Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Ethereum Needs A Narrative

Bitcoin Thoughts And Analysis

Legacy Markets

Strategy Is Almost At 500,000 BTC

Robinhood Rides the Wave of Prediction Market Success

Crypto ETF News Is Moving Quickly

Don’t Fall For This

Bitcoin Sell-Off SHOCKS Markets. Here's Why Investors Are Flocking To Gold! | Macro Monday

Ethereum Needs A Narrative

The other day, I posted this:

Today, I have more to say…

Does Ethereum need a new narrative, or does it require fundamental structural changes? Maybe it needs QE from the Fed or for Vitalik to finally grow a pair and address the community’s demands. Or perhaps all it really needs is a few more whales to short it – setting the stage for one of the most explosive short squeezes this space has ever seen.

Yesterday, Standard Chartered – whose bullish reports have gained popularity over the past few years – completely changed its stance on Ethereum.

The report is literally titled, “Ethereum – Midlife Crisis” – oh boy.

Take a look at an image of the report below. I couldn’t get my hands on the full report, but by piecing together what I found from others and media outlets, we can get a good idea of its contents.

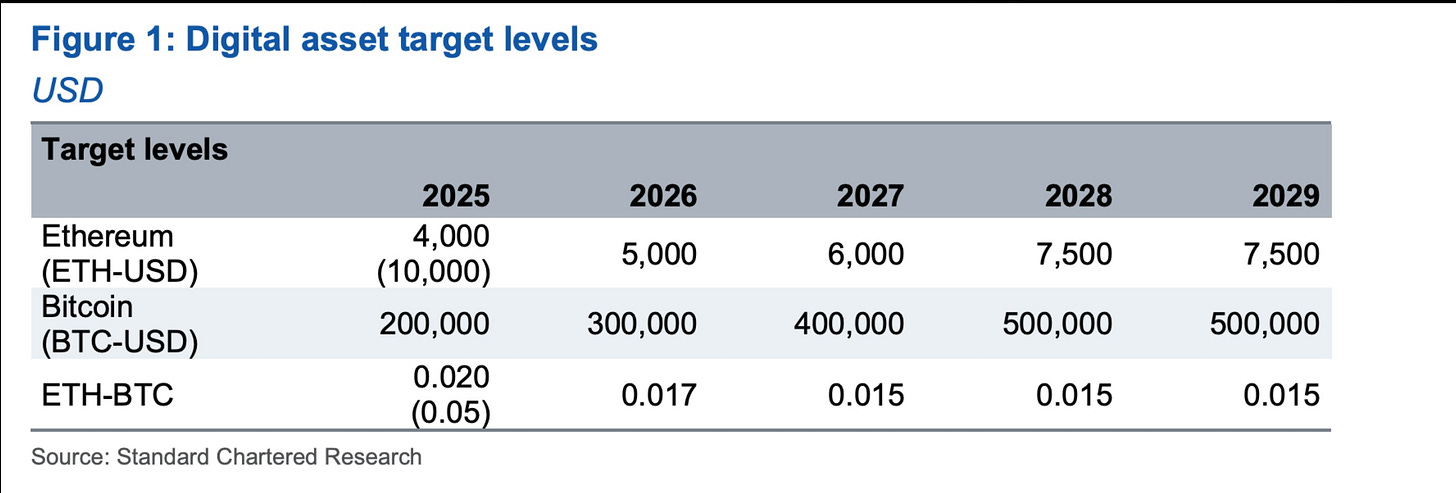

The TLDR is that Standard Chartered, a British multinational bank with a crypto arm, previously predicted Ethereum would reach $10,000 and Bitcoin would hit $200,000 by 2025 but has now decided to slash its Ethereum forecast by more than half.

Let’s unpack the reasons why (these are summarized from the report):

Layer 2 scaling has reduced the market cap by $50B.

The ETH/BTC ratio could fall to 0.015 by 2027, reaching a 2017 low.

Tokenization of real-world assets needs to grow substantially.

Let’s begin with the first reason, which is arguably the most legitimate of the three. Since the Merge, it’s no secret that Ethereum’s value accrual on the main chain has significantly diminished, which has contributed to a decline in its price. Geoff Kendrick, the individual behind the report who is the Global Head of Digital Asset Research, estimates that Base has removed $50 billion from ETH’s market cap. He attributes this loss to users shifting their transactions to Layer 2 solutions, where fees go to platforms like Coinbase instead of the Ethereum Foundation, reducing the revenue it would otherwise receive.

