for at least one year during their working lives.”

“Over 11 percent of Americans will be counted among the top 1 percent of income-earners (i.e., people making at minimum $332,000 per annum) for at least one year.”

“Some 94 percent of Americans who reach ‘top 1 percent’ income status will enjoy it for only a single year.”

“Approximately 99 percent will lose their ‘top 1 percent’ status within a decade.”

Here’s an economists take on all this, “Whenever we hear commentary about the top or bottom income quintiles, or the top or bottom X% of Americans by income (or the Top 400 taxpayers), a common assumption is that those are static, closed, private clubs with very little dynamic turnover. Once you find yourself in a top or bottom quintile, or a certain income percentile, or the Top 400, you’ll likely stay there for decades or even for life. But economic reality is very different – people move up and down the income quintiles and percentile groups throughout their careers and lives. The top or bottom 1/5/10% by income, just like the top or bottom income quintiles, are never the same people from year to year, because there is constant, dynamic turnover as we move up and down the income categories.”

It’s not just the upper echelons of society that are constantly shifting—the same is true at the lower end of the economic spectrum. People's circumstances can change dramatically at any time, in any place. While the fragility of wealth may seem unsettling, I choose to see it through an optimistic lens. Upward mobility is always within reach, and we never know when that breakthrough year of opportunity is just around the corner.

Let me let you in on another secret: anytime an individual experiences a massive jump in their earnings, whether it’s someone breaking into the Forbes Top 400 or entering the top 10% of global earners for the first time, it typically isn’t because of a salary increase. Rather, it’s the realization of capital gains - often from a one-time sale. This could come from selling a business, cashing out on stocks, selling a valuable piece of real estate or art, or being fortunate enough to find yourself in a generous inheritance.

Due note: This is less true for those just starting out, but it becomes increasingly relevant for those who have made progress and are on their way up.

Those of you who know me know I’m not an art dealer, I’m not flipping real estate, and I’m not selling my podcast or newsletter. What I am counting on, however, is that the crypto I’ve accumulated over the years will pay off. One way or another, we all see crypto as a path to improving our financial position. Now, hope isn’t the strategy here - not even close - but you get what I’m saying. I believe that being smart and patient in crypto will prove to be a highly lucrative strategy, creating opportunities across all levels of the wealth spectrum.

Before I finish here, I have a couple of final points: first, bear in mind that keeping the wealth is also a challenge in and of itself. Even Bitcoin, our beloved asset, is down about 25% from the highs. It goes to show that even when you’re doing everything ‘right,’ you’re still going to bounce around - and that’s okay. I know 99% of traders and investors would be worse off if they tried trading the asset to time the tops and bottoms. Second, don’t be discouraged by your income. Income is not the same as wealth. While it can help accelerate your net worth, it doesn’t need to be as ‘high’ as you might assume to achieve success. True wealth also includes your health, family, and happiness.

Count your blessings and then count your sats.

Bitcoin Thoughts And Analysis

Bitcoin is simply riding the 200 MA as resistance… if it breaks up, we have something to talk about.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

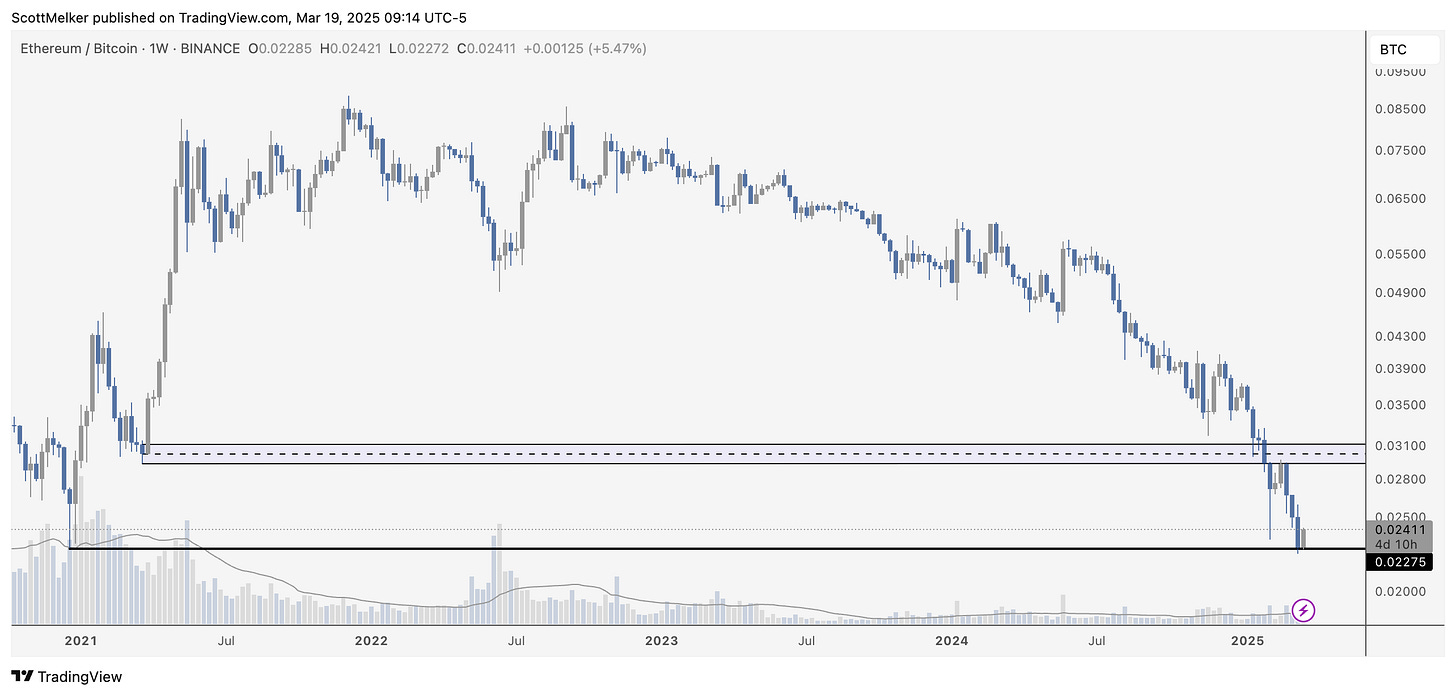

Either this is the generational bottom for Ethereum vs. Bitcoin, or it breaks support, stays there, and the party is over.

