Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

247% annually. That’s what our Bitcoin Algorithm Arbitrage Strategy has produced over the past six years.

81% annually. That’s what our Nasdaq Algorithm Swing Strategy has produced over the past ten years.

61% annually. That’s what our S&P500 Algorithm Gap Strategy has produced over the past ten years.

Algorithmic excellence. Daily liquidity. Extraordinary service. Join Arch Public today!

In This Issue:

World Liberty Financial: DeFi-ing the Odds

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

North Korea Holds A Lot Of Bitcoin

Russia Is Utilizing Crypto To Avoid Sanctions

Pavel Durov Is Allowed To Travel Again

21Shares Is Liquidating Its BTC Futures and ETH Futures ETFs

Unlocking Trillions: Sergey Nazarov On Tokenizing Real World Assets & The White House Crypto Summit

World Liberty Financial: DeFi-ing the Odds

It’s not exactly the easiest time for altcoins in crypto. Some of the most anticipated launches and projects haven’t gone as smoothly as their founding teams hoped – SUI, HYPE, ONDO, and TAO, to name a few, are now down 50%–60% or more from their highs. This is happening at a time when altcoins should historically be thriving – Q1 during a bull market – that’s just the nature of the beast.

Despite the challenging backdrop for altcoins, World Liberty Financial has been nothing short of a spectacle. Leading up to the token launch, excitement was high. Just a week after Trump was elected, he posted a video announcing that he would join Spaces during WLF’s launch, stating, “We’re embracing the future with crypto and leaving the slow and outdated big banks behind.”

That Spaces was a success – everyone was talking about what was said, but not exactly for the reasons World Liberty was hoping for. At this point, the details were scarce, and the platform’s mission wasn’t exactly clear. WLF opened a whitelist requiring KYC verification and wallet connection. WLF made it clear that the token wouldn’t carry any financial rights, would be nontransferable, wouldn’t earn yield, and would only be available to accredited investors.

On the flip side, during the X Space, we also got some insight into the project’s tokenomics: 63% of the tokens will be sold to the public, 20% will go to the team, and 17% is set aside for user rewards. To my surprise, the tokenomics distribution looked better than 95% of what I usually cover in this newsletter, so that’s a plus. And, unsurprisingly, the team made it clear that WLFI (the token) is not a security (of course they said that).

Despite many unanswered questions around Trump’s exact role and the underlying purpose behind another DeFi platform and token, WLFI launched and – drum roll please – it was a pretty big flop at first. Three days after launch, the native token presale raised only 4% of its $300 million goal, bringing in just $12 million. That shortfall resulted in a 20% price drop when WLFI hit the open market. It didn’t take long for Bitcoin maxis to jump on the opportunity to kick WLFI while it was down, forcing the team to adjust their goal down to $30 million.

“He said nice things about crypto but he immediately wants to extract value. None of this is liberalizing or democratizing access to finance.” – Nic Carter

“I’m not investing in that, and you should not invest in that. It’s just another scam. There’s greatness in our industry and then there’s nonsense like this.” – Anthony Scaramucci

As some time passed and $TRUMP was launched, the perception around the WLF project began to shift from bad to better. The initial sale wrapped up by January 20, 2025, with 20% of the token supply successfully sold. The Trump team capitalized on this demand and raised their goal, releasing an additional 5 billion WLFI tokens on January 20, priced at $0.05 each.

On January 19, Justin Sun increased his investment by an additional $45 million.

“I think they'll appreciate greatly in value. I believe a Trump DeFi company can be worth very much and that the public sale price was attractive.” - Mike Dudas

It always helps to have the president’s son bull posting.

As momentum grew, World Liberty Financial garnered new attention as it built out its crypto portfolio with large purchases in the space, funded through the sale of its own tokens. Ethereum has been and remains the asset of choice for the World Liberty Financial team, currently accounting for 58% of the portfolio. Other notable purchases include ONDO, AAVE, SUI, TRX, LINK, MOVE, and WBTC.