The argument that Layer 2s are essentially paying nothing for Ethereum’s security – on which they depend – while providing little financial incentive for Ethereum to continue offering this service is valid. From my conversations with those more knowledgeable about the revenue structure, it’s clear that if Ethereum doesn’t address this issue, native ETH holders will continue to be negatively impacted. The only way to offset the shortfall is for Ethereum to find financial relief elsewhere – such as through RWA, which I’ll briefly address next. That said, the community cares deeply about this issue and is pushing for change. Rightfully so – the community’s bags largely depend on this. My gut feeling is that we’ll see improvements in 2025, especially since Vitalik has already shown he’s willing to listen to the community.

The second point is essentially bogus. The claim that the ETH/BTC ratio could fall to 0.015 by 2027, reaching a 2017 low, relies on circular logic – essentially saying, “Ethereum is going down, so it will continue to go down.” This kind of reasoning has been applied to assets like Bitcoin, XRP, and Solana during their rough patches, only for them to rebound later for different reasons. While technical analysis has its place, I rely on it to find confluence with other tools – if it’s one of the main justifications for slashing a prediction by more than half, then we probably shouldn’t have trusted the original forecast in the first place. It’s a self-fulfilling prophecy that overlooks the possibility of change, innovation, or shifts in market sentiment that could reverse the trend.

As for the third point, I have more to say on that in the second half of this newsletter. Here’s a quote from the report:

“Ether is at a crossroads and while it still dominates on several metrics, this dominance has been falling for some time. Market forces could eventually stop this structural decline, especially if tokenized real-world assets were to grow significantly, as ETH's security dominance means it should maintain its 80% share of this market. Only a proactive change of commercial direction from the Ethereum Foundation – such as taxing layer 2s – could achieve that now.”

Another image I managed to capture from the report is this:

Maybe it’s just me, but isn’t this a bit odd? No bear market, no decline – just a steady climb in Bitcoin and a lackluster one in Ethereum. I understand the general thought process that prices will trend upward over time, but at least acknowledge that there will likely be slowdowns or pullbacks at some point. So, between 2028 and 2029, prices will just stay the same that year? This feels low effort for a large-scale institution.

In all fairness, there are two ways to interpret this prediction:

A) Oh shit, this is bad – Ethereum needs serious changes to succeed, or

B) Bearish predictions usually come near the bottom – if ETH’s price were strong, nobody would care about any of this.

L2s are truly reducing fees and activity on the main chain without adding much value to ETH, and that’s a real concern. But market sentiment is often overly negative near bottoms, and bullish narratives tend to dominate when prices rise, so this could just be another cycle of FUD before a rebound.

I dug up some of the old reasons from Standard Chartered as to why Ethereum would go to $10,000. This one is directly from the bank:

“The dominance of institutional inflows to ETFs is likely to support BTC and ETH performance; we see their prices reaching the $200,000 and $10,000 levels by end-2025, respectively.”

This is from CryptoSlate analyzing their previous report:

“Beyond Bitcoin, the report projected that smart contract platforms and layer 2 blockchains, which facilitate decentralized applications and DeFi protocols, will gain value at a faster rate than Bitcoin over the coming years. The sector currently represents roughly 25% of the total digital assets market cap and has the potential to grow to $2.5 trillion by 2025 as these platforms benefit from an expanding array of end-use applications. According to the lender, Ethereum (ETH) and Solana (SOL) are particularly well-positioned to capture this growth, with Ethereum potentially reaching $10,000 by the same timeline.”

To me, it seems like the original prediction was largely based on momentum, with popular narratives simply attached to it. The previous report mentioned ETF flows and DeFi growth – neither of which are revisited or readdressed in the new report from what I can see. This suggests that the underlying basis for the old and new prediction was more about market trends than a thorough analysis of key drivers.