I would bet on the former, but there is always risk.

Legacy Markets

US stocks rebounded as investors prepared for the Federal Reserve’s rate decision and outlook following weeks of market turmoil. Gains were led by megacaps like Tesla and Nvidia, with the S&P 500 and Nasdaq 100 both rising 0.4%. Short-term Treasury yields rose slightly, while money markets priced in that the Fed will likely hold rates steady for at least the first half of 2025. Options markets are pricing a 1.2% move in the S&P 500 in either direction on Wednesday — above the 0.8% average for Fed days over the past year, according to Citigroup.

Fed officials are expected to keep rates unchanged as they evaluate the impact of President Donald Trump’s trade policies on an economy grappling with inflation and slowing growth. Economists expect the Fed’s "dot plot" to continue projecting two rate cuts this year. Fed Chair Jerome Powell is set to hold a press conference after the rate decision at 2 p.m. ET on Wednesday.

The dollar strengthened 0.3%, while the yield on 10-year Treasuries rose two basis points to 4.30%. The yen weakened after the Bank of Japan indicated no urgency to raise rates. Turkish markets came under pressure after the detention of President Recep Tayyip Erdogan’s most prominent rival.

Corporate highlights included Boeing forecasting improved cash flow this quarter, Morgan Stanley planning to cut about 2,000 jobs, General Mills lowering its sales guidance, and Tencent outlining plans to boost AI infrastructure spending.

Stocks

The S&P 500 rose 0.4% as of 9:51 a.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 fell 0.3%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.4% to $1.0897

The British pound fell 0.3% to $1.2965

The Japanese yen fell 0.5% to 149.99 per dollar

Cryptocurrencies

Bitcoin rose 2.6% to $84,181.1

Ether rose 5.8% to $2,016.93

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.30%

Germany’s 10-year yield was little changed at 2.81%

Britain’s 10-year yield was little changed at 4.65%

Commodities

West Texas Intermediate crude fell 0.3% to $66.73 a barrel

Spot gold fell 0.1% to $3,030.57 an ounce

Dip Then Rip

Over the past few weeks, Matt Hougan from Bitwise has been dropping some serious alpha on the market drawdown, and I’m hooked. His latest memo, “Dip Then Rip,” dives into Bitcoin’s correlation with broader markets during times of crisis, how Wall Street values assets, where Bitcoin should be trading today, and how tariffs are holding its price back. I have a few of my favorite paragraphs from the memo copied below. Spoiler alert!

Michael Saylor Struck A Chord

Has Saylor lost his mind, or are we witnessing greatness continue to unfold? I’ve always said, Saylor will either go to zero or hero - there’s no in-between. The release of Strife only accelerates his journey to one of those extremes. Strategy is going all-in, pushing every button and pulling every lever to acquire more Bitcoin. It’s bold, even admirable, but there’s no ignoring the risk - this could easily fuel a bear market. Critics are questioning how Strategy plans to cover annual dividends without selling Bitcoin. Another public offering? If a Bitcoin bear market hit right now, I don’t see this ending well for Strategy. A 10% dividend on $500 million translates to $50 million annually now owed. Saylor will do whatever it takes before he’s in a position where he has to sell his Bitcoin.

Solana Released A Controversial Advertisement

Solana leaned a little too hard into politics in a strange way, releasing an ad that many have called “offensive,” “cringe,” and “divisive.” I have to agree with the backlash - this commercial missed the mark for what a crypto ad should be. However, I don’t see the need to attack Solana over it. Yes, the main account posted it, but this poor decision (and lapse of judgment) shouldn’t reflect on the entire community. Even if multiple people thought the commercial was a good idea, people make mistakes and learn.

Solana deleted the video and is clearly feeling the backlash. My take:

A) Solana should take notes from Coinbase on how to structure their commercials - neutral, relatable, and enjoyable.

B) Like every blockchain, Solana needs to stay out of politics. This technology is built to promote trust, neutrality, and independence from banks and government overreach - not to take political sides.

Tron Is Coming To Solana

Justin Sun announced that TRON (TRX) will soon have a wrapped version on Solana, bridging two major ecosystems. While details remain unclear, this move should boost TRX demand and liquidity through Solana’s DeFi sector, expanding its user base and use cases. It remains to be known how TRX will be introduced to Solana - i.e. through a bridge, as collateral, or through other means.

Why You MUST Buy Bitcoin Right Now (No Matter the Price) | Mark Yusko Explains

Is now the perfect time to buy Bitcoin? Mark Yusko believes it is—and he's joining us today to reveal why! He'll dive into what's driving Bitcoin's price action this year and share his market outlook. Plus, our friends from Arch Public, Andrew Parish and Tillman Holloway, will be hosting the show and delivering a fresh update on our $10K algorithmic portfolio. Don't miss out!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.