Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '25OFF' for a 25% discount.

In This Issue:

Saylor Delivered An Epic Speech

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

BlackRock And Fidelity Are All That Matter

Rumble Buys Bitcoin

Binance Finds Itself A Massive Investor

Russia Is Inching Closer To Being Pro-Crypto

Bitcoin To Crash More? | Here Is When To Buy The Dip

Saylor Delivered An Epic Speech

Michael Saylor, the executive chairman of Strategy (formerly MicroStrategy), delivered a keynote address at Bitcoin for America two days ago in Washington, D.C., organized by the Bitcoin Policy Institute. In attendance were senators, members of Congress, and policy workers deciding on various high-level crypto-related issues. Some will carry over Saylor’s advice to propose state-level legislation, others will use it to make more informed decisions on crypto policy - like the broker-dealer rule - and a few will help shape history by working toward a national Bitcoin reserve.

Some may do all three.

For any of these large-scale initiatives to succeed, it will take more than just good ideas - it will require a majority of ‘yes’ votes and bipartisan support from both sides. The Bitcoin issue has to be motivating enough for politicians to risk their credibility, put pen to paper, and sign their name to their fate. This is exactly why these talks from Saylor are so pivotal. If Saylor orange pills a handful of legislators, they will take what they've learned to their networks of friends, family, respective parties, constituents, and advisers, and spread the message exponentially.

It took a long time, but Bitcoin eventually found its way into a few legislators' hands through grassroots efforts, goodwill, and a genuine desire for change. Once it spreads far and wide enough, game theory takes hold, Bitcoin reaches unfathomable valuations, and citizens of countries with a reserve benefit.

None of this will happen overnight, but the acceleration we are witnessing in winding down the game clock - where those who hold Bitcoin win and those who don’t simply lose - is coming at us fast. Saylor is basically one of the leaders of Team Bitcoin, which is why I’ve highlighted the key moments from this epic speech below.

If you've ever heard Saylor give a Bitcoin presentation, you know he loves to use some really far-out metaphors and analogies. I’ve tried to sift through those and provide you with the statements I believe will resonate most with decision-makers.

I know it can be fun to describe Bitcoin as “a swarm of digital cyber hornets” or say that “Bitcoin is channeling energy through time and space,” but I chose to leave those out. Saylor’s mind operates at a genius level, but I prefer to focus on simple, grounded statements. An 80-year-old senator from the Midwest learning about Bitcoin for the first time isn’t going to take us seriously with these kinds of claims, nor will they easily grasp the fundamentals of Bitcoin or be able to sell it to their colleagues and staffers.

The Speech

“The word ‘Strategic Bitcoin Reserve,’ to the casual observer, sounds like a stockpile of an asset. To a closer observer, it sounds like a stockpile of the most valuable asset the human race has ever invented. But I'm here today to show you how the Strategic Bitcoin Reserve represents a strategy for United States digital supremacy in the 21st century.”

“At its worst case and in its narrowest form, you could think about the Strategic Bitcoin Reserve as a stockpile of the apex asset of the human race. And so, what's it worth? Well, over the next 20 years, I think it's worth anywhere from 3 trillion to 106 trillion dollars to the United States.”

“It's hard to rent out or finance or develop your cheese, your gold, or your natural gas buried in a vault. So, a more powerful metaphor is Bitcoin is digital property…In 20 years, the United States could be generating 10 trillion dollars per year by renting, developing, or financing the assets in that strategic Bitcoin reserve.”

This sounds a lot like the plans Saylor discussed late last year to transform formerly MicroStrategy into a Bitcoin bank. Here’s what he had to say on the topic a few months ago:

“How big can the business get? Pretty big. I think there’s room for a $1 trillion company that securitizes every flavor of capital. I’m talking about the transformation of capital markets. These securities will be backed by digital capital, not physical, financial, or property-type capital. That’s our end game.”

Anyway, back to the highlights of the speech…

“When you start to visualize Bitcoin as a digital energy network, what you realize is that trillions of dollars of digital commerce will flow over that network. The banking system of the world is going to rebuild itself on a digital energy network. We're going to have 40,000 banks that'll be settling with each other in real time, finally moving billions, tens of billions, or hundreds of billions of dollars an hour over a pure digital network.”

This makes sense, though I’d add that for it to truly happen, it will require scalable and flexible blockchains. While Bitcoin’s value can move seamlessly on its own blockchain, it isn’t designed to be the sole chain supporting this grand vision.

“What is driving the growth of Bitcoin?”

This chart really puts Bitcoin into perspective. While it’s slightly outdated – given that Bitcoin’s market cap is now $1.6 trillion – it still illustrates the same point. Even if Bitcoin’s 4x growth were adjusted for, the chart would look virtually the same.