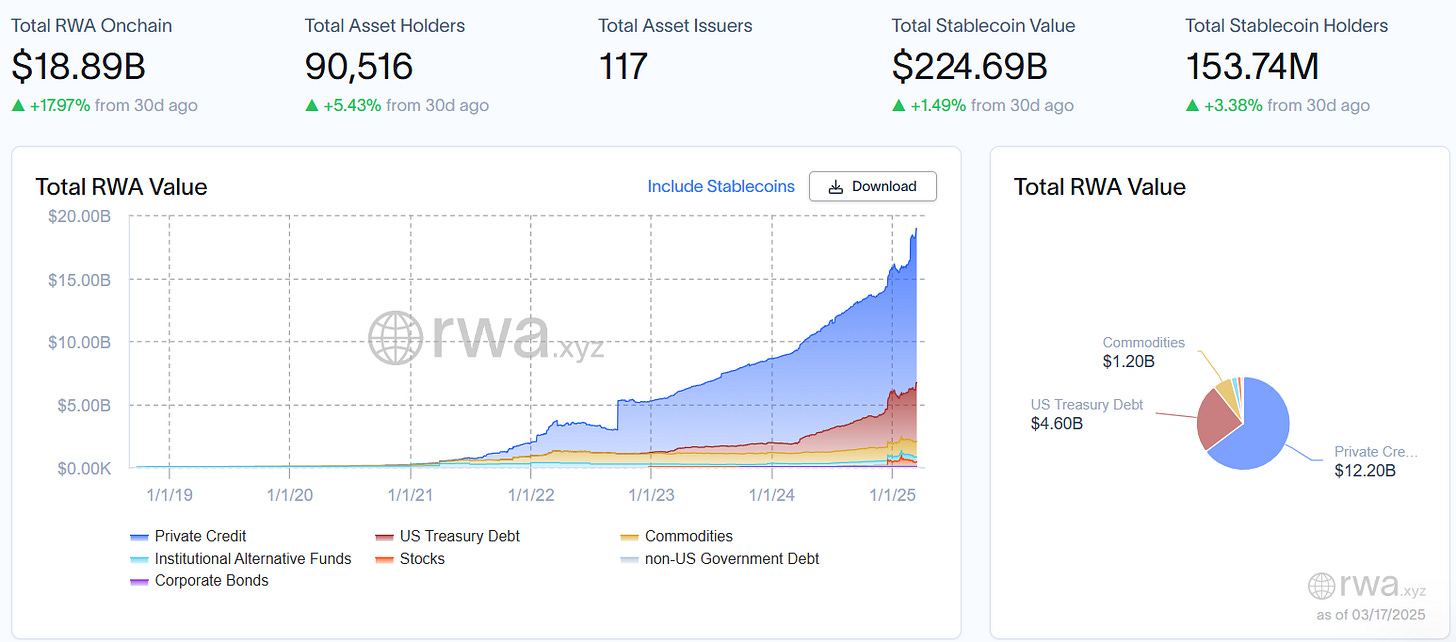

Anyway, let’s move on to the second half of this newsletter, which addresses Standard Chartered’s third point about real-world assets and the need for ETH to grow in this space. While I don’t have the exact details of what was said, I know that this area is evolving rapidly. We’re starting to see more regulatory clarity and a stronger push from key players. It’s only been a little over a month since the SEC began working on language regarding tokenization.

Just recently, we learned that Coinbase wants to tokenize COIN, and Vlad Tenev from Robinhood said tokenization is a means to “unleash the true power of the crypto revolution.” Earlier this year, Larry Fink from BlackRock urged the SEC to “rapidly approve” asset tokenization. Another quote from him: “ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset.” BlackRock isn’t presenting this as a prediction - they’re stating it as a fact, and they intend to make it happen.

Just a few days ago, this happened:

The RWA market is booming. While two-thirds of it consists of private credit on Figure Protocol and the Provenance blockchain – platforms I’m not familiar with that don’t seem to leverage Ethereum or other leading ecosystems – the RWA market is still expanding rapidly, even excluding this sub-section.

Just yesterday, Ethena and Securitize announced the upcoming launch of Converge, “a new blockchain designed to support and advance DeFi and tokenized assets.” Instead of hearing from me, here are statements from Guy Young, the founder of Ethena, and Carlos Domingo, the CEO of Securitize, on the partnership:

“We’re developing Converge to fill a clear gap in the market as the go-to settlement layer for institutional-grade DeFi and tokenized assets. We see two core use cases for blockchains: settlement for speculation, and the storage and settlement of stablecoins and tokenized assets. While the first category is important, we view the second as a much larger opportunity over the next decade. Ethena and Securitze are uniquely positioned to win this category, together. We are thrilled to be teaming up with Securitize, the market leader in tokenizing RWAs and tokenization to bring Converge to market, and are confident that our combined expertise uniquely positions us to realize our shared vision together.”

