Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Is This A Correction or A Crash?

Bitcoin Thoughts And Analysis

Legacy Markets

Senator Lummis Is Fully Committed To Bitcoin

Fidelity Is Ready For ETH Staking, BlackRock Is Next

Bitwise Launches ETF That Tracks Public Companies Holding Bitcoin

The Ethereum Foundation Is Not Leveraged Long

Bitcoin Crash Alert: Could $70K Be the Next Painful Stop?

Is This A Correction or A Crash?

The terms correction and crash are often used interchangeably, but they are not the same.

The S&P 500 hasn’t crashed. Neither have the Nasdaq 100 or the Russell 2000.

From its high of 6,147, the S&P 500 is down 9.47%, currently at 5,565.

From its high of 22,222, the Nasdaq 100 is down 12.92%, currently at 19,350.

From its high of 2,449, the Russell 2000 is down 17.76%, currently at 2,014.

The last time the S&P 500 traded this low was September 2024.

The last time the Nasdaq 100 traded this low was September 2024.

The last time the Russell 2000 traded this low was February 2024.

Both corrections and crashes refer to market declines, but they differ in magnitude, speed, and impact. A correction typically involves a 10% to 20% drop, lasting from a few weeks to a few months. A crash, on the other hand, is a sharp decline of 20% or more, occurring suddenly and often leading to a prolonged bear market. If a decline is under 10%, it’s considered a pullback.

Crashes make global headlines – the Dotcom Bubble, the Global Financial Crisis, and COVID-19. They go down in history, wipe out savings, have far-reaching consequences beyond the markets, and often take years to recover from. In contrast, corrections and pullbacks are more like a healthy reset – noted briefly, rarely celebrated, and usually seen as necessary in hindsight.

From the numbers above, some major indexes are technically approaching crash territory. But since nothing extreme has happened yet – nothing resembling the crashes listed above – this still looks like a correction. A couple of days of positive news on tariffs or interest rates could be enough to reverse the current trend.

When it comes to individual stocks and the crypto market, we are undeniably in crash territory. But this shouldn’t spark the same level of concern as a crash in major indexes. Higher volatility is baked into the DNA of tech and crypto, which means corrections and crashes happen more frequently and with bigger swings. The reaction should be measured accordingly.

If you’re feeling bad about your crypto portfolio, you may find comfort in this:

Tesla is down 54% from its all-time high.

Palantir is down 38.57% from its all-time high.

NVIDIA is down 29.53% from its all-time high.

Microsoft is down 19% from its all-time high.

Meta is down 18.95% from its all-time high.

Tech stocks that are pushing the boundaries of innovation are getting absolutely crushed right now.

Risk-on investors, especially those in tech and crypto, need to develop thicker skin. A 10% drop in major indexes might feel catastrophic, but in high-volatility assets, a 30% drop is often just part of the ride. Not all declines deserve the same level of panic. Depending on where your holdings fall on the risk curve, you need to adjust your expectations and psychological approach.

At this point, I don’t see tariffs justifying a full-blown market crash. But I could be wrong. If Trump goes completely off the rails, a broader crash would be in the cards. He’s already proven he can inflict a serious wound on the markets anytime he wants. If anything, crypto holders – despite taking the hardest hit – should be the most prepared for what’s happening right now. We’ve already survived worse.

Rather than panicking over what the headlines are calling this – a crash or a correction – I encourage you to take control of this messy situation and do everything you can to turn it to your advantage. Ask yourself these questions honestly:

Do I have cash readily available to deploy?

Am I currently investing in quality assets?

Can I withstand further drawdowns?

Will I regret not buying if this turns out to be the market's lowest point?

Am I staying true to my strategy?

Have I overleveraged myself?

If I had cash equal to my portfolio’s value, would I buy the same assets again?

Am I optimizing my tax strategy by taking advantage of the dips?

An optimistic and forward-thinking investor sees pullbacks, corrections, and crashes as opportunities for growth. No one times it perfectly, but with patience and courage, you can supercharge your portfolio when the market rebounds. Not all of us can be Warren Buffett and sell over $100 billion in equities over the past three months. Only one of us can do that, and it’s exactly Warren Buffett.