“It's all of the smart money in the world running from risk, running from the past toward the future, from something less secure to something more secure. And they're doing it in the most visible way with their capital. This is a map of the wealth distribution in the world, about $900 trillion…Long-term capital is being merged into the Bitcoin network.”

Bitcoin will eventually surpass gold (my base case). Whether it does so by a small margin or by multiples remains uncertain, but my long-term base case – with the highest confidence – is that Bitcoin is superior to gold and will overtake it. How far it goes, however, is a much tougher question.

“Where is it headed?”

I like the chart below, though it's clearly influenced by someone very pro-Bitcoin. Even the bear case is notably bullish, projecting Bitcoin at $3,000,000. My personal bear case is that Bitcoin either fails completely or trends toward zero over the long run. While I don’t believe this will happen, as I own Bitcoin, I can’t completely rule it out. Also, take a look at the ARR projections below. A 20% return seems possible for the next decade, but it’s likely to slow over time.

“If it decelerates from 60% a year to 20% a year, the average return is going to be 29% a year over the 20 years. That is the base case, which arrives at a price of 13 million Bitcoin in USD terms or $280 trillion in the network.”

I’d love for this to turn out to be true, but my base case, intuitively speaking, isn’t nearly as optimistic. Where is your base case? Mine is above.

“Bitcoin is less than 1% of the capital of the world. What does it compete with? Not the dollar. Bitcoin competes with property, equity, and bonds—property, equity, and bonds. And what is it? It's 1%. And what is it going to? I just showed you the shocker: $13 million Bitcoin forecast. That gets us to 13% of the capital in 2045.”

“Why should the U.S. want to be the Bitcoin superpower?”

“Cyber power requires Bitcoin miners operating as, throwing up a wall of digital energy. And you want to hope that more than 50% of that is controlled by you or your allies. What does it mean to own cyberspace? If you want to be a Bitcoin superpower, you need to own the asset—own Bitcoin. But that's only half of it…You have to control the network—the cyber network, the digital energy network that flows around the world.

This is a solid argument. Metaphors aside, Saylor is right – if politicians are unsure about where they stand on Bitcoin, it’s better for us to control 50% of it between the U.S. and its allies rather than Russia or China.

This next paragraph may read like a hypothetical, but it’s actually a reality for billions of people around the world. Inhabitants of the financially modern world are fortunate to have nearly everything they desire at their disposal, but for about half the world, that’s not the case.

“If I took all your money, dropped you in Africa, and said you’ve got to invest in a diversified portfolio—private and public equity, real estate, art in Africa—or you can put your money into the digital capital network and move it anywhere else at the speed of light, and I gave you a choice to punch the orange button or leave it in Africa for a hundred years, you would punch the orange button. Everybody else in the world is figuring out the same thing right now.”

Now Saylor returns to his banking thesis…

“With the appropriate digital asset’s framework, we can become the bankers to the world. Right, when we export Bitcoin to the world, we're exporting our value sovereignty, sound money, integrity, and property rights.”

This sounds a lot like what Strategy, the company, is trying to achieve.

Saylor understands that advocating for Bitcoin to the government is in Strategy’s best interest. After acquiring a substantial amount of Bitcoin, Strategy is now working to persuade the government – this is undeniable. However, I firmly believe that the government purchasing Bitcoin is ultimately the right move for the American people, as well as any entity on this planet seeking a reliable store of value.

“Bitcoin is the greatest opportunity of the 21st century, right? It's worth anywhere from 3 trillion to 106 trillion, depending on how programmatic and aggressive we want to pursue this opportunity. These opportunities don't come along often. This is the once-in-a-century opportunity.”

I agree.

When he mentions $3 trillion to $106 trillion, he is referring to what the U.S. could potentially pay off in terms of debt.

While it’s true that Saylor is doing what any rational Bitcoiner would do – helping onboard others because it ultimately benefits him – he is also doing an incredible service to the world. There are only a handful of people who can explain Bitcoin as effectively as he can while truly walking the walk. He is one of a kind.

If you're struggling this cycle, hold tight to your Bitcoin, do what you can to bring your cost average down, and stay patient. Bitcoin presents extraordinary potential, but it will demand a high cost – one that requires the highest level of resilience, perseverance, and forward-thinking.

Ignore the commentary and the noise – just hold.

Bitcoin Thoughts And Analysis

Bitcoin is now facing resistance at the 200-day moving average (currently around $83,645). After bouncing from recent lows, price is struggling to reclaim this key level, which aligns with prior support turned resistance. A clean break above the 200 MA would be a bullish signal and could open the door for higher prices, but for now, this area is acting as a significant barrier.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Ladies and gentlemen, the Ethereum Time Machine! Welcome back to 2020.