“Institutions have been watching DeFi evolve with interest, but the lack of regulatory clarity and institutional-grade infrastructure has hindered their participation. With Converge, we’re solving this problem by creating a purpose-built blockchain designed to seamlessly bridge traditional finance with the opportunity of DeFi. By combining Ethena’s innovation in DeFi with Securitize’s leadership in tokenizing real-world assets, Converge sets a new standard for how institutions can confidently engage with on-chain financial markets.”

This isn’t related to tokenization, but it perfectly captures the bigger picture:

The takeaway here is that we shouldn’t put too much weight on any single prediction nor base our decisions on any one statement or report (especially from banks). Just because a bank said something doesn’t mean it’s true or even well thought out. Bitcoin faced relentless FUD for years before it caught on, Solana was declared dead after the FTX collapse, and now Ethereum is going through its own growing pains. Sometimes, you have to go against the grain to get it right – and that requires leaning heavily on your own ideas – crazy thought, right?

Ethereum doesn’t need a narrative – they are already here. It simply needs to keep an interested community of builders, investors, and believers, and the rest will sort itself out. Part of making the life-changing gains we all dream about in this space requires a level of conviction, patience, foresight, and courage most investors simply can’t find. I’m holding ETH until I have a real reason to walk away as a supporter or until it reaches a level so high that taking profit becomes a life-changing necessity.

What about you?

Bitcoin Thoughts And Analysis

Bitcoin is stuck in no-man’s land after the recent bounce from the $77K low. The 200 MA (red) is proving to be a stubborn ceiling, with price grinding just below it around $83.6K. Bulls have made progress, but the lack of volume on the bounce suggests they might be running out of gas.

It’s a classic "show me the money" situation – without stronger buying pressure, this could just be a dead-cat bounce. The $85K zone, which should have been support, is now acting like a brick wall. If price can’t reclaim that level soon, the door is wide open for another trip down to $77K.

On the flip side, a clean break above $85K would likely send Bitcoin straight toward $91K – but the bulls need to wake up first. RSI is hovering in neutral territory, reflecting hesitation. The next few days will tell us whether this is just a pit stop before higher prices – or the start of another leg down.

Legacy Markets

US stock futures slipped as economic concerns and geopolitical tensions weighed on sentiment. Futures for the S&P 500 and Nasdaq 100 fell at least 0.2% after Russian President Vladimir Putin reportedly demanded that all weapons deliveries to Ukraine be suspended as part of a ceasefire proposed by Donald Trump. Meanwhile, Israel launched airstrikes across Gaza, ending a nearly two-month ceasefire with Hamas. These developments added to growing fears that Trump’s trade and labor policies are slowing the US economy.

Oil prices rose for a third day, while gold hit a new record high above $3,000 an ounce as investors sought safety. Gold ETFs saw inflows for the fifth straight day. European markets were more upbeat, with the Stoxx 600 rising 0.7% as German lawmakers prepared to vote on a landmark fiscal package worth hundreds of billions of euros. This boosted the euro to a five-month high and lifted optimism around European growth.

Investors are increasingly shifting toward European equities, with Bank of America’s latest survey showing the highest weighting toward Europe since mid-2021. In contrast, US allocations have seen record outflows as investors remain uncertain about the administration’s economic strategy. Treasury Secretary Scott Bessent’s dismissal of the recent market slump as a “healthy correction” has further unsettled Wall Street.

Nvidia rose in premarket trading ahead of CEO Jensen Huang’s keynote at the GAI conference, while Tesla fell, extending its 41% slide this year amid signs that Elon Musk’s actions have alienated the company’s core customer base. European auto stocks, however, gained after China’s BYD unveiled rapid-charging EV models. Thyssenkrupp and BAE Systems extended recent gains, benefiting from Germany’s increased defense spending.