World Liberty continued to hustle and began offering “token swap” deals to various blockchain teams. According to sources familiar with the matter, the platform is proposing that projects buy at least $10 million worth of WLFI tokens (with a 10% fee) in exchange for World Liberty Financial purchasing an equal amount of the project's native token. This is an interesting deal because WLFI tokens would be transferred at a $1.5 billion fully diluted valuation (FDV), with the platform set to launch in Q3 at that valuation.

Teams that agreed were paying a premium with a 10% fee and taking on the risk of a speculative $1.5B FDV for WLFI tokens. Additionally, the lack of a vesting period allows WLF to immediately sell the tokens they receive, creating potential downward pressure on the partner projects’ tokens while securing $10 million upfront. Furthermore, a source in the original article revealed $10 million was just the minimum – it would take $15 million to receive “priority treatment.”

Regardless of how you feel about their strategy – WLF using funds from token sales to buy other crypto – World Liberty Financial completed its latest sale on March 14, bringing its total raised to over $590 million since launch. Tracking the portfolio has been challenging due to the team frequently moving funds, but to my knowledge, they have only bought crypto and have not sold any, aside from their own WLFI token.

Opinions are still mixed: Mike Dudas, one of the early supporters of the project, changed his tune following the recent announcement of SUI partnering with WLF.

Andre Cronje, the creator of Yearn Finance, recently said the following:

Clearly, this project remains polarizing despite its recent comeback. The involvement of one of the most divisive families in American political and business history only intensifies the divide among investors, observers, and outsiders. For most in the crypto space, World Liberty is a love-it-or-hate-it project. That said, this might be the most fascinating and bizarre crypto team I’ve ever seen – hands down.

Steven Witkoff, an American billionaire real estate investor, lawyer, and diplomat, also serves as the U.S. Special Envoy to the Middle East; Zak Folkman, who created his own social media agency, said in an interview with Justin Sun, “We want to make ICOs great again;” and Chase Herro, known as an e-commerce expert, described himself as “the dirtbag of the internet” in 2018 on YouTube.

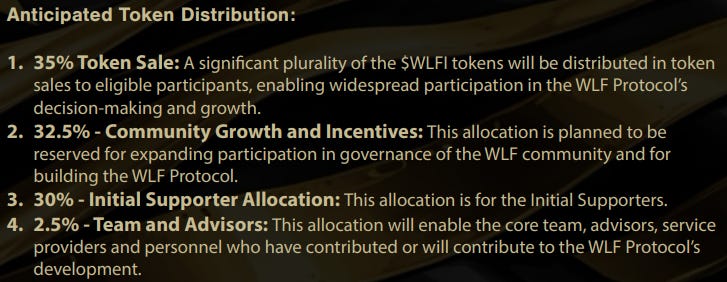

For those curious about more specific details on the distribution of the token, see here:

If you are interested in reading up on World Liberty, I have the “Gold Paper” (the white paper) linked HERE. In the interest of fair reporting, below is the mission as stated by them.

I am trying to stay as neutral as possible on all of this, but I will share a few thoughts:

First, I hope the World Liberty Financial investors succeed. It’s the same feeling I have for ETH investors, SOL investors, XRP investors, TRUMP investors, and the list goes on. At the end of the day, success for any one group often benefits the entire crypto ecosystem, and I’m not in the business of praying on anyone’s downfall. I know some will disagree here, but when we put aside our differences, we’re all here to improve ourselves financially and fix a broken system.

Second, World Liberty is still in its infancy. Judging it based on the first few days was just as misguided as judging it now, only a few months in. Definitive statements should be reserved until more time has passed, as few crypto projects look their best early on. World Liberty isn’t following the typical expectations, but it’s working, and something interesting is unfolding with how aggressively and quickly the team is adapting to demand, acquiring new tokens, and securing credible partnerships.

Third, and most importantly, rather than nitpicking the flaws, I’m more focused on what the team is buying. This isn’t just any crypto team – it’s the family of the President of the United States and their closest confidants. I don’t think WLF holding 58% ETH is a coincidence or without careful consideration. The same goes for every altcoin they’re acquiring. Will the Trump family really stand by and let Ethereum fail when they’ve been purchasing tens of millions of dollars’ worth at a time?