Ethereum’s weekly chart against Bitcoin has reached a major historical support level. This is a critical area where price previously found a strong base before launching into the 2021 bull market. The current retest of this zone suggests that buyers could begin stepping in here, although there’s no confirmed reversal signal yet.

Despite being largely wrong about Ethereum’s performance so far, I’ve maintained a sizable position and have not sold any. The price action has been weak for months, but this area of historical support could provide a foundation for a meaningful bounce.

Volume has increased slightly, which could indicate early accumulation, but confirmation will require more follow-through from buyers. A decisive hold of this support level and a higher low would be the first sign of potential trend reversal. However, if this level breaks down, there’s little visible support until significantly lower levels.

Legacy Markets

US stock futures were steady as investors awaited US wholesale inflation data to see if price growth is continuing to moderate. S&P 500 and Nasdaq 100 futures were down less than 0.1%, paring earlier sharp losses. Wednesday’s softer-than-expected CPI data reinforced hopes that inflation is cooling, helping lift stocks. However, weak earnings reports weighed on sentiment, with Adobe Inc. and American Eagle Inc. falling in premarket trading, while Intel jumped as much as 11% after naming a new CEO.

European stocks rose about 0.5%, continuing to outperform US peers this year. Gold prices approached record highs as several banks predicted further gains, citing global trade tensions. Investors are now focused on the US producer price index (PPI) and initial jobless claims, with wholesale inflation expected to moderate to 0.3% in February.