I’ve been buying Bitcoin all the way down and will continue to do so as much as possible. I’m human, and it’s not easy seeing prices drop after a purchase, but I trust the strategy I put in place. It stings even more knowing I’m exposed to altcoins that are down over 50%. But I’ve consolidated my holdings into assets I’m confident in for the long haul and won’t be shaken by short-term volatility. Ethereum and Solana are still solid holdings – and if DeFi is going to succeed, these two will be at the forefront.

From this recent drop, Elon Musk probably lost around a third of his net worth – largely due to his work at DOGE and support for Trump, who is driving the market down. If that’s not enough inspiration to keep pushing forward – whether you love him or hate him – I don’t know what is. If you don’t have cash right now, be grateful that the pullback will strengthen quality assets for the next rally – otherwise, find new ways to save or earn to buy the dip.

Ignore the noise and focus on the bigger picture…

Not everyone is a fund manager who can strategically buy low and sell high – or buy high and sell higher. That’s a game for the best funds, with teams of analysts, quants, and experts, along with tens of millions in cash to adjust their strategy when needed.

The guaranteed way to win in this market, through any pullback, is simple: buy quality and wait. Wait so long that by the time selling even crosses your mind, prices have surged far beyond your cost average, you can’t remember where it is, and the money will meaningfully impact your life.

Until then, just wait.

The news coming out of this drawdown will be epic, and for the first time – maybe ever – we’re getting an early glimpse of what’s to come. It’s rare for the market to offer both a hefty discount and a flashing buy signal at the same time. Do with that information what you will. Godspeed.