Tracking the portfolio has become far more difficult due to the team moving its assets into Coinbase Prime, but as far as I know, there haven’t been any sales. So, WLF is holding through this downturn just like the rest of us, probably down a significant amount. When Eric Trump posted this, ETH was trading around $2,900.

My gut tells me that World Liberty Financial is more likely to win than lose – that statement is entirely irrespective of my personal opinions on the ethics of all this playing out. I could easily see, once the Bitcoin reserve is established, major altcoins like Ethereum being included or considered for the U.S. sovereign wealth fund – just an idea. Just like with Ripple vs. the SEC, which many in the crypto space wanted to see fail, we should probably still back World Liberty Financial at the end of the day. That doesn’t mean ignoring its shortcomings or even ethical concerns, but ultimately, we’re all on the same team.

Also, if World Liberty were truly insiders, they wouldn’t have bought at a crappy time and taken such a large drawdown on their portfolio. They are hopeful investors just like you and me. They probably thought there was a decent chance Ethereum and other major altcoins would be included in the reserve but then realized it’s not likely to happen anytime soon. Try not to get too caught up in crypto politics – just hold and focus on the day ahead. Soon enough, the market will have to decide whether it has bottomed or if there’s more downside ahead – we’re almost there.

Bitcoin Thoughts And Analysis

Bitcoin has confirmed a bullish divergence on the daily chart, with price making a lower low while RSI formed a higher low — a classic signal that downward momentum is weakening. However, the follow-through has been weak so far, with Bitcoin now consolidating beneath the key resistance at $85,010.

The 200-day moving average (around $83,645) has not provided strong support or resistance in recent days, as price has hovered just above and below it without a decisive move. Volume also remains low, indicating a lack of conviction from buyers despite the bullish divergence.

For bulls to regain control, Bitcoin needs to reclaim $85,010 and build upward momentum toward the $91,271 resistance zone. Failure to hold above the 200 MA could lead to a retest of the $77,000–$78,000 support zone or even a drop toward the $73,835 level, which represents the next major structural support.

Overall, Bitcoin has shown early signs of bottoming, but bulls need to step in with stronger volume and momentum to confirm a more significant trend reversal.

Legacy Markets

US stock futures slipped after Treasury Secretary Scott Bessent dismissed recent market declines as healthy, suggesting that the Trump administration is unlikely to step in to support markets. S&P 500 and Nasdaq 100 contracts fell 0.3%, setting the stage for a fifth consecutive week of losses. The Magnificent Seven tech stocks mostly edged lower in premarket trading, though Nvidia rose ahead of its AI conference. Europe’s Stoxx 600 gained 0.4%, continuing to outperform US stocks this year.

Bessent’s comments, made during an NBC interview, downplayed the recent $5 trillion selloff in the S&P 500 and dashed hopes that Trump’s team would provide liquidity support to stabilize markets. This further unsettled investors already on edge from Trump’s trade policies, which have heightened fears of slower growth and rising inflation.

Haven assets benefited, with gold holding near $3,000 an ounce and Treasury yields edging lower. In Europe, bund yields dropped five basis points as investors awaited Tuesday’s parliamentary vote on Germany’s landmark spending package. Brent crude rose above $71 a barrel amid US threats of "unrelenting" strikes on Houthi militants in Yemen, which prompted the Houthis to warn of attacks on US vessels in the Red Sea. Shares of shipping companies such as AP Moller-Maersk and Hapag-Lloyd gained.

Markets are also bracing for policy meetings this week from the Federal Reserve, the Bank of England, and the Bank of Japan. While no rate changes are expected, investors will closely watch Fed Chair Jerome Powell for signals on potential policy support. US retail sales data, due Monday, is expected to confirm signs of a slowing economy, reinforcing the outlook for rate cuts. Swaps currently imply a high likelihood of three Fed cuts this year.