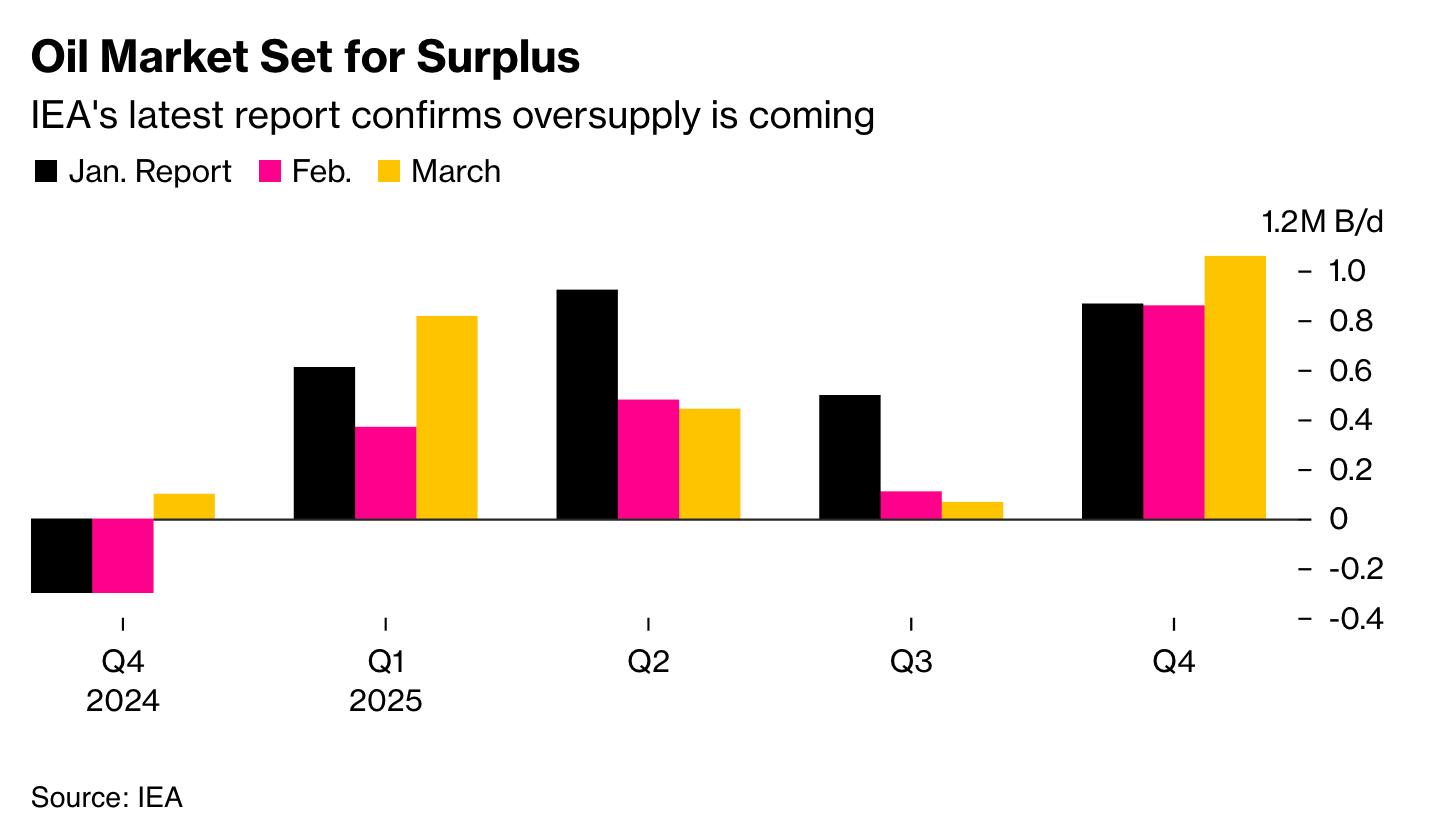

Trump’s $1.4 trillion tariff threat has increased market uncertainty, with some analysts warning of stagflation risks. Goldman Sachs and Citigroup have cut their S&P 500 targets, citing slowing economic growth and higher tariffs. Still, JPMorgan said the worst of the correction may be over, with credit markets signaling lower recession risks. Treasury yields edged higher despite the cooler inflation print, as investors considered the impact of tariffs on future prices. The Federal Reserve, which meets next week, is expected to maintain a cautious stance before deciding on further rate cuts. Meanwhile, crude oil futures fell after the International Energy Agency warned that global demand is under pressure from the trade war.

Key events this week:

Eurozone industrial production, Thursday

US PPI, initial jobless claims, Thursday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.6% as of 10:19 a.m. London time

S&P 500 futures were unchanged

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.4%

The MSCI Emerging Markets Index fell 0.6%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0871

The Japanese yen was little changed at 148.14 per dollar

The offshore yuan was little changed at 7.2459 per dollar

The British pound was little changed at $1.2954

Cryptocurrencies

Bitcoin rose 0.1% to $83,219.29

Ether fell 0.3% to $1,885.46

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.32%

Germany’s 10-year yield advanced two basis points to 2.90%

Britain’s 10-year yield advanced one basis point to 4.74%

Commodities

Brent crude fell 0.6% to $70.49 a barrel

Spot gold rose 0.3% to $2,943.97 an ounce

BlackRock And Fidelity Are All That Matter

The XRP community is celebrating the news that Franklin Templeton has become the ninth firm to file for an XRP ETF. Sure, it’s adoption – but when it comes to ETF inflows, the only two issuers that really matter are Fidelity and BlackRock, and even then, it’s mostly BlackRock.

This isn’t specific to XRP; the same rules apply to SOL, HBAR, LTC, and even ETH, which has already secured both Fidelity and BlackRock. None of the other issuers are generating meaningful inflows substantial enough to move prices, and even ETH isn’t seeing much momentum from Fidelity or BlackRock.

Bitcoin remains the only ETF that truly matters to Wall Street investors (right now), and that’s unlikely to change until we see a strong narrative for altcoins and the SEC approves staking for ETFs. Until then, ETF inflows outside of Bitcoin will remain weak and negligible.

Rumble Buys Bitcoin

Rumble, the popular video streaming platform, is going headfirst into the crypto space following $775 million in backing from Tether and following through on its commitment to buy up to $20 million in Bitcoin. As seen from the infographic above, Rumble spent $17 million to purchase 188 BTC at an average cost of $91,000. I have a feeling this won't be the last time Rumble purchases Bitcoin.

GameStop, what are you doing?

Binance Finds Itself A Massive Investor

The largest investment ever made in a crypto company has just closed – and it’s also the biggest investment ever paid in crypto. MGX, an Abu Dhabi-based AI and advanced technology investor, has become the first institutional investor in Binance with a groundbreaking $2 billion investment.

Details on why MGX chose to invest in Binance were scarce, aside from the usual statements about advancing digital asset adoption and other generic remarks. But one thing is clear: Binance is undeniably the leading global exchange – and by a wide margin.

“MGX’s investment in Binance reflects our commitment to advancing blockchain’s transformative potential for digital finance. As institutional adoption accelerates, the need for secure, compliant, and scalable blockchain infrastructure and solutions has never been greater. Binance has long been a driving force in cryptocurrency innovation, from exchange technology and tokenization to staking and payments. Together, we are committed to building a more inclusive and robust digital finance ecosystem” — Ahmed Yahia, CEO of MGX.

Russia Is Inching Closer To Being Pro-Crypto

The Russian central bank is considering a three-year experimental program to allow select investors to trade cryptocurrencies. The proposal would permit investors with at least $1.1 million in securities and deposits to buy and sell crypto while introducing penalties for violations. The plan, submitted for government discussion, aligns with directives from the Russian president on regulating crypto investments.

Hopefully, this news will push the U.S. to accelerate its Bitcoin strategy and start accumulating before adversarial countries take the lead and potentially erode the growing interesMElkadick1!

Bitcoin To Crash More? | Here Is When To Buy The Dip

Markus Thielen from 10x Research shares his analysis on why Bitcoin is crashing and identifies key levels where buying the dip makes sense. Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.