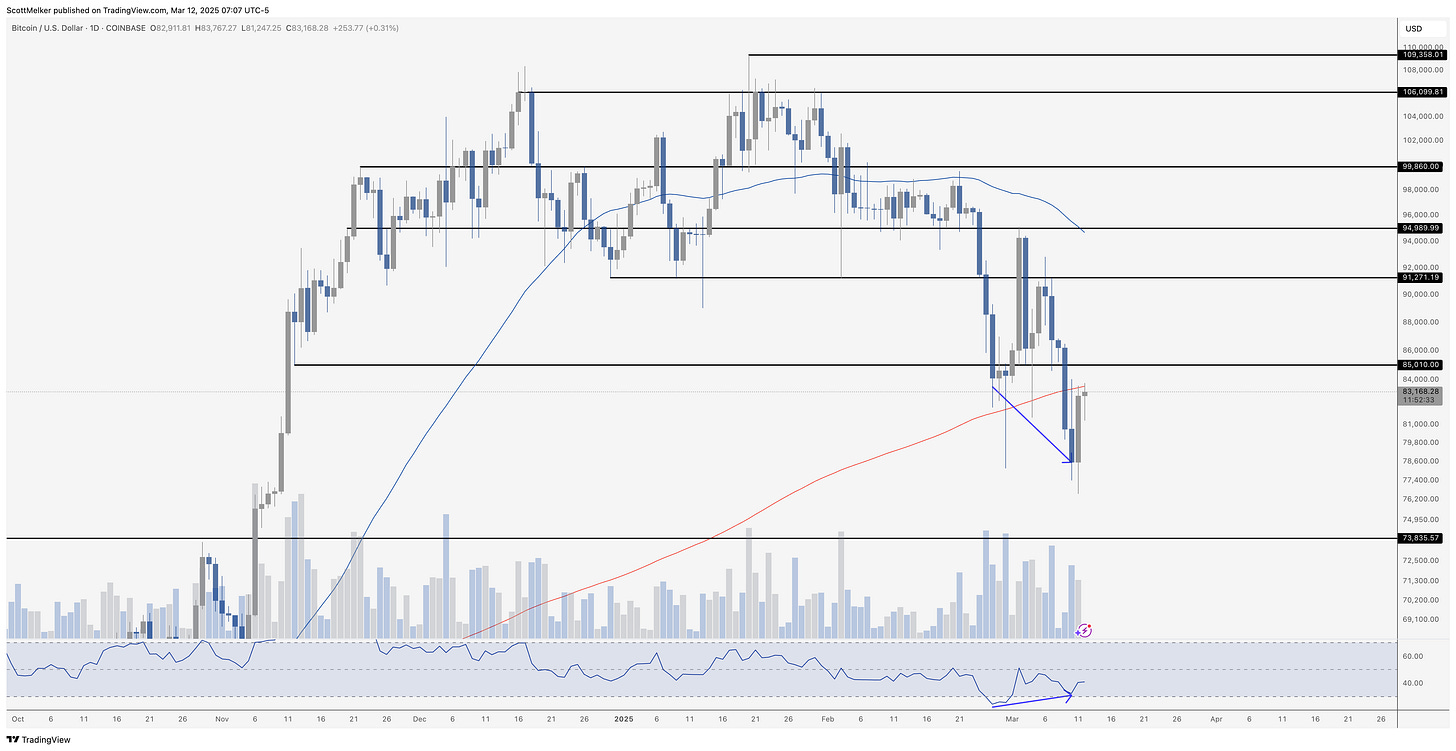

Bitcoin Thoughts And Analysis

Bitcoin’s daily chart is showing a significant shift in momentum, with a confirmed bullish divergence now in play. The price made a lower low while the RSI printed a higher low and has since turned upward, confirming the divergence. This is a strong signal that downward momentum is weakening, and buyers are stepping in.

The RSI has now exited oversold territory, reinforcing the idea that a local bottom may be in. Additionally, the recent bounce came after filling bids near $77,000 and testing key support.

However, the 200 MA (red line) continues to act as resistance. A clean break and hold above this level would further strengthen the bullish case. Immediate resistance lies at $85,000 and $91,000 — a reclaim of these levels would signal a potential shift back into an uptrend.

Volume has also increased during this bounce, suggesting that buyers are becoming more aggressive. If this trend continues and price starts printing higher highs and higher lows, Bitcoin could be setting up for a larger recovery.

Legacy Markets

US stock futures advanced as traders awaited key inflation data, with tech megacaps leading a rebound after the S&P 500 neared a technical correction. Futures on the S&P 500 rose 0.8%, Nasdaq 100 futures added 0.9%, and Dow Jones contracts gained 0.5%. Traders are focused on the consumer price index (CPI) report, which is expected to show that inflation remained sticky in February. Options markets indicate the S&P 500 could swing 1.5% in either direction after the data, the largest implied move ahead of CPI in at least two years.

Goldman Sachs lowered its year-end target for the S&P 500 to 6,200 from 6,500, citing reduced US GDP growth forecasts, higher tariffs, and increased uncertainty. The bank also raised its outlook for European earnings, highlighting growing skepticism about the US economic outlook relative to Europe. Bond yields edged higher, with 10-year Treasury yields rising one basis point to 4.29%, while the Bloomberg Dollar Spot Index climbed 0.2%.

President Donald Trump’s shifting trade policies have weighed on markets, adding to concerns about the broader economy’s softening. However, a cooler-than-expected inflation print could provide support for stocks after recent losses. Goldman’s outlook reflects lower expected returns from the "Magnificent 7" tech stocks and a higher equity risk premium due to the economic uncertainty tied to tariffs and slowing growth.

Key events this week:

Eurozone industrial production, Thursday

US PPI, initial jobless claims, Thursday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets*:

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.8% as of 7:54 a.m. New York time

Nasdaq 100 futures rose 0.9%

Futures on the Dow Jones Industrial Average rose 0.6%

The Stoxx Europe 600 rose 1.1%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.1% to $1.0903

The British pound was little changed at $1.2948

The Japanese yen fell 0.6% to 148.69 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $82,915.88