Markets are now focused on the Federal Reserve’s two-day policy meeting starting Tuesday. While rates are expected to remain unchanged, investors are looking for signals from Chair Jerome Powell on the outlook for rate cuts and broader economic support. Treasury 10-year yields edged up slightly to around 4.3%.

Key events this week:

US housing starts, import price index, industrial production, Tuesday

Bank of Japan rate decision, Wednesday

Federal Reserve rate decision, Wednesday

China loan prime rates, Thursday

Bank of England rate decision, Thursday

US Philadelphia Fed factory index, jobless claims, existing home sales, Thursday

Eurozone consumer confidence, Friday

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 7:52 a.m. New York time

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0919

The British pound fell 0.1% to $1.2975

The Japanese yen fell 0.3% to 149.73 per dollar

Cryptocurrencies

Bitcoin fell 1.7% to $82,551.85

Ether fell 2.3% to $1,891

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.32%

Germany’s 10-year yield advanced three basis points to 2.85%

Britain’s 10-year yield advanced four basis points to 4.67%

Commodities

West Texas Intermediate crude rose 1.2% to $68.37 a barrel

Spot gold rose 0.8% to $3,025.49 an ounce

Strategy Is Almost At 500,000 BTC

Michael Saylor’s Strategy is now just 774 BTC away from reaching the historic 500,000 BTC milestone. Yesterday, the company announced a small purchase of 130 BTC for ~$10.7 million at an average price of ~$82,981 per BTC. With this latest addition, Strategy has now accumulated Bitcoin worth ~$33.1 billion at an average cost of ~$66,360 per BTC.

For the most part, Strategy has remained quiet during this market dip, likely because its Bitcoin purchasing power is heavily tied to the performance of MSTR stock, which has suffered amid the market decline. Once MSTR rebounds, we can expect Strategy to resume buying – which ultimately requires Bitcoin finding a bottom.

Robinhood Rides the Wave of Prediction Market Success

Following the success of Polymarket and Kalshi, Robinhood Derivatives, LLC (RHD) has announced a prediction markets hub within the Robinhood app, allowing users to trade on major global events. At launch, customers can trade contracts on the upper bound of the Fed’s target rate for May and the upcoming men’s and women’s College Basketball Tournaments.

“We believe in the power of prediction markets and think they play an important role at the intersection of news, economics, politics, sports, and culture. We’re excited to offer our customers a new way to participate in prediction markets and look forward to doing so in compliance with existing regulations.”

According to the press release, the platform will initially be available across the U.S. through KalshiEX LLC, a CFTC-regulated exchange, with Robinhood maintaining close contact with the CFTC to support innovation in futures, derivatives, and crypto markets.

In the short term, this doesn’t directly intersect with crypto, but Robinhood has several potential avenues to expand this product line in ways that could directly benefit digital assets and blockchain in the future.

Crypto ETF News Is Moving Quickly

My X feed has basically become an ETF reporting machine. Yesterday, Solana futures trading launched on the Chicago Mercantile Exchange (CME), marking a major milestone and bringing SOL ETFs one step closer to reality. CME now offers SOL futures in two contract sizes: 25 SOL and 500 SOL.

In other news, Hashdex proposed an amendment that would include new cryptocurrencies in the Hashdex Nasdaq Crypto Index US ETF. The amendment is looking to add LTC, XRP, ADA, LINK, AVAX, UNI, and SOL to its U.S.-based crypto ETF.

Lastly, Canary Capital Group has filed the first SUI ETF – pretty neat. At some point this year, we’re going to have a LOT of crypto ETF options out there.Don’t Fall For This

A new type of scam is targeting cryptocurrency users with phishing emails impersonating Coinbase and Gemini. These emails trick users into setting up wallets with recovery phrases controlled by attackers. The messages falsely claim that users must transition to self-custodial wallets by April 1 due to legal developments.

While the emails direct users to download legitimate wallet apps, they provide pre-generated seed phrases, giving scammers control over any funds transferred to compromised wallets. The Coinbase scam, for example, falsely claims that a class-action lawsuit requires users to move assets to Coinbase Wallet.

Moral of the story: Don’t set up a wallet with pre-generated or pre-provided keys – you risk losing everything.

Bitcoin Sell-Off SHOCKS Markets. Here's Why Investors Are Flocking To Gold! | Macro Monday

Join Noelle Acheson, Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.