Key events this week:

US retail sales, Empire manufacturing, Monday

Canada CPI, Tuesday

US housing starts, import price index, industrial production, Tuesday

Brazil rate decision, Wednesday

Eurozone CPI, Wednesday

Indonesia rate decision, Wednesday

Japan rate decision, industrial production, Wednesday

US Fed rate decision, Wednesday

Australia unemployment, Thursday

China loan prime rates, Thursday

South Africa rate decision, Thursday

Sweden rate decision, Thursday

Switzerland rate decision, Thursday

Taiwan, rate decision, export orders, Thursday

UK rate decision, jobless claims, unemployment, Thursday

US jobless claims, existing home sales, Thursday

EU leaders summit in Brussels to discuss defense spending, Thursday

ECB President Christine Lagarde speaks, Thursday

Bank of Canada Governor Tiff Macklem speaks, Thursday

Chile rate decision, Friday

Japan CPI, Friday

Malaysia CPI, Friday

New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 6:43 a.m. New York time

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.0905

The British pound rose 0.3% to $1.2969

The Japanese yen was little changed at 148.57 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $83,367.38

Ether rose 1% to $1,913.58

Bonds

The yield on 10-year Treasuries declined three basis points to 4.28%

Germany’s 10-year yield declined six basis points to 2.82%

Britain’s 10-year yield was little changed at 4.66%

Commodities

West Texas Intermediate crude rose 1.2% to $67.97 a barrel

Spot gold rose 0.5% to $2,998.04 an ounce

North Korea Holds A Lot Of Bitcoin

North Korea has climbed to third place among governments holding Bitcoin after the Lazarus Group’s $1.4 billion Ethereum heist on Bybit. Following the hack, the funds have largely been converted into Bitcoin, increasing North Korea's total Bitcoin holdings to 13,562 BTC, worth $1.14 billion. This move now places North Korea ahead of Bhutan and El Salvador in Bitcoin holdings, behind only the U.S. and the U.K. Despite global efforts to freeze the funds, $300 million from the heist has already been cashed out. I know some Bitcoin maximalists were pleased to see Ethereum fall into the wrong hands, but crypto has a funny way of shaping its own fate.

Russia Is Utilizing Crypto To Avoid Sanctions

Reuters reported that Russia is using cryptocurrencies, including Bitcoin, Ethereum, and stablecoins like Tether, in its oil trade with China and India to bypass Western sanctions. The sources haven’t been identified, but this seems plausible given that Russia has publicly supported crypto and passed a law in 2022 to allow digital currency payments in international trade – its use in the oil sector has not been previously reported. Although this is a small but growing part of Russia's $192 billion oil trade, it highlights the increasing use of crypto in international trade amid sanctions. I can’t imagine the U.S. government is happy to hear this is happening – and the North Korea news too. Hopefully this encourages the U.S. to buy rather than slowing it down.

Pavel Durov Is Allowed To Travel Again

TON coin reacted positively to the news that founder Pavel Durov had his passport returned by French authorities, surging more than 20% in the last 24 hours to trade above $3.45, with a market capitalization of $8.14 billion. This move restores Durov’s ability to travel freely and ends a situation that had raised concerns among privacy and free speech advocates. Durov, who co-founded Telegram – a messaging platform with nearly a billion users – has been a strong advocate for privacy and secure communication. Just another crypto win.

21Shares Is Liquidating Its BTC Futures and ETH Futures ETFs

According to the official press release, 21Shares has announced the scheduled liquidation of two Bitcoin and Ethereum futures ETFs due to “routine review of the firm’s product lineup to ensure it aligns with market dynamics, the needs of its clients, and a maturing digital assets landscape.” The ETFs to be liquidated are the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY) and the ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC). Shareholders can sell their holdings by March 27, 2025, with the liquidation occurring around March 28, 2025. My guess is that this probably has to do with limited demand.

Unlocking Trillions: Sergey Nazarov On Tokenizing Real World Assets & The White House Crypto Summit

We're diving into an exclusive conversation on The Wolf Of All Streets podcast with Sergey Nazarov, co-founder of Chainlink, who was invited to the groundbreaking White House Digital Asset Summit. Sergey reveals how blockchain technology will radically transform the government, financial institutions, and everyday life. Join us to understand why the U.S. is pivoting towards blockchain and why Chainlink is set to power the future.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.