Ether fell 1.2% to $1,912.98

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.29%

Germany’s 10-year yield advanced three basis points to 2.93%

Britain’s 10-year yield advanced three basis points to 4.70%

Commodities

West Texas Intermediate crude rose 1.1% to $67.01 a barrel

Spot gold was little changed

Senator Lummis Is Fully Committed To Bitcoin

There’s so much happening with Bitcoin in the U.S. right now, it’s tough to keep up. While states are individually pursuing their own path, we now have Trump’s executive order and Cynthia Lummis’s bill gaining momentum in Congress. The ideal scenario would involve the Presidential Working Group finding budget-neutral ways to acquire Bitcoin, while Congress separately passes Lummis’s Bitcoin Act, which would authorize the purchase of a significant amount of Bitcoin. While none of these initiatives are likely to go smoothly or exactly according to plan, they will evolve over time and, eventually, break through.

“I'm so pleased to announce that today, I will be reintroducing the Bitcoin Act. I'll be joined shortly by Senator Justice of West Virginia, who is one of the co-sponsors. We also have several additional co-sponsors, and much of this is the result of the excitement that has been building.”

It’s almost never the case that someone abandons Bitcoin. That alone will eventually give this asset class the numbers it needs to pass these large government initiatives.

Fidelity Is Ready For ETH Staking, BlackRock Is Next

The path has now been paved for BlackRock, the largest ETH ETF issuer, to file for staking in its ETH ETF product. Fidelity now joins Grayscale and 21Shares in an attempt to secure staking approval for their ETH product. This is also happening amid Franklin Templeton filing for SOL staking. Staking remains the strongest untapped strategy for alternative digital asset ETFs to attract inflows. Fidelity ranks second only to BlackRock, capturing a significant share of cumulative net inflows, with $1.45 billion into FETH since launch, compared to BlackRock’s $4.21 billion into ETHA.

Speaking of BlackRock, I have an infographic of what BlackRock uses to sell its ETH ETF product shared below:

In other ETF news, the SEC sent out delays to a number of requests yesterday including in-kind creation & redemption for spot BTC & ETH ETFs, staking in ETH ETFs, and XRP, SOL, LTC, and DOGE ETFs.

Bitwise Launches ETF That Tracks Public Companies Holding Bitcoin

Bitwise Asset Management, one of the leading crypto asset managers with $12 billion in client assets, has launched the Bitwise Bitcoin Standard Corporations, a brand-new ETF (OWNB). The ETF tracks the Bitwise Bitcoin Standard Corporations Index, which includes companies holding at least 1,000 BTC in their corporate treasuries.

At the launch, the top 5 holdings include:

Strategy (MSTR 20.87%)

MARA Holdings (MARA 12.12%)

CleanSpark (CLSK 6.26%)

Riot Platforms (RIOT 6.23%)

Boyaa Interactive (434 HK 5.75%)

“Companies are sitting on trillions of dollars in cash, and they look at the U.S. government running a more than $2 trillion annual deficit and think, ‘This isn't going to end well.’ These companies perceive bitcoin as a strategic reserve asset that’s liquid and scarce—and not subject to the whims or money printing of any government. We think companies are only getting started here, and this ETF gives investors exposure to innovative firms at the forefront of this trend” — Matt Hougan.

The Ethereum Foundation Is Not Leveraged Long

A combination of false claims and poor fact checking lead to a rumor being spread across X that the Ethereum Foundation is leveraged long on ETH with a liquidation price of $1,127. Notable Ethereum ecosystem members Anthony Sassano and Eric Conner denied the allegations, stating the wallet in question does not belong to the Ethereum Foundation. It should have been common sense the Ethereum Foundation isn’t trading like a degenerate, but I guess it wasn’t obvious to everyone, or we were all just successfully click-baited.

Bitcoin Crash Alert: Could $70K Be the Next Painful Stop?

Is Bitcoin set to drop even further below $80K and test $70K? What's happening with the concept of the crypto capital, and why are Bitcoin and the broader crypto market crashing? I'm joined by Jeff Park, Head of Alpha Strategies at Bitwise, along with my friends from Arch Public, Andrew Parish and Tillman Holloway, who will share